Eurosceptic billionaire Andrej Babis and his populist ANO party won the Czech parliamentary elections, securing 40% of the seats, short of an outright majority. The outcome was broadly in line with expectations but was viewed…

Our Emerging Markets strategists recommend investors go long CE3 domestic bonds, as a deflationary shock in core Europe drives Bund yields and CE3 rates lower. USD-based should go unhedged, while Euro-based investors should hedge…

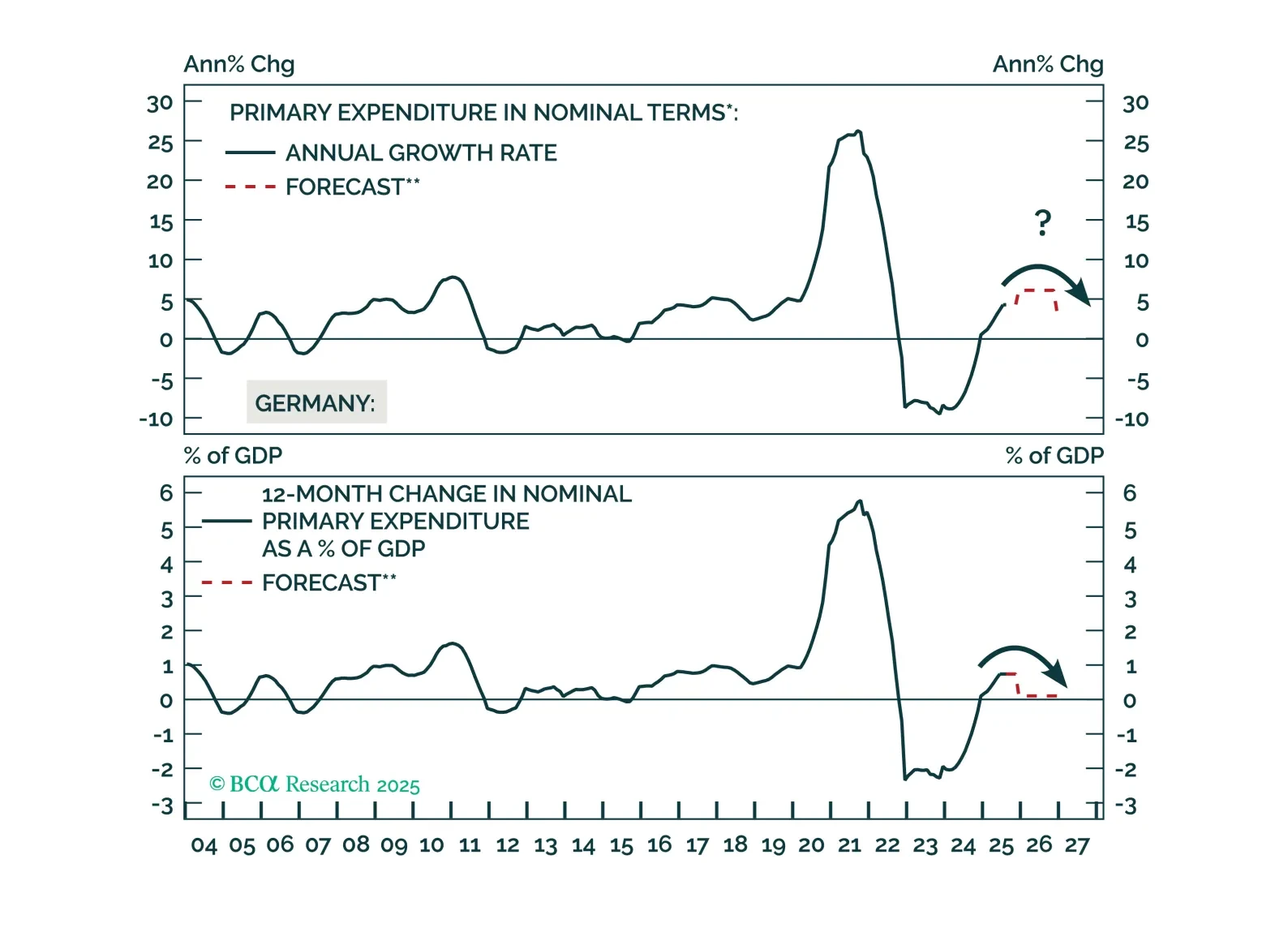

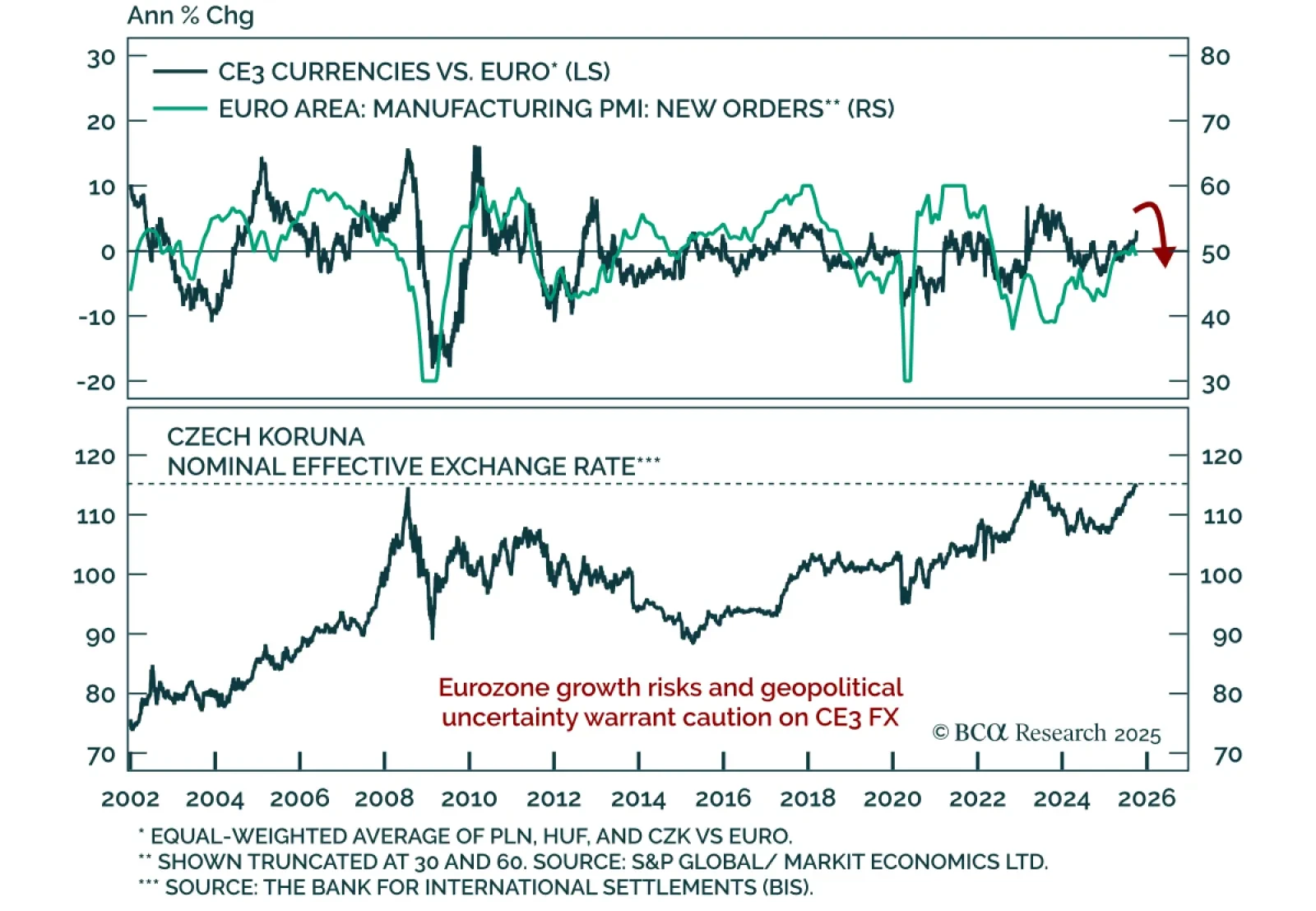

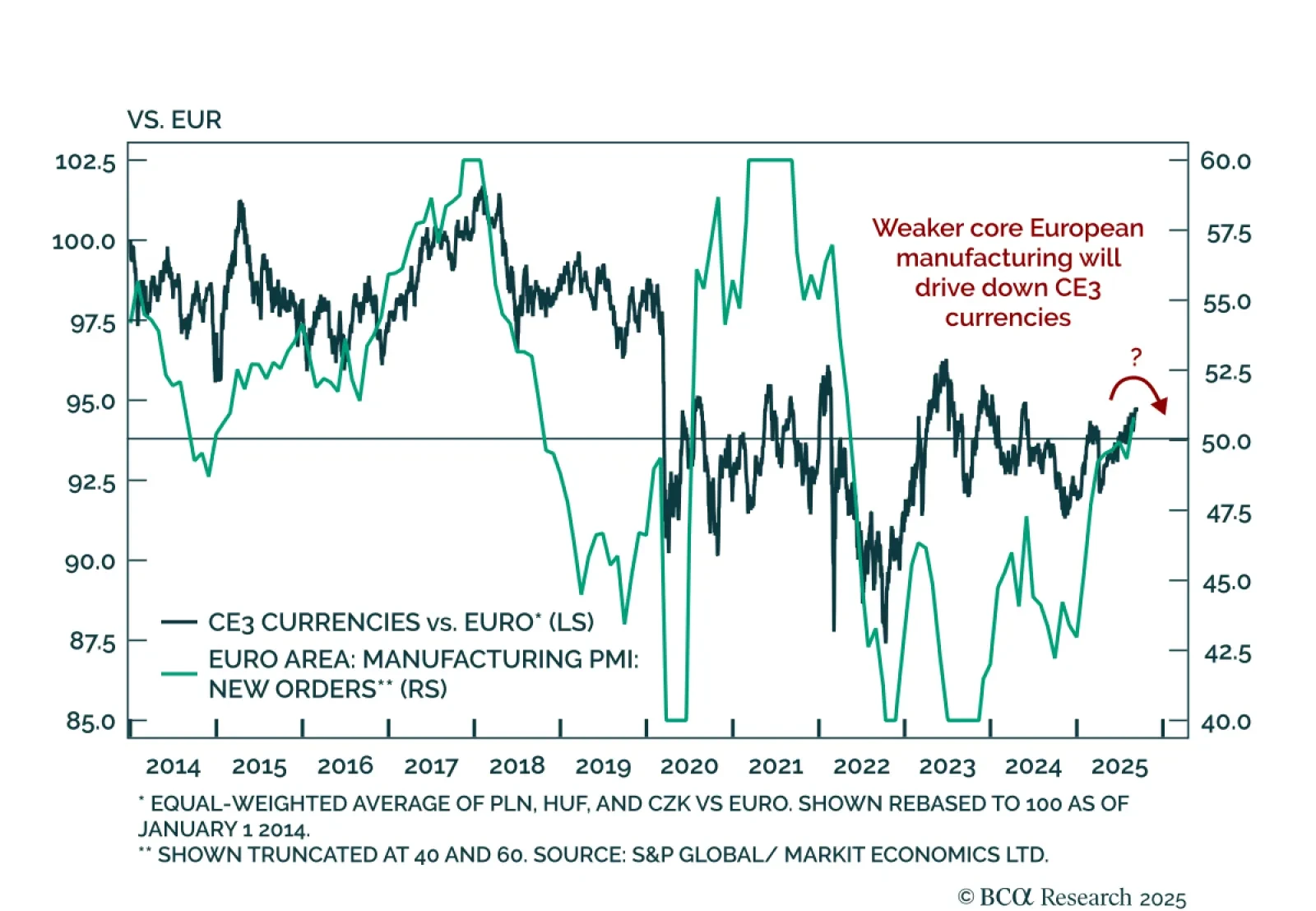

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

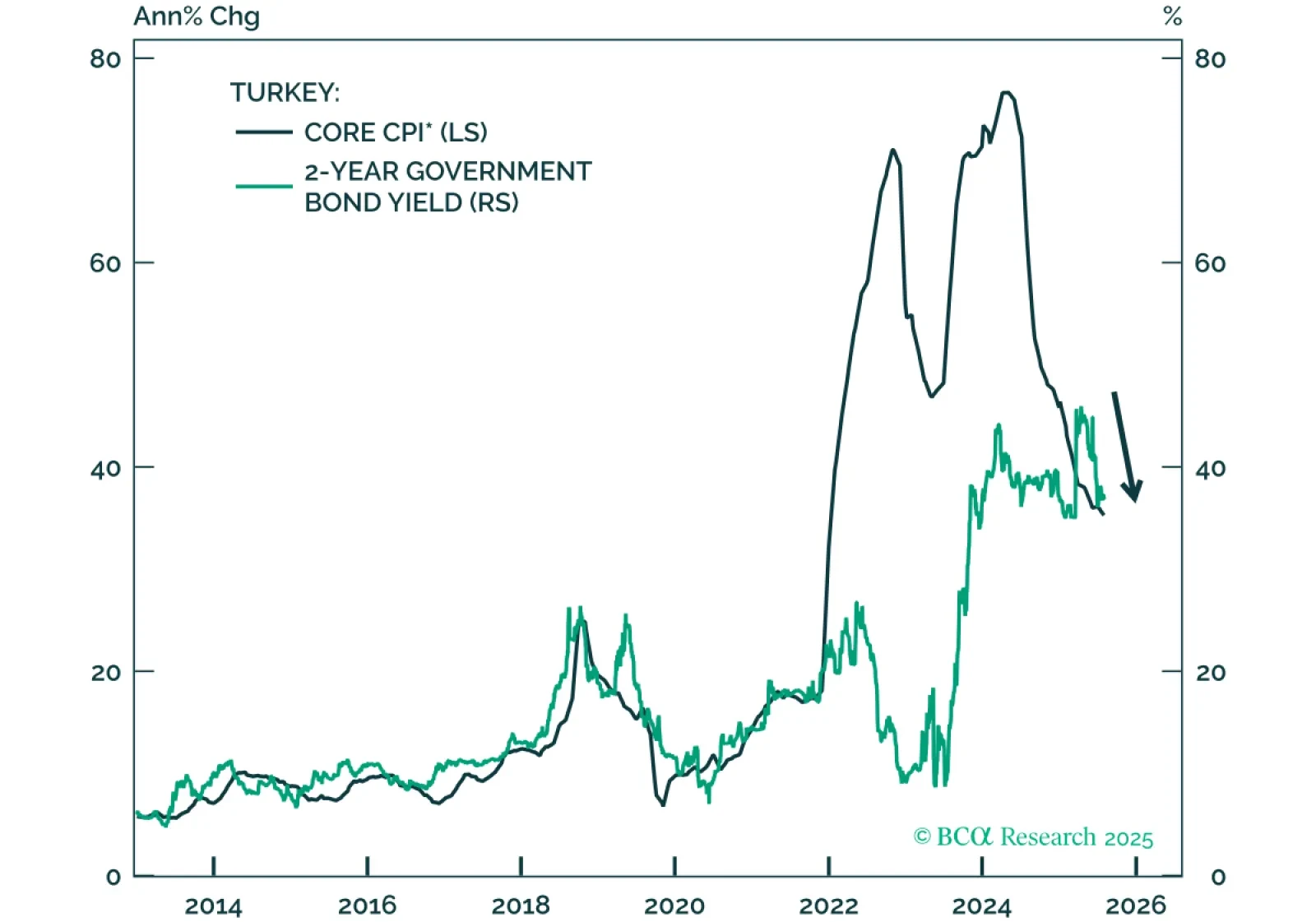

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

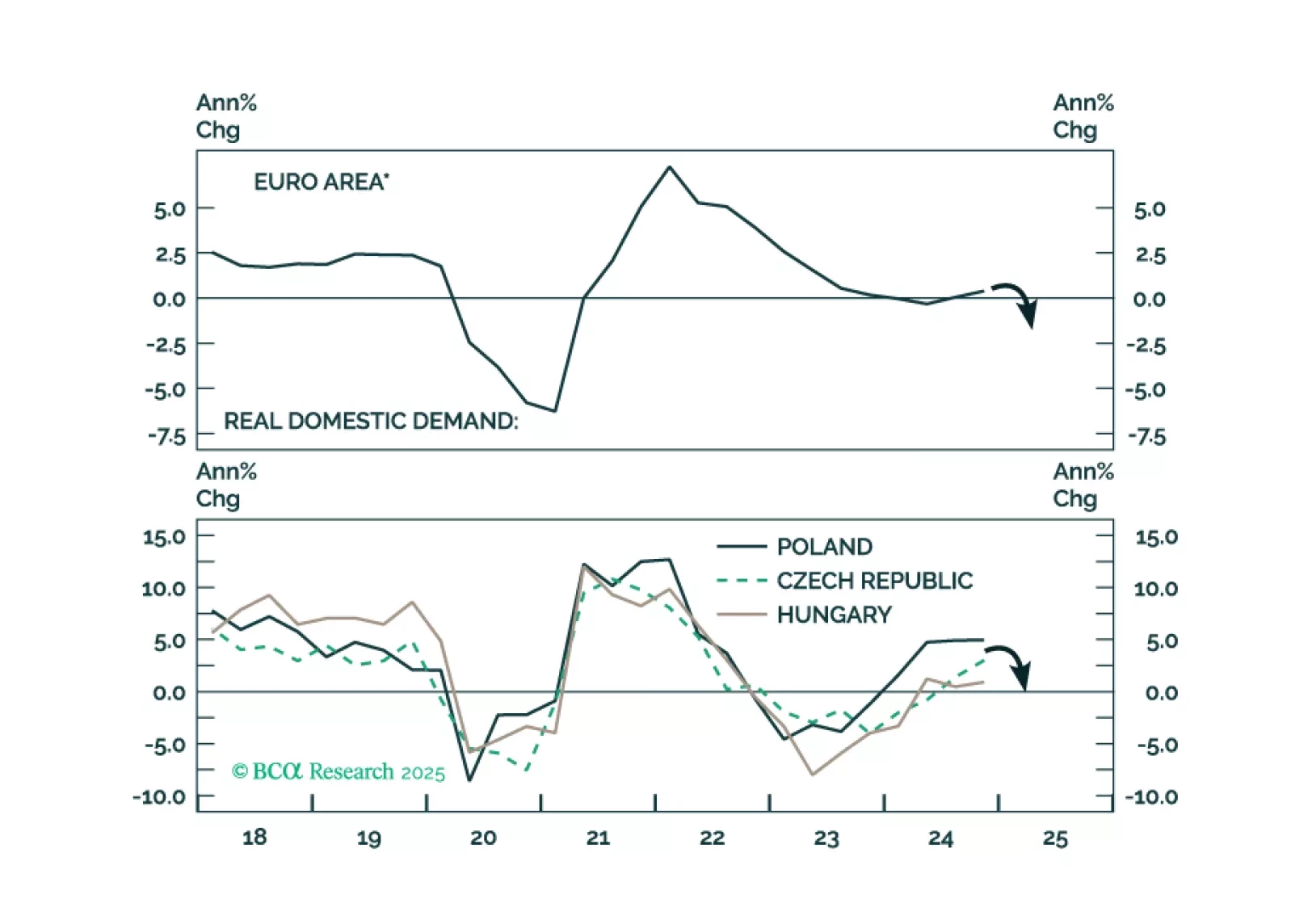

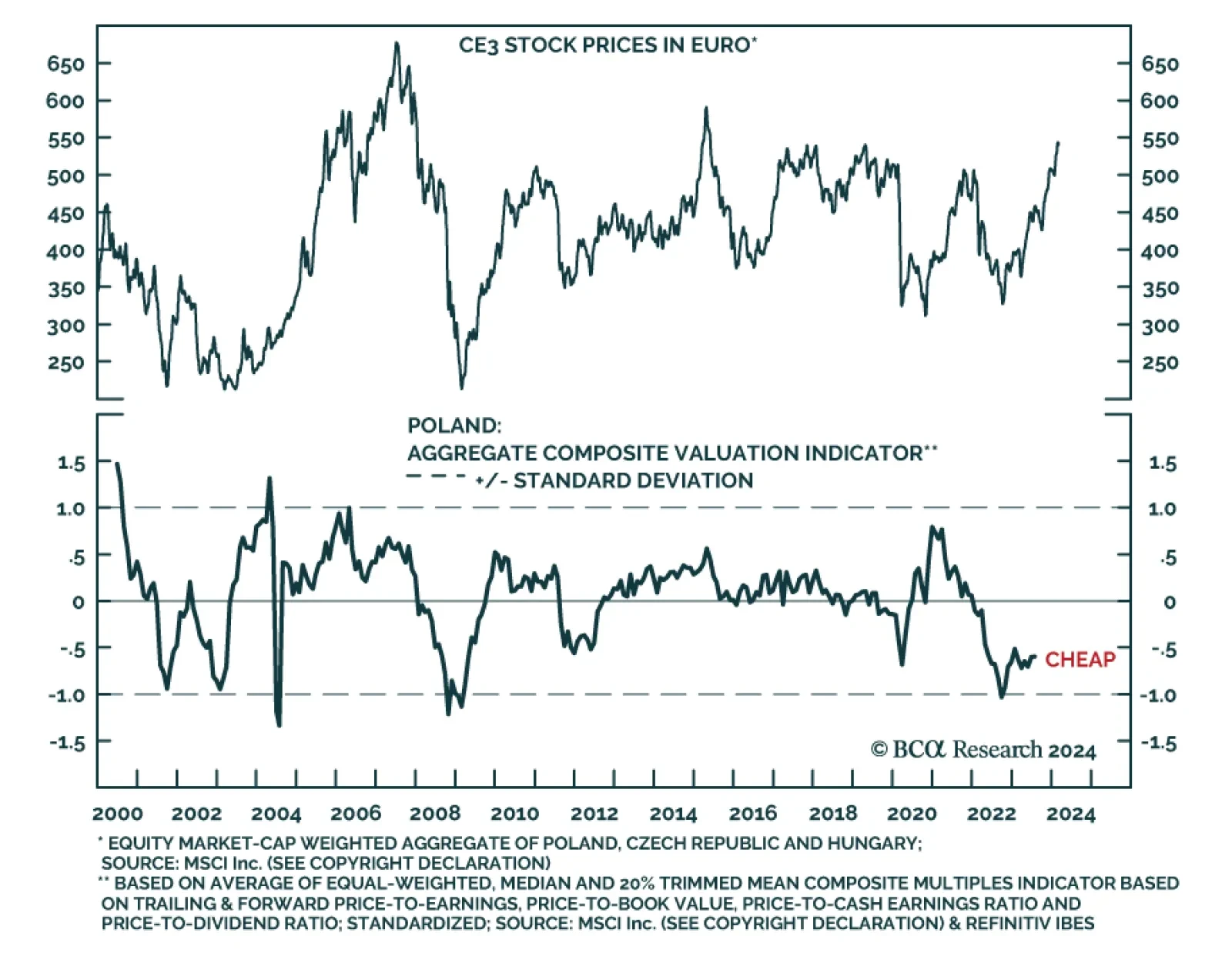

The European economies are facing a major deflationary shock. We recommend that investors stay long a basket of Central European (CE3) domestic bonds. They should also upgrade CE3 bonds and stocks in their respective EM portfolios.

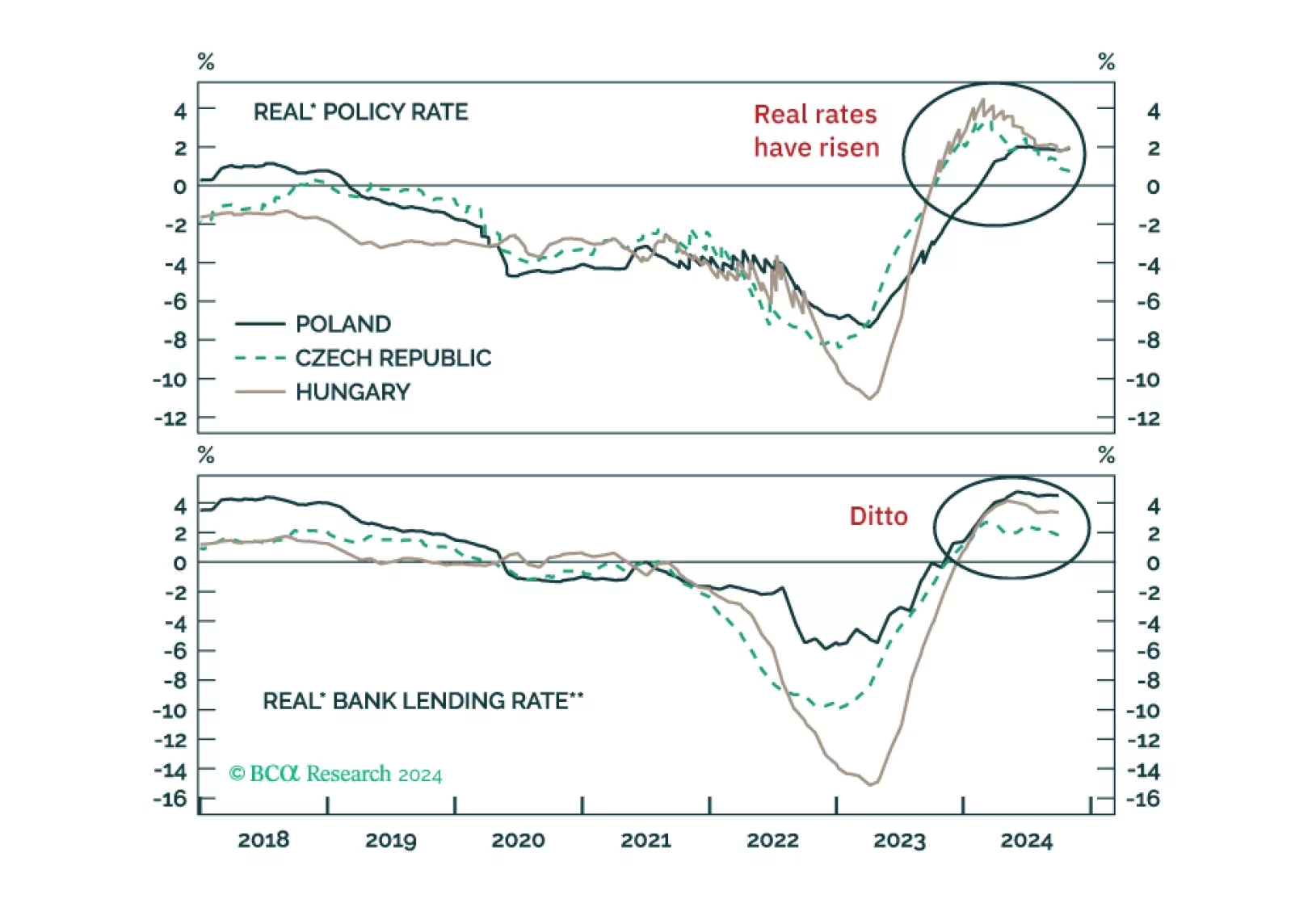

Domestic bond yields in the three major central European markets have recently inched up more than their German counterparts. This is despite economic growth staying quite weak in CE3. What should investors make of it (Chart 1)? Our…

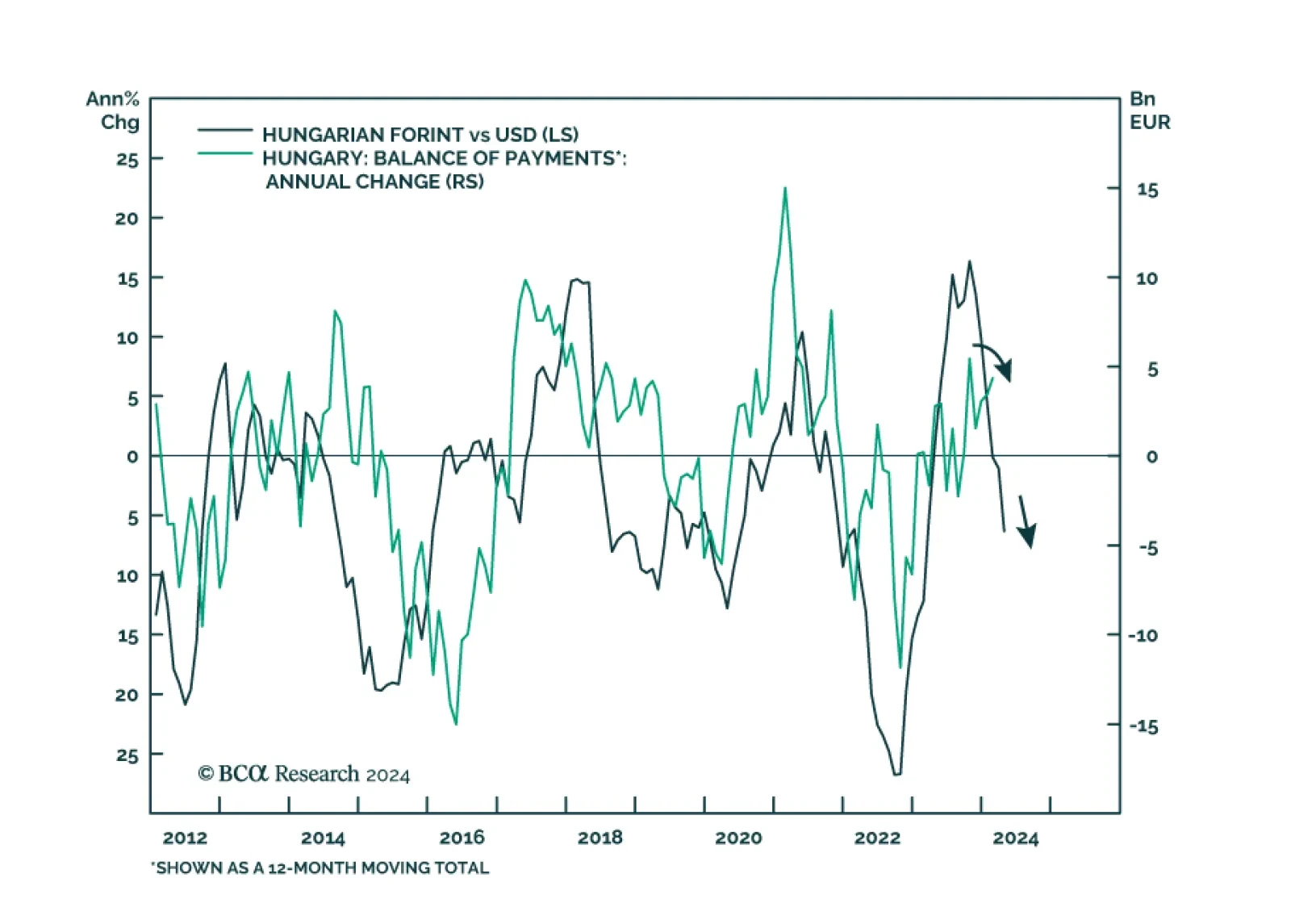

BCA Research’s Emerging Markets Strategy service concludes that among the CE3 currencies, the zloty and the koruna will be the relative winners, while the forint will likely be the worst performer of the three. That said,…

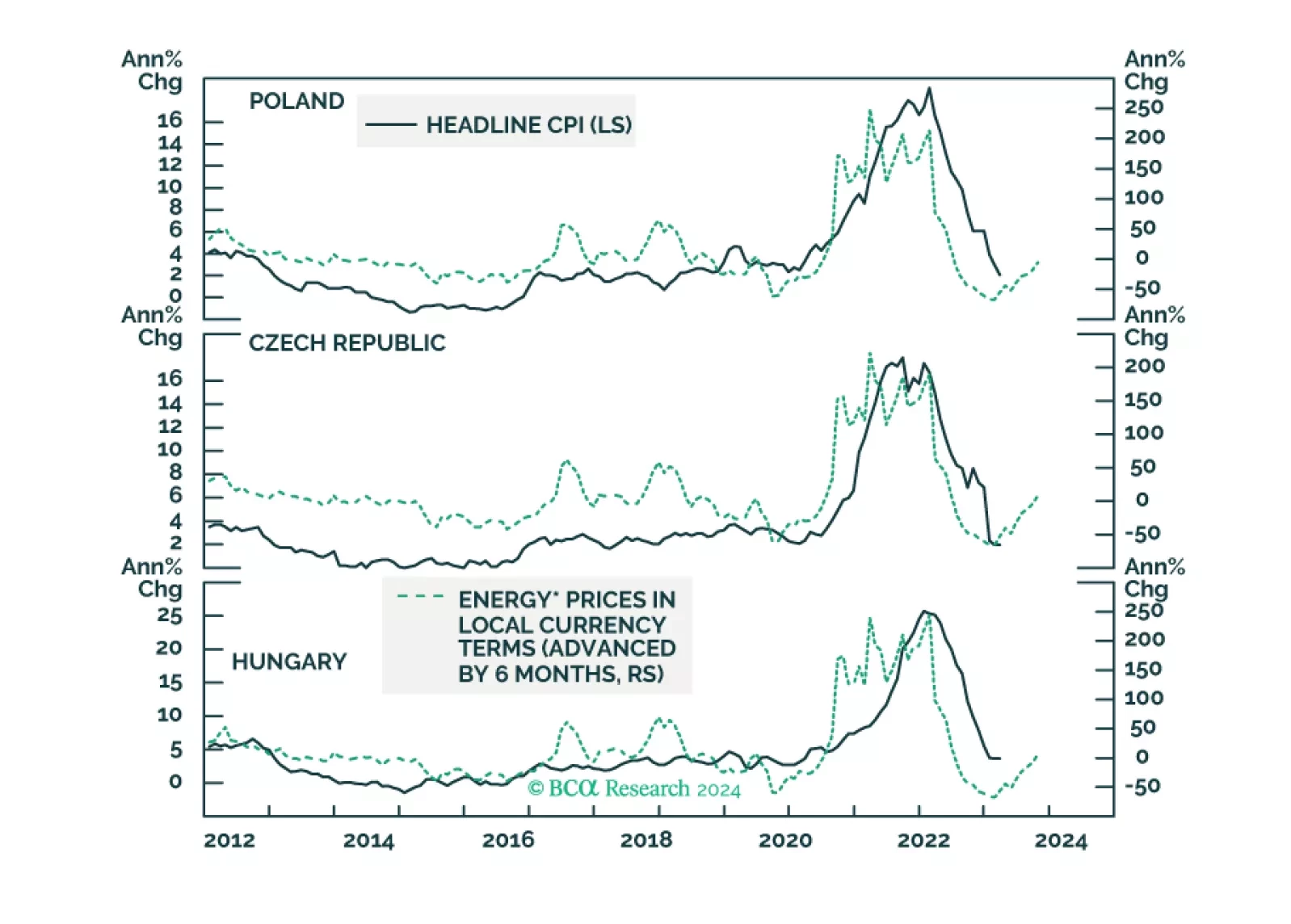

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…

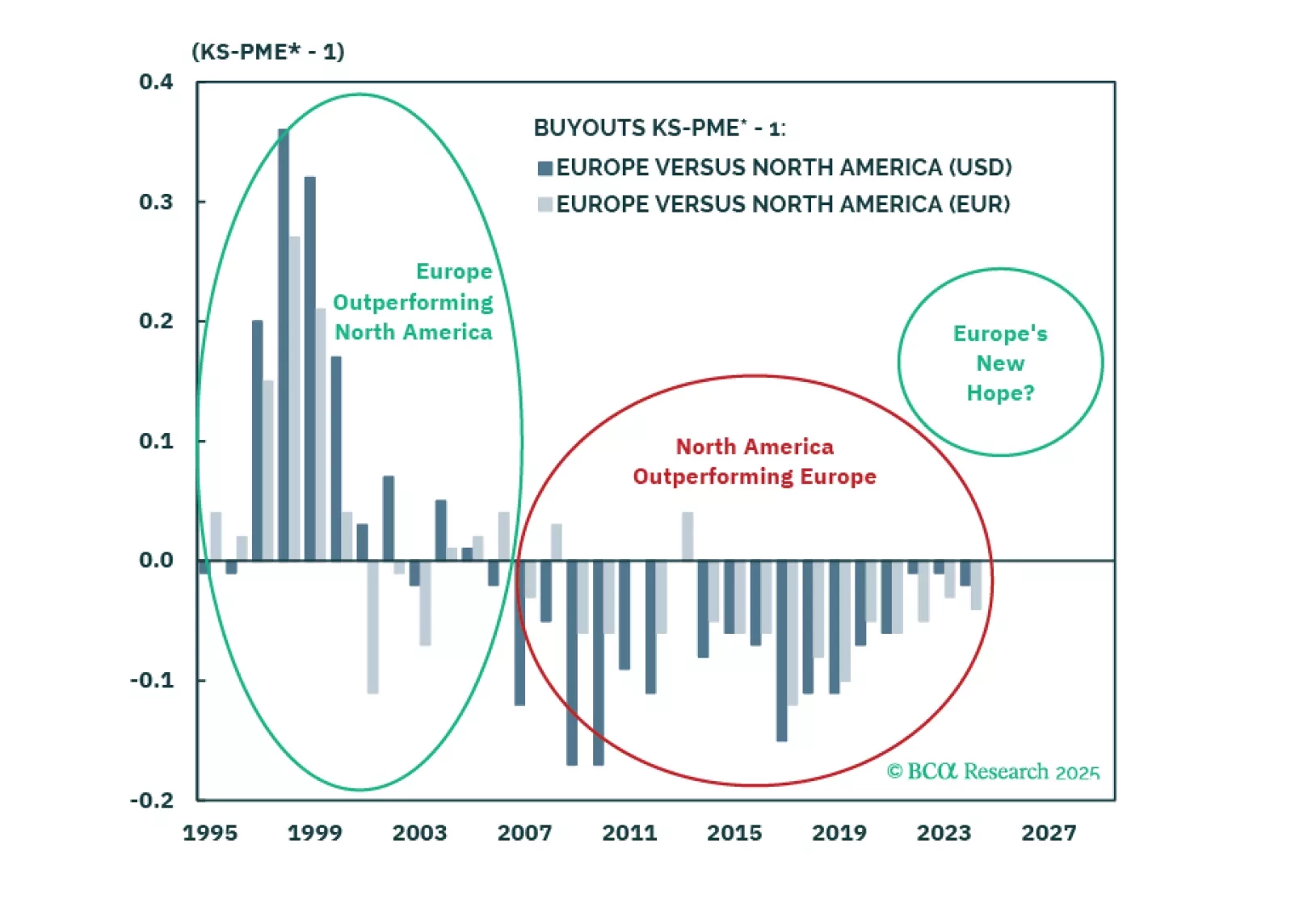

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…