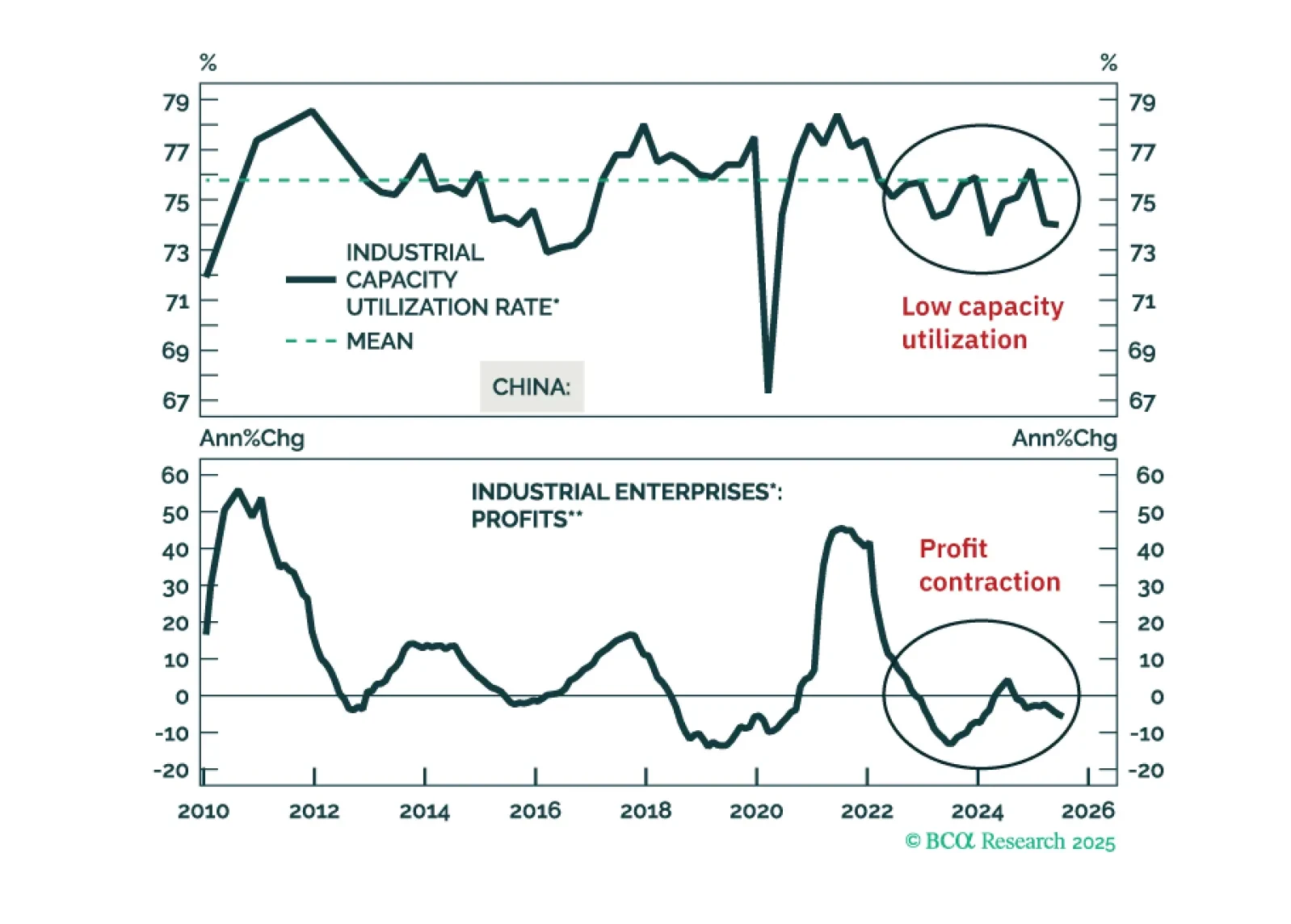

China’s Fourth Plenum outlined priorities for its 2026–2030 plan, emphasizing household consumption and technological upgrading but signaling continuity over change. The document highlights a rebalancing toward consumption as a share…

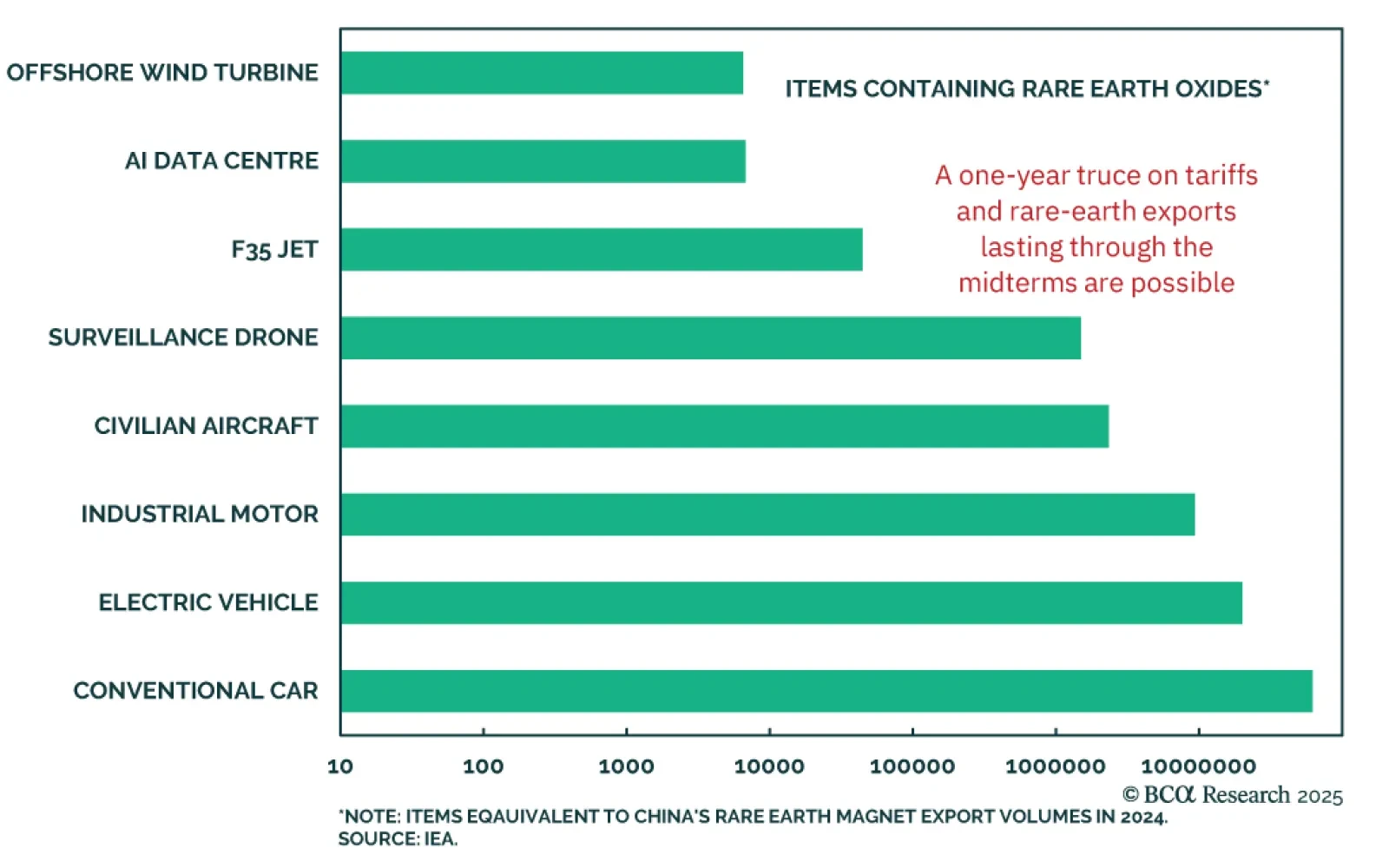

The US and China appear to be moving toward a trade deal, though it remains unclear whether the goal is simply damage control or a genuine expansion of market access. Presidents Trump and Xi are scheduled to meet on October 30 in…

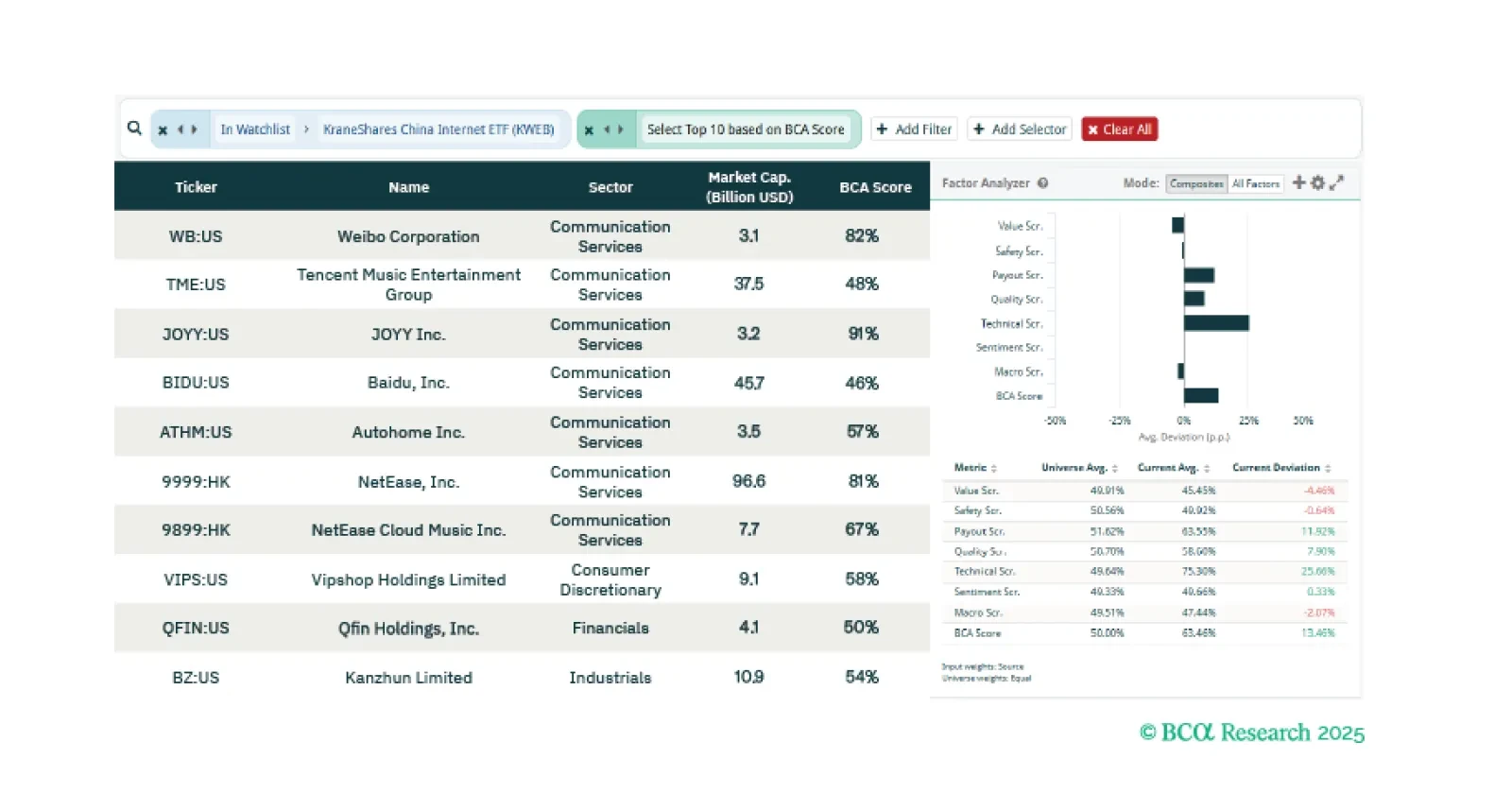

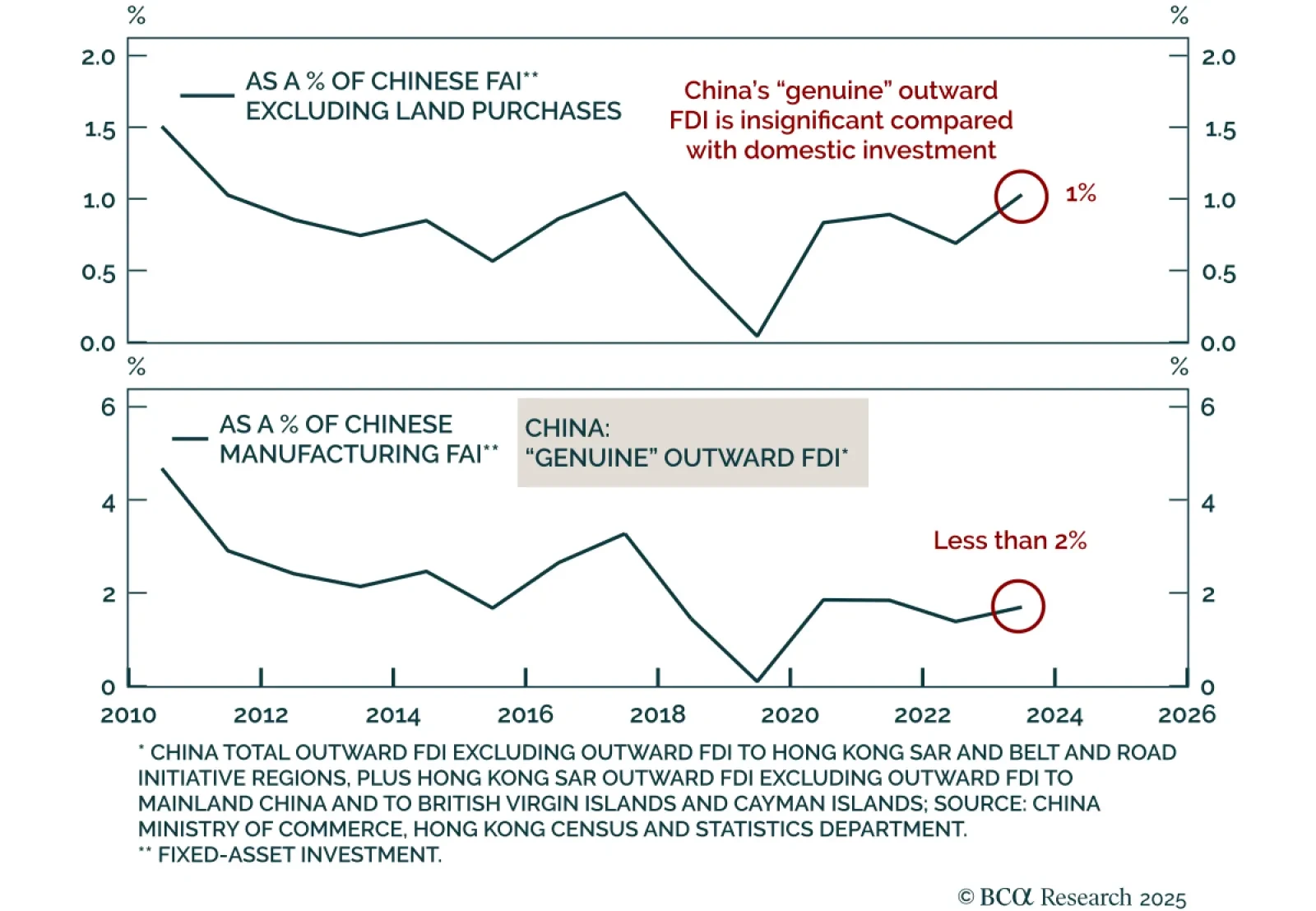

Our China Investment strategists argue that China’s manufacturing offshoring is modest and overstated, with only firms demonstrating pricing power and technological leadership likely to generate durable shareholder returns. Headline…

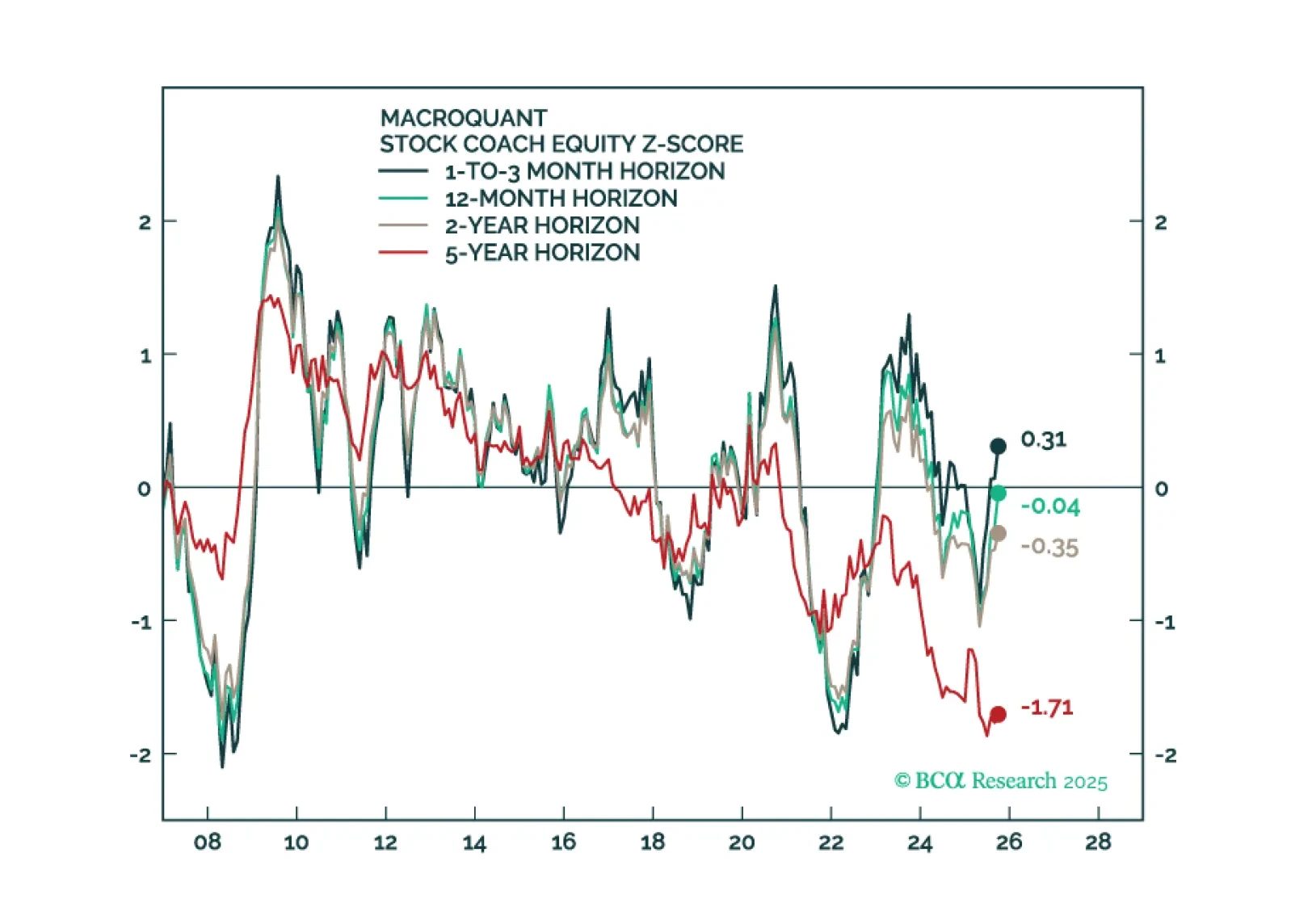

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

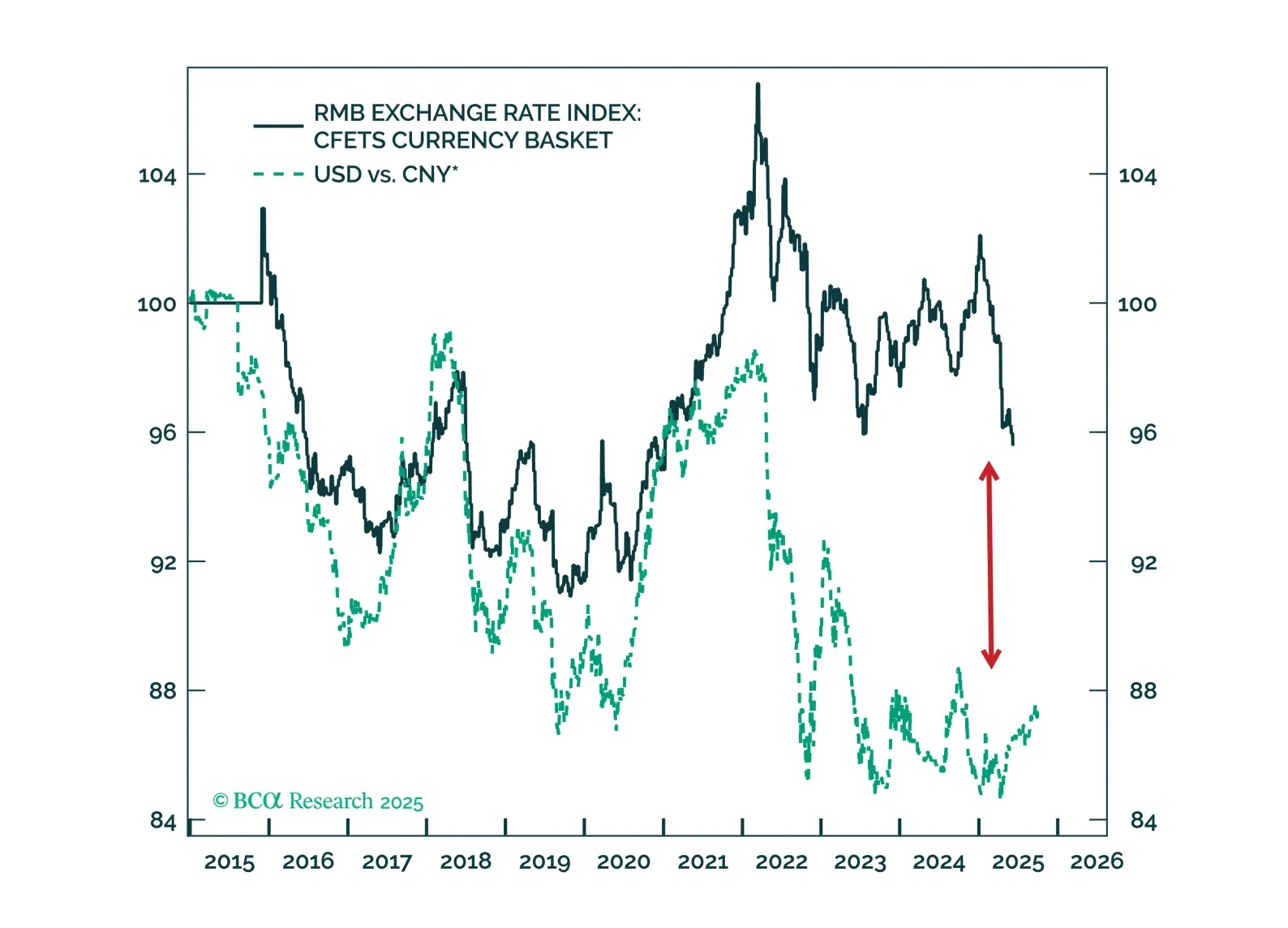

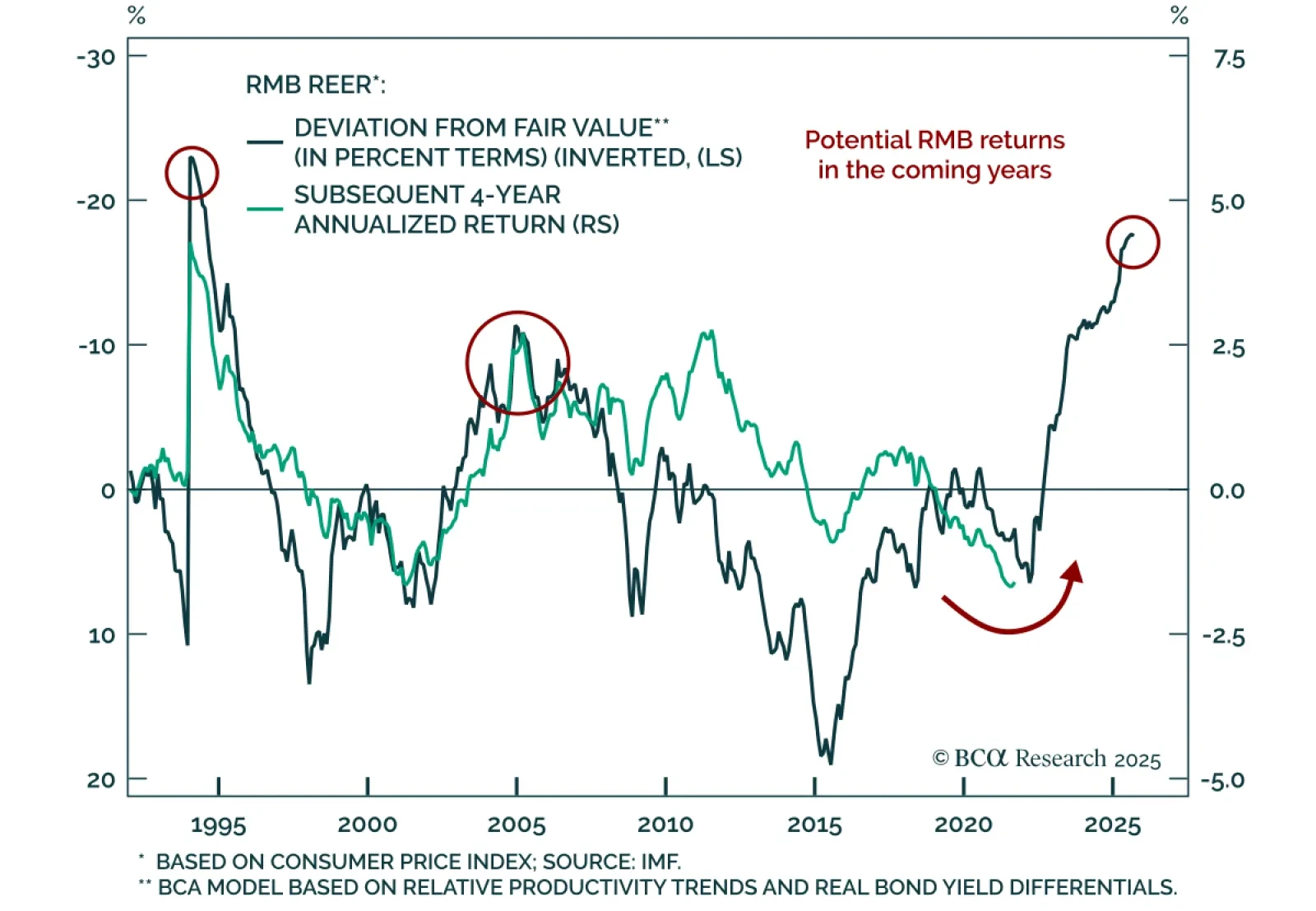

The CNY/USD has room to appreciate both cyclically and structurally, while nominal yields on China’s long-duration government bonds are set to fall. This combination supports Chinese equities.

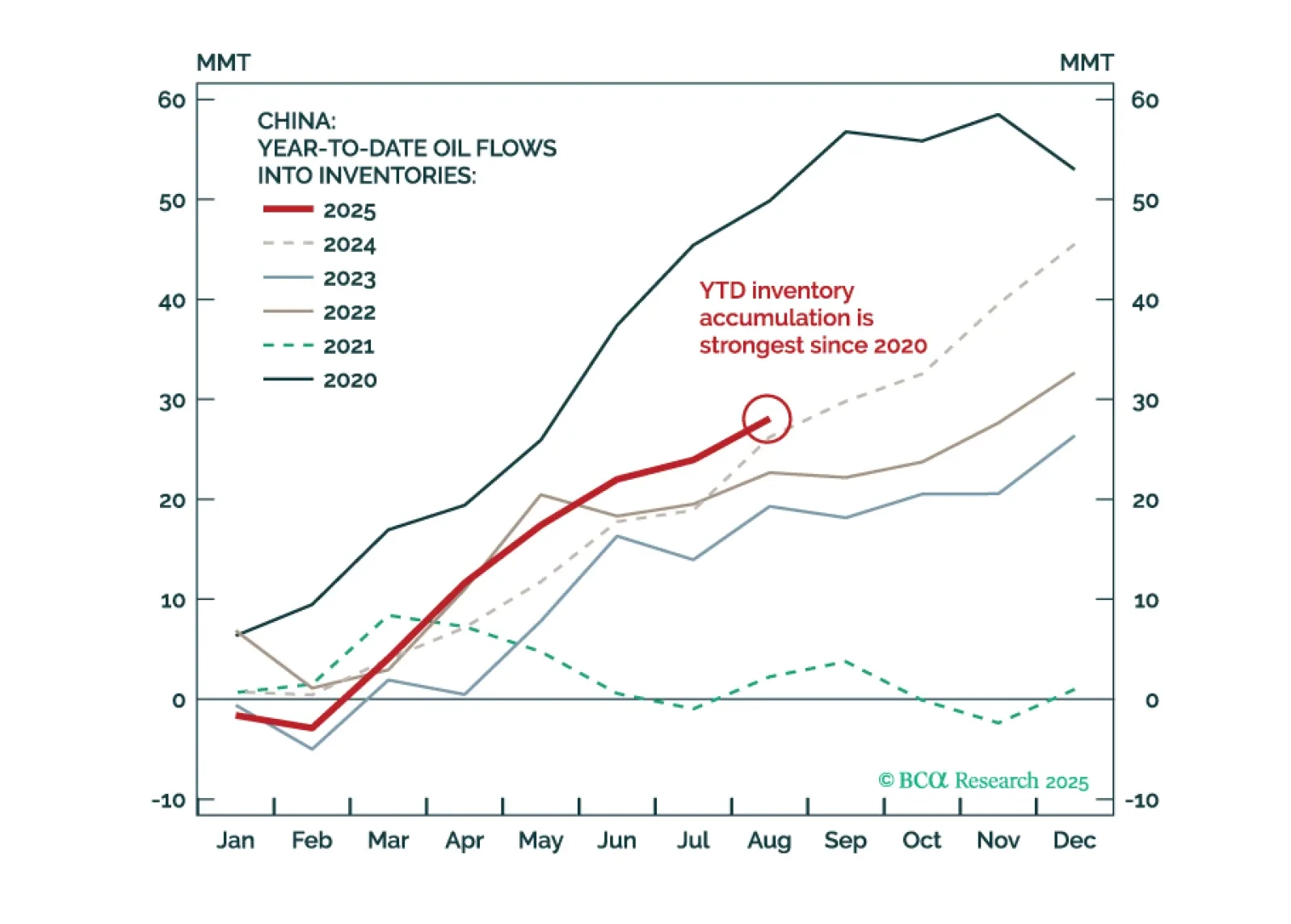

We remain cyclically short Brent but are tightening the stop loss to $73/bbl to guard against a geopolitics-driven upside break.

This week our screeners explore offshore Chinese internet stocks, US Healthcare equities, and sectoral opportunities in the Canadian bourse.

Rising Russia-NATO risks, tactical oil/gold trades, tougher sanctions on Russia (maybe China), China stimulus with ~5% growth target, and US checks on Trump’s ambitions will define Q4.

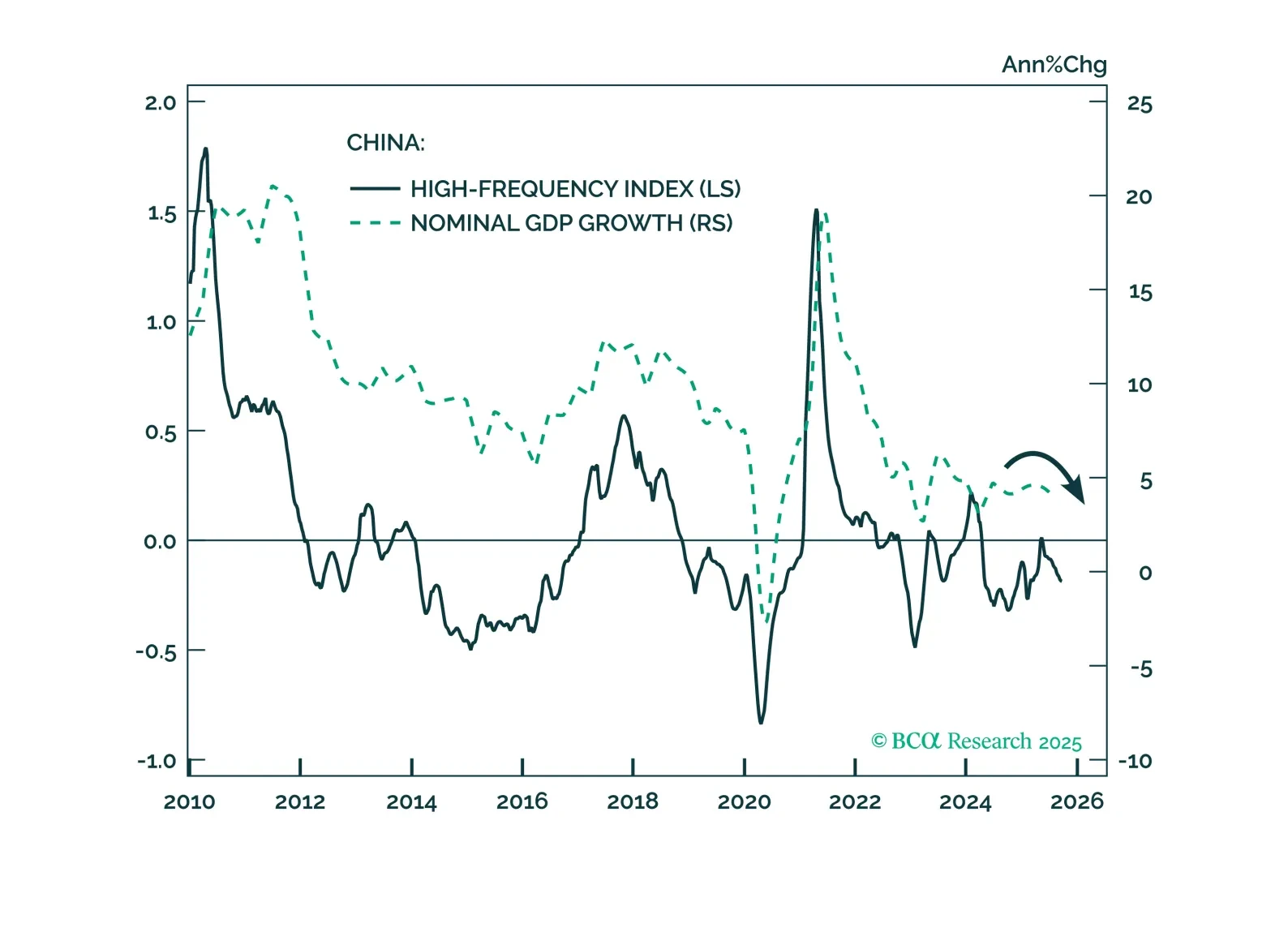

Our high-frequency indicators show China’s growth momentum weakening further in September, increasing the likelihood of new stimulus in the weeks ahead. We remain tactically cautious on Chinese equities, but strategically…