Executive Summary Upgrading Brazil Within An EM Equity Portfolio Brazilian risk assets are cheap and will get a positive impetus from the rising odds of ex-president Lula winning this year's election. As we have…

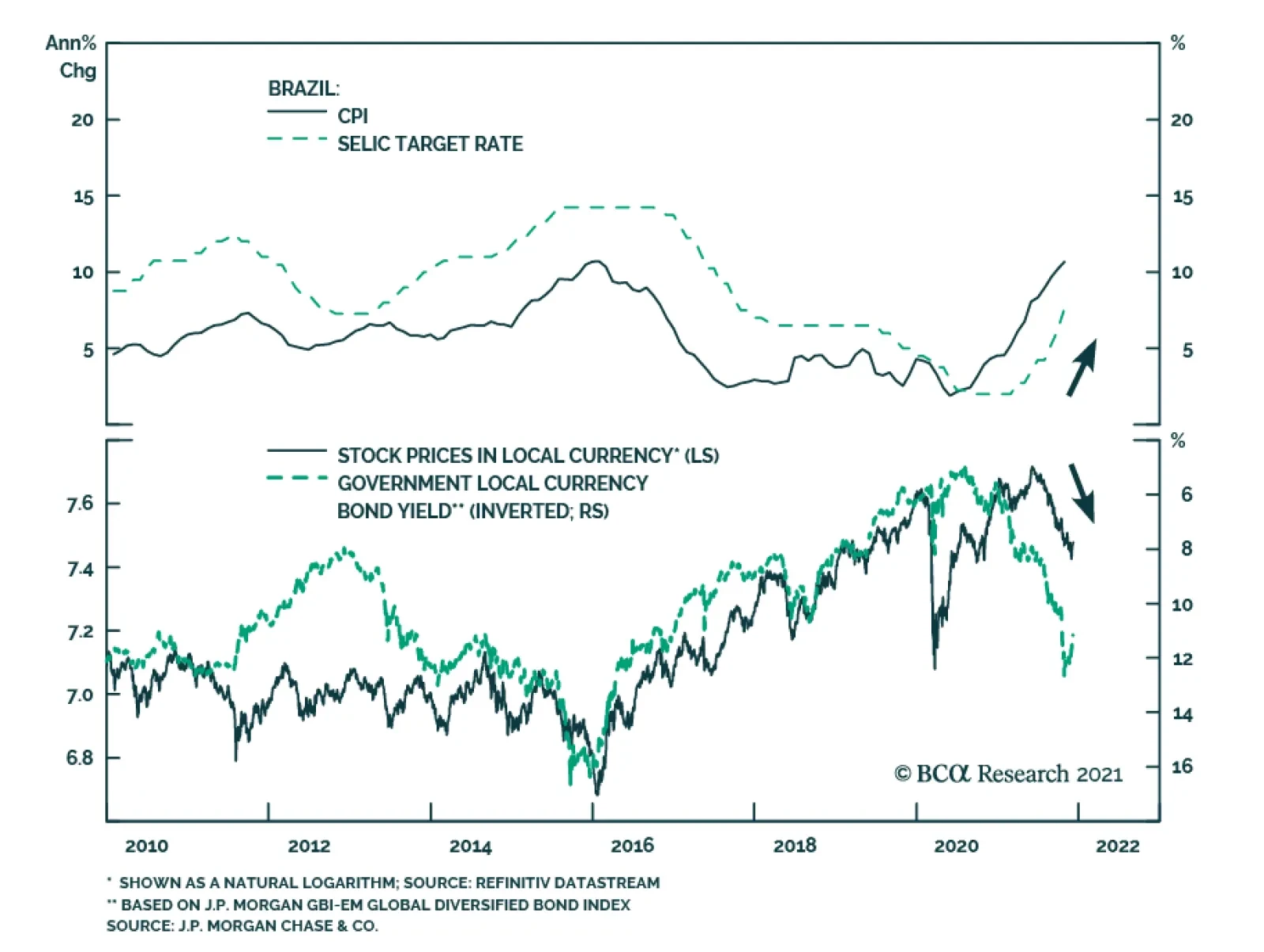

As expected, Brazil’s Central Bank lifted the benchmark Selic rate by 150 bps to 9.25% on Wednesday. This move brings the total increase since the beginning of the year to 725 bps. Policymakers also signaled that another…

Highlights Remain neutral on the US dollar. A breakout of the dollar would cause a shift in strategy. Russia’s conflict with the West is heating up now that Germany has delayed the certification of the Nord Stream II pipeline.…

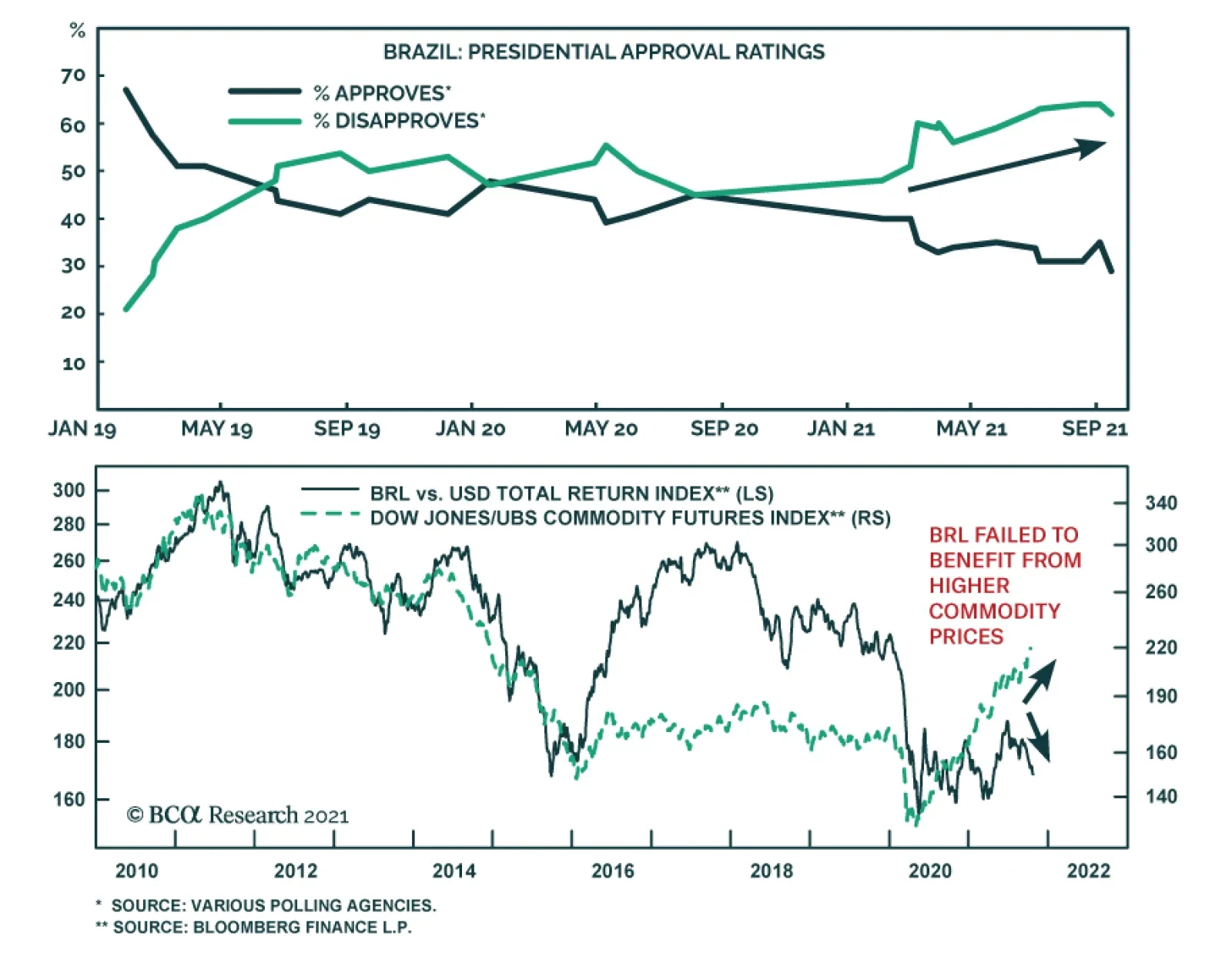

The Brazilian real has been among the worst performing EM currencies over the past few months, second only to the Turkish lira. Similarly, Brazilian equities peaked in mid-June and have been on a downtrend since. The latest…

Highlights Faced with record low approval ratings, President Bolsonaro will try to cling to his seat by all means possible, and his attacks on state institutions will escalate. This will further destabilize the socio-political…

Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

Highlights The US Climate Prediction Center gives ~ 70% odds another La Niña will form in the August – October interval and will continue through winter 2021-22. This will be a second-year La Niña if it forms, and…

Highlights The US government issued its first-ever water-shortage declaration for the Colorado River basin in August, due to historically low water levels at the major reservoirs fed by the river (Chart of the Week). The drought…

Highlights The rapid spread of the COVID-19 delta variant in Asia will re-focus precious metals markets anew on the possibility of another round of lockdowns and the implications for demand, particularly in Greater China and India,…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…