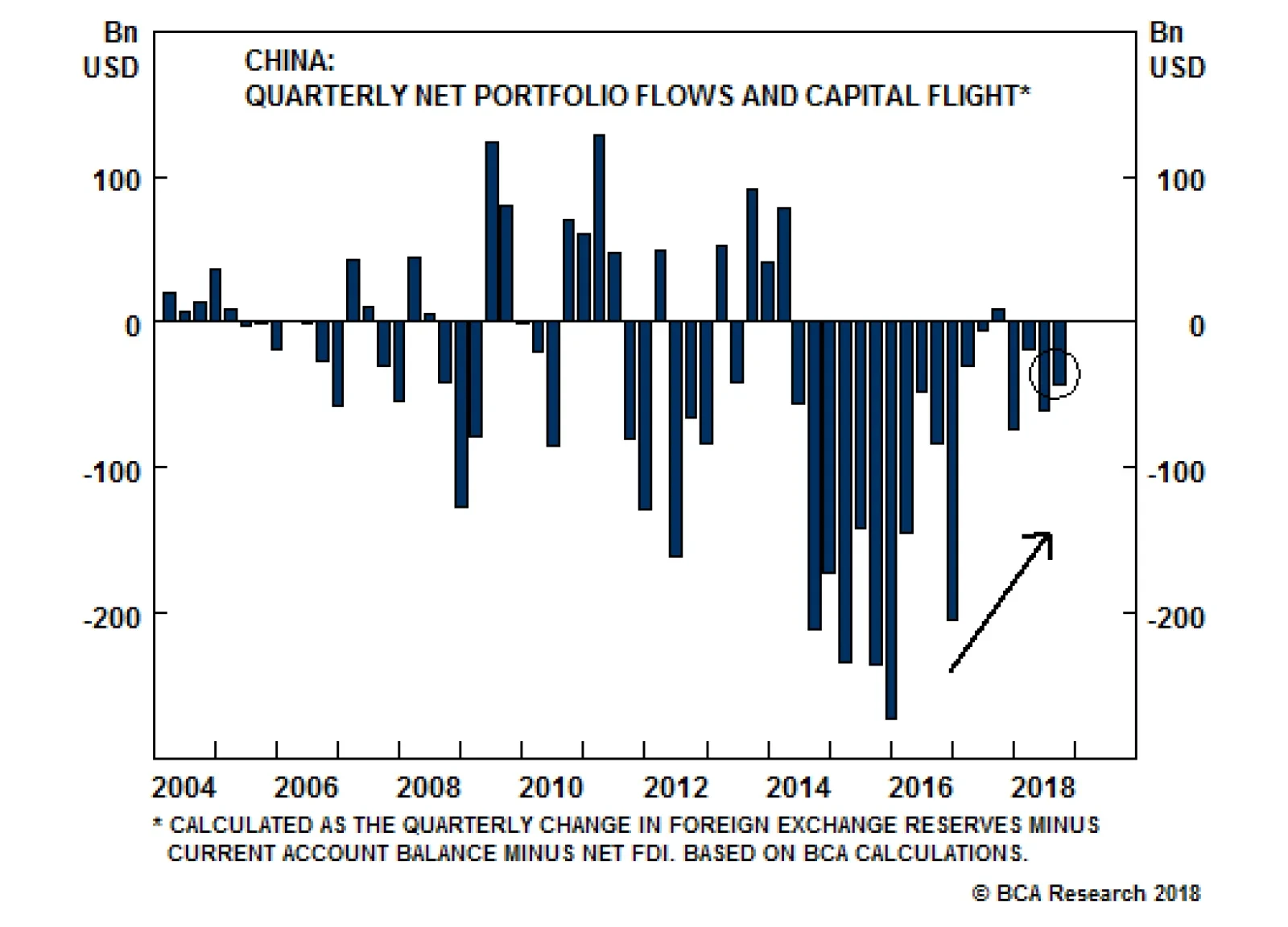

In 2015, a 4.7 percent depreciation precipitated a US$483 billion outflow of Chinese FX reserves. Conversely, the RMB has declined by about 10% in 2018 without any meaningful capital outflows or FX reserve deployment (see chart…

Highlights The ongoing selloff in EM risk assets and commodities resembles a domino effect. Given that domino effects transpire in bear markets - not corrections - we believe that EM risk assets and commodities are indeed in a bear…

Highlights Paradox 1: U.S. growth will slow, and this will force the Fed to raise rates MORE quickly. Paradox 2: China will try to stimulate its economy, and this will HURT commodities and other risk assets. Paradox 3: Global…

Highlights The chaotic conclusion to last weekend's G7 summit in Charlevoix is a reminder that the specter of trade wars will not fade quietly into the night. A trade war would hurt the U.S., but would punish the rest of the world…

Highlights The Swan Diagram depicts four different "zones of economic unhappiness," each one corresponding to a case where unemployment and inflation is either too high or too low, and the current account position is either…