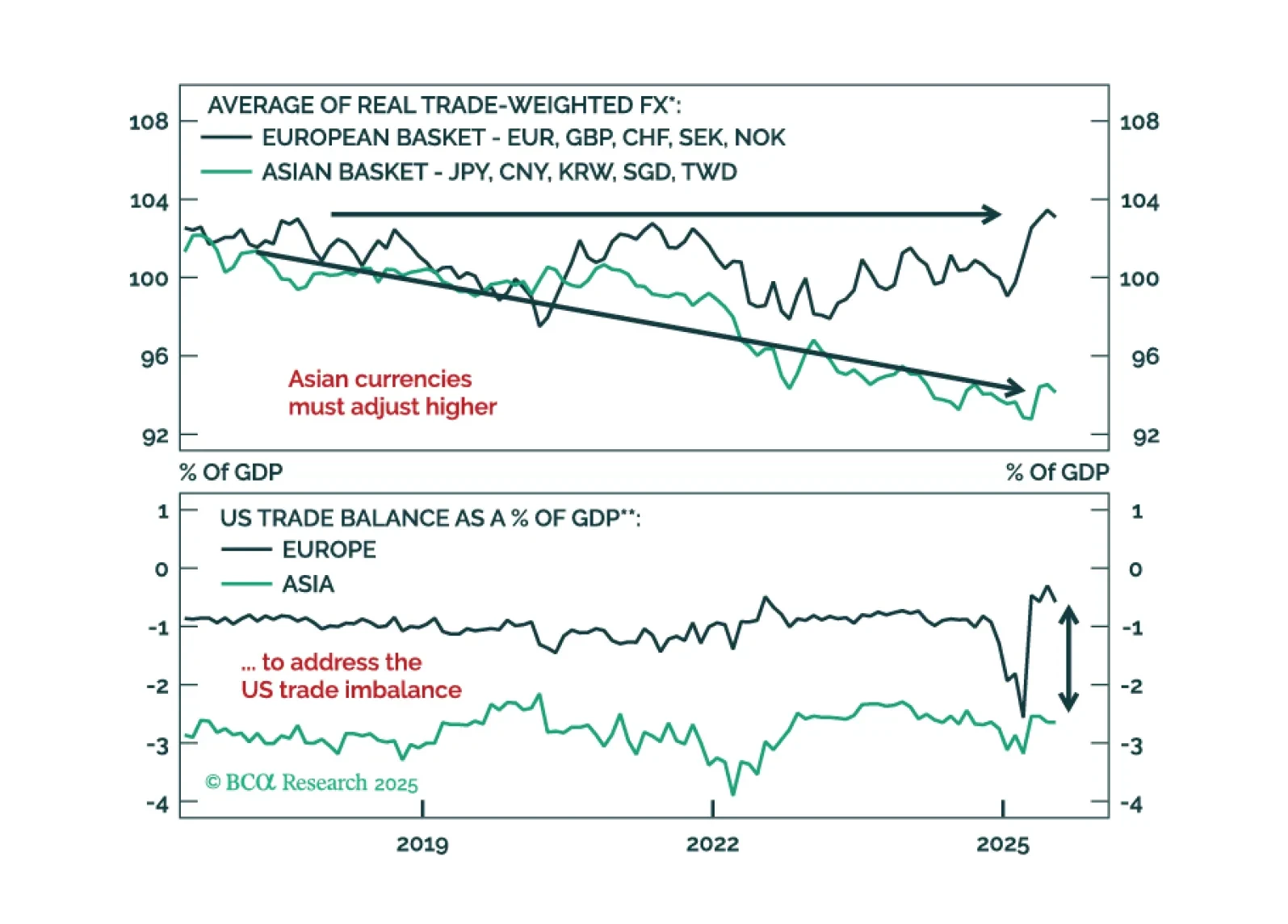

The dollar’s early 2025 decline was a reflection of a global rush to hedge accumulated USD exposure, not a mass exodus from US assets. With most hedging now complete, currency moves should again follow fundamentals, setting the stage…

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

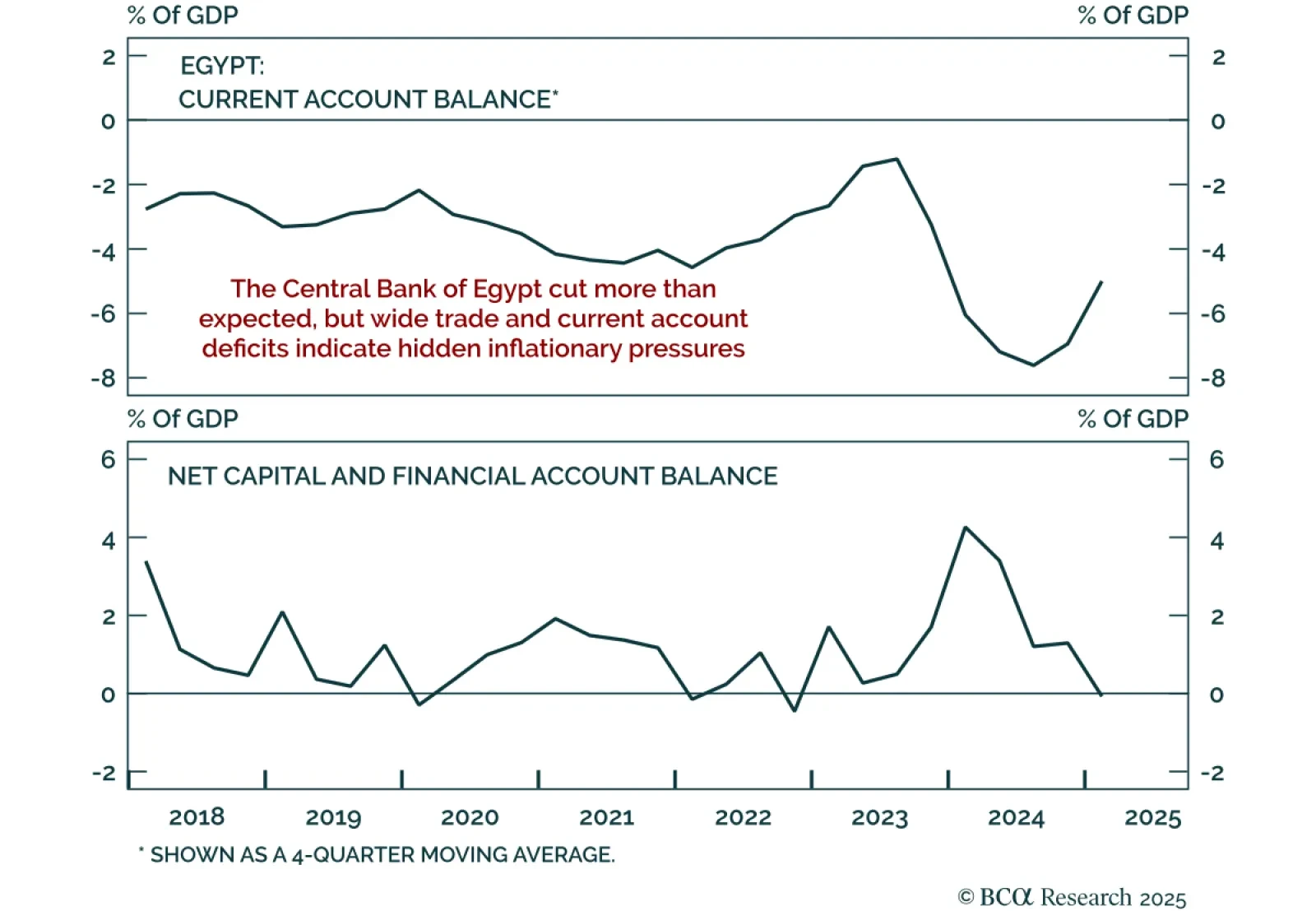

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…

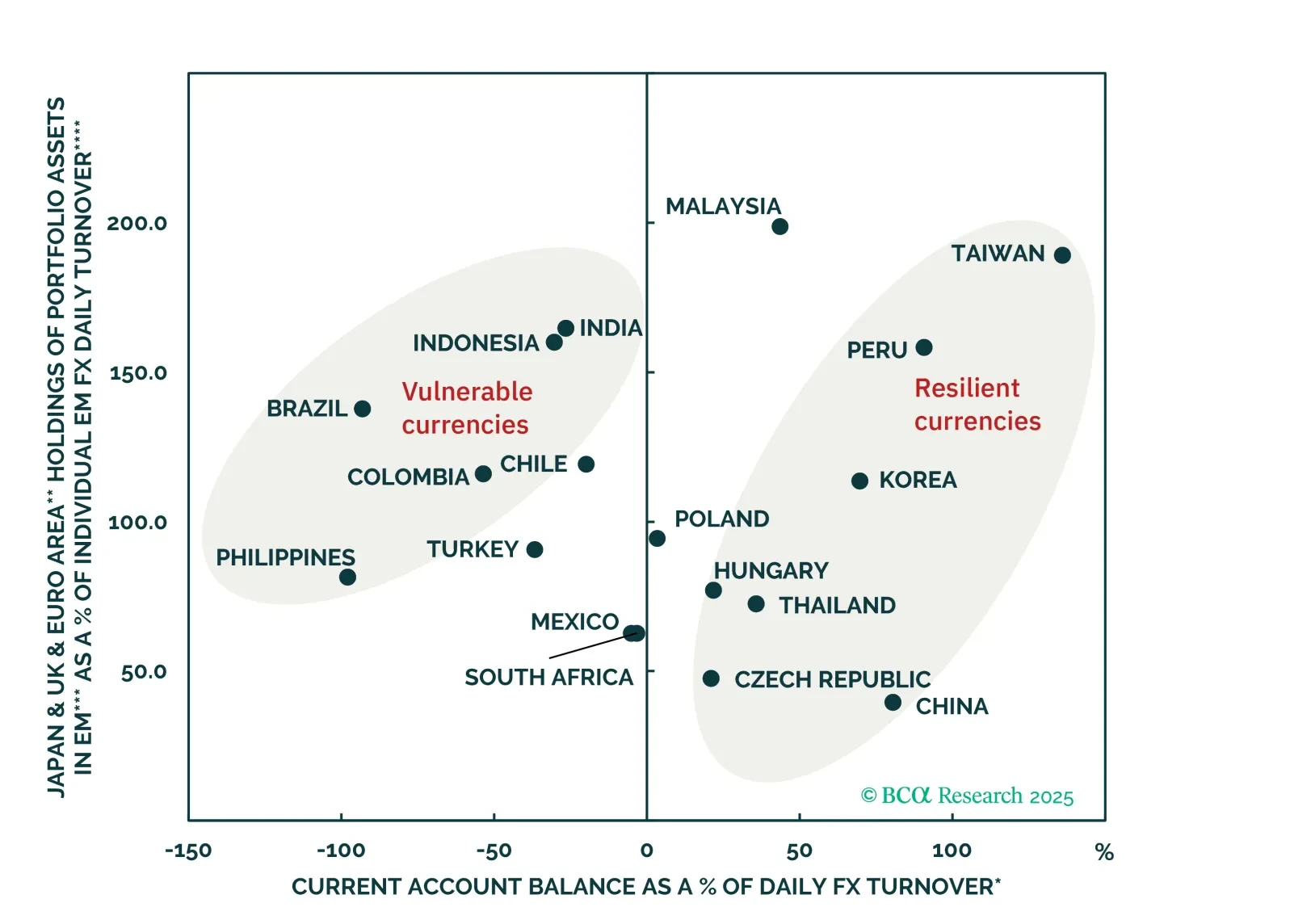

Despite widespread investor optimism Brazil’s currency outlook is challenged by a toxic mix of poor external, fiscal, and macro fundamentals. Expect BRL to underperform most EM peers.

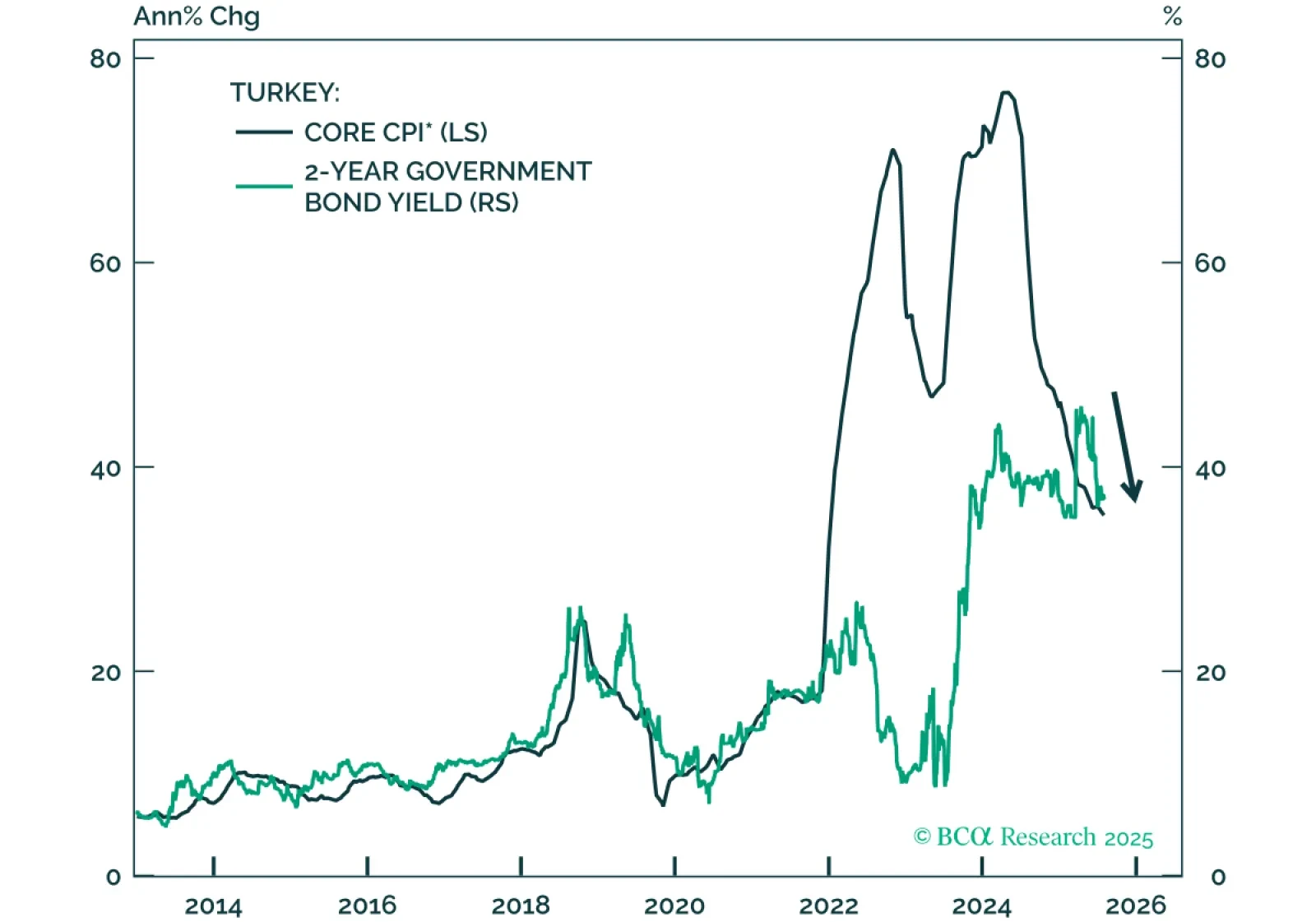

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

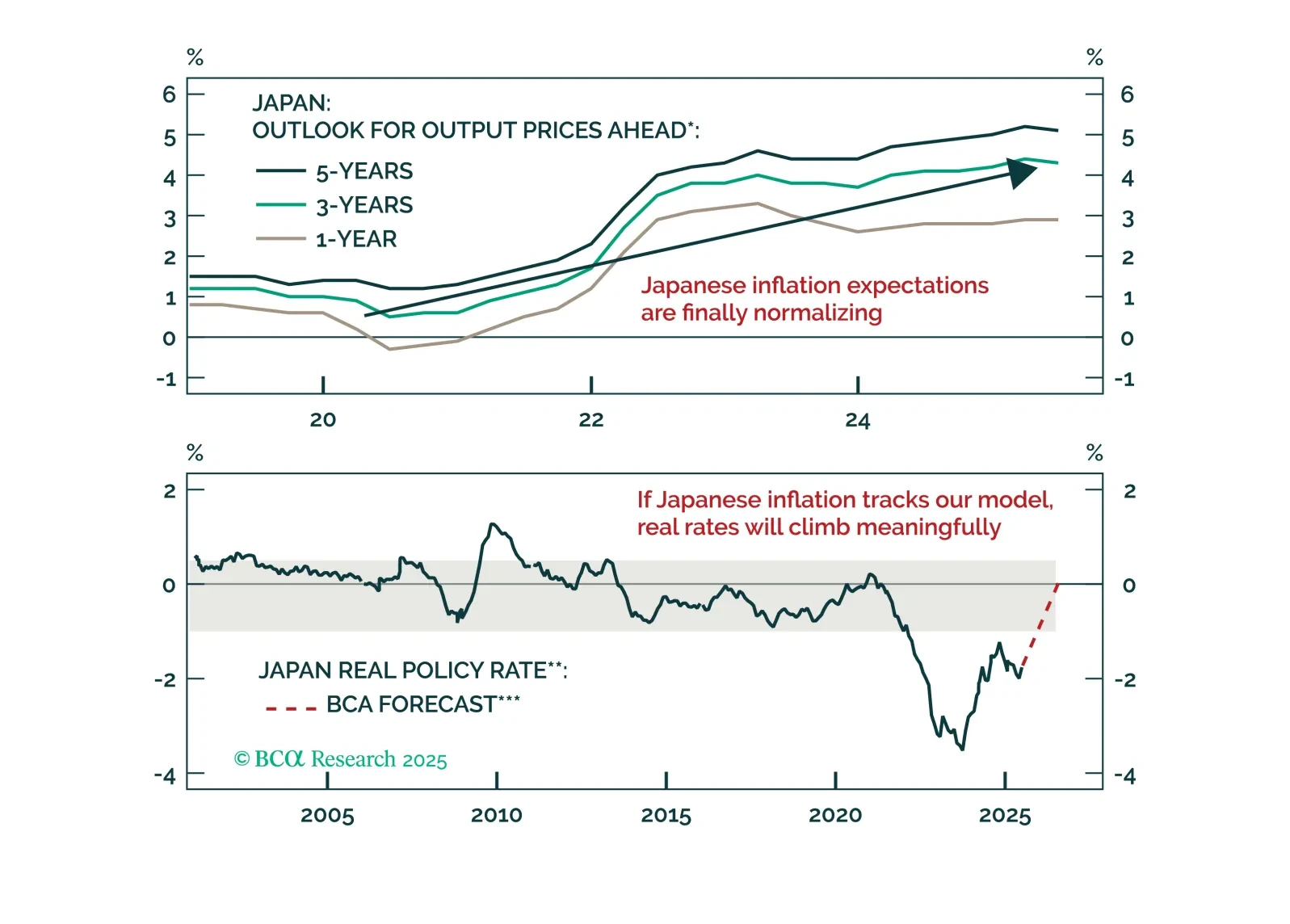

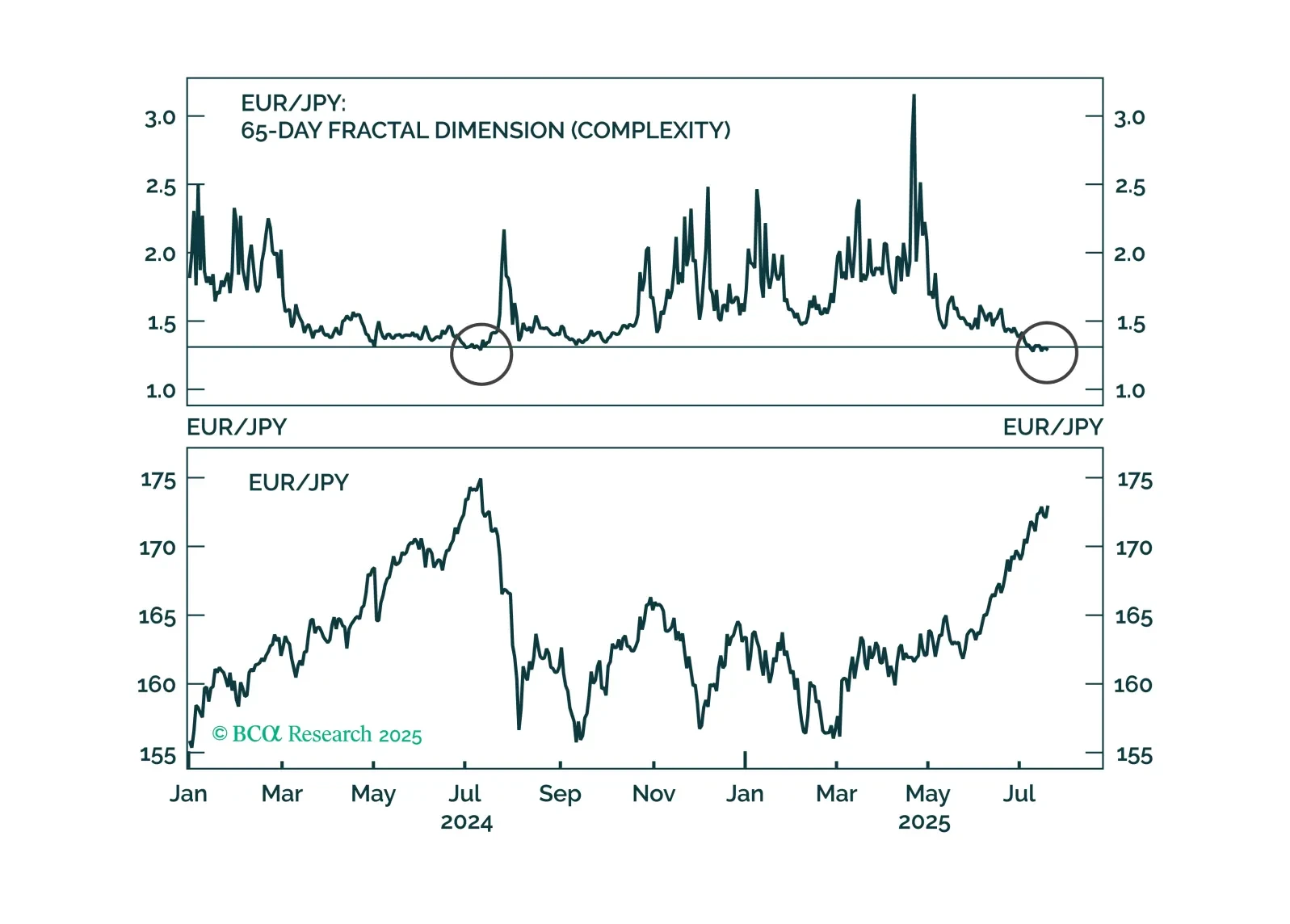

The yen’s discount, surplus, and rising real rates line up for a multi-quarter surge. Find out why EUR/JPY is the first short and when USD/JPY follows.

EUR/JPY has reached stretched levels, prompting new short trade recommendations across BCA Strategies. The calls are underpinned by compelling valuation, macro, and technical signals.

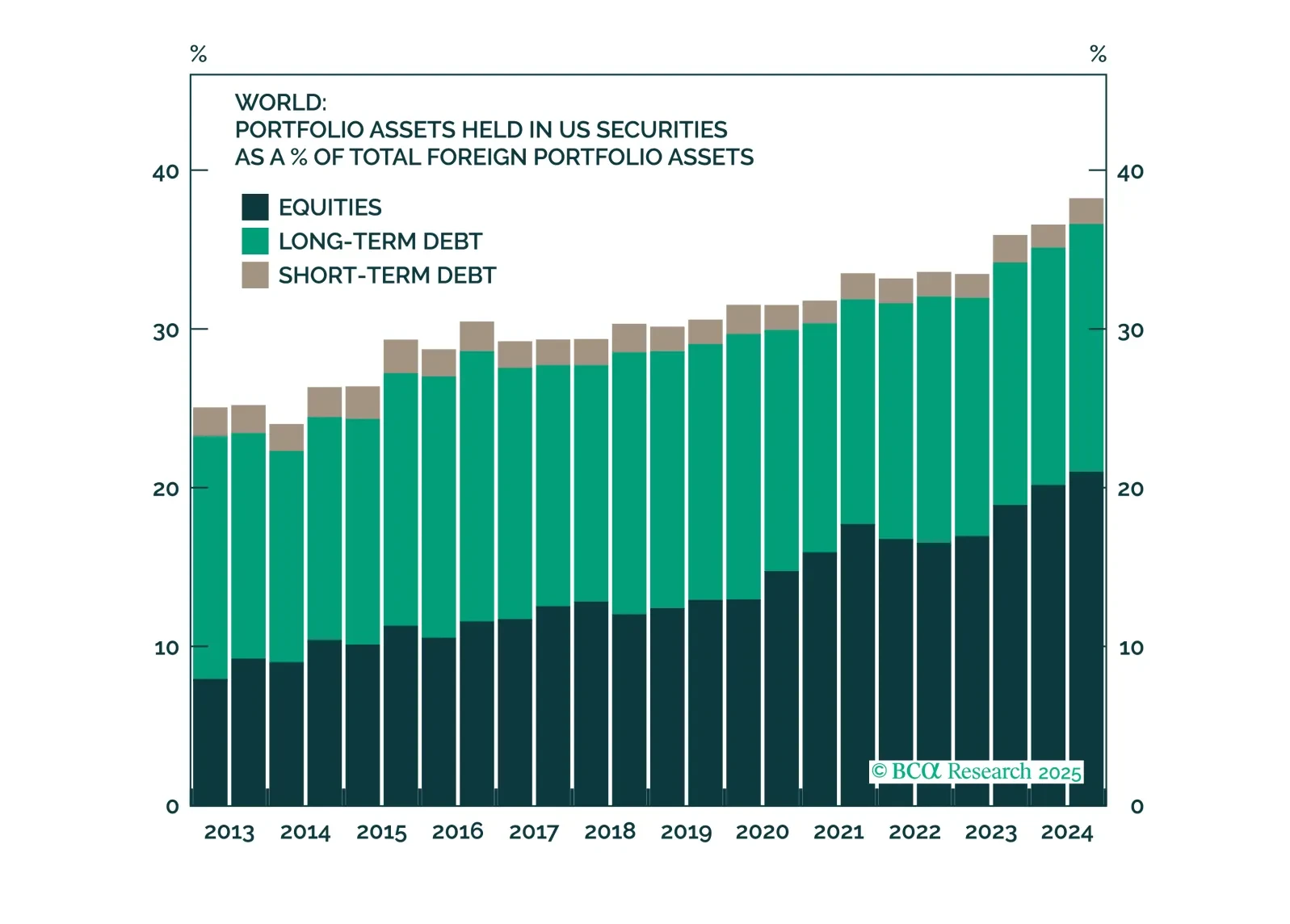

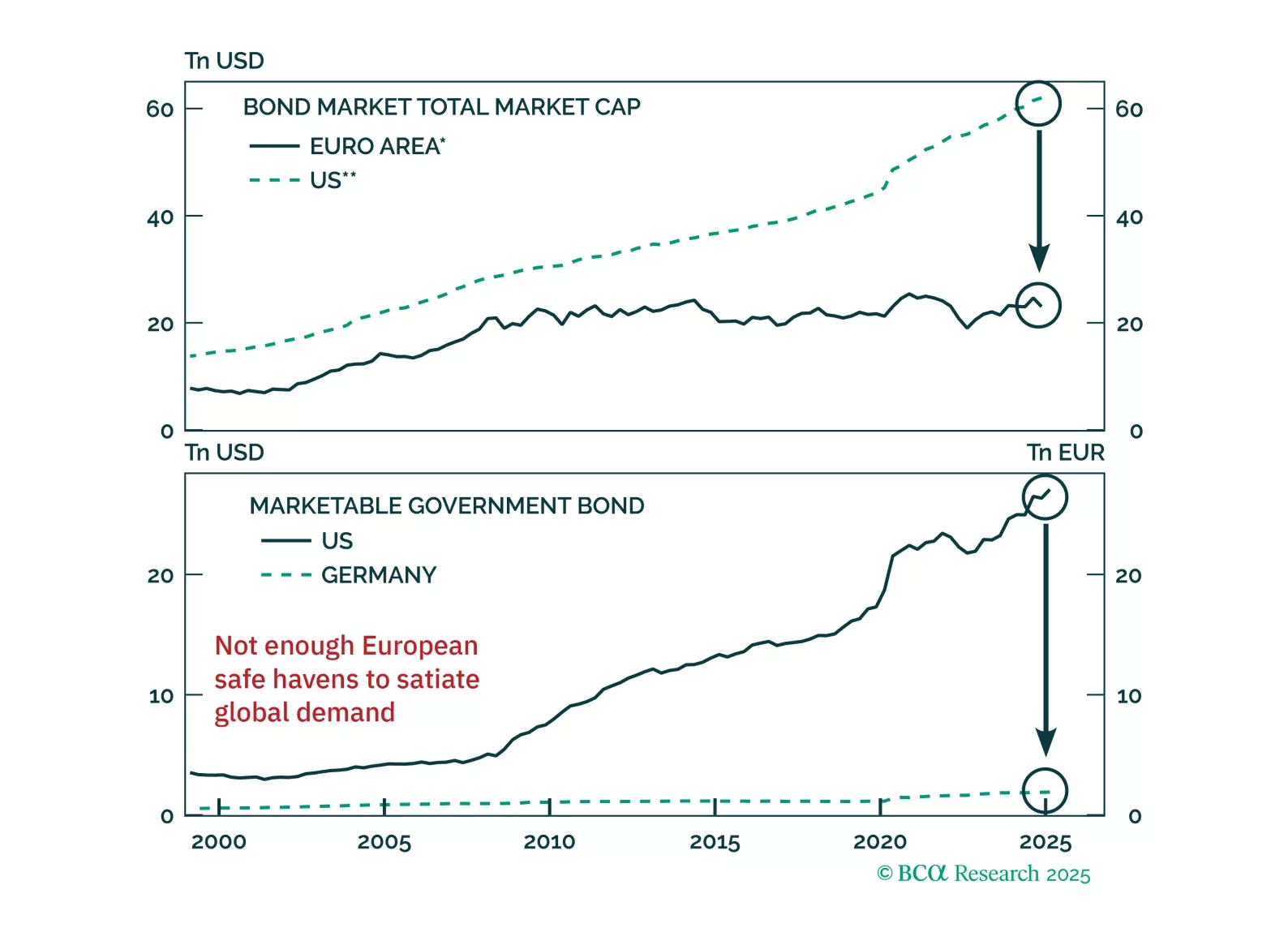

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.