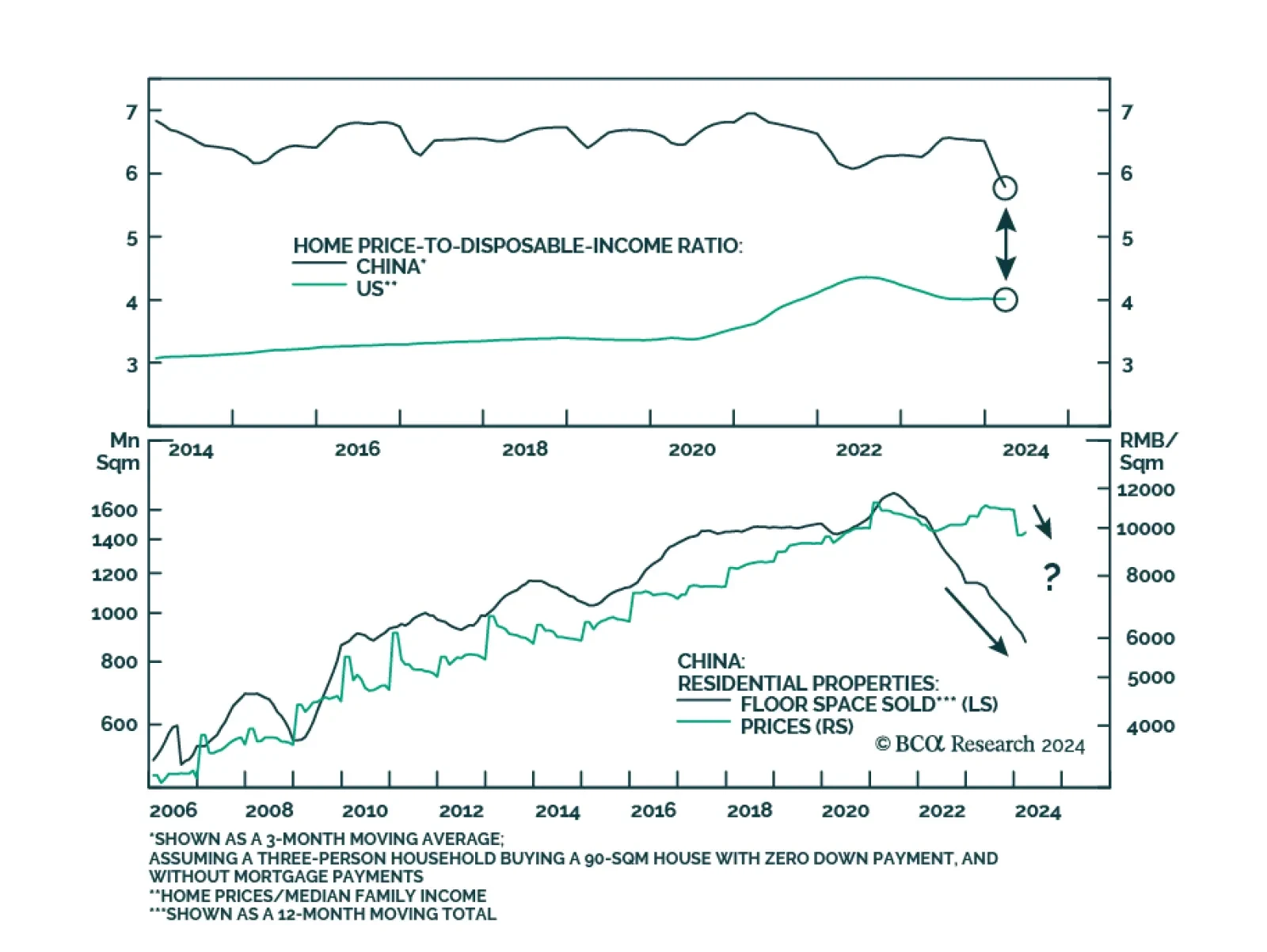

The large buildup in Chinese households’ savings deposits is unlikely to fuel consumption. Poor outlooks on labor market conditions, income, and households’ unwillingness to borrow will hinder consumption through the rest of 2024.

Although a strategic détente between the US and China would benefit both sides, BCA Research’s Geopolitical Strategy service warns that the trade war will continue. The team has argued that Biden and Xi would fail to…

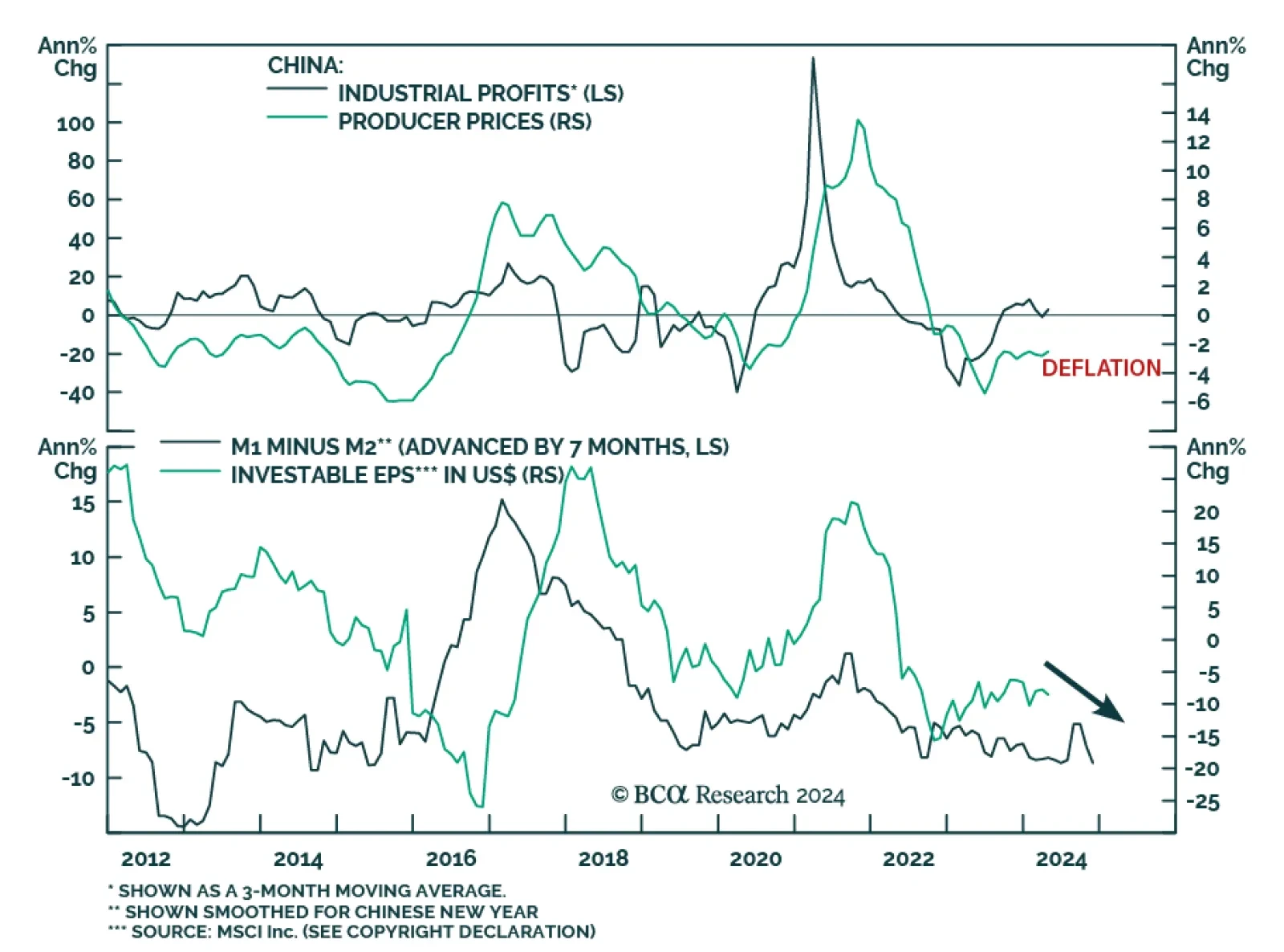

Chinese industrial profits rose by 4.0% y/y in April, from a 3.5% y/y contraction in March. They grew by 4.3% in the first four months of the year, compared to the same period in 2023. In March, the central government pledged…

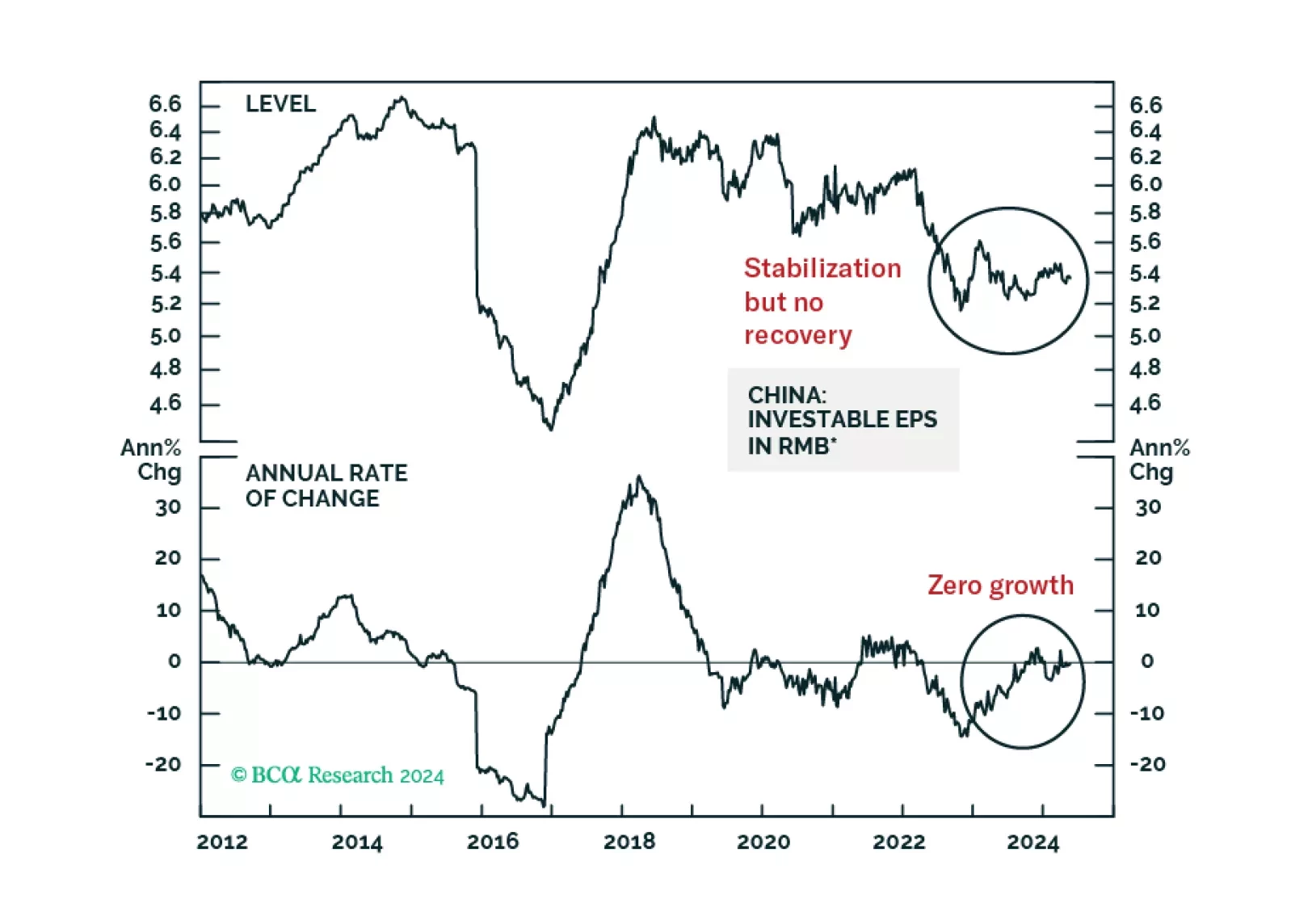

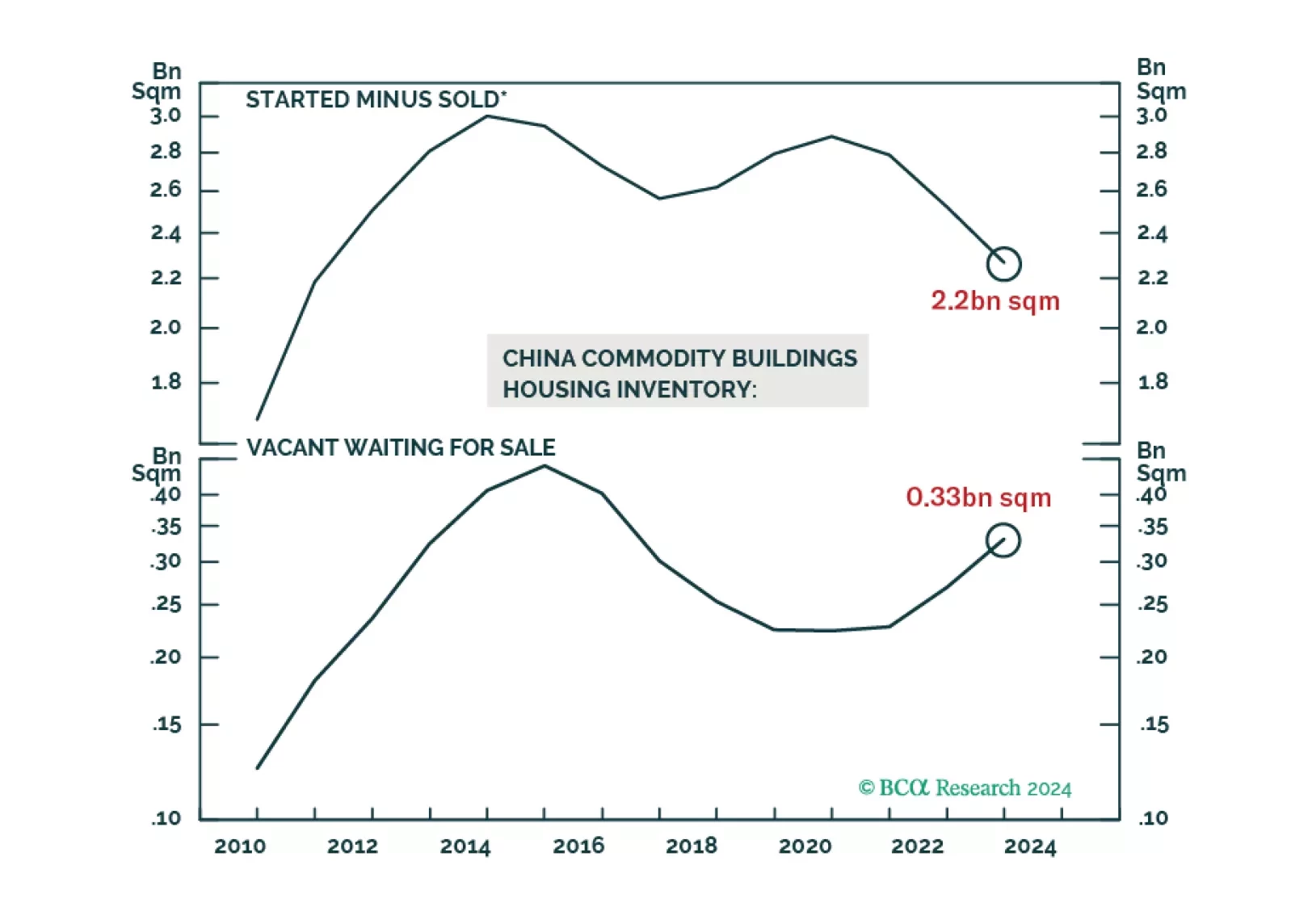

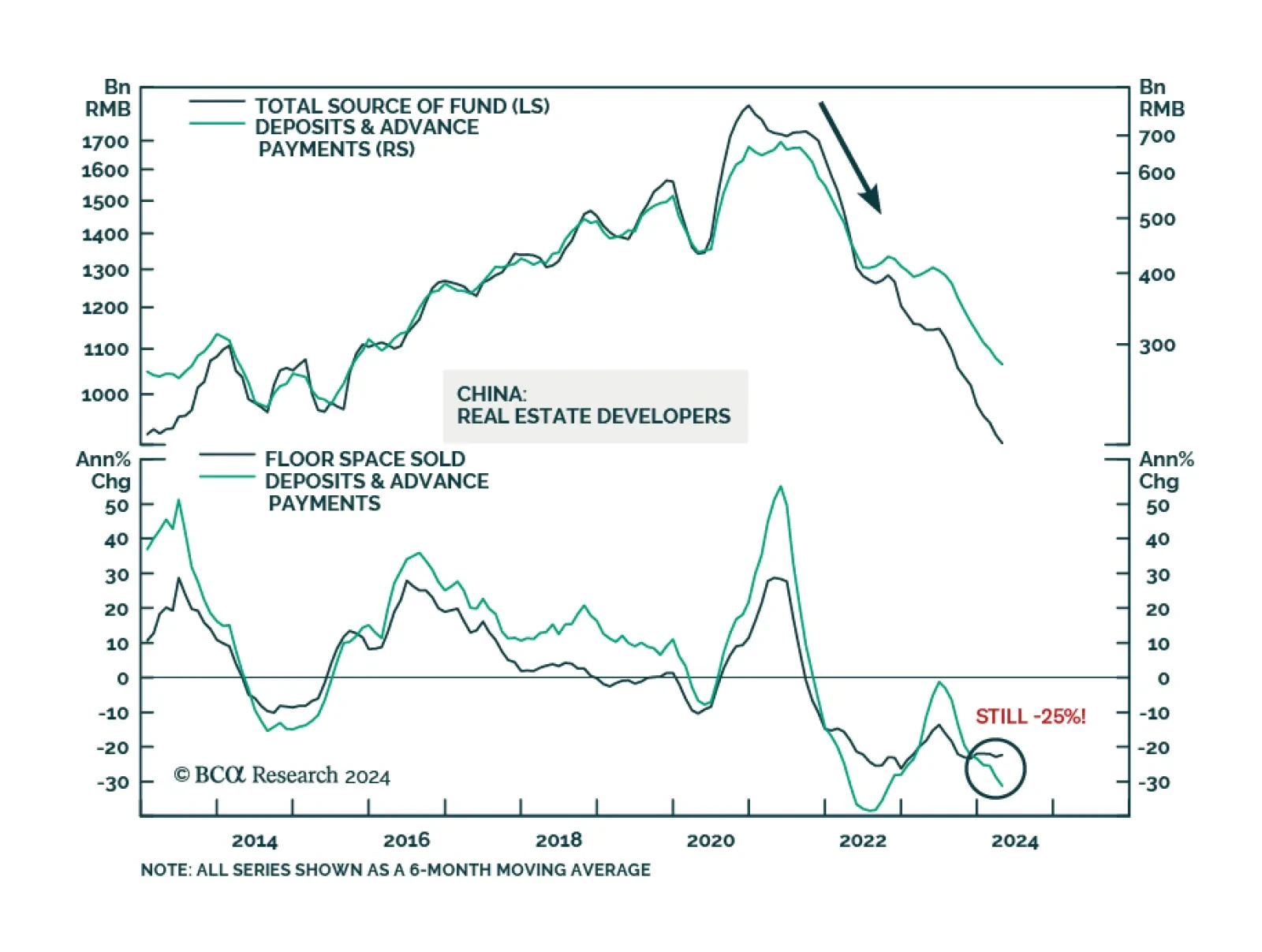

The RMB 500 billion program is small, as it is equivalent to only 4% of property developers' total funding from the past 12 months. This will preclude a recovery in property construction this year. Corporate profits will determine…

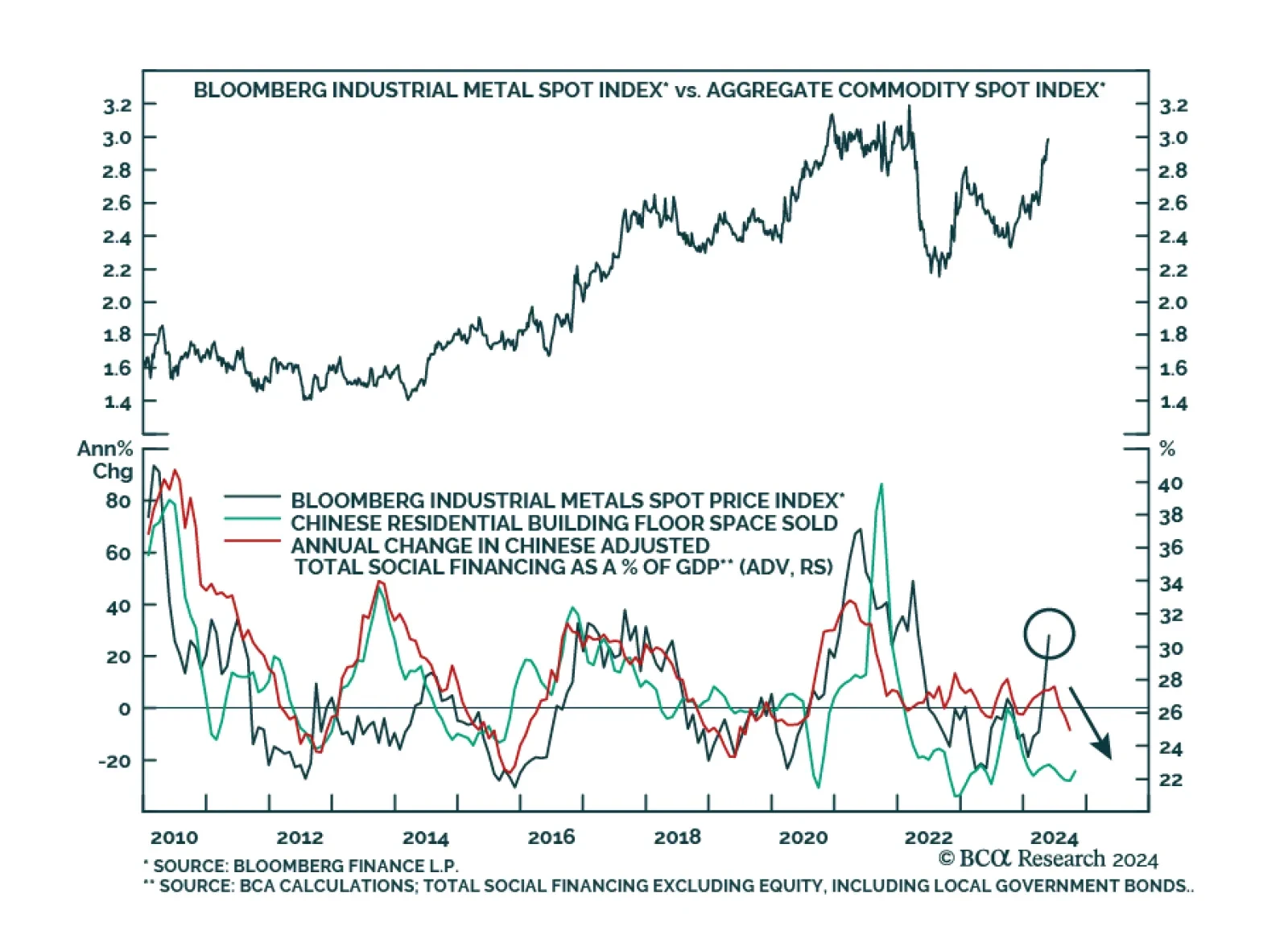

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

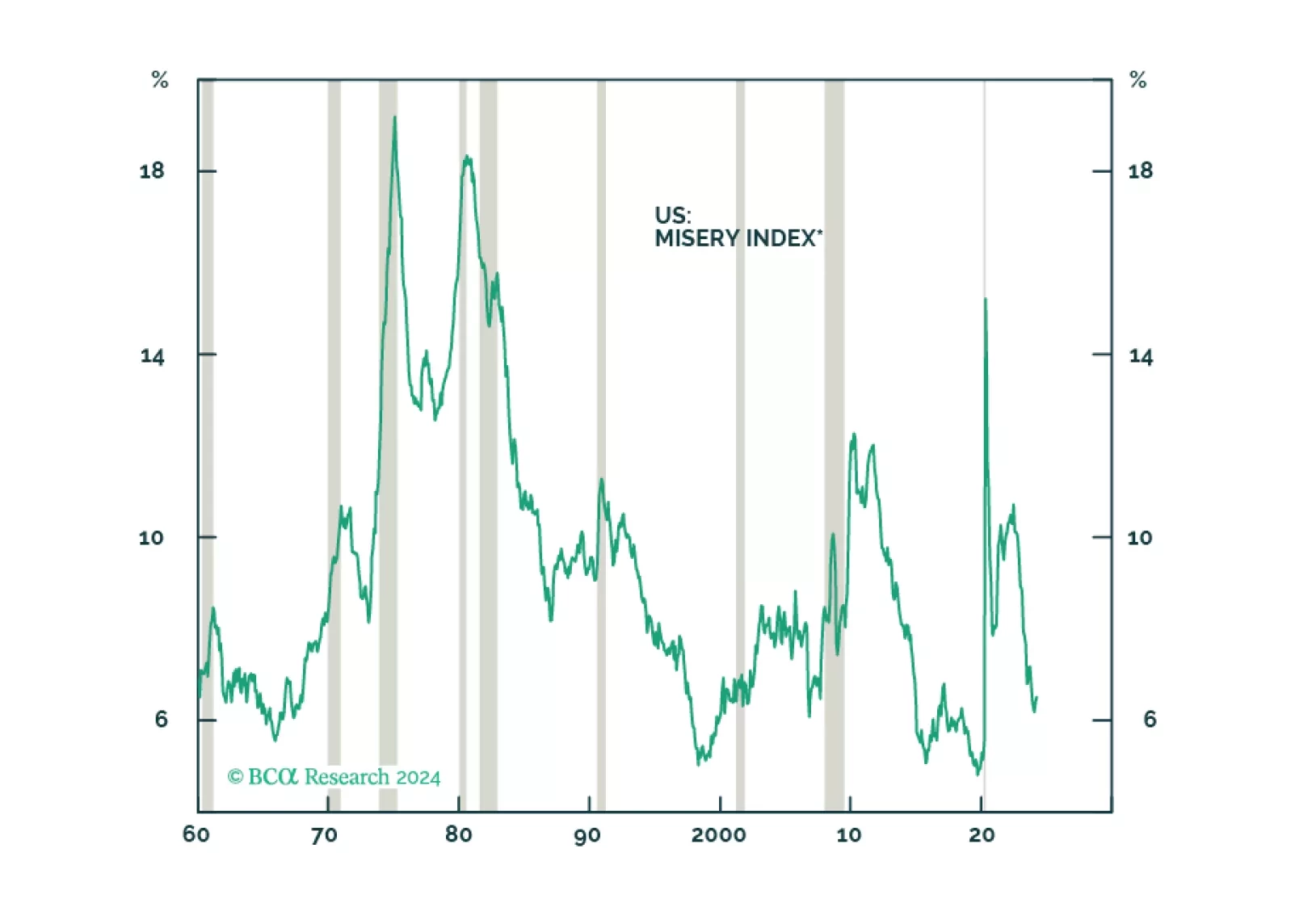

The stock market will suffer a setback from the weakening labor market and a rebound in US and global policy uncertainty.

According to BCA Research’s China Investment Strategy service, a decisive turnaround in China’s economy hinges on a revival in the country’s property market. The April 30th Politburo meeting signaled…

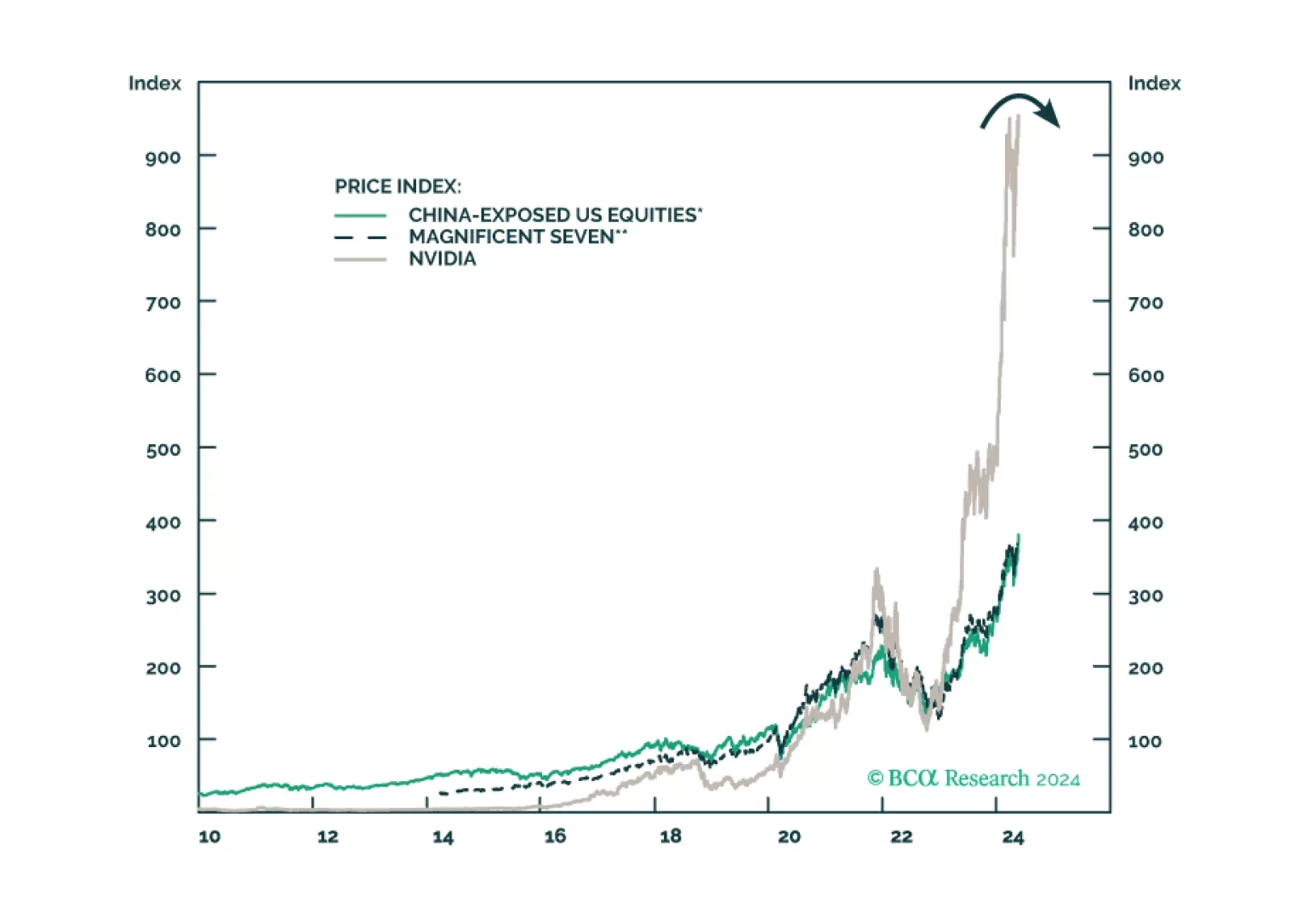

A reality check on credit data and announced property sector support measures indicates that the recent surge in Chinese share prices is unjustified based on the country's economic fundamentals.