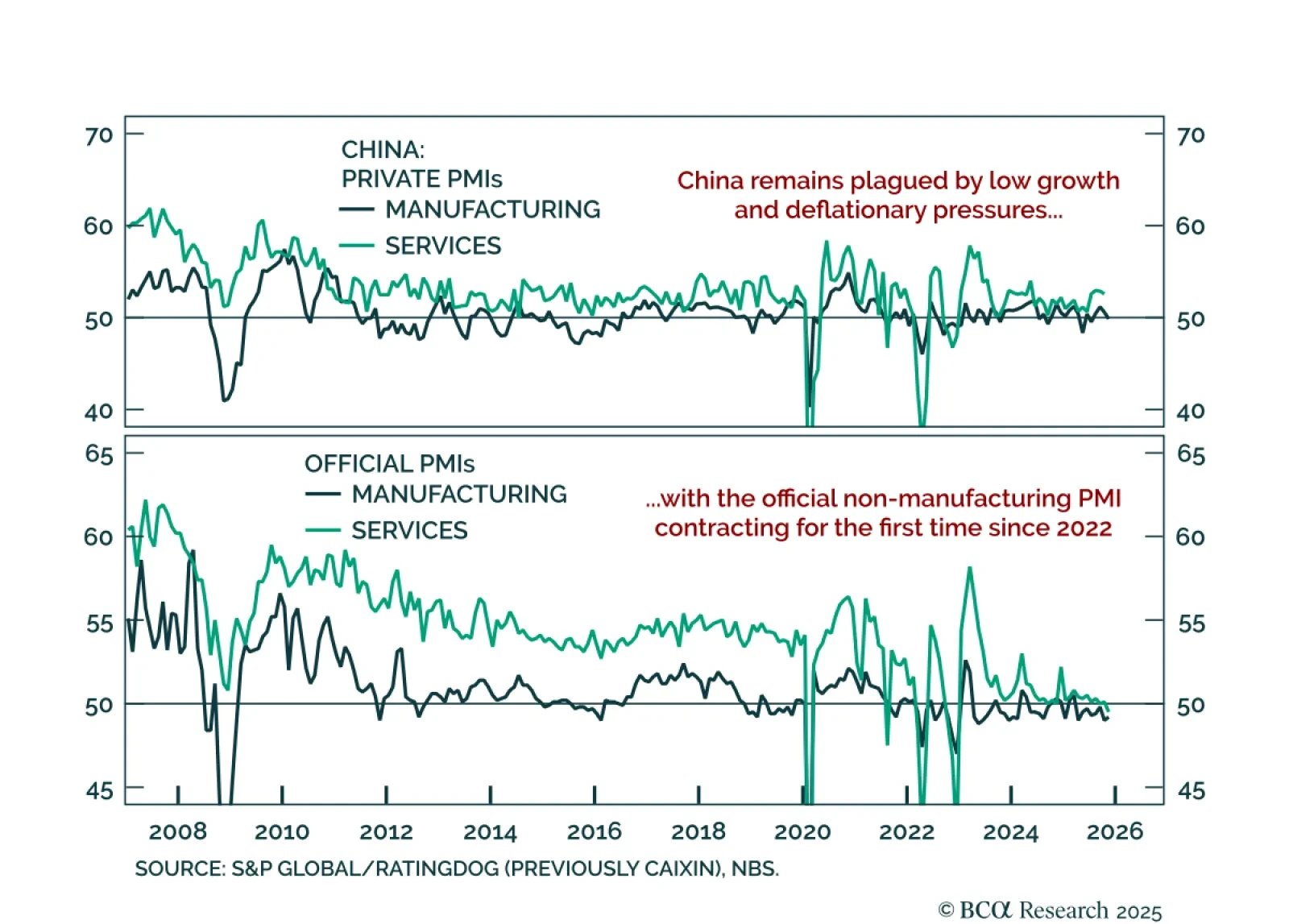

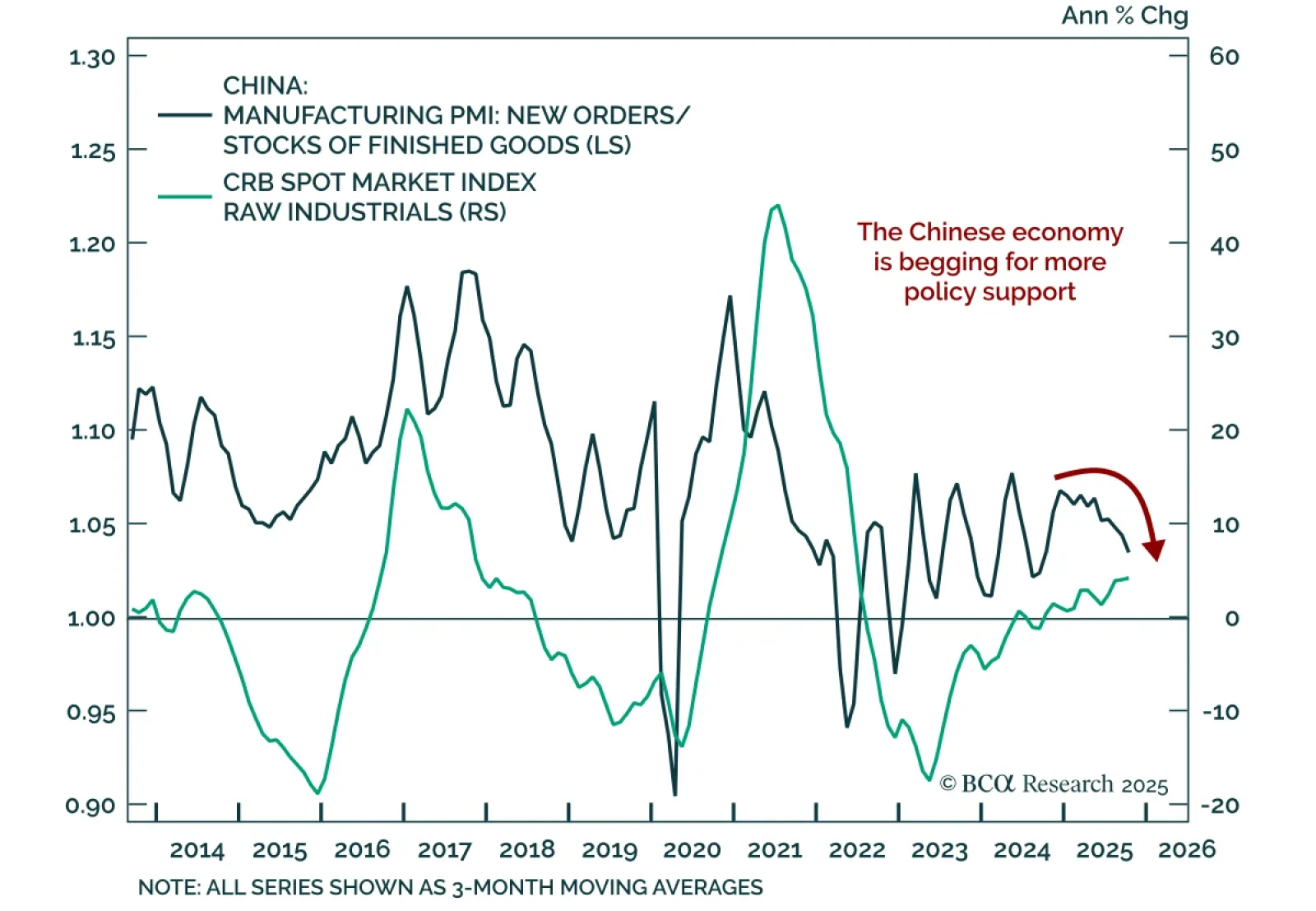

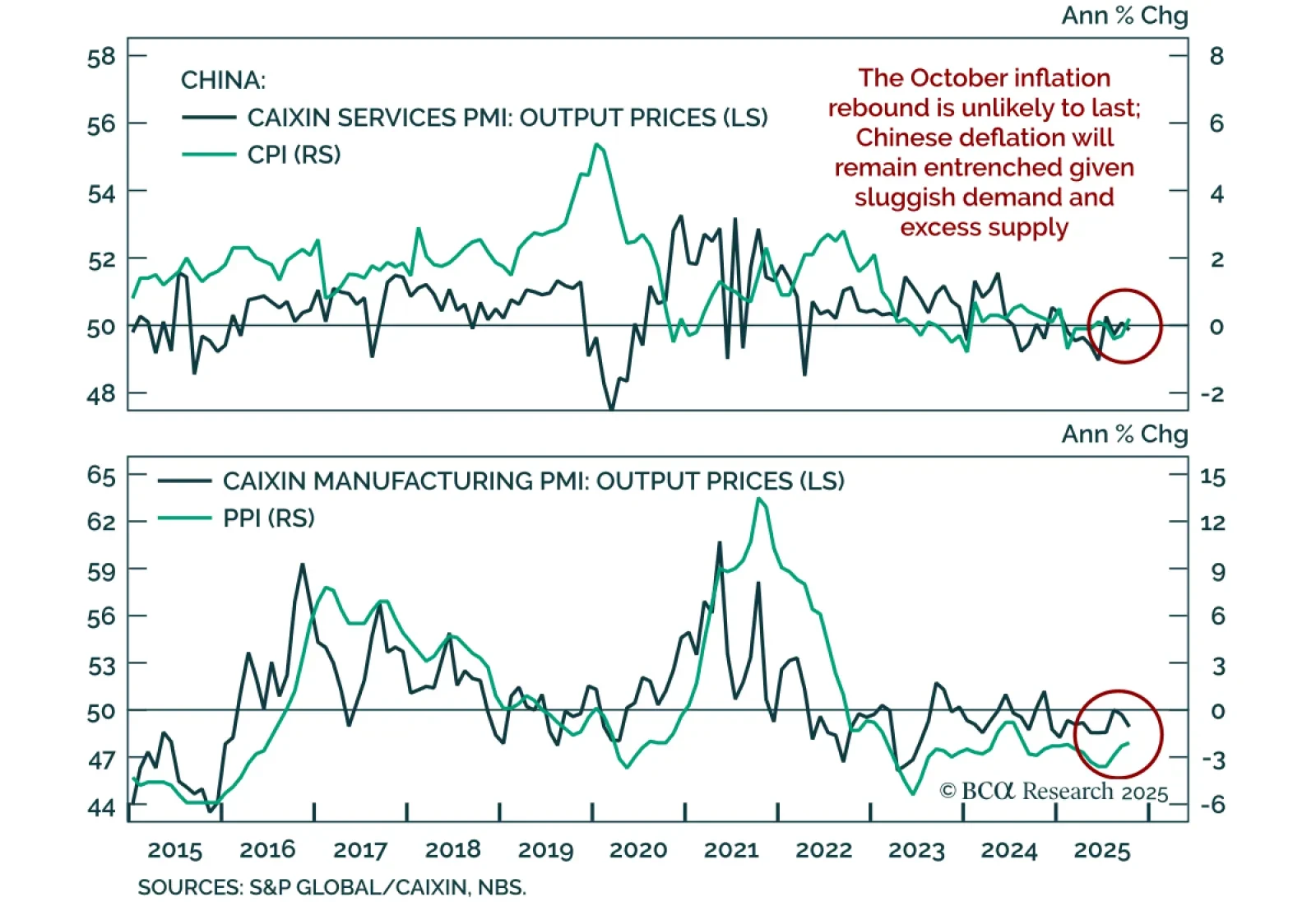

Stay constructive on onshore Chinese bonds as weak PMIs and deflationary pressures point to further stimulus. China’s PMIs continue to signal sluggish growth with little momentum. The official NBS composite PMI slipped to 49.7 from…

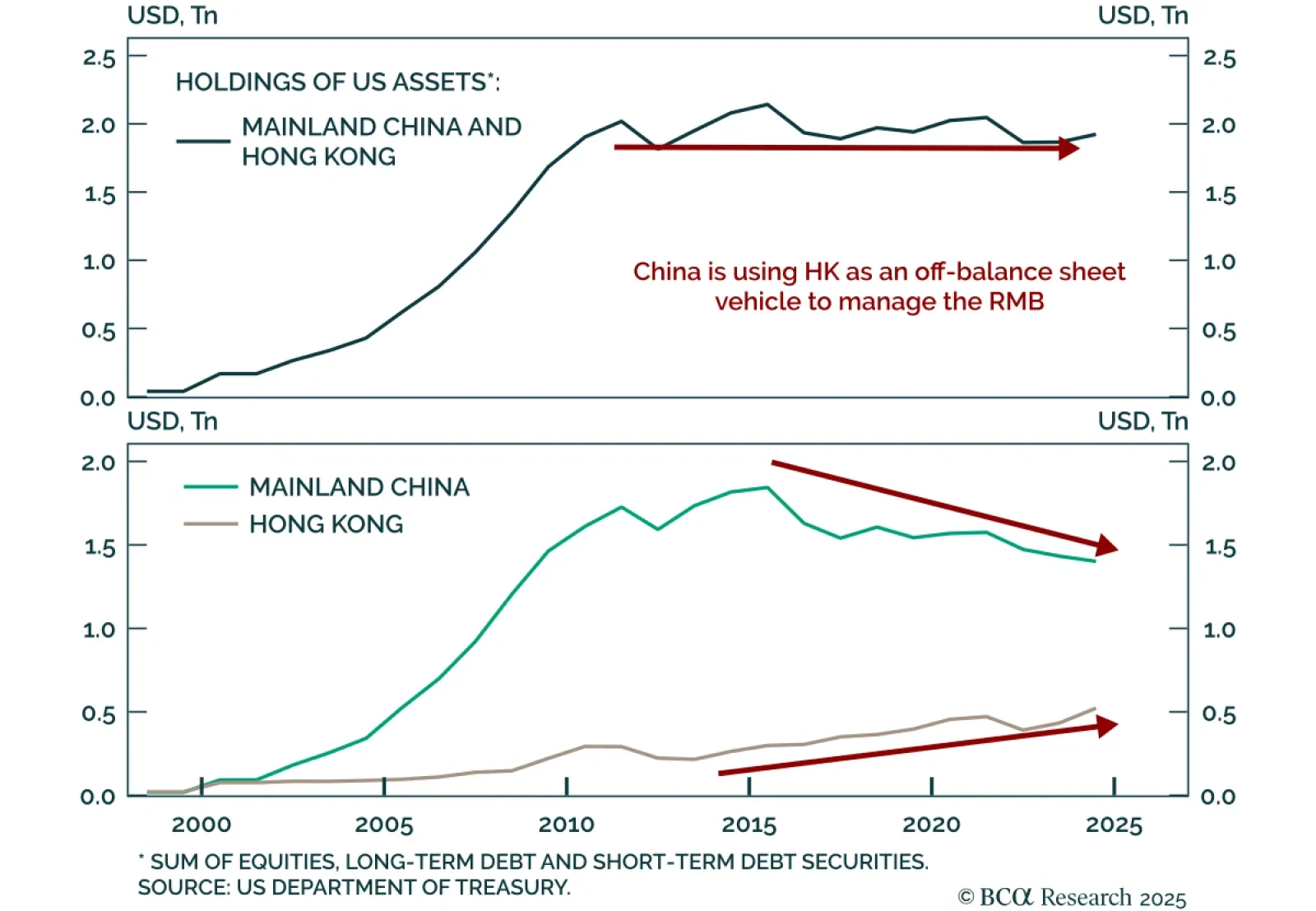

China is increasingly using Hong Kong as a vehicle to manage the RMB and limit currency appreciation. Our Chart of the Week comes from Mathieu Savary, Chief Strategist Developed Market ex-US. Mathieu shows that, despite narratives of…

China’s economy is weakening across the board as global risk-off hits equities. With housing conditions worsening and exports contracting—a perfect storm—Beijing faces mounting pressure to deliver stronger, housing-focused stimulus…

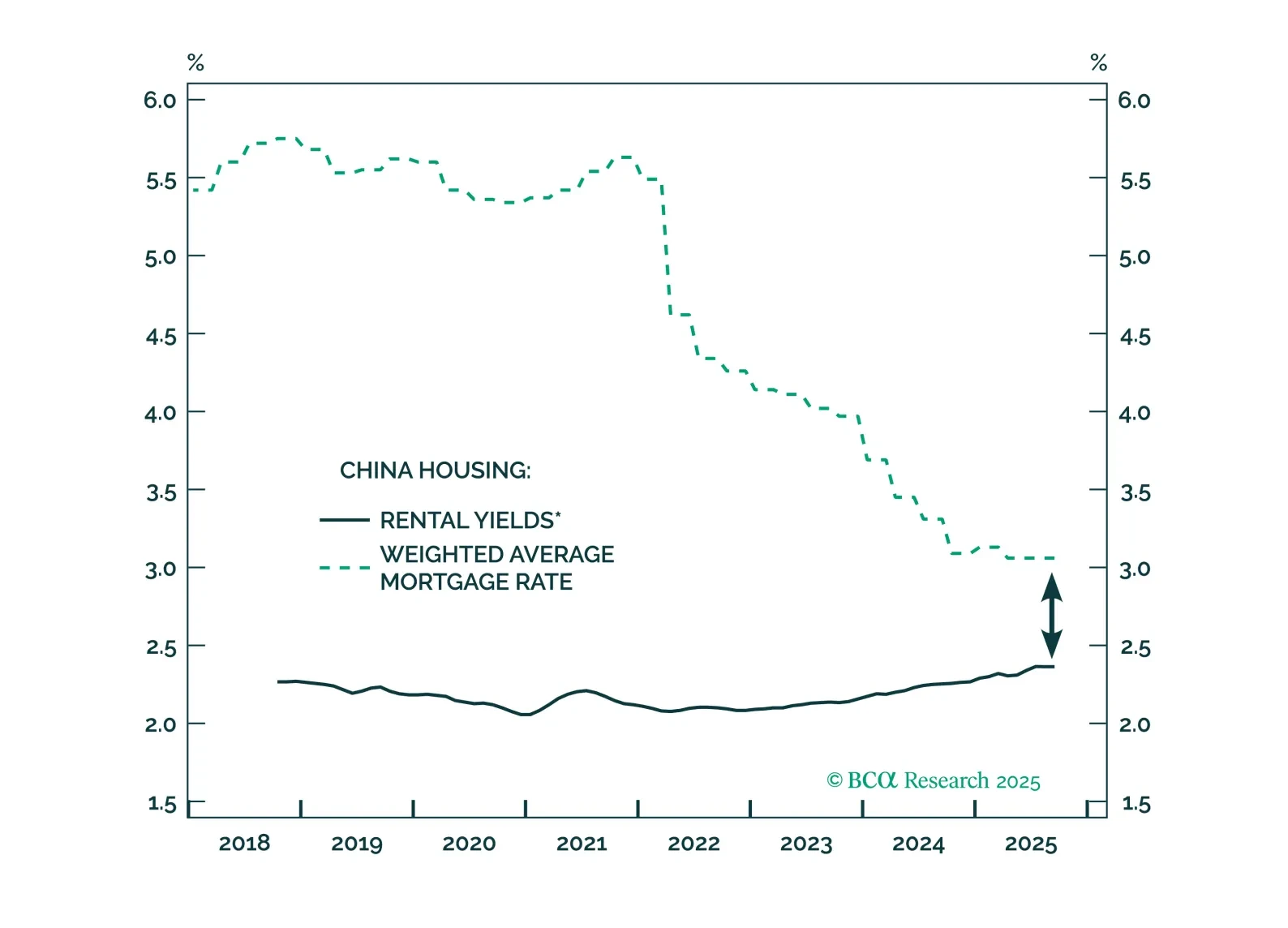

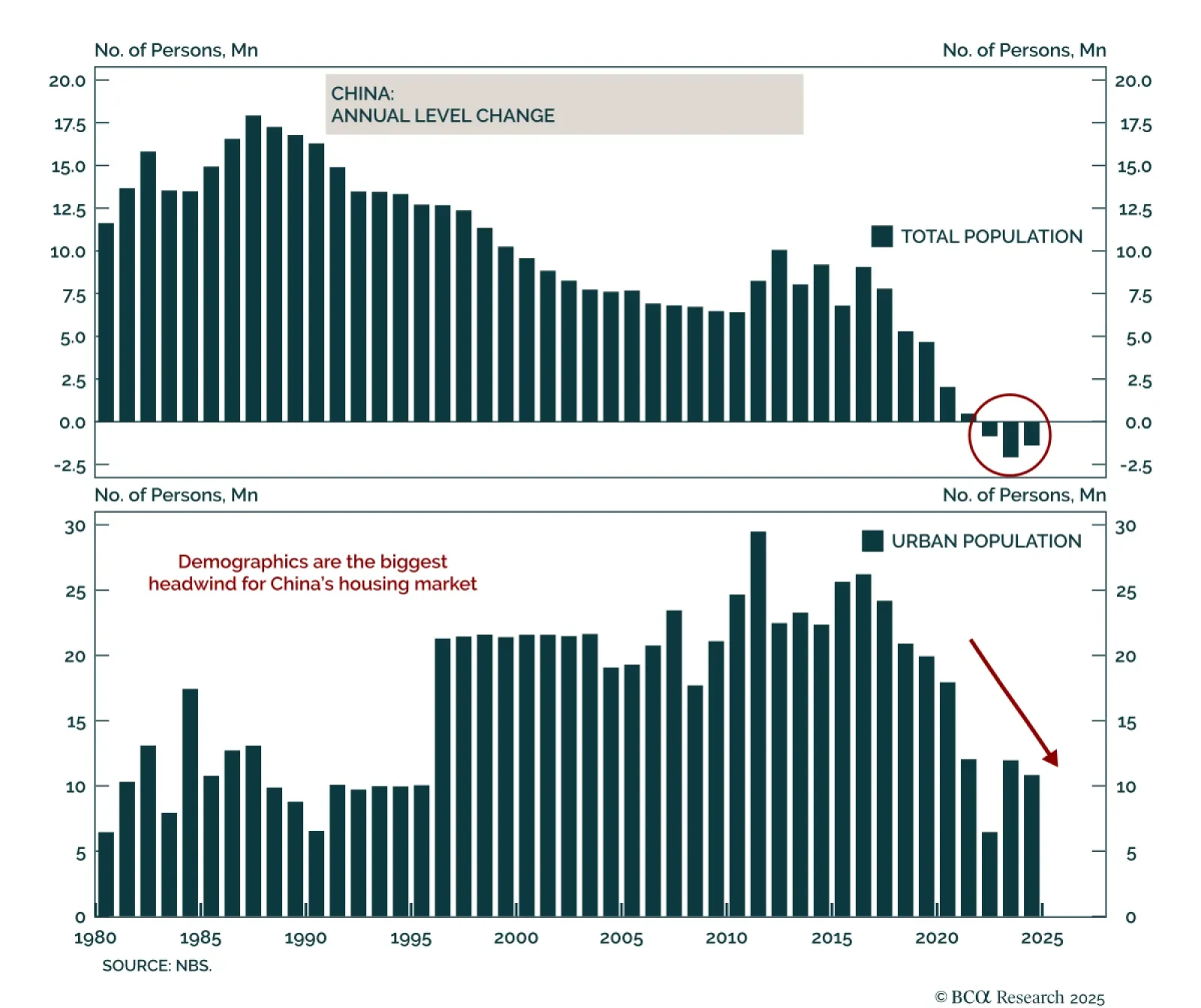

Our China strategists remain bearish on property sector stocks as cyclical and structural headwinds persist, but see long-term opportunities emerging in China’s shift toward a “new housing market.” Home sales and prices have yet to…

This report revisits China’s property market through both cyclical and structural lenses, assesses the likely policy responses, and evaluates their investment implications.

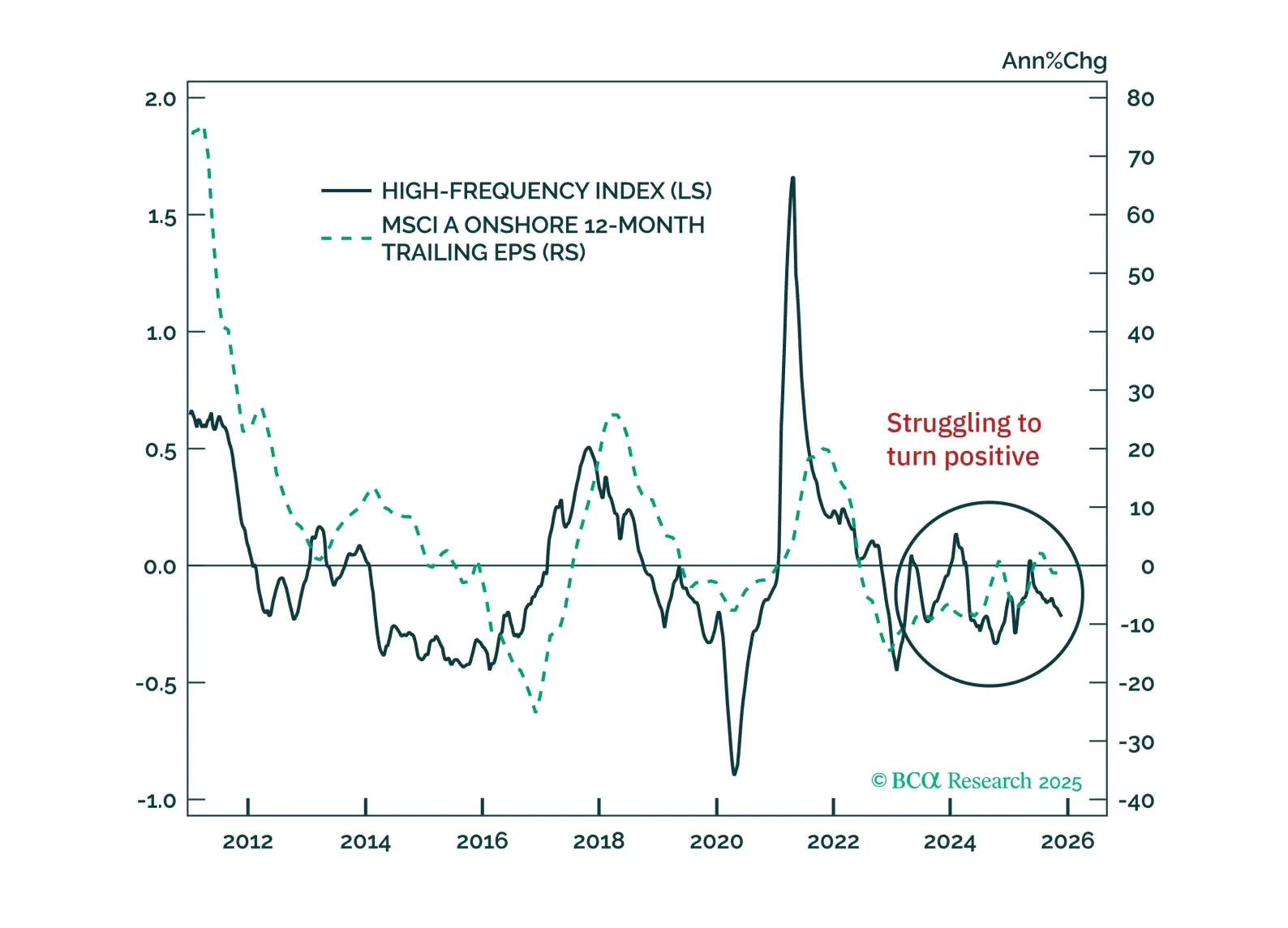

China’s economy is weakening again, with successive mini cycles revealing the limits of incremental policy easing. Our Chart Of The Week comes from Jing Sima, Chief China Investment Strategist. Economic data released by the NBS…

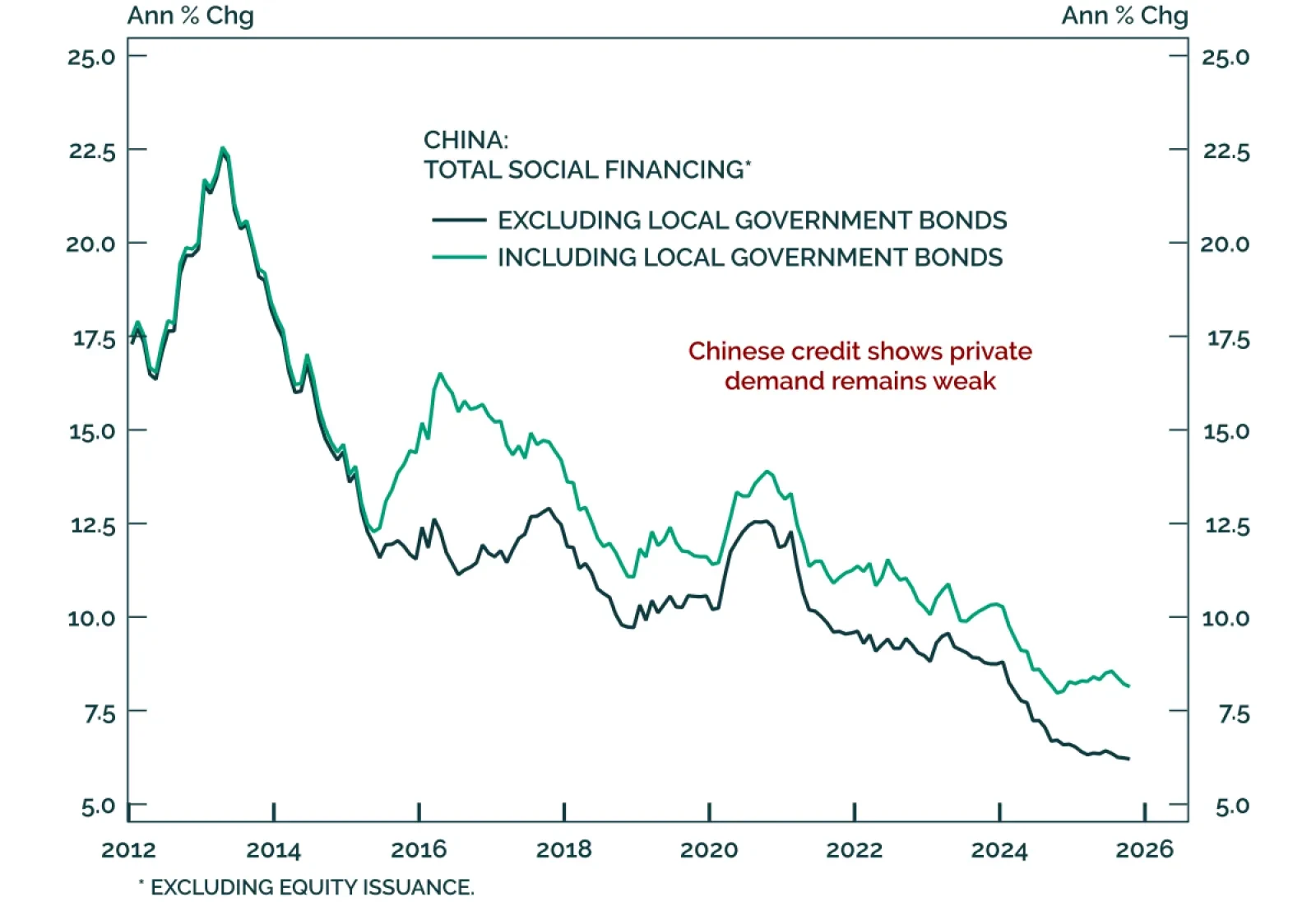

China’s October credit data disappointed, reinforcing evidence of weak private-sector demand and a fragile recovery. New yuan loans and aggregate financing both missed expectations, even after being boosted by a one-off CNY 500…

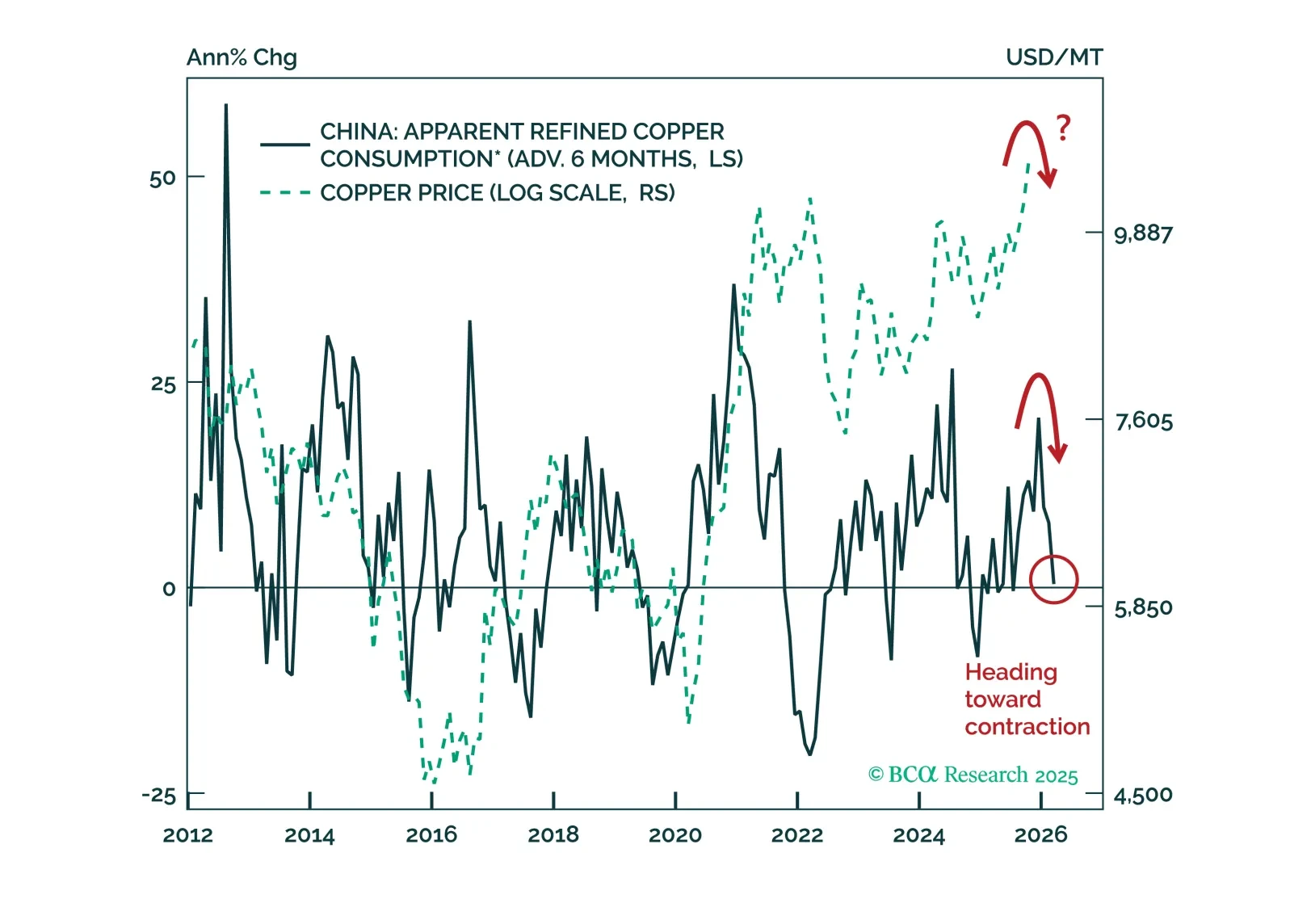

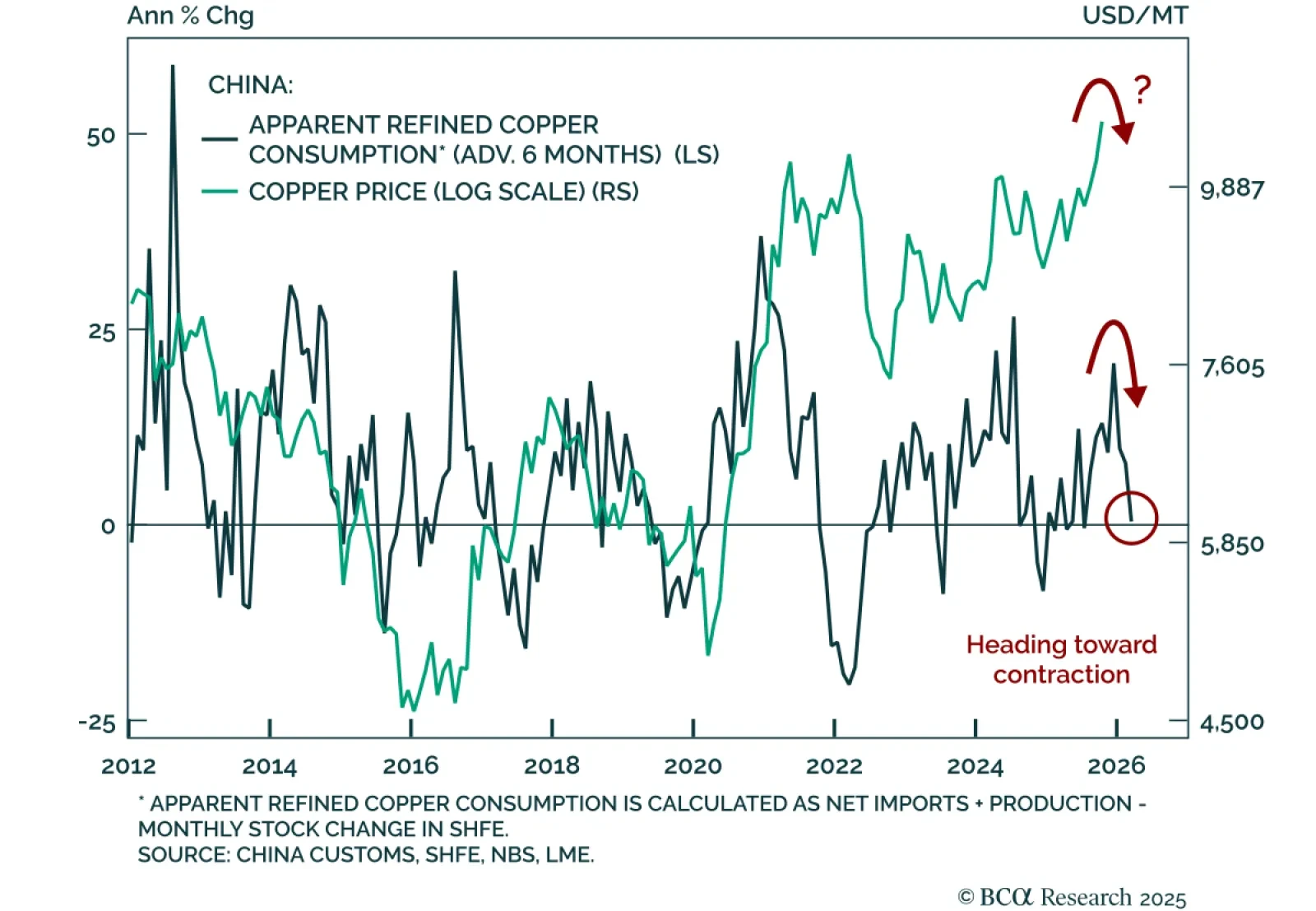

Our Commodity strategists remain cyclically short LME copper and introduce a stop-loss at $11,500, as supply-driven strength faces growing demand headwinds. While recent price gains have been fueled by production disruptions and…

Should investors chase the copper rally or use the latest bout of strength as an opportunity to sell?We warn that weakening Chinese demand and shrinking global manufacturing will weigh on the metal’s price over a cyclical timeframe…

China’s October inflation rebound is unlikely to last, as idiosyncratic factors drove the uptick. Headline CPI rose to 0.2% y/y from -0.3% in September. PPI also improved but remained in contraction at -2.1% y/y. Our China…