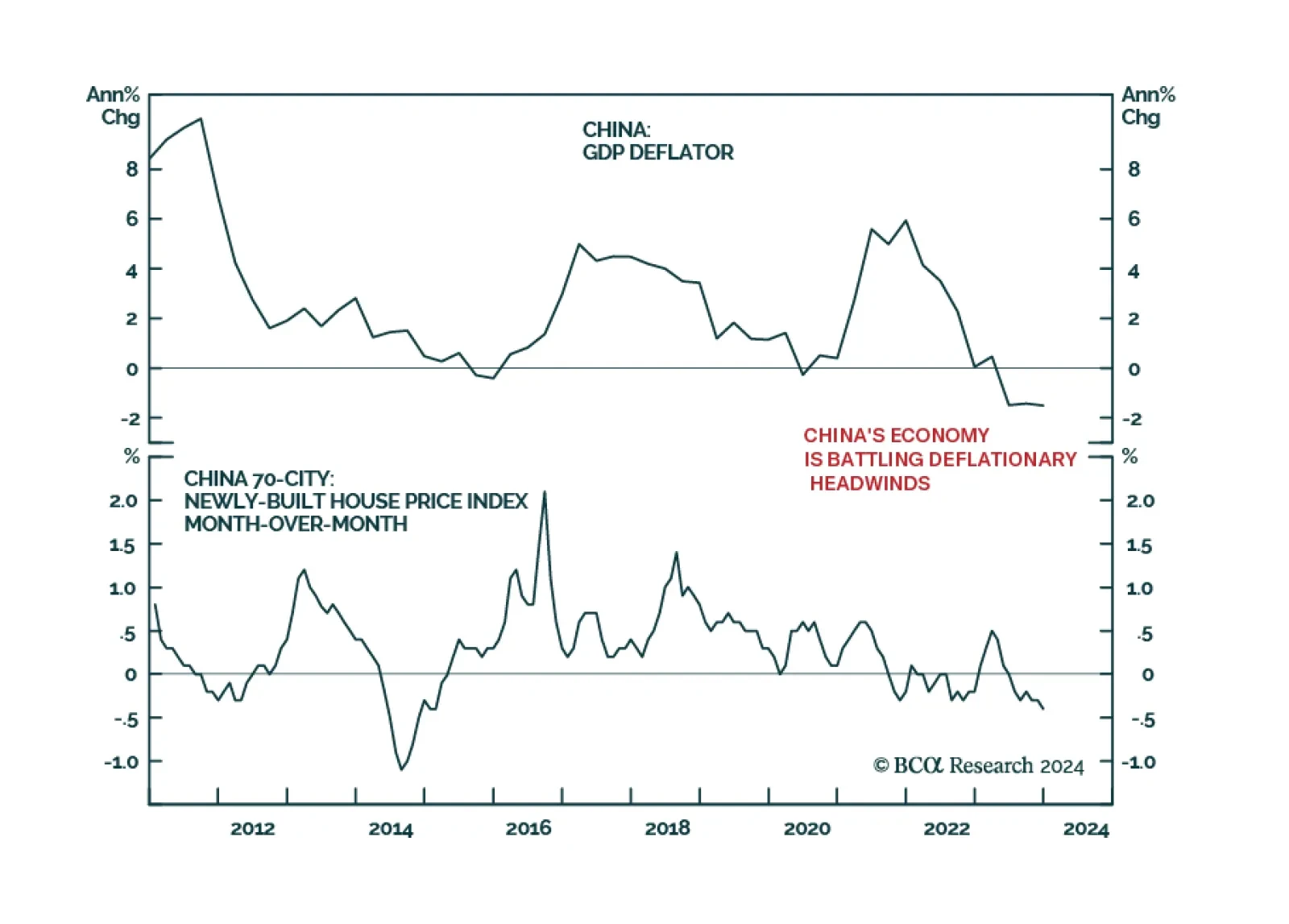

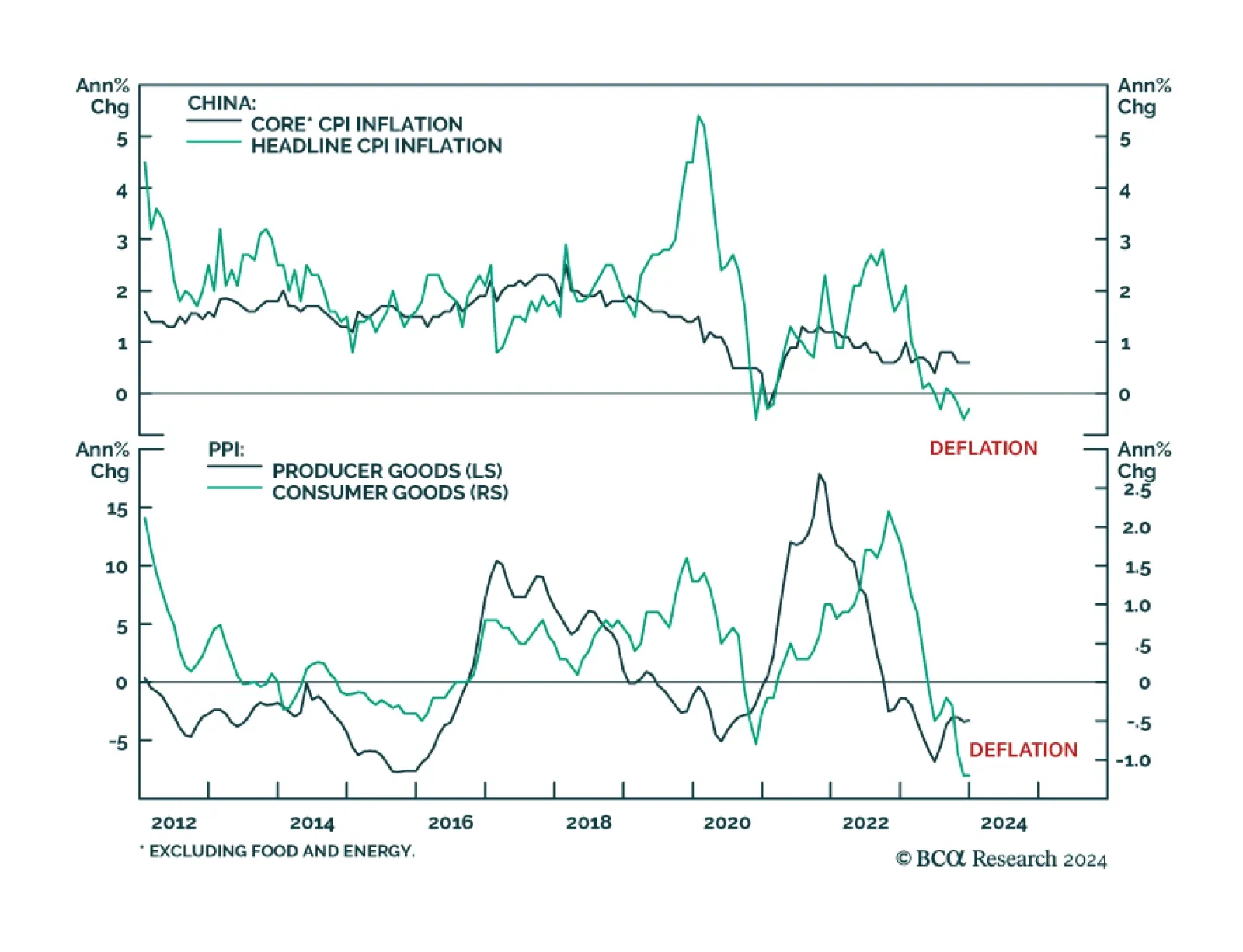

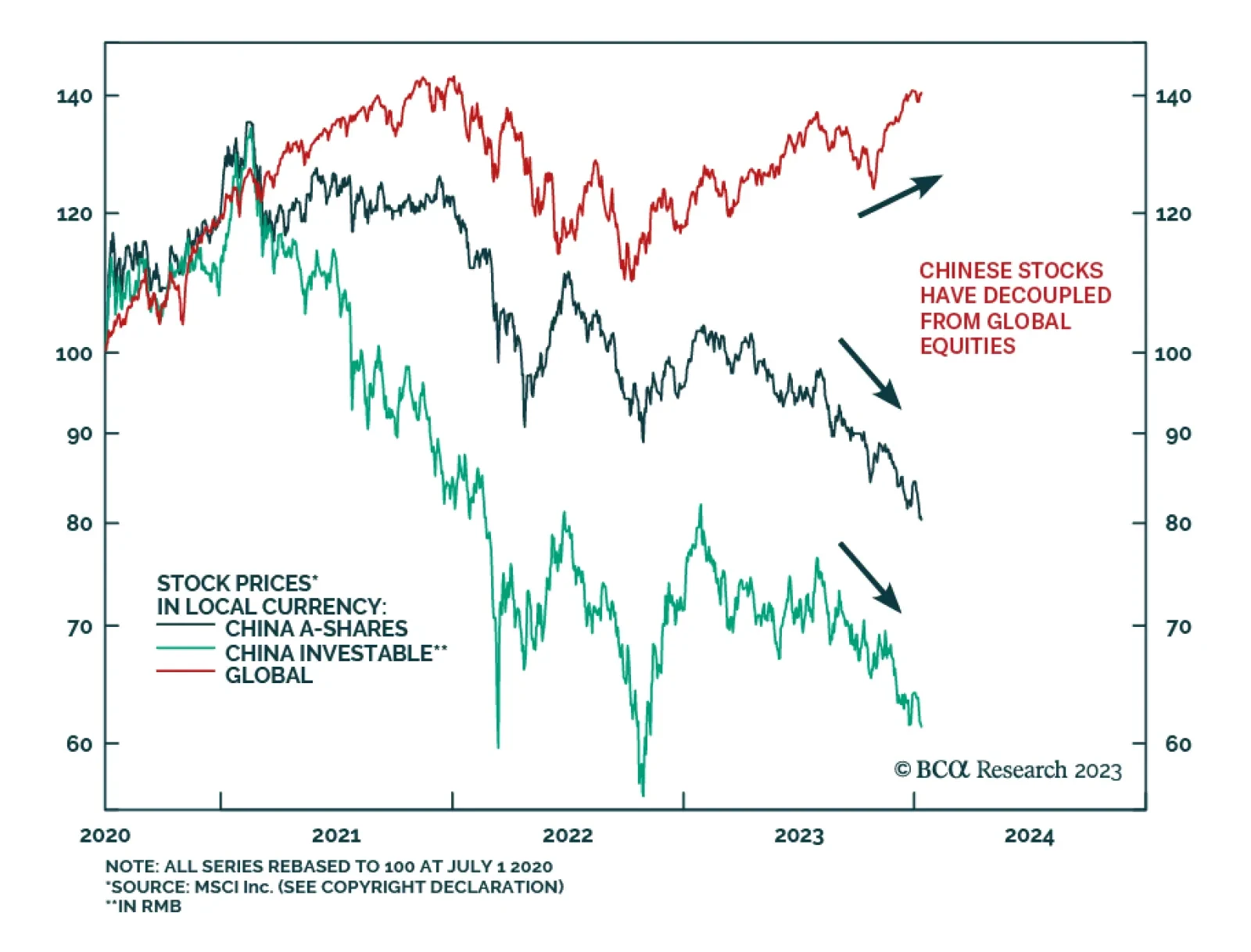

There is no easy way for China to forestall deflation. Provided policymakers are still reluctant to unleash large-size stimulus, more economic disappointments are likely in the coming months, and Chinese stocks will continue to sell…

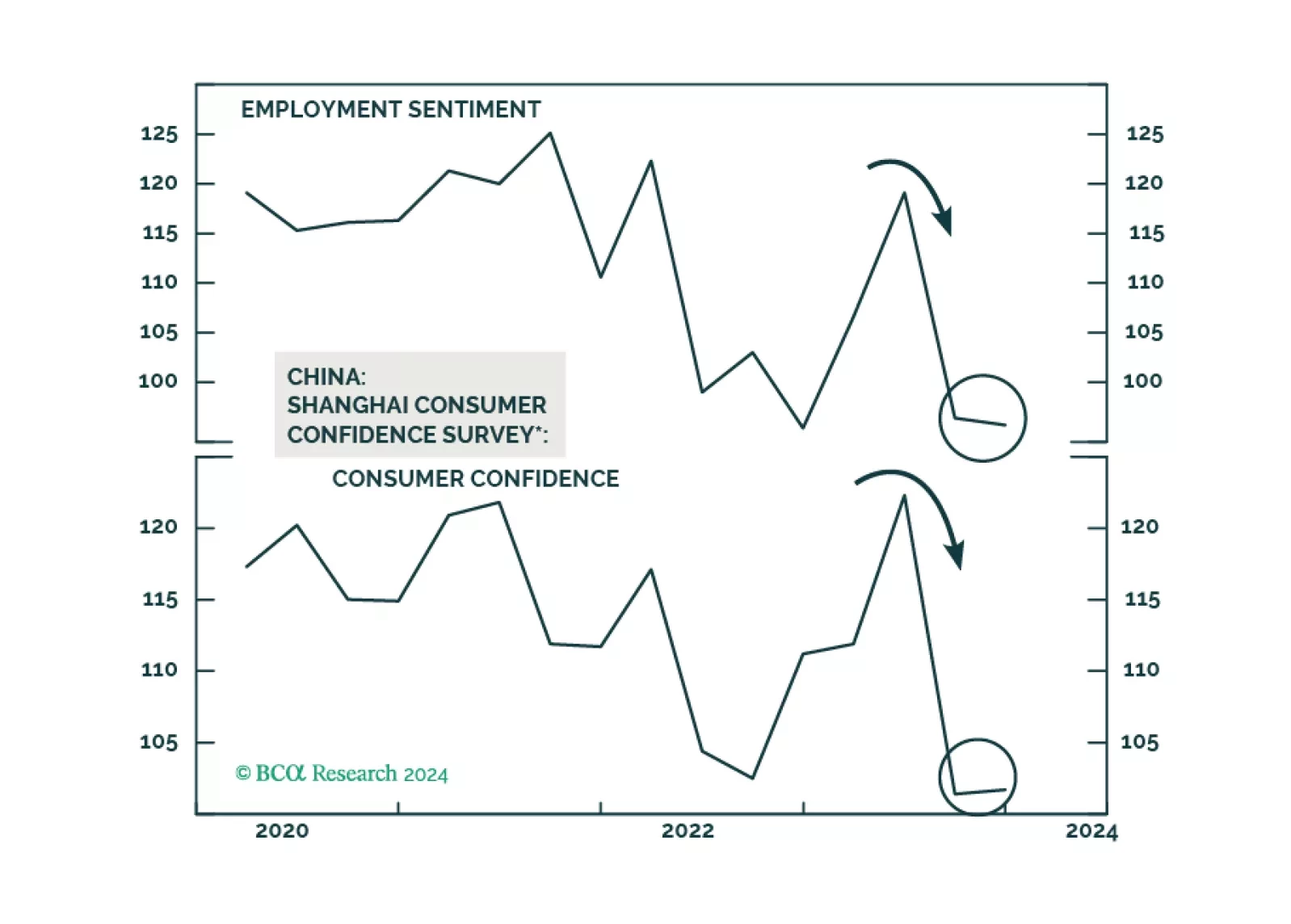

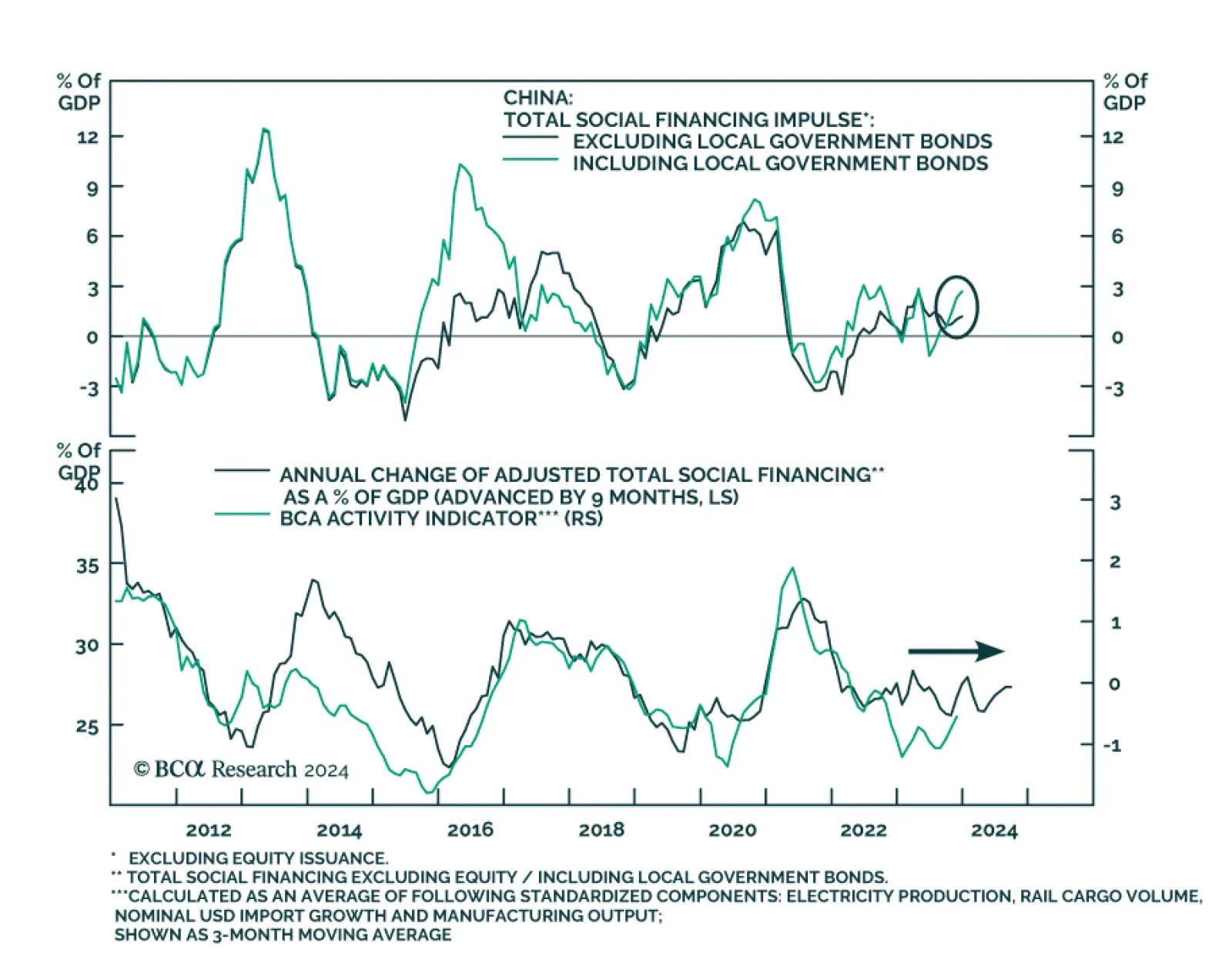

Chinese data continues to send a pessimistic signal for domestic risk assets and China plays. Although at 5.2% in Q4, GDP growth stands above the official target, it underwhelmed anticipations of 5.3%. Moreover, other data…

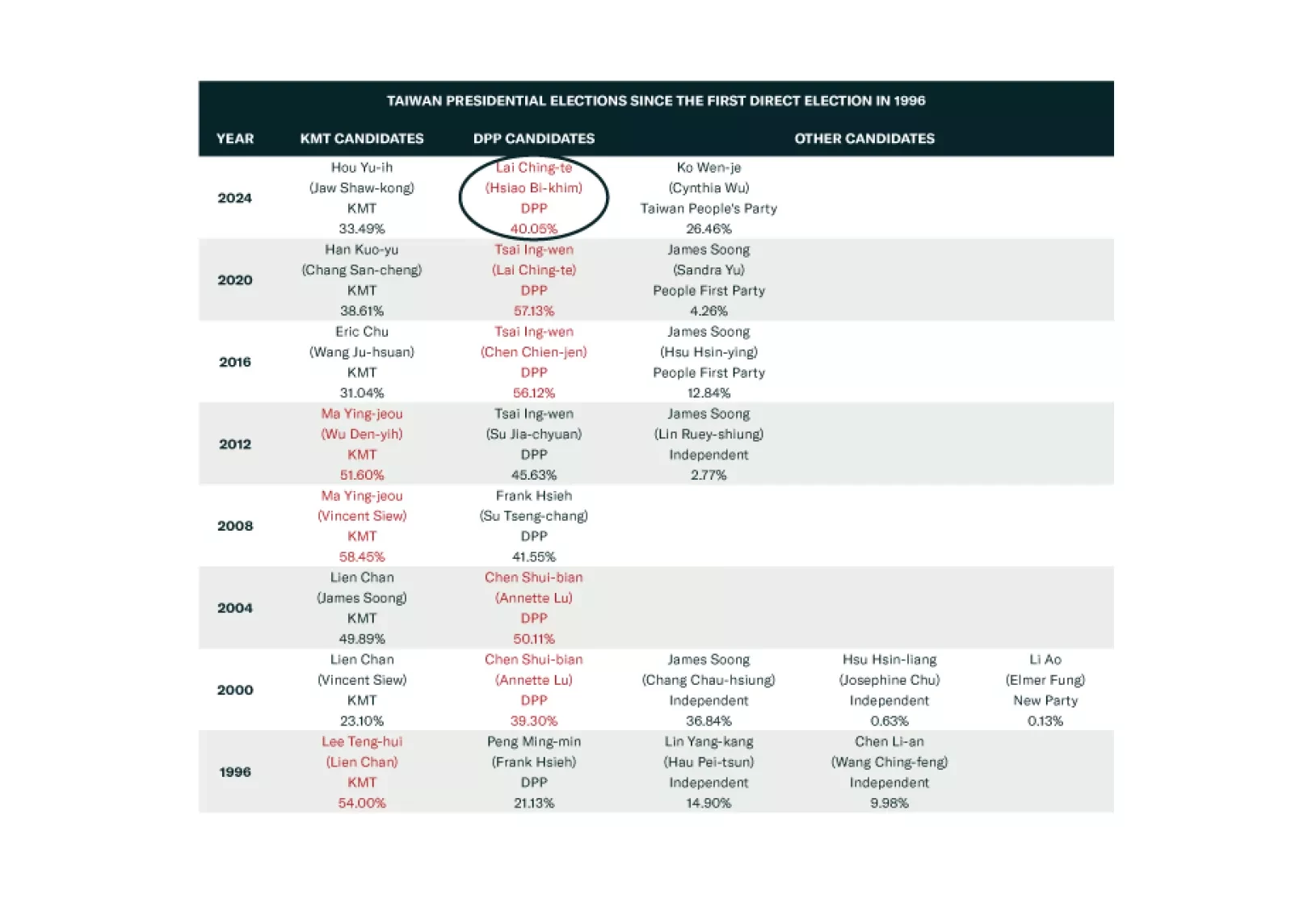

China will increase economic and military pressure on Taiwan but there is no basis for immediate full-scale war. That is the takeaway from the Taiwanese election on January 13, which returned the nominally pro-independence…

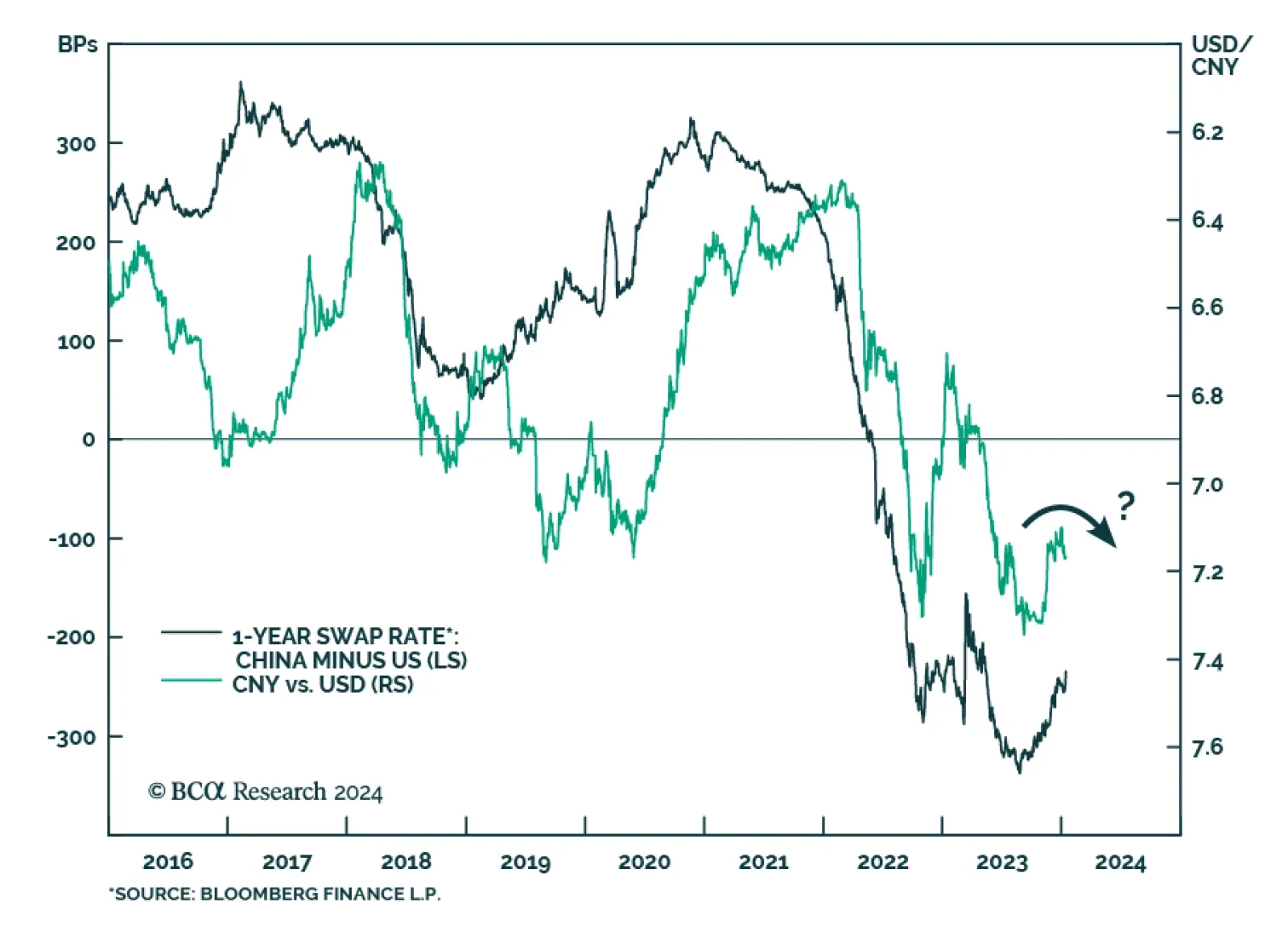

China’s central bank unexpectedly held the medium-term policy rate unchanged at 2.5% on Monday, surprising expectations of a 10 basis point cut. Given that deflationary forces dominate China’s economy, the decision to…

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.

Chinese credit dynamics remain muted with the expansion in total social financing easing from 2.45 trillion yuan to 1.94 trillion yuan in December, below expectations of a tamer slowdown to 2.16 trillion yuan. Loan growth also…

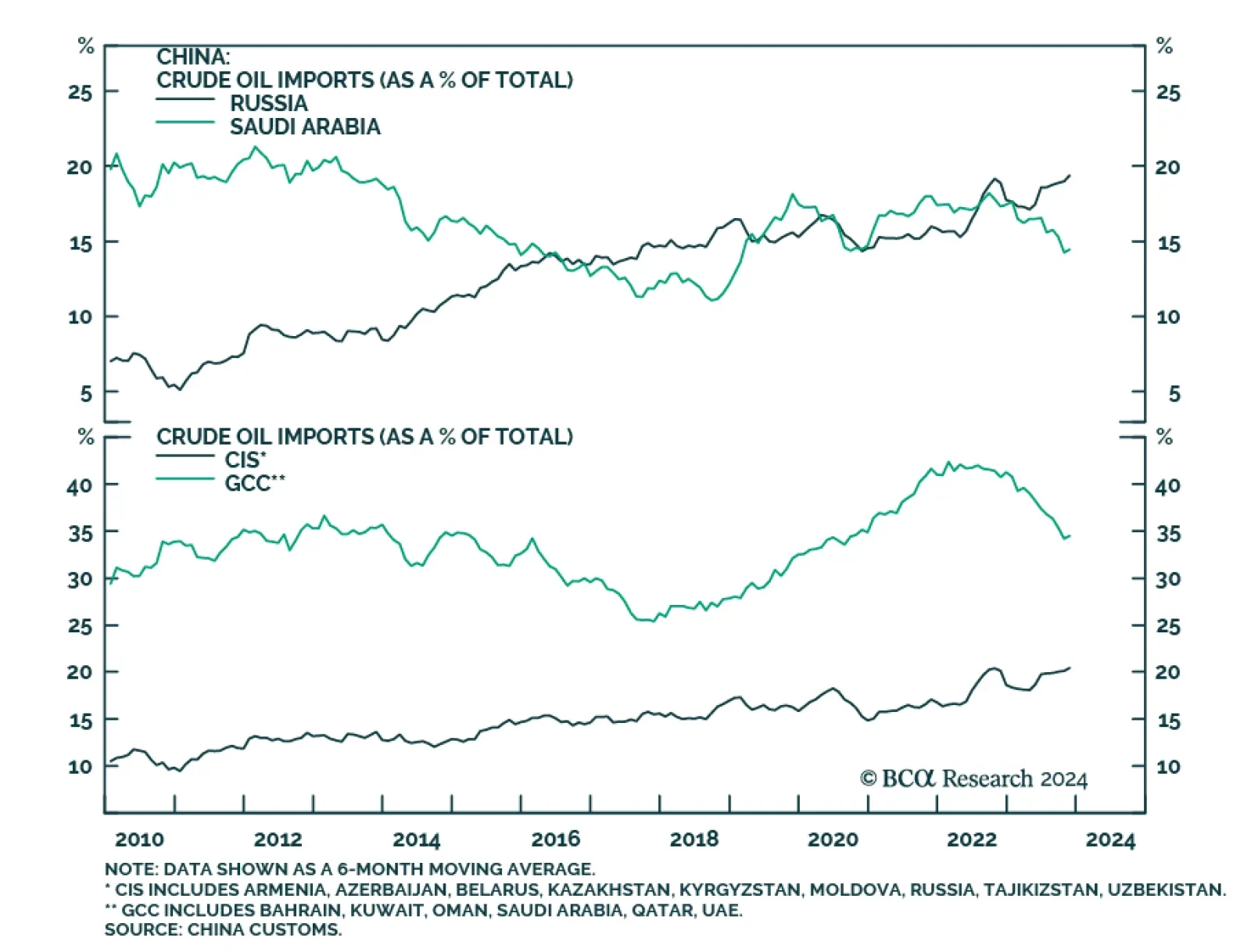

On the surface, domestic economic data painted a mixed picture of conditions in China at the end of 2023. On the positive side, the December trade data beat expectations. The dollar value of Chinese imports expanded by 0.2% y/…

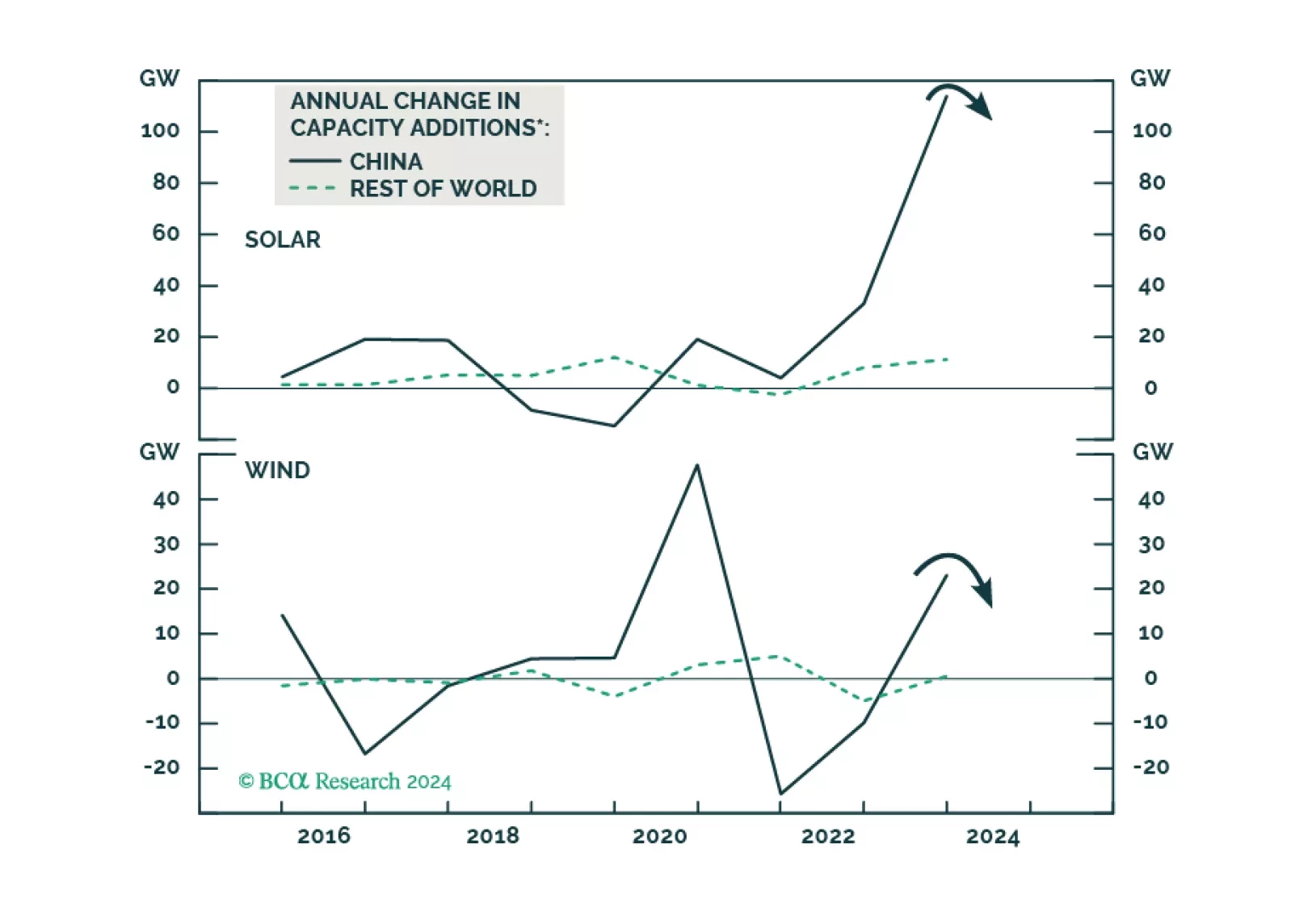

According to BCA Research’s Emerging Markets Strategy service, the recent improvement in global manufacturing and Asian exports will likely prove to be a mid-cycle amelioration rather than a cyclical recovery. Global…