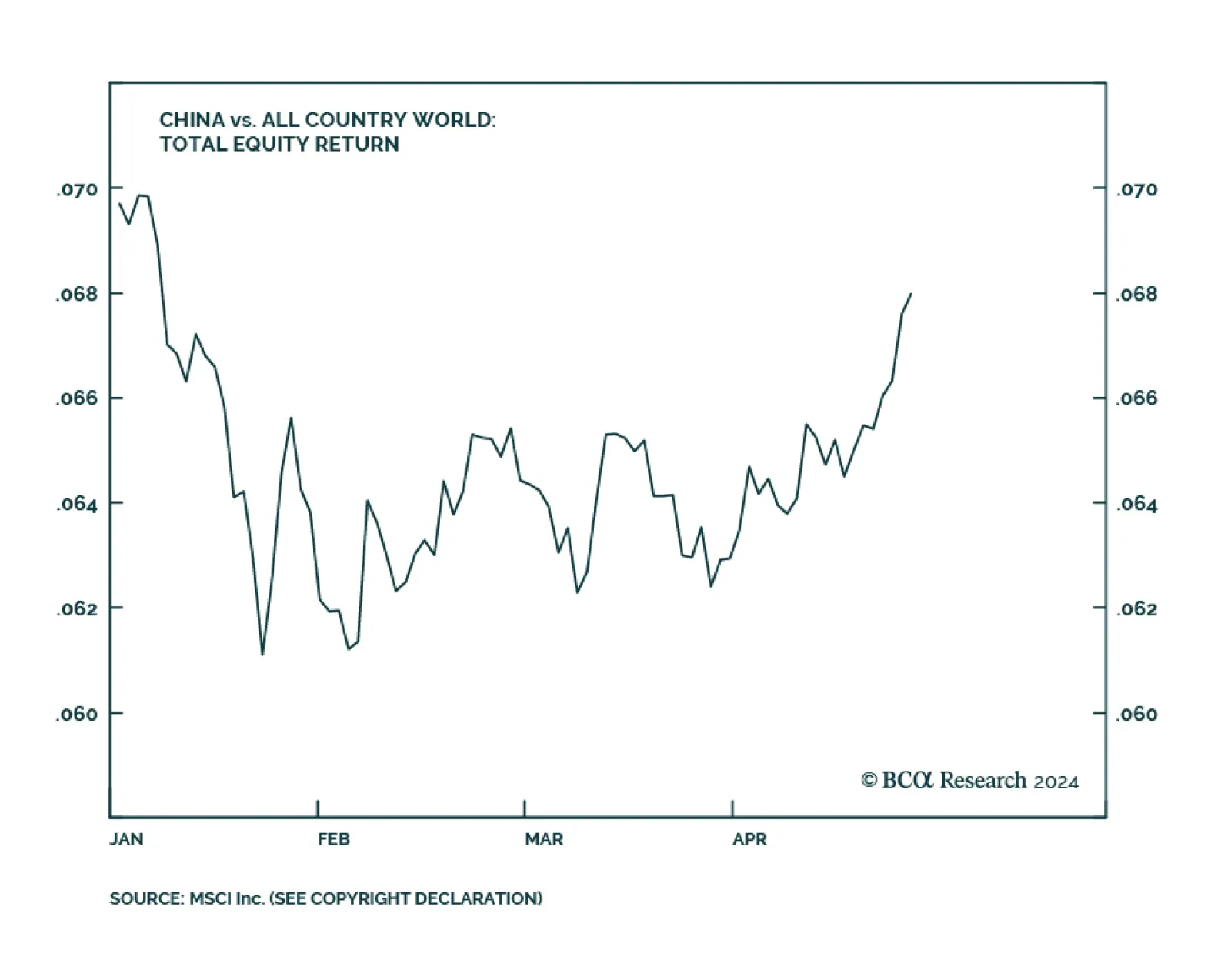

2023 was an awful year for Chinese equities. Though last year, the MSCI China Investable index declined by over 10% even as global equities rallied by over 20%. The pain extended into January of this year, with Chinese stocks…

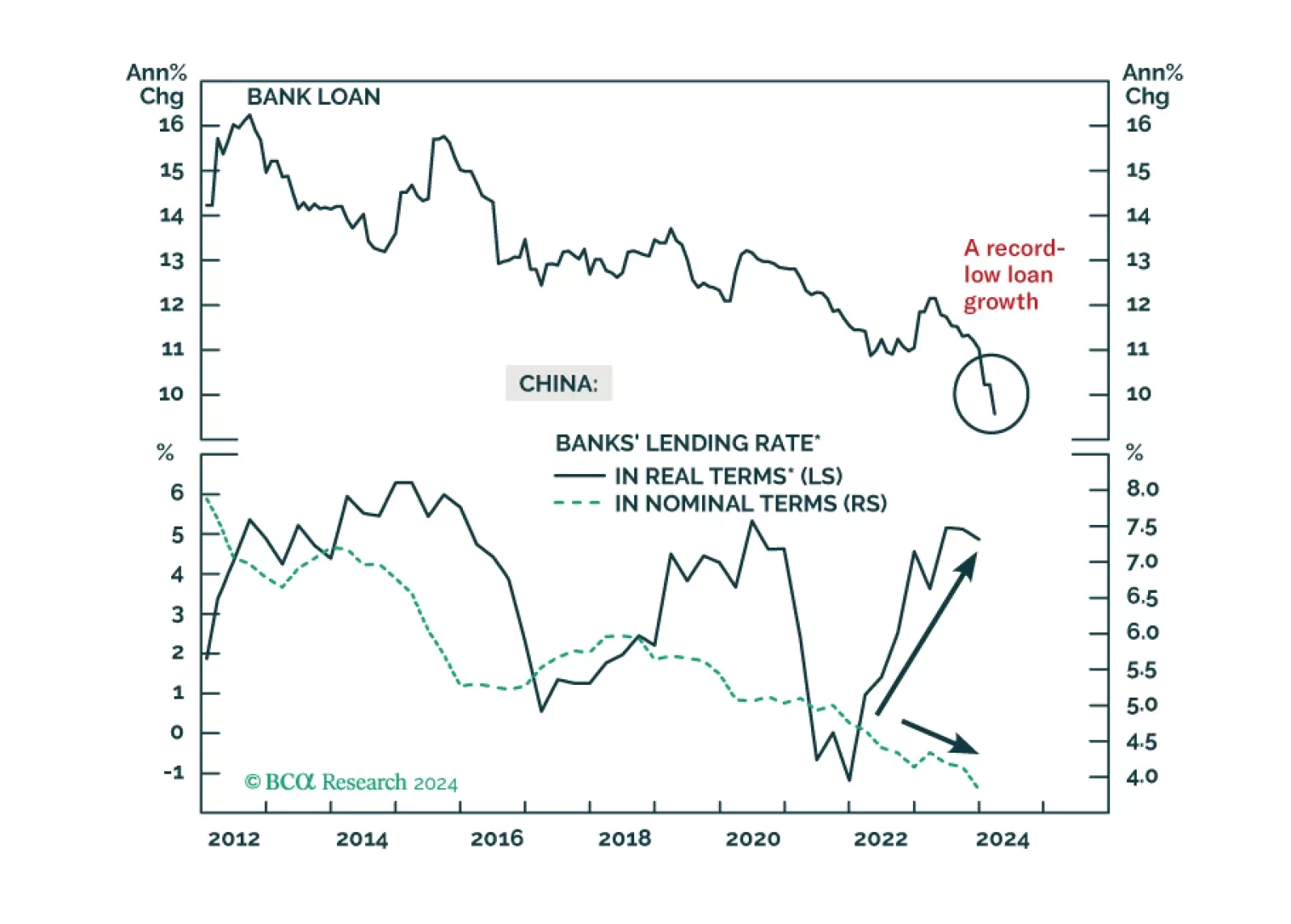

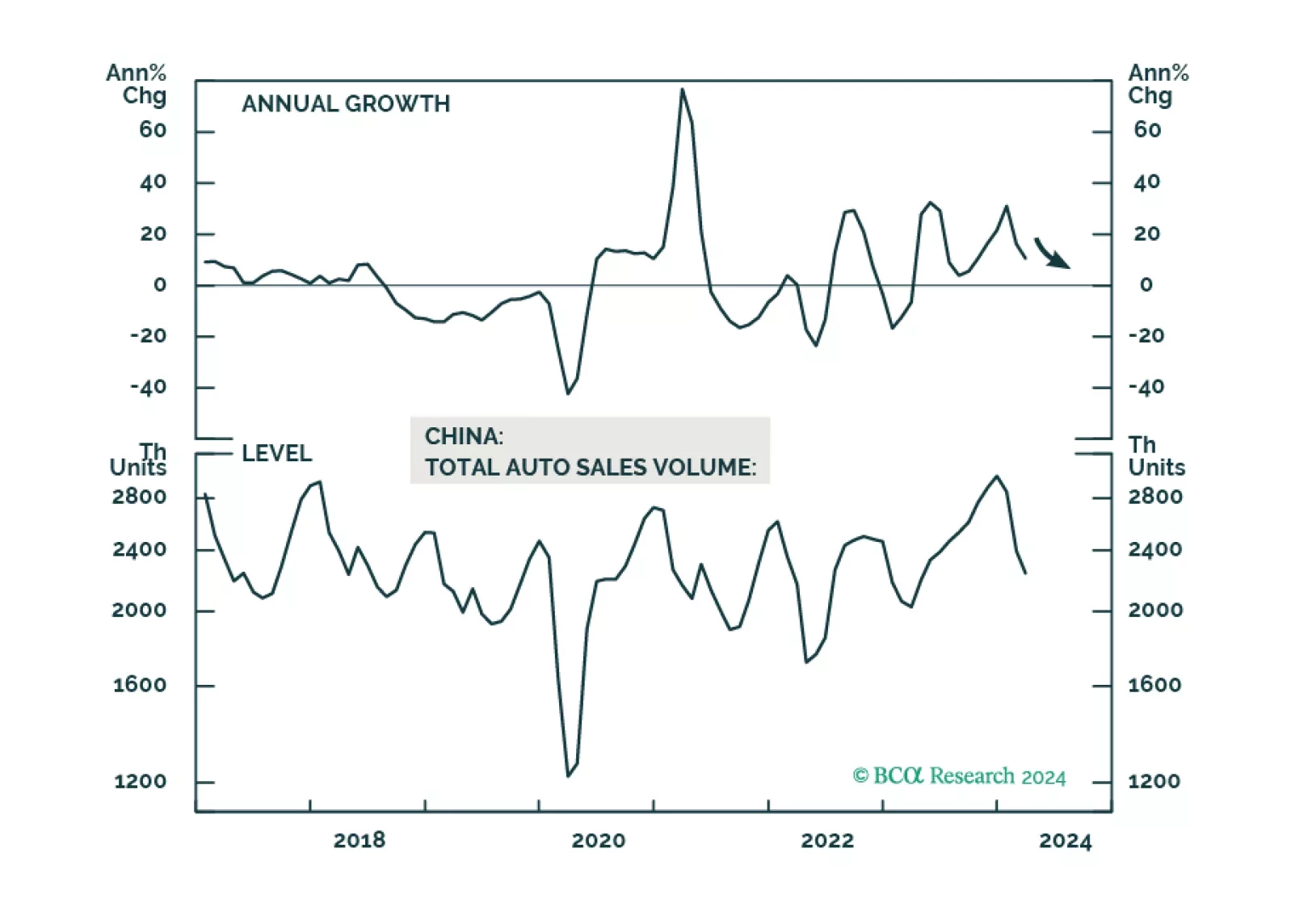

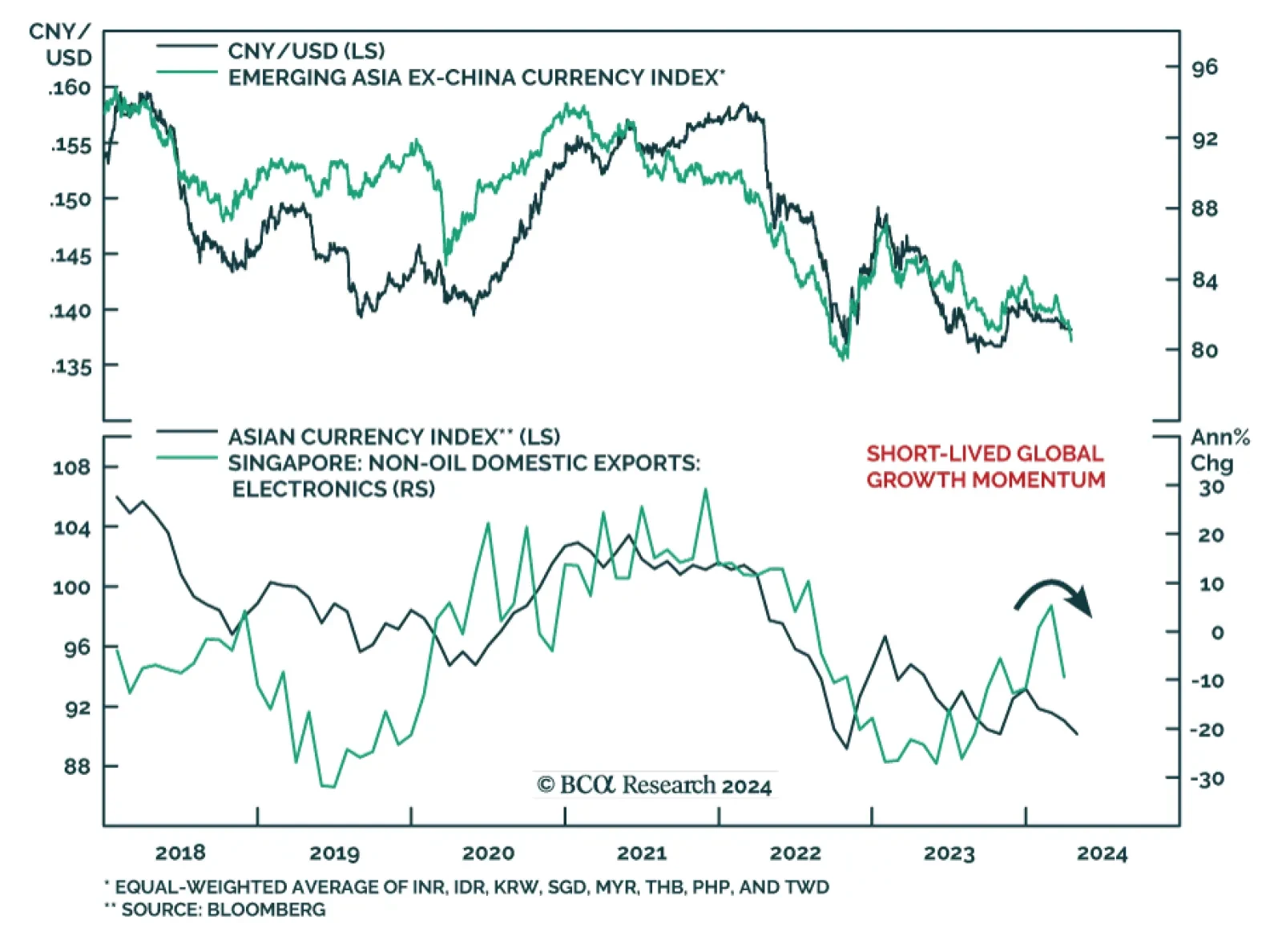

China’s economy is cruising at a very low altitude. The odds are that China’s equity rebound is running out of time. The RMB will continue to depreciate versus the US dollar in the coming months, albeit the pace may be modest.

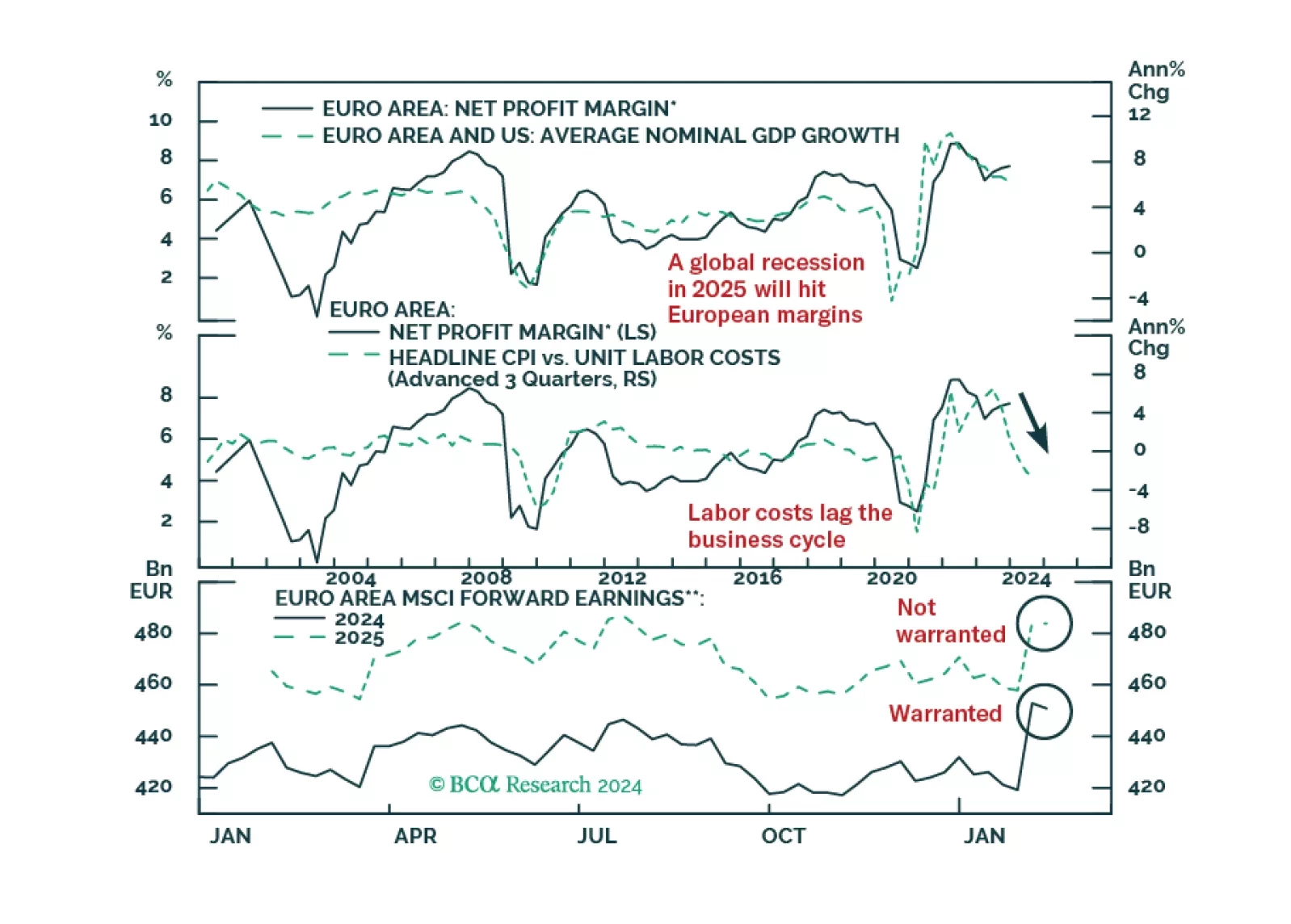

European profits margins are elevated. Will a mild recession be enough to bring them down?

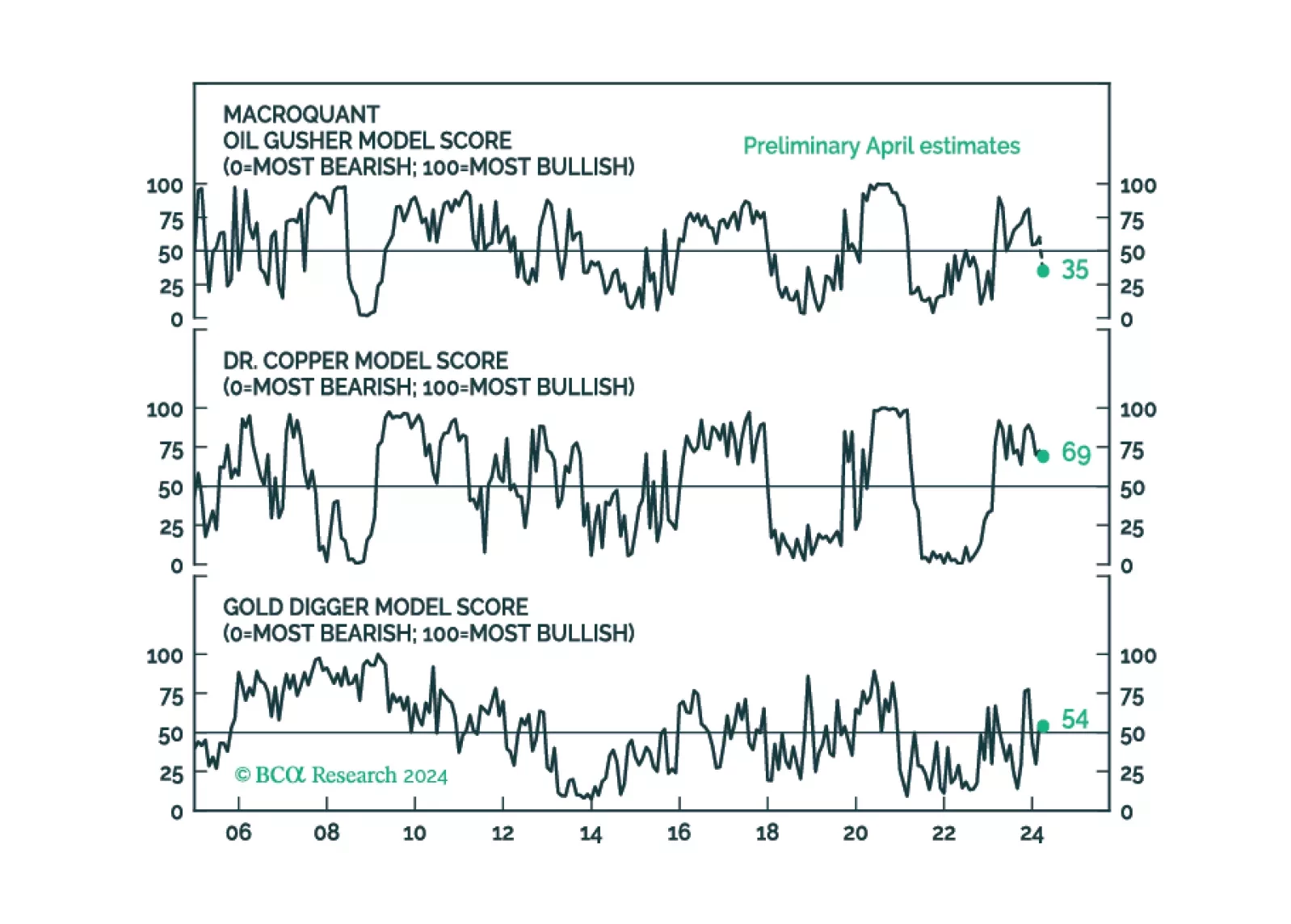

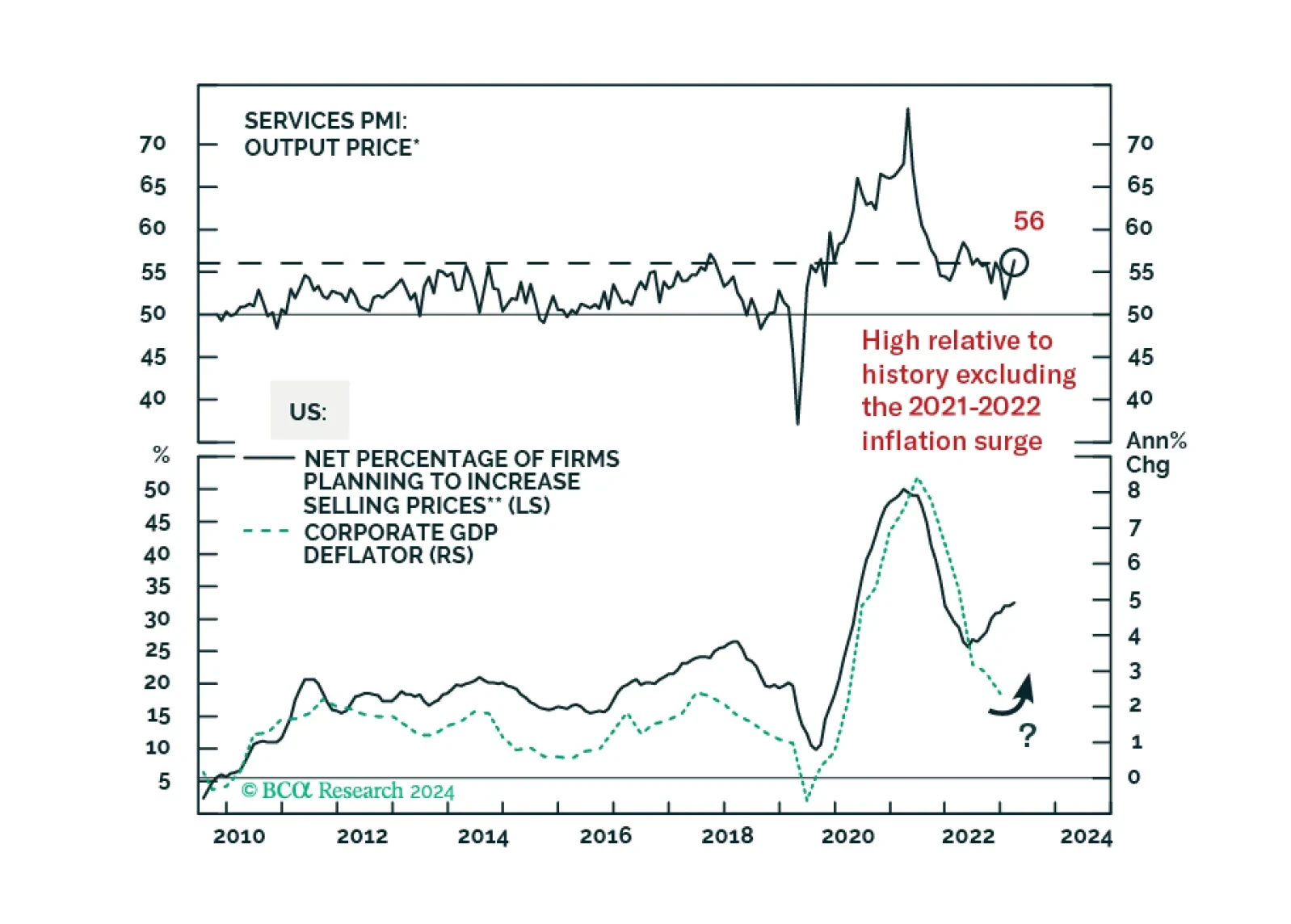

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

The Asian currency index posted the largest negative post-GFC abnormal returns (z-score) among the major financial markets we tracked in March. Indeed, Asian currencies have been on a general downtrend since early 2023, and more…

Chinese economic data releases painted a mixed picture of domestic conditions on Tuesday. Chinese real GDP growth accelerated from 5.2% y/y to 5.3% y/y in Q1 2024, beating expectations of 4.8% and suggesting that economic…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

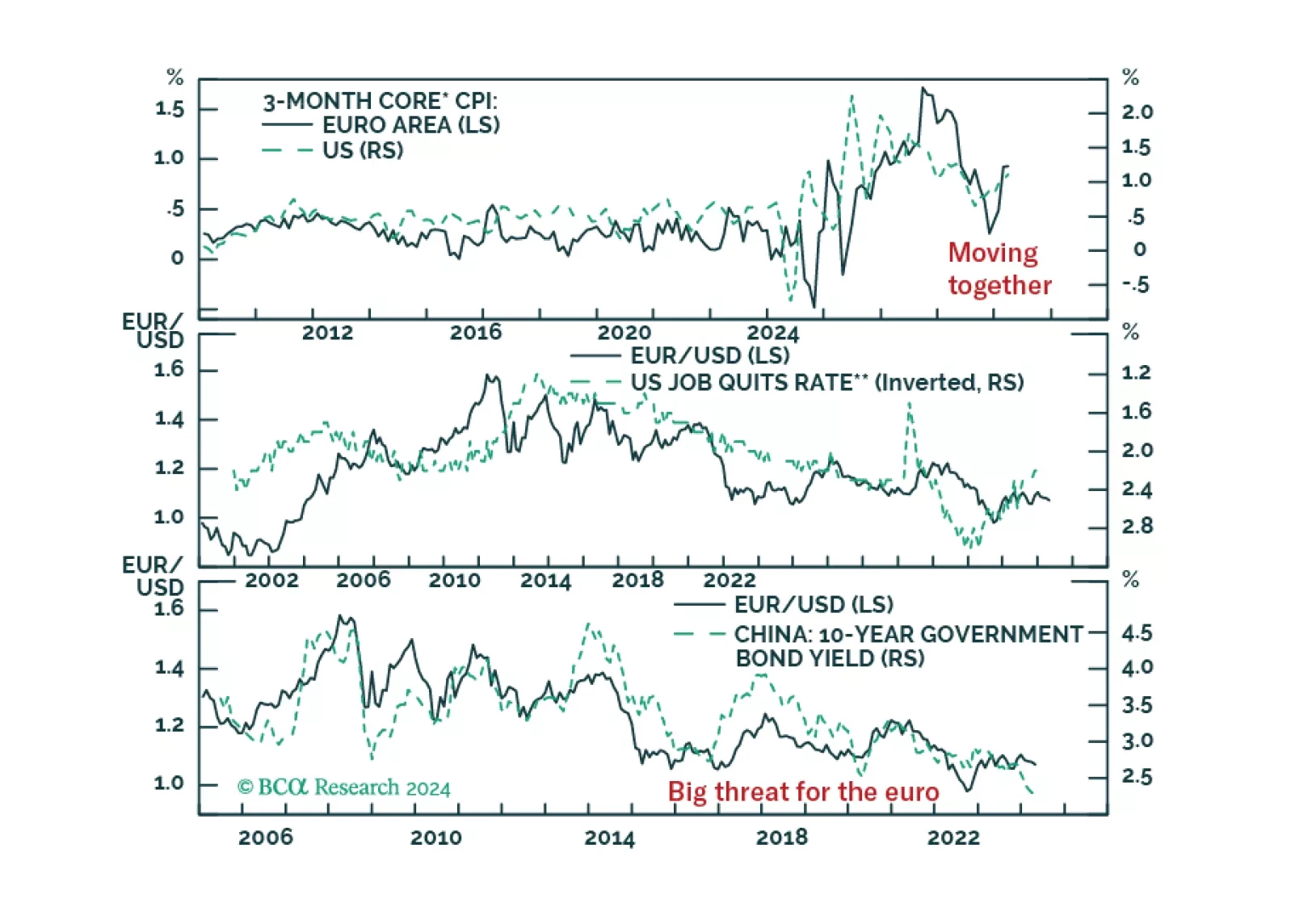

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?