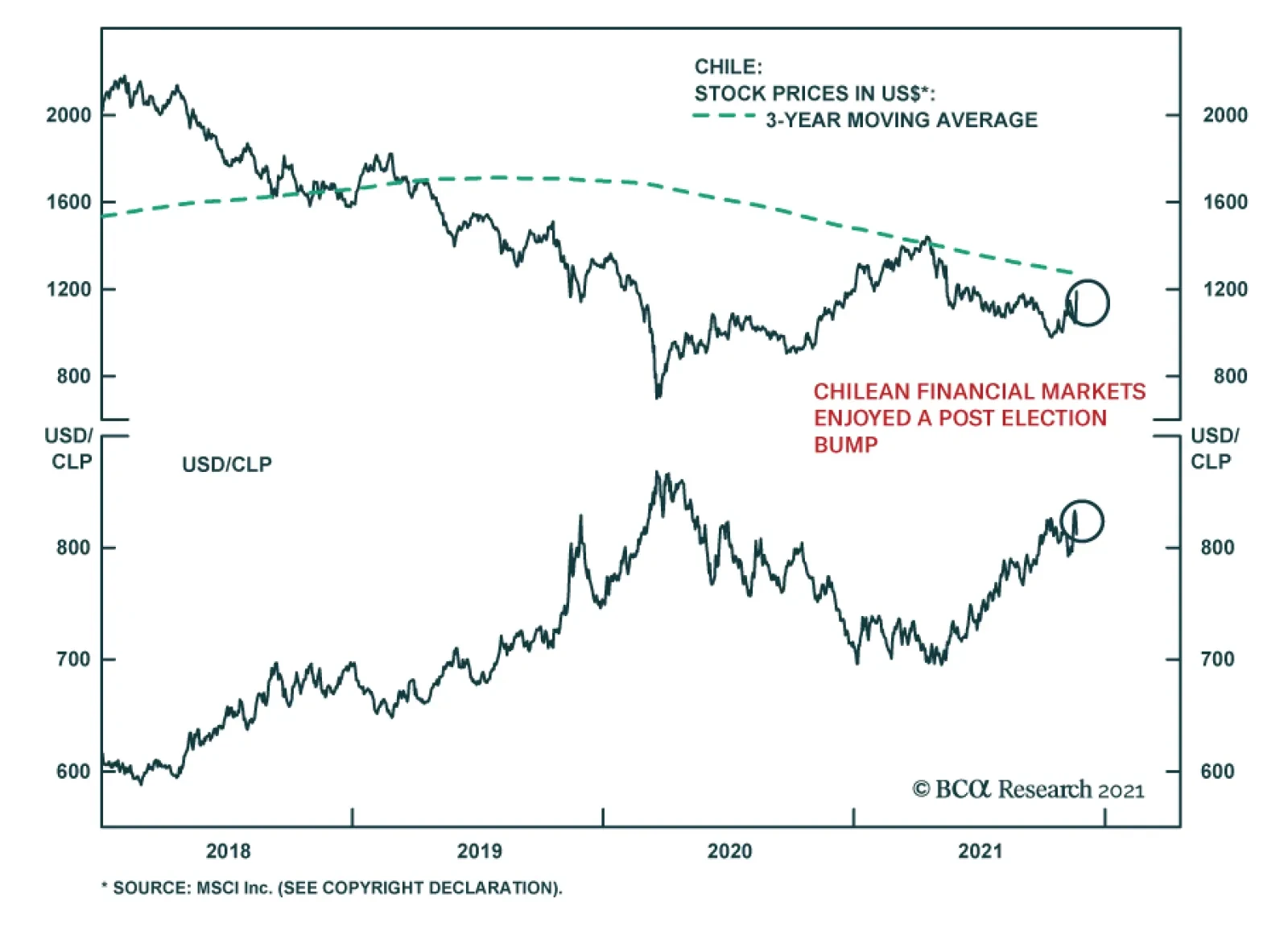

Chilean financial markets rallied following the first round of the presidential elections which ended in favor of conservative candidate José Antonio Kast. Kast secured 27.9% of the votes and came in slightly ahead of his…

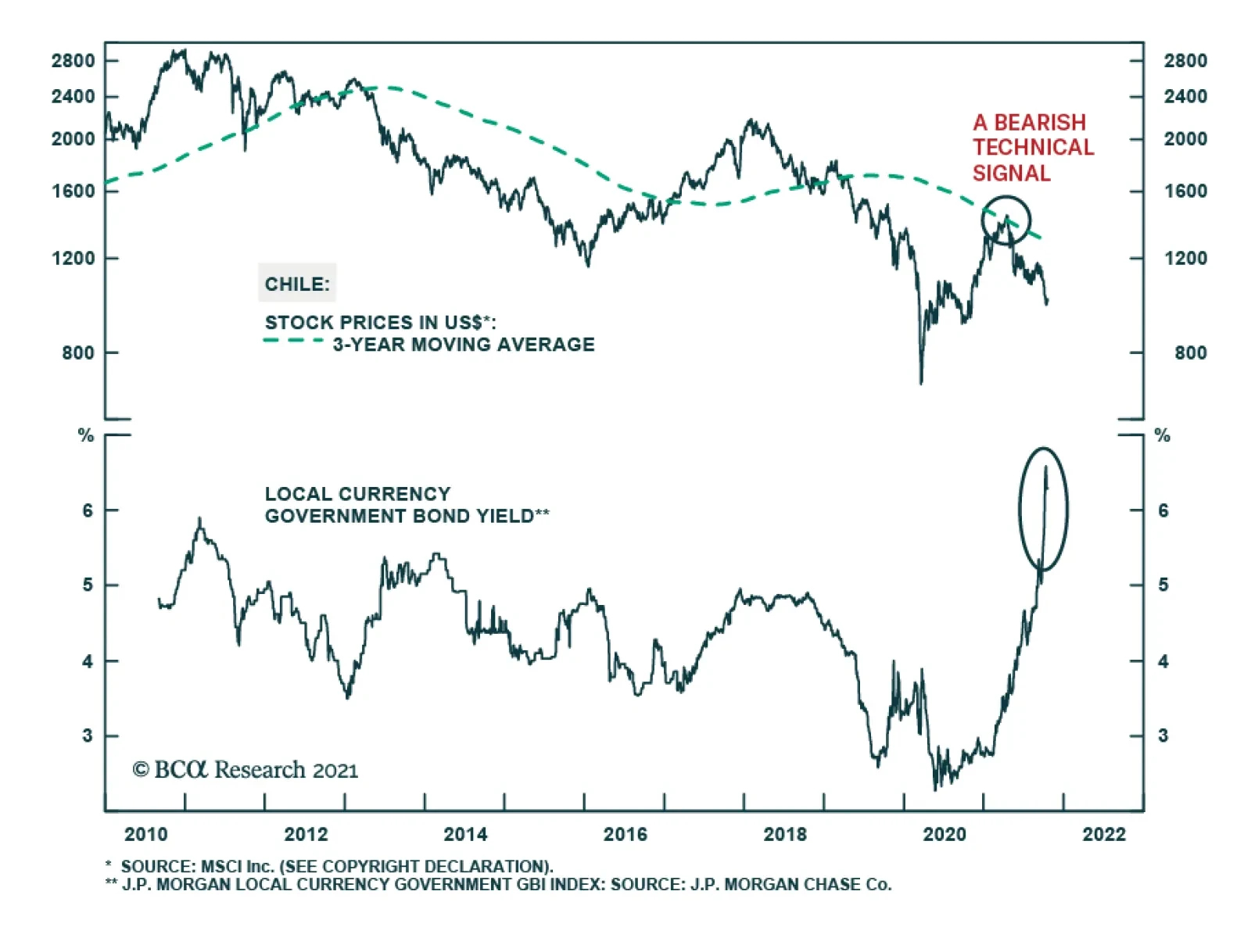

Chilean assets are set to endure a period of turbulence over the next few months. The rising odds of the victory of popular left-wing presidential candidate Gabriel Boric will continue to alarm markets and place upward pressure…

Highlights Gabriel Boric – a popular independent left-wing candidate – will likely win the presidential elections. Chile’s financial markets will remain very turbulent with a downward bias until the second voting…

Highlights The US Climate Prediction Center gives ~ 70% odds another La Niña will form in the August – October interval and will continue through winter 2021-22. This will be a second-year La Niña if it forms, and…

Highlights The US government issued its first-ever water-shortage declaration for the Colorado River basin in August, due to historically low water levels at the major reservoirs fed by the river (Chart of the Week). The drought…

Highlights Going into the new crop year, we expect the course of the broad trade-weighted USD to dictate the path taken by grain and bean prices (Chart of the Week). Higher corn stocks in the coming crop year, flat wheat stocks and…

Highlights The rapid spread of the COVID-19 delta variant in Asia will re-focus precious metals markets anew on the possibility of another round of lockdowns and the implications for demand, particularly in Greater China and India,…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…