Highlights Analysis on Brazil is available below. If banks in China are forced by regulators to properly recognize and provision for non-performing assets, large banks would become substantially undercapitalized while many small- and…

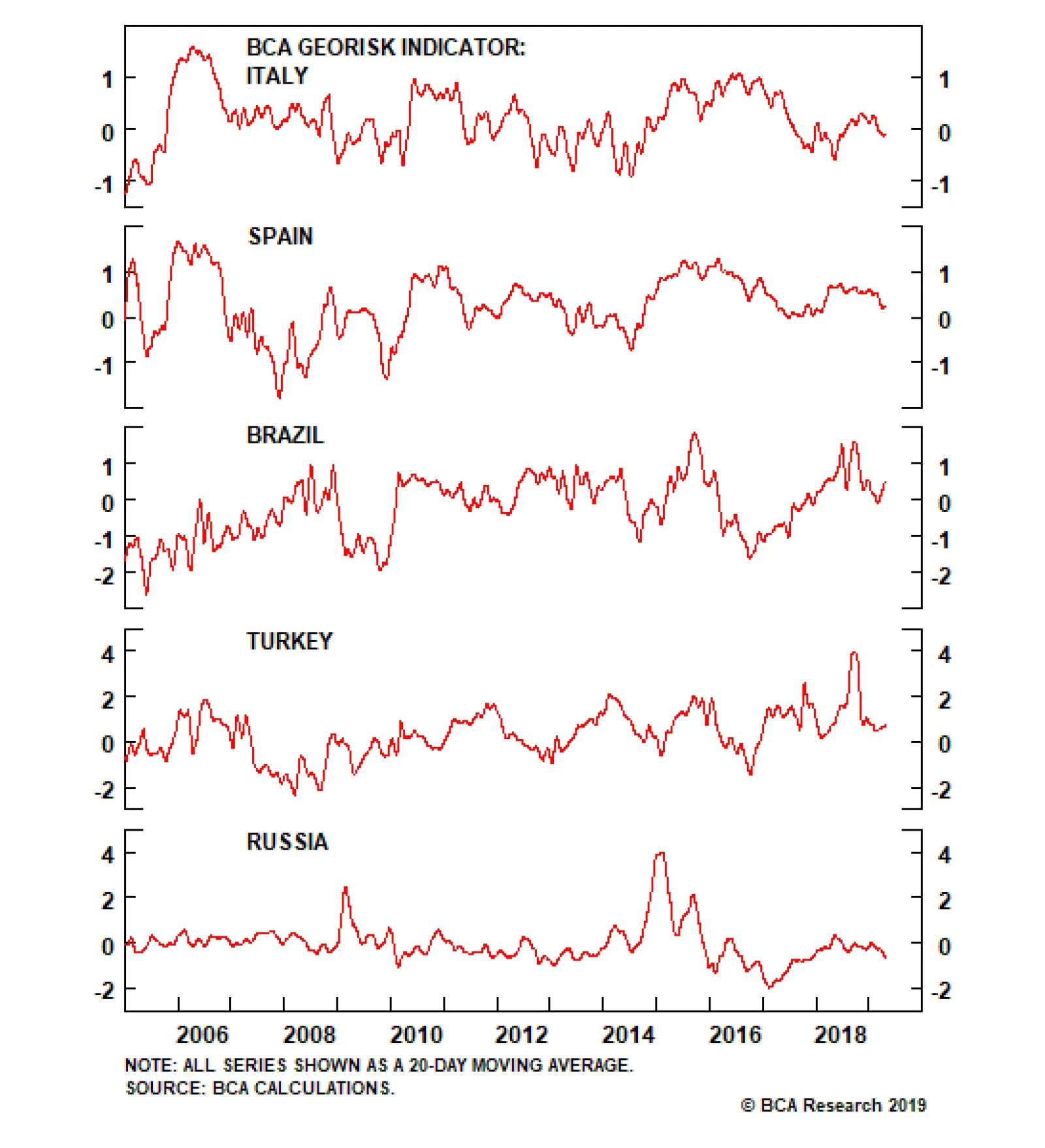

Investor surveys show that the majority of investors’ top concerns are political or geopolitical in nature. Yet there is limited research devoted to quantifying these risks. The most prominent techniques involve tallying…

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

In our October 9 report, we upgraded Brazil following the outcome of the first round of presidential elections. We, like the market, gave a benefit of the doubt to the new president. However, the honeymoon is over for President Bolsonaro…

Highlights Odds are that the recent improvement in Chinese manufacturing PMIs could be due to inventory re-stocking rather than a decisive turnaround in final demand. “Hard” data have not shown meaningful improvements in…

Brazilian stocks have lately exhibited a low correlation with the overall EM equity index. Thus, even if our negative view on EM risk assets pans out, Brazilian domestic equity plays will likely suffer moderate downside in…

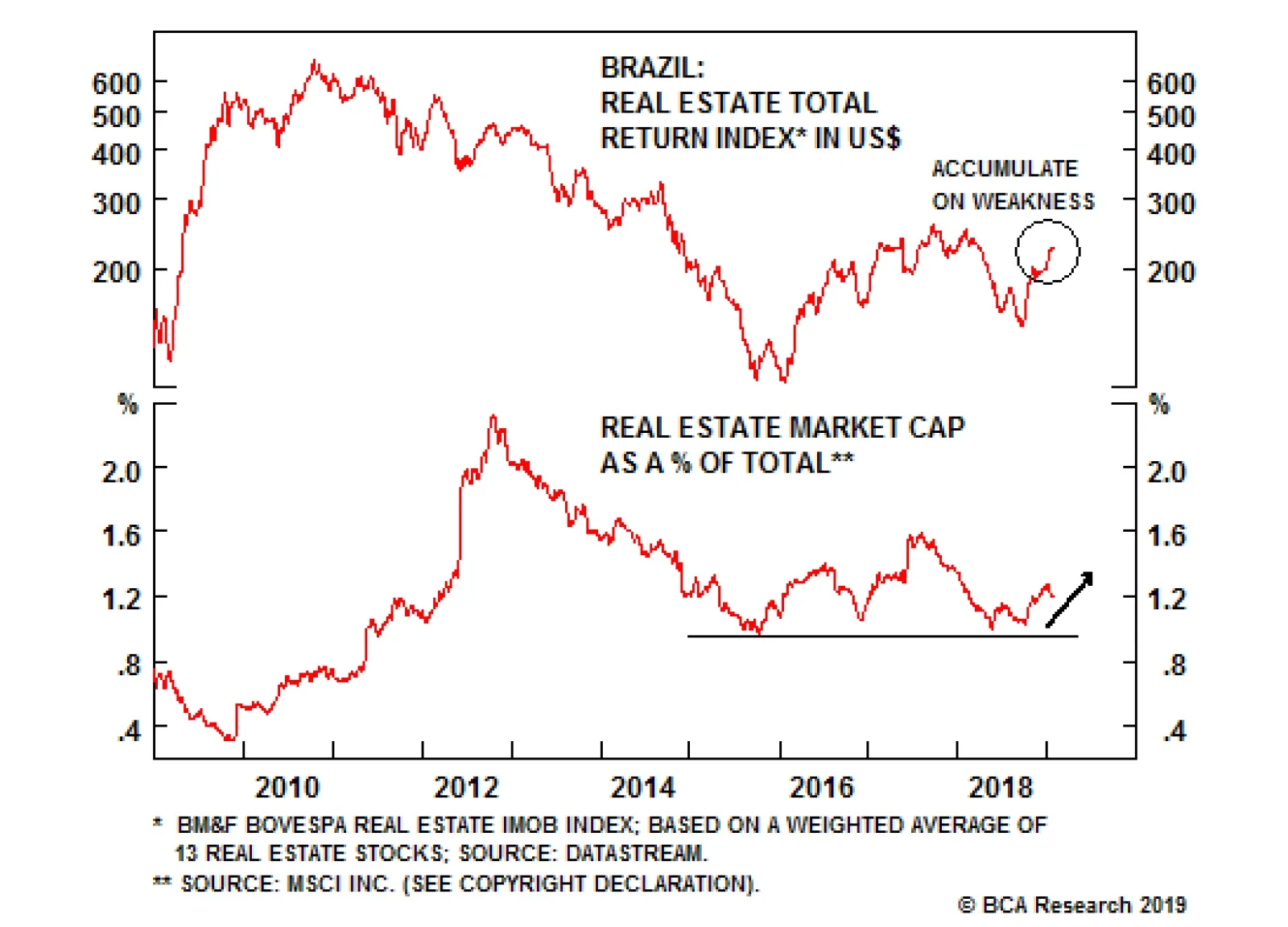

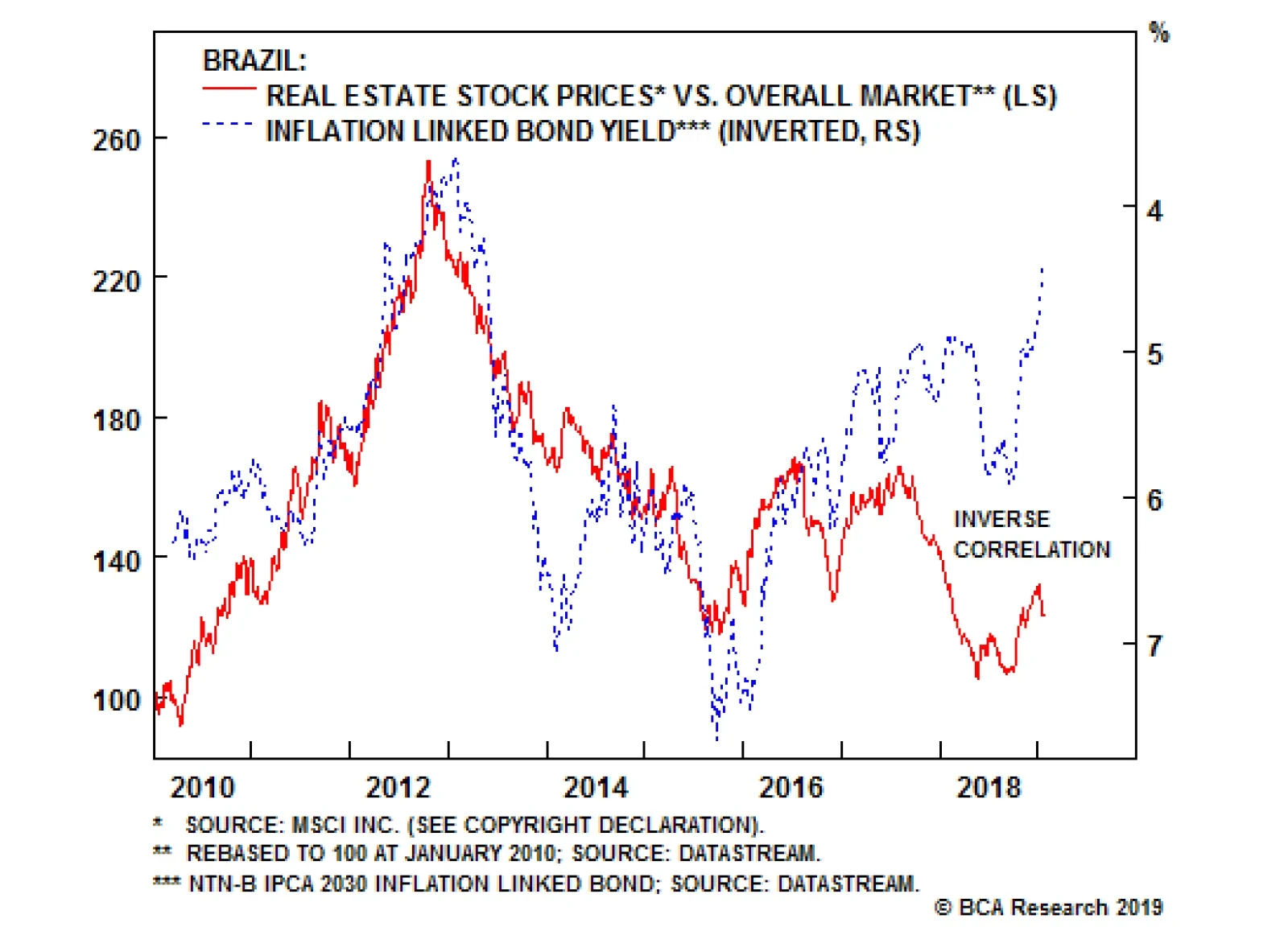

The Brazil is recovering from its most severe economic depression of the past several decades. Consequently, there is a lot of pent-up demand for discretionary spending in general and properties in particular. The property…

Feature Conditions are falling into place in Brazil that will facilitate a recovery in physical property prices as well as the outperformance of real estate stocks. With the overall Brazilian equity index having rallied considerably,…

Highlights So What? Our best and worst calls of 2018 cast light on our methodology and 2019 forecasts. Why? Our clients took us to task for violating our own methodology on the Iranian oil sanctions. Sticking to our guns would…