Please note that yesterday we published Special Report titled Do Not Overlook China’s Innovation Drive. Please click on it to access it. Today, we publish analysis on Brazil and Ukraine. Chart I-1Brazilian Share Prices…

We believe risks to Brazilian assets remain to the downside. Chart III-1Brazil: Recurring Crises Political infighting among various branches of power and state institutions will depress consumer and business confidence,…

Analyses on Chinese autos and Brazil are available below. Highlights The Fed’s aggressive monetization of public and some private debt has inspired investors to allocate cash to risk assets However, a number of cyclical…

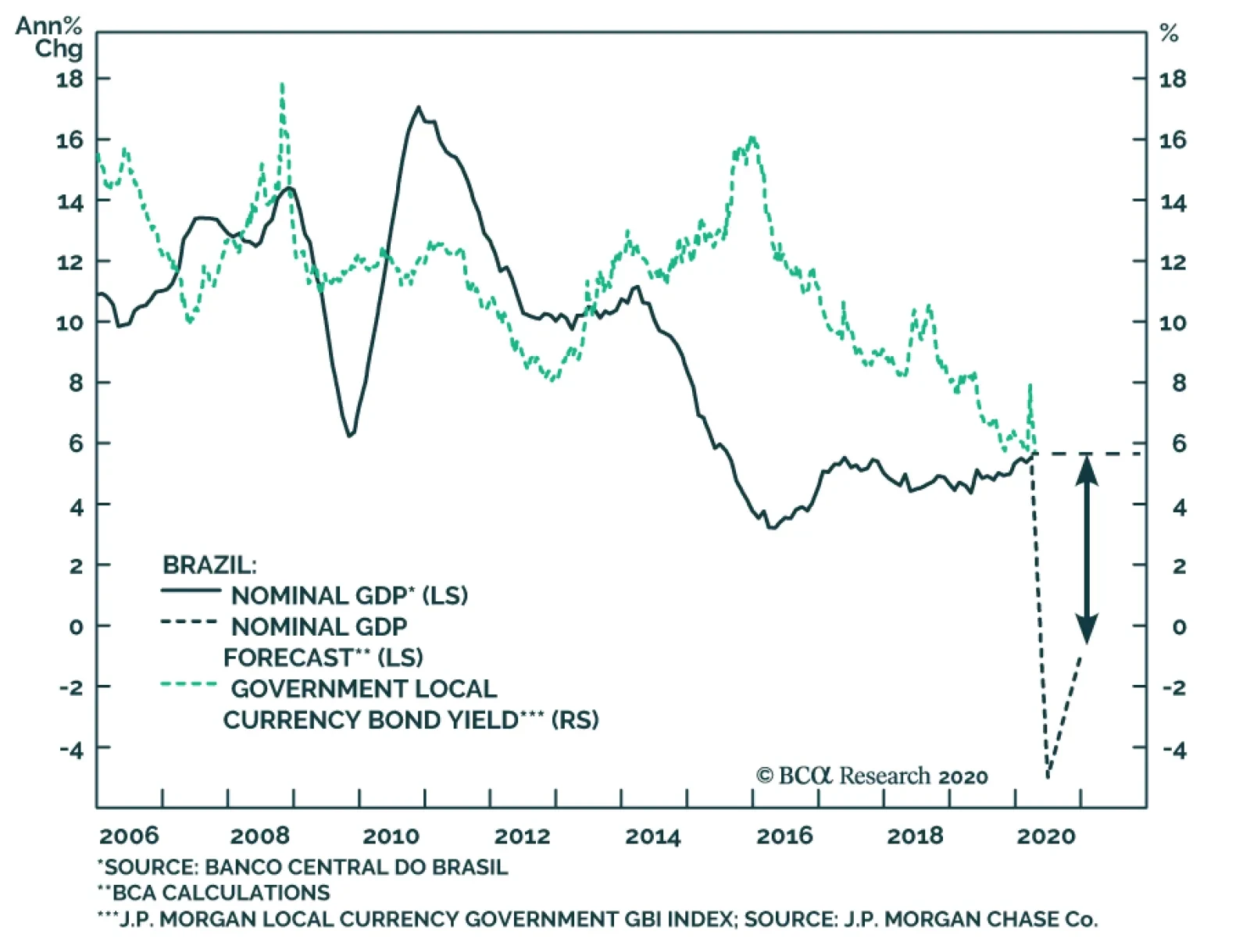

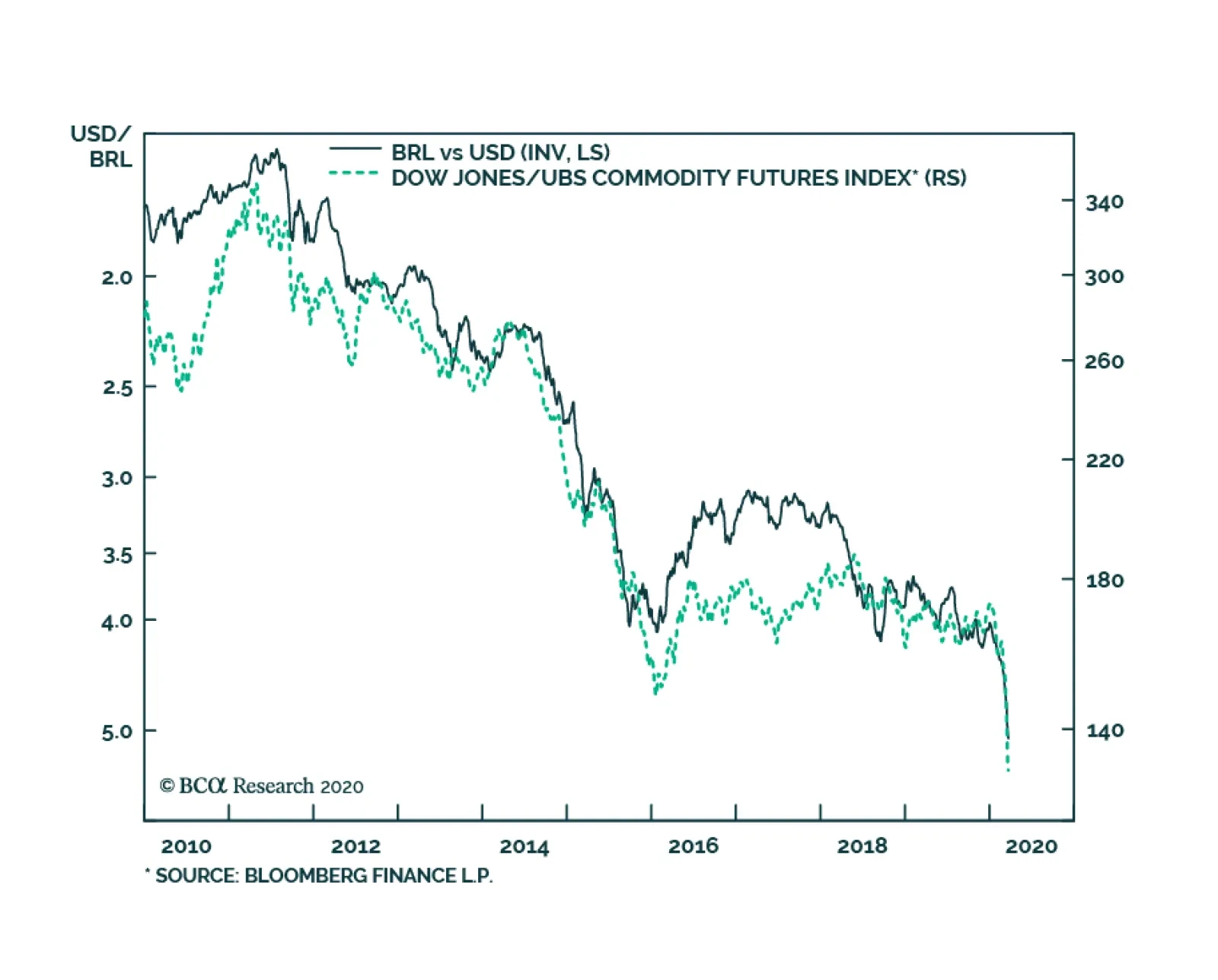

BCA Research’s Emerging Markets Strategy service continues to recommend underweighting Brazil and shorting the BRL versus the US dollar. Brazilian markets plunged last Friday due to the ongoing political crisis.…

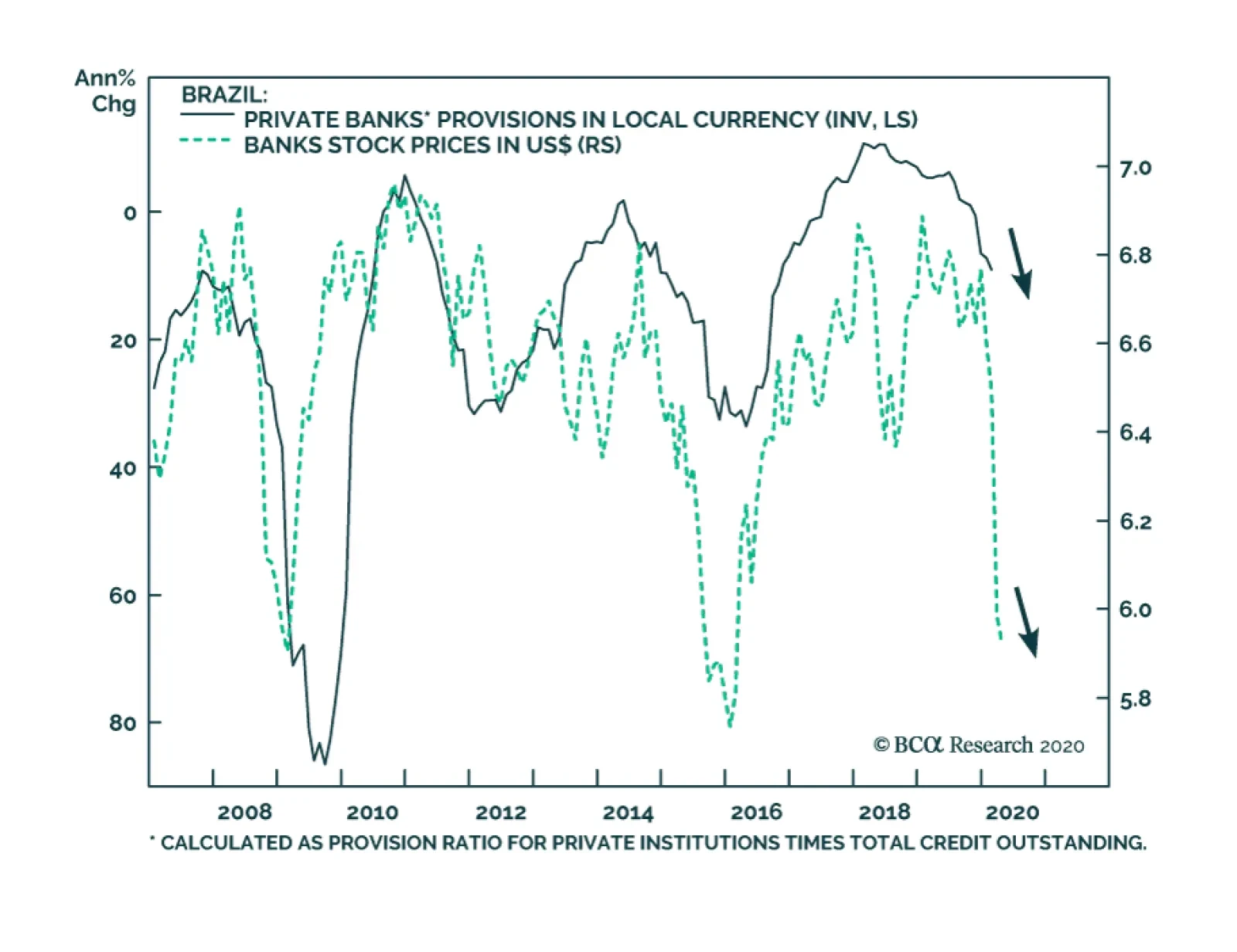

On Tuesday, BCA Research's Emerging Markets Strategy service concluded that the cyclical outlook for Brazilian bank stocks has worsened further due to the COVID-19 pandemic, despite the fact that valuations have improved. Brazilian…

Highlights Even though Brazilian bank stocks have plunged a lot, their cyclical and structural profitability outlook is dismal. Structurally, Brazilian banks will be facing more competition and their profit margins will narrow.…

Highlights The pandemic has a negative impact on households and has not peaked in the US. But a depression is likely to be averted. Our market-based geopolitical risk indicators point toward a period of rising political turbulence…

The selloff in Brazilian financial markets has been vicious. A bottom might not be too far away given the 57% drop in large cap and a 62% drop in small cap stocks in US dollar terms since their peak. However, downside risks…

Highlights The US-China trade talks will continue despite Hong Kong. The UK election will not reintroduce no-deal Brexit risk – either in the short run or the long run. European political risk is set to rise from low levels,…