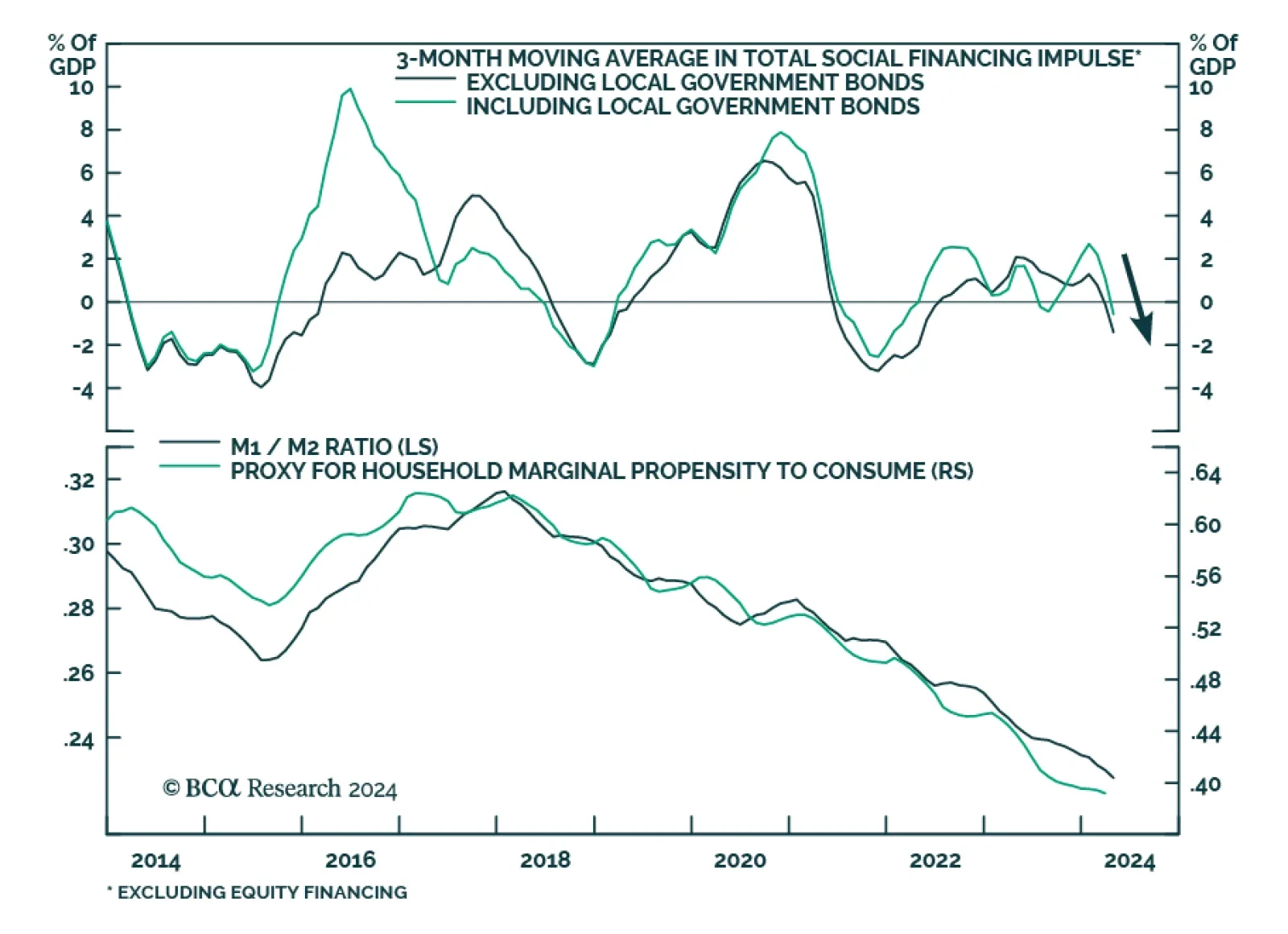

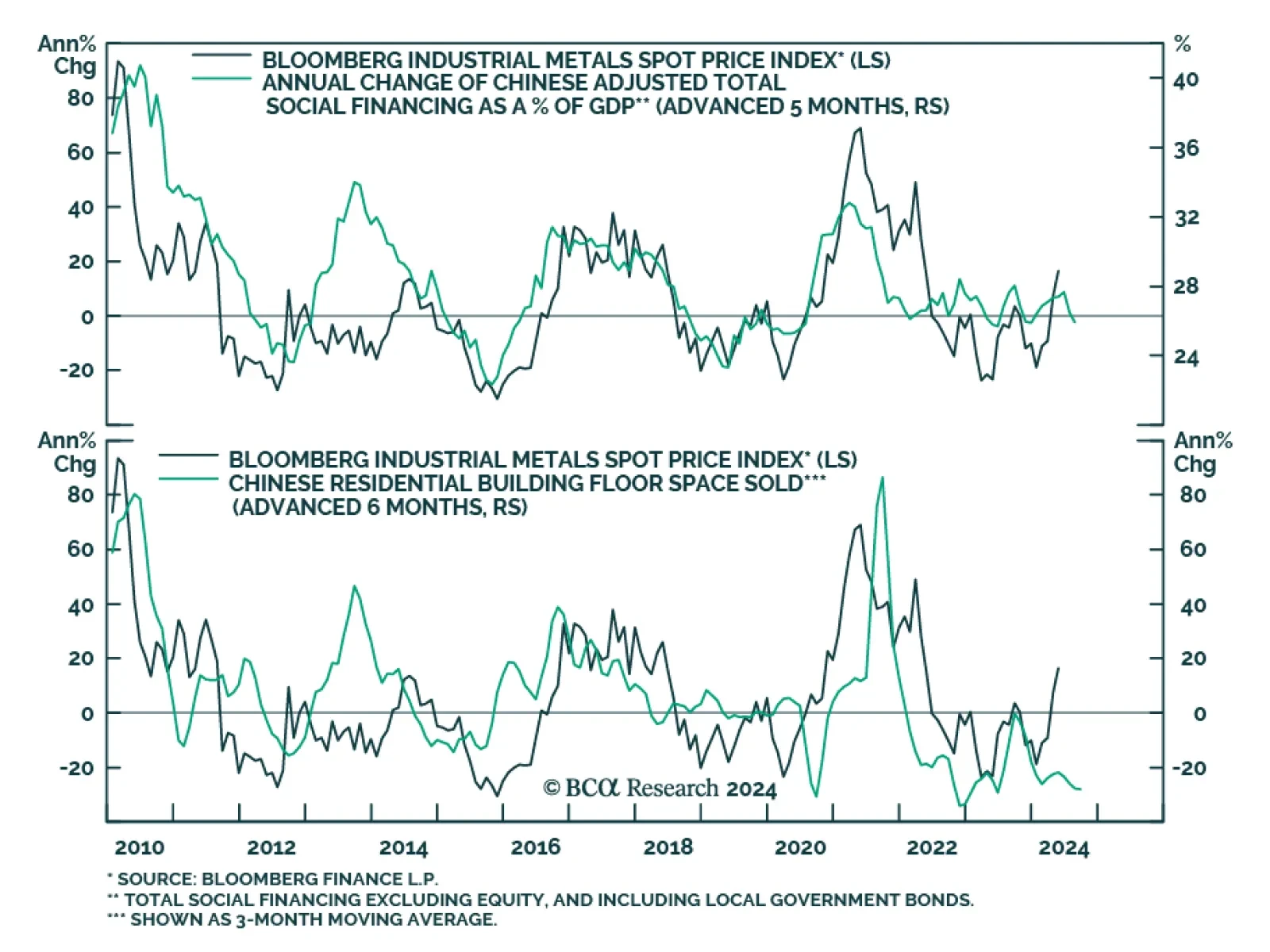

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…

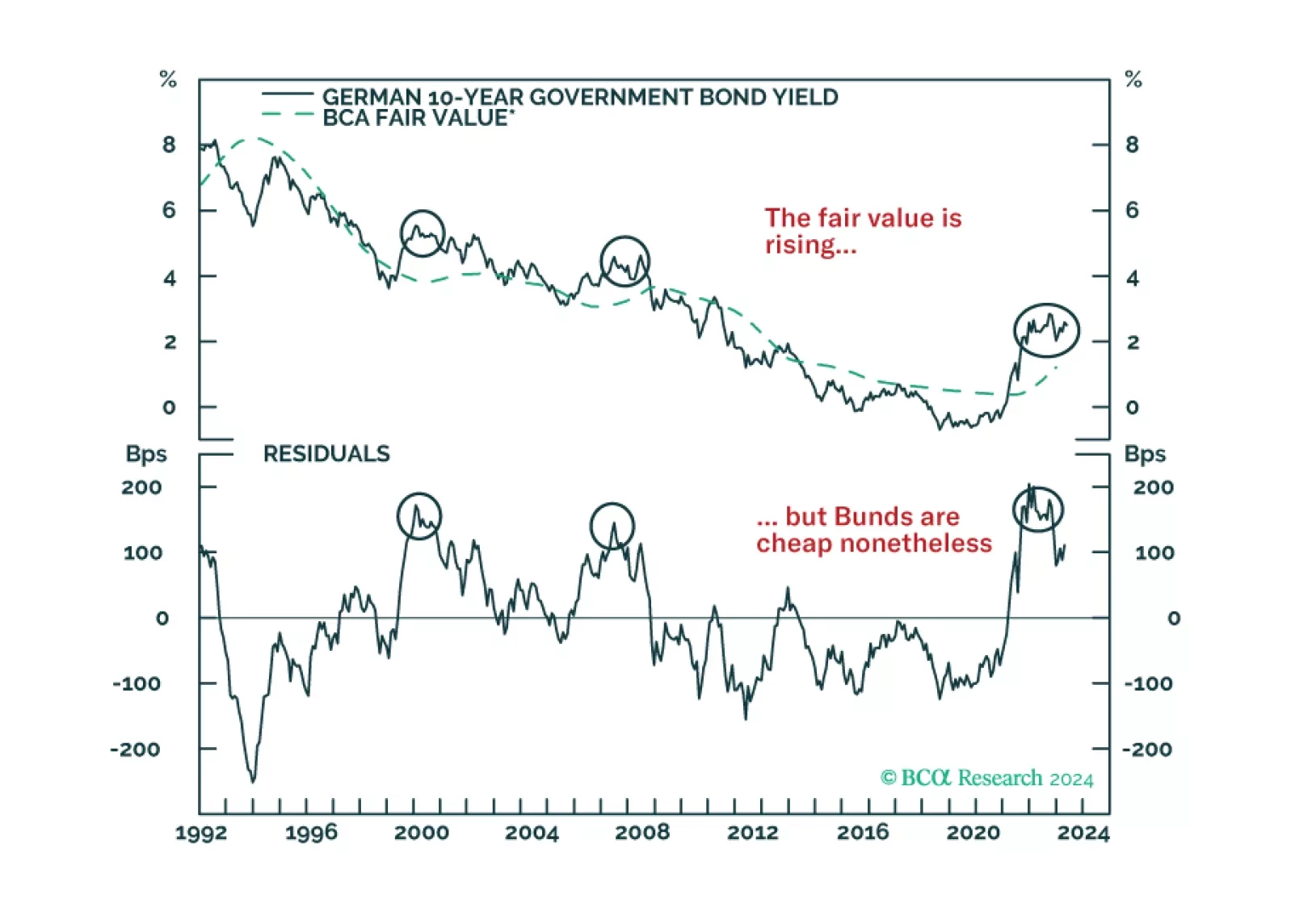

German Bunds have cheapened considerably, and the ECB is about to start cutting rates. Does this combination guarantee immediate profits from buying these bonds?

Upward growth revisions for China and India have led the IMF to recently upgrade its 2024 growth forecast for Asia to 4.5% from 4.2%. The regional growth forecast for 2025 remains unchanged at 4.3%. The IMF now expects the…

The S&P GSCI broad commodity index has returned 8% year-to-date. Improving investor sentiment has significantly broadened the rally since the beginning of the year. Over 65% of commodities in the index are now trading above…

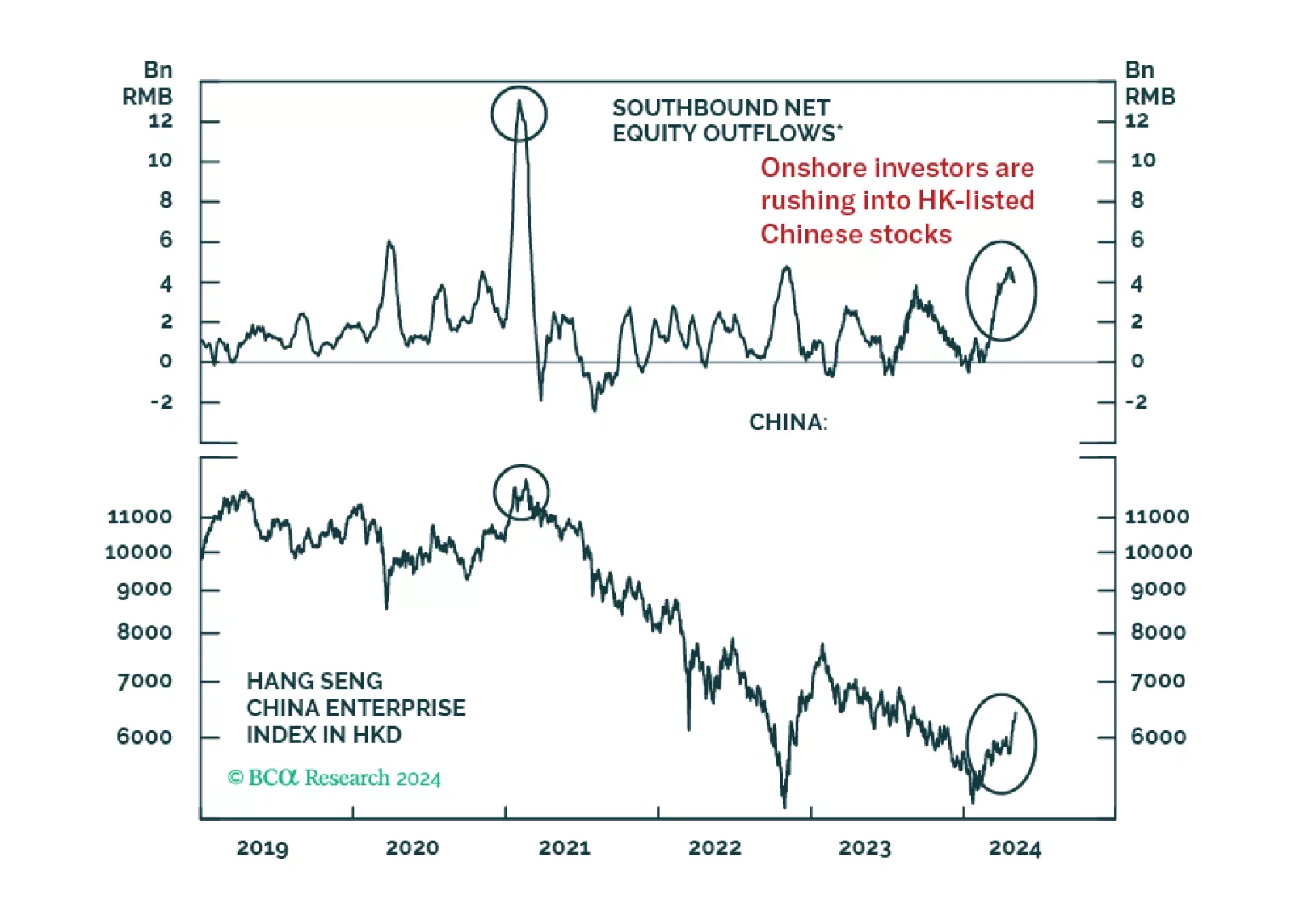

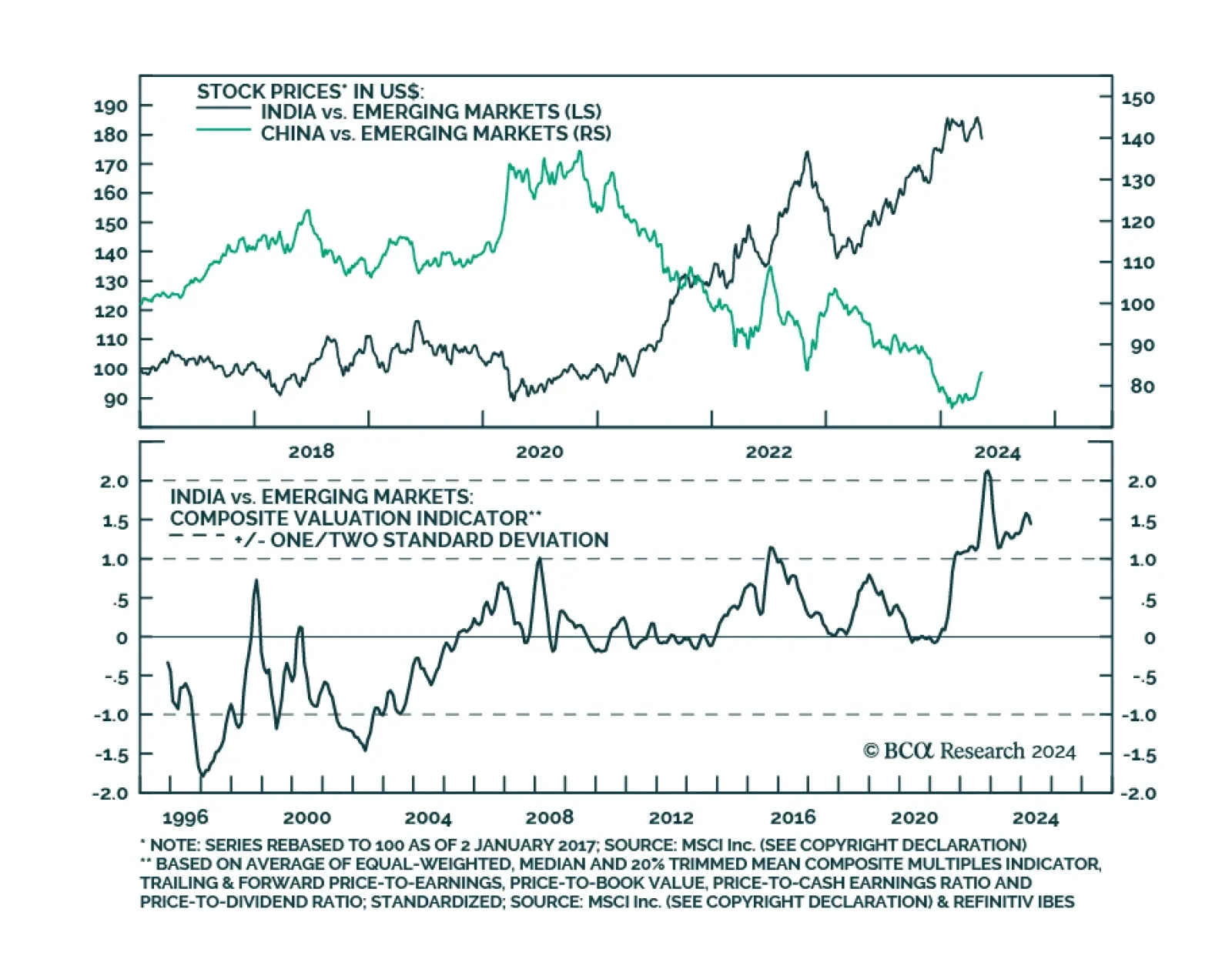

Chinese investable stocks have rallied on a combination of investors’ hopes for stimulus, revival in the global manufacturing cycle and cheap valuations. The MSCI China index and the Hang Seng have both gained close to 15%…

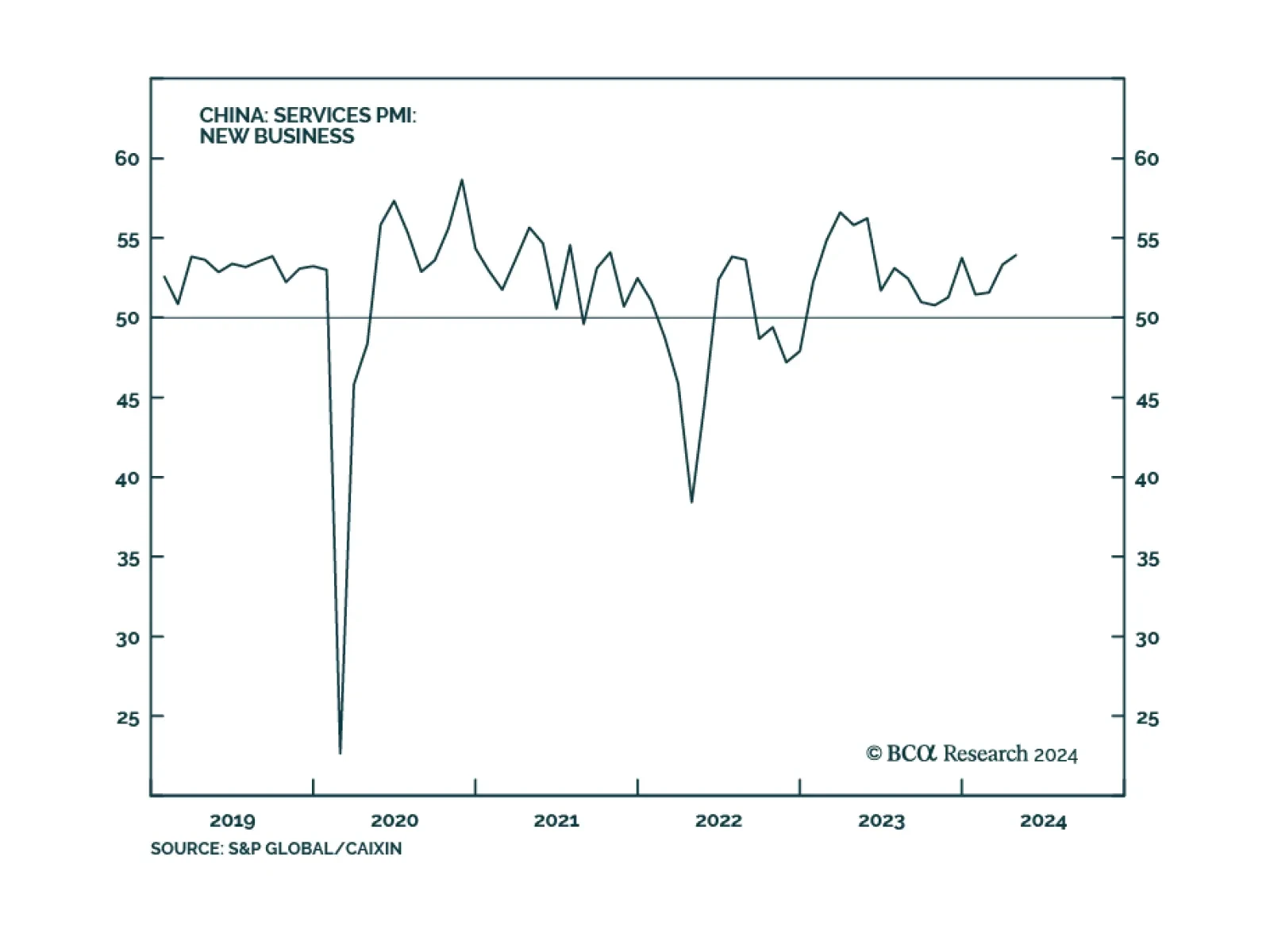

The Caixin services and composite PMIs were broadly unchanged in April. The services PMI decreased from 52.7 to 52.5, in line with expectations, while the composite PMI increased from 52.7 to 52.8. Details underscored positive…

Mainland residents’ investments in gold, other metals, and Hong Kong-traded stocks are a form of capital outflow. Chinese authorities will counter any excessive capital flight with stricter administrative controls. Thus, markets…

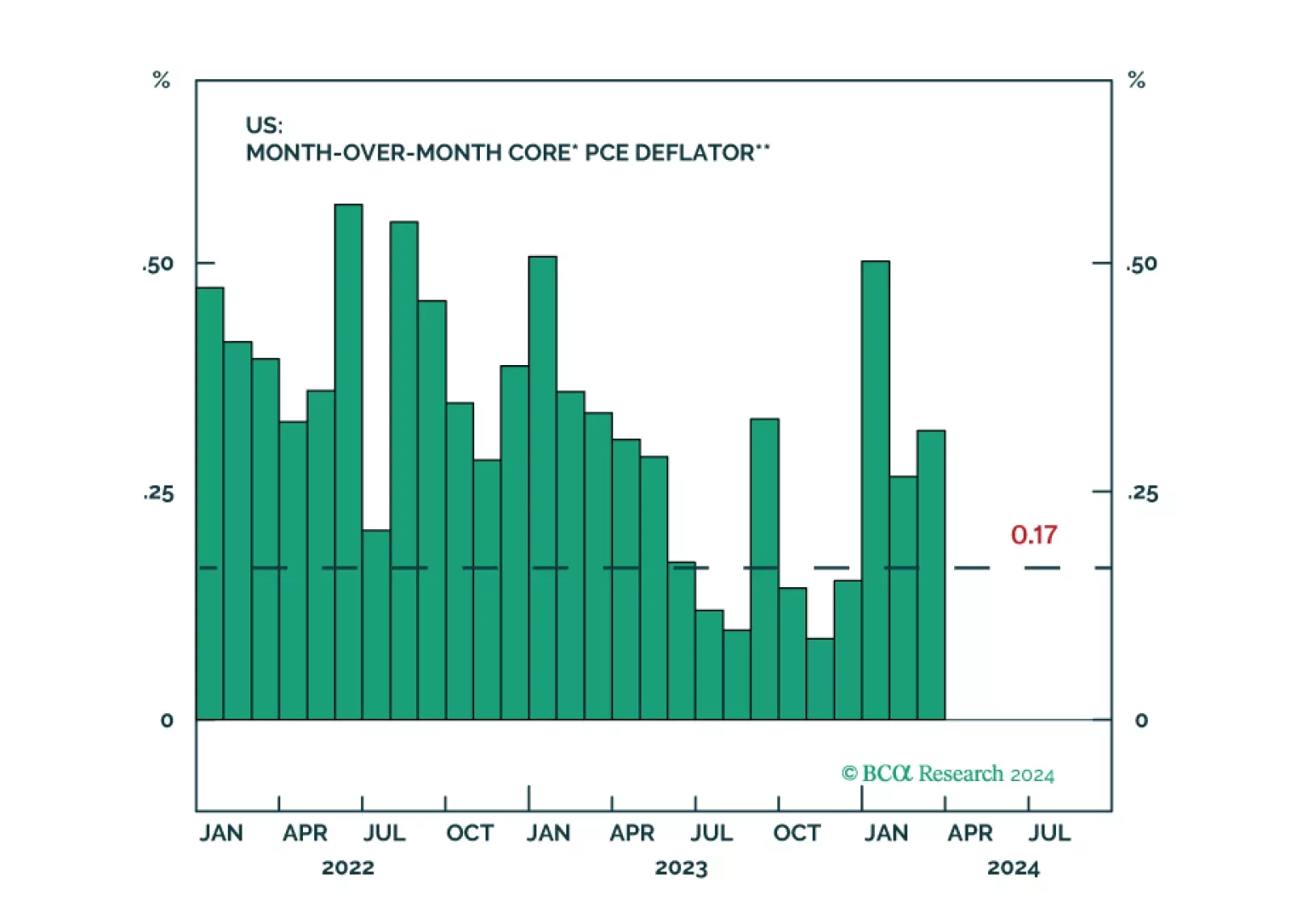

Central banks are in a dilemma whether to prioritize supporting growth or bringing inflation back to target. This is unlikely to end well. Investors should be defensively positioned.

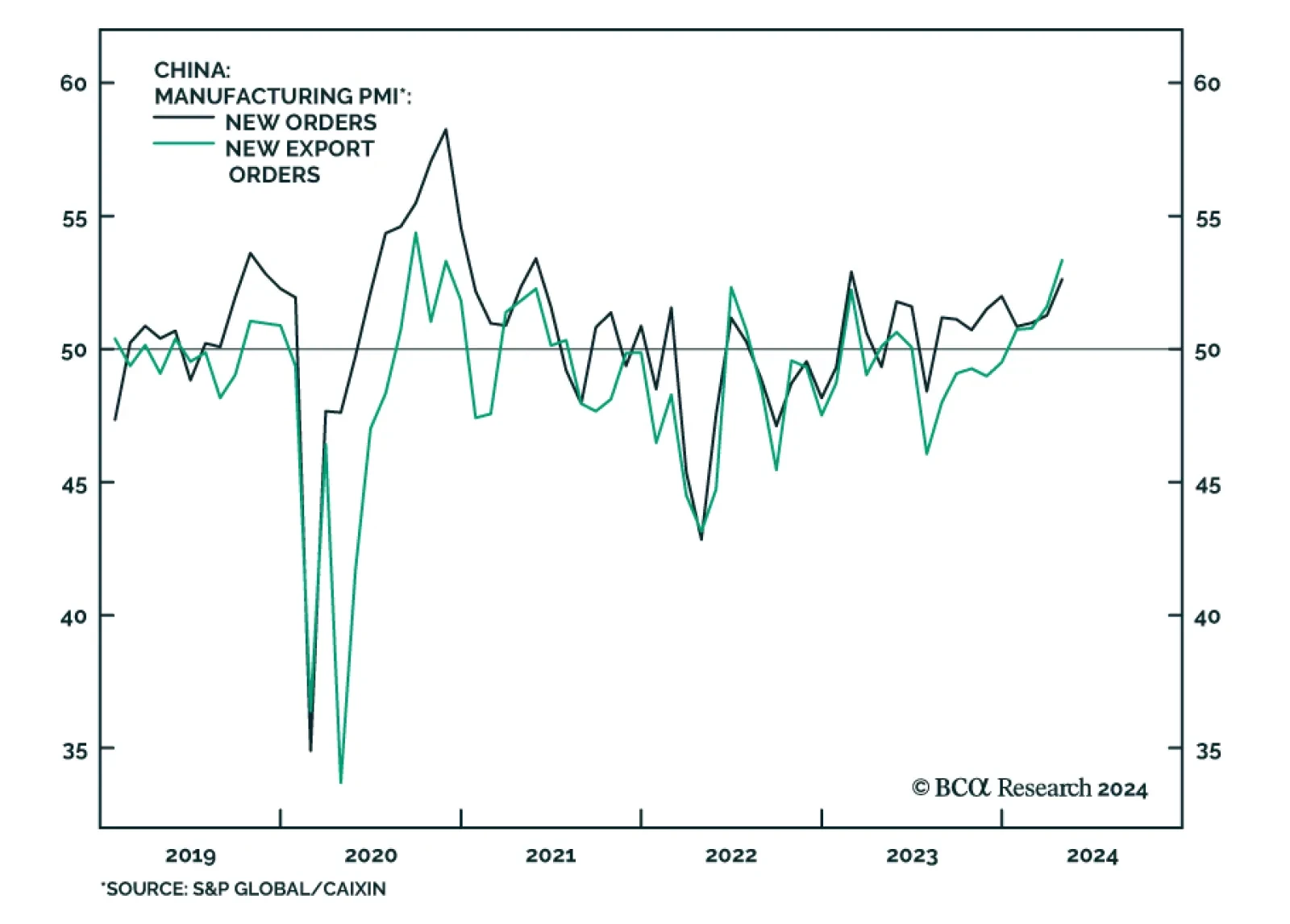

The Chinese NBS non-manufacturing PMI came in at 51.2, below the previous month’s number of 53 and below expectations of 52.2. Moreover, the NBS manufacturing PMI also decreased to (a better-than-expected) 50.4 in April…

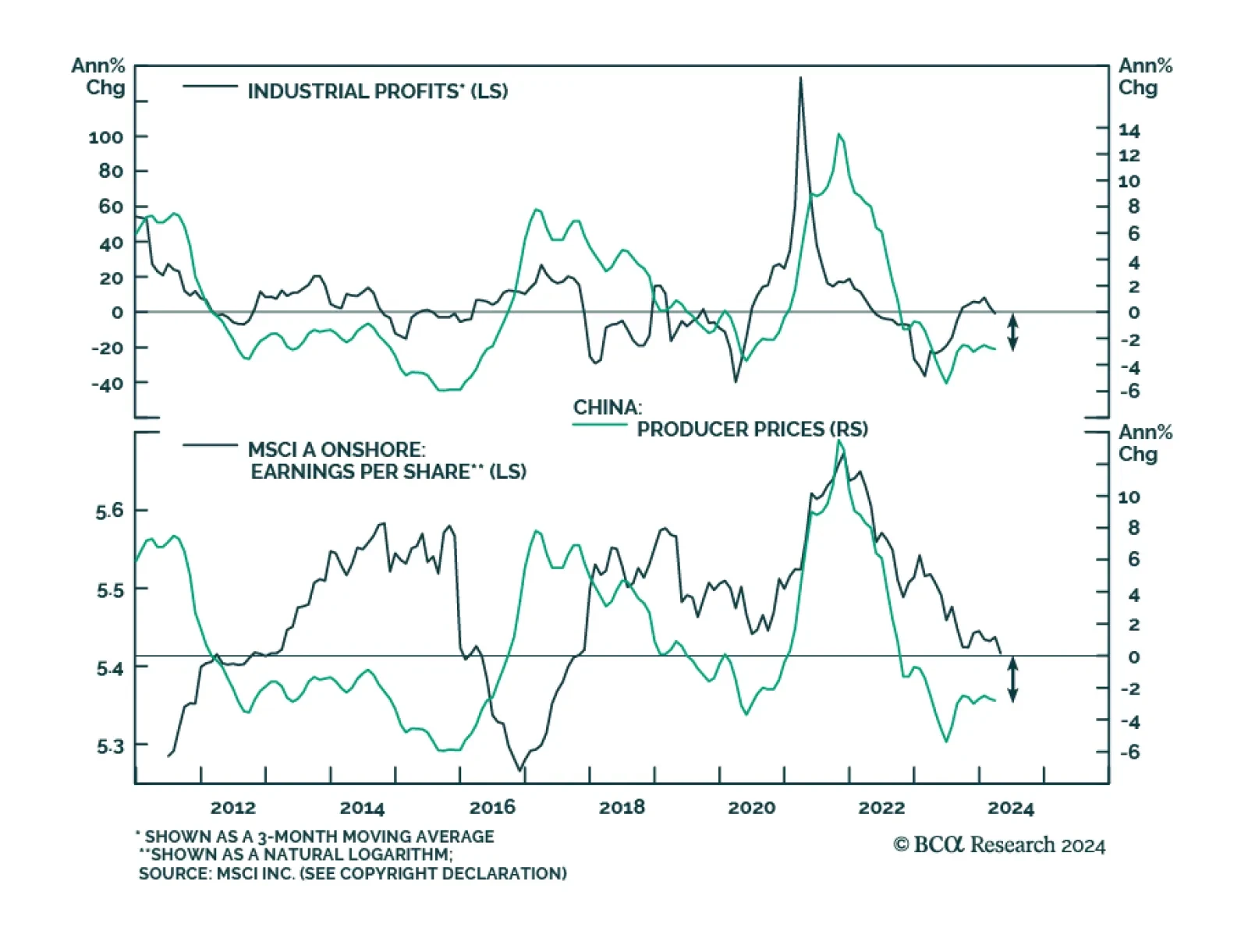

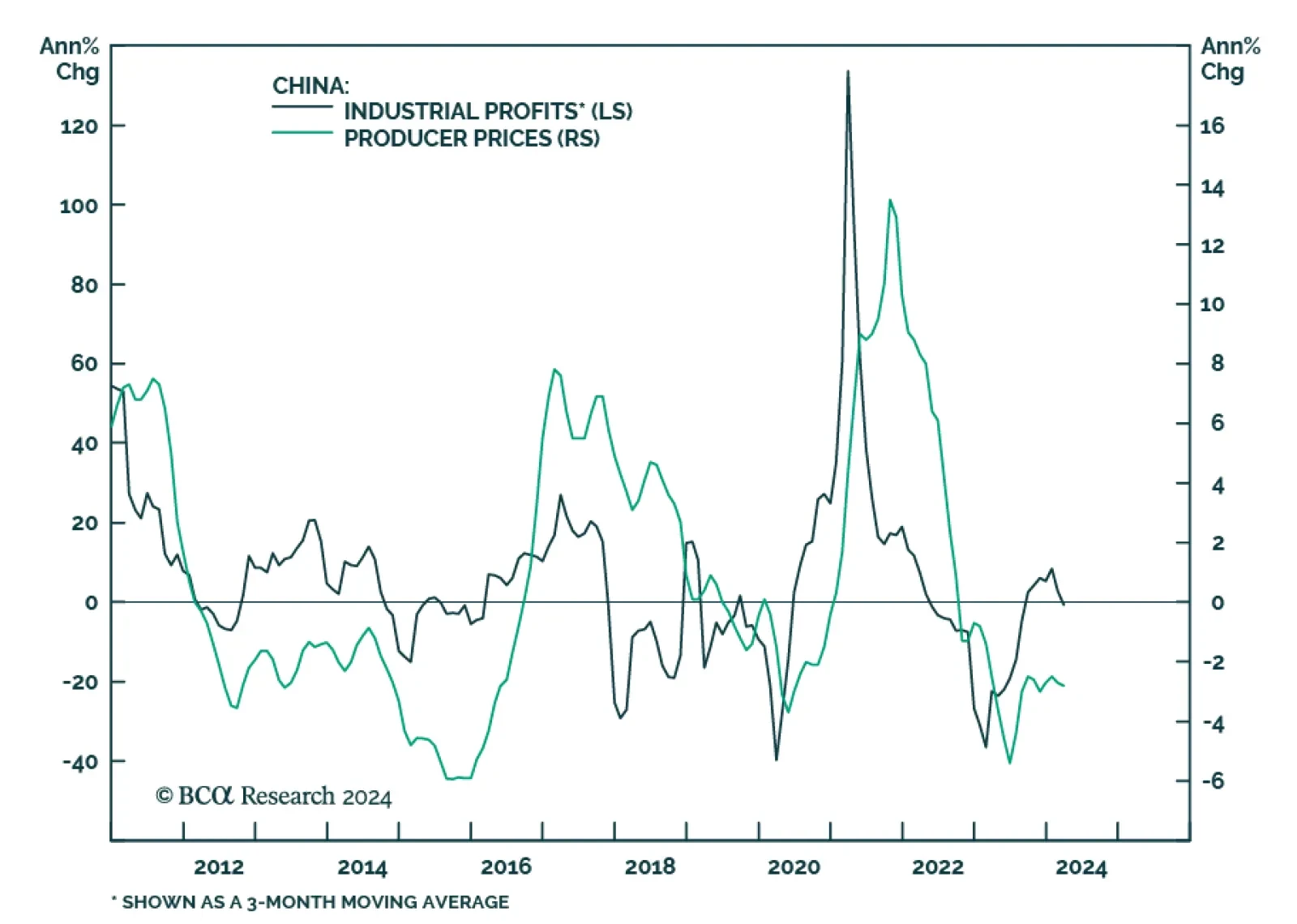

Chinese industrial profit growth slowed in the first three months of the year to 4.3% YTD y/y, from 10.2% y/y in January and February. The March slowdown is meaningful since industrial profits outright contracted by 3.5% relative…