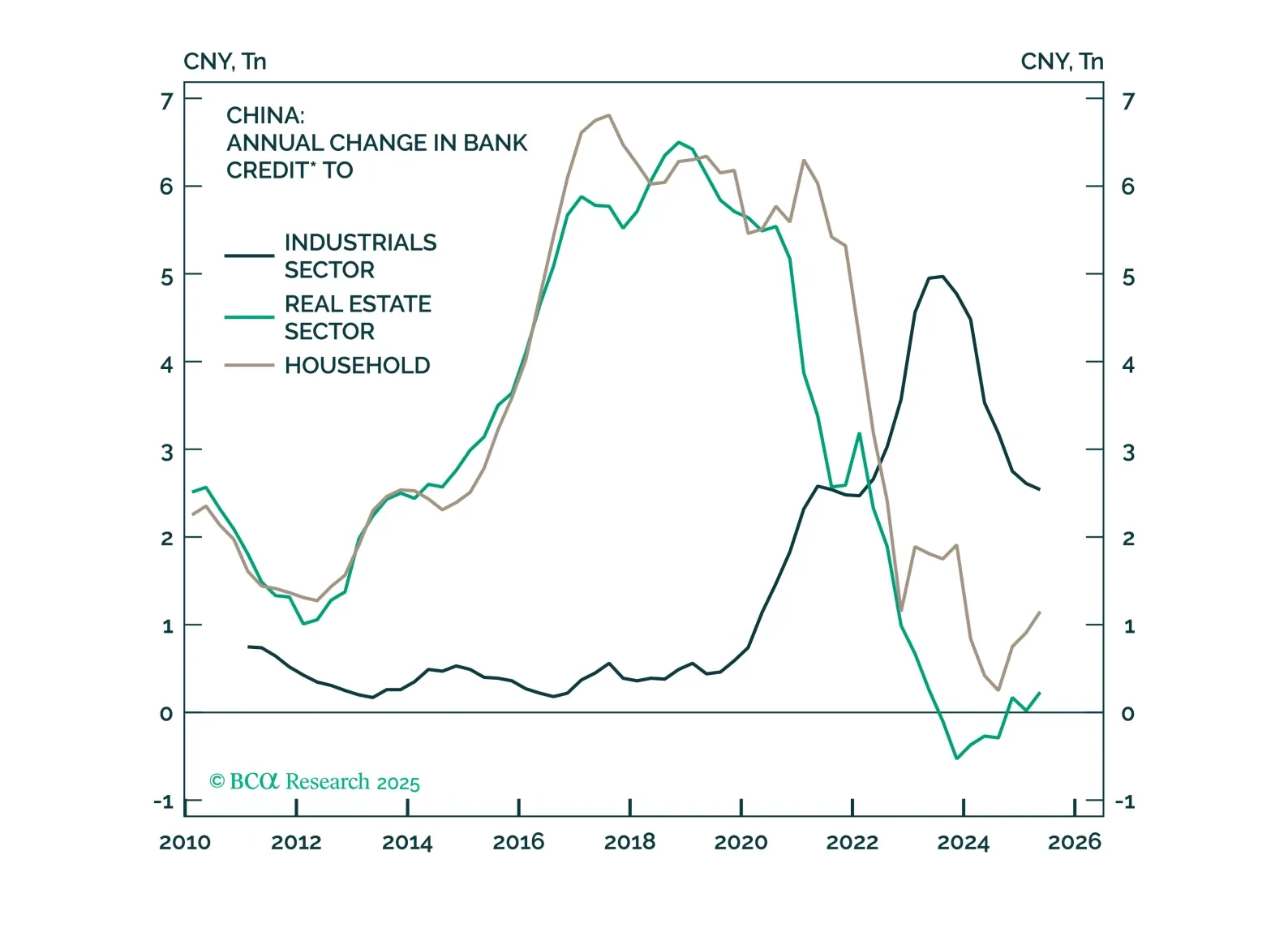

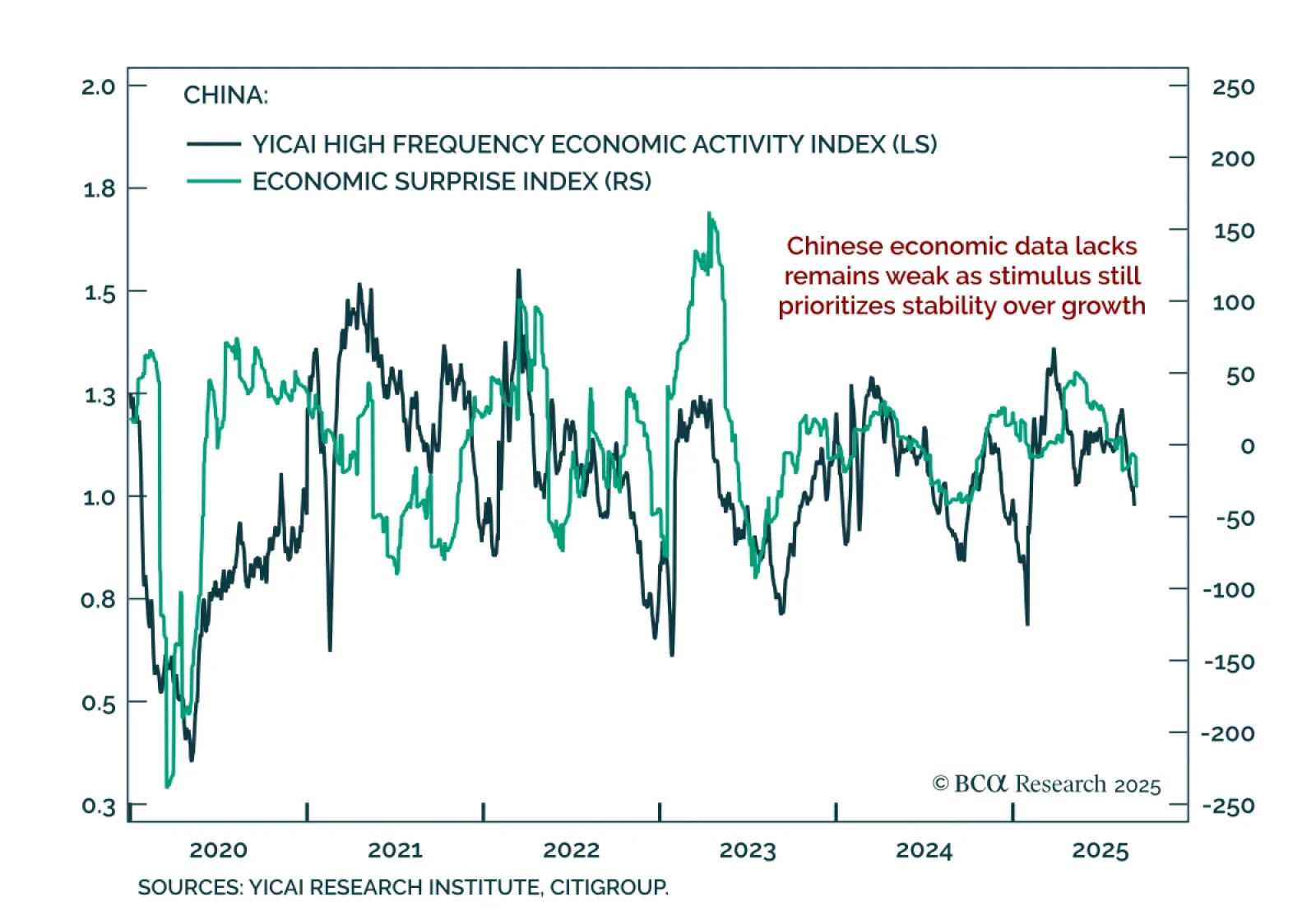

China’s August hard data weakened, keeping policy support likely and reinforcing overweights in domestic bonds. Retail sales cooled, fixed-asset investment edged toward contraction, and property investment continues to lag falling…

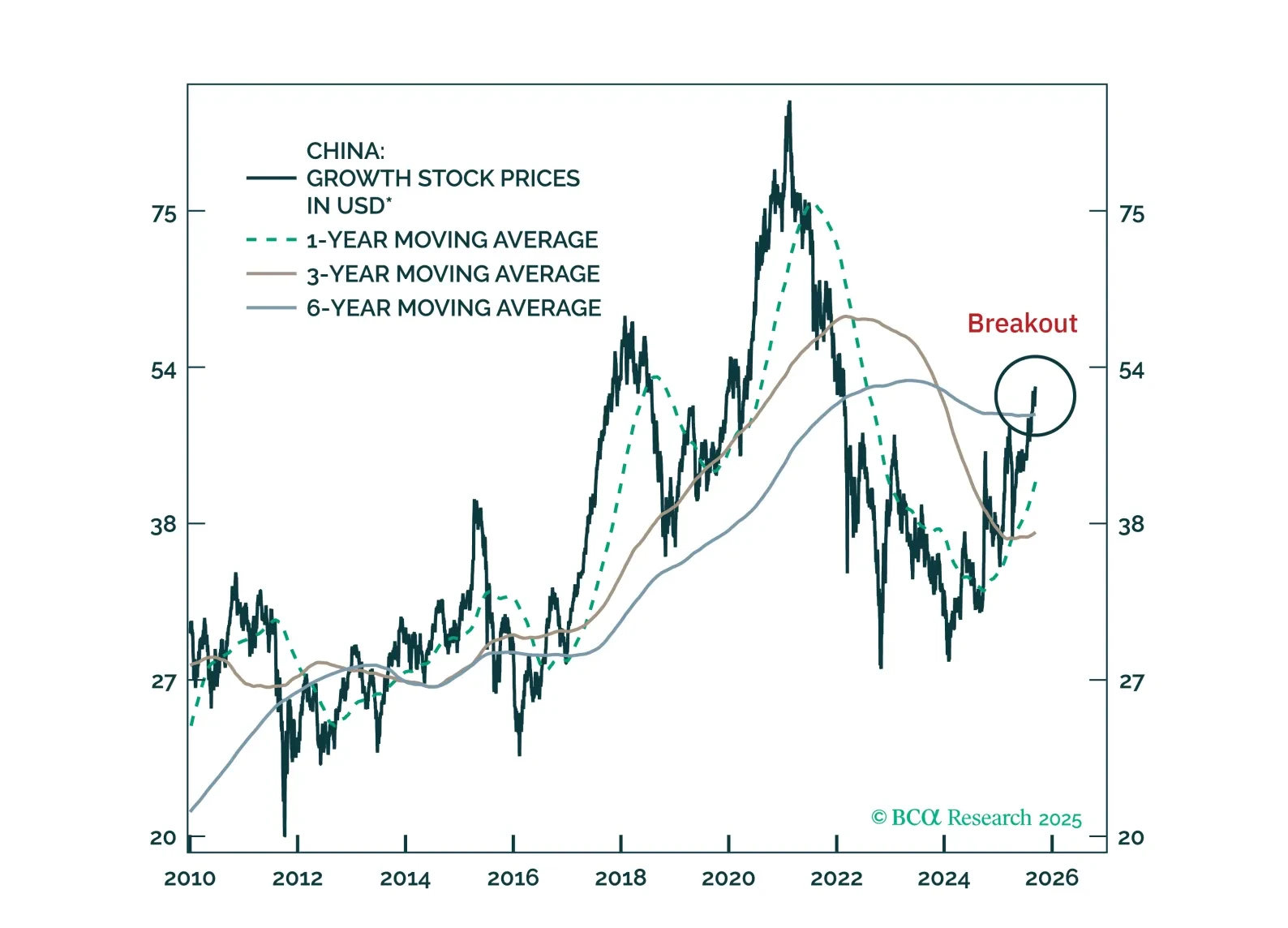

We are turning more constructive on Chinese internet stocks after several years of caution. We recommend going long offshore internet equities in absolute terms and upgrading MSCI China to overweight in a global equity portfolio.

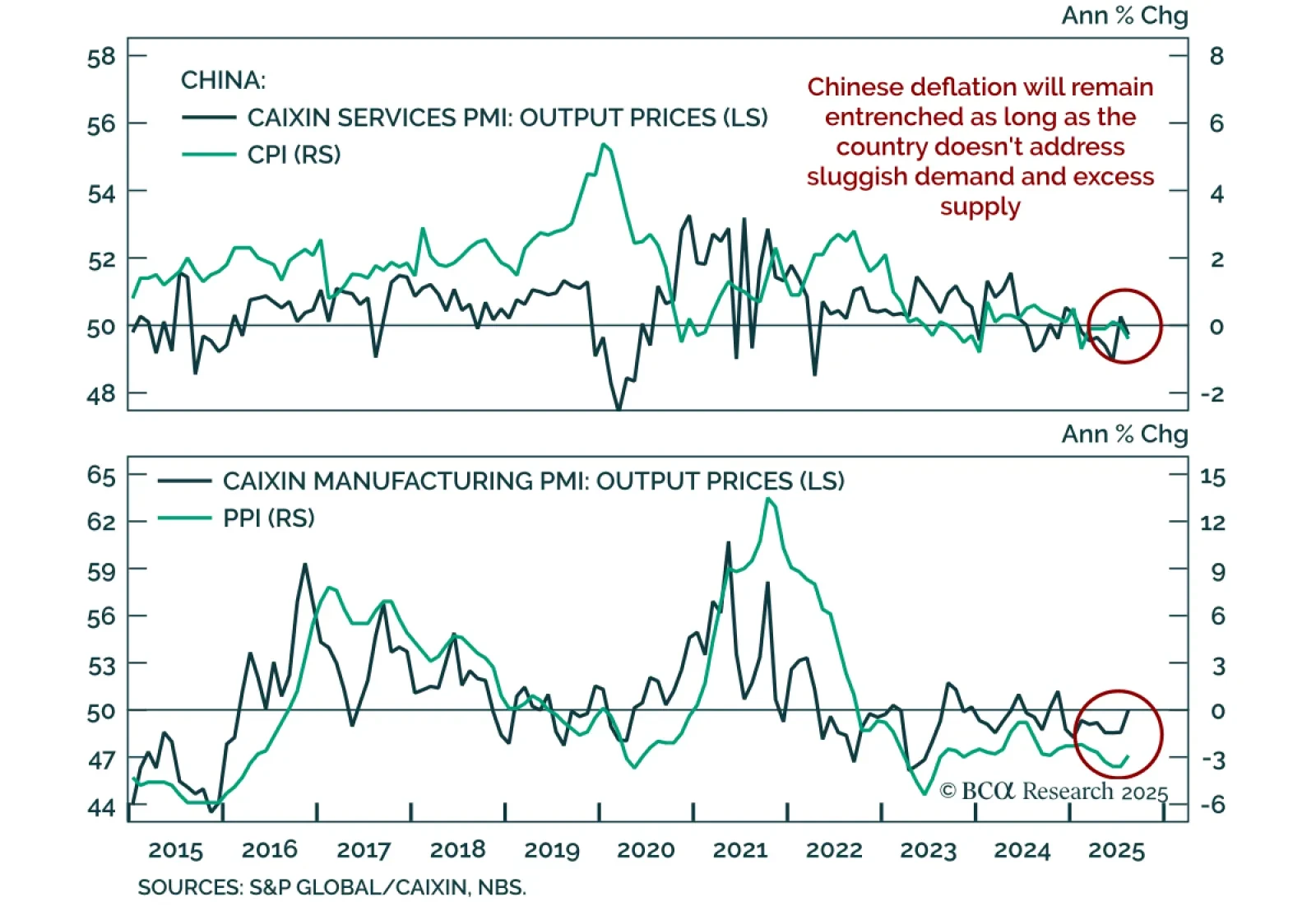

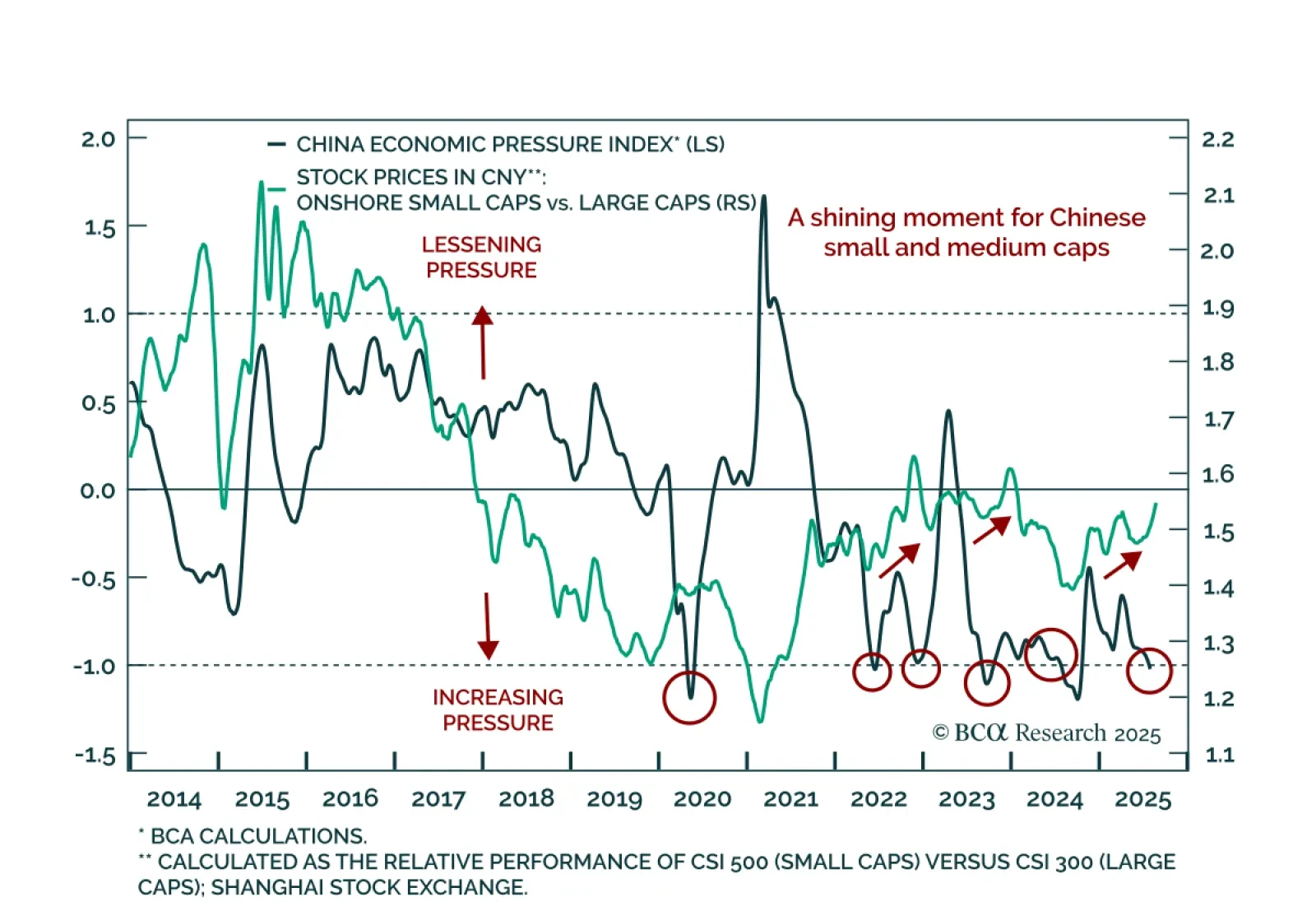

China’s August inflation data confirm entrenched deflation, reinforcing our overweight in onshore bonds and a tactical long in onshore small- and mid-caps versus large caps ahead of potential stimulus. Producer prices declined 2…

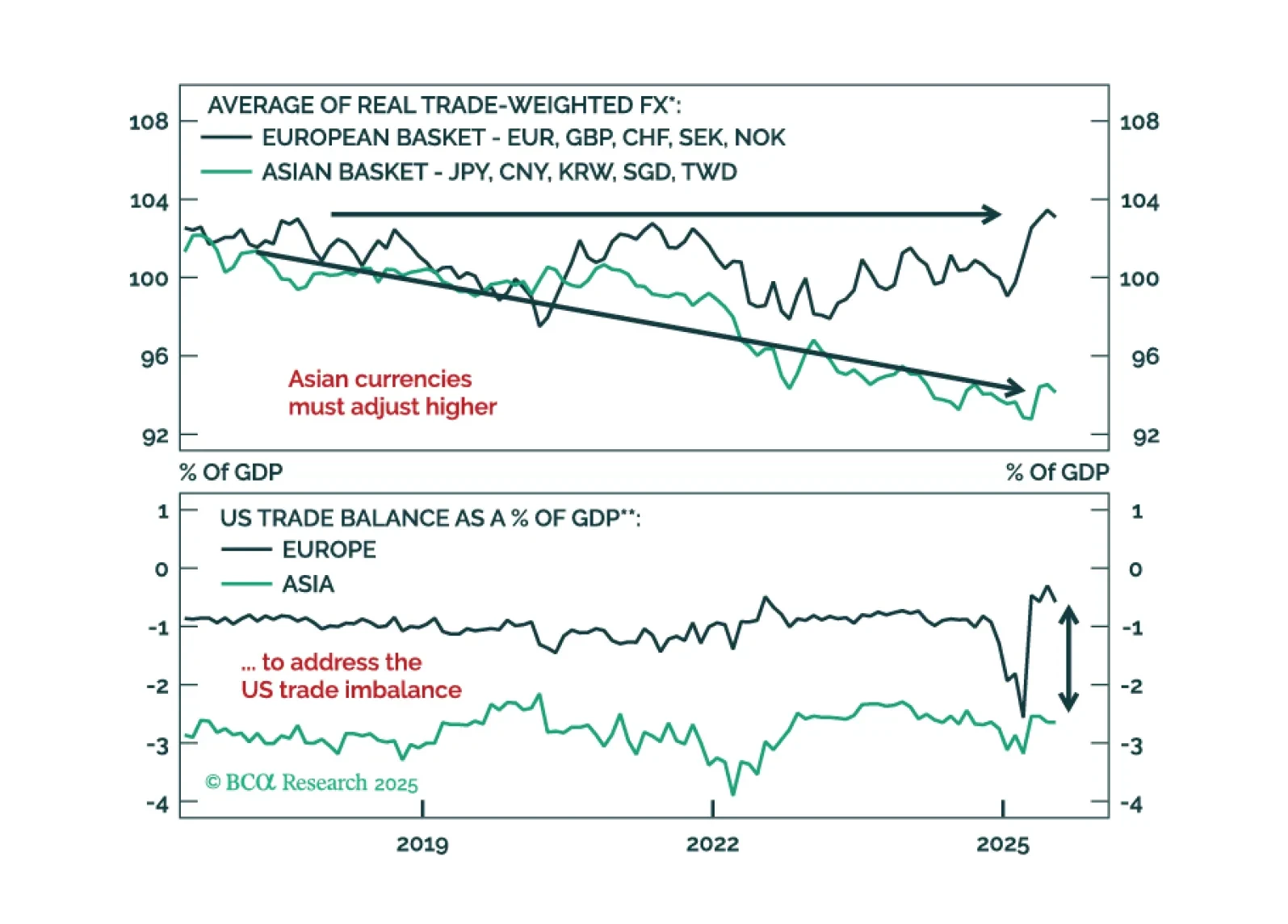

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

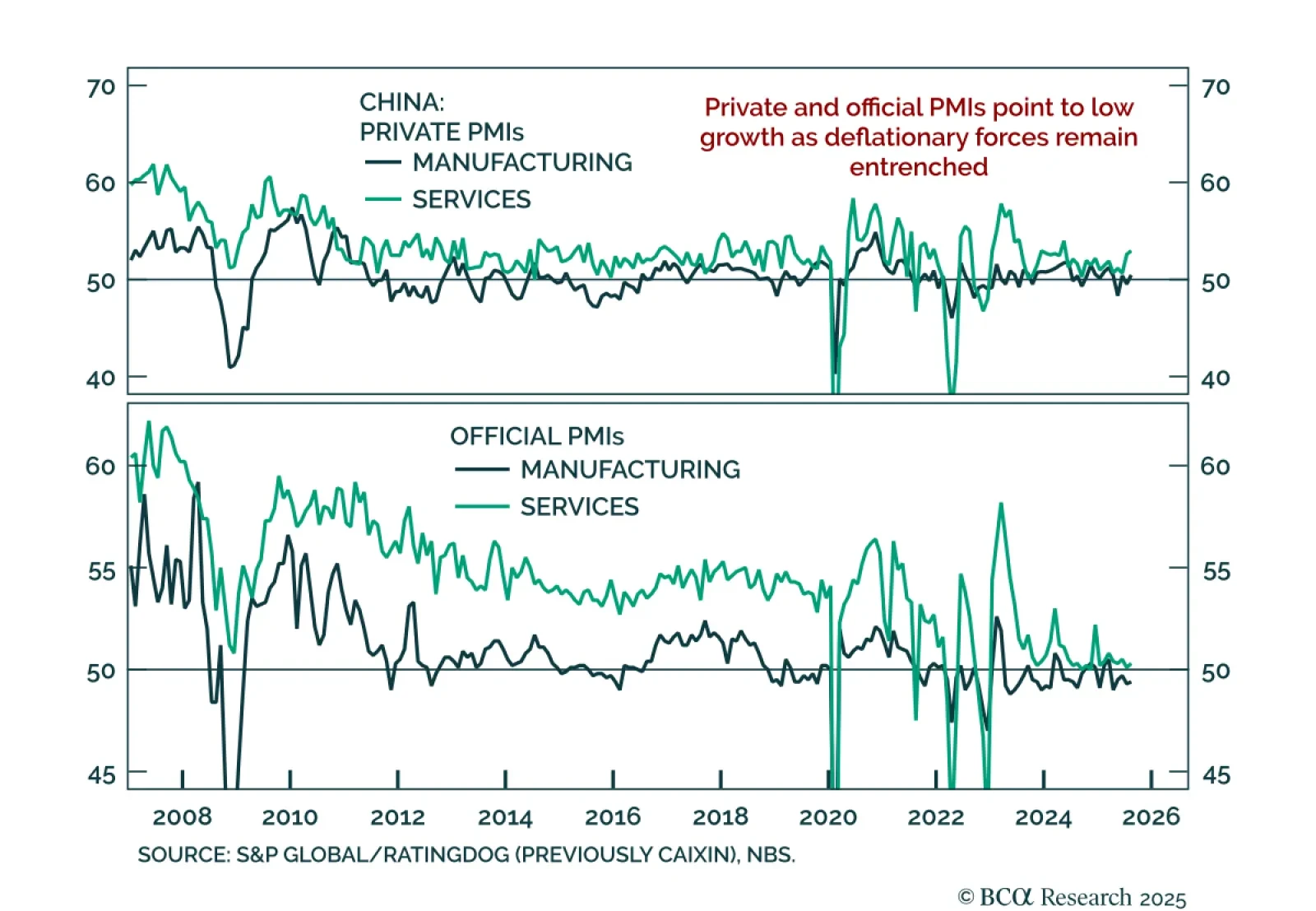

China’s August PMIs improved, but underlying data point to persistent weakness and limited momentum. The official NBS composite rose to 50.5 from 50.2, with manufacturing still in contraction at 49.4 and services edging higher to 50.…

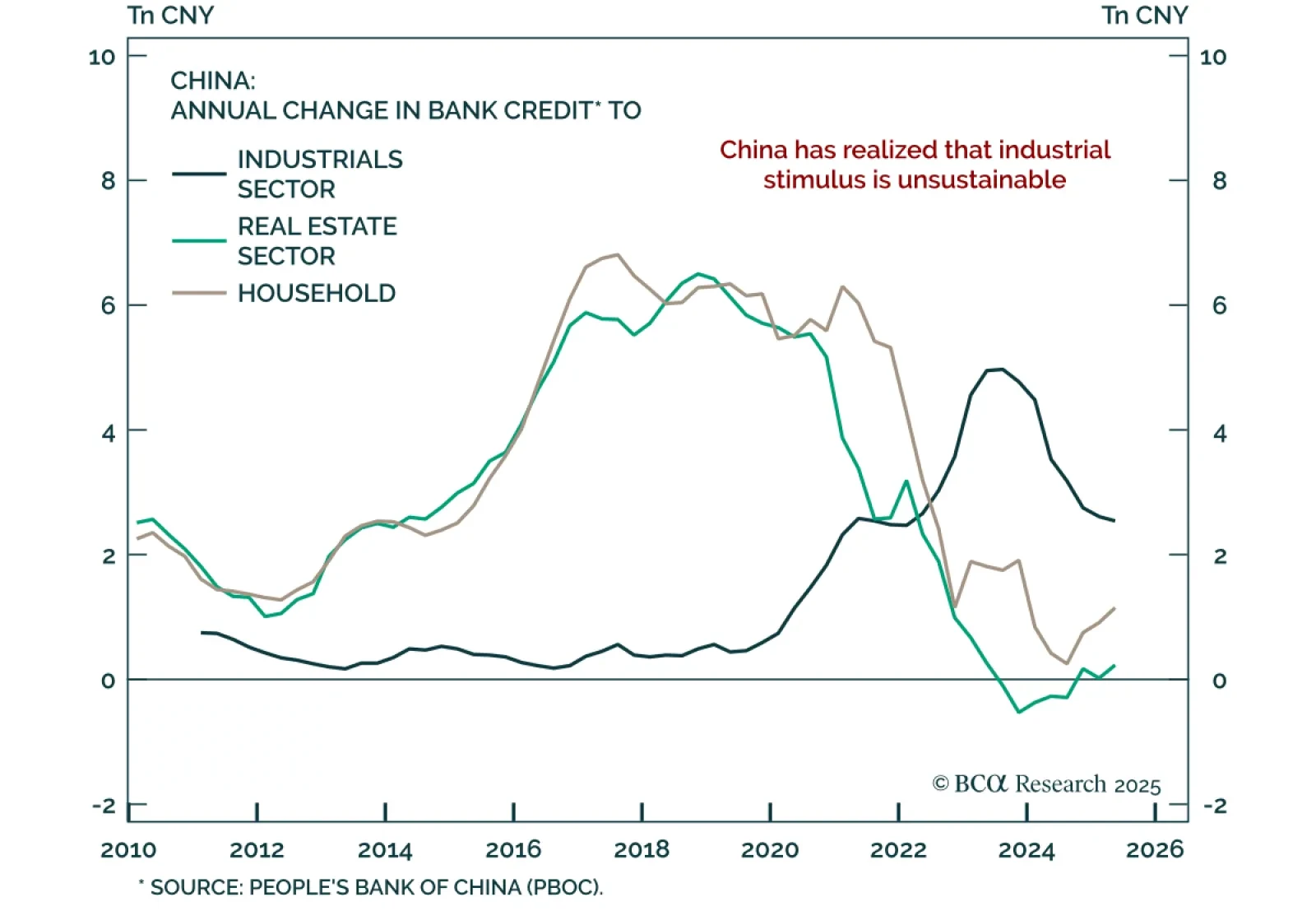

Our Global Asset Allocation strategists upgrade the Chinese yuan to overweight as global imbalances between production and consumption begin to reverse. The US continues to overconsume and underproduce, while China overproduces and…

The US overconsumes and underproduces. China overproduces and underconsumes. There are early signs that this decades-old imbalance has peaked and is beginning to reverse. Upgrade the CNY to overweight.

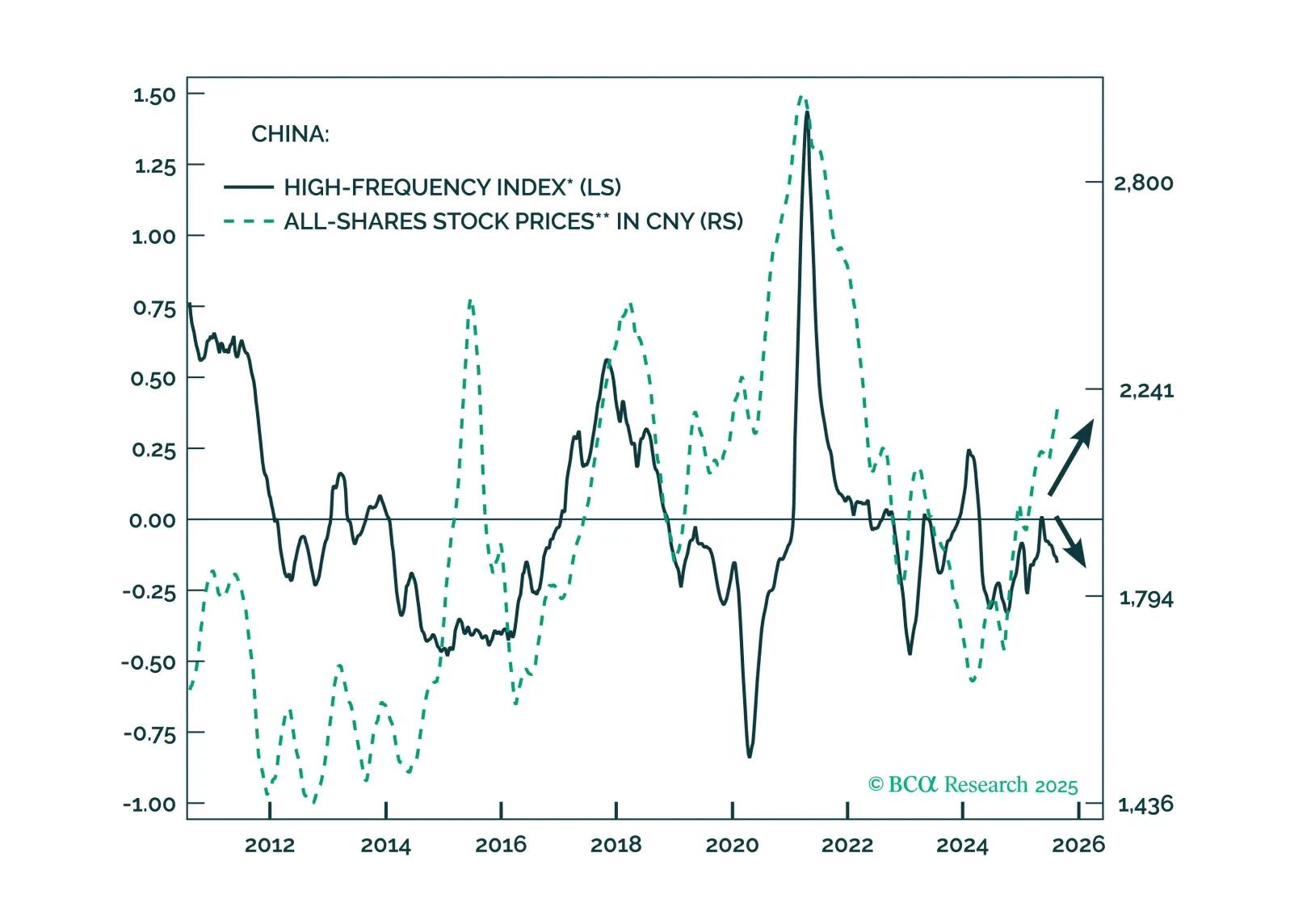

Our China Investment strategists advise against chasing the recent equity rally but recommend a tactical long on onshore small and mid caps versus large caps ahead of potential stimulus. Their new China Economic Pressure Indicator (…