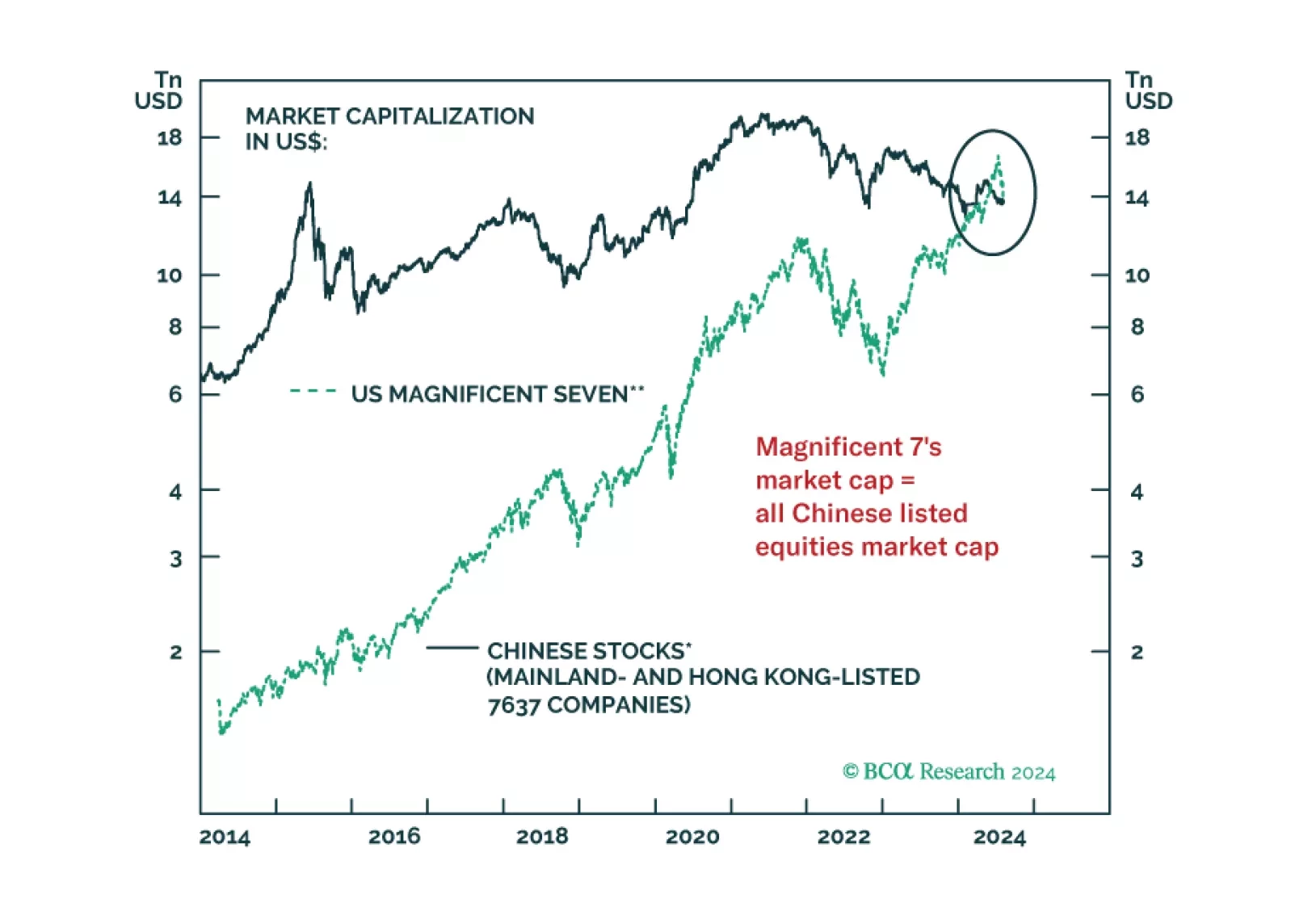

The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…

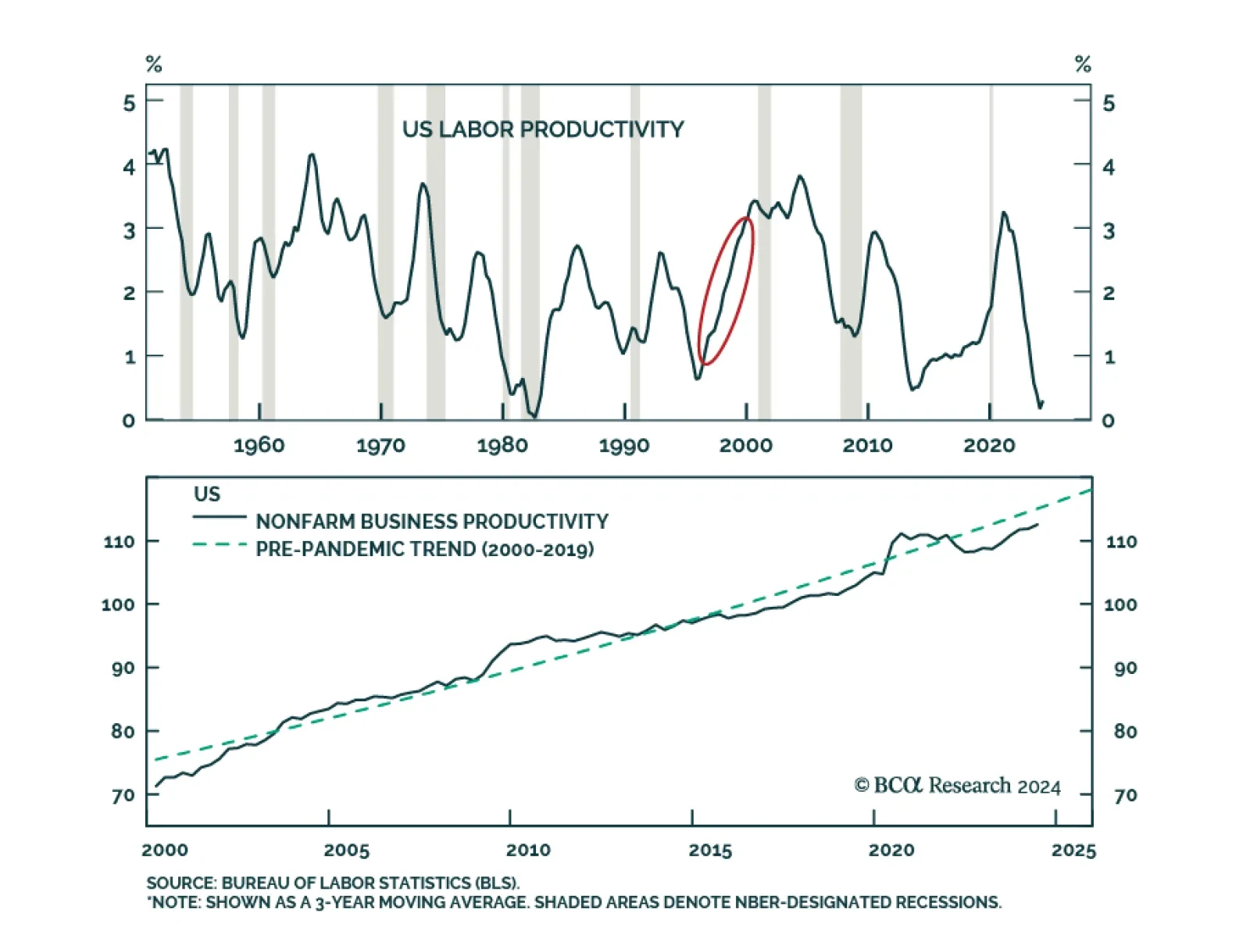

We have previously highlighted that an upside surprise in China’s fiscal stimulus as well as an AI-triggered jump in US productivity could potentially prolong the expansion, and constitute two key risks to our recession…

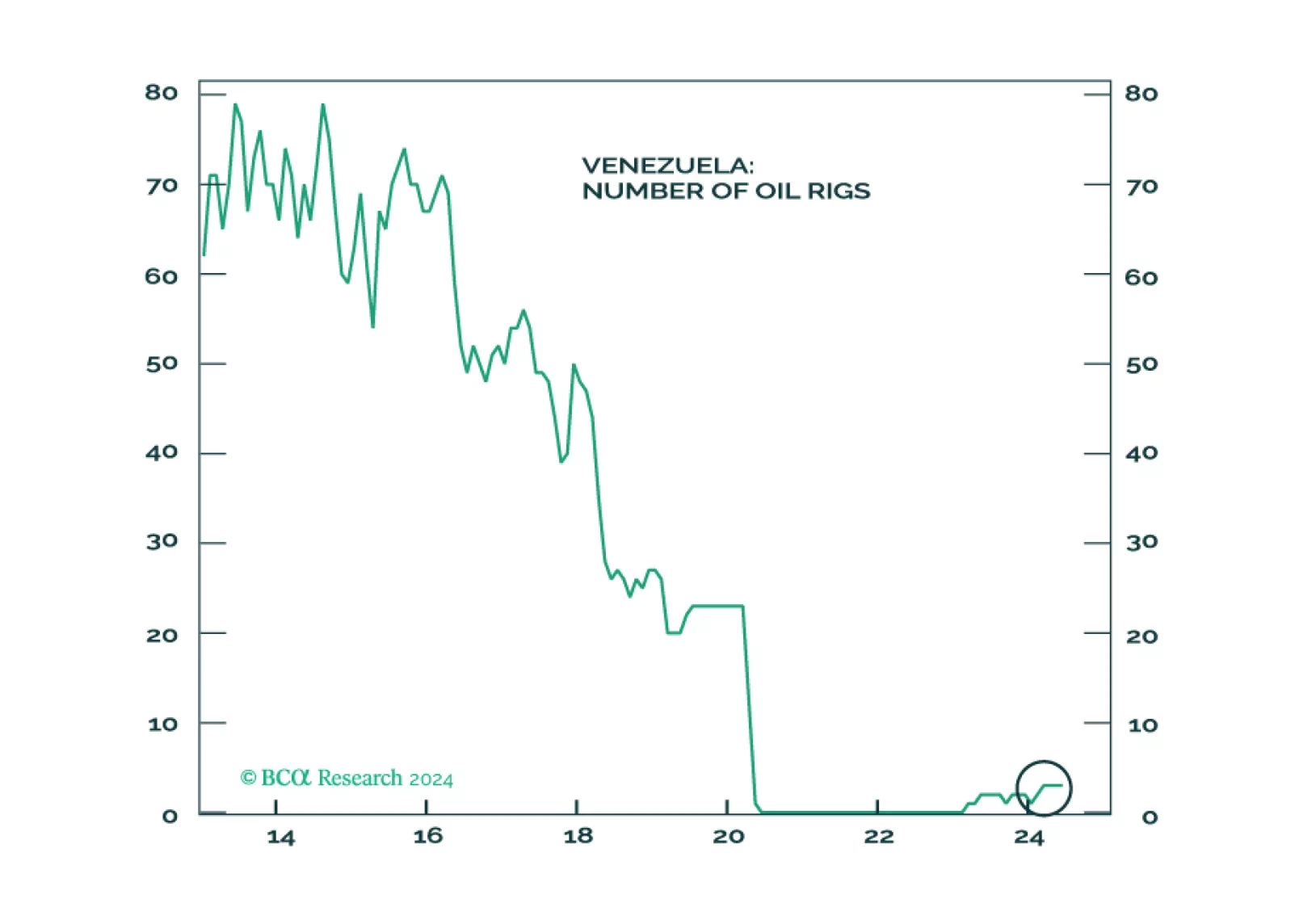

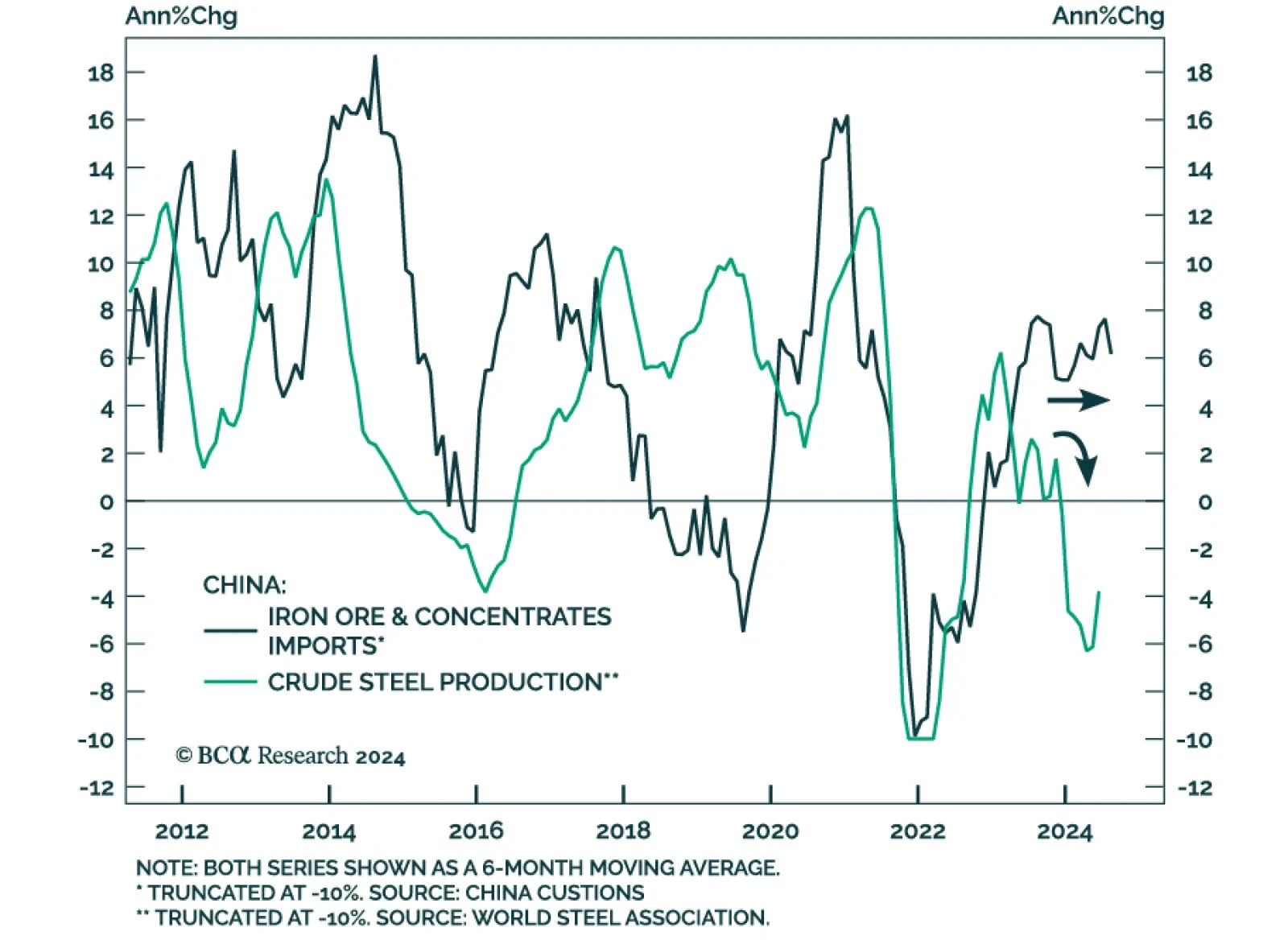

According to BCA Research’s Commodity & Energy Strategy service, robust iron ore imports are sending a false signal about steel demand. Instead, these supplies are being used to restock inventories. By the end of…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

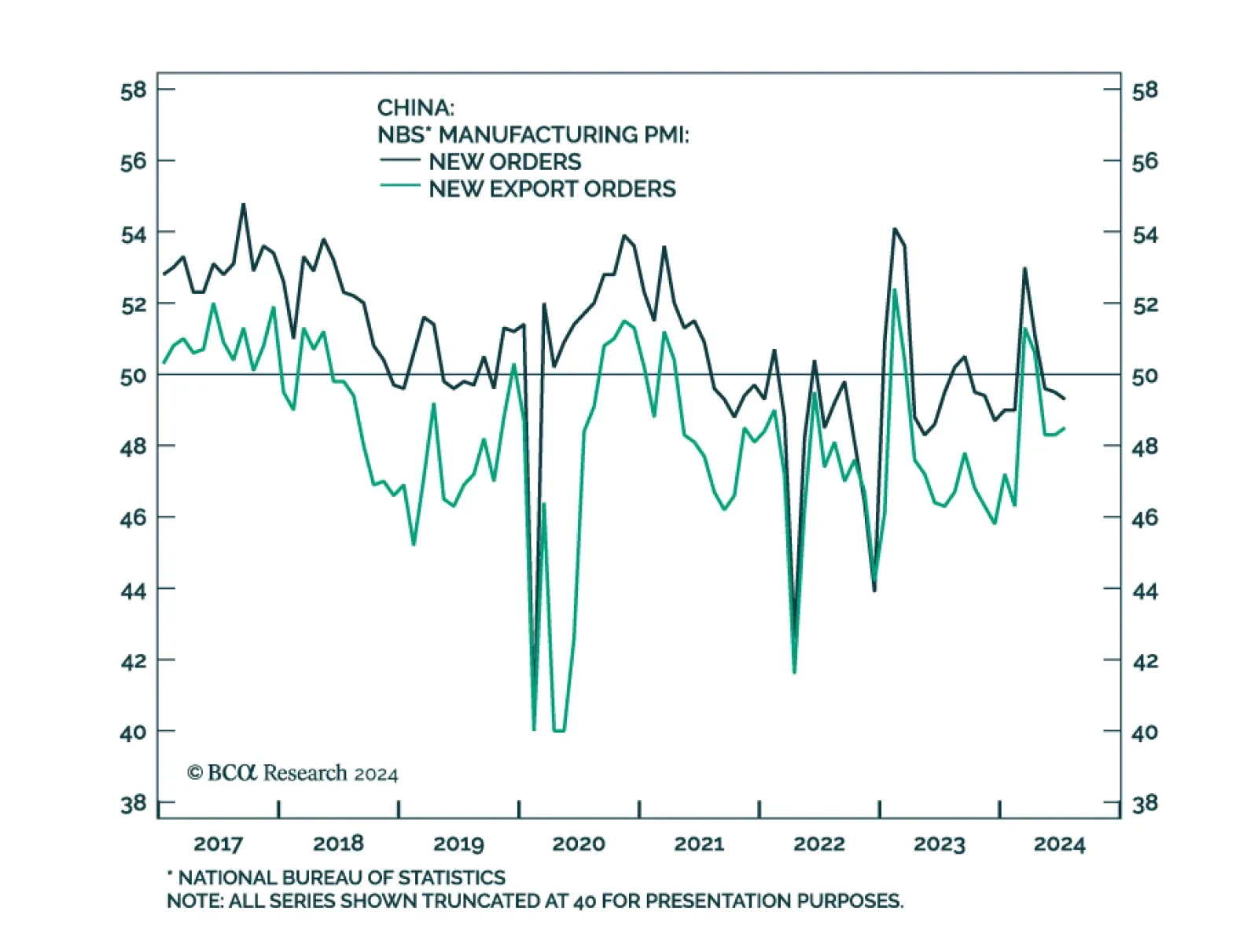

China’s NBS manufacturing PMI declined further in July, from 49.5 to 49.4, marking a third consecutive month of contraction. New orders and new export orders underscored continued weakness in both domestic and foreign…

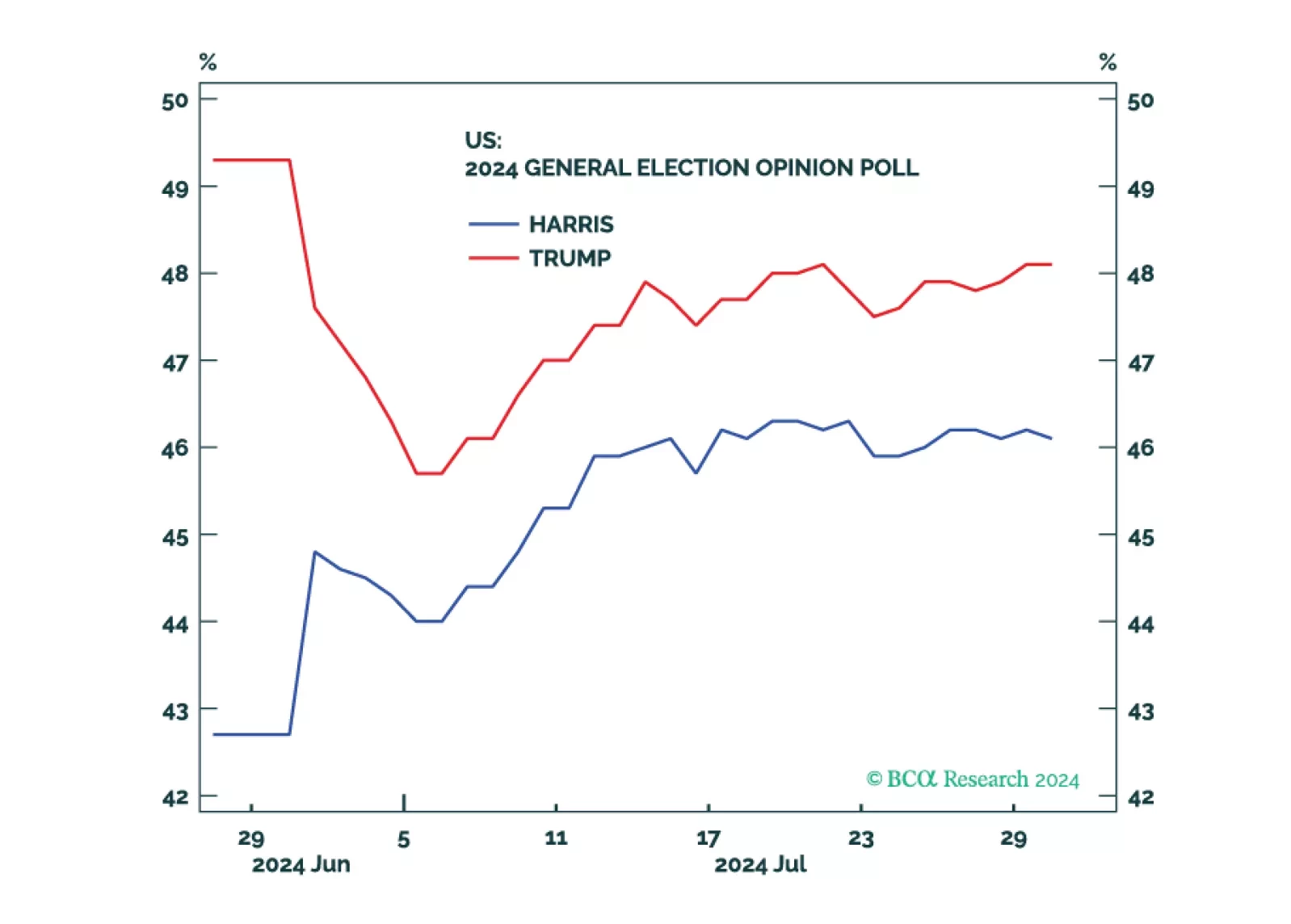

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

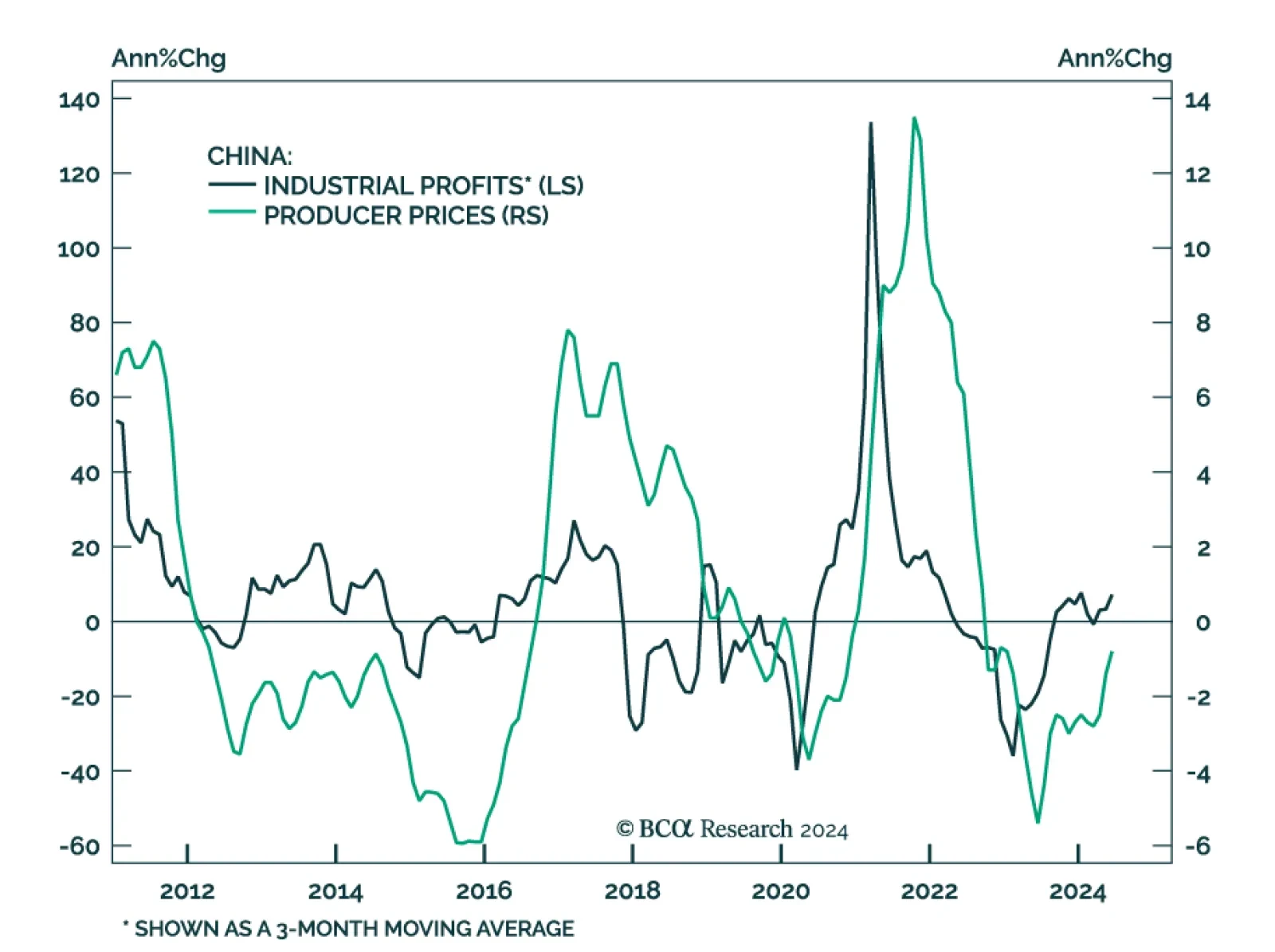

Chinese industrial profits growth accelerated in June, rising from 0.7% y/y to 3.6%. Profits expanded at 3.5% in the first half of 2024, compared to 3.4% in the first half of 2023, and suggest that China’s manufacturing…

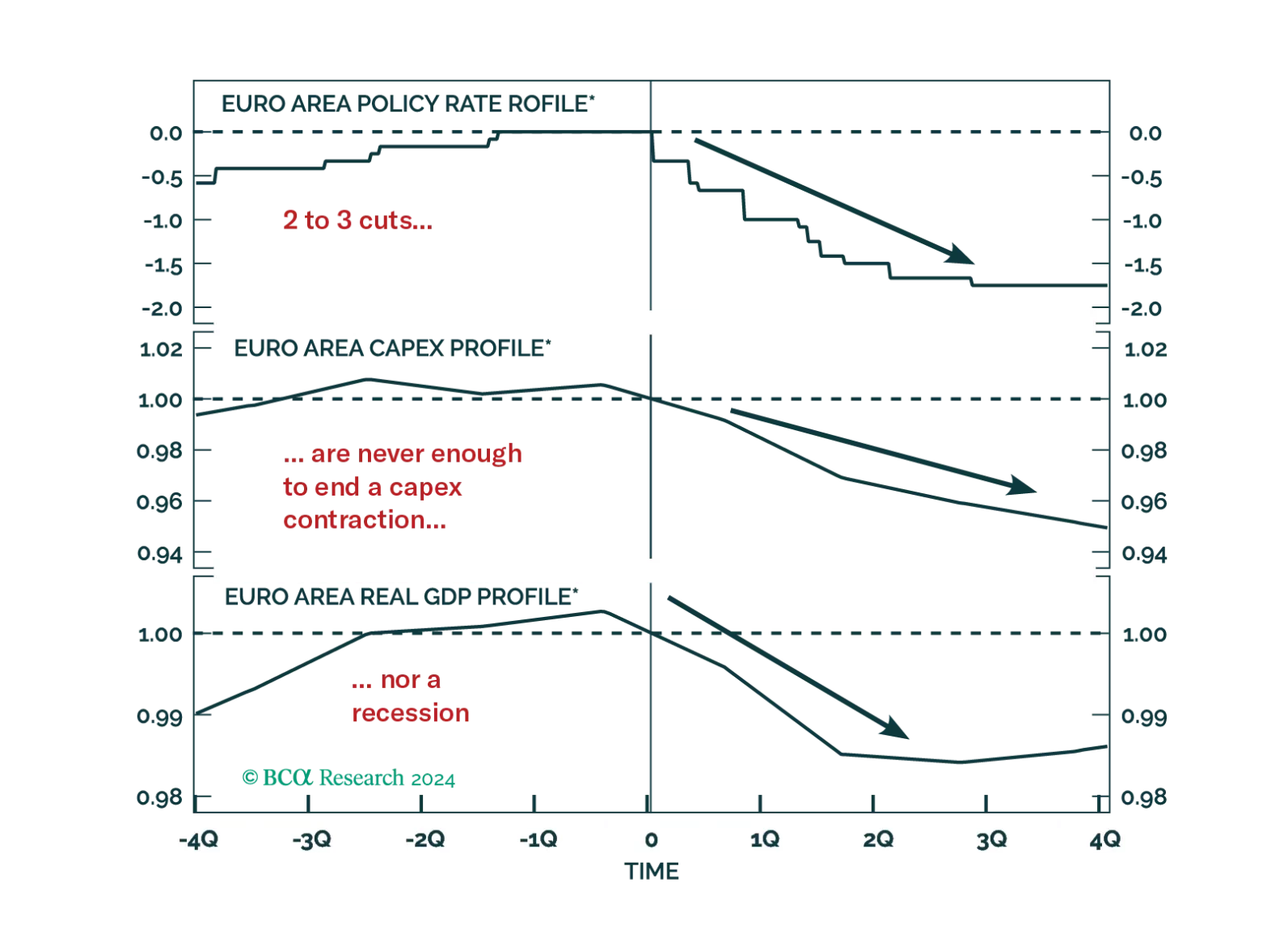

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

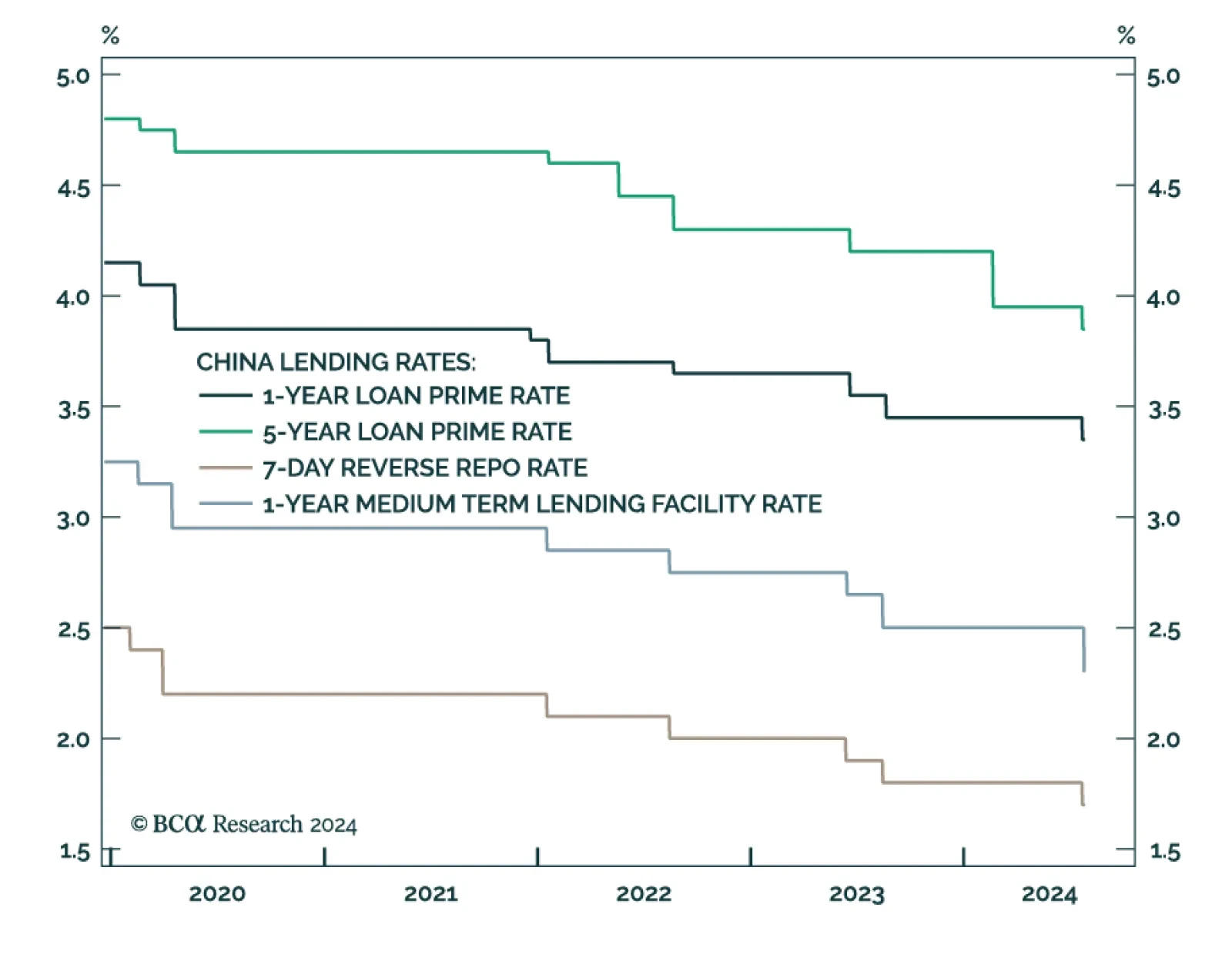

Just a few days after unexpectedly lowering three key borrowing rates by 10 basis points (bps), the PBoC cut the 1-year medium-term lending facility rate by 20 bps, from 2.50% to 2.30%. While the earlier cut lowered the…