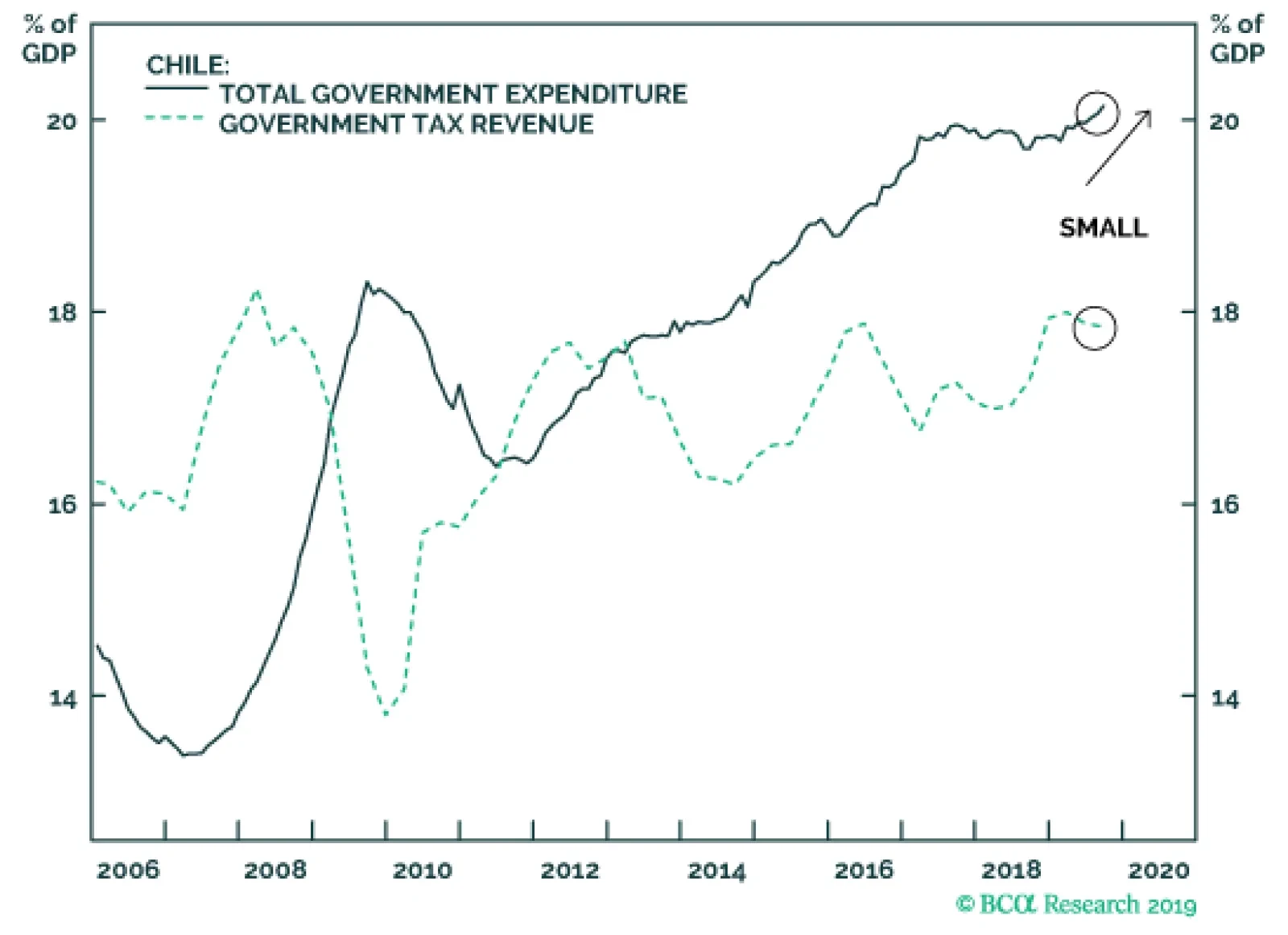

The government will ultimately meet the popular demands of protesters, albeit not immediately. We expect Chile to move towards a Welfare State-style of government. Under a Welfare State system, the government prioritizes the…

Highlights Chile is undergoing a paradigm shift from a neoliberal economic model to a Welfare State. It will not be a smooth transition, as the political and business elites are resisting such a transformation. Indeed, protesters…

The latest violent protests in Chile have raised doubts about its socio-political and economic stability. As a result, Chilean share prices could be facing both absolute and relative (versus other EM bourses) de-ratings. We are…

Highlights Analysis on Chile is available below. EM local bond yields have decoupled from their traditional macro drivers. This could be a sign that EM domestic bonds are entering a New Normal. We refer to a New Normal for EM local…

Chart II-1Our Strategy For Chile We have been betting on sluggish growth, lower interest rates and a weakening currency in Chile. These positions have panned out well as the economy has slowed considerably, local bond yields…

Analysis on Chile is available below. Highlights Major equity leadership rotations normally occur around bear markets or corrections. Hence, a major broad selloff will likely be a precondition for EM, commodities, global cyclicals…

Our recommended strategy2 for Chile has been to (1) receive three-year swap rates, (2) favor local bonds versus stocks for domestic investors, (3) short the peso versus the U.S. dollar, and (4) overweight Chilean equities within an EM…

Dear Client, Tomorrow we will publish a debate piece on China shedding more light on the ongoing discussions at BCA on this topic. This report will articulate the conceptual and analytical differences between my colleague, Peter Berezin…

Chart II-1Chile: Favor Bonds Over Stocks Local currency bonds will outperform equities in Chile over the next six to nine months (Chart II-1). The central bank is raising interest rates to cap inflation. However, we believe…