The Brazilian real is breaking below its previous support. We recommend shorting the BRL against the US dollar. The primary macro risk in Brazil is not inflation but rather mounting deflationary pressures. Inflation has fallen to very…

An analysis on Brazil is available below. Feature Chart I-1Poor Performance By EM Stocks, Currencies And Commodities I had the pleasure of meeting again with a long-term BCA client Ms. Mea last week during my trip to Europe…

Highlights The U.S. and China are moving toward formalizing a trade ceasefire that reduces geopolitical risk in the near term. The risk of a no-deal Brexit is finished – removing a major downside to European assets. Spanish…

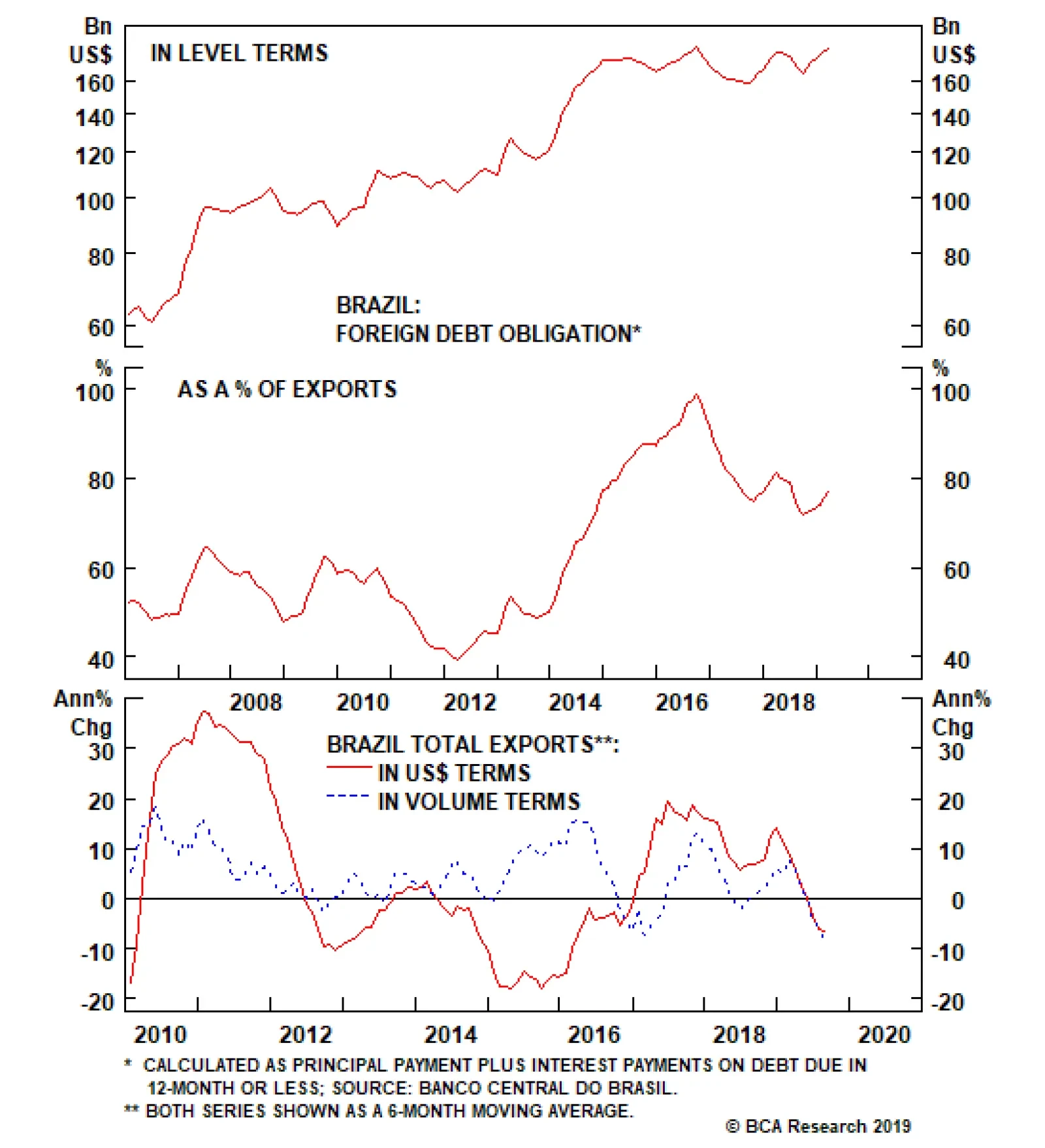

Foreign debt obligations (FDO) – the sum of short-term claims, interest payments and amortization over the next 12 months – stand at $180 billion, equivalent to 78% of Brazil’s annual exports. Problematically,…

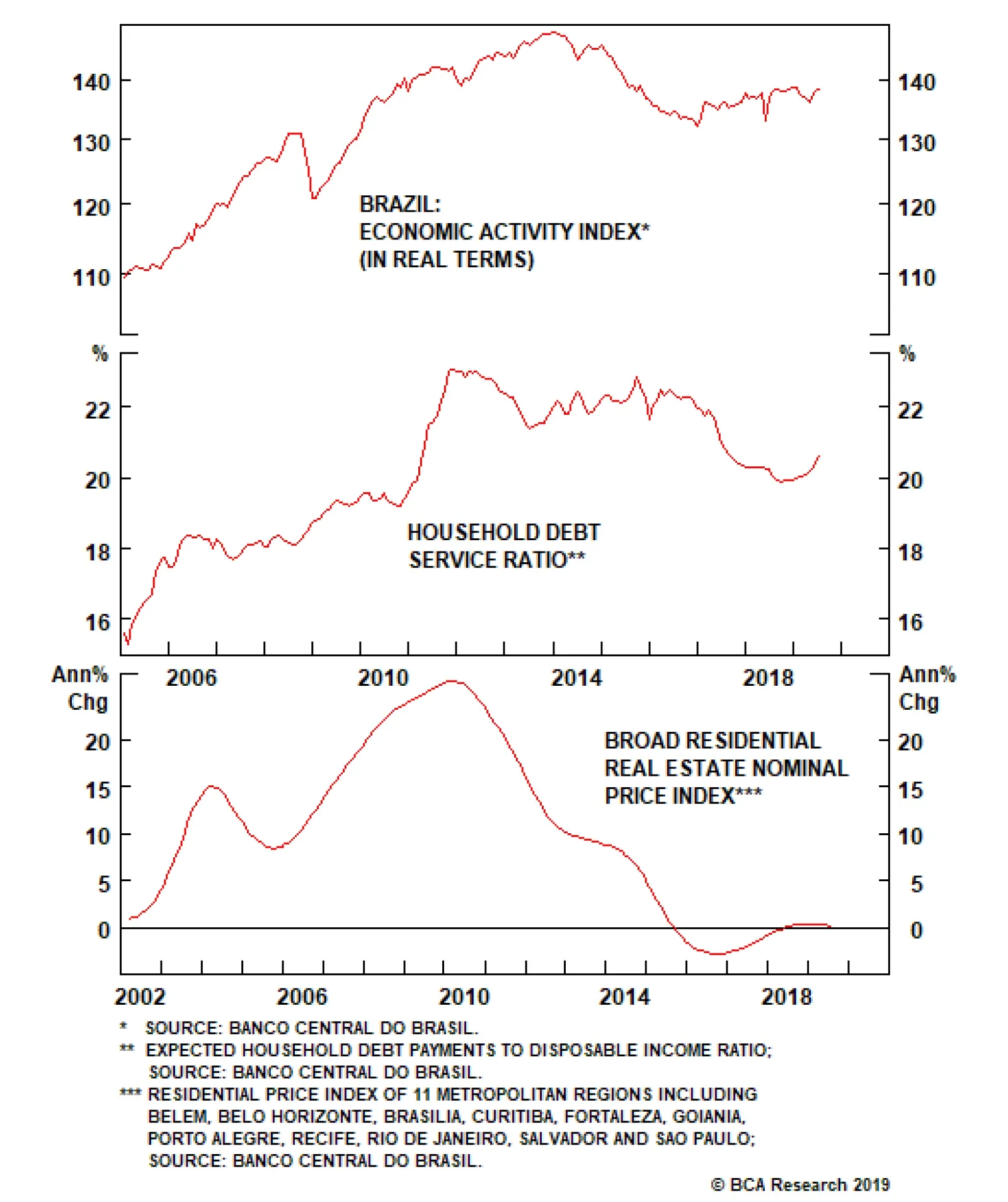

The Brazilian economy is recovering, albeit slowly. The level of economic activity is still well below its pre-recession level but is grinding slowly back. The key economic risk is stall speed. Like an aircraft, if the pace of…

Highlights Pension reform in Brazil is pushing through. The upcoming 12-18 months offer a window of opportunity, most notably on the privatization and tax reform front. Ongoing efforts should sustain an improvement in “animal…

Highlights Four ghosts of 2016 are knocking at the door: Brexit, Trump, Brazil, Italy. President Trump and U.S. trade policy are keeping uncertainty high. Upgrade the odds of a no-deal Brexit to about 33%. Expect limited stimulus…

Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…

Having surged on the back of Congress’s initial approval of the social security reform, Brazilian financial markets are attempting to break above important technical resistance levels both in absolute and relative terms (Chart II-1…