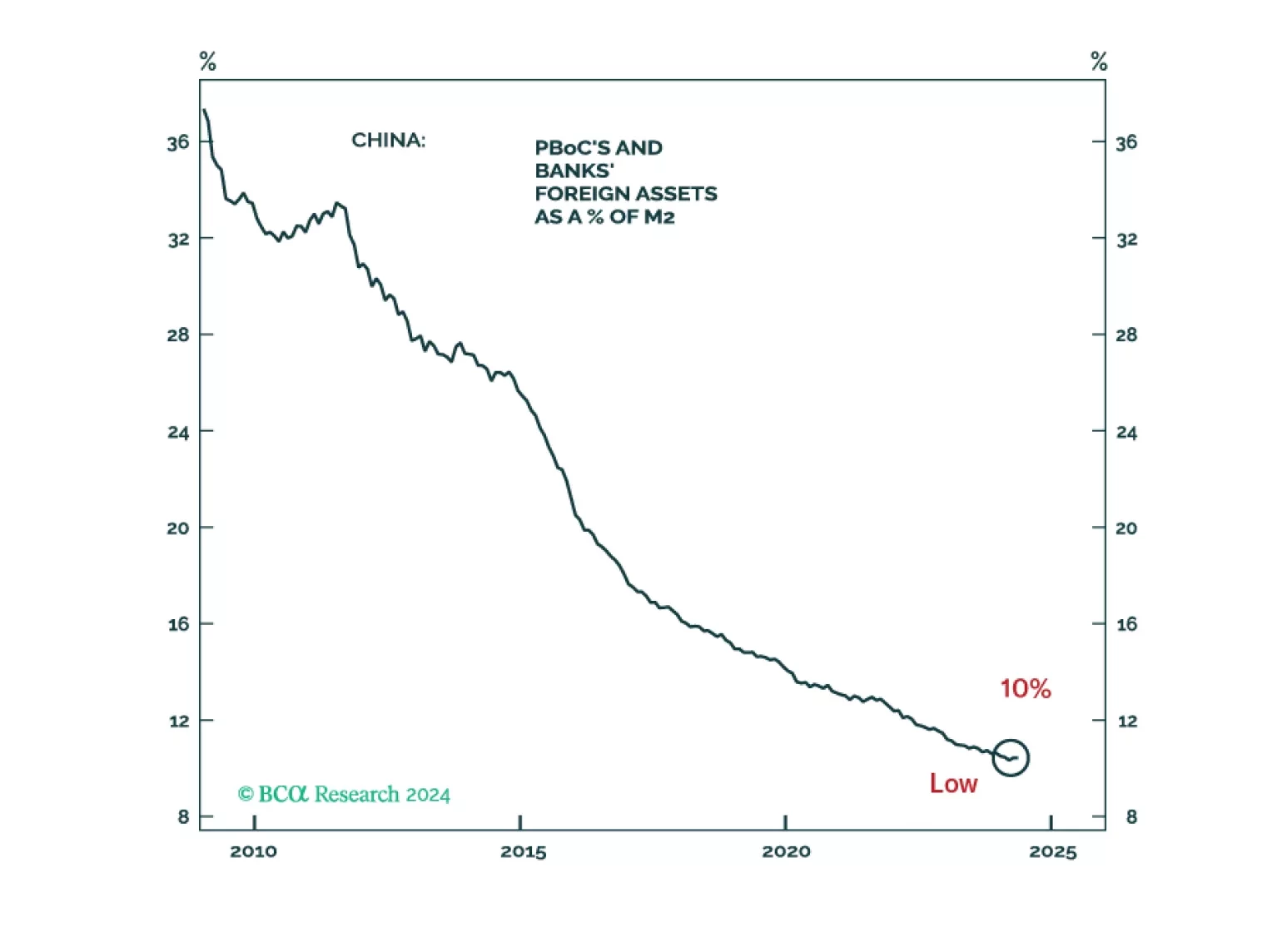

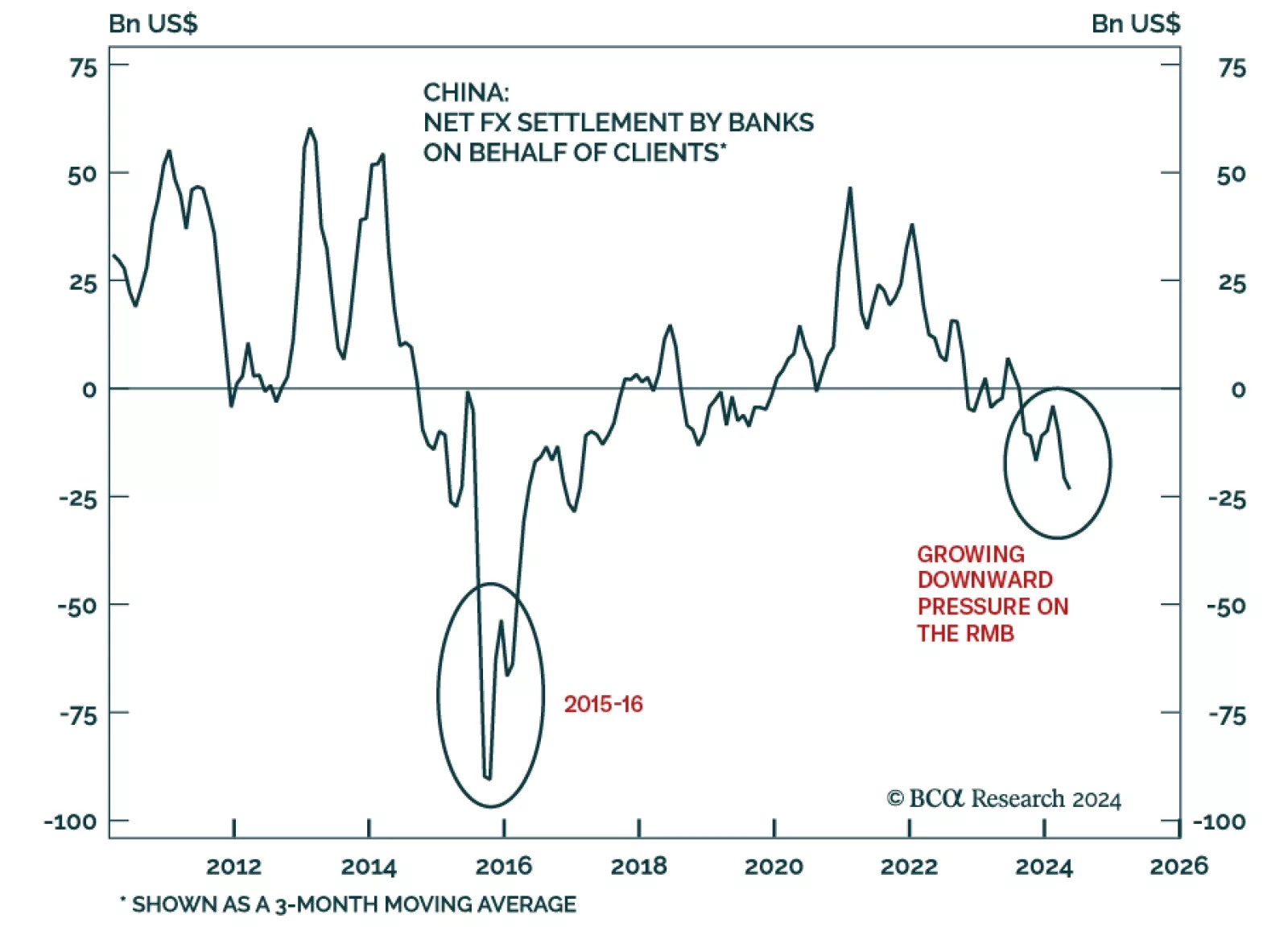

The Chinese currency has been under considerable depreciation pressure due to capital outflows. Additionally, the economy is grappling with debt deflation and a balance sheet recession, conditions that typically call for lower…

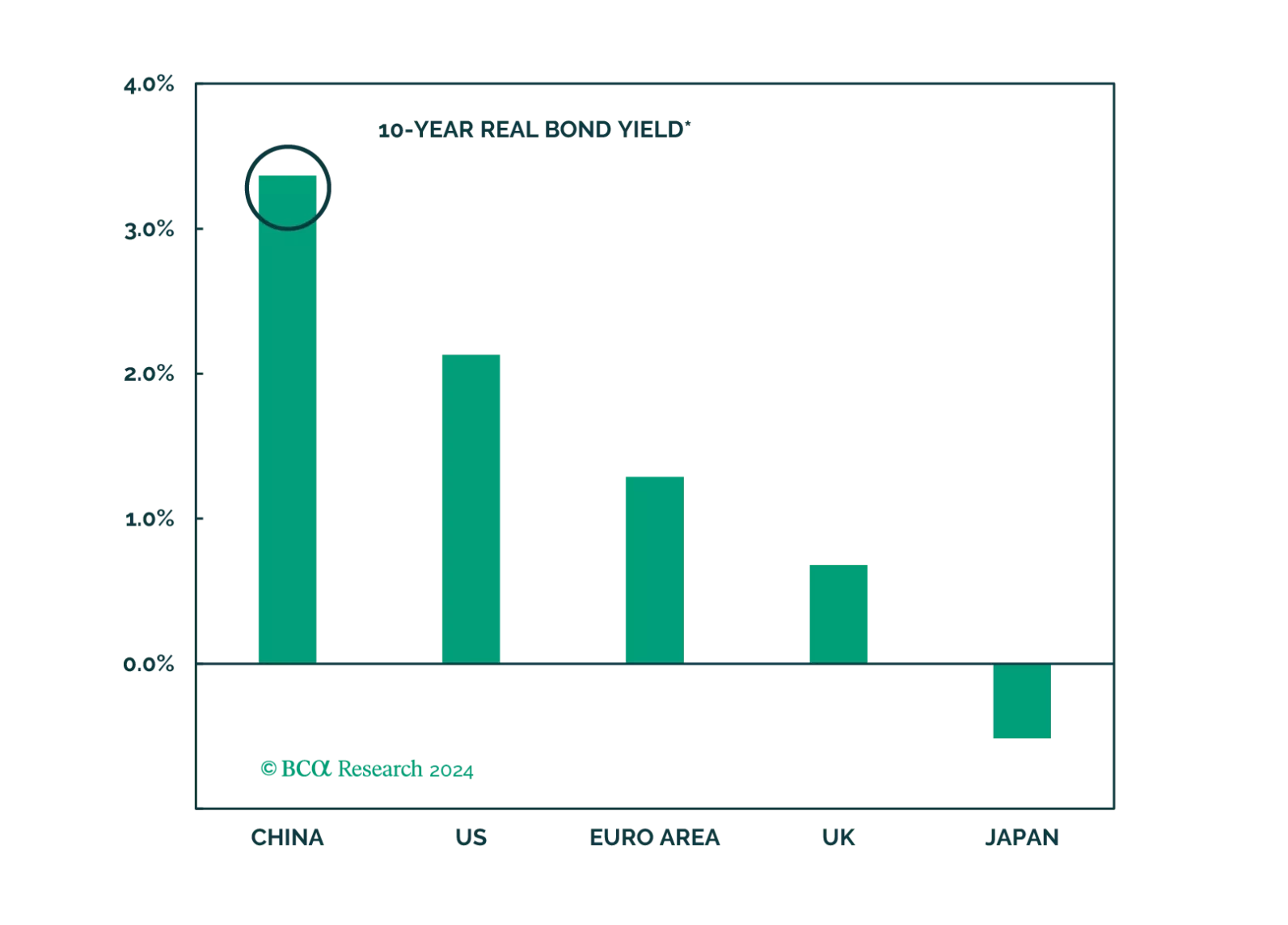

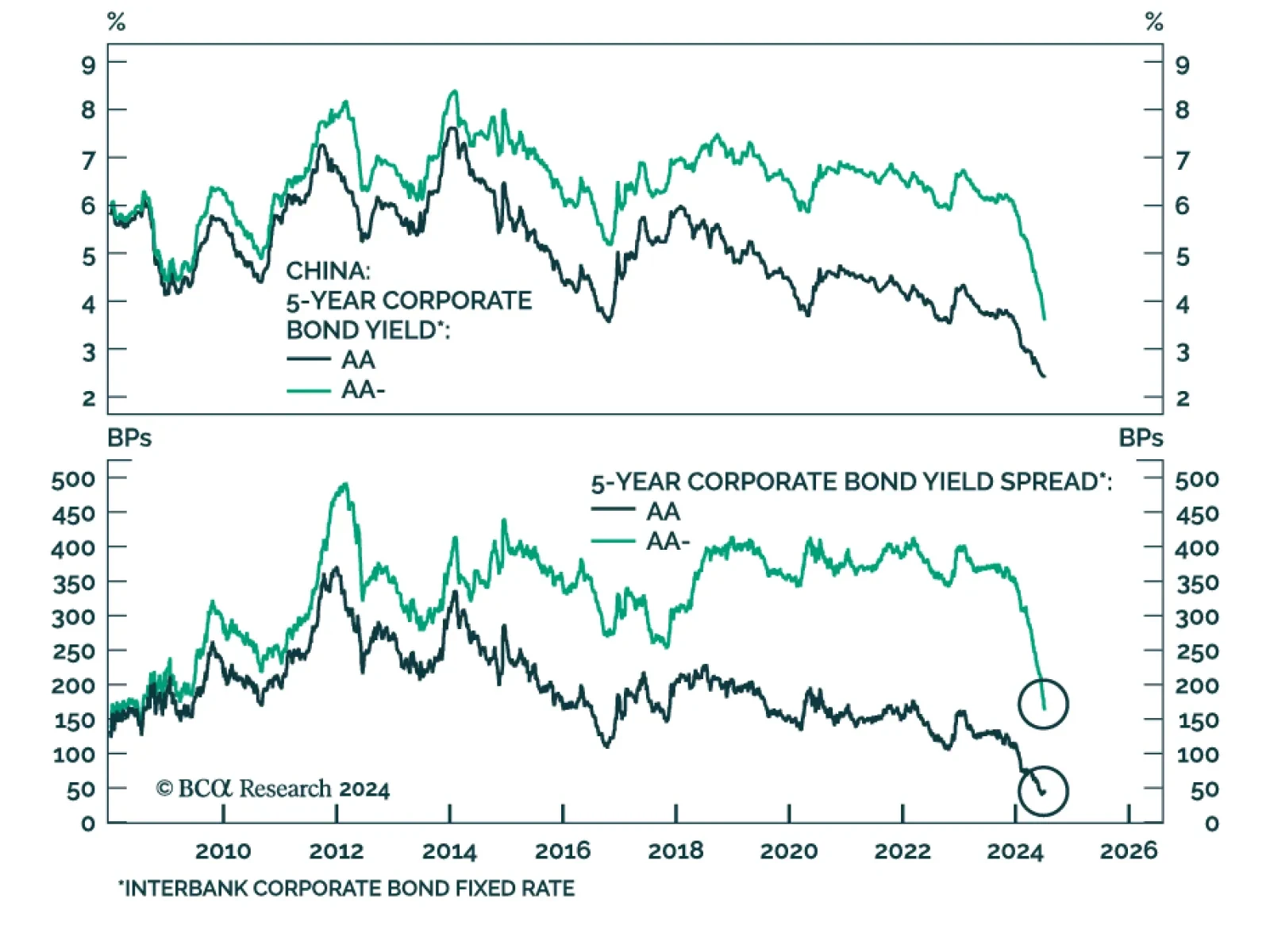

According to BCA Research’s China Investment Strategy service, onshore bonds are vulnerable to an investor sentiment reversal. Chinese 10-year government bond yields will likely trend lower to below 2% over the next 12…

The PBoC appears increasingly uncomfortable with the rapid decline in the Chinese government bond yields. While the PBoC will succeed in temporarily curbing investors’ enthusiasm for bonds, the central bank will be unwilling to raise…

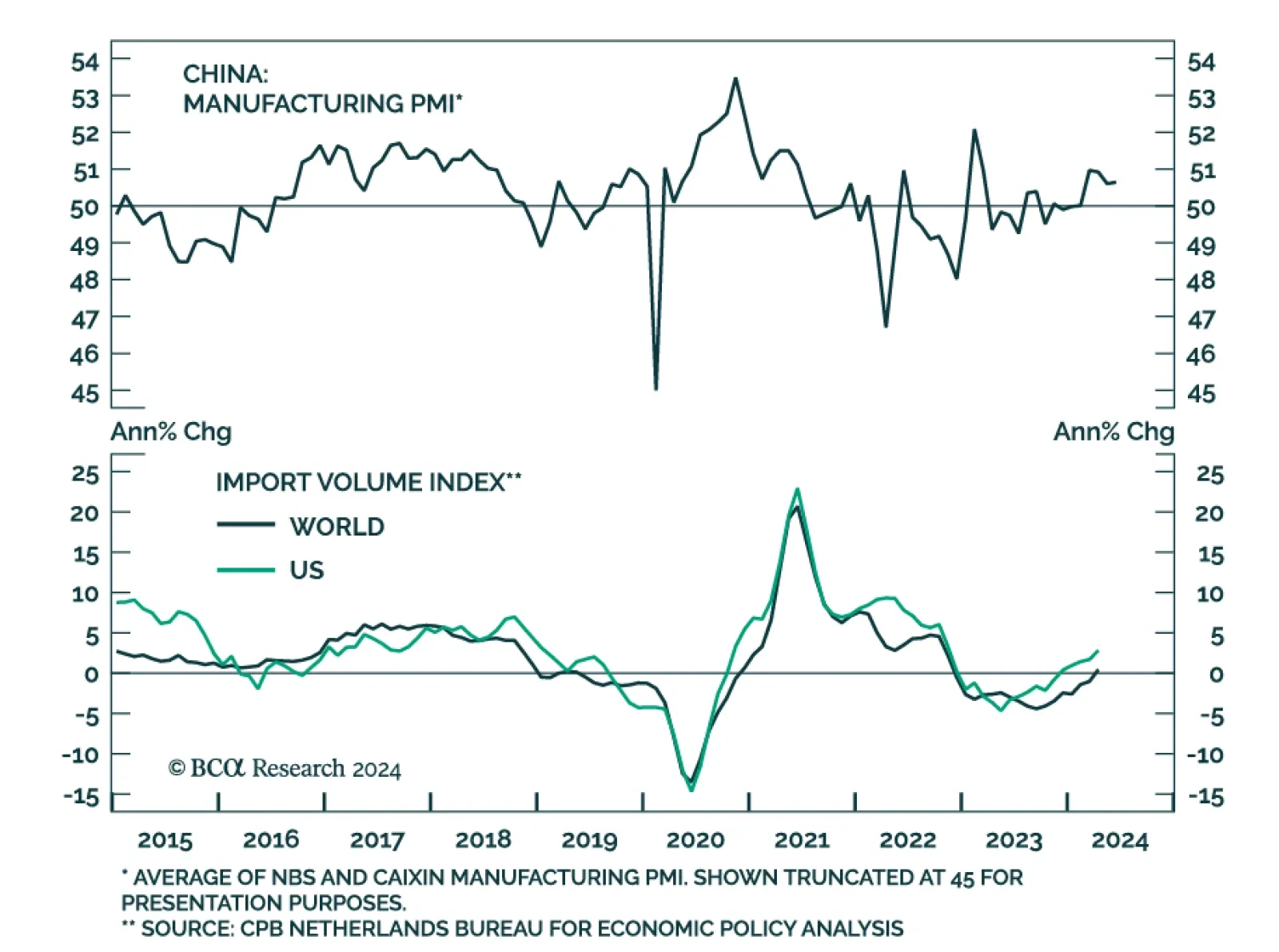

Chinese manufacturing PMIs remained mostly stable in June. The Caixin PMI ticked 0.1 point higher to 51.8 while the NBS measure remained at 49.5. Both leading gauges of Chinese manufacturing activity are thus sending seemingly…

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

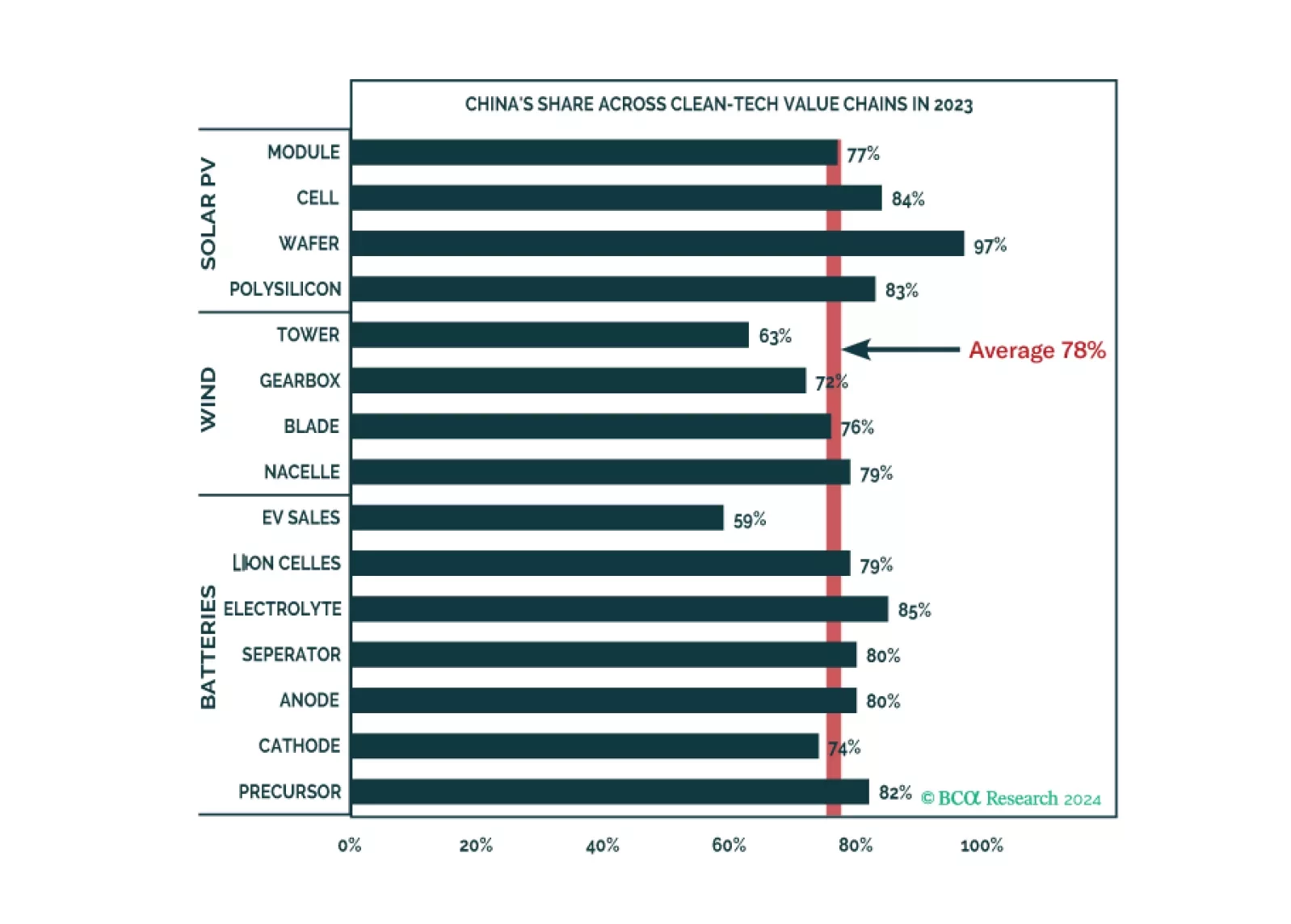

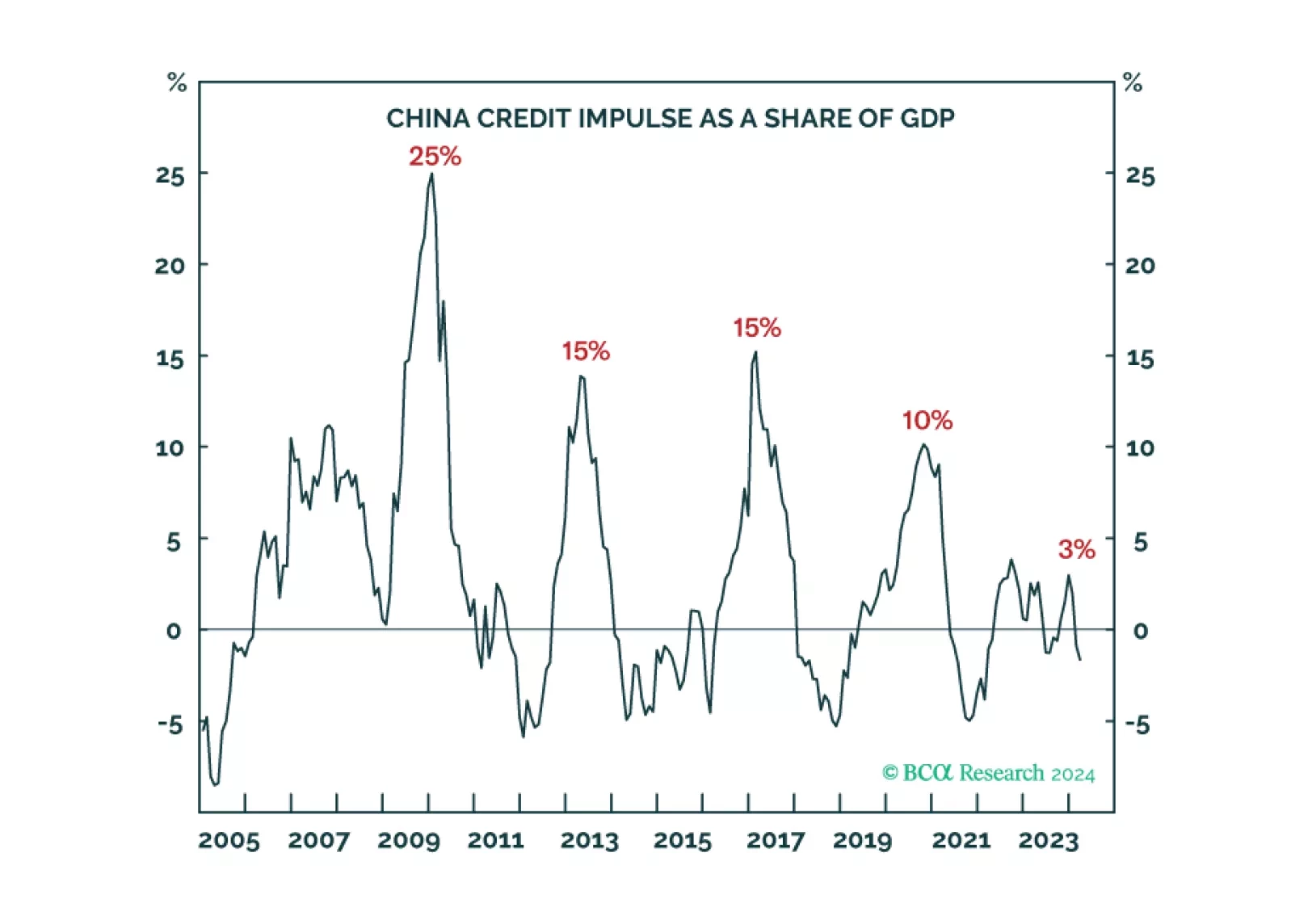

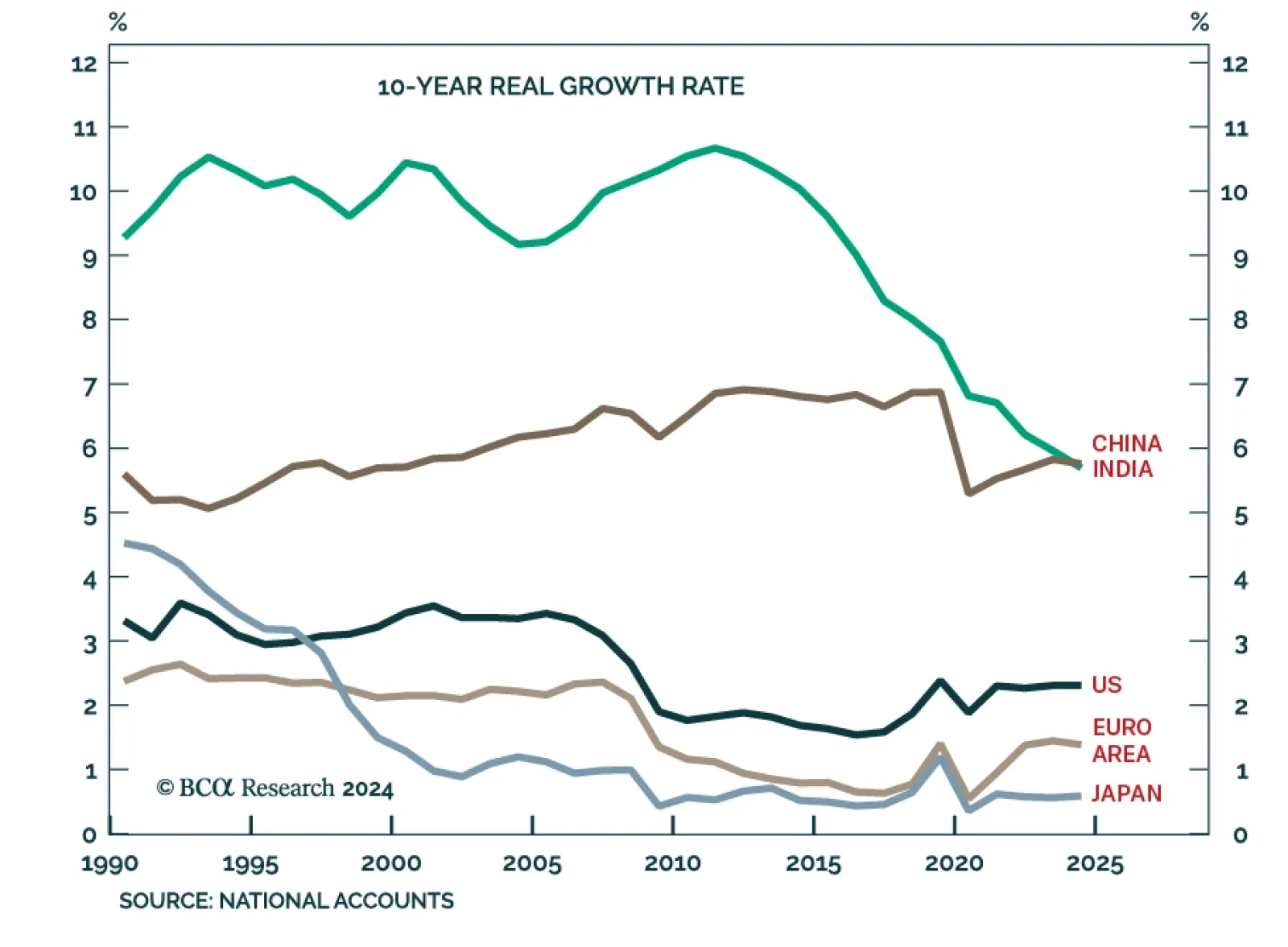

According to BCA Research’s Counterpoint service, absent China’s exponential credit growth, China’s trend growth rate will fall to 4 percent and the world’s trend growth rate will fall to sub-3 percent.…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…