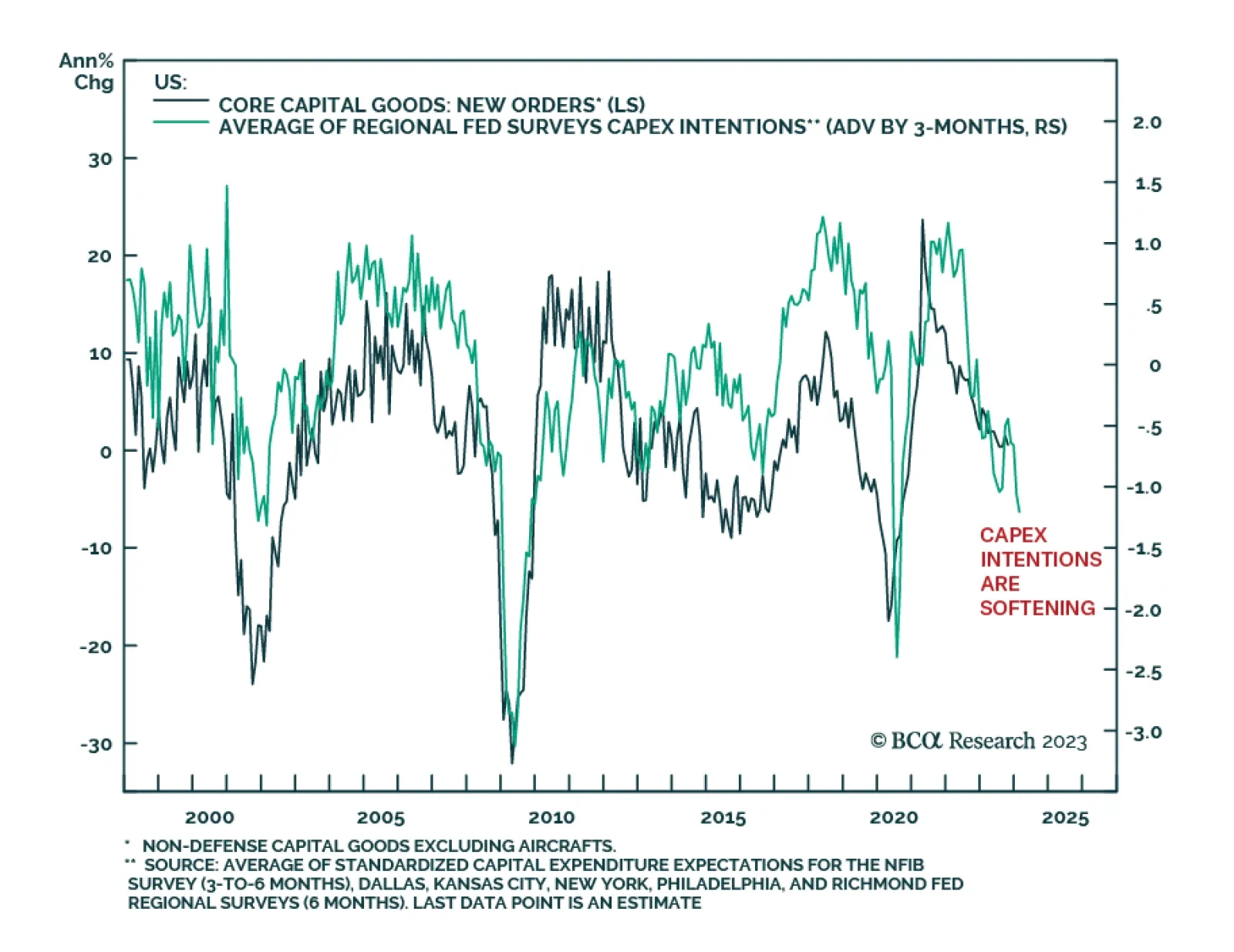

US durable goods orders delivered a negative surprise on Wednesday. New orders for manufactured durable goods dropped by 5.4% m/m in October, below consensus estimates of a 3.2% m/m decline. Moreover, the September increase was…

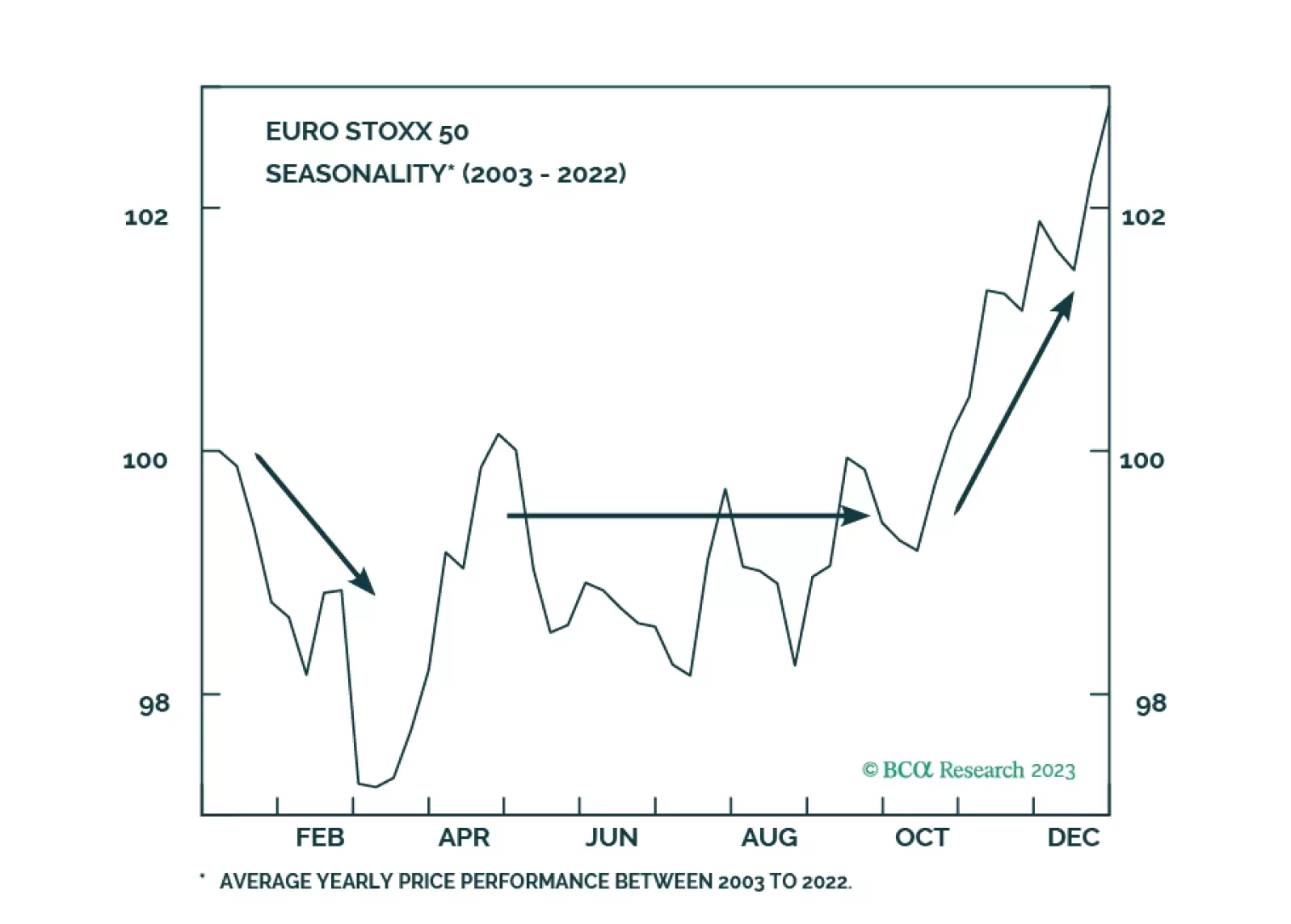

European markets have room to rebound in the coming weeks, however, a recession looms. What are the lessons from history that investors can use to position themselves under these conditions?

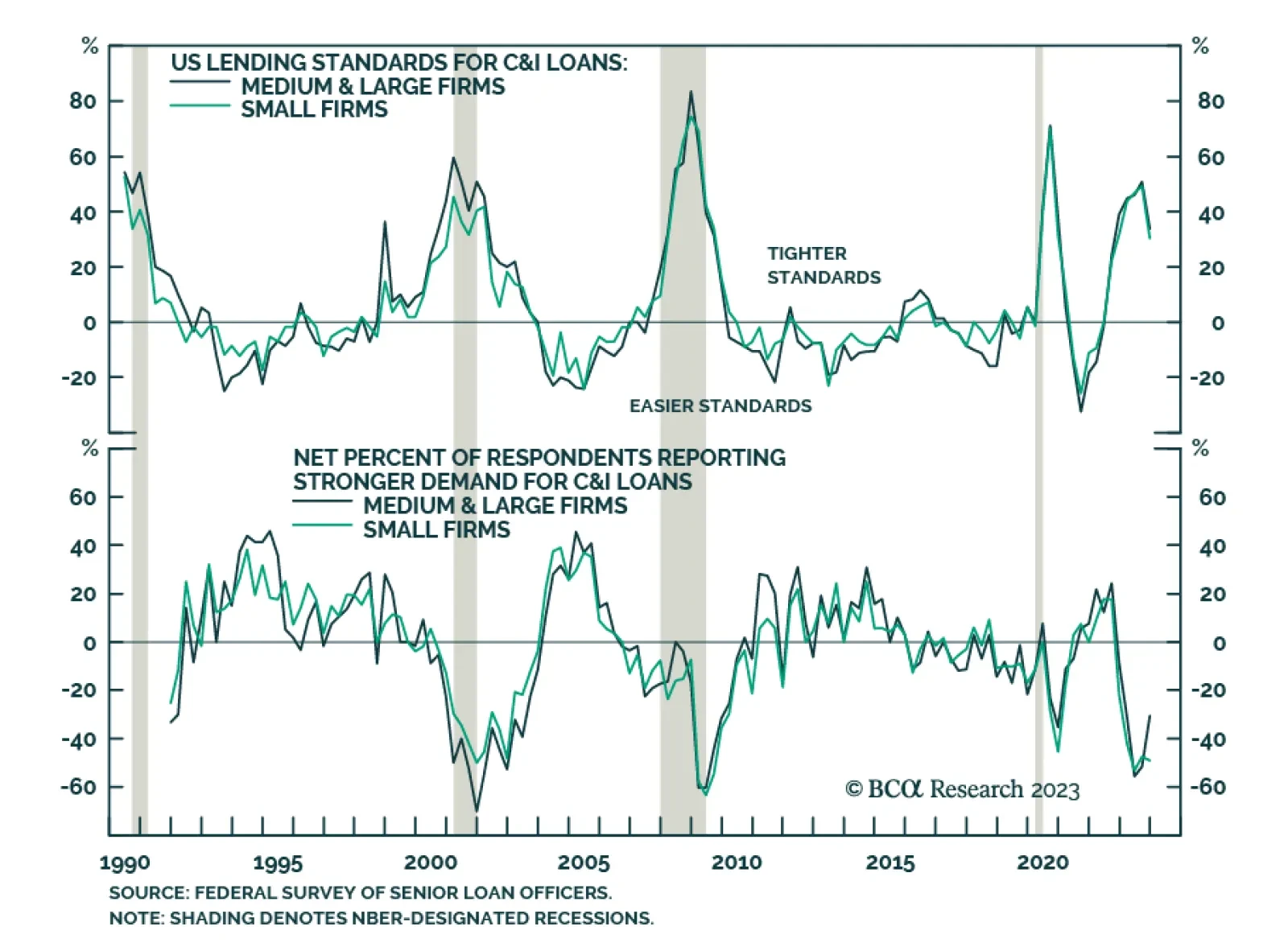

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continued to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE)…

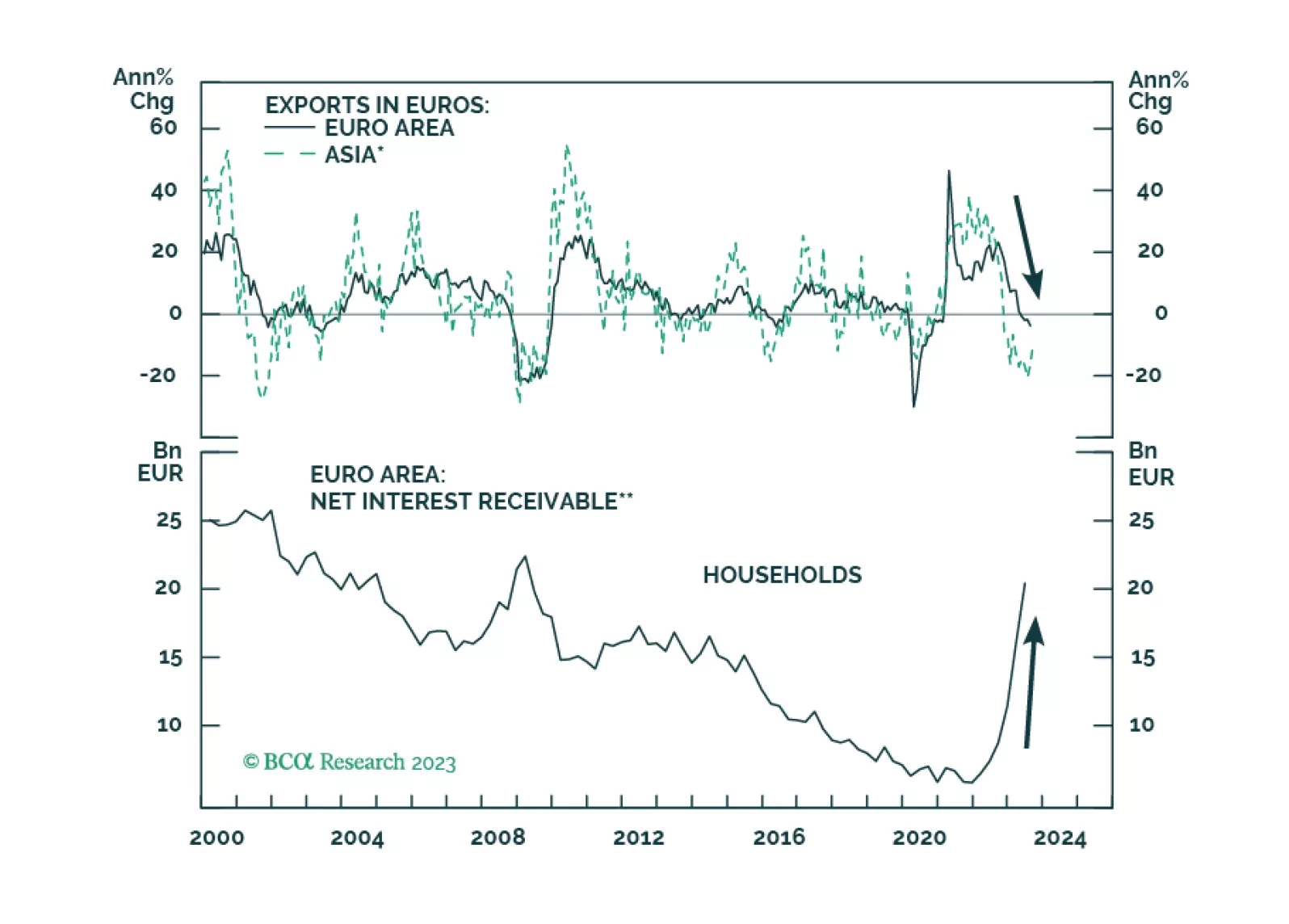

Europe’s weak patch is not about the ECB’s policy tightening, at least not yet. 2024 is another story, and the ECB’s policy will prompt a Eurozone’s recession around the summer.

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

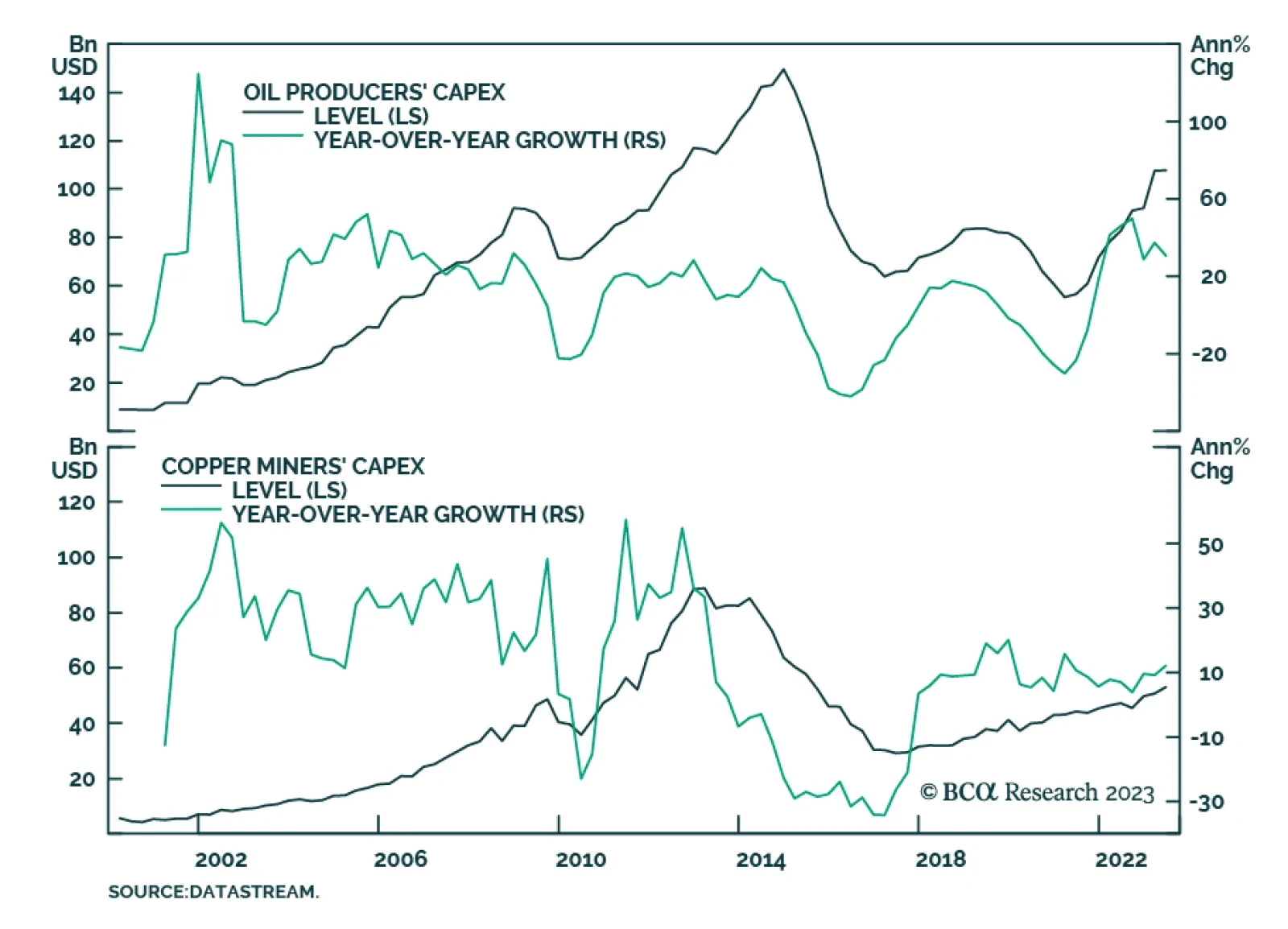

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…

The global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. We remain long exposure to the equities of oil and gas producers via the XOP ETF; the COMT ETF to…

US durable goods order delivered a positive surprise on Wednesday. New orders unexpectedly expanded by 0.2% m/m in August, beating expectations of a 0.5% m/m decline. Similarly, core capital goods orders (a proxy for business…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…