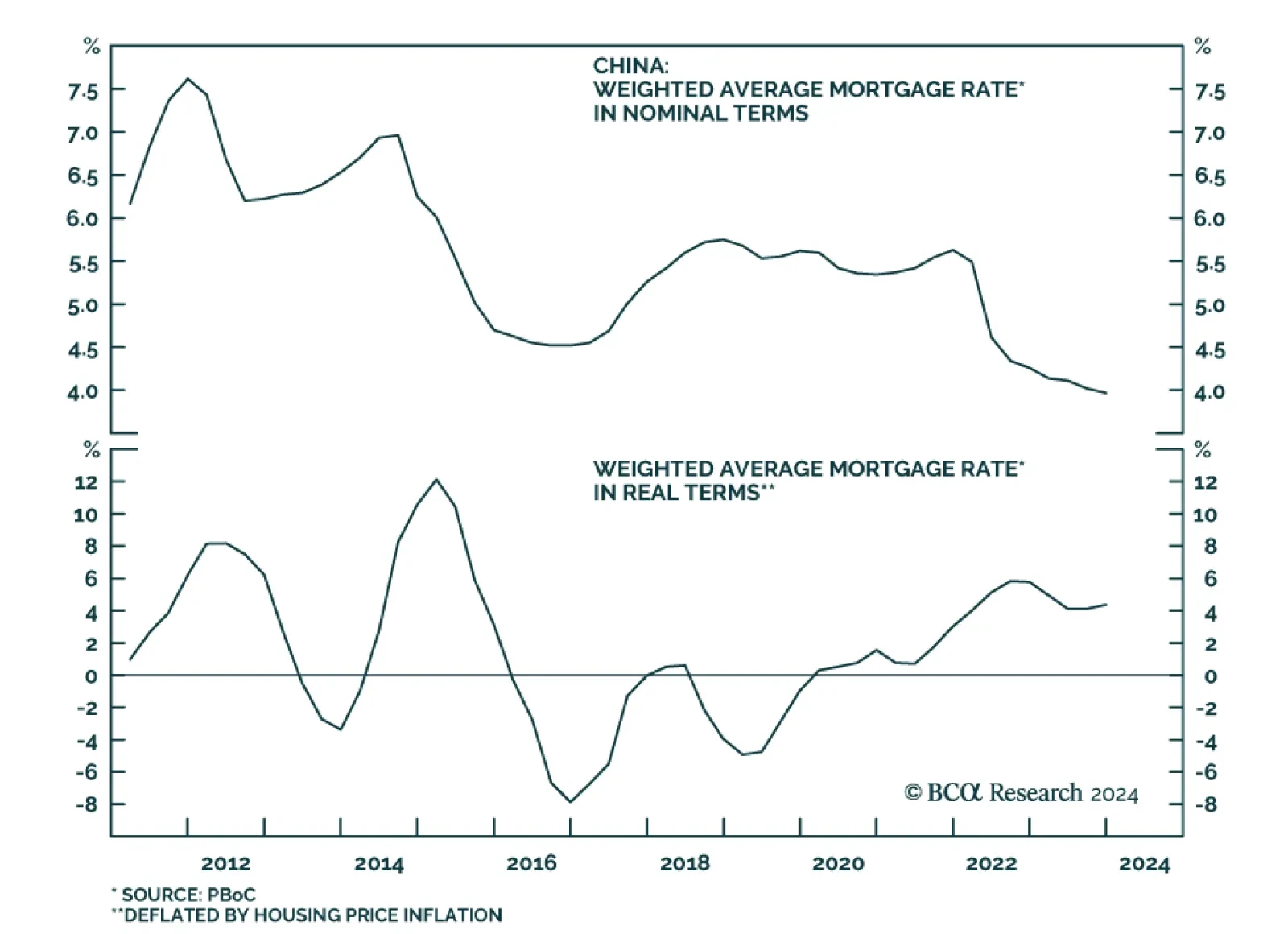

Chinese policymakers surprised on Tuesday with greater-than-anticipated easing for the troubled property market. Although the 1-year loan prime rate (LPR) – the benchmark for most household and corporate loans – was…

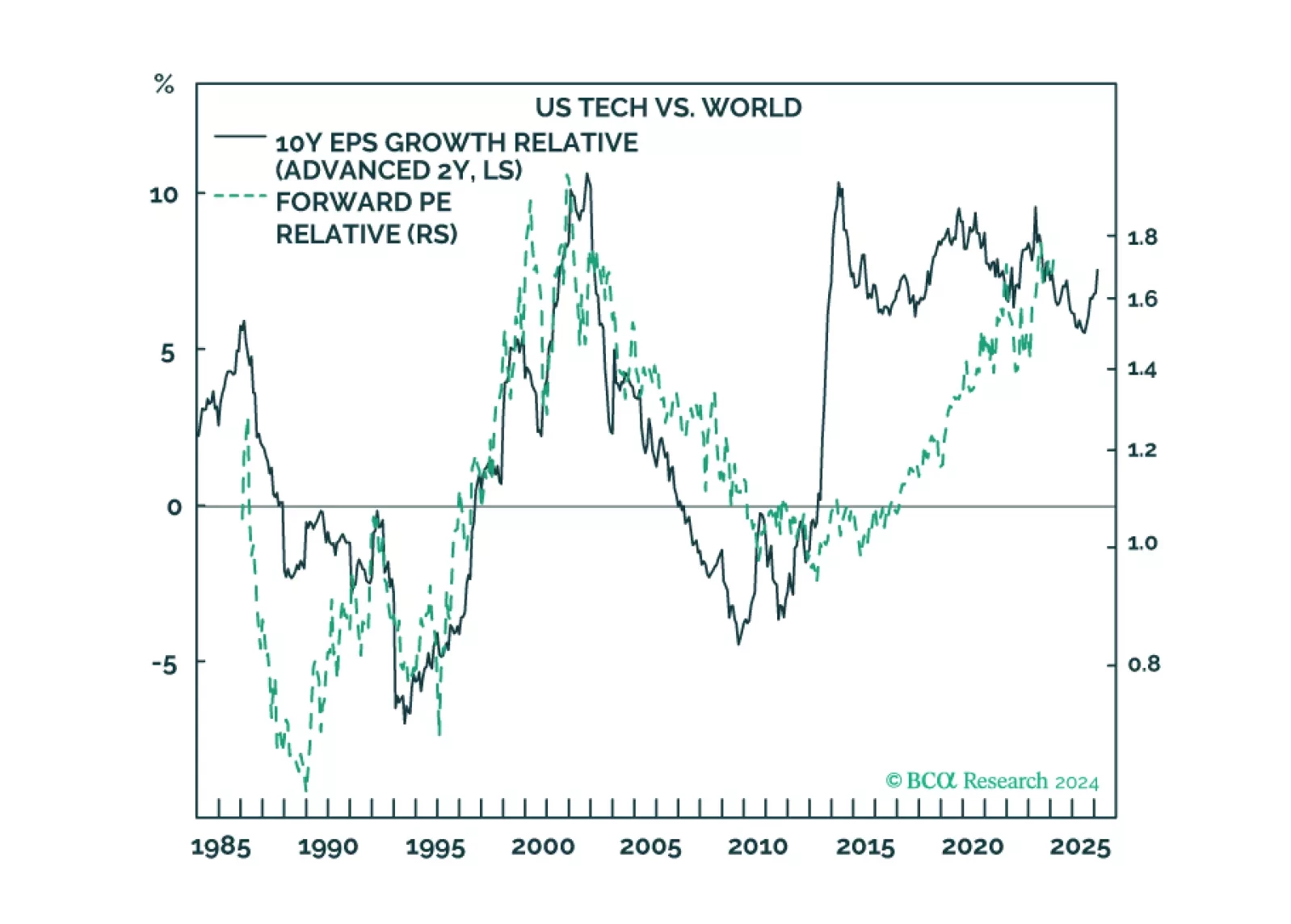

Our Valentine’s Day report is about two love stories: the infatuation with US tech and China’s infatuation with housing. We describe how these love stories will end, and why Europe could be the winner.

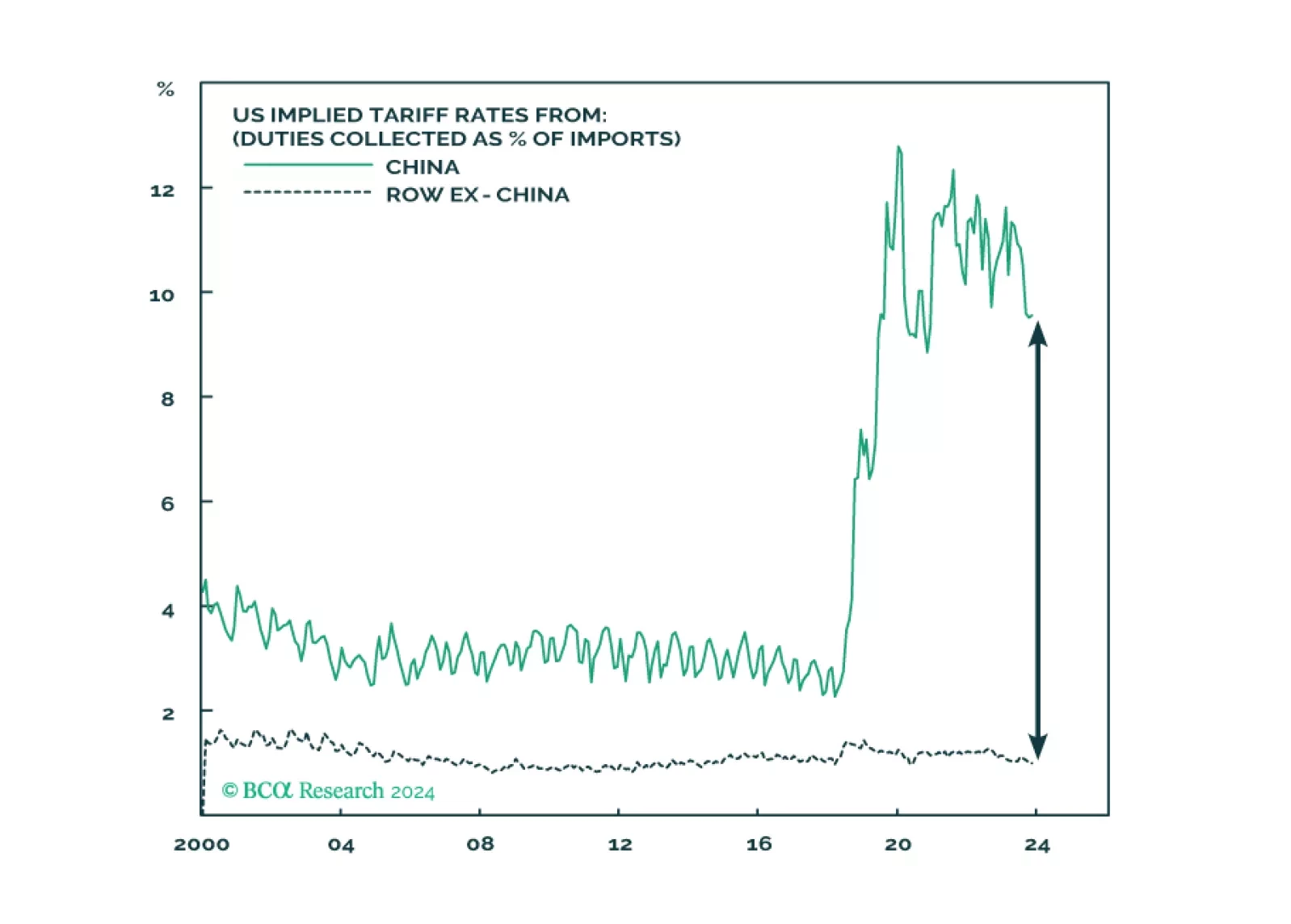

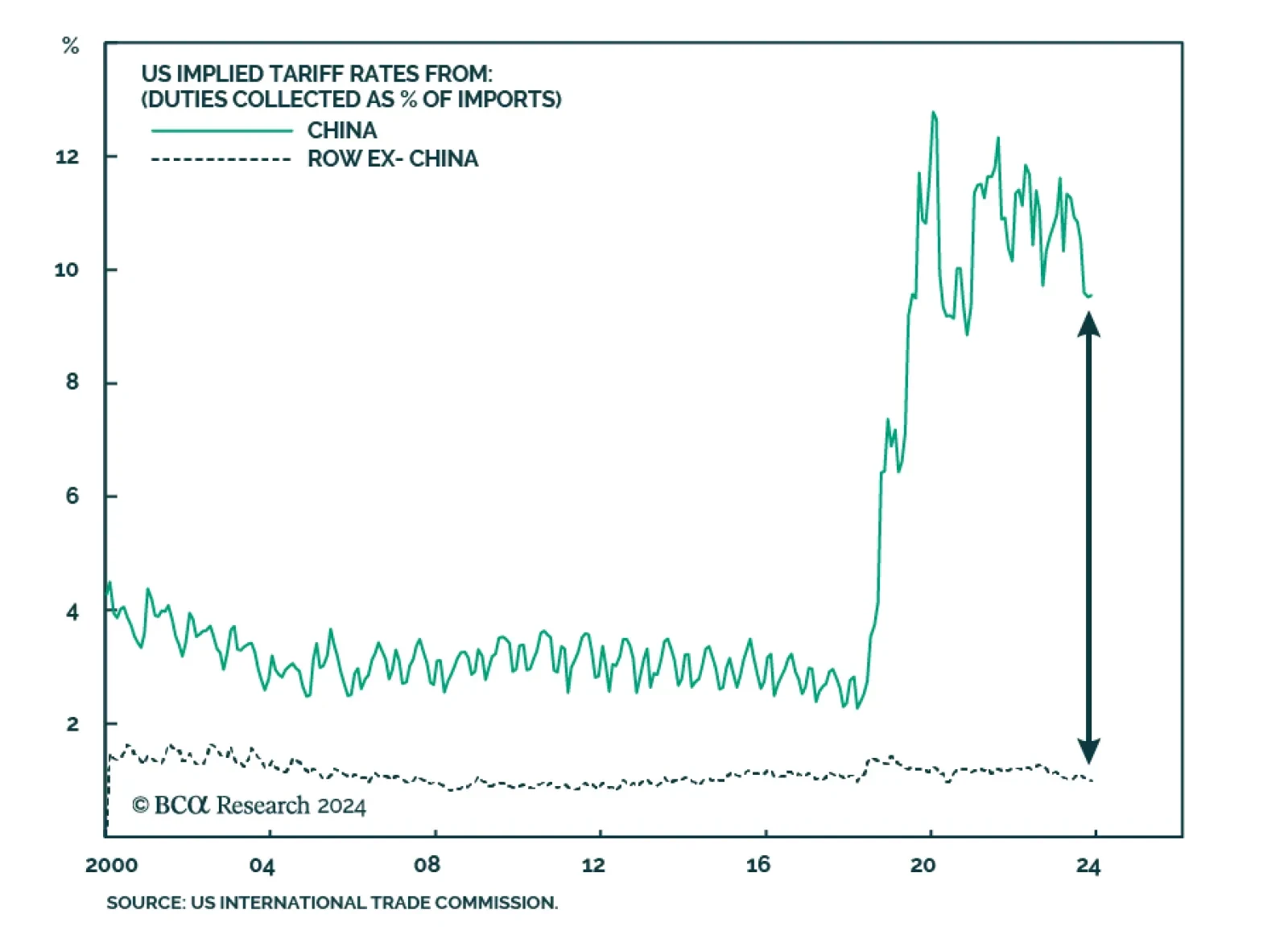

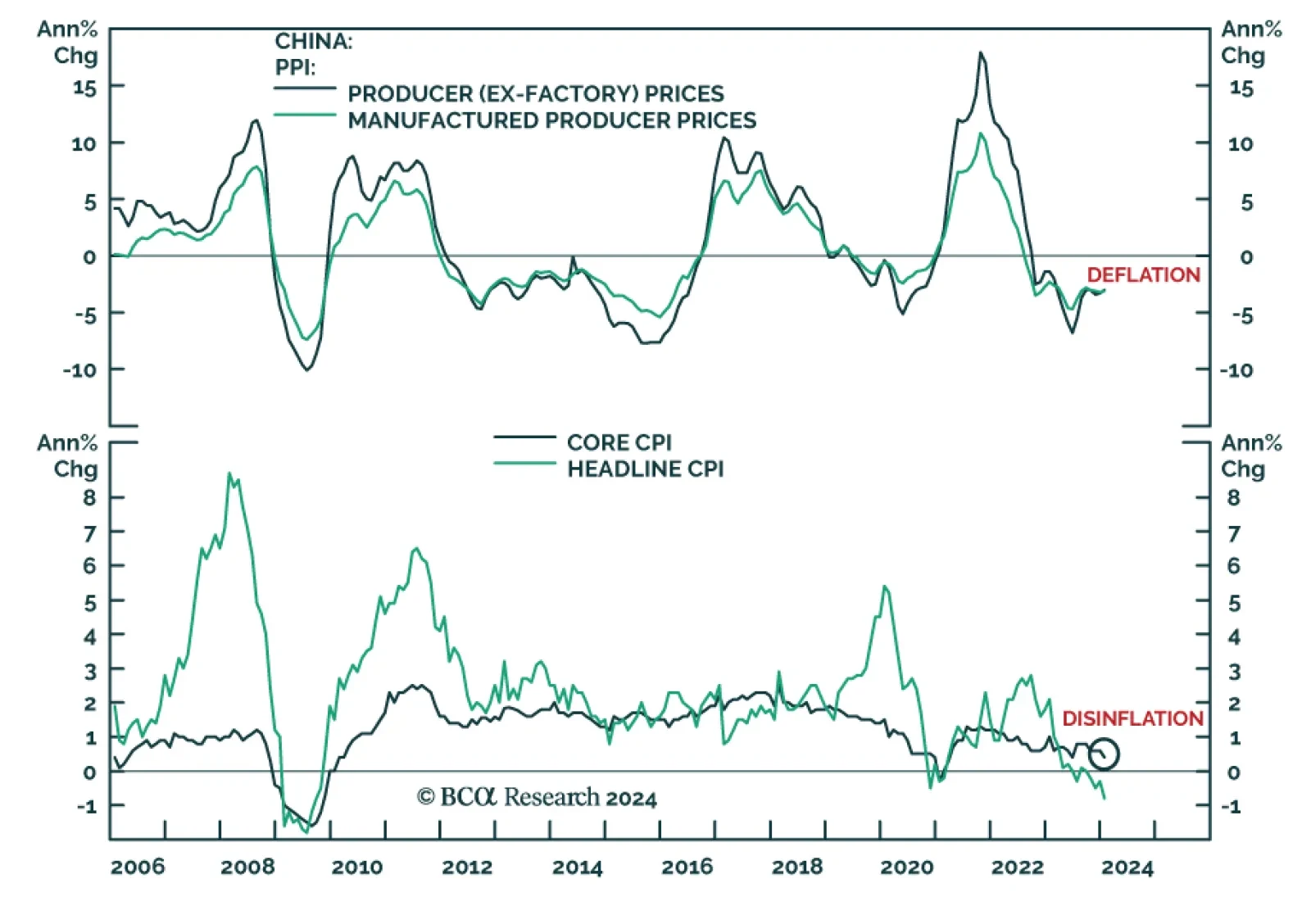

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…

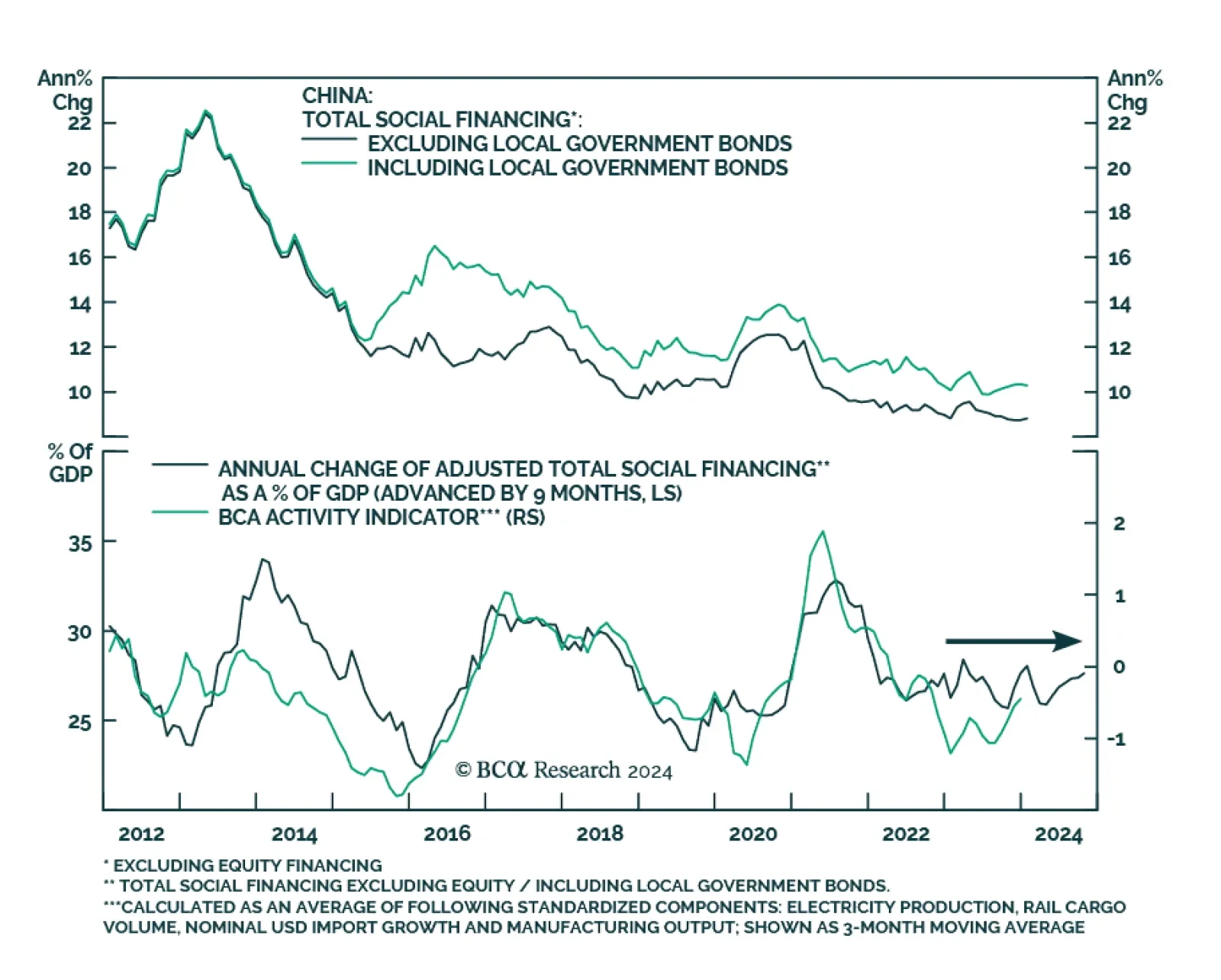

China’s credit data update for January delivered a mixed signal on Friday. The CNY 6.50 trillion increase in aggregate financing beat expectations of CNY 5.60 trillion and marked a significant acceleration from CNY 1.94…

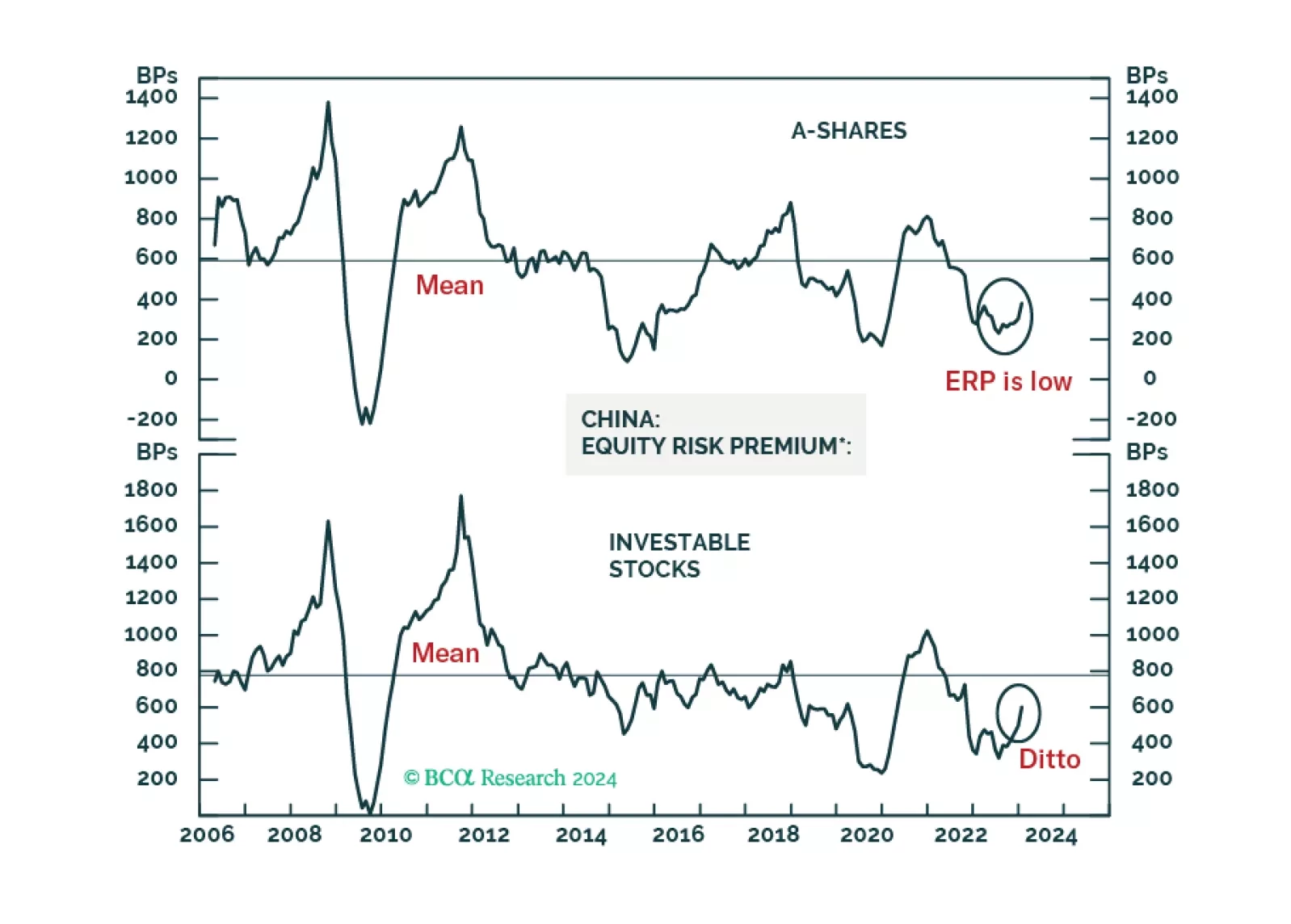

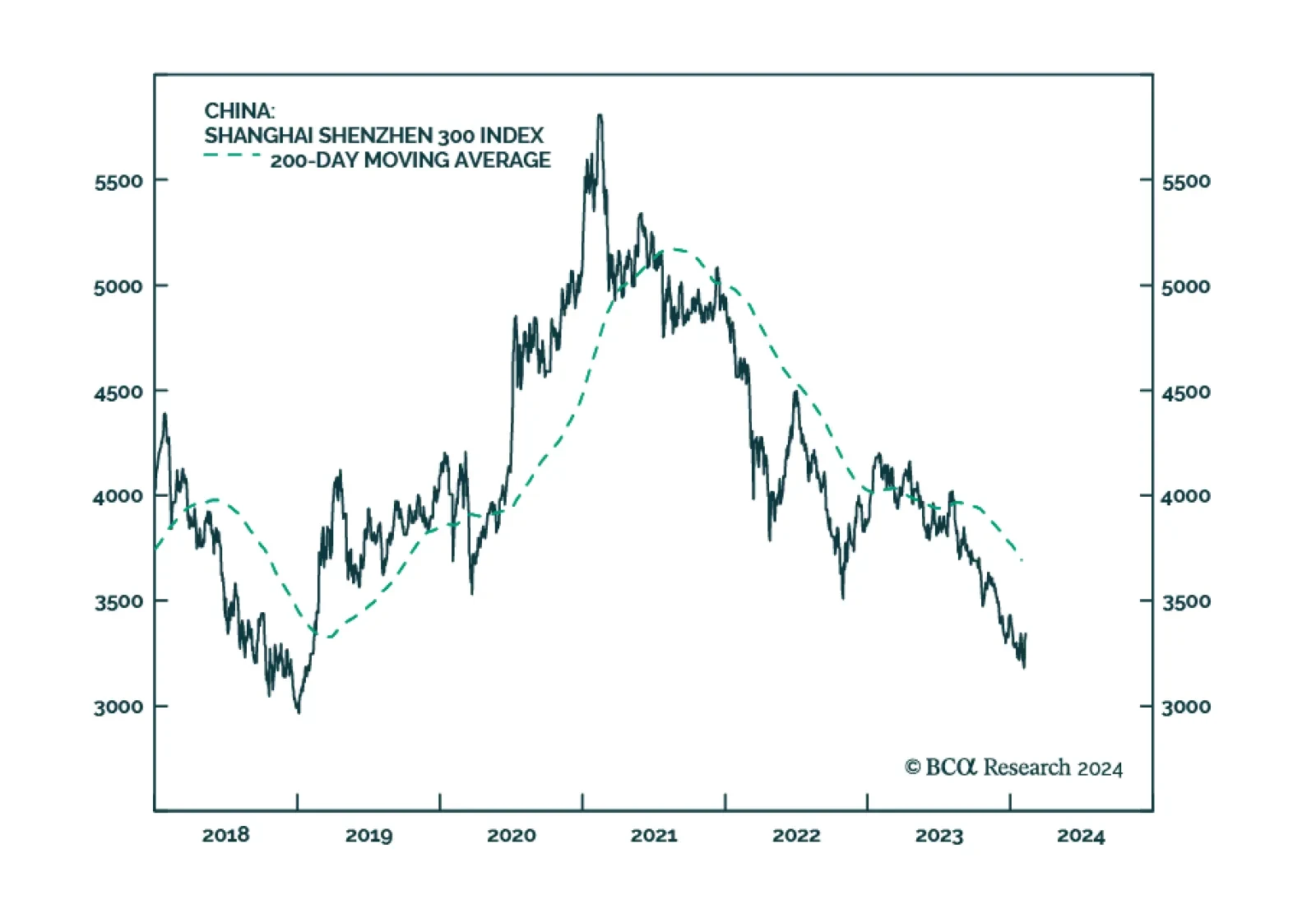

Chinese A-shares will probably begin forming a volatile bottom. The basis is that authorities will likely throw the kitchen sink at the onshore market in an attempt to stabilize share prices. The same is not true for offshore listed…

Thursday’s Chinese CPI and PPI release for January indicates that deflationary pressures continue to dominate the domestic economy. On the consumer side, prices registering the fastest pace of annual decline in 15 years.…

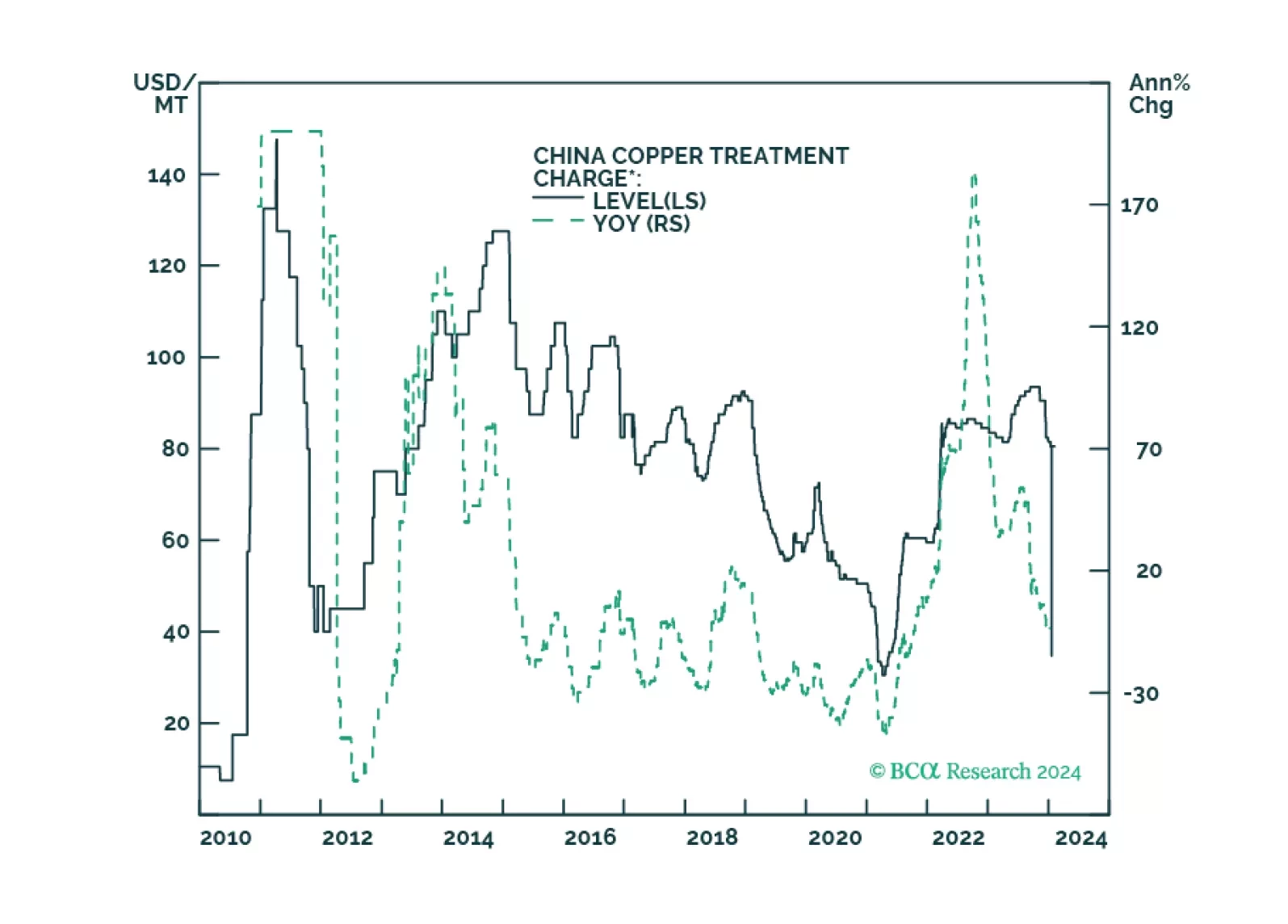

Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

Chinese domestic stocks have fared quite poorly over the past year. Since late-January 2023, the Shanghai Shenzhen 300 index fell roughly 24% to last week’s low, driven by ongoing weakness in China’s economy and a…

Our Portfolio Allocation Summary for February 2024.