Stay overweight Chilean risk assets and long local-currency government bonds as elections deliver a pro-business shift that supports a structural re-rating. This weekend’s elections marked a decisive return to pro-business politics,…

Following this weekend's election, we reiterate an overweight stance across Chilean risk assets relative to EM benchmarks and advise buying local currency government bonds (currency unhedged).

Our EM strategists see Chilean assets entering a structural re-rating phase and recommend going long 10-year local currency government bonds for absolute-return investors. A likely right-wing victory in the November elections,…

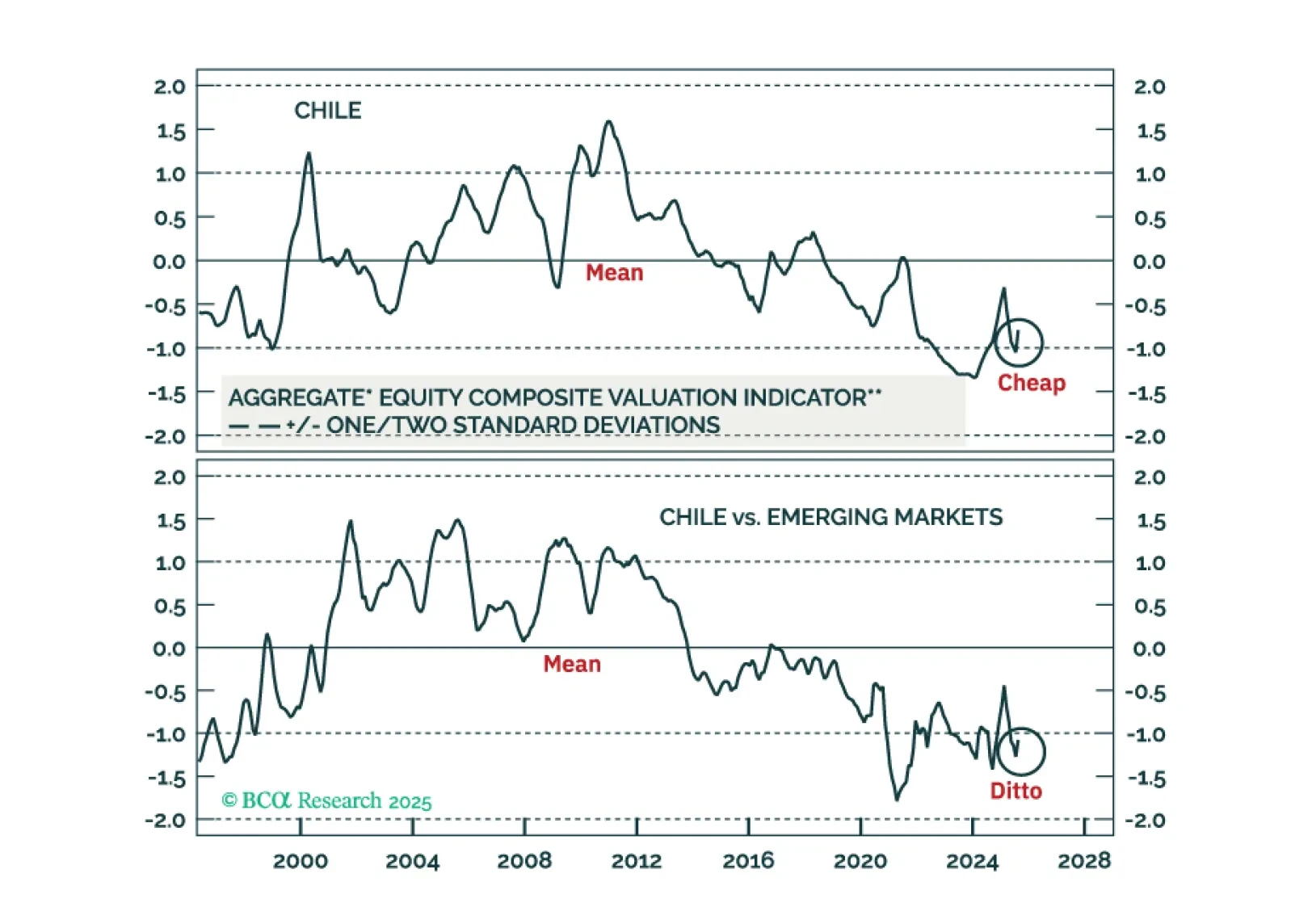

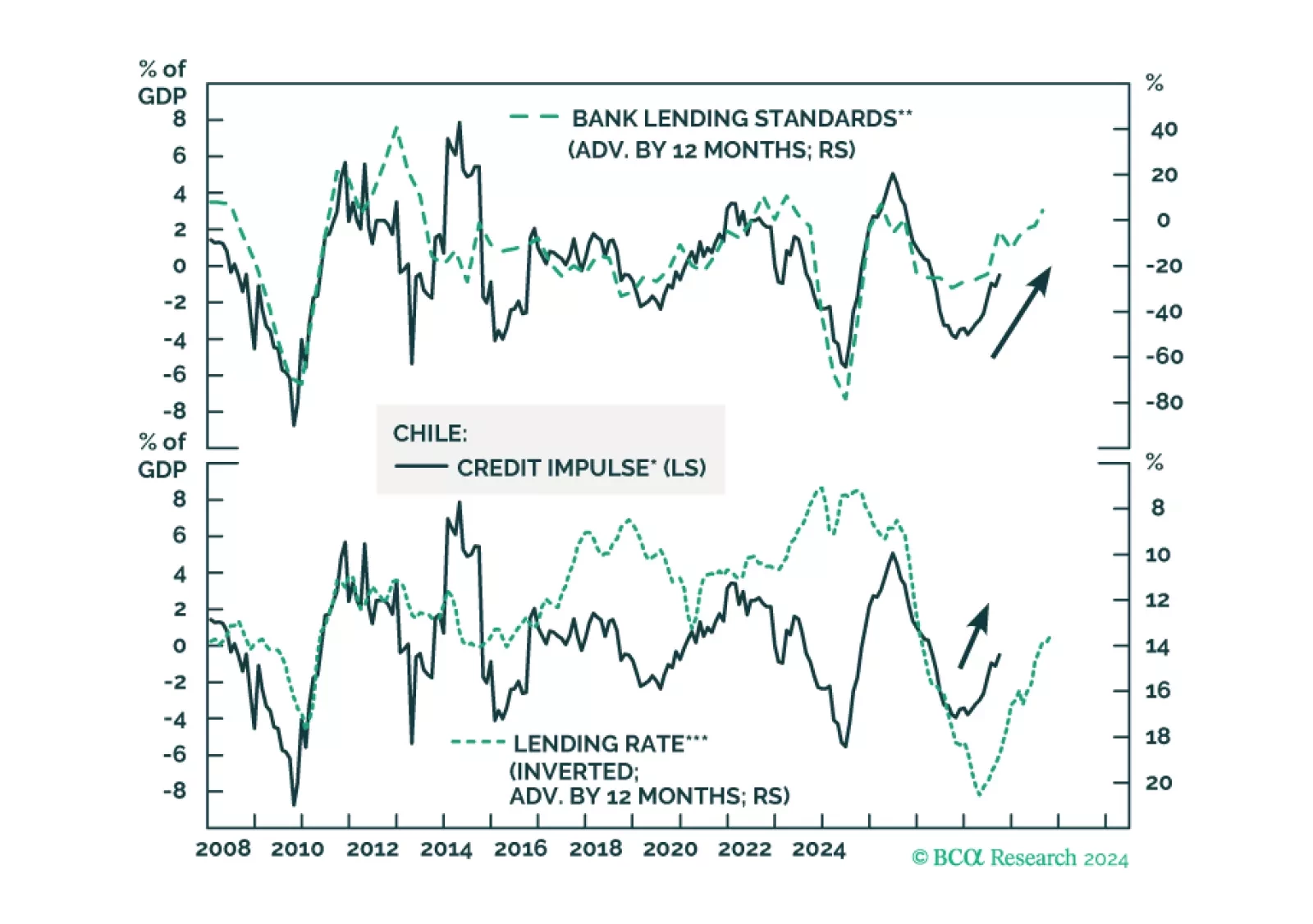

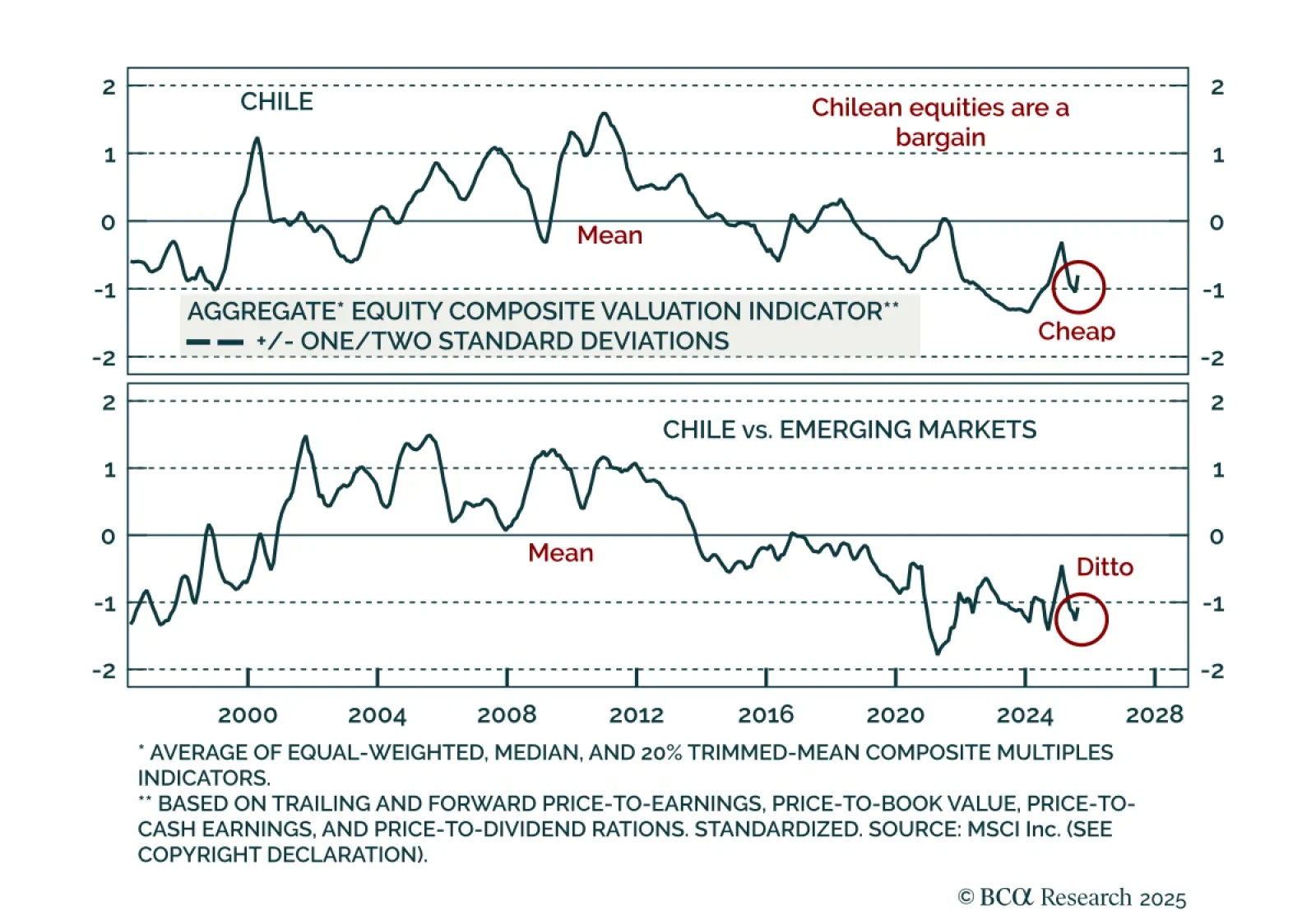

Chilean equities are undergoing a structural re-rating. A political swing back to a pro-business administration, a benign macro backdrop, and a resilient exchange rate will drive Chilean markets’ outperformance versus EM peers.…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

In absolute terms, Chilean markets and the currency will fall given a strengthening trend in the US dollar and weak global trade. However, Chile’s economy can withstand the global trade slump relatively well due to substantial…

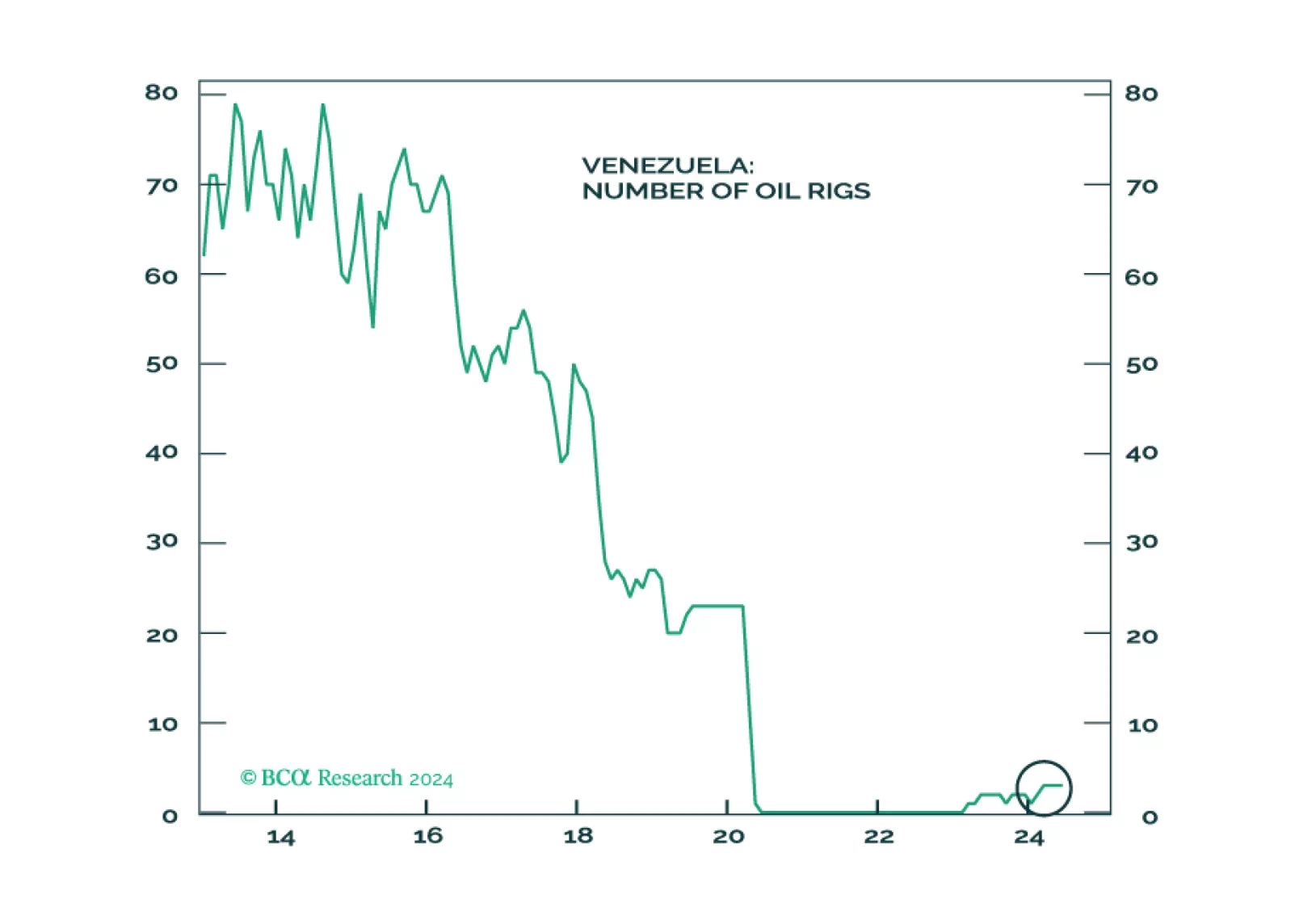

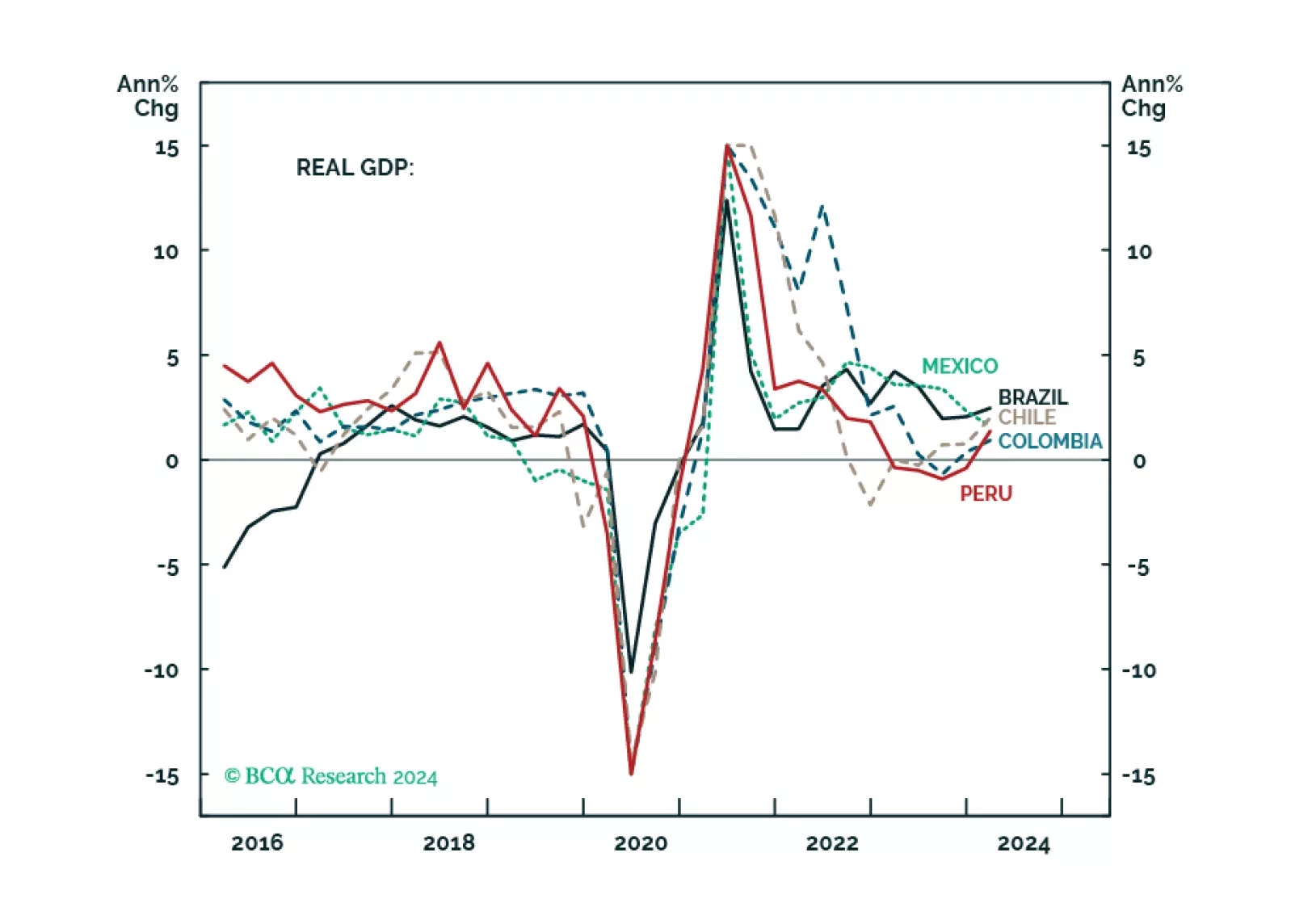

Non-trivial macro divergences have emerged between mainstream LATAM economies. This report compares and ranks Brazil, Mexico, Colombia, Chile, and Peru based on their business cycle outlook, macro policy stance, external accounts,…

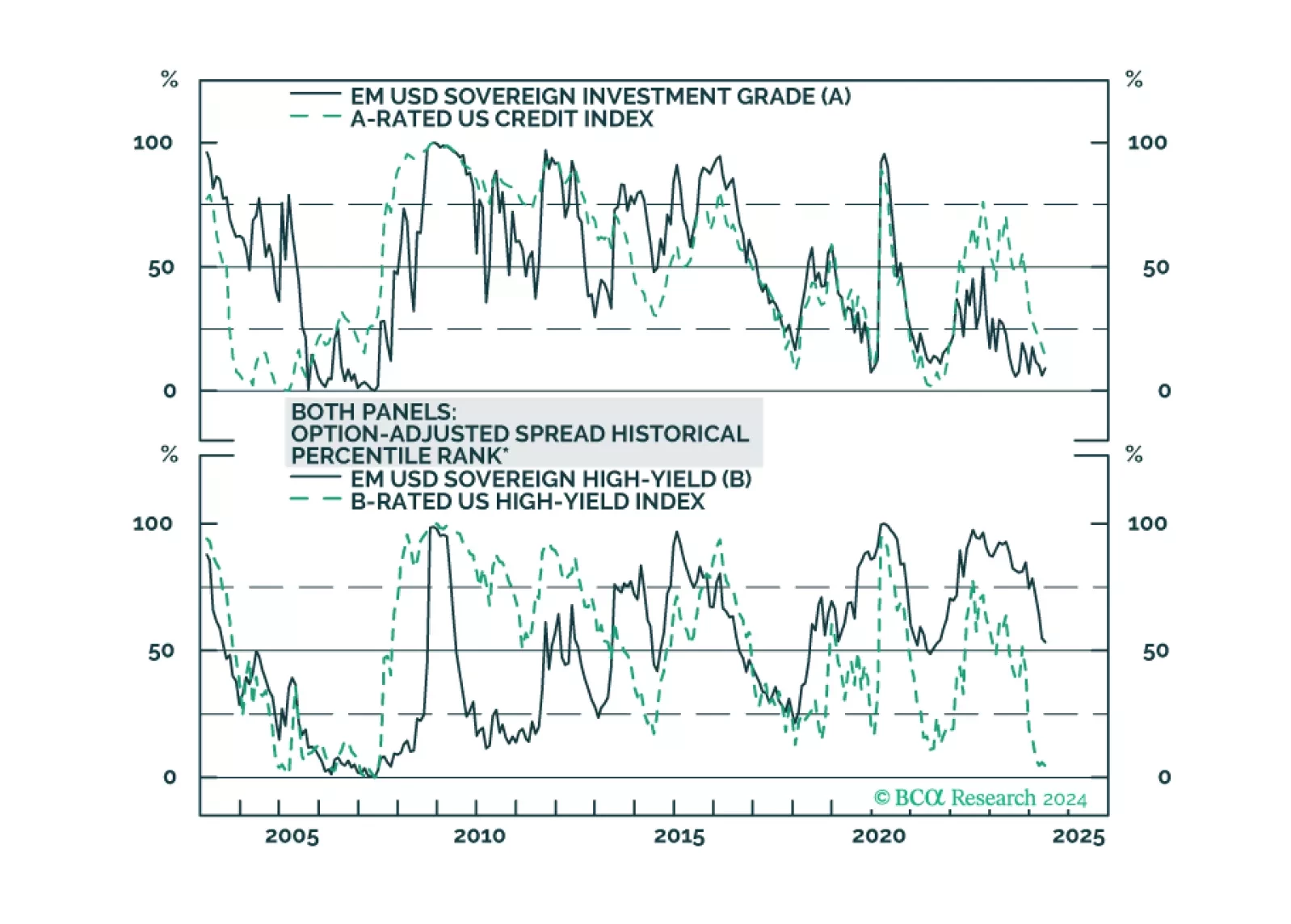

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

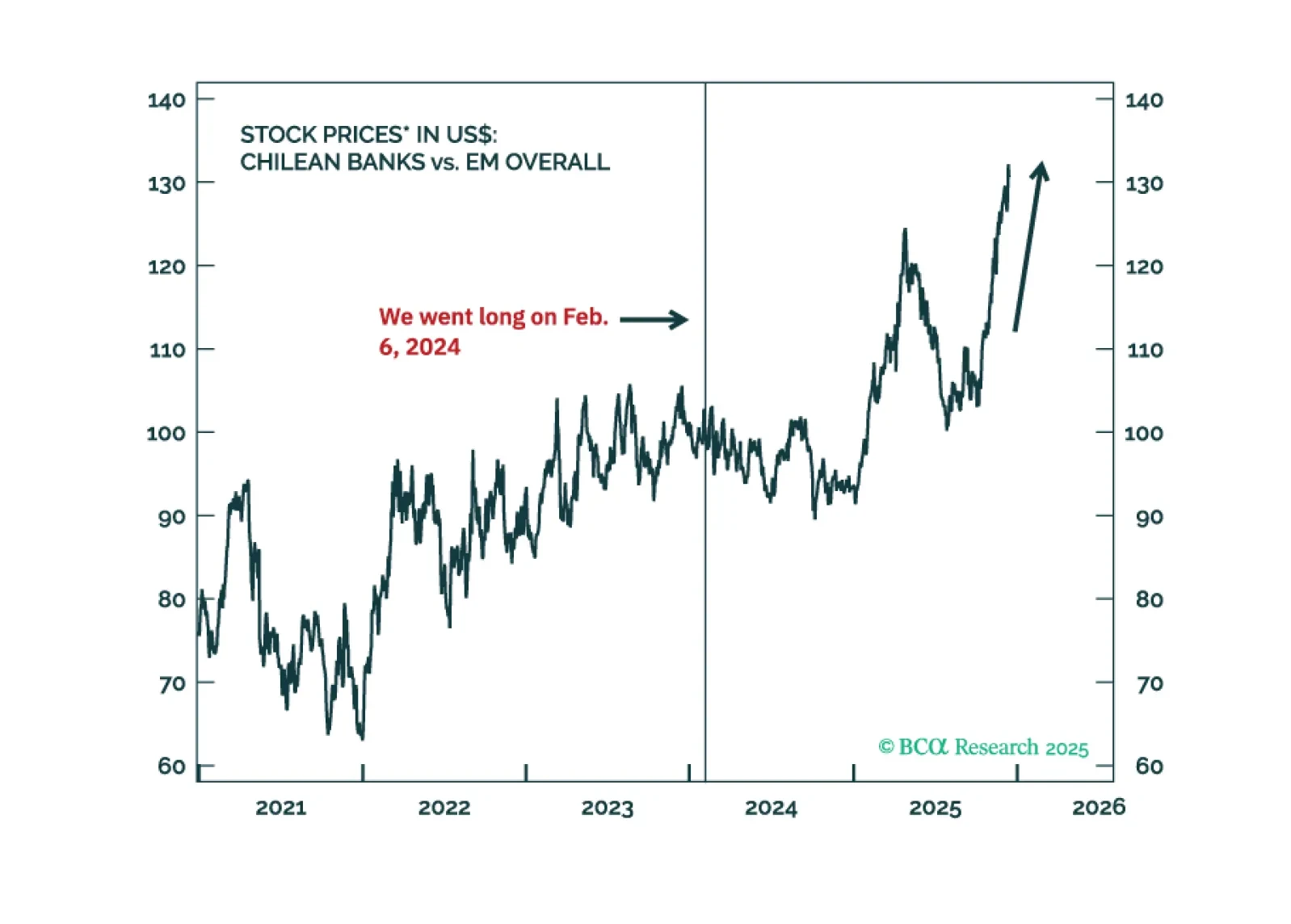

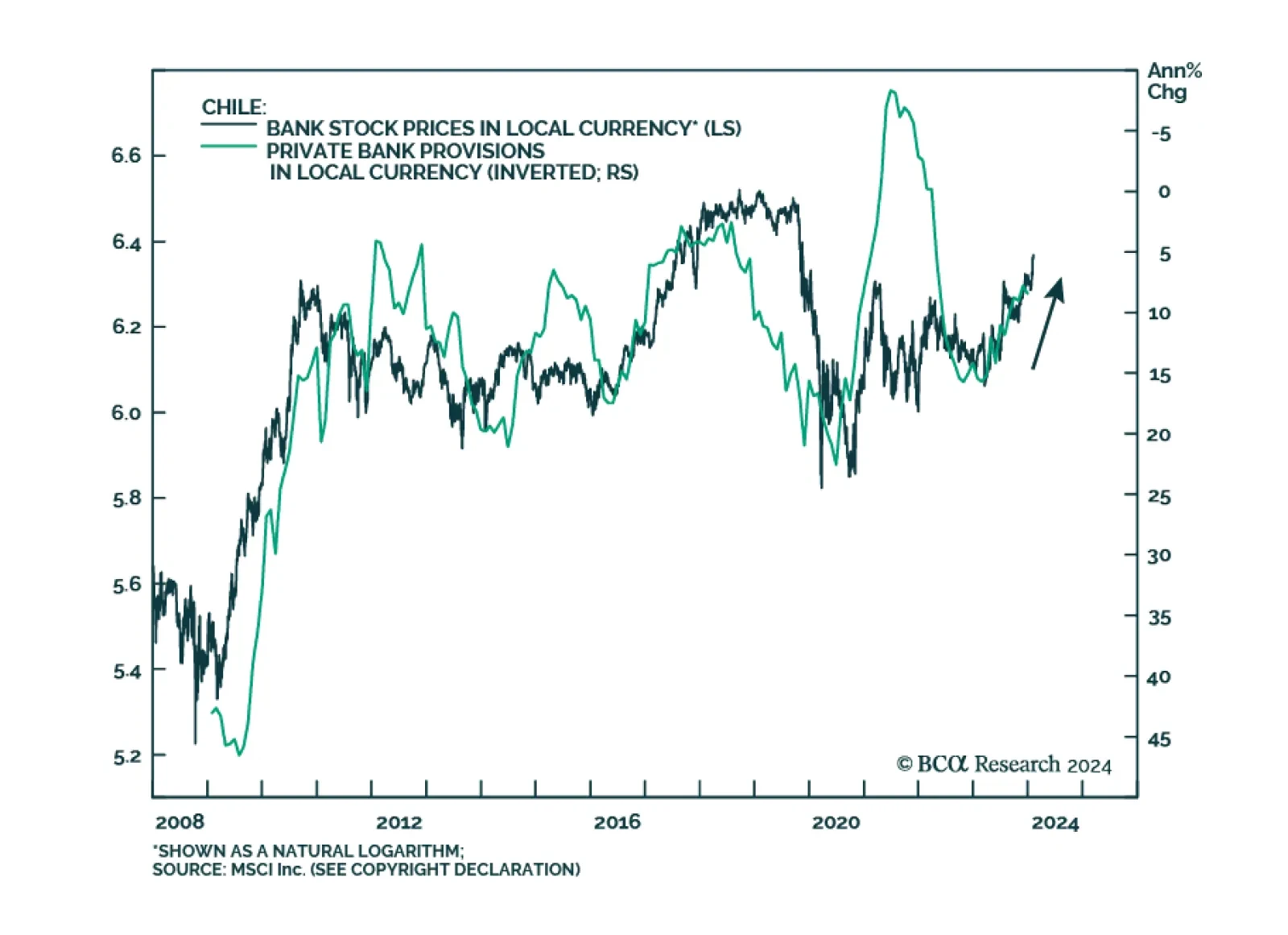

According to BCA Research’s Emerging Markets Strategy service, Chilean bank stocks offer great value and are poised to outperform the EM equity benchmark. Chilean bank share prices are well-positioned to outperform due…