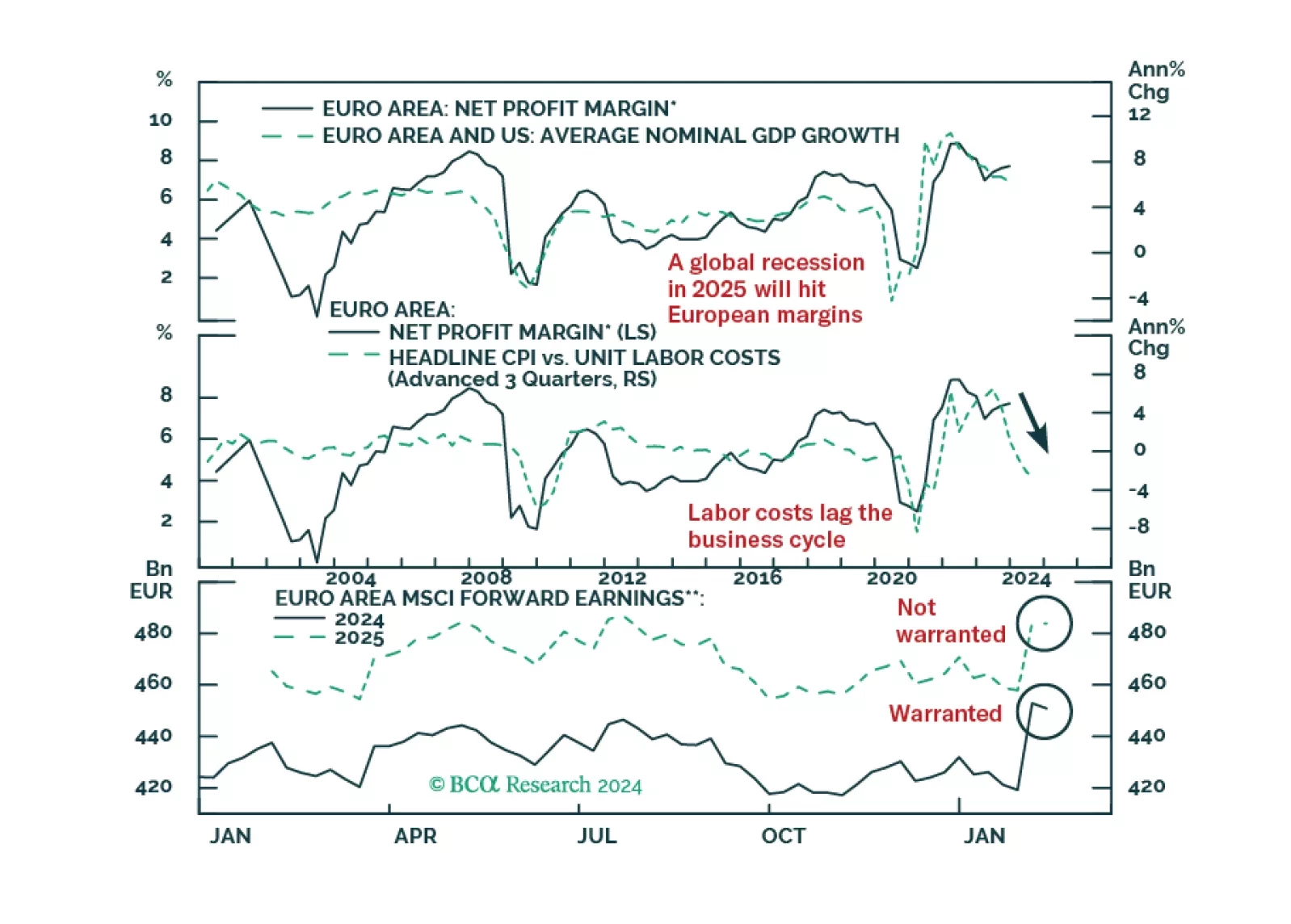

European profits margins are elevated. Will a mild recession be enough to bring them down?

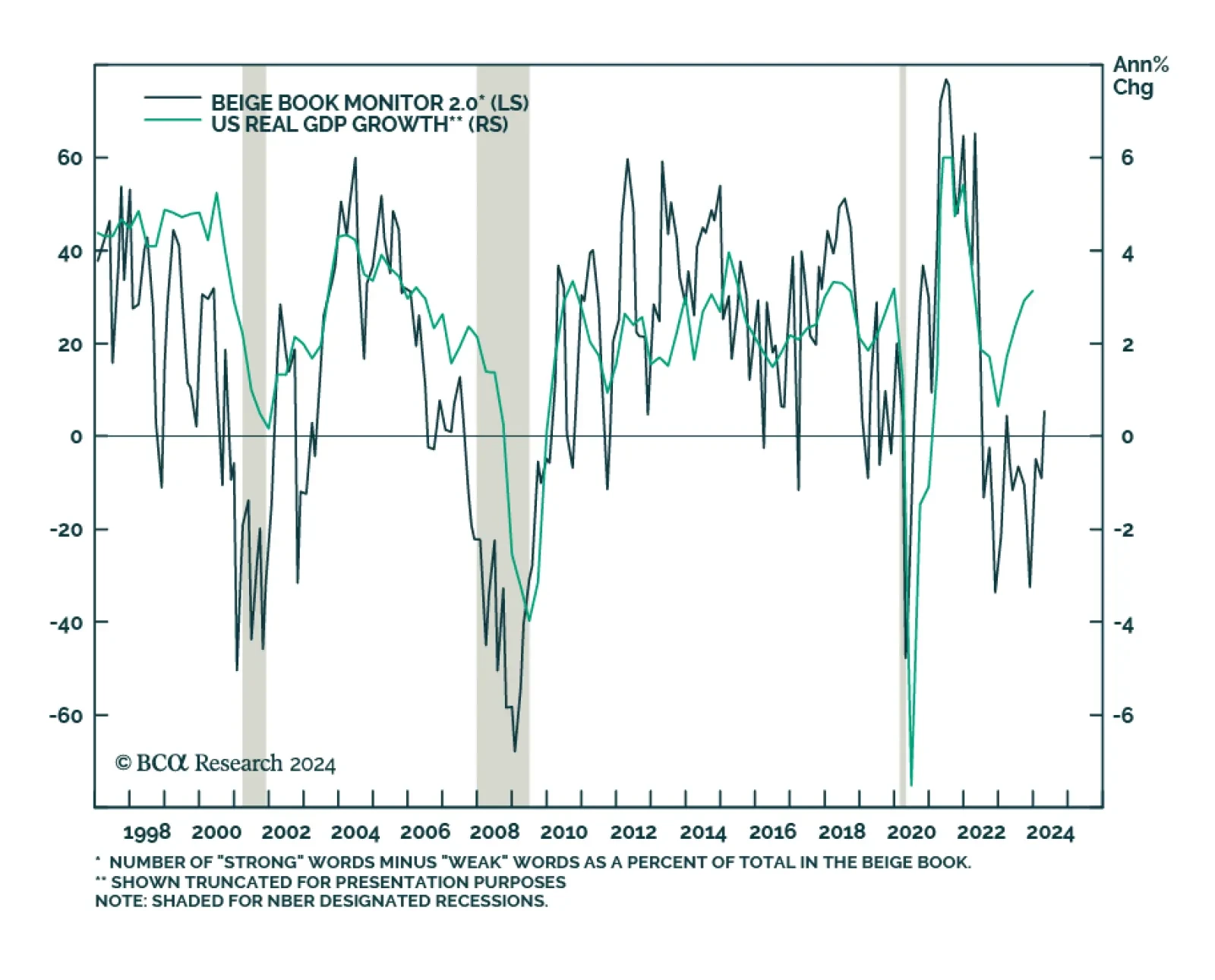

BCA’s US Beige Book Monitor – an indicator we use to gauge changes in the language of the Fed’s Beige Book report and which historically tracks US GDP growth – has improved in April. Nevertheless…

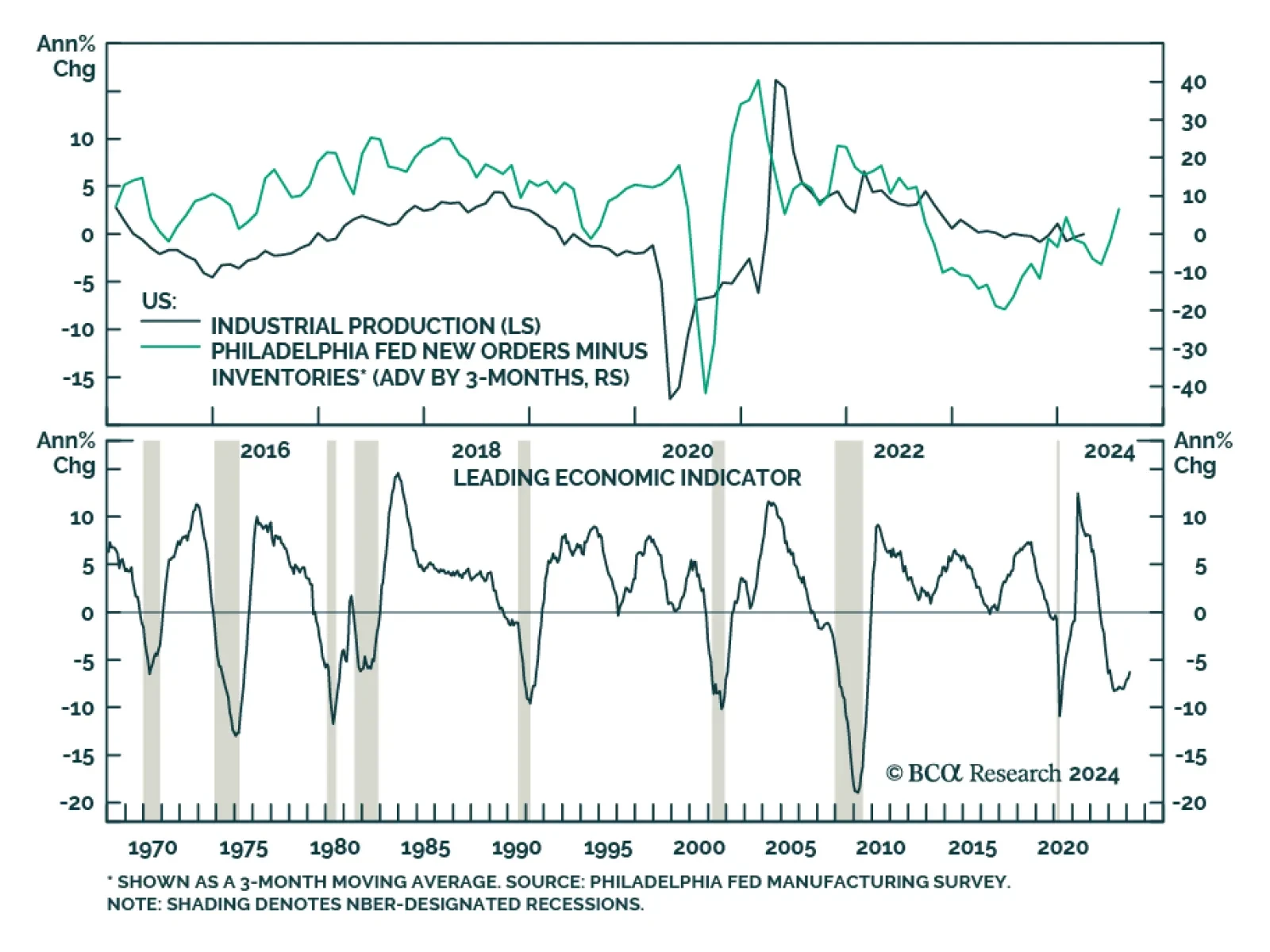

The headline Philadelphia Fed manufacturing survey for April delivered a positive surprise on Thursday, increasing from 3.2 to a twelve-month high of 15.5 and beating expectations it would soften to 2.0. Measures of demand…

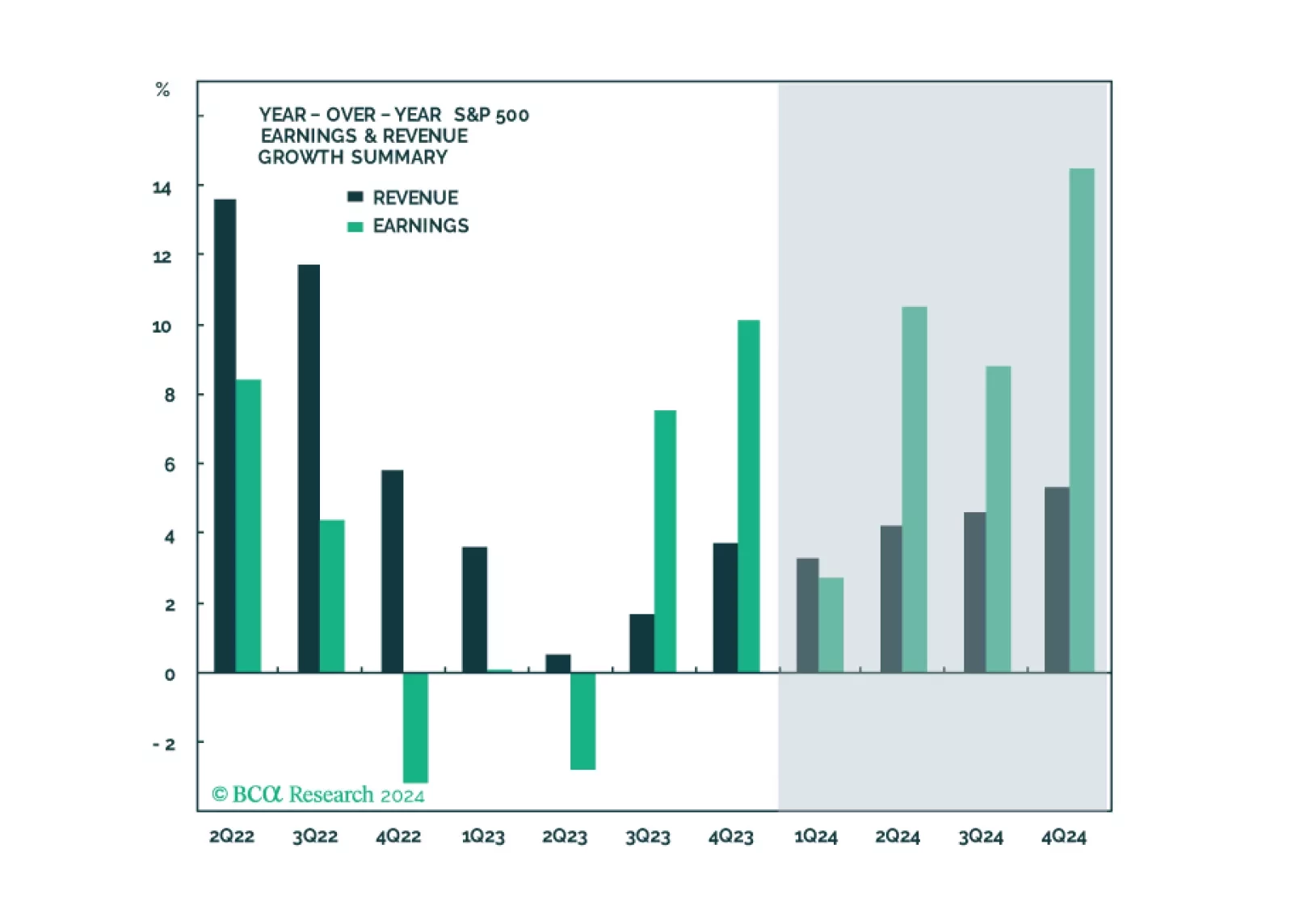

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

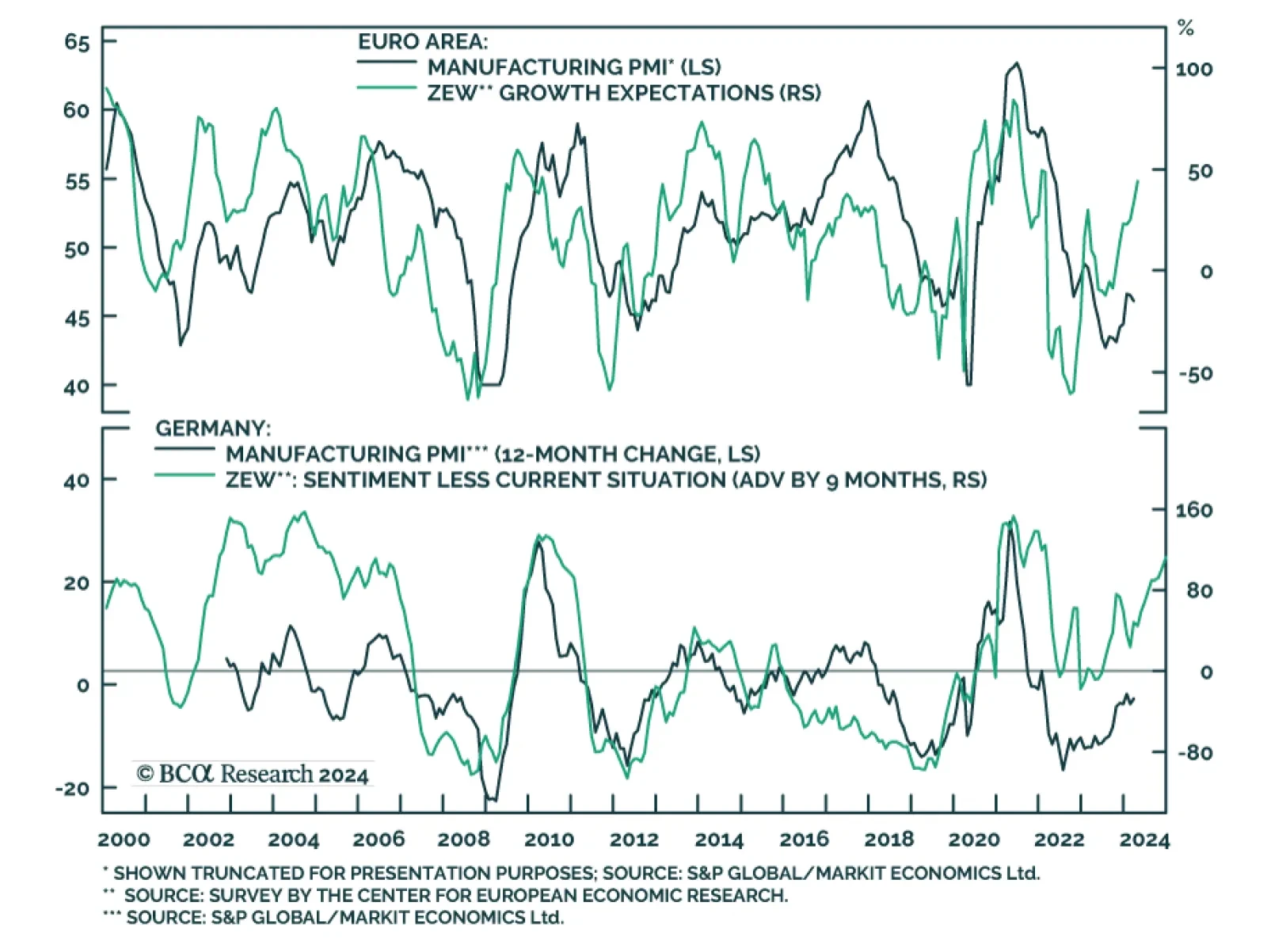

Optimism about the future continues to boost investor confidence in the Euro Area. The ZEW Expectations series for the Eurozone (+10.4 to 43.9) and Germany (+11.2 to 42.9) surged and are now both at their highest in 26…

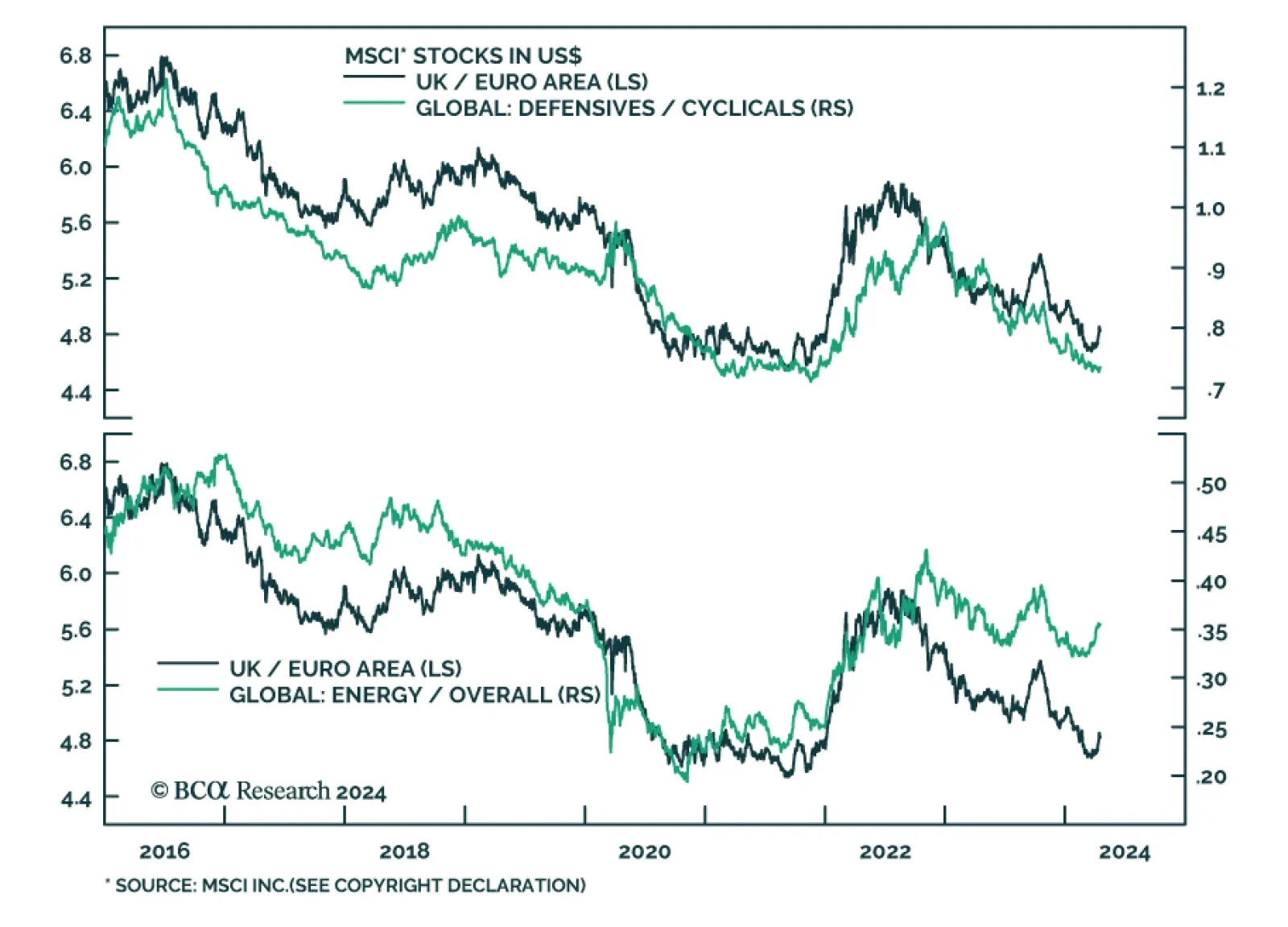

UK stocks posted one of the largest positive abnormal returns (z-score) among the major financial markets we tracked in March. The MSCI UK index has gained 2% relative to Eurozone stocks since late February. However, the…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

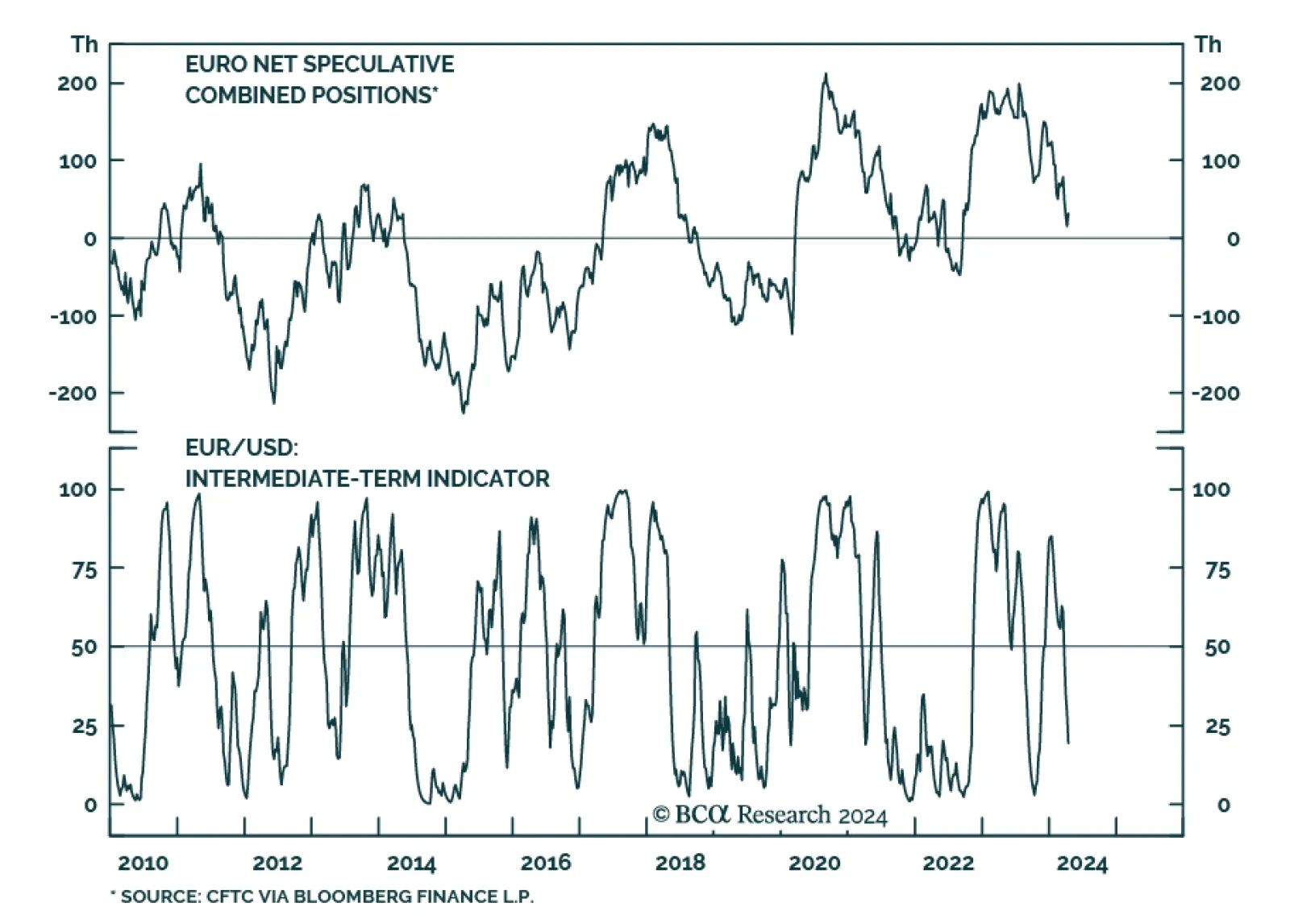

According to BCA Research’s European Investment Strategy service, a tactical buying opportunity for EUR/USD is approaching. However, this will not lead to a renewed bull market, only to a bounce toward 1.10-1.12. …

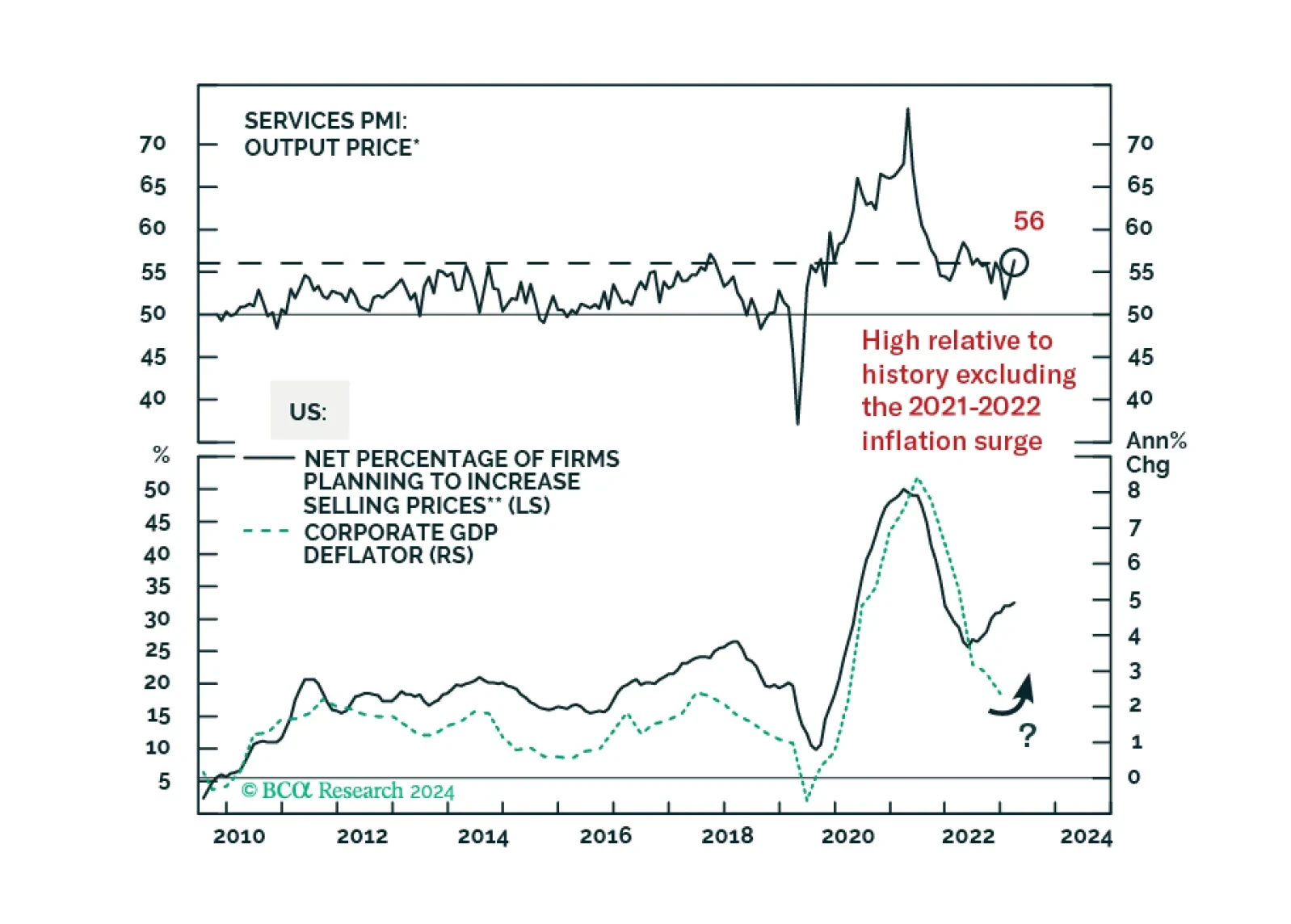

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

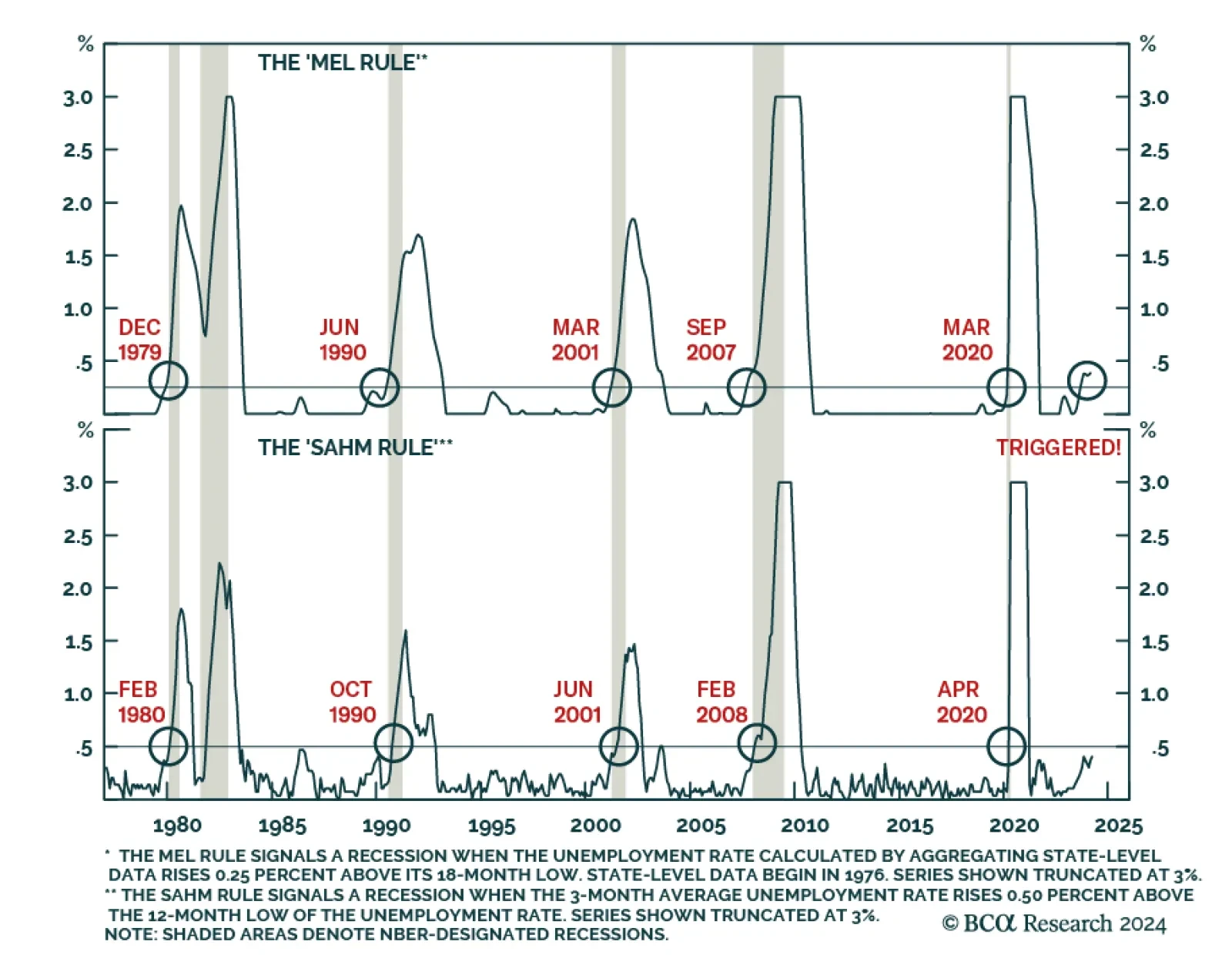

According to BCA Research’s Global Investment Strategy service, a comprehensive review of leading US labor market indicators reveals that most are now flashing red. This includes the “Mel rule,” a refinement of…