Highlights In China, “helicopter” money and the socialist put are positive for growth in the medium term but will prove harmful for the economy over the long run. In the socialist put scenario, a buy-and-hold strategy is…

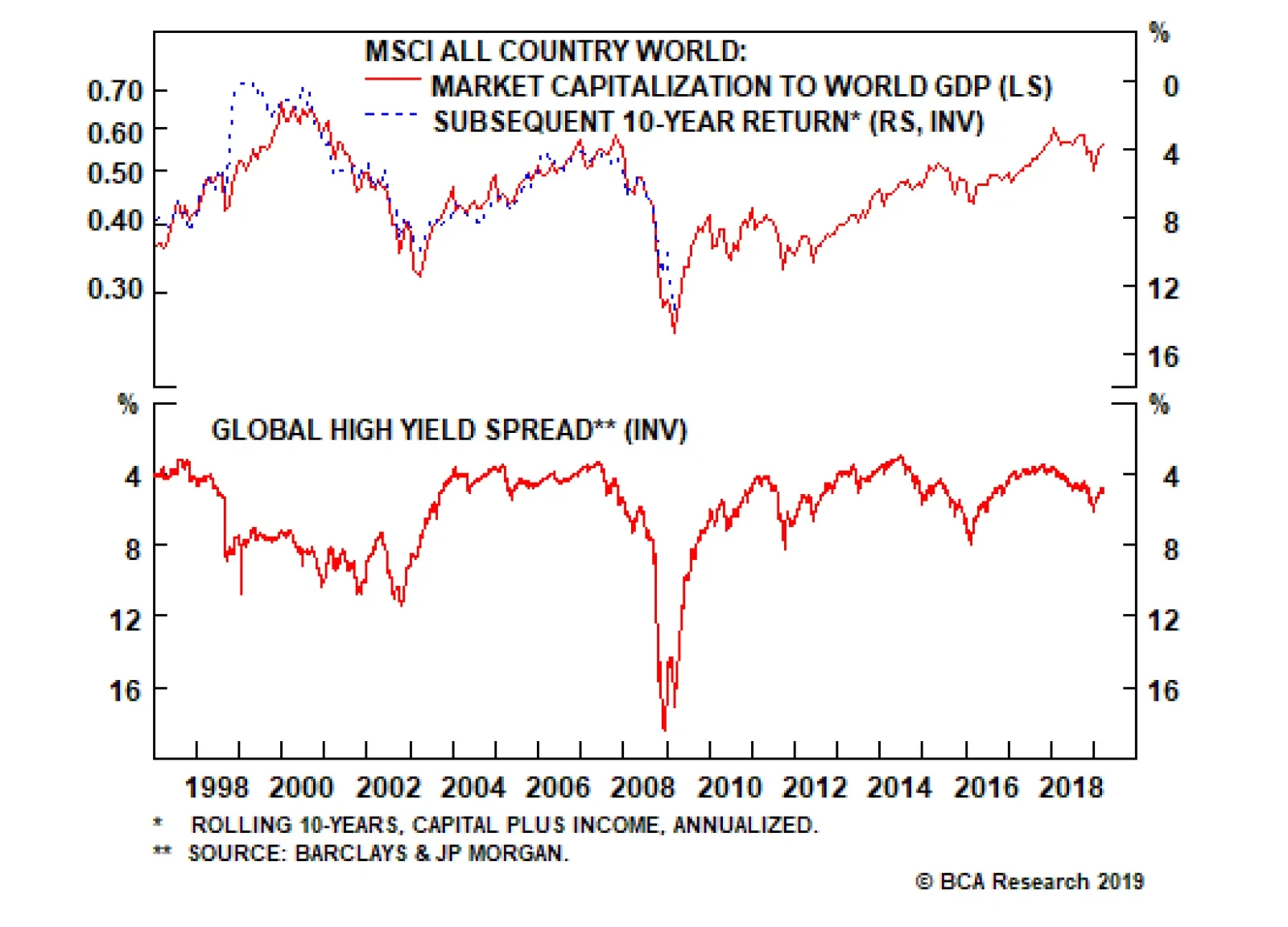

Previous episodes of elevated risk-asset valuations tended to be localized, either by geography or sector: 1990 was focused in Japan; 2000 was focused in the dot com related sectors; 2008 was focused in the U.S. mortgage and credit…

Highlights Hyman Minsky famously said that “stability begets instability.” The converse is also true: Instability begets stability. None of the preconditions for a U.S. recession are in place yet. The Fed’s decision…

Highlights Investors ran for cover in December as they succumbed to a litany of worries regarding the outlook. The key question is whether the pessimism is overdone or an extended equity bear market is underway. Our outlook for the U.…

Highlights We do not view October's equity downdraft as a signal to further trim risk assets to underweight. Nonetheless, stocks have not yet fallen enough to justify buying either. The economic divergence between the U.S. and the…

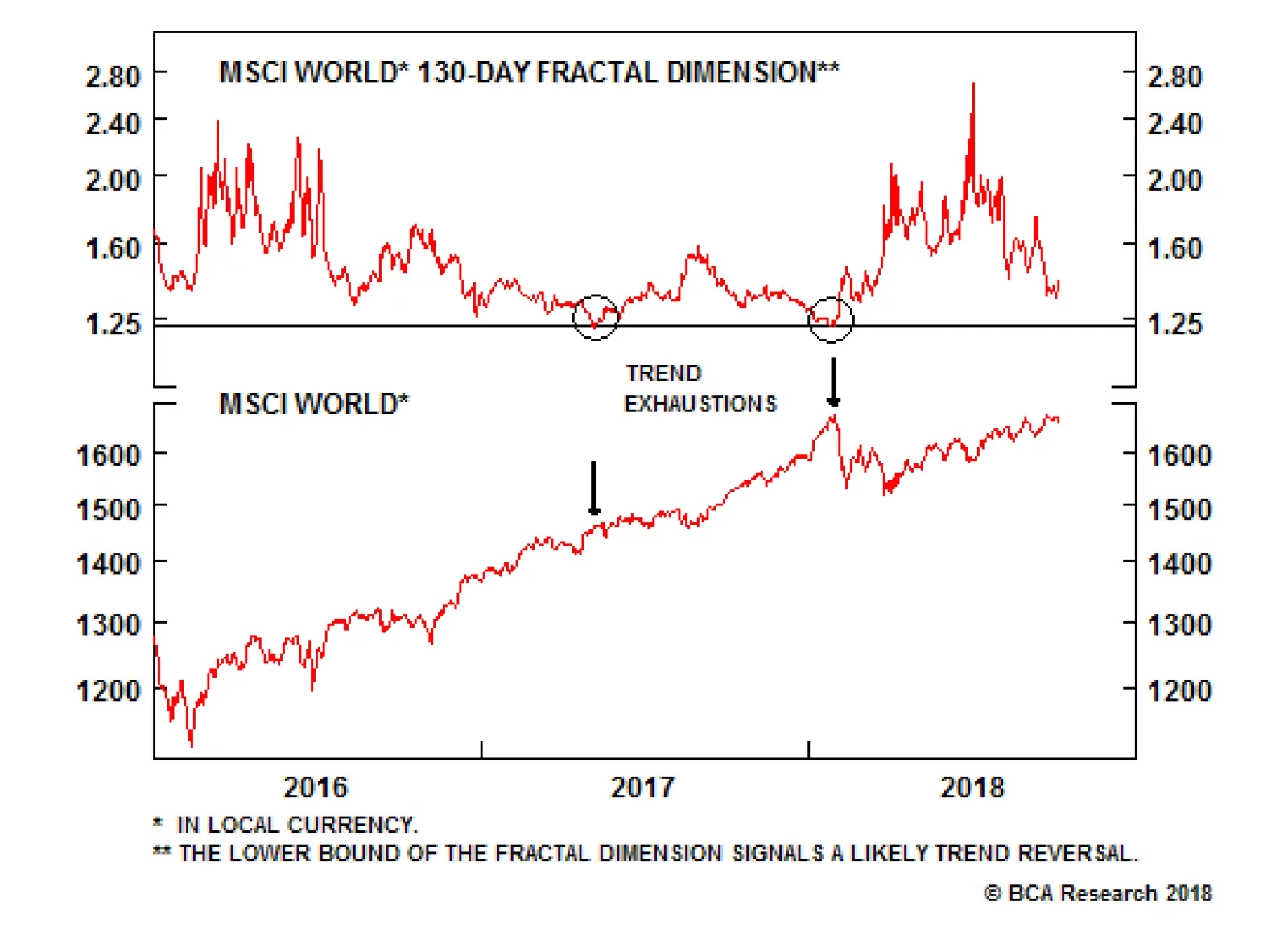

A bubble forms when value investors stop investing based on their valuation framework. At some point, nearly all the value investors have joined the momentum herd, yet, a few of them suddenly reverts to type, and begin focusing…

Highlights The Turkish economy is in disarray, ... : The lira's plunge has reminded some investors of the Thai baht's in 1997, but we do not foresee a replay of the Asian Crisis. ... highlighting emerging markets'…