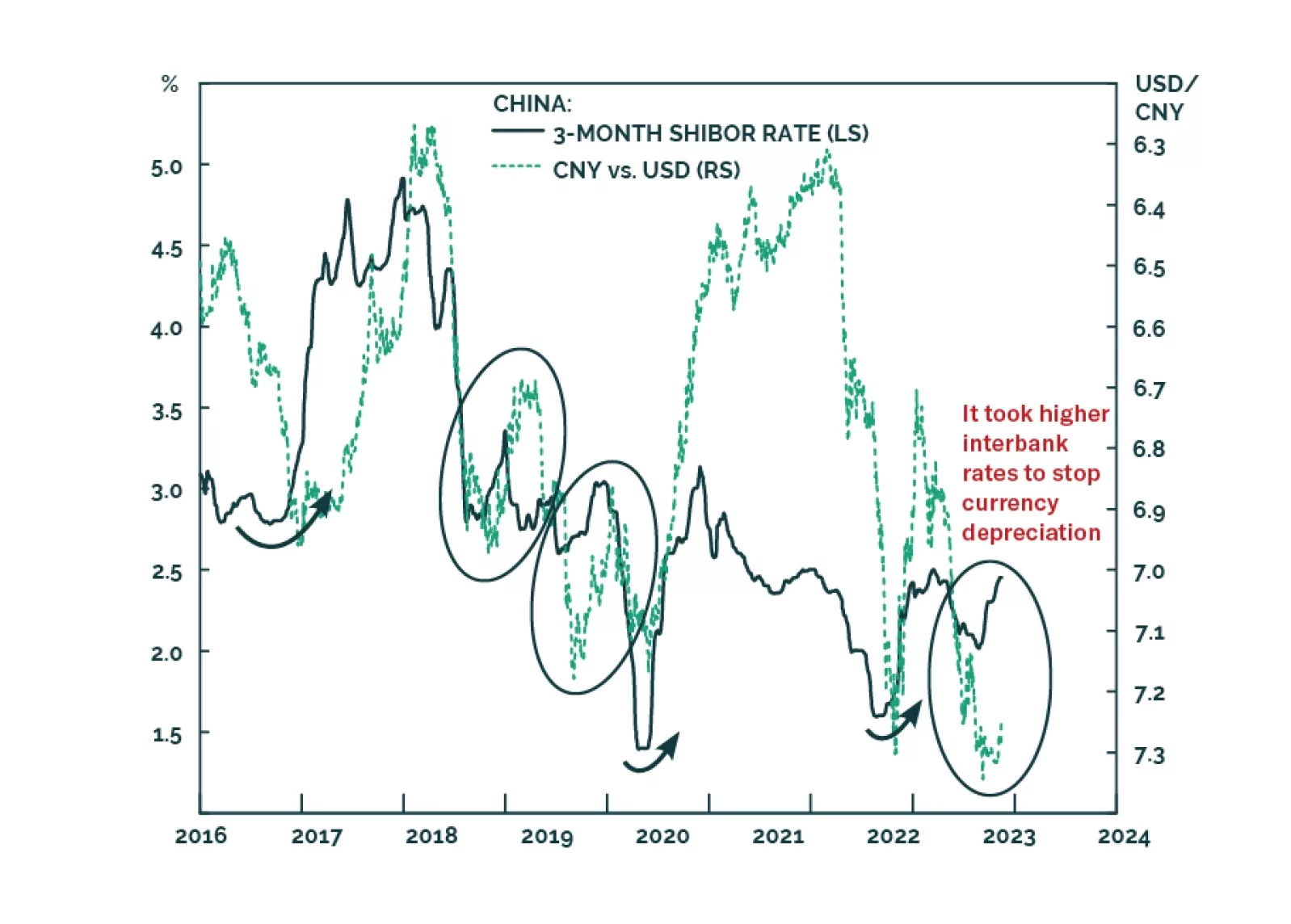

Many commentators have attributed the latest increase in Chinese interest rates to an improving economy, the large issuance of government bonds, the tax payments season, and other technical factors. Yet, these explanations are…

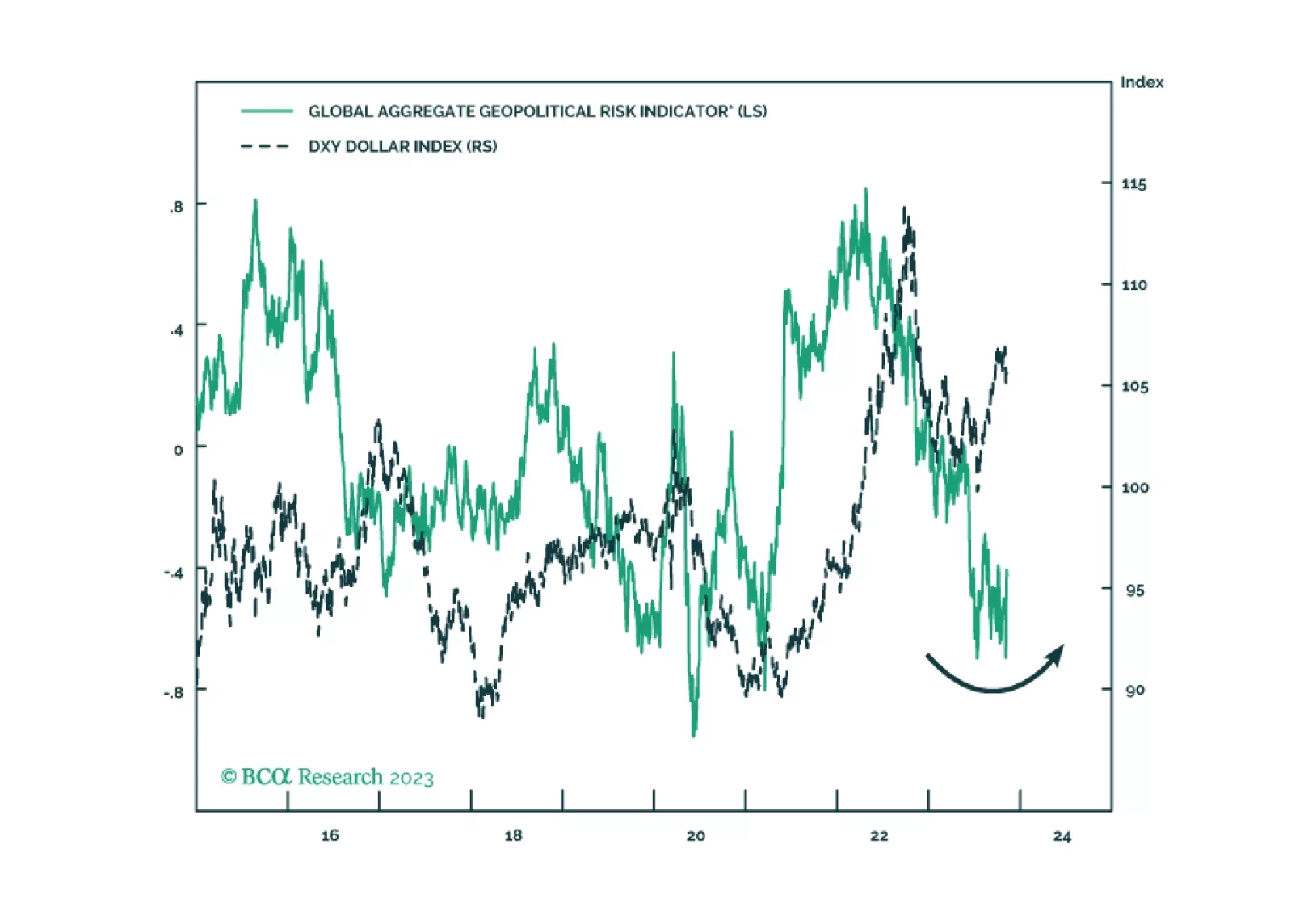

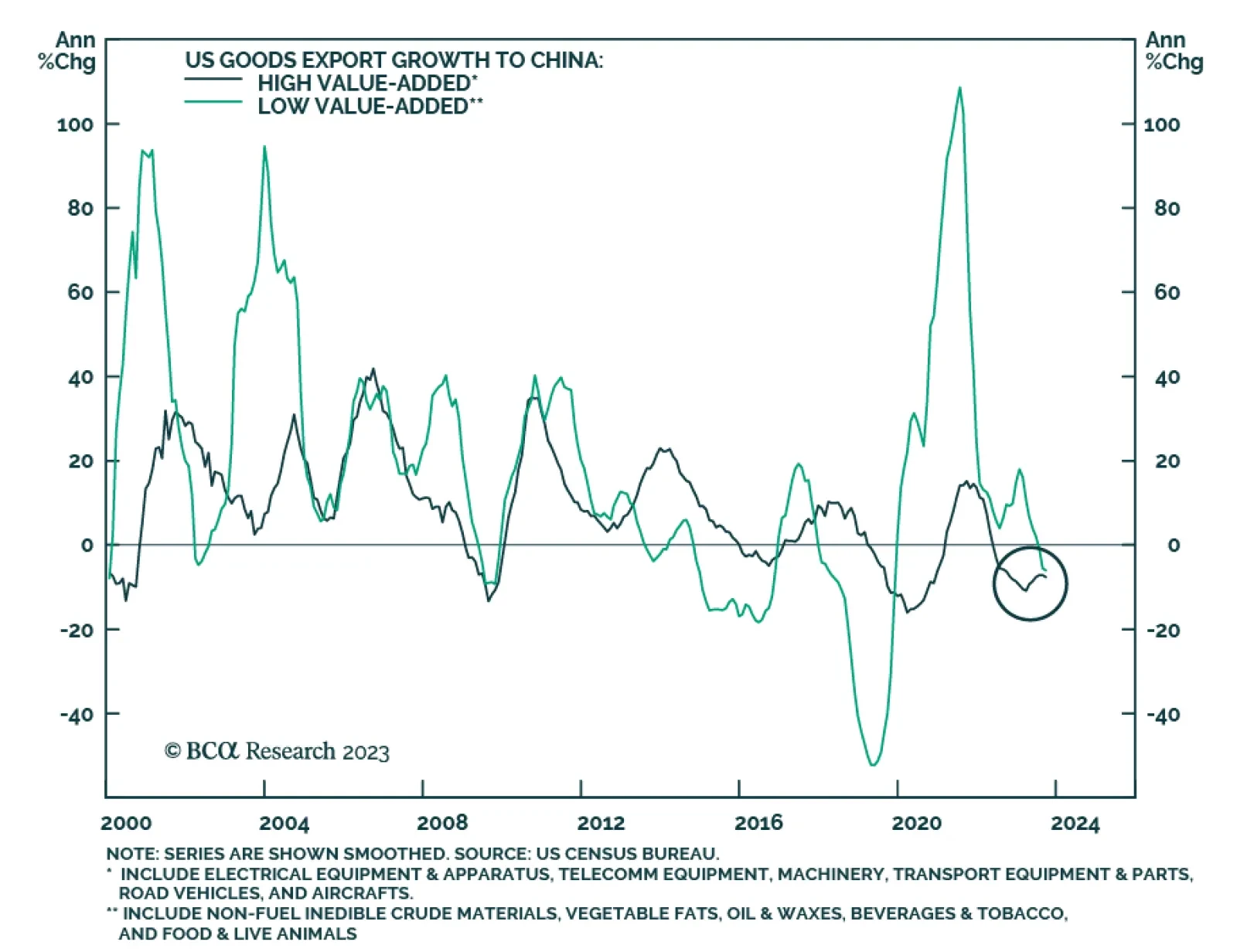

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

Investors should not get their hopes up about this week’s US-China summit. Chinese President Xi Jinping and US President Joe Biden will meet on the sidelines of the Asia Pacific Economic Cooperation (APEC) summit in San…

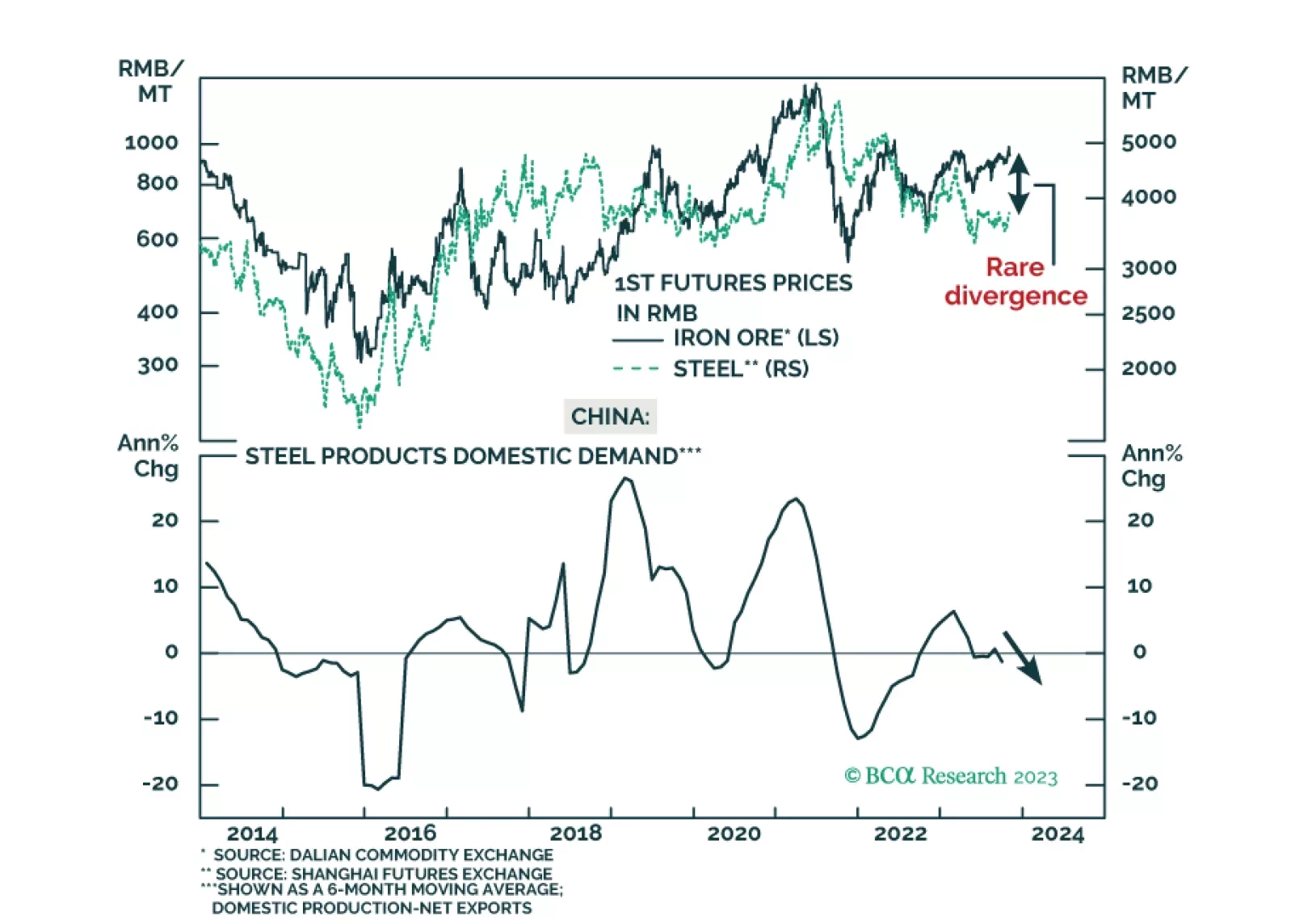

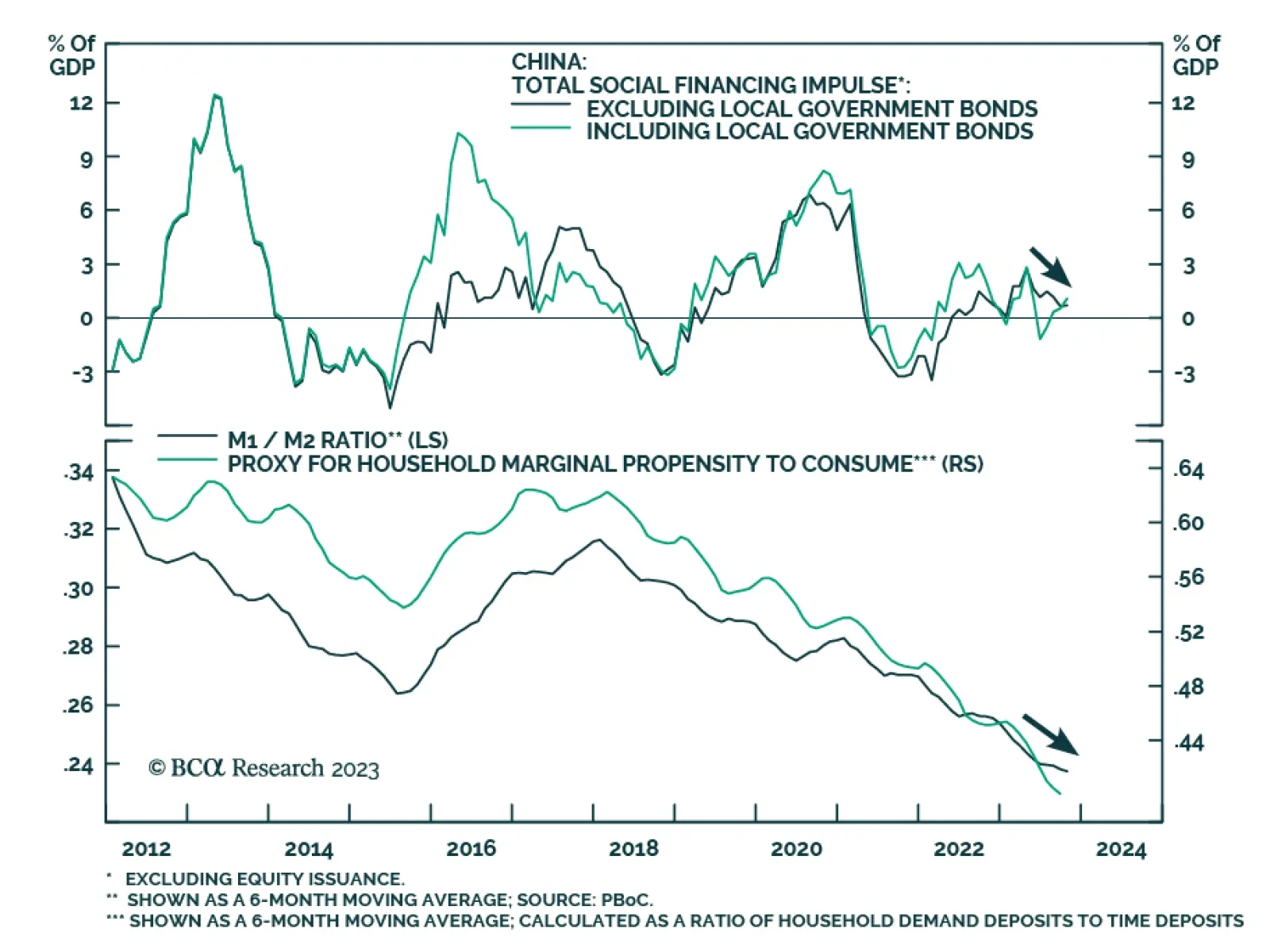

China's money and credit data remained weak in October. New total social financing amounted to RMB 1.85 trillion – less than the RMB 1.95 trillion anticipated and below the prior month's increase of RMB 4.12…

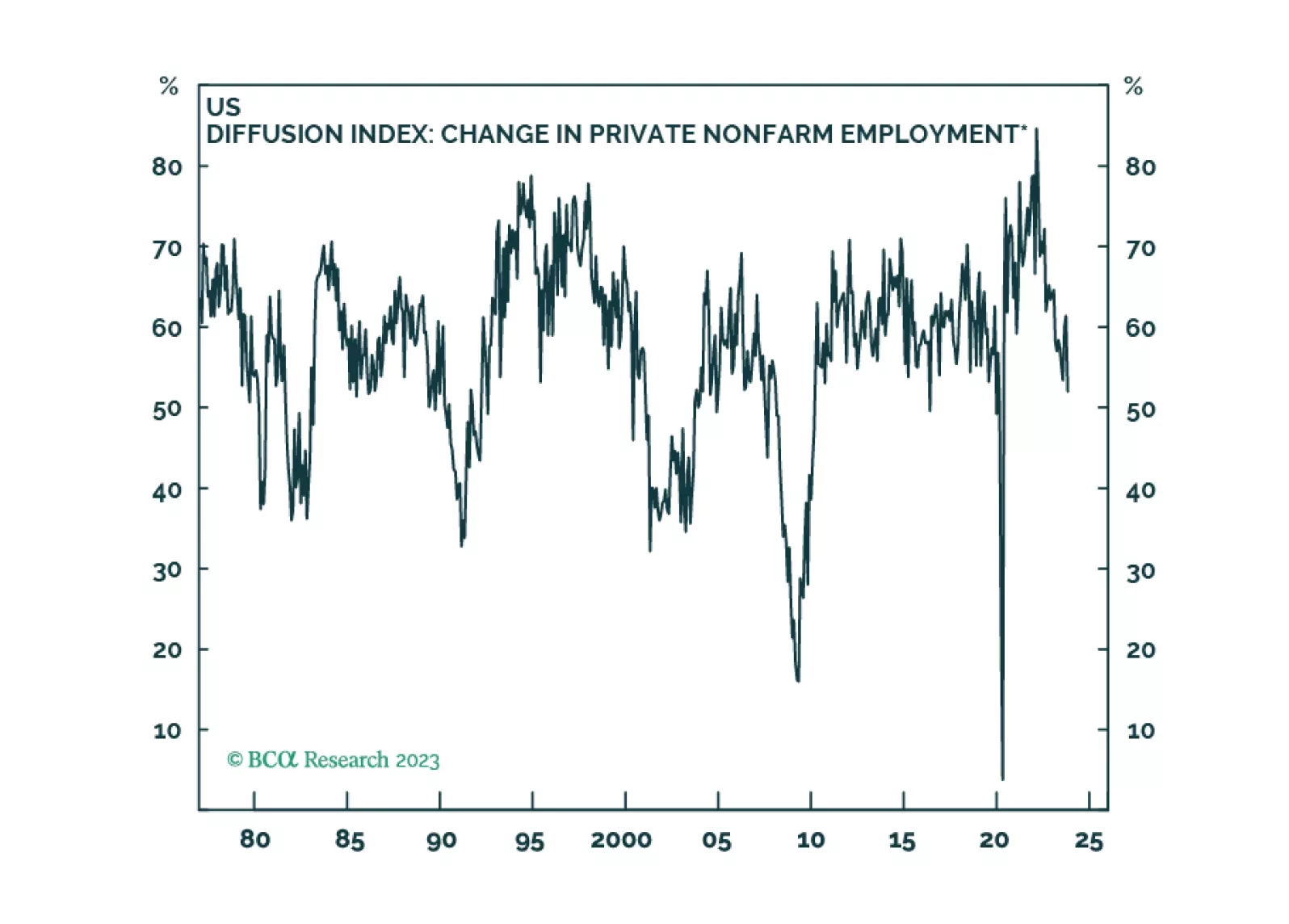

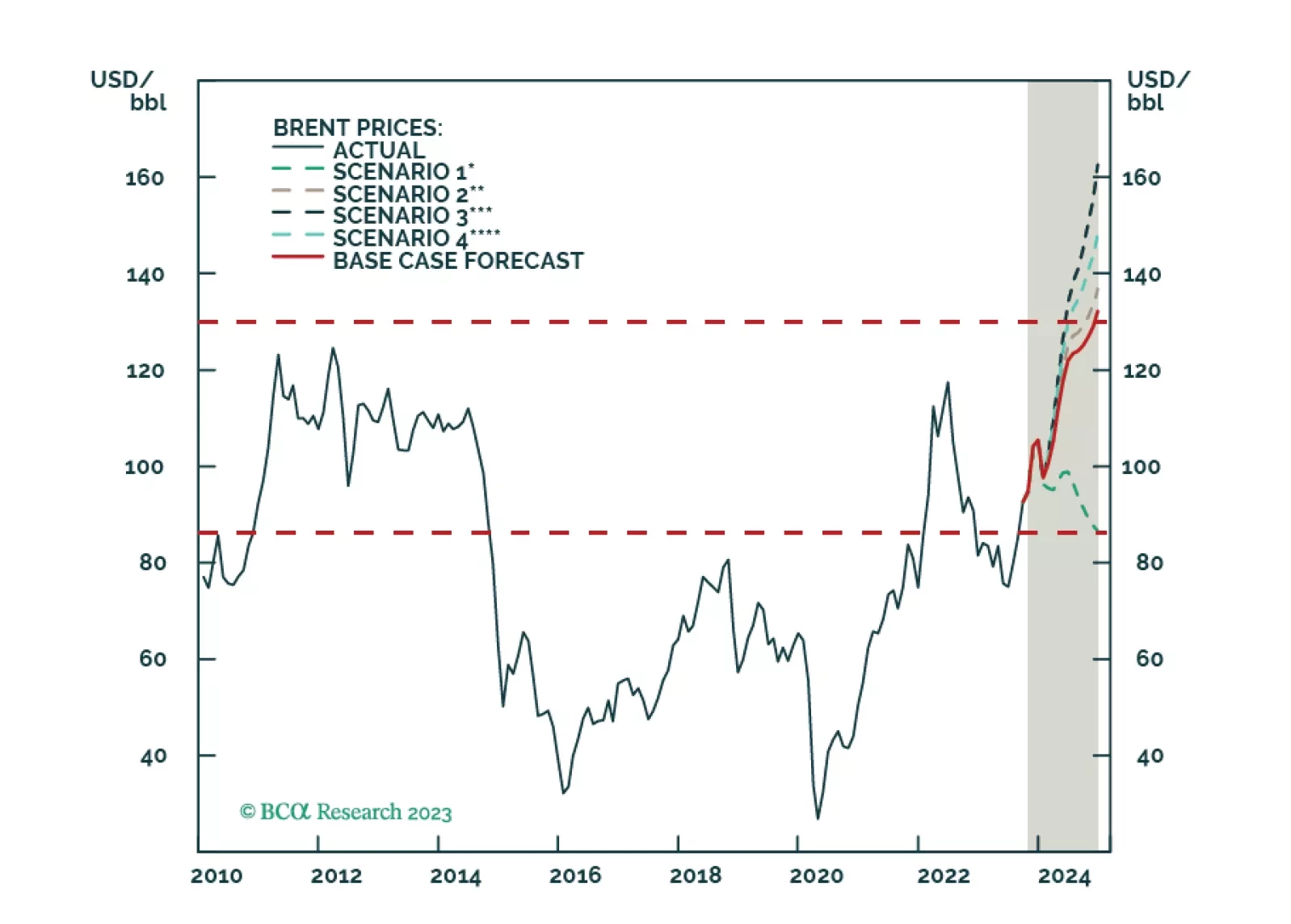

Labor markets are softening in most developed economies, as is usually the case in the lead-up to recessions. Our base case is that the global recession will begin in the second half of 2024, but we will be monitoring our MacroQuant…

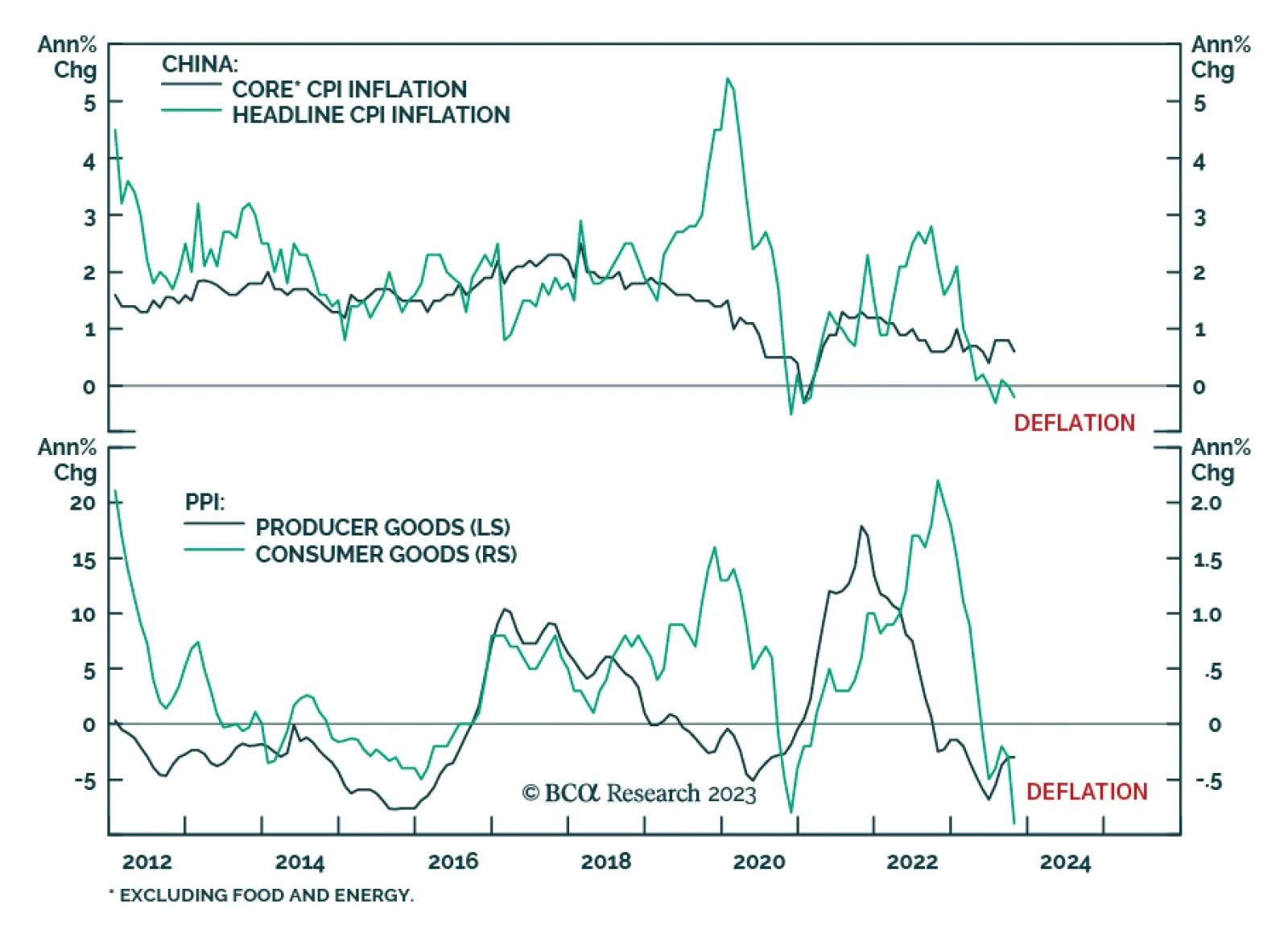

China's CPI and PPI inflation release for October indicates that deflationary pressures continue to dominate the domestic economy. After remaining unchanged in September, consumer prices declined by 0.2% y/y last month,…

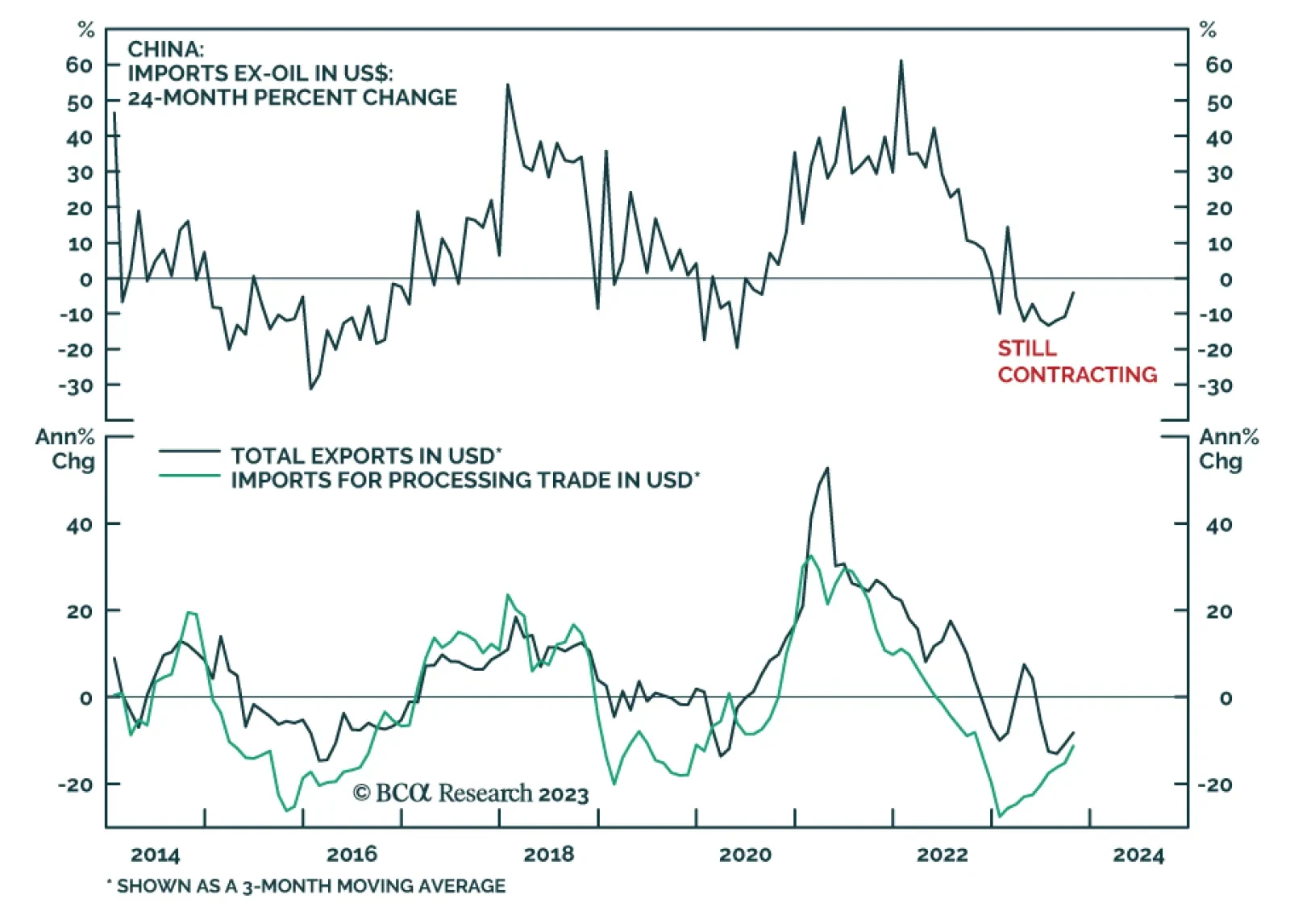

Chinese trade data for October delivered a mixed message on Tuesday. On the one hand, the export contraction deepened to -6.4% y/y following -6.2% y/y in September and surprised expectations that it would moderate to -3.5% y/y.…

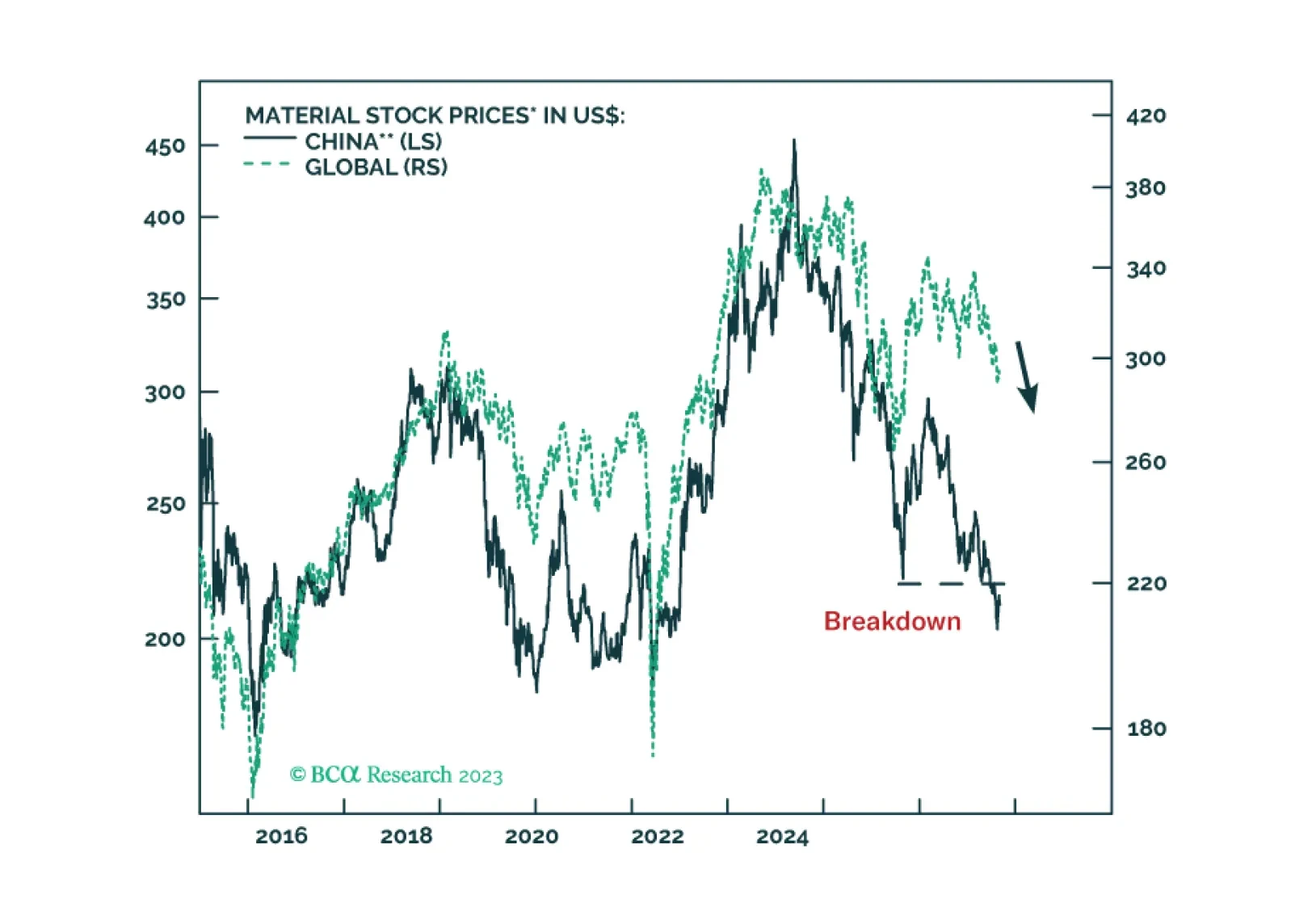

In financial systems, cracks typically begin on the periphery and then expand to the center. Hence, the ruptures on the fringes often act as an early warning. These fissures tend to widen and spread to the core, causing a breakdown…