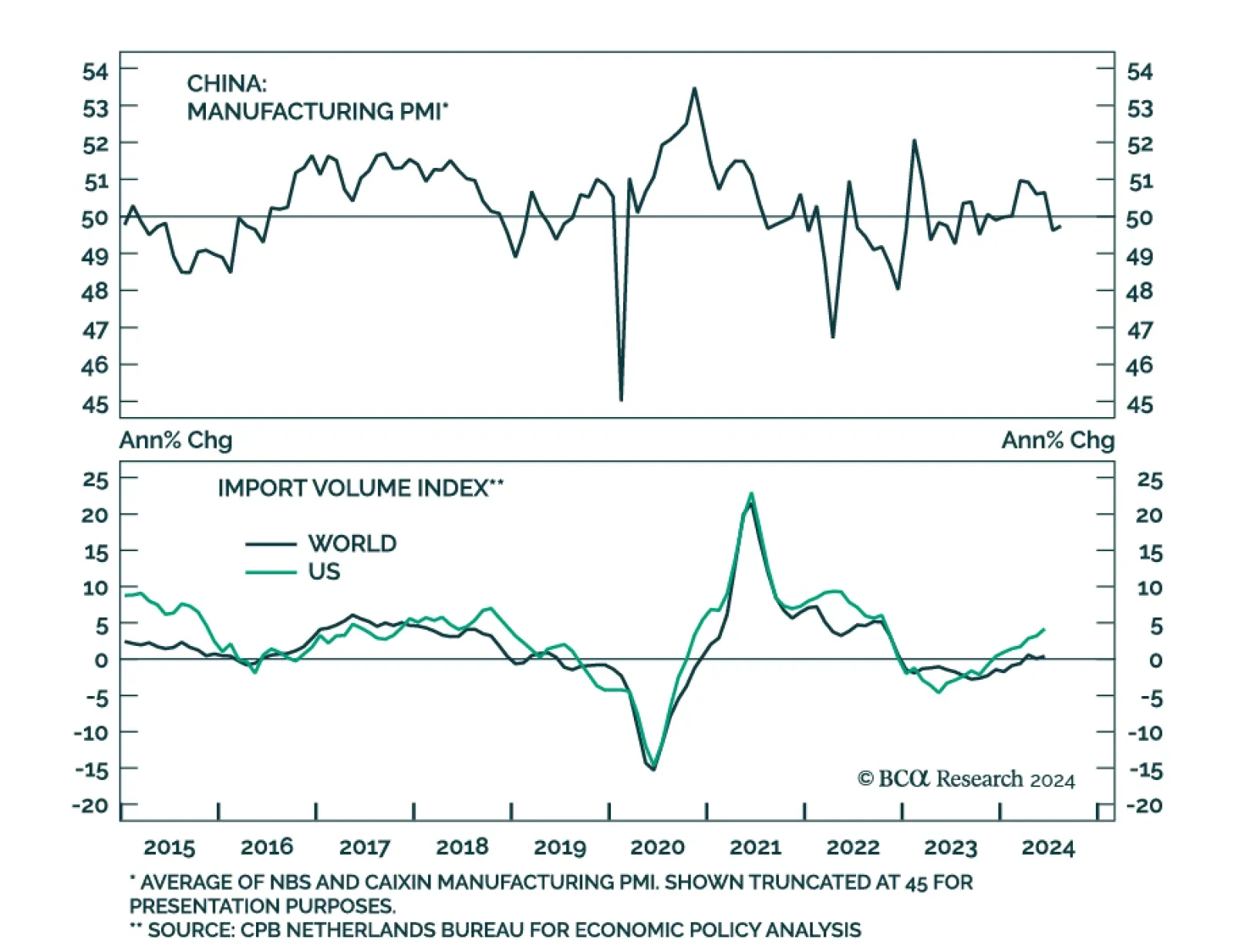

Both leading PMI measures painted a sluggish picture of China’s economic conditions in August. The NBS composite PMI suggested that overall activity barely expanded (50.1) and that the manufacturing sector’s…

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

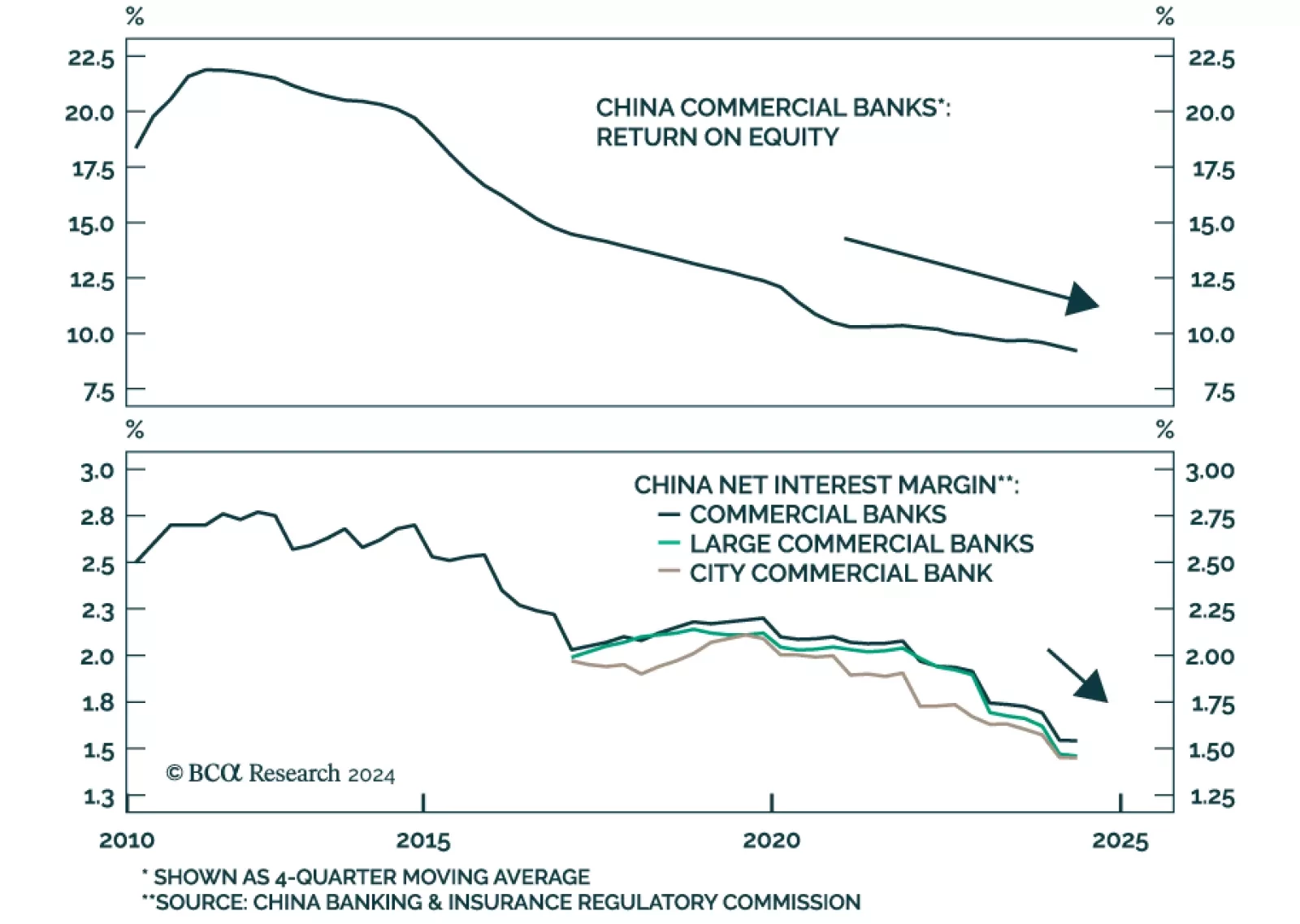

Chinese onshore and offshore bank stocks have outperformed their respective broad markets by 26% and 24% since October. Despite deteriorating return on assets, return on equity and net interest margins, investors have sought out…

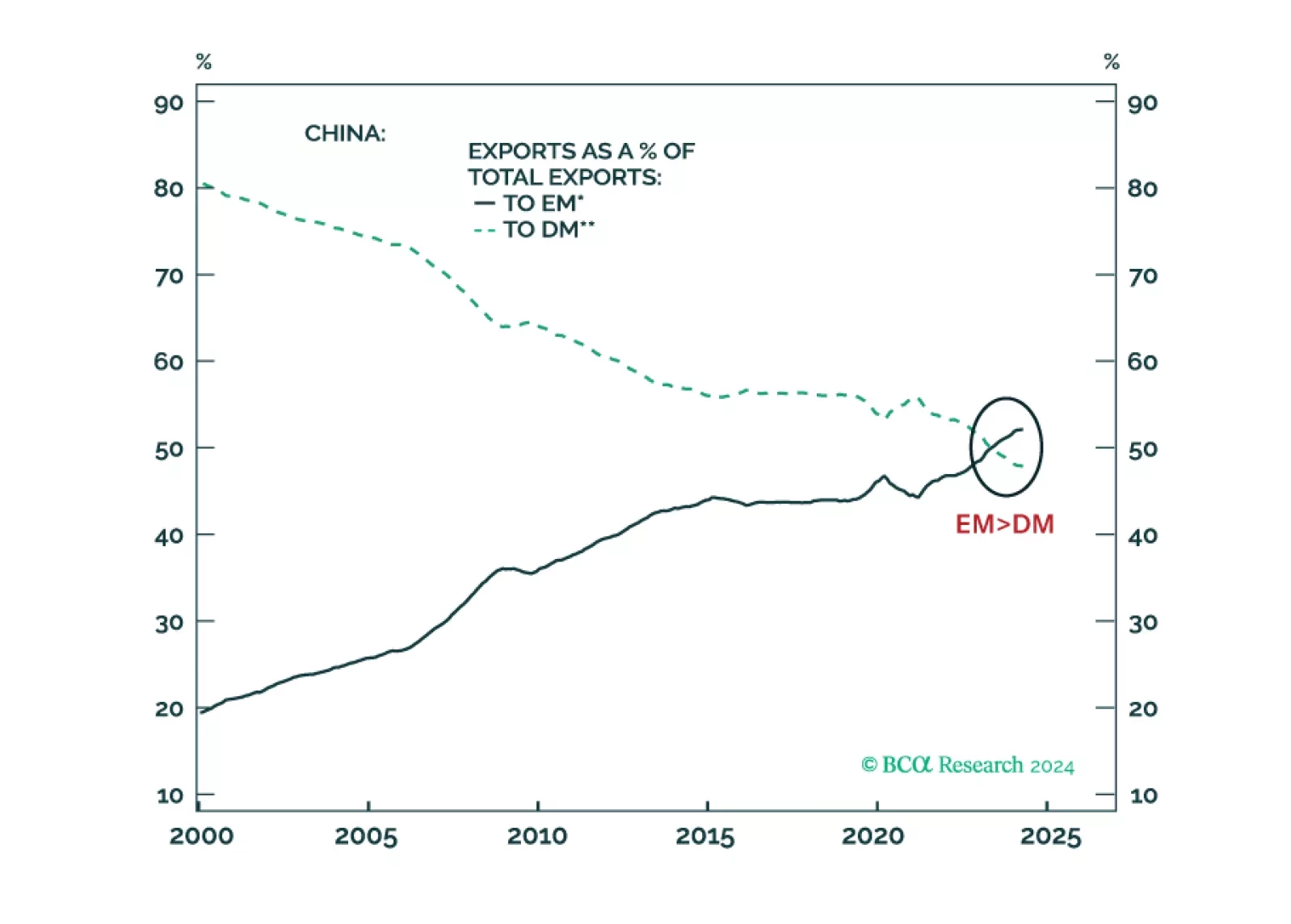

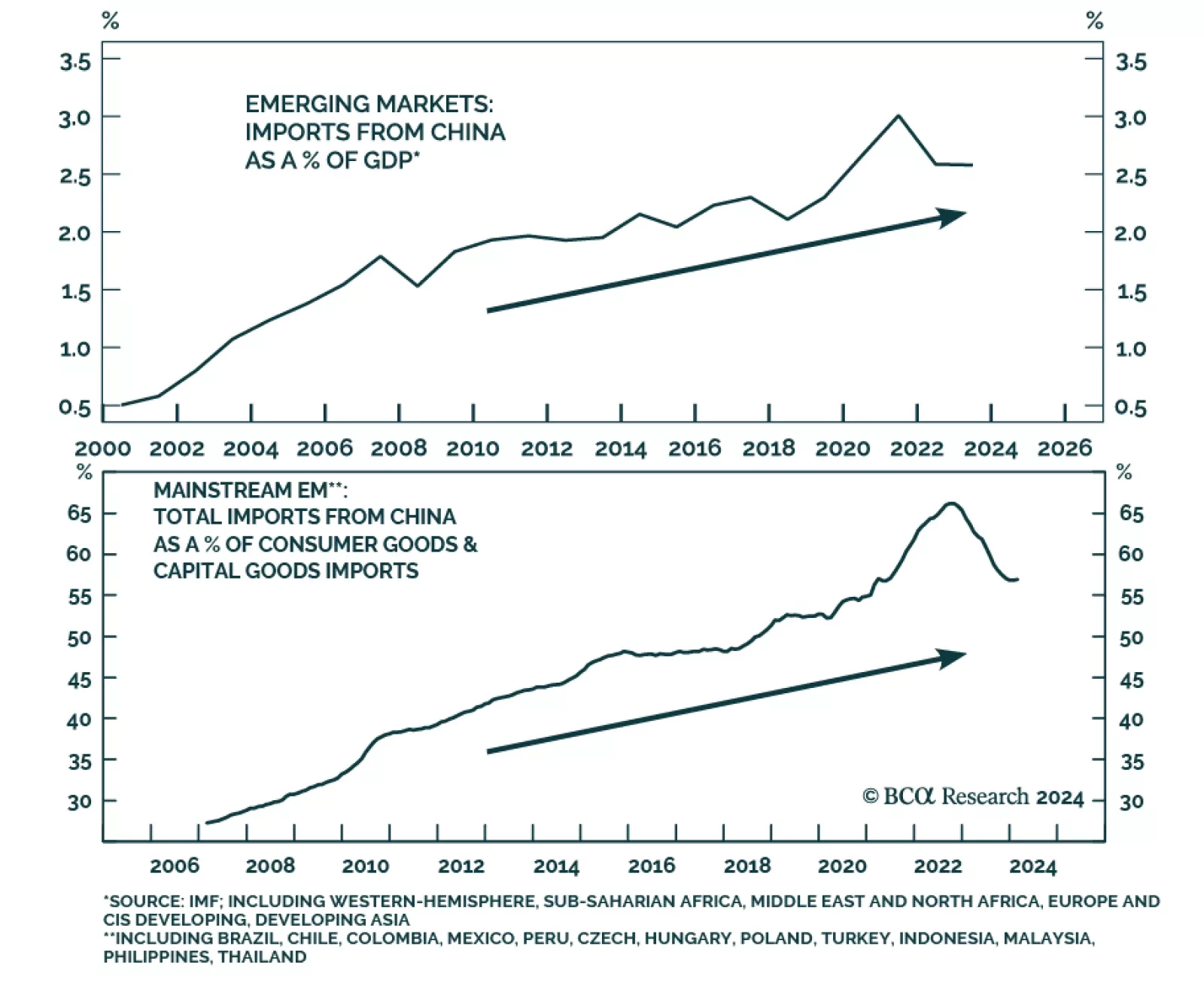

China has notably diversified its export markets over the past two decades, reducing its dependence on the US and other DM economies and strengthening trade ties with EM nations. Since 2000, shipments to the US have halved (…

Chinese property developers will require at least RMB 500 billion in additional government funding to prevent further declines in housing completions for the rest of 2024. However, without addressing the underlying challenges, any…

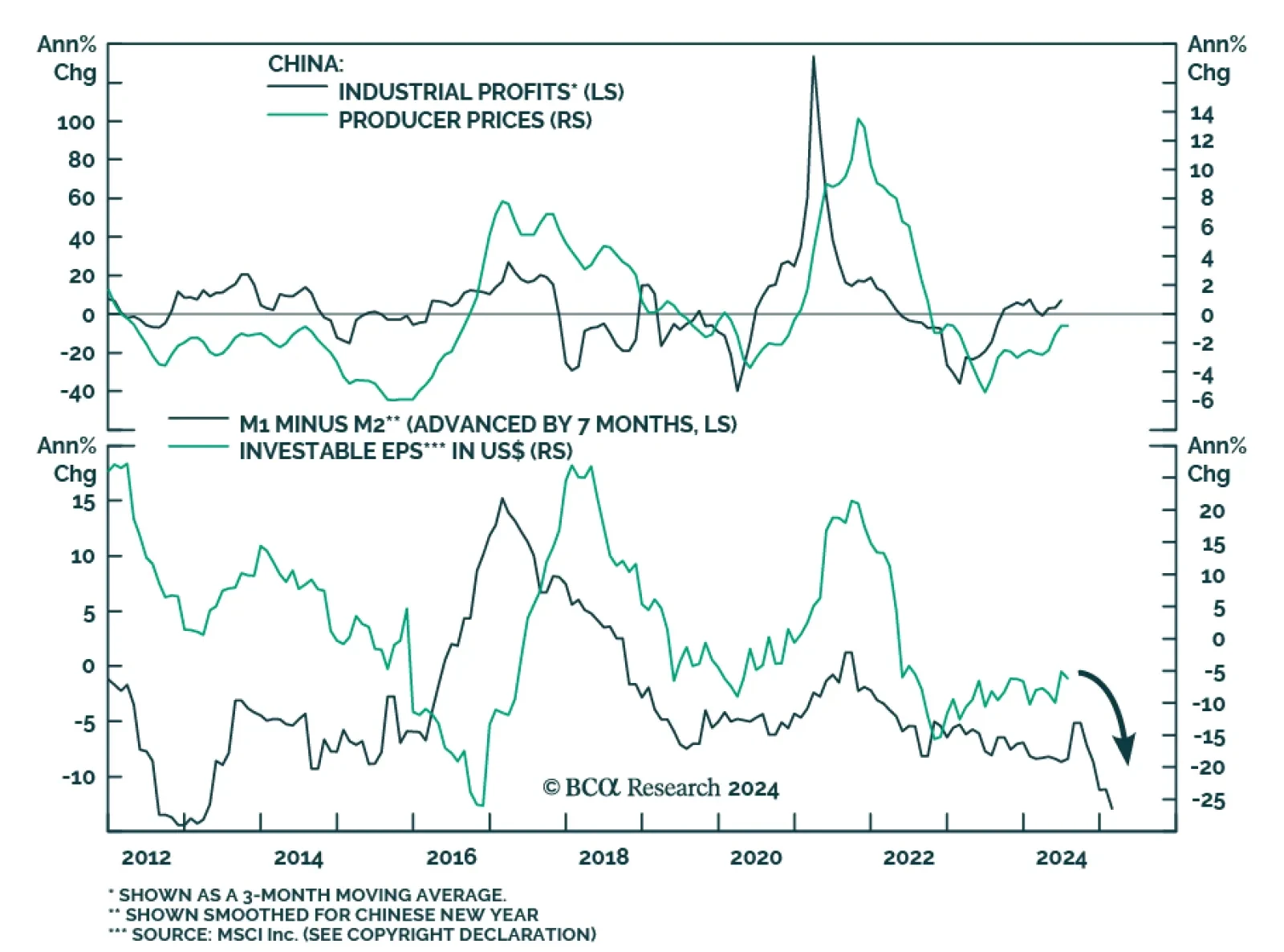

Chinese industrial profits rose by 4.1% y/y (3.6% YTD y/y) in July, from 3.6% (3.5%) in June. Upstream mining industries’ profits contracted 9.5% from January to July 2024, whereas downstream manufacturing sectors’…

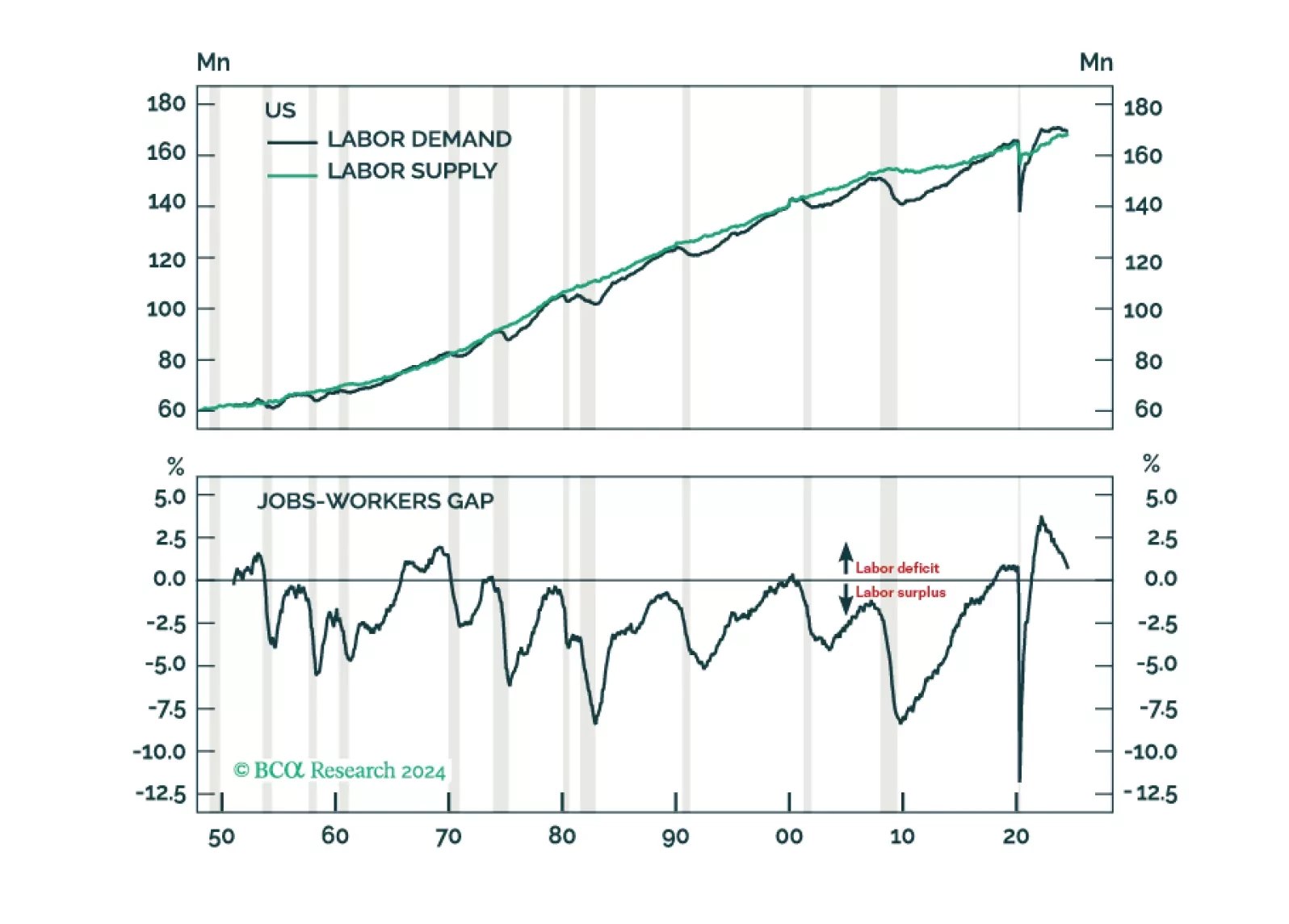

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

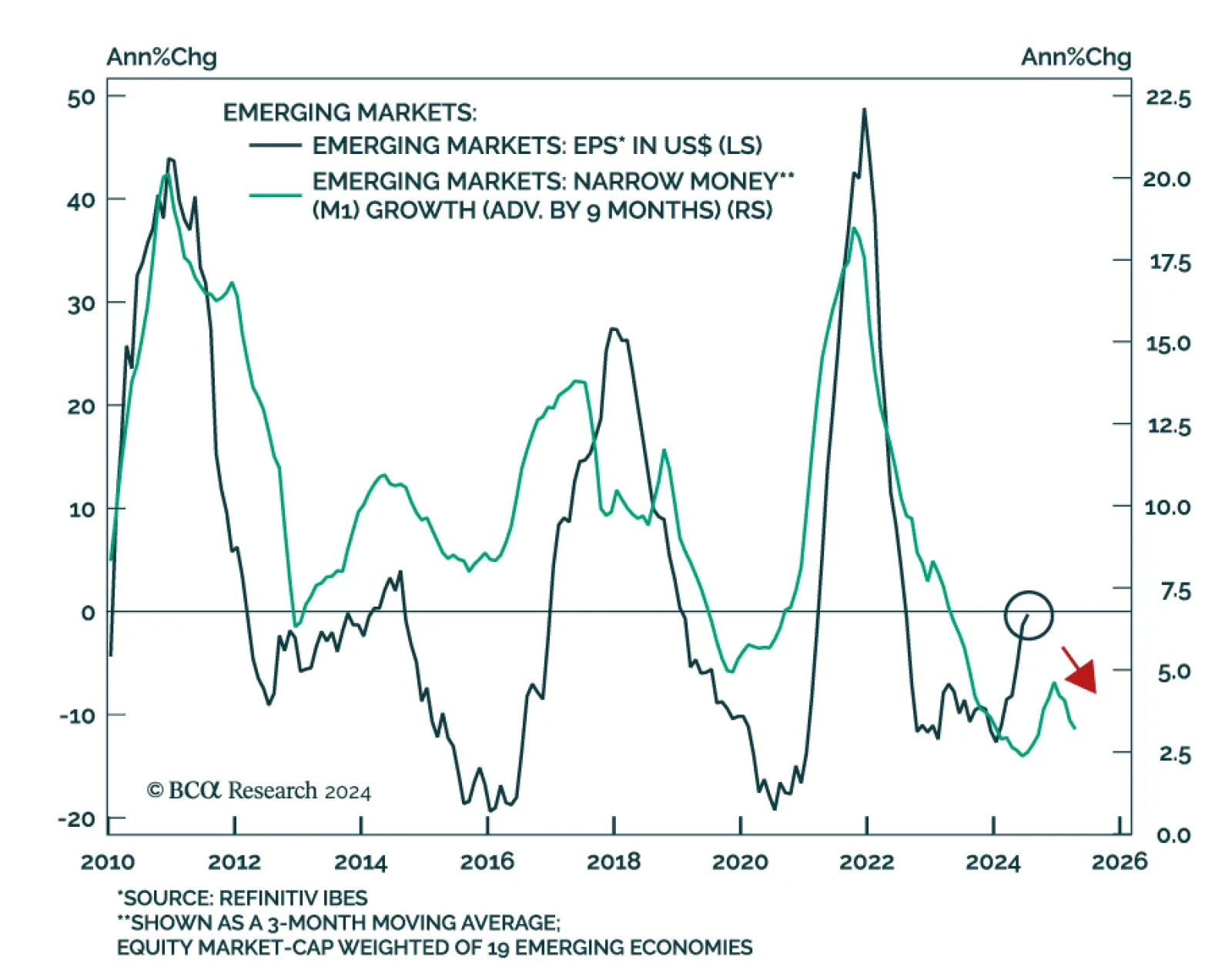

EM equities have dramatically underperformed their US and Eurozone peers in USD terms over the past 15 years. The inability of EM and EM Asia companies to grow their EPS largely explains EM equities “lost decade” (and…

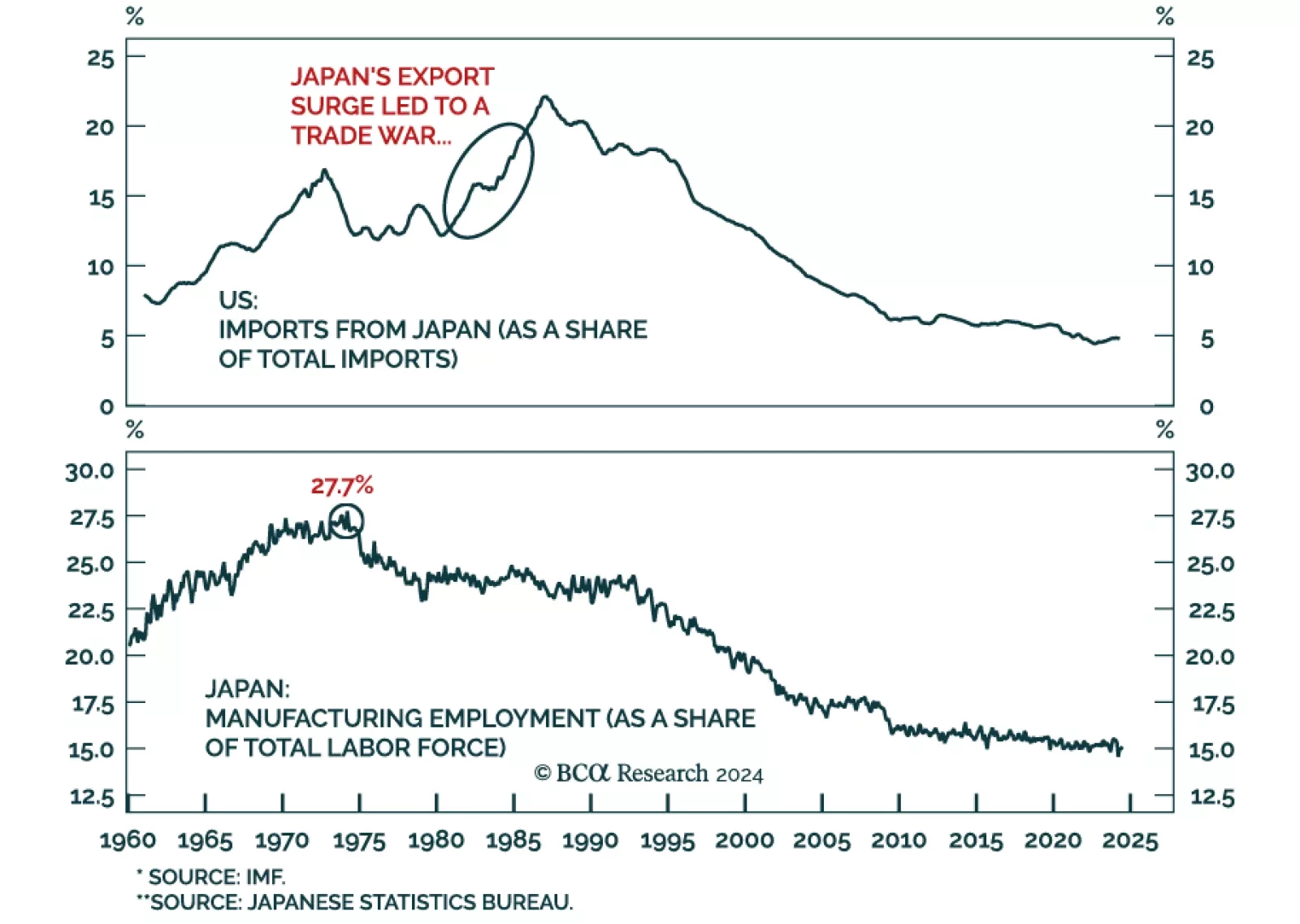

According to BCA Research’s GeoMacro Strategy service, while the idea that Donald Trump would allow China to build factories in the US does not mesh with the contemporary media narrative, it would fit the historical track…