Our China and Emerging Market strategy teams analyzed this weekend press conference by the China’s Ministry of Finance (MoF), that provided additional details on the recently announced fiscal stimulus plan. Our…

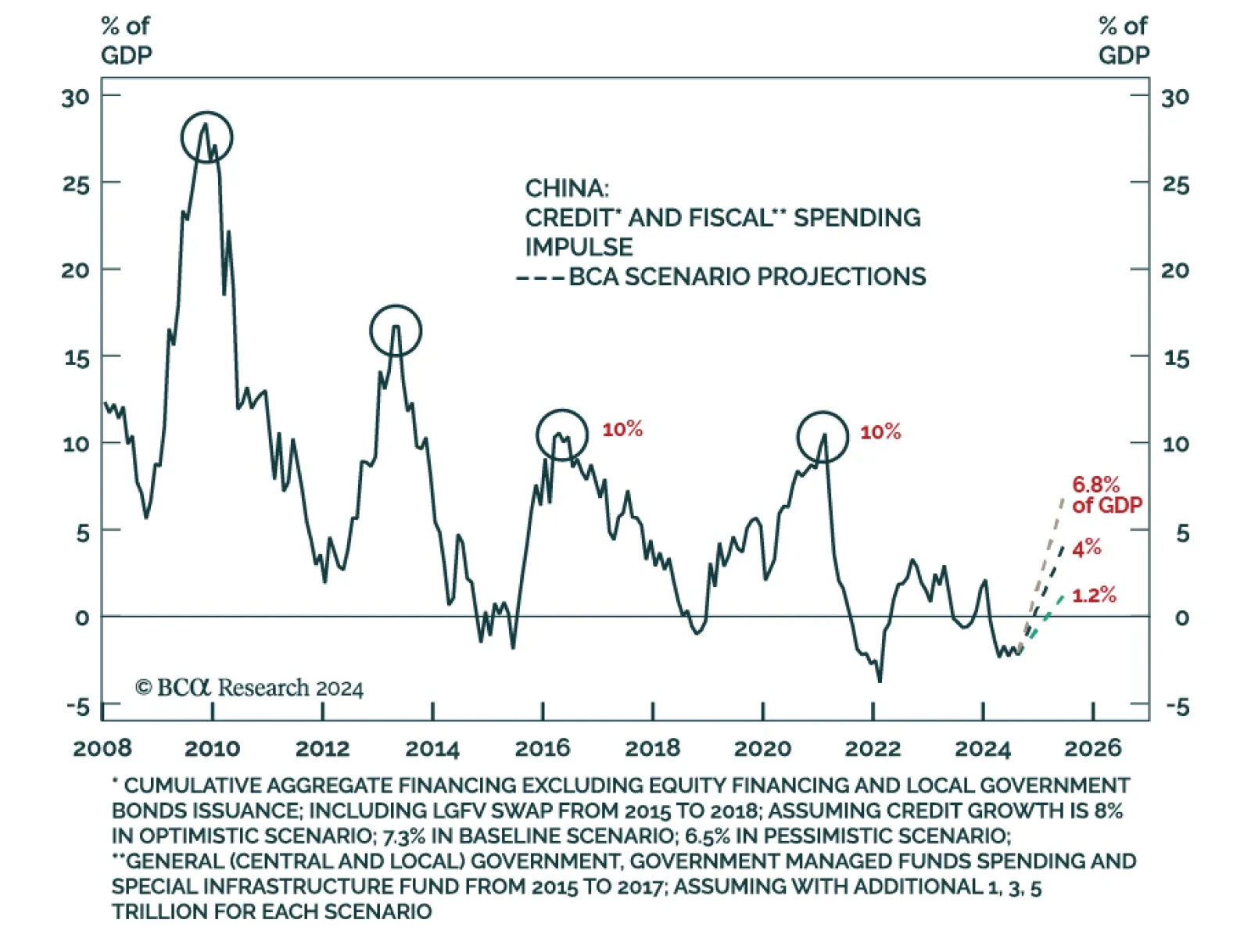

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

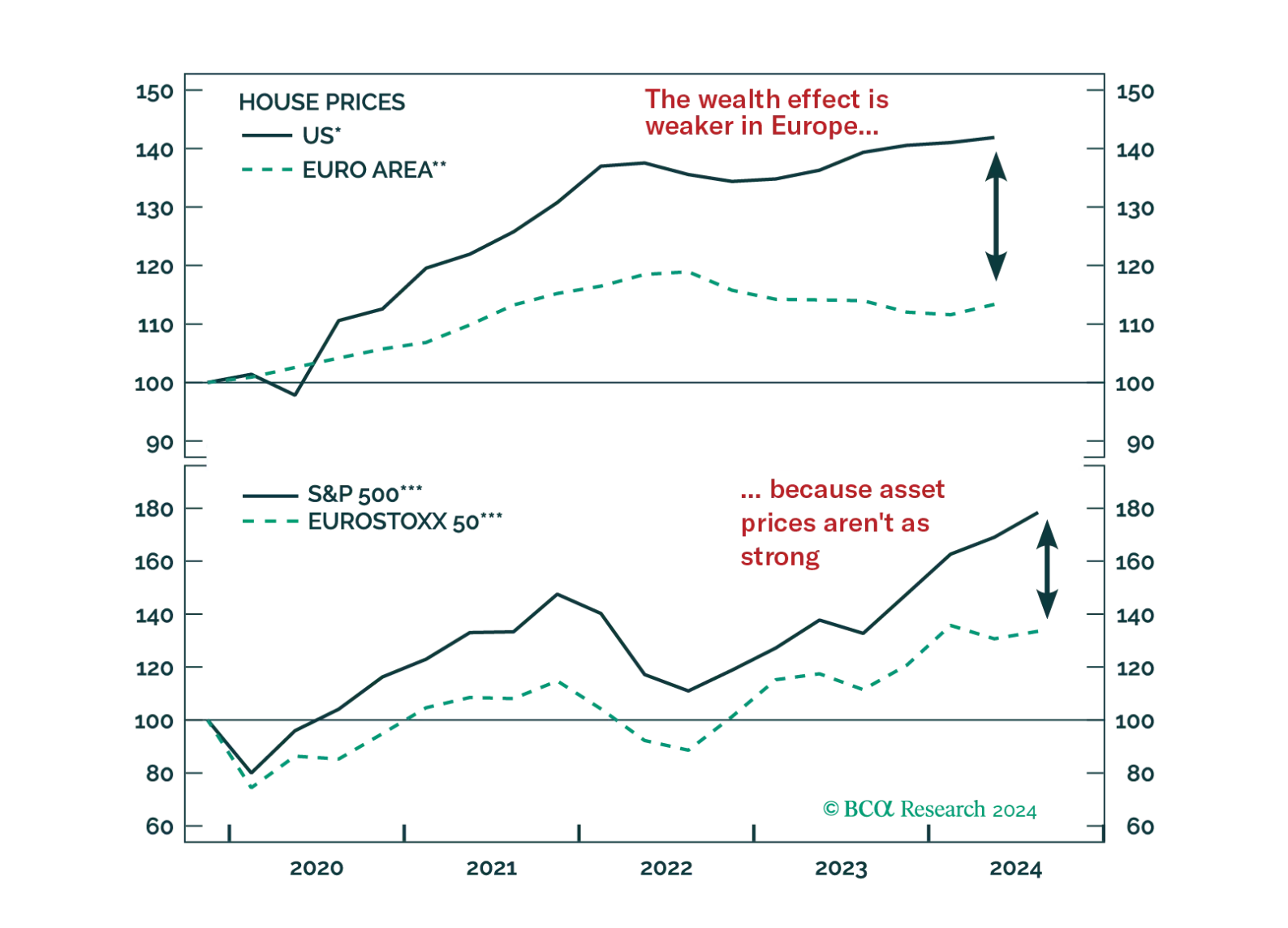

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

The webcast addressed the following topics:

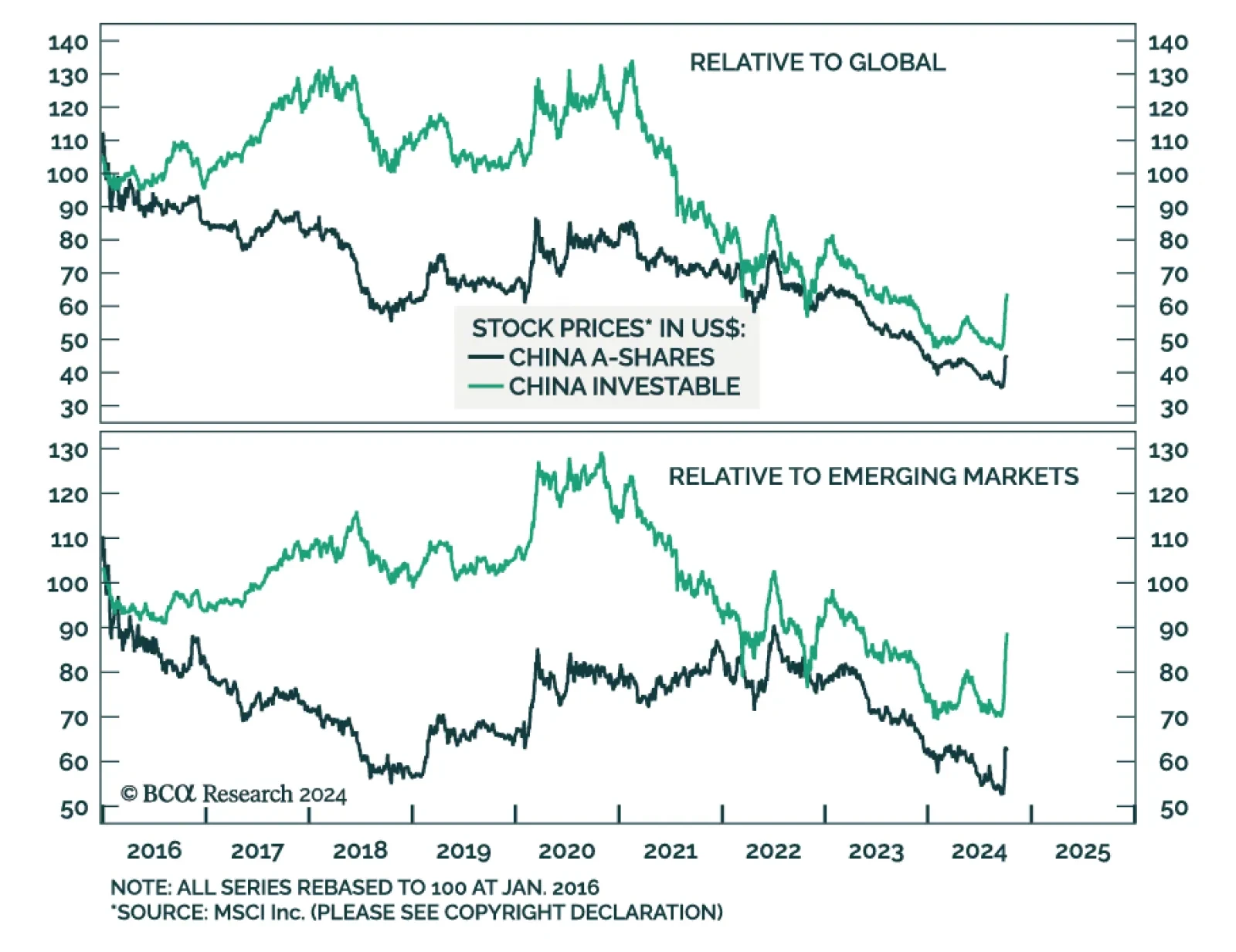

Is the latest surge in Chinese share prices the beginning of a bull market or a bull trap?

Are Chinese policy announcements sufficient to stabilize growth or create a cyclical recovery?…

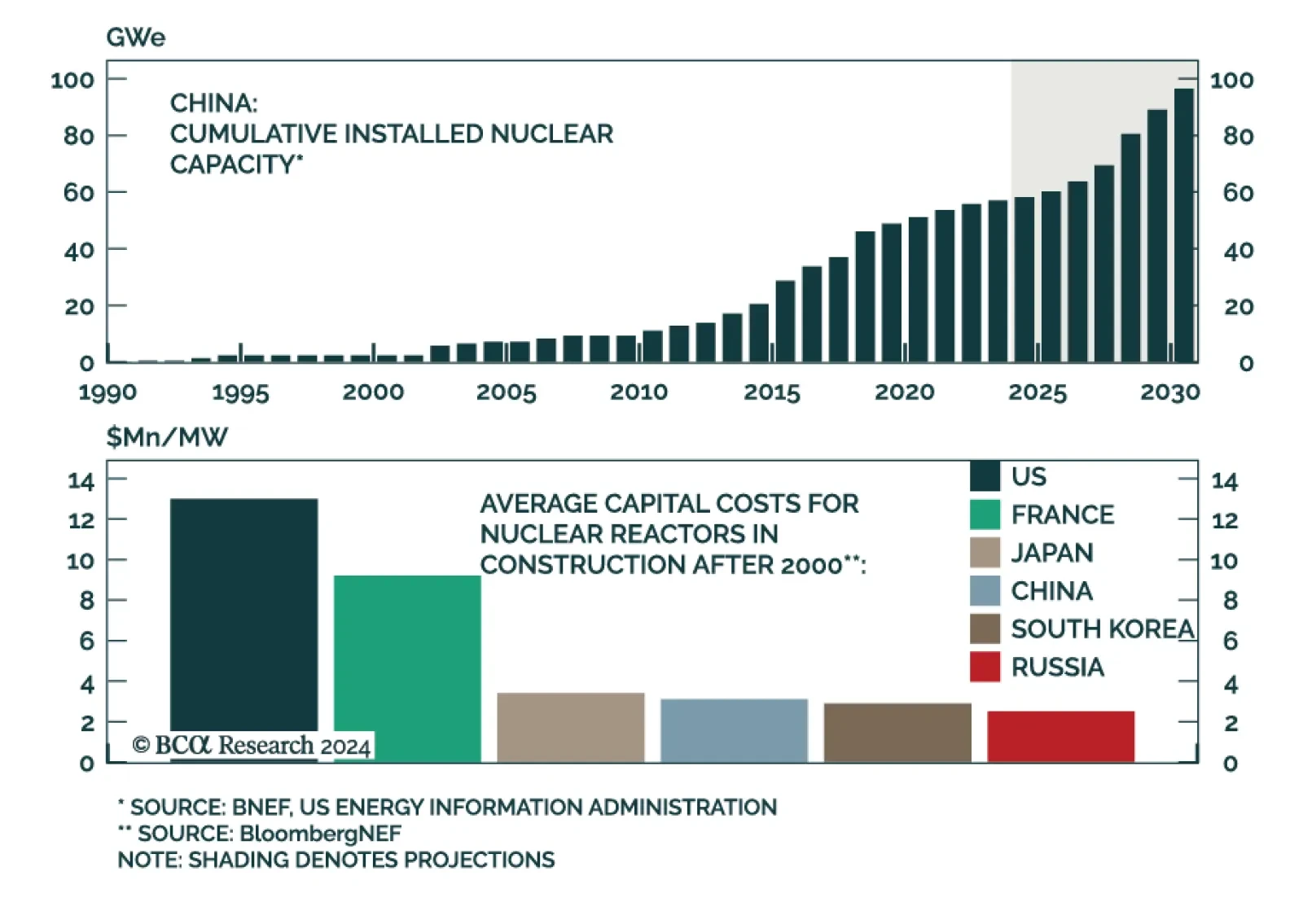

In the fifth installment of a BCA Special Report series on nuclear energy, our colleagues argue that US nuclear energy dominance is decaying. Though still the world’s leader in generation and capacity, the US will not hold…

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

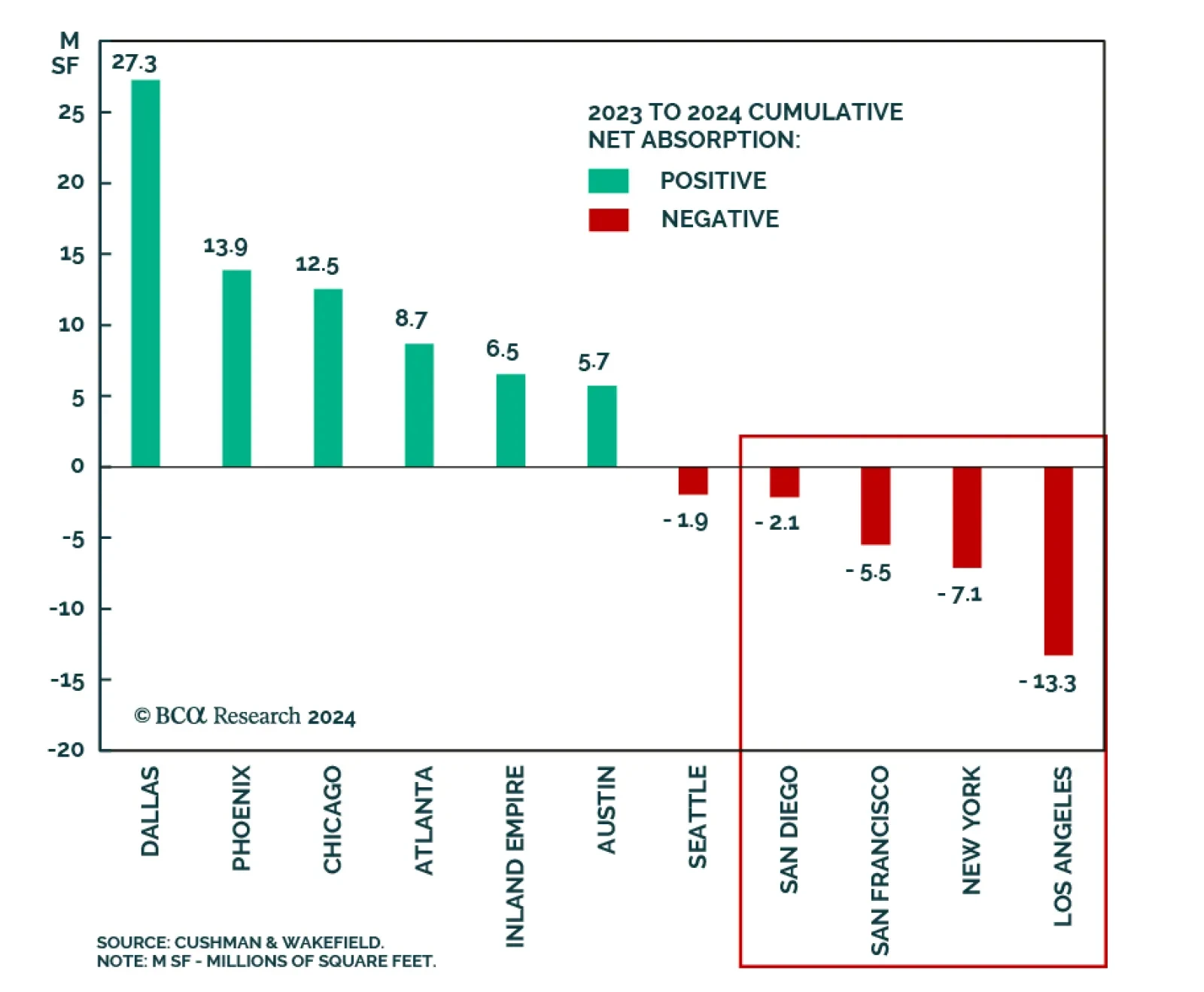

According to BCA Research’s Private Markets & Alternatives service, intra-market repricing will offer investors a unique opportunity to enter the industrial real estate space in the next two years. In the short…

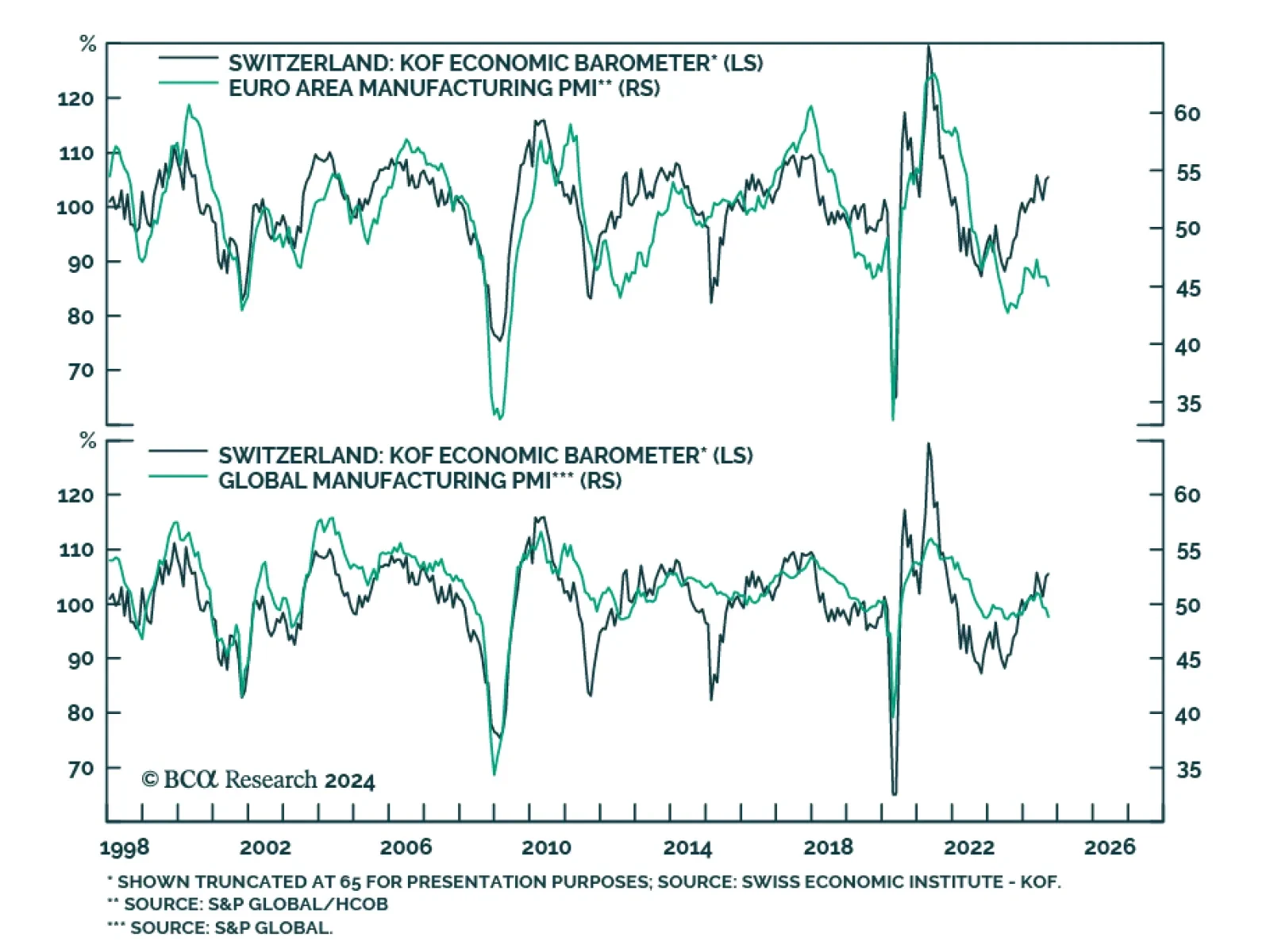

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the upside in September coming in at 105.5 against expectations of 101.0. The August reading was also significantly revised higher,…

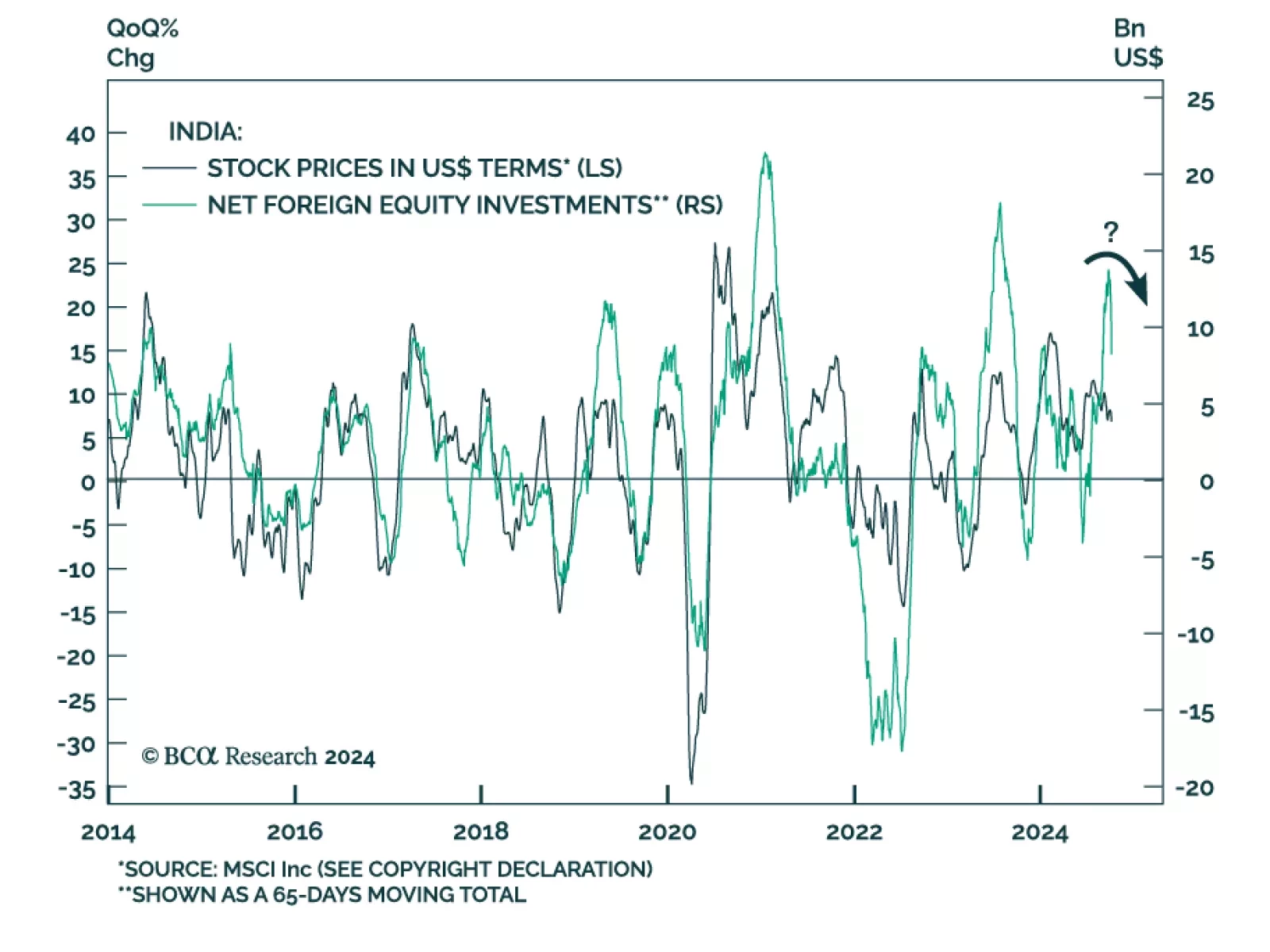

Indian equities reached new highs in late September. Our Emerging Market strategists recommend dedicated EM investors use these gains as an opportunity to reduce Indian equity allocations from neutral to underweight. They expect both…