Chilean equities collapsed last week on news of the ruling coalition’s surprise underperformance in the election for members of the constitutional convention tasked with rewriting the constitution. President Sebastian…

Highlights Political volatility and uncertainty have peaked for the time being, which should serve to reduce the equity risk premium in Chile. Chilean equities are cheap. We are upgrading Chilean stocks from underweight to overweight…

Highlights Rising CO2 emissions on the back of stronger global energy growth this year will keep energy markets focused on expanding ESG risks in the buildout of renewable generation via metals mining (Chart of the Week). …

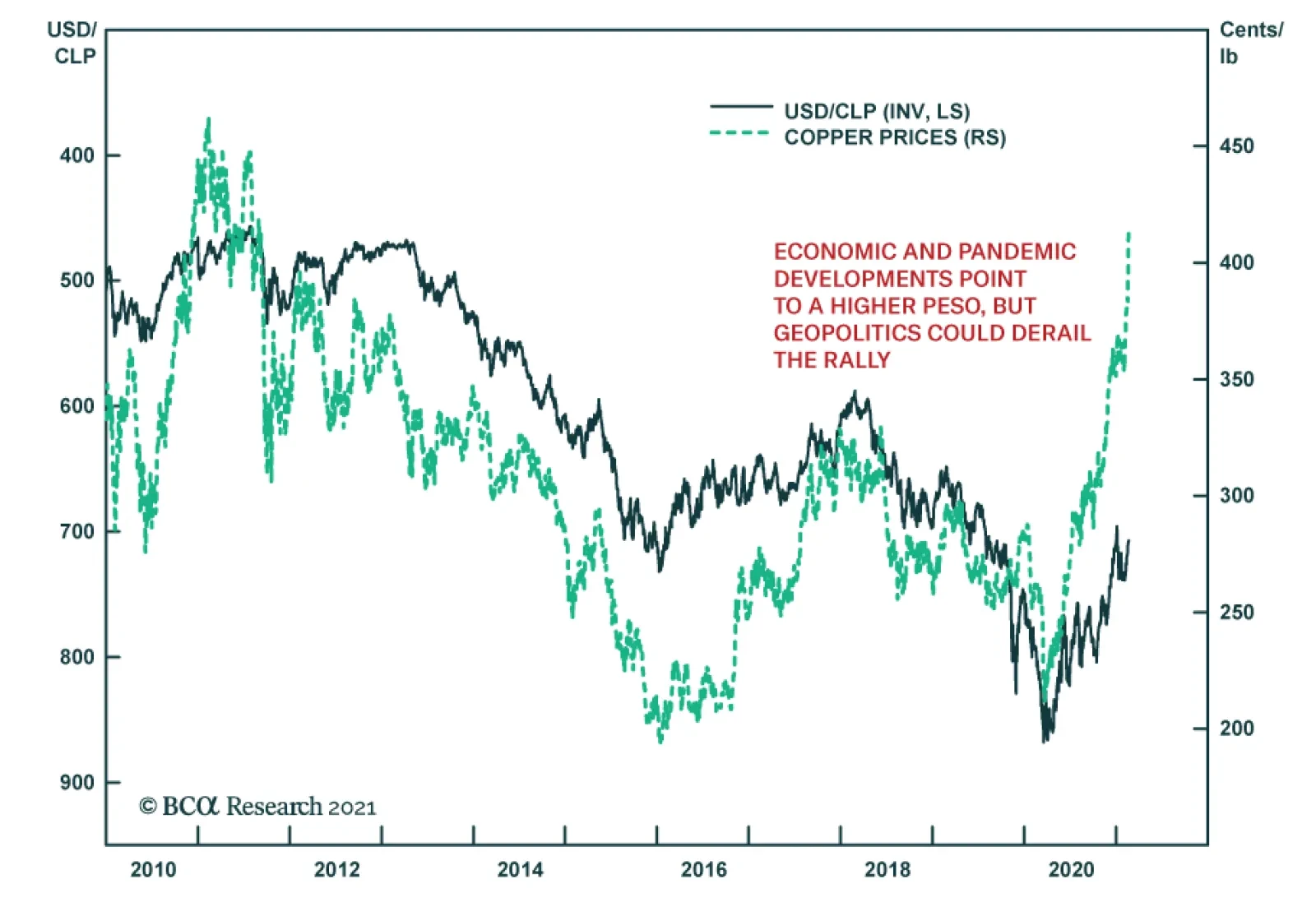

After having stagnated last year, the Chilean peso is recovering smartly, following copper prices higher. As the world’s top producer of the red metal, Chile’s currency typically benefits from favorable copper market…

Highlights A Biden victory with a Republican Senate (28% odds) poses the greatest risk to the global reflation trade. The US is the most susceptible to social unrest of all the developed markets. Europe is stable relative to the US,…

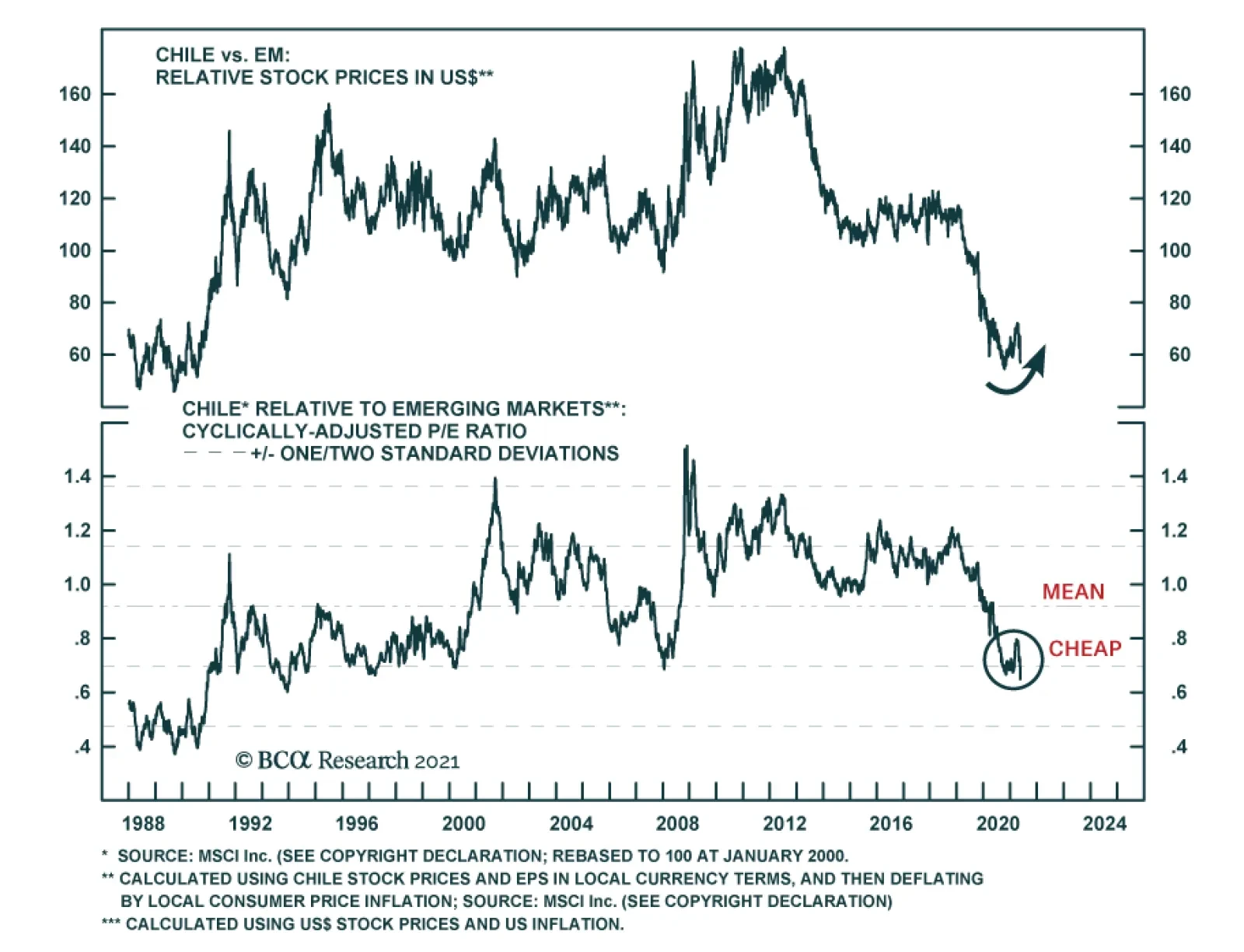

Copper prices have staged an impressive rally in the past four months, but the performance of Chilean markets remains lackluster (Chart II-1). While the red metal has broken above its January highs, Chile’s equities and currency are…

Last Friday, my colleague Dhaval Joshi and I held a webcast discussing investment strategies. The topics of discussion included global equity valuations, mega-cap stocks leadership and the outlook for EM stocks, fixed-income and…

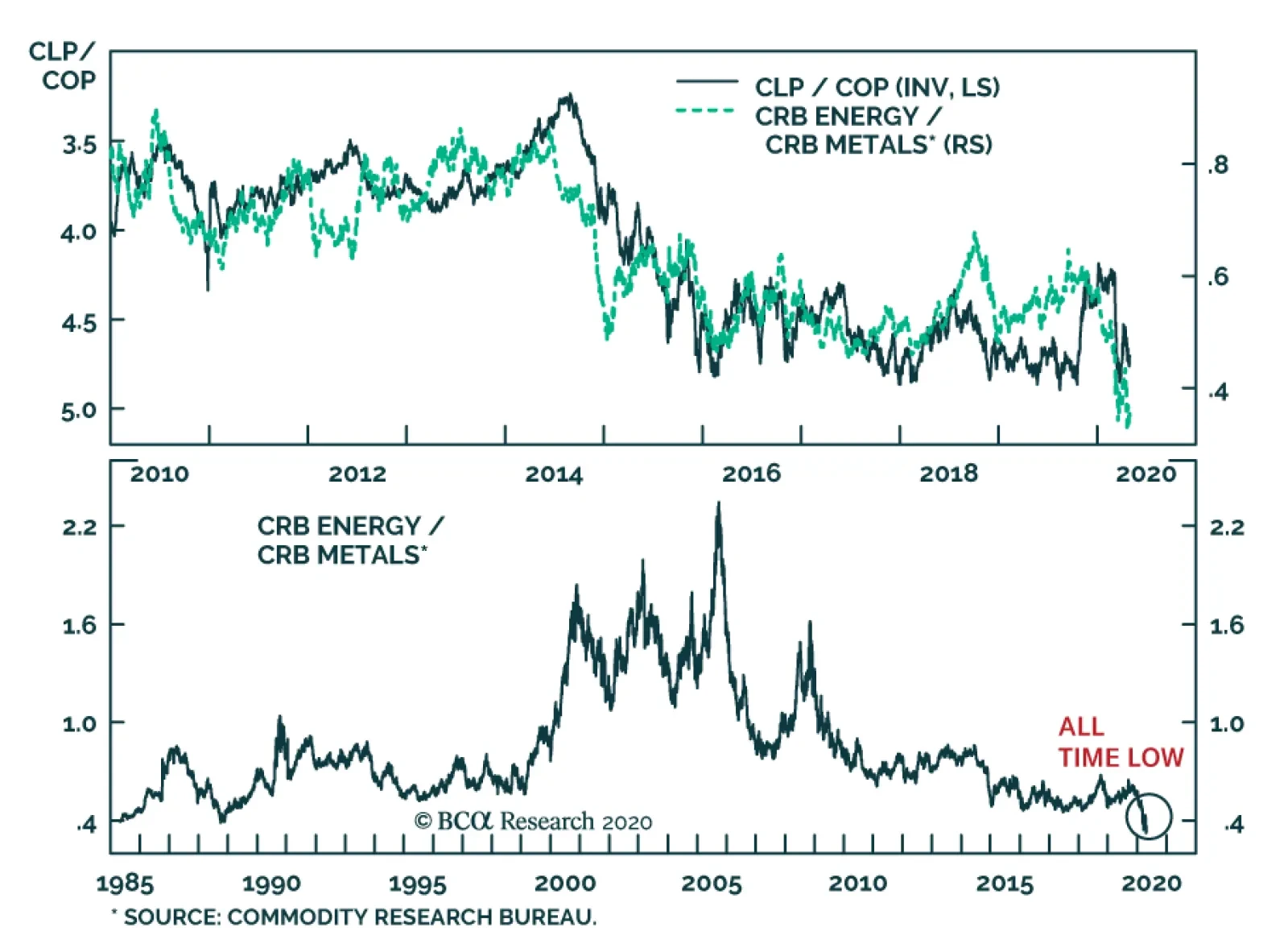

Based on the CRB indices, energy prices have fallen to an all-time low relative to industrial metals. Sure, oil demand has collapsed and storage is near full capacity, but the slope of the oil curve suggests that prices already…

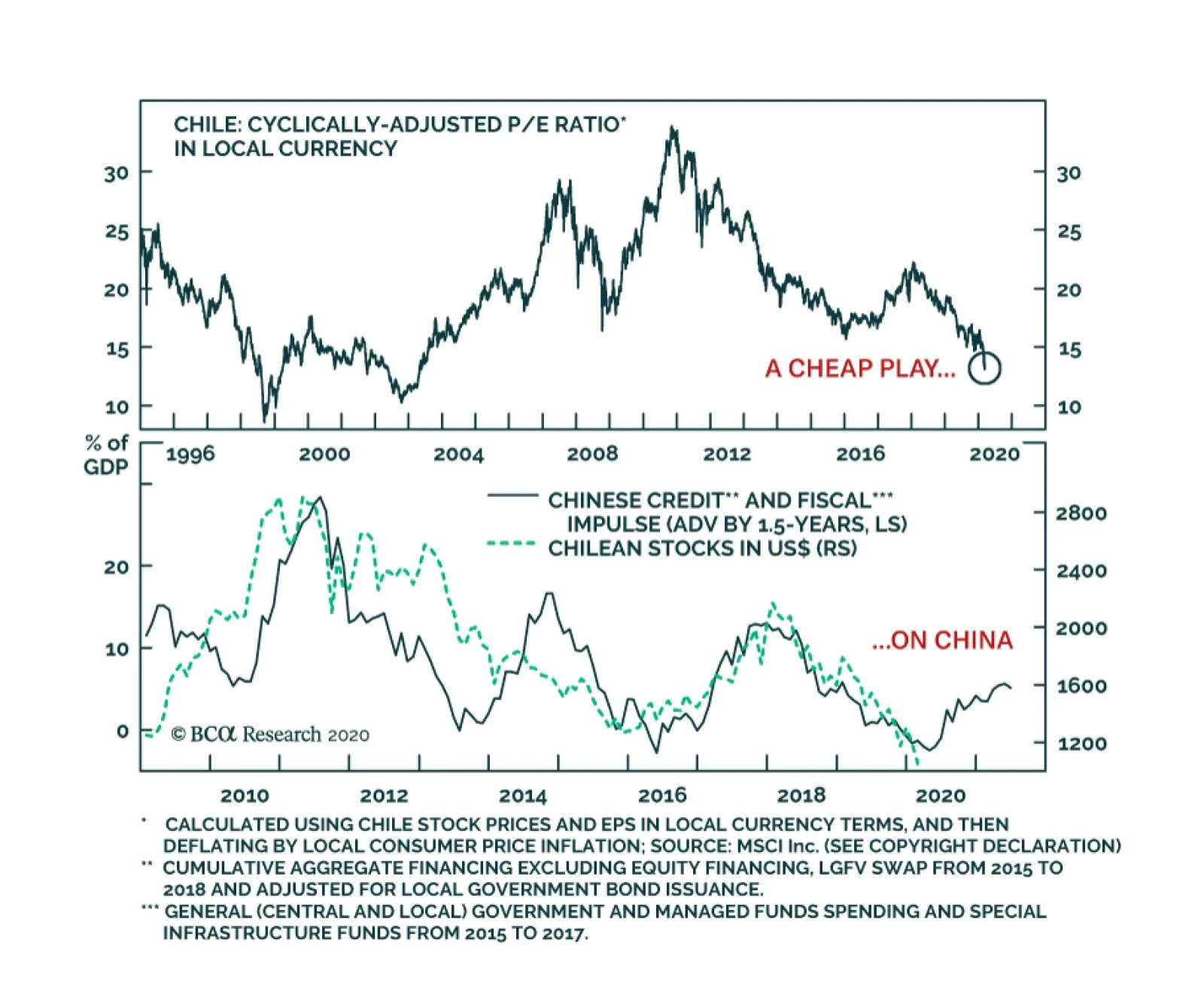

Since February 2018, Chilean stocks in USD terms have fallen more than 50% to their 2008 lows. They now trade at their cheapest cyclically-adjusted P/E ratio since 2003. This cheapness is particularly significant as Chilean and…