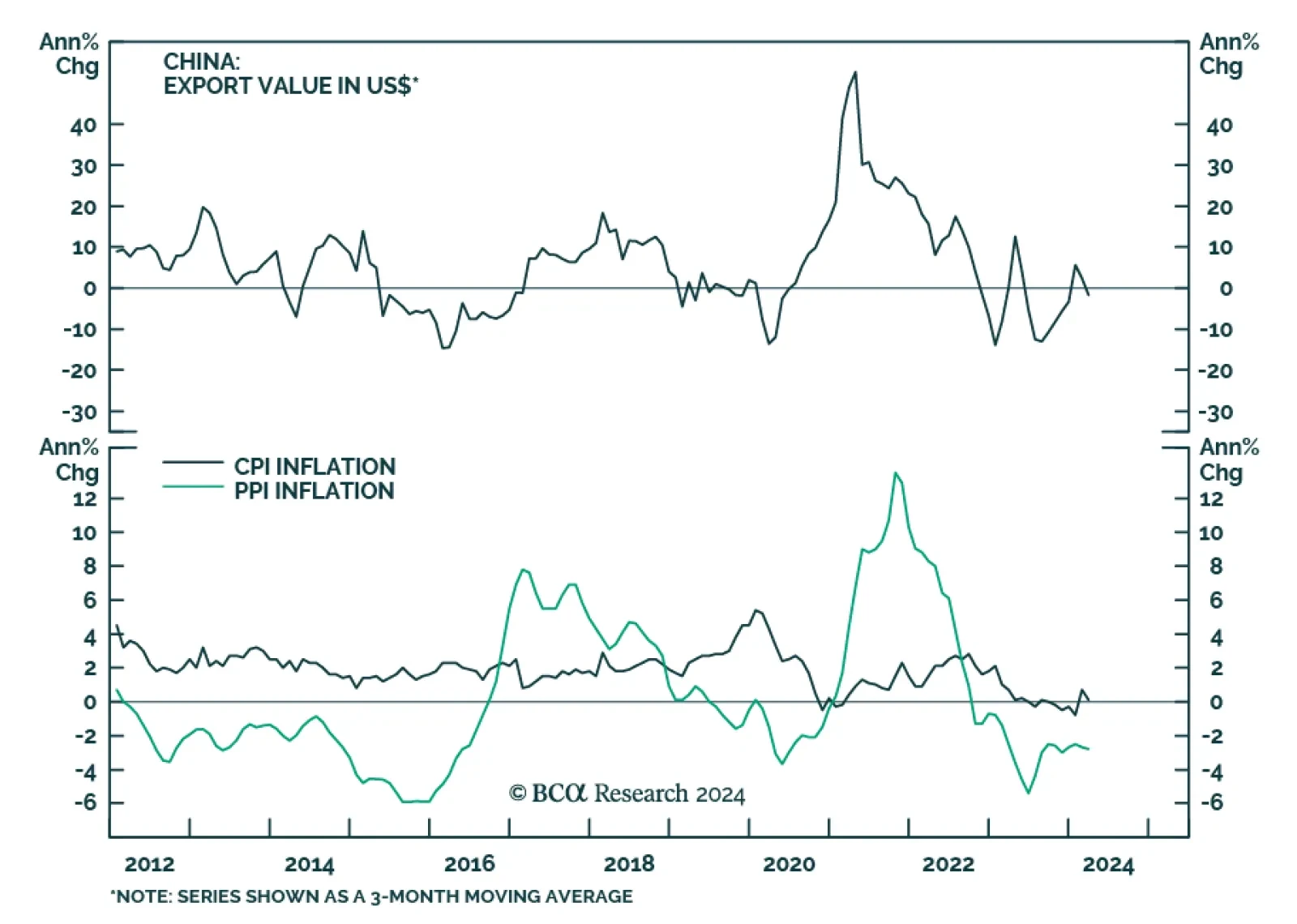

Chinese trade and credit data delivered a negative surprise for March. On the trade front, the 7.5% y/y drop in exports came in below expectations of a 1.9% y/y decline following four consecutive months of growth. While the jump…

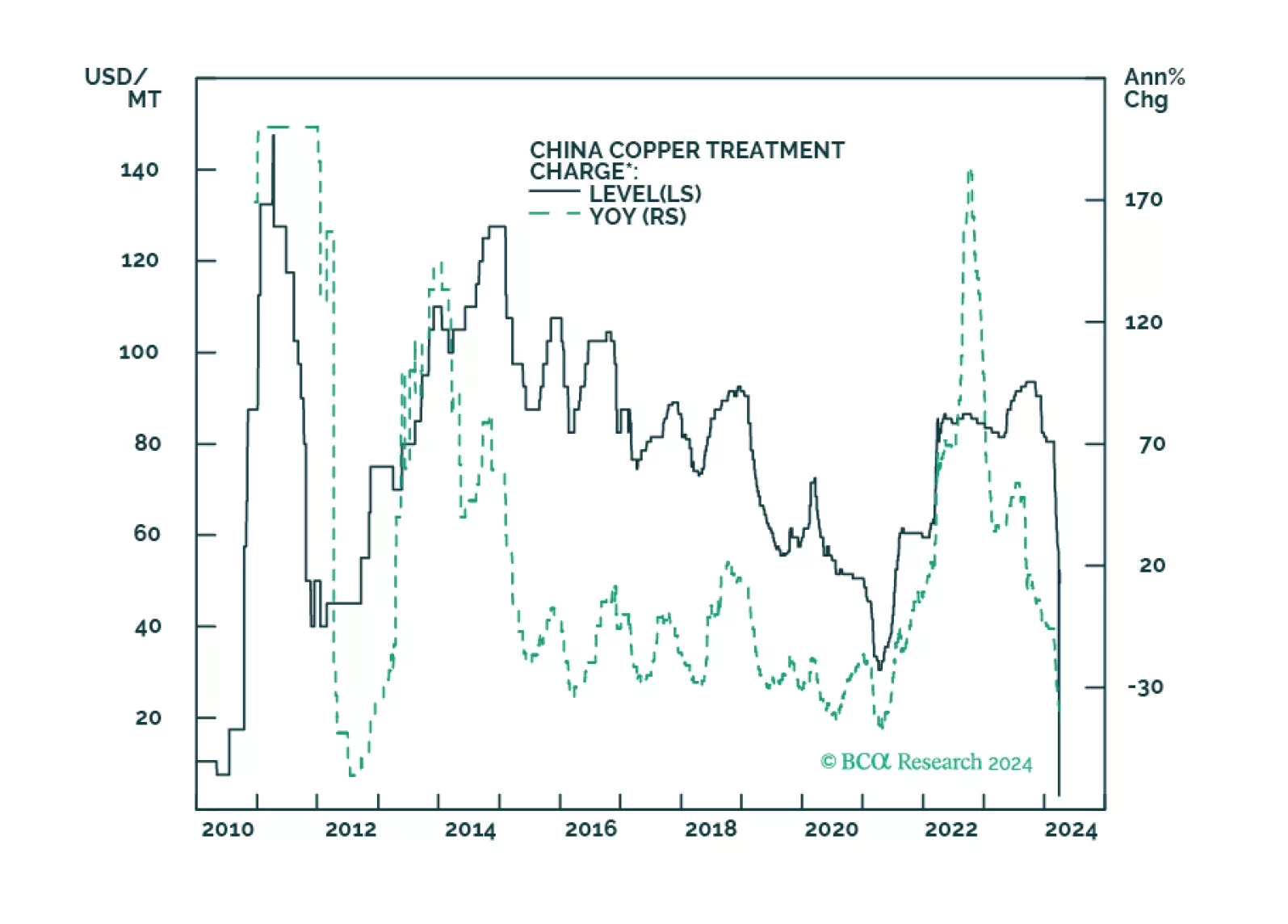

Copper markets are fast approaching a price breakout, as Chinese smelters scramble to find ore to meet increasing refined-copper demand in the wake of a global manufacturing rebound. We are holding fast to our expectation of $4.50/lb…

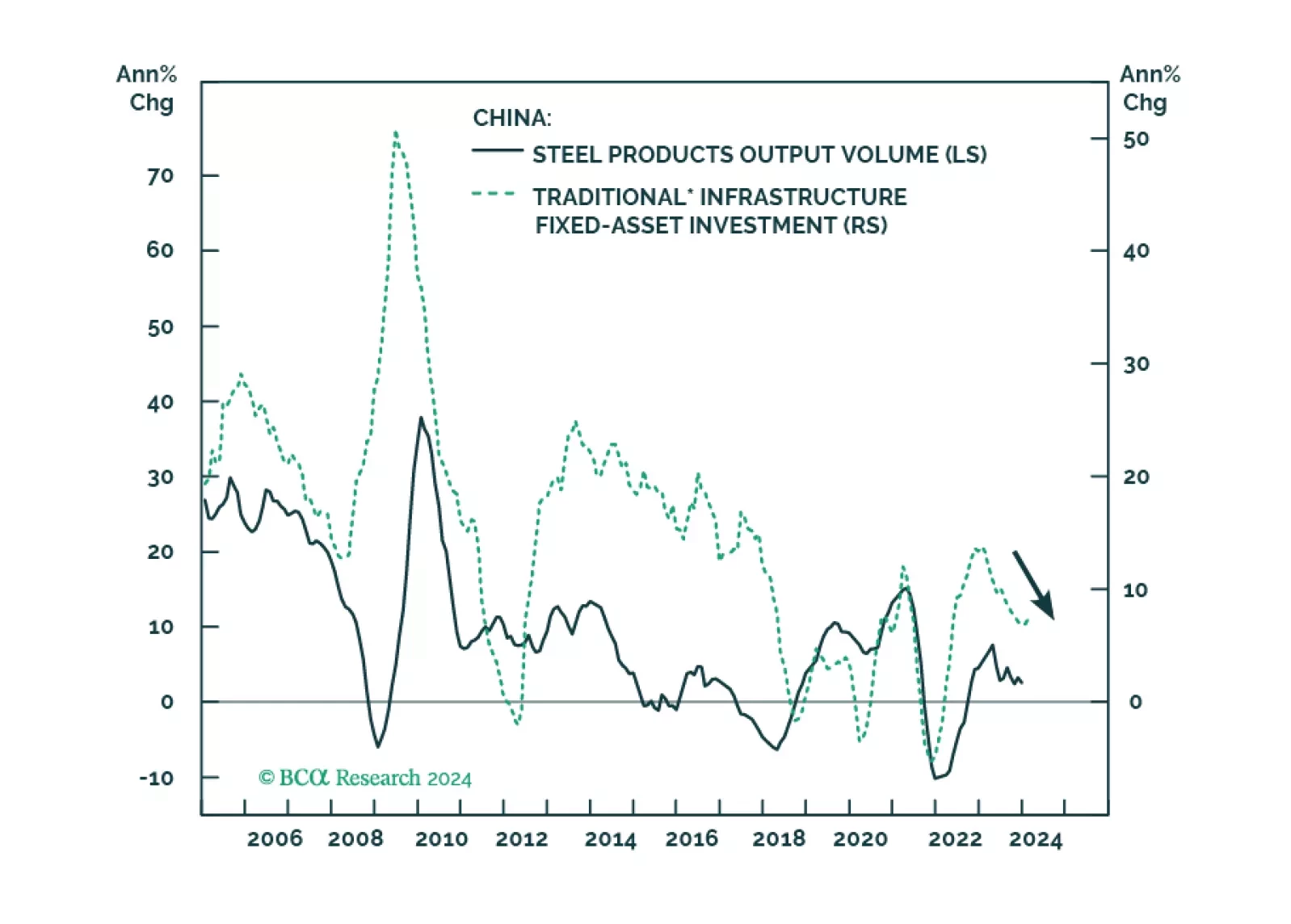

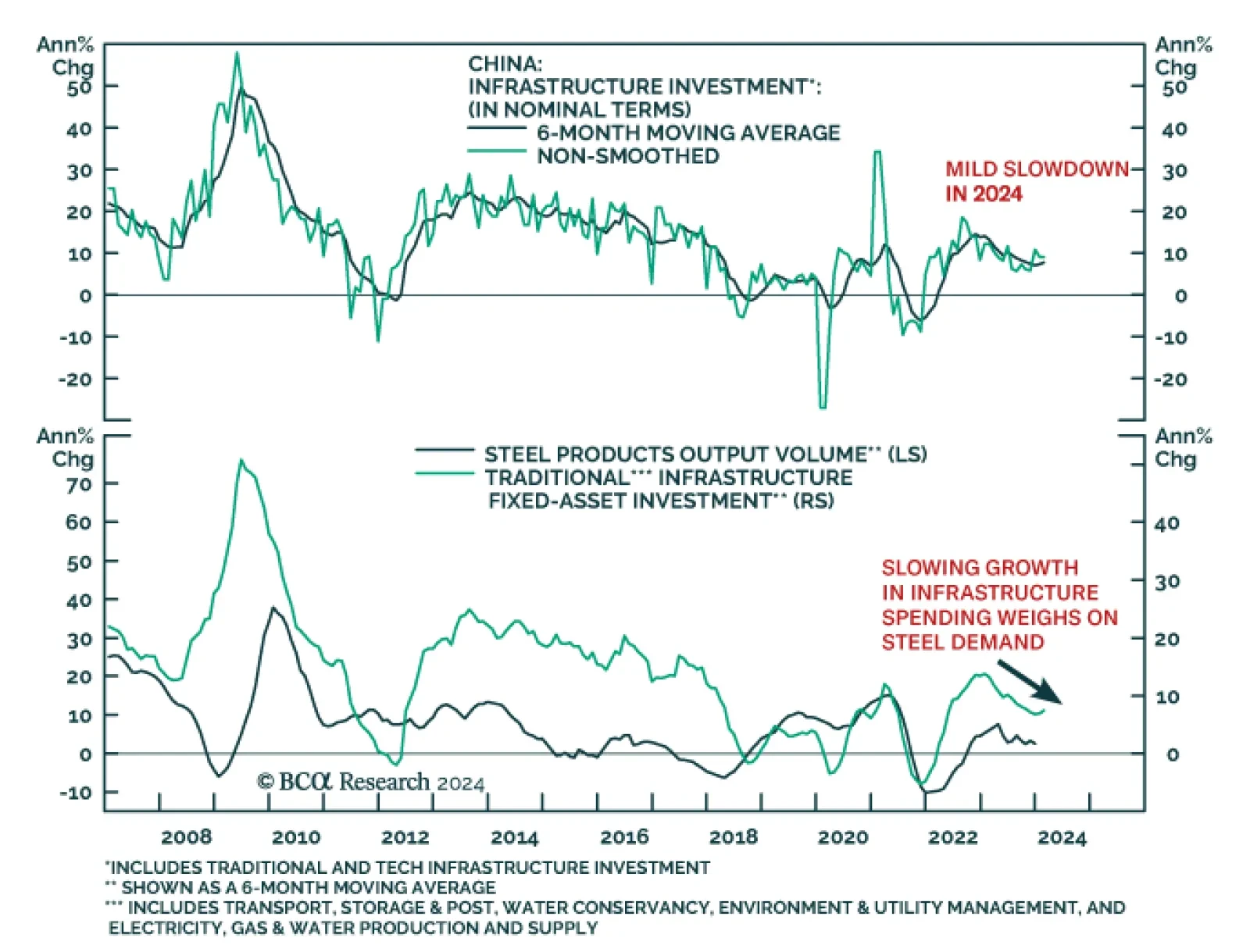

According to BCA Research’s China Investment Strategy service, the growth rate of China’s infrastructure investment will likely slow from a nominal 9% last year to about 6% this year. Funding constraints will limit…

Our Portfolio Allocation Summary for April 2024.

The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

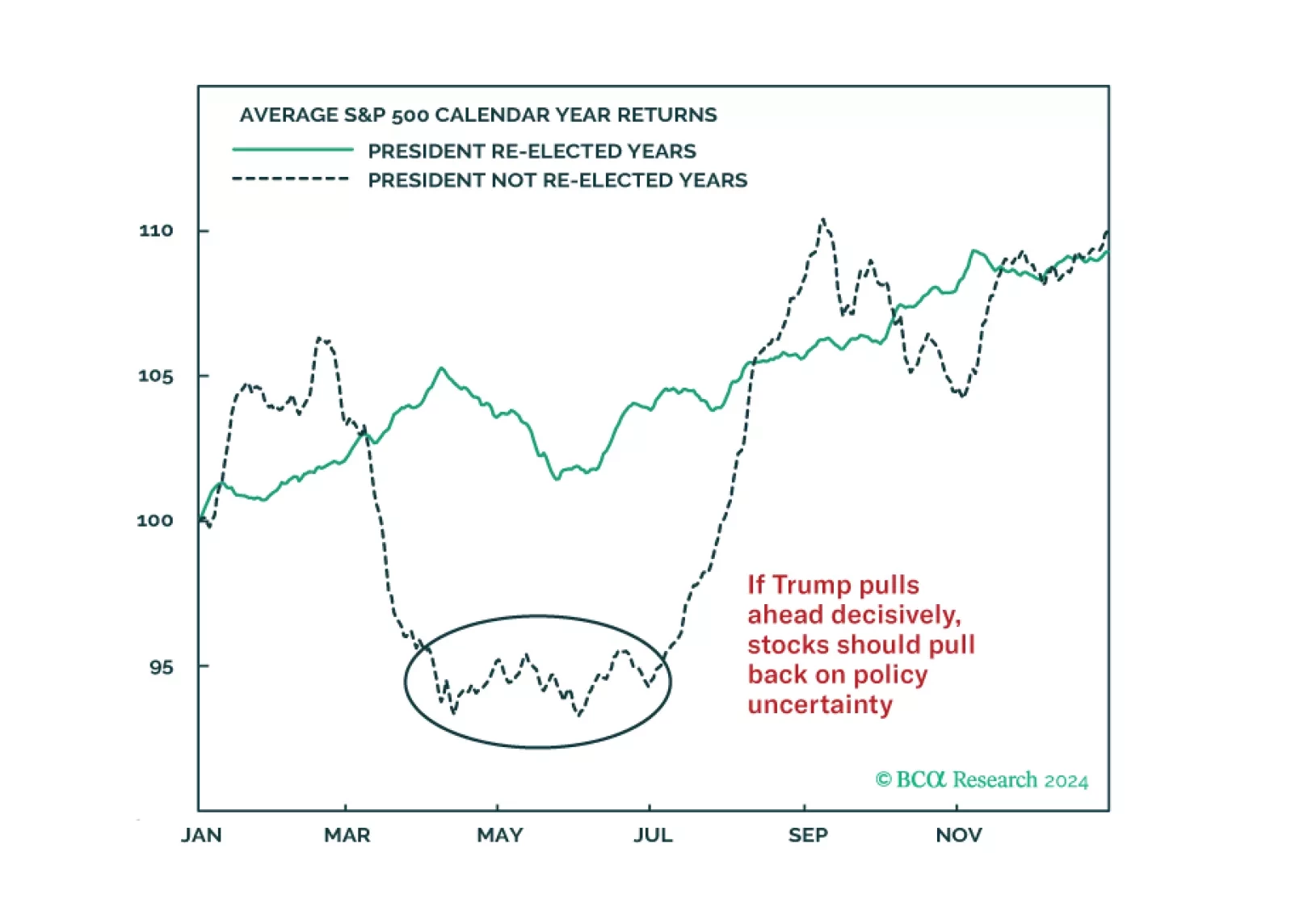

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

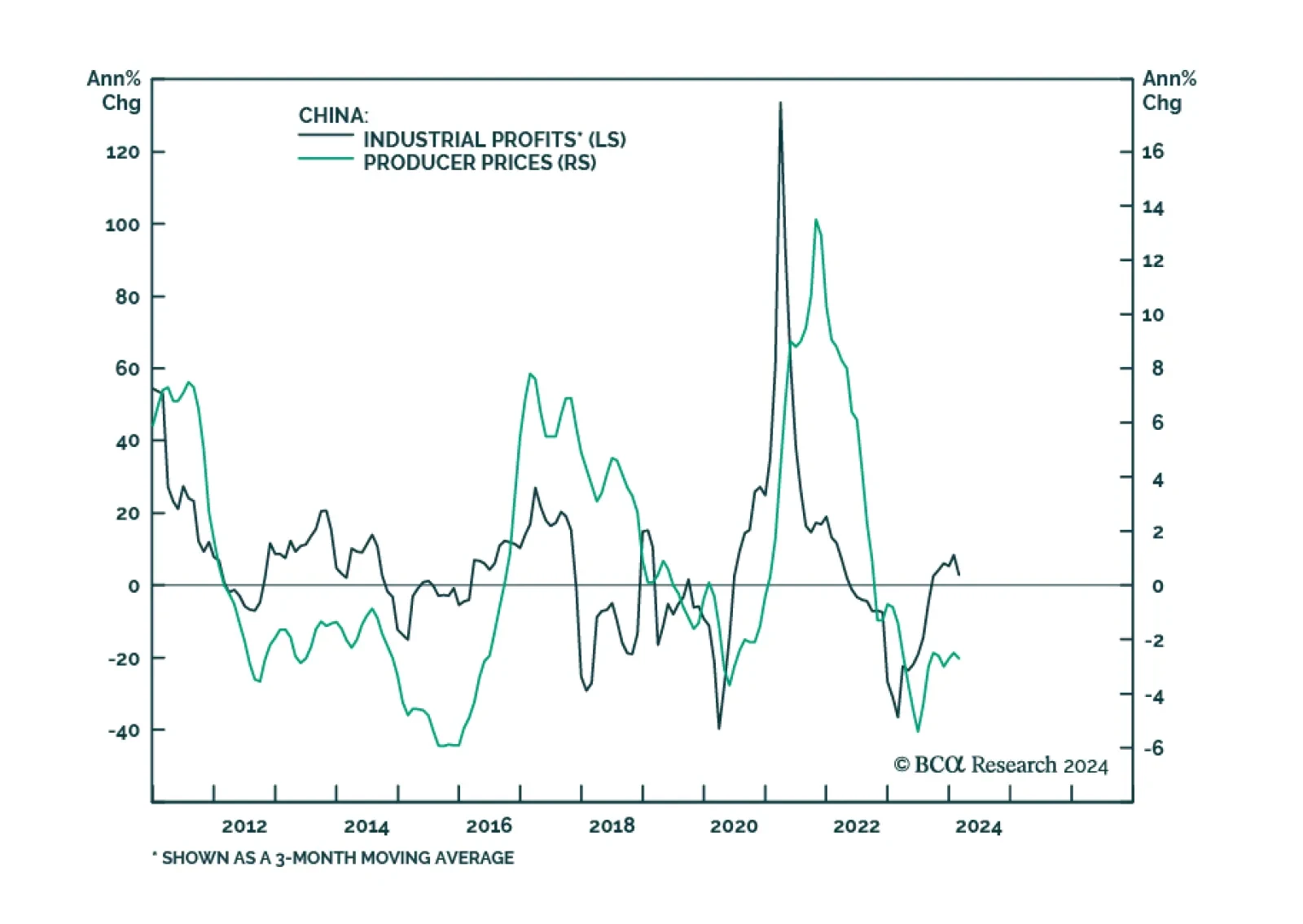

Chinese industrial profit growth surged to 10.2% y/y in the first two months of the year after having contracted by 2.3% in 2023. Does this rebound in profits suggest that investors should become more optimistic about the Chinese…

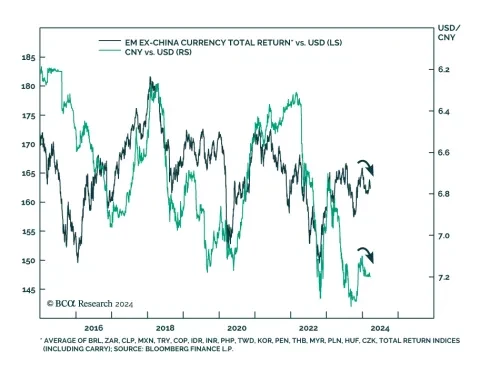

The Chinese yuan slide sharply against the US dollar on Friday, breaching the 7.2 level. The weakness comes after the PBOC loosened its hold on the currency by setting a weaker-than-anticipated daily fixing. The move…

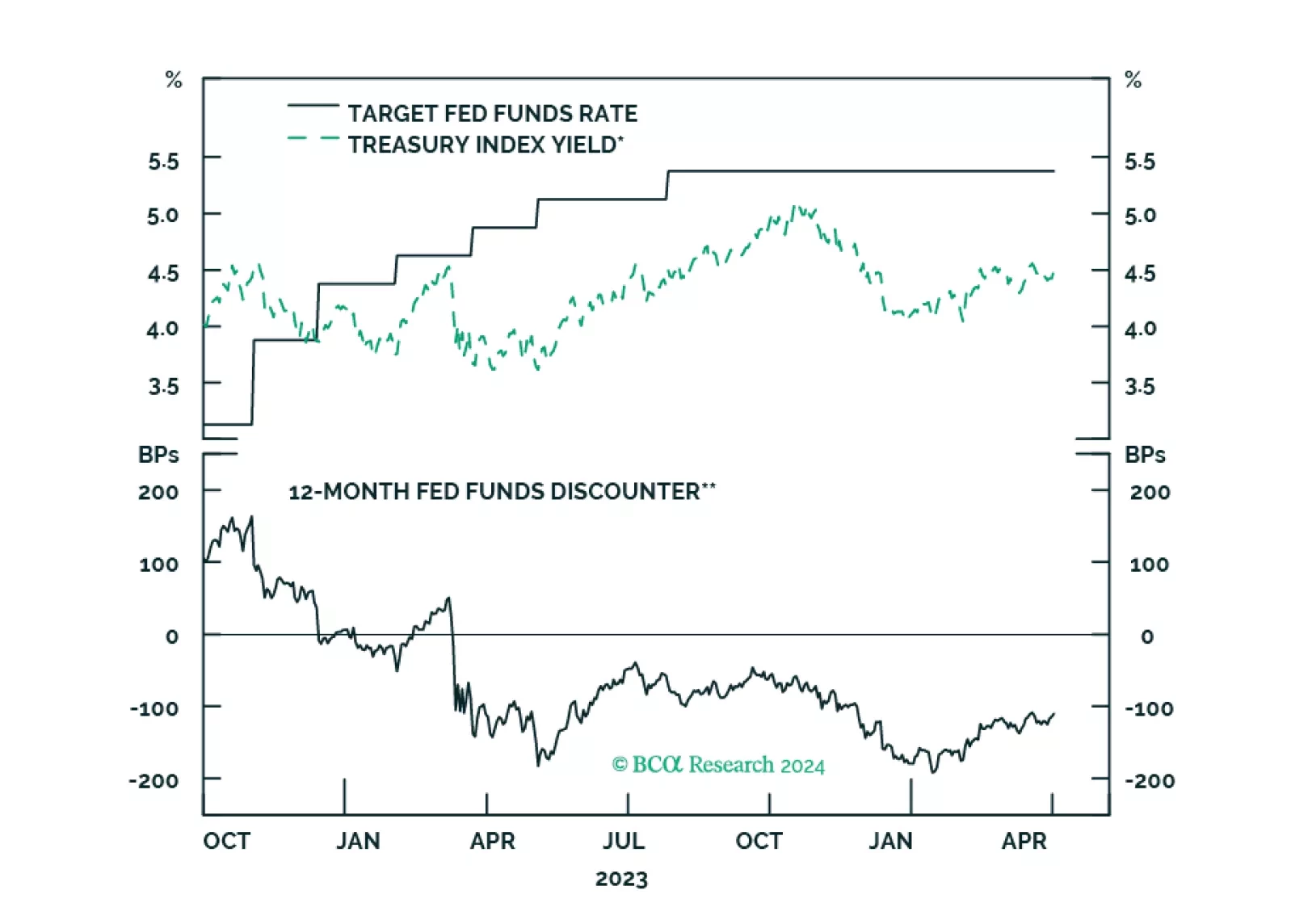

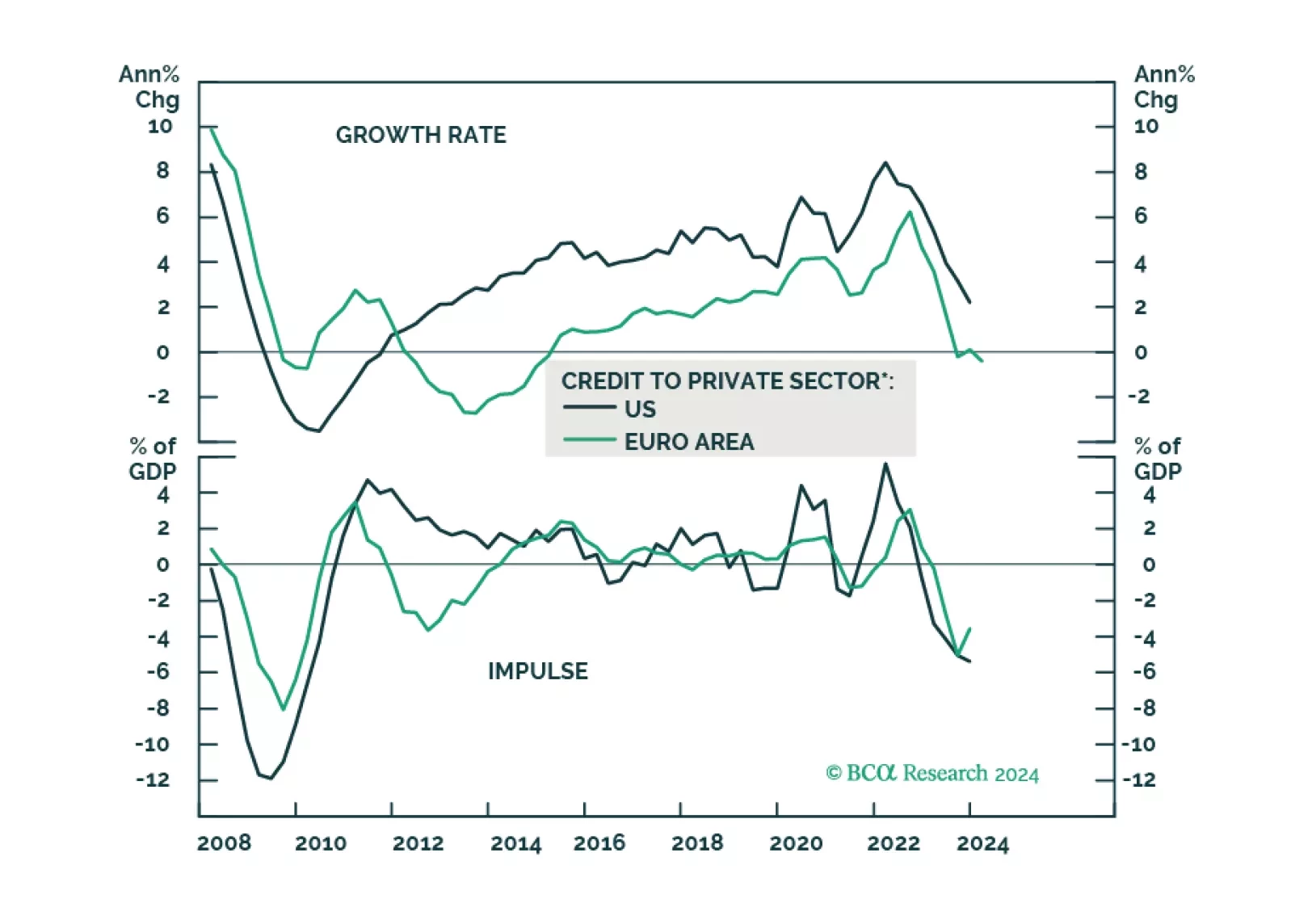

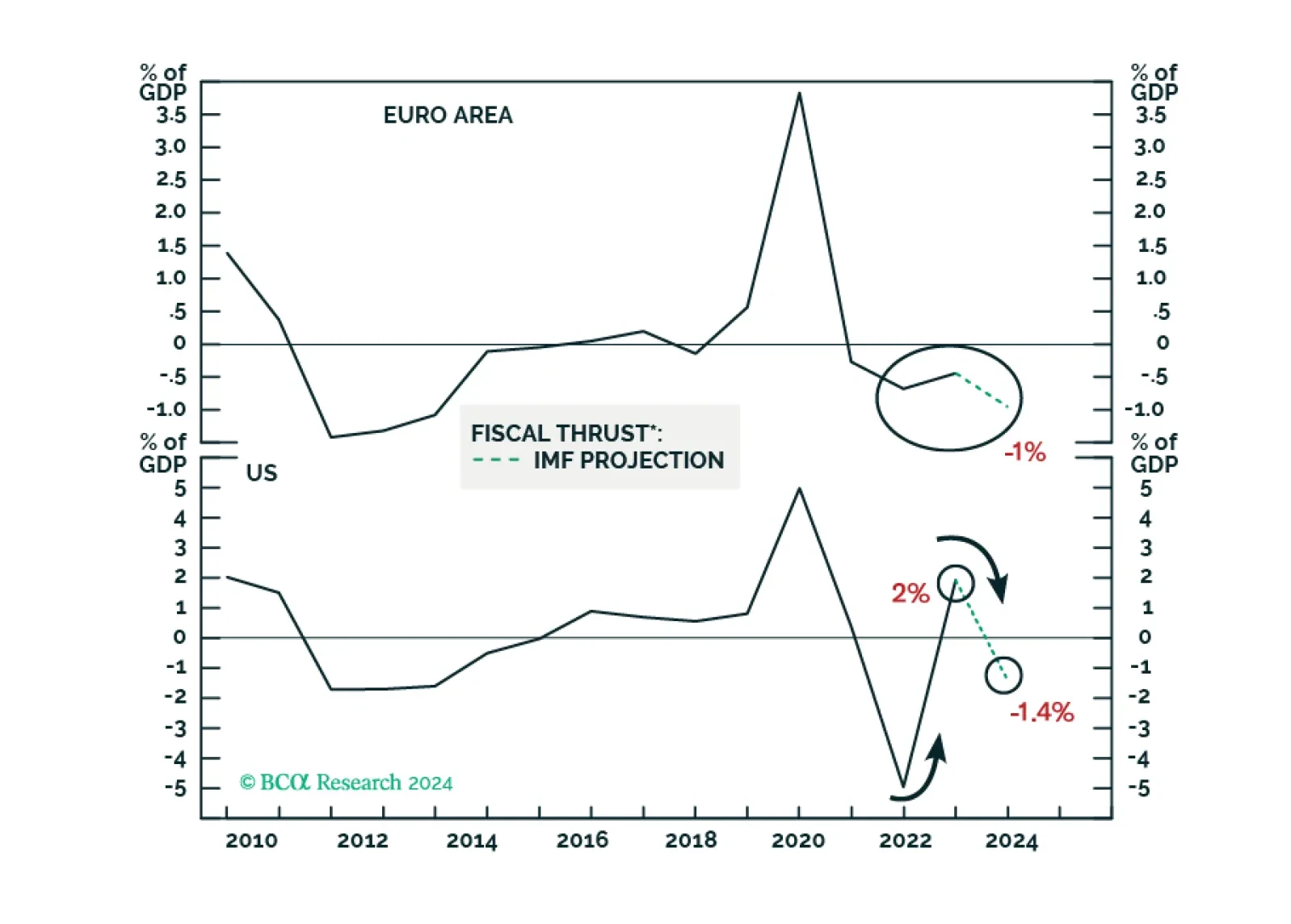

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…