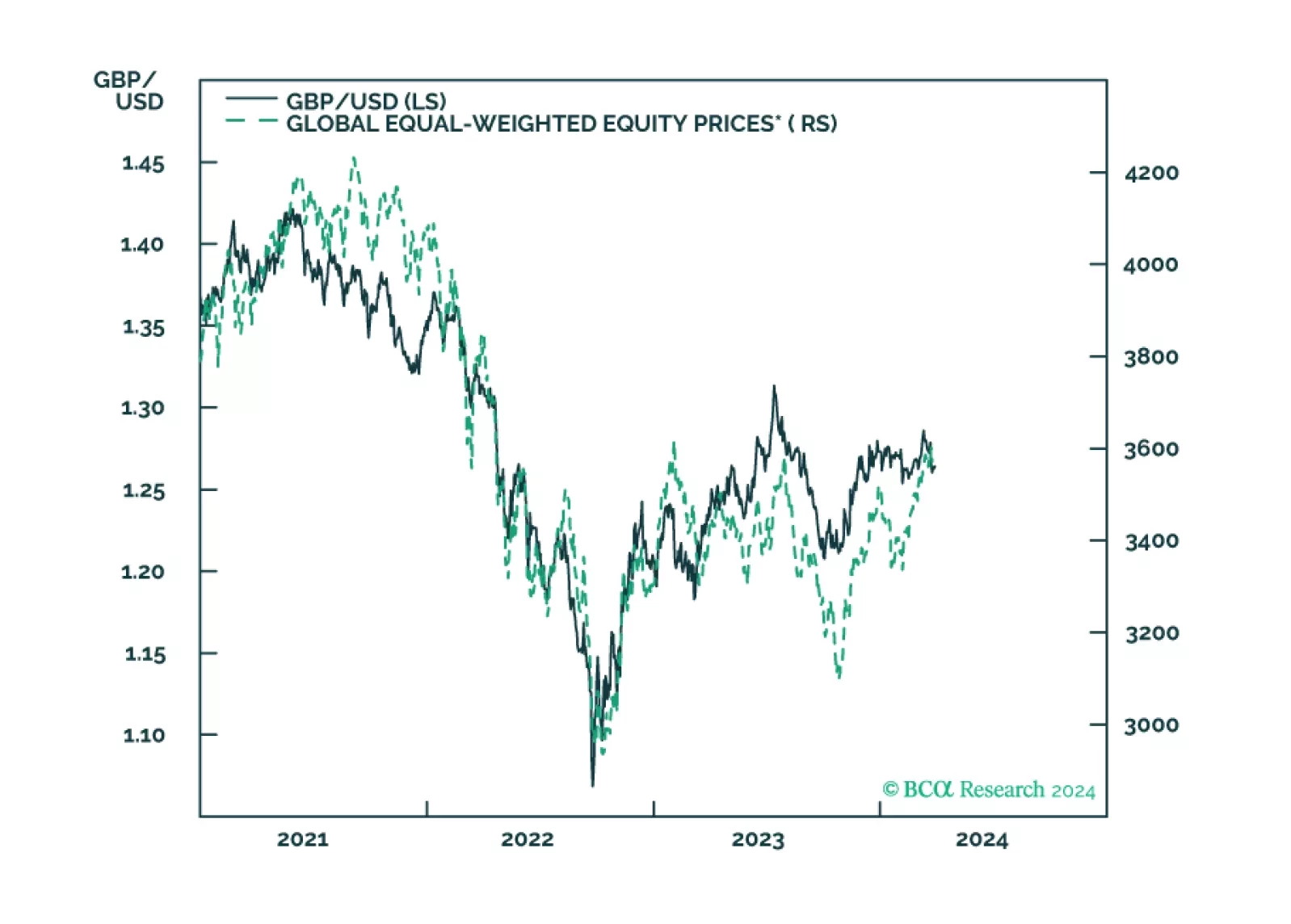

In this Insight, we discuss our rationale for a short sterling position.

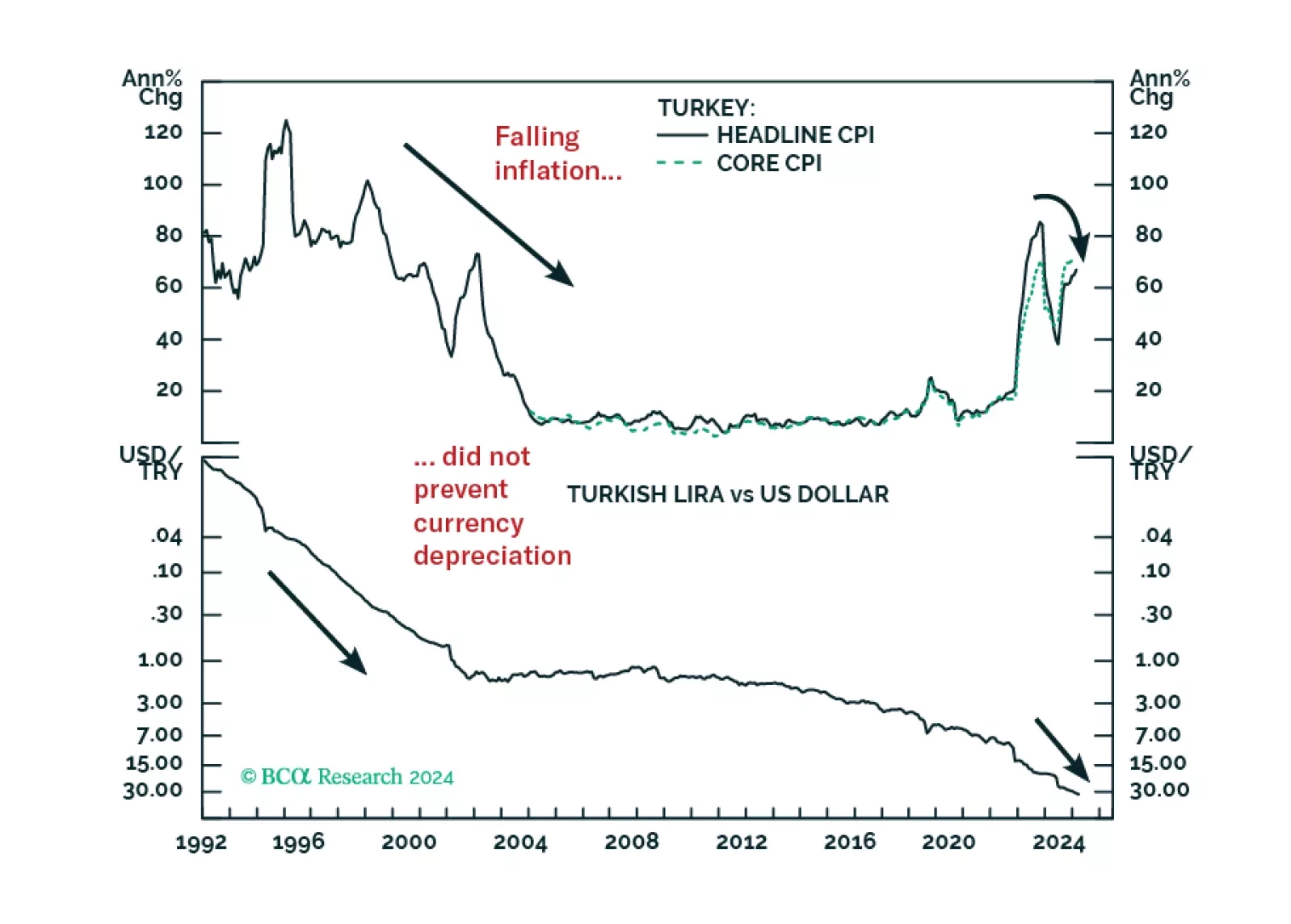

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

According to BCA Research’s Geopolitical Strategy and The Bank Credit Analyst services, trade policy under a second Trump presidency represents the greatest cyclical risk to investors. In 2018, the Trump administration…

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…

This report examines if investors should worry about a balance of payments crisis in the next 3-to-6 months.

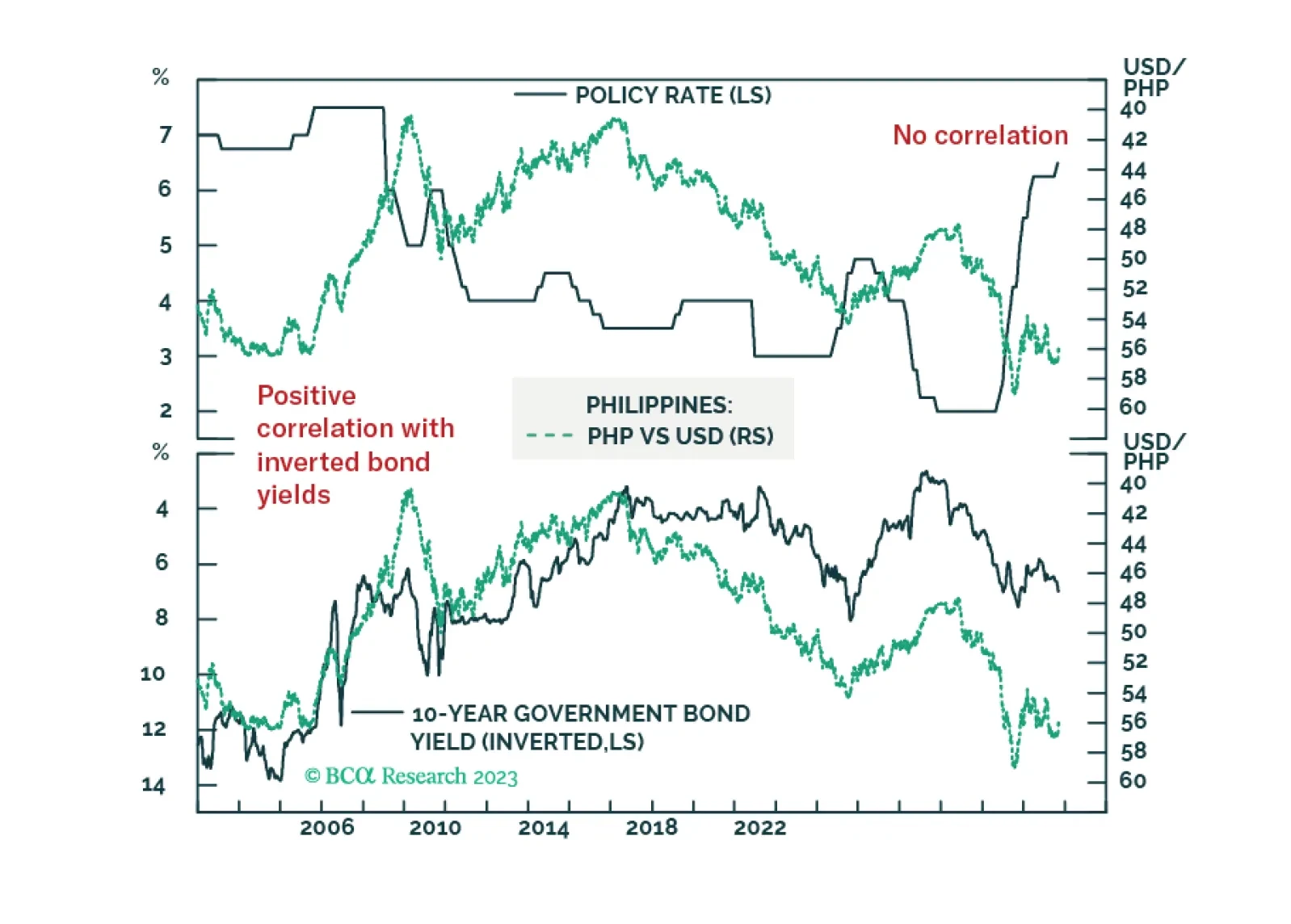

The recent rate hike by the Philippines central bank cannot control food inflation. Nor can it stem the currency slide.

In this short weekly report, we review some of the most common questions clients asked us in the last few weeks.

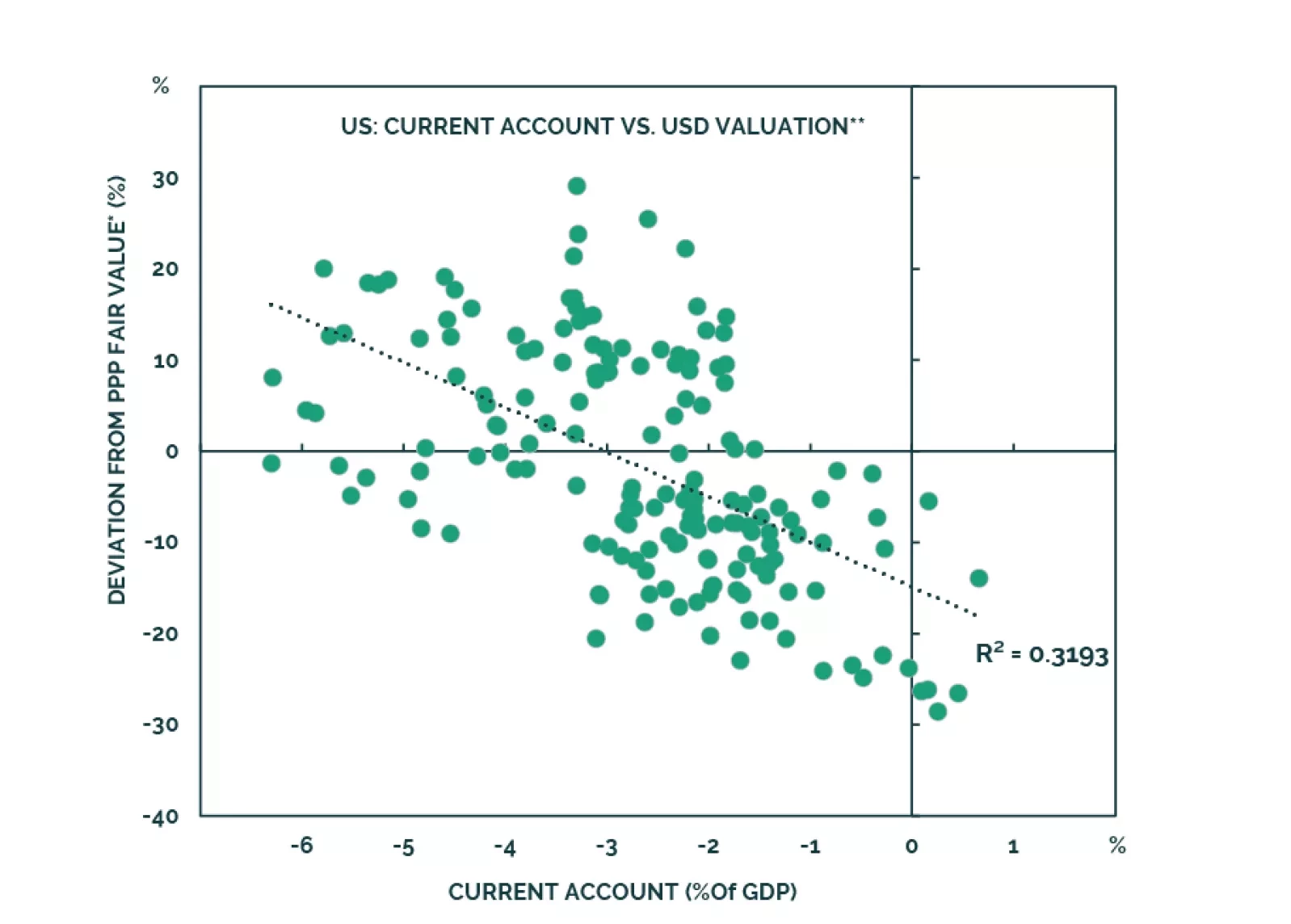

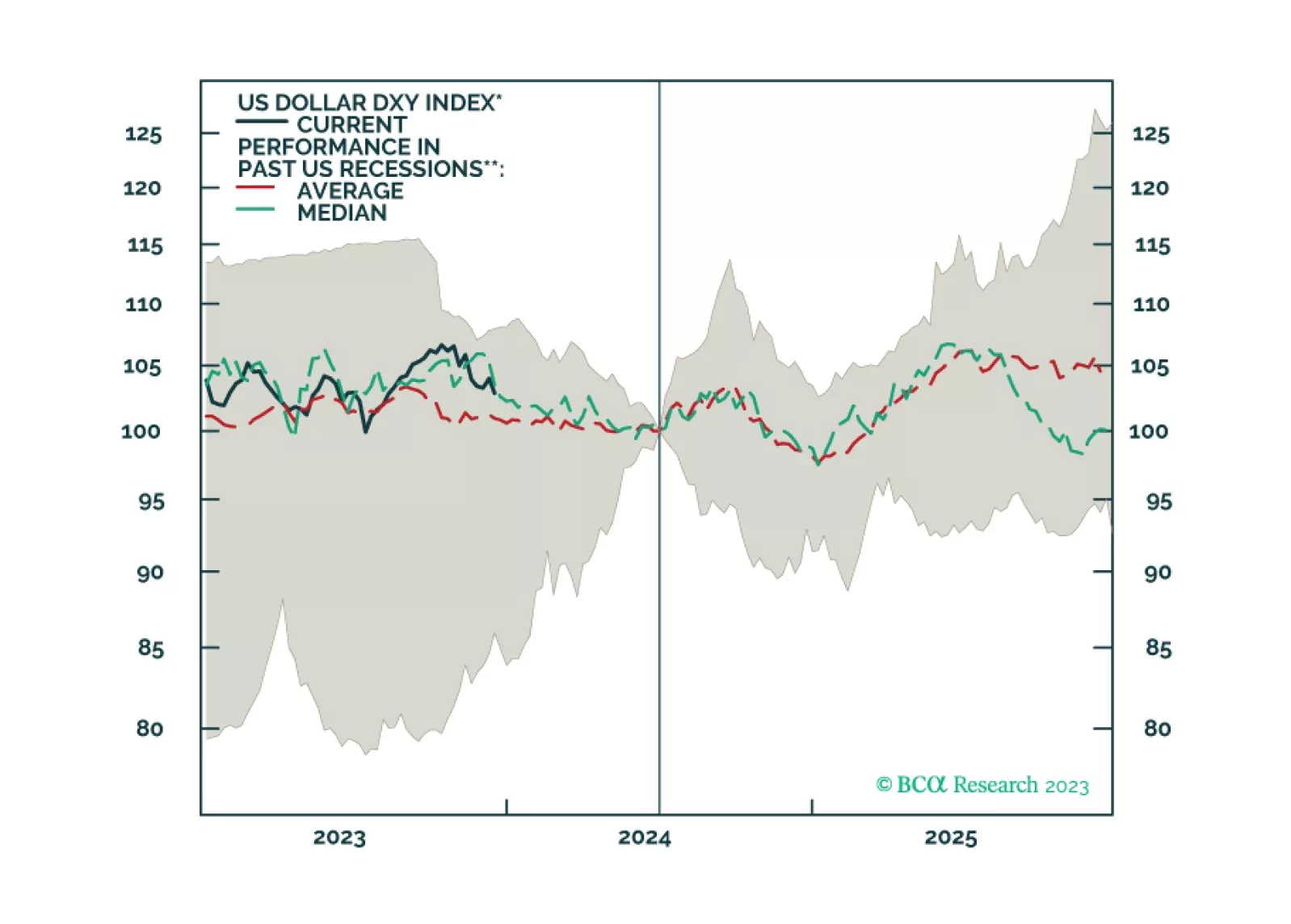

In this week’s report, we look at the current de-dollarization discussion within the context of the USD’s near-term cyclical outlook, and whether it warrants a bullish or bearish stance.

The dollar has entered a structural bear market. Although the greenback could get a temporary reprieve during the next recession, investors should position for a weaker dollar over the long haul.