The Czech National Bank surprised markets with a massive 125 basis point rate hike on Thursday – significantly above the anticipated 75 bp increase. The central bank’s sharp move – which follows a 75 bp hike in…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

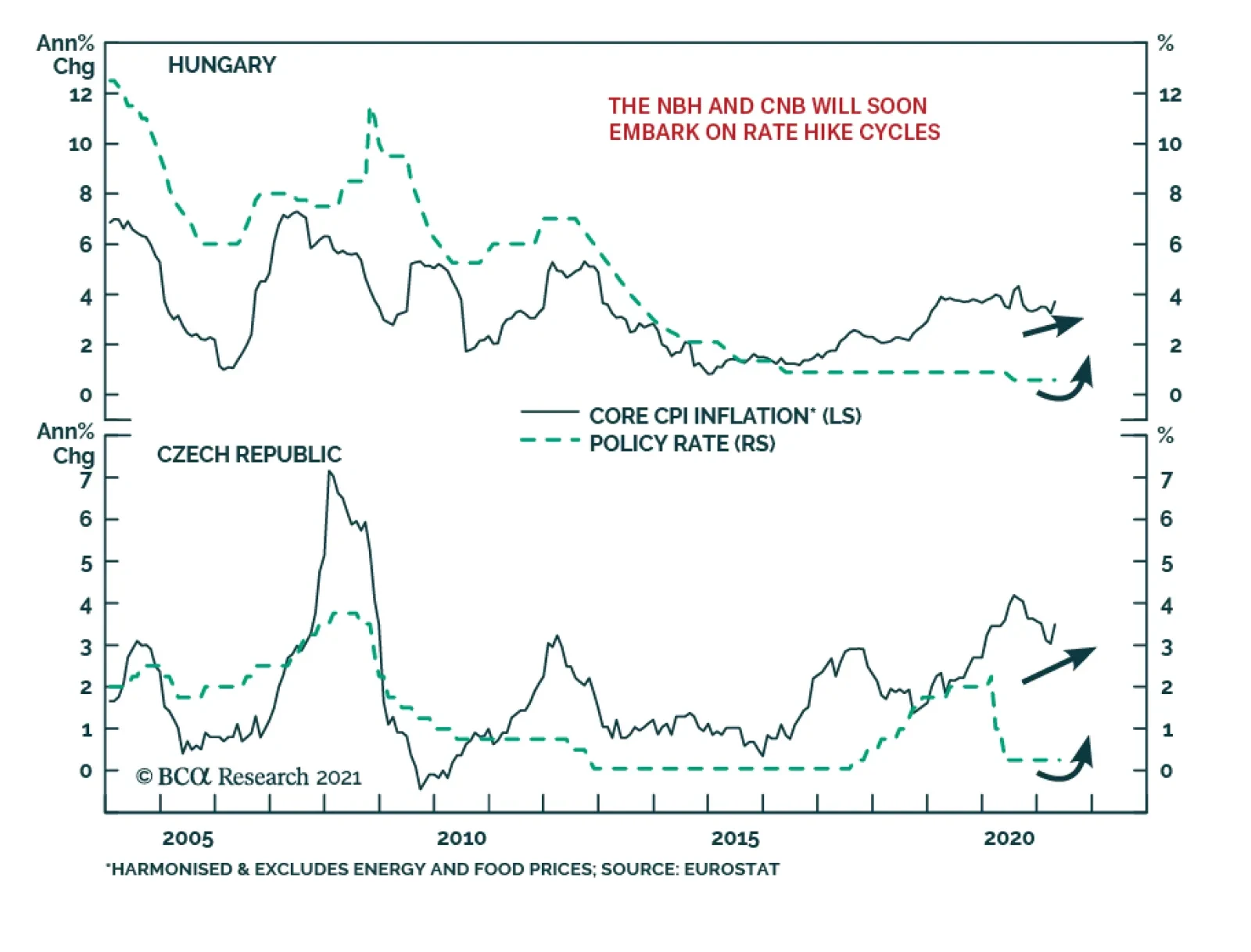

BCA Research’s Emerging Markets Strategy service concludes that the Czech koruna will outperform the Hungarian forint. Conditions for central bank rate hike cycles are in place in Hungary and the Czech Republic. Yet…

Highlights Even though the National Bank of Hungary is set to hike its policy rate, the pace and magnitude of these rate hikes will be insufficient to contain the inflation outbreak. In the meantime, Czech policymakers – both…

Chart 1Rates To Rise In Czech Republic, But Will Remain Low In Poland & Hungary Among Central European (CE) currencies, we remain upbeat on the Czech koruna (CZK) due to a relatively hawkish central bank. Meanwhile, the…

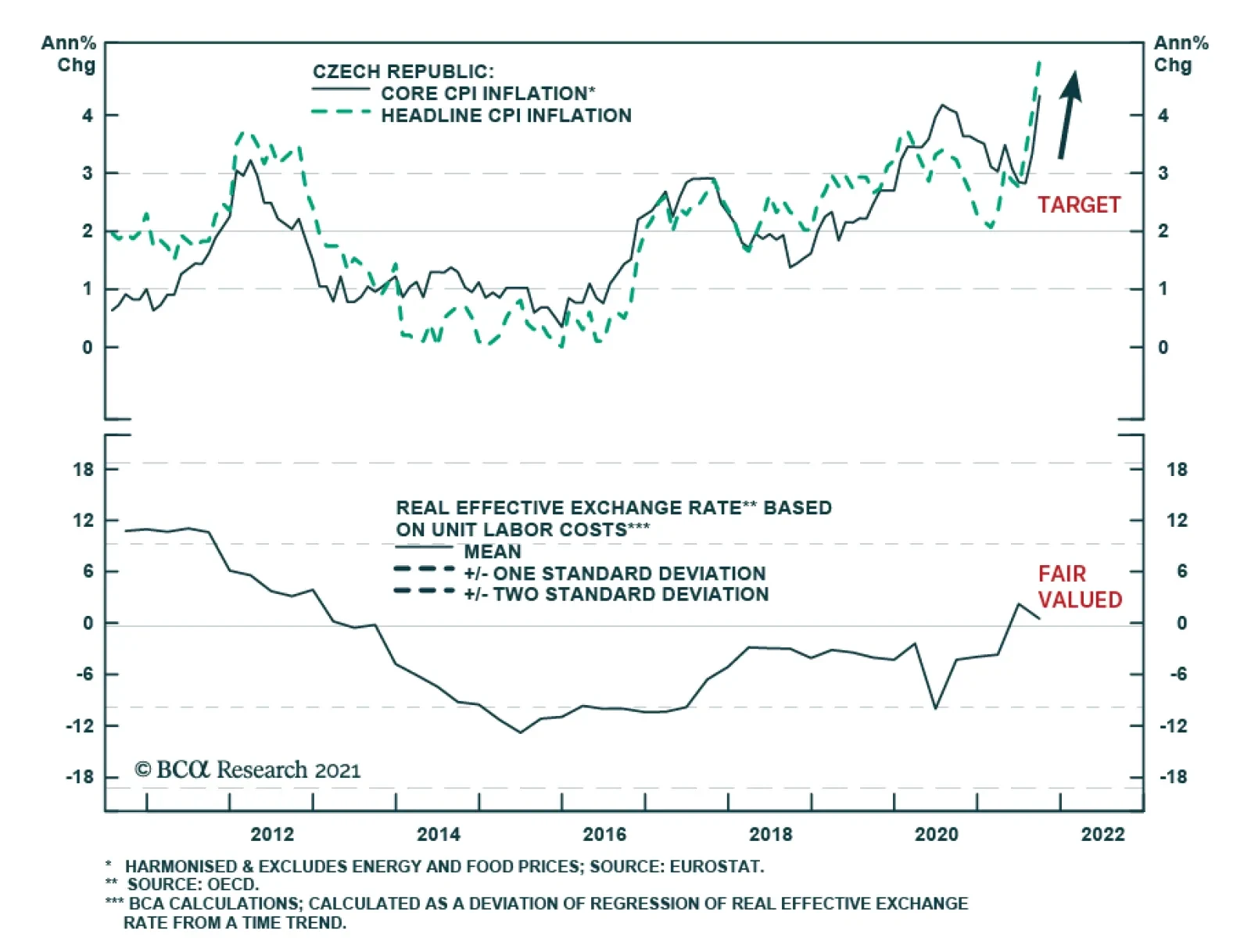

An opportunity to bet on higher longer-term interest rates and on a stronger currency has emerged in the Czech Republic (Chart III-1). Consumer price inflation is above the central bank’s 2% target and will continue to rise, which…

Last Friday, my colleague Dhaval Joshi and I held a webcast discussing investment strategies. The topics of discussion included global equity valuations, mega-cap stocks leadership and the outlook for EM stocks, fixed-income and…

Conditions are set for the Hungarian forint to outperform the Polish zloty over the coming months. We recommend going long the HUF against the PLN. Hungarian opposition parties criticized the government about the considerable…

Please note that yesterday we published Special Report on Egypt recommending buying domestic bonds while hedging currency risk. Today we are enclosing analysis on Hungary, Poland and Colombia. I will present our latest thoughts on the…