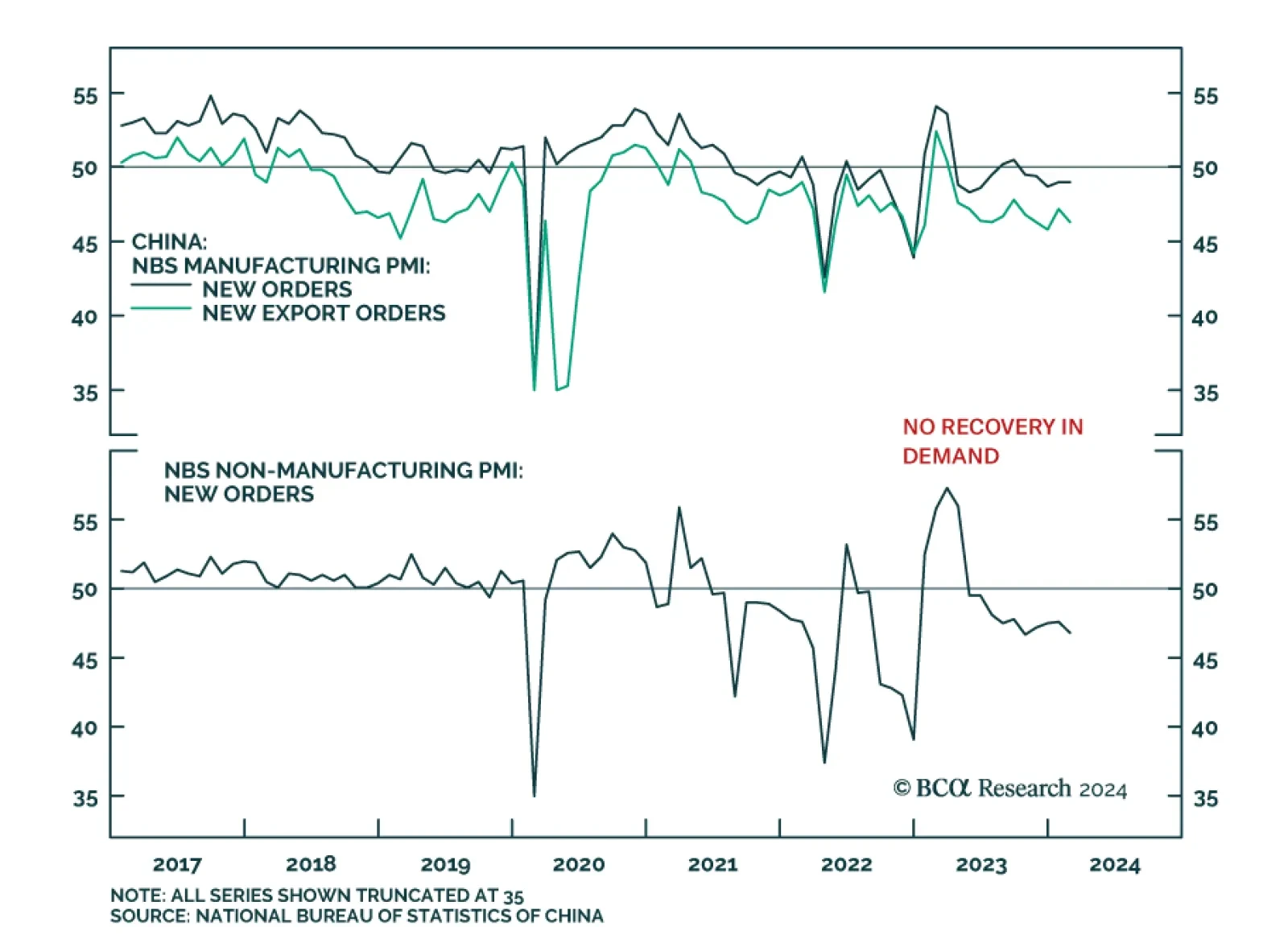

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

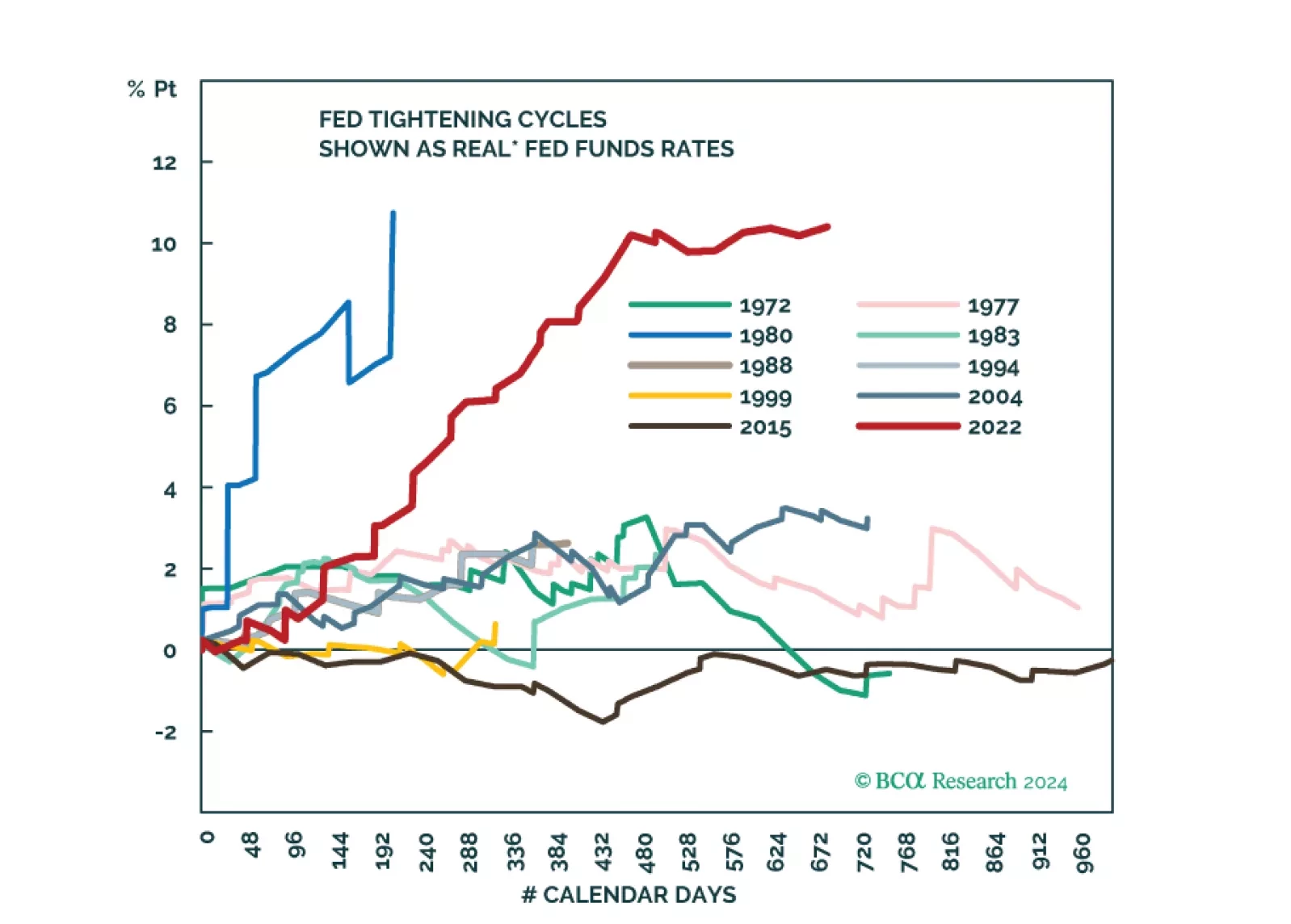

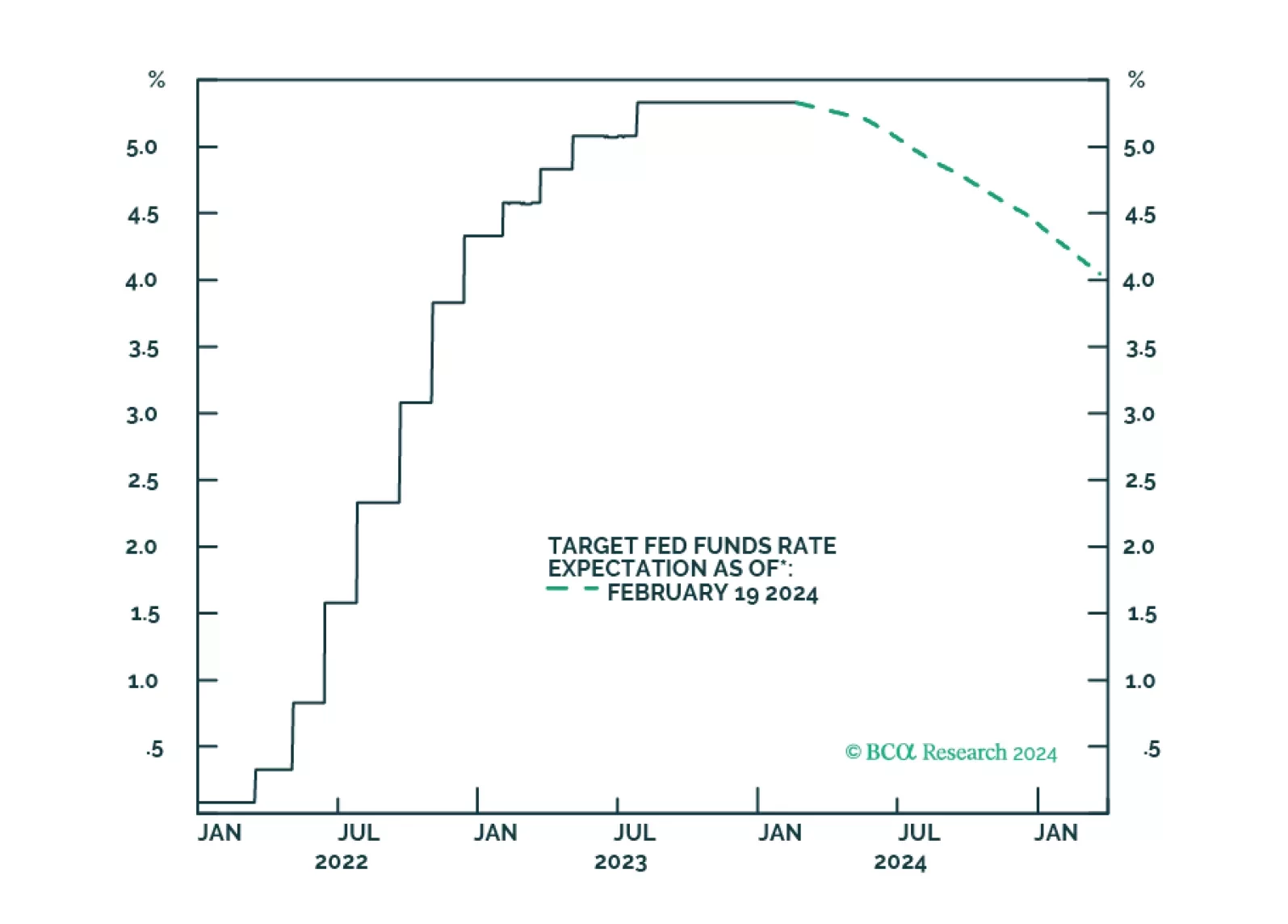

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

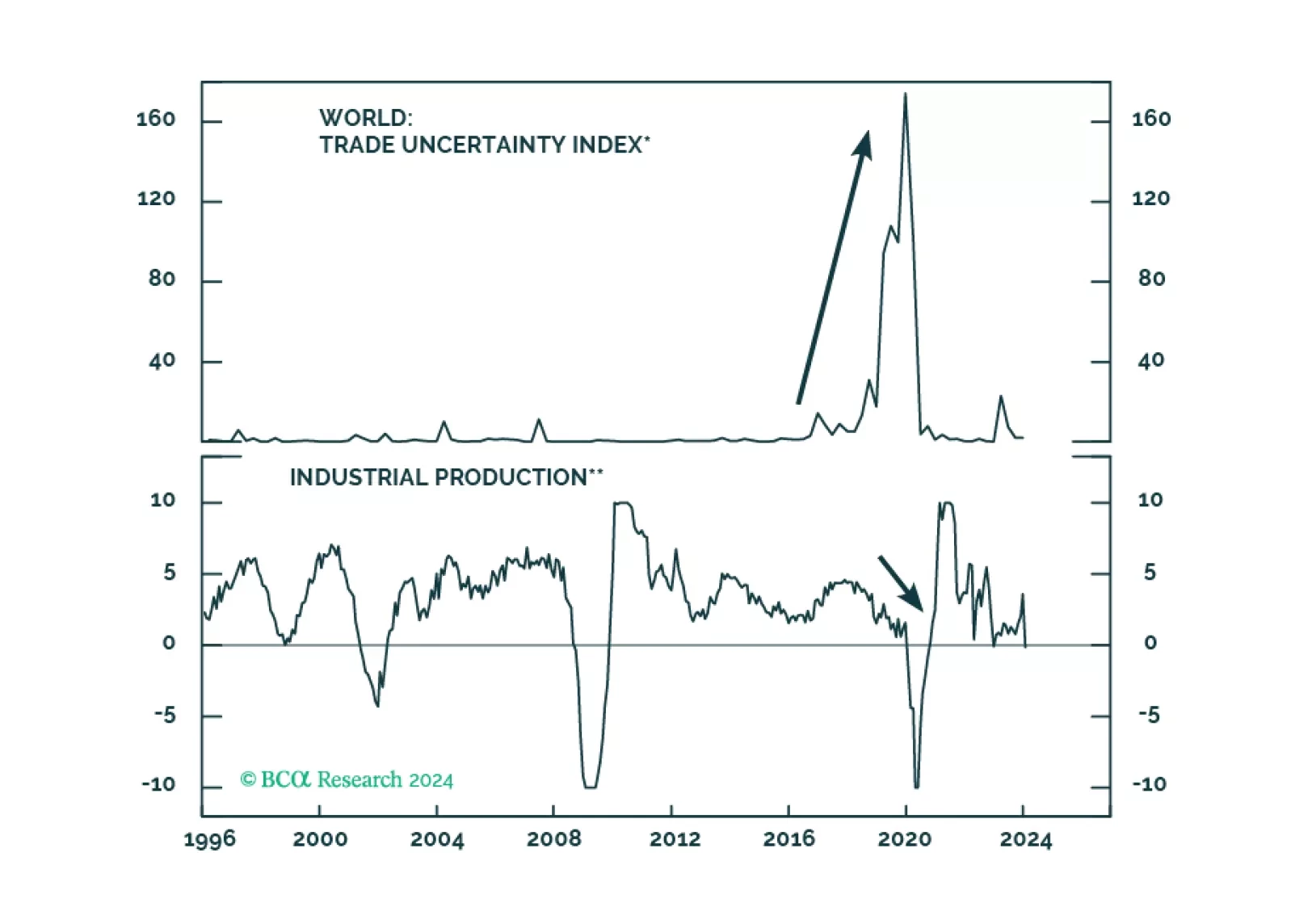

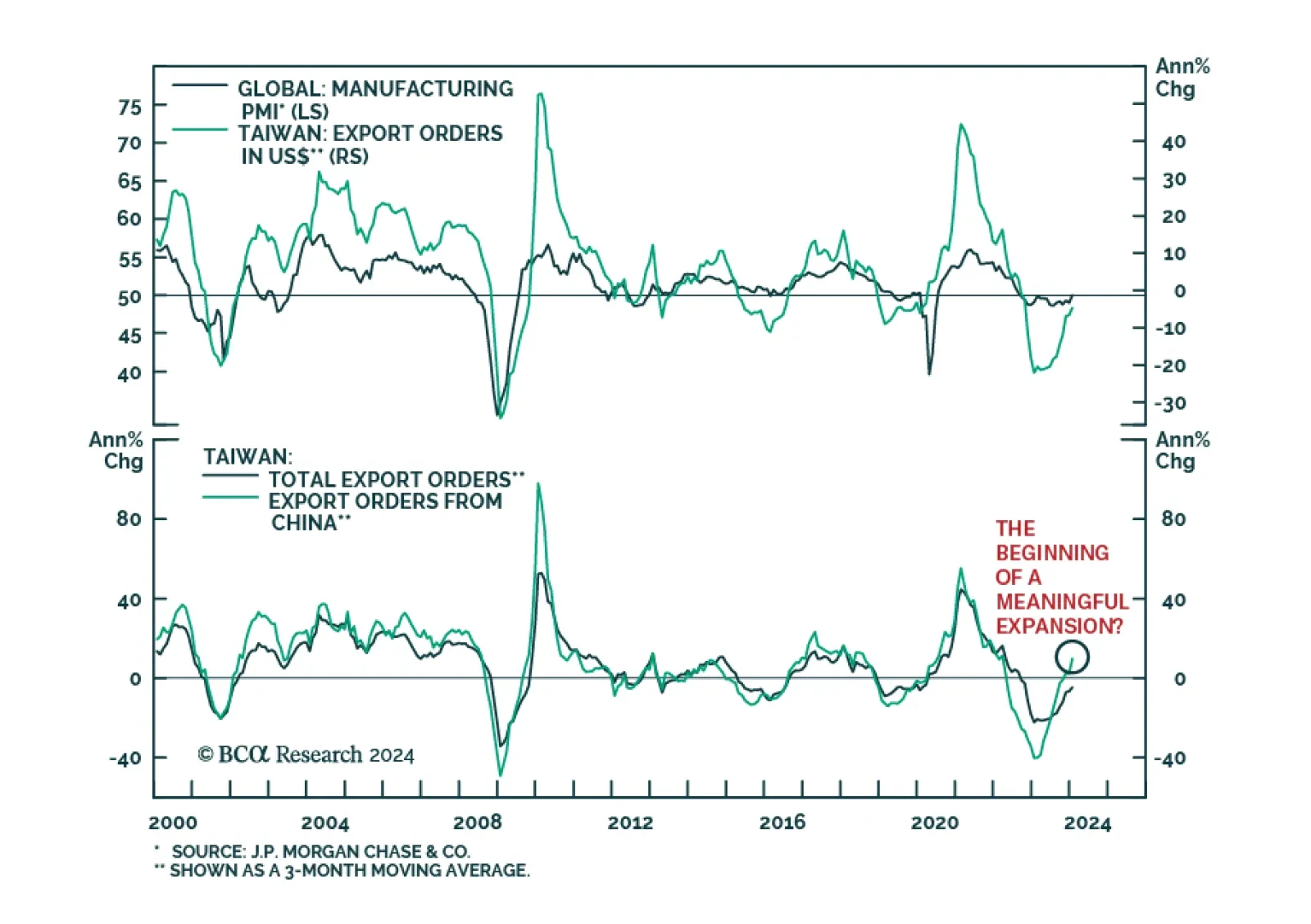

On the surface, the latest Taiwanese export orders release delivered a positive signal on the global trade cycle. The 1.9% y/y expansion in January marks a significant improvement from the 16.0% contraction in December. Moreover…

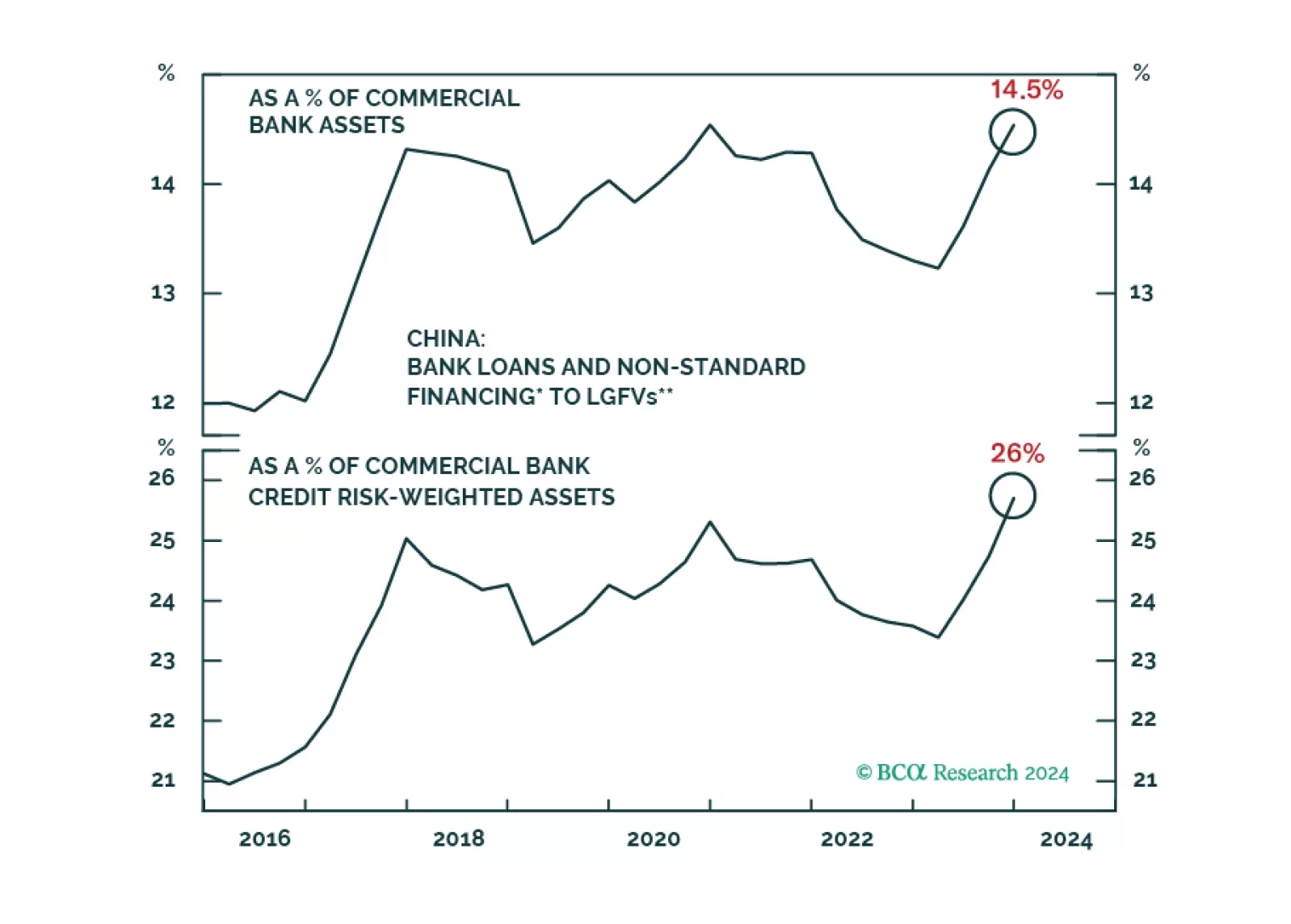

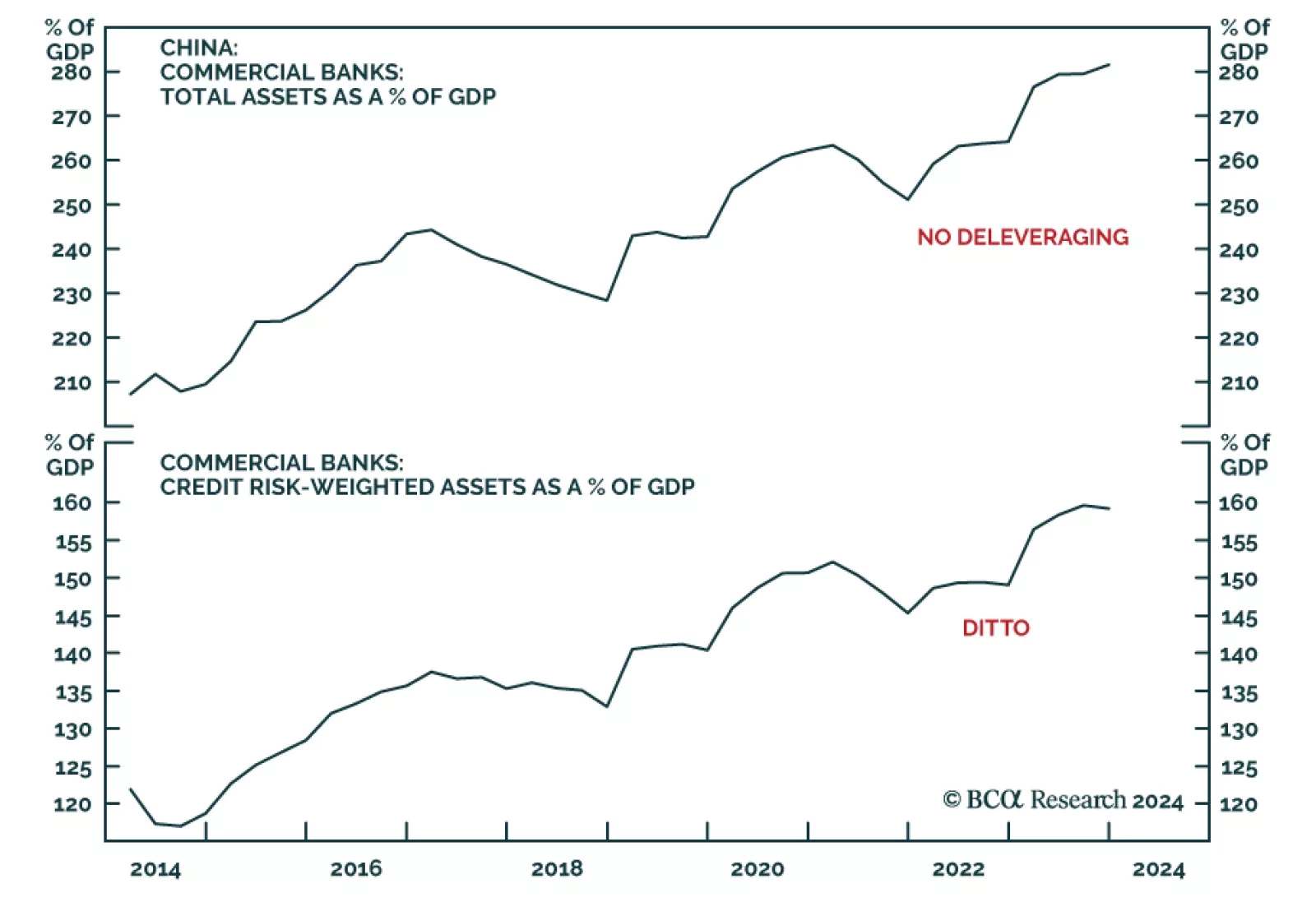

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

While efforts by policymakers to stabilize the stock market are buoying Chinese equities, domestic economic data remains soggy. Home prices declined further on both a monthly and annual basis in January, reinforcing the…

Seasonal weather and price variability in the first quarter will dissipate, which will reduce the agita caused by the recent inflation scare. This will increase the Fed’s comfort level in initiating a rate-cutting cycle in June with…

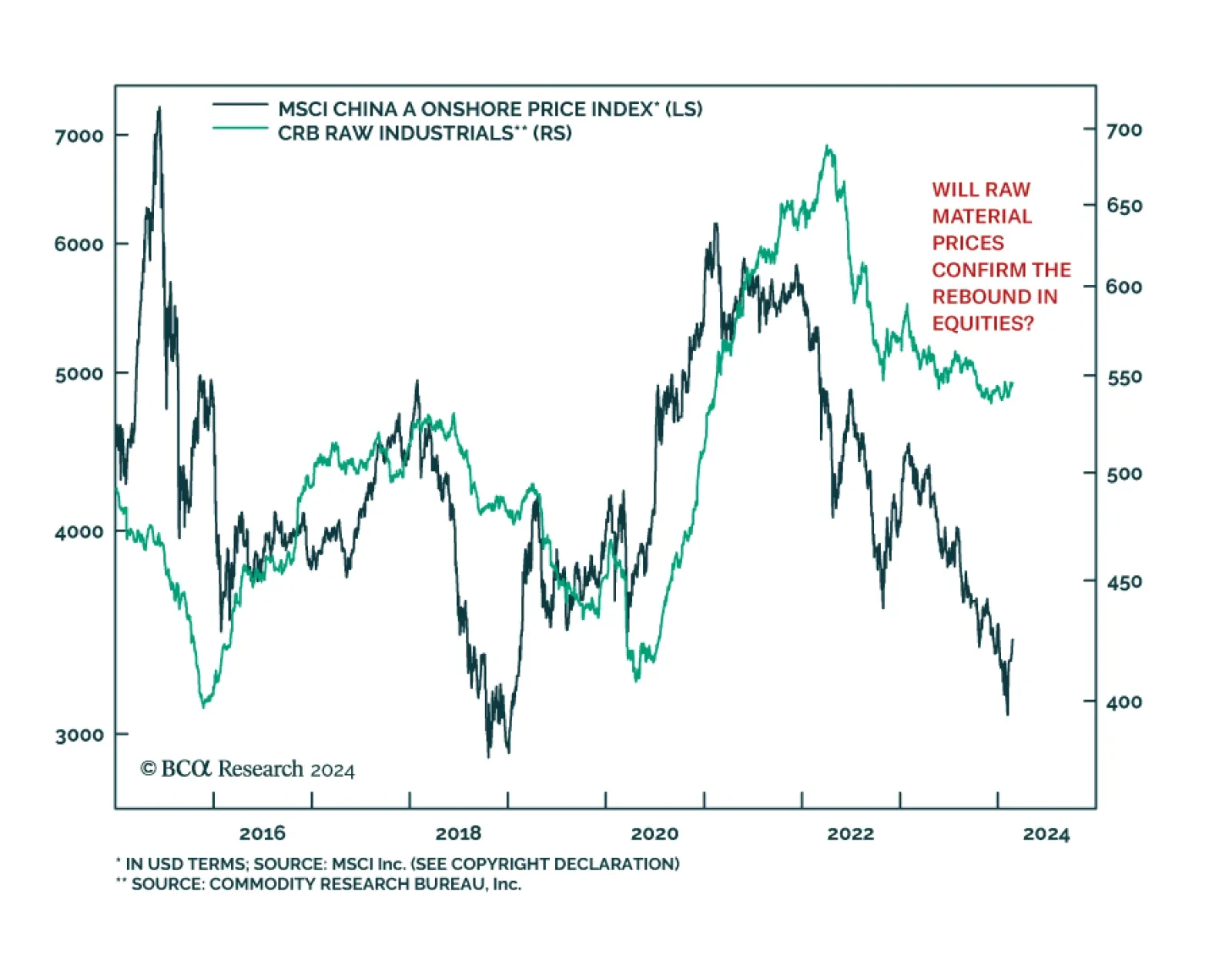

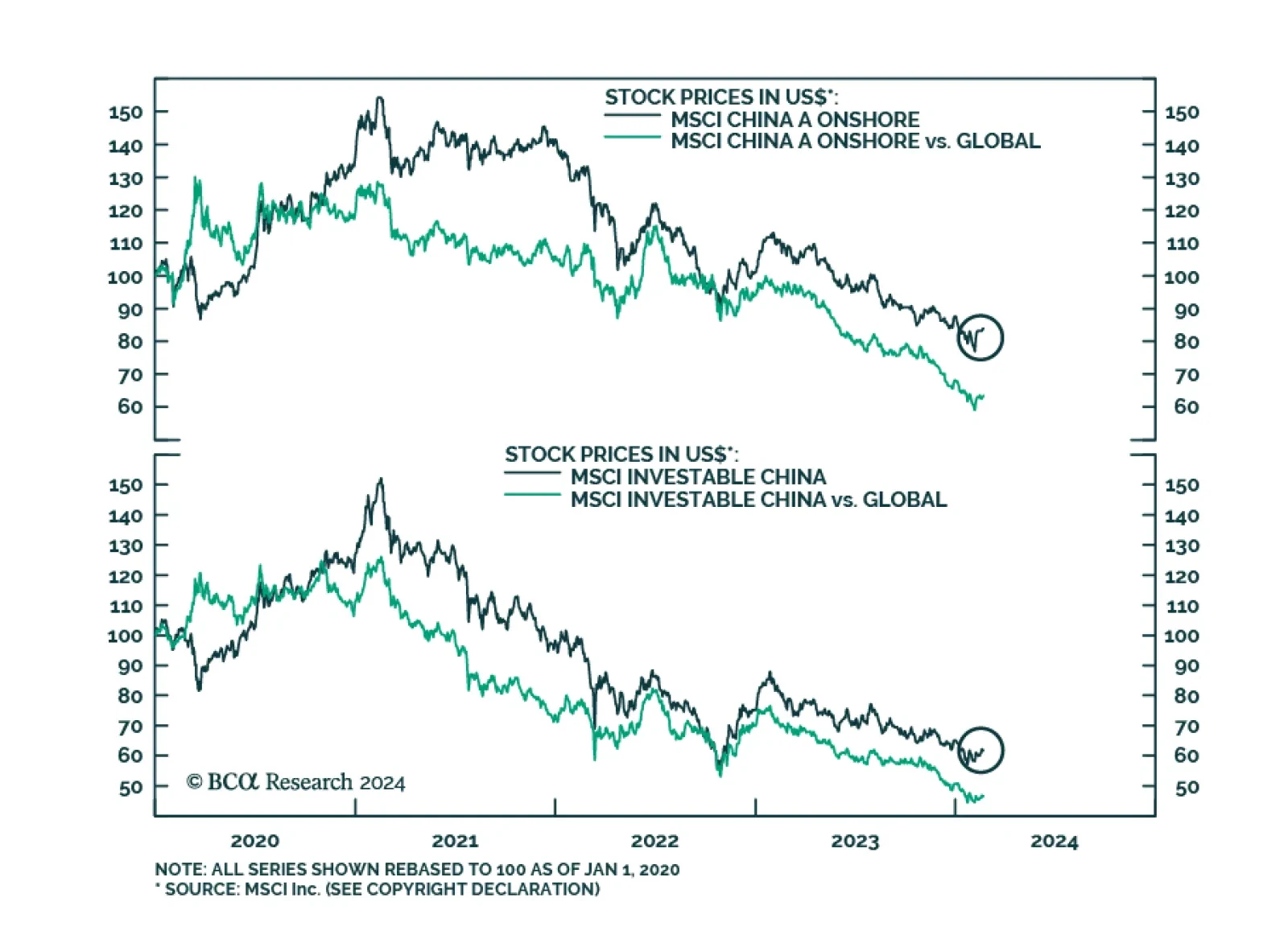

Chinese equities are extending their gains following the end of the Lunar New Year holiday. Onshore stocks have gained 9.0% since February 5, outperforming the global benchmark by 7.5 percentage points over this period. Similarly…

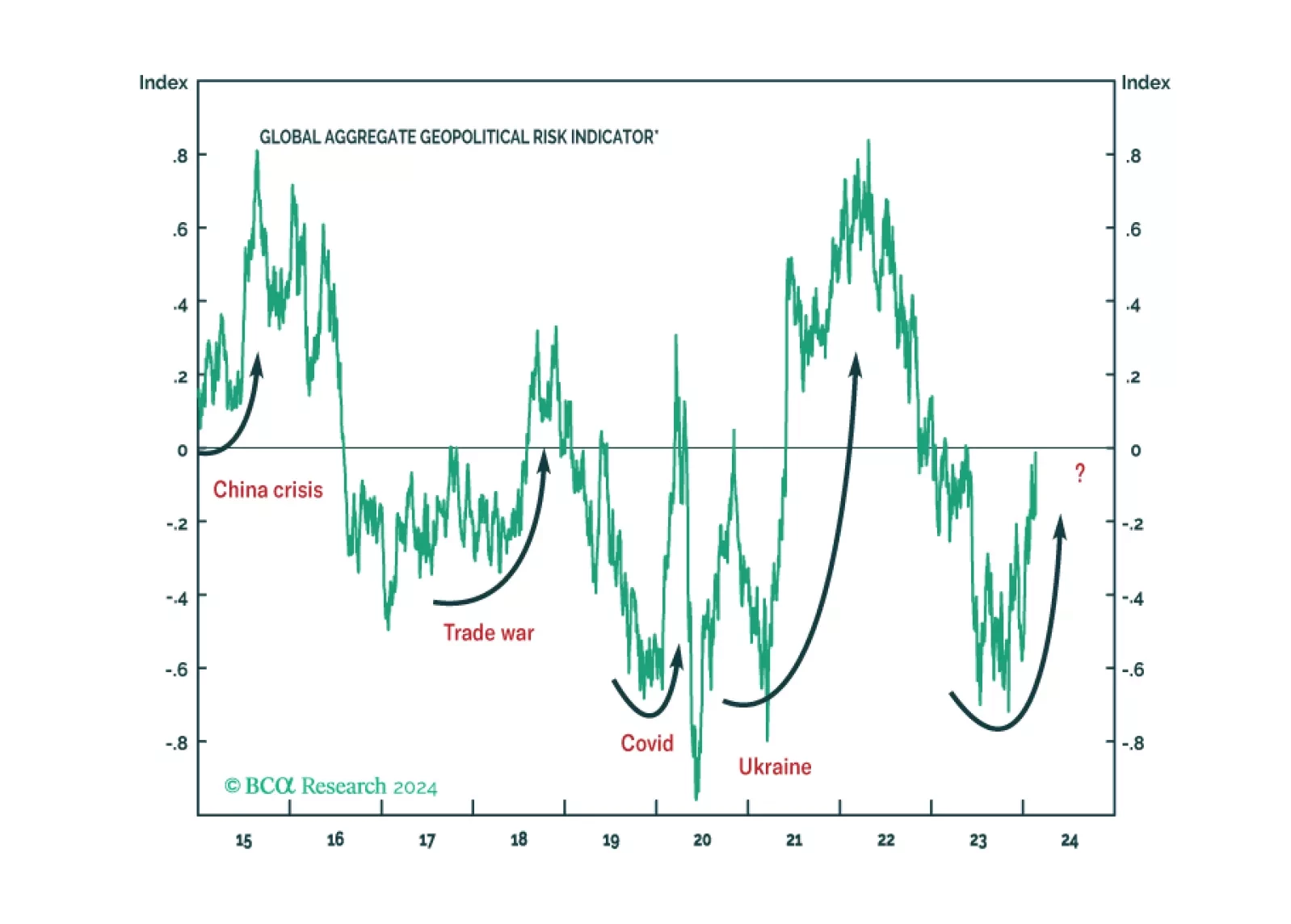

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…