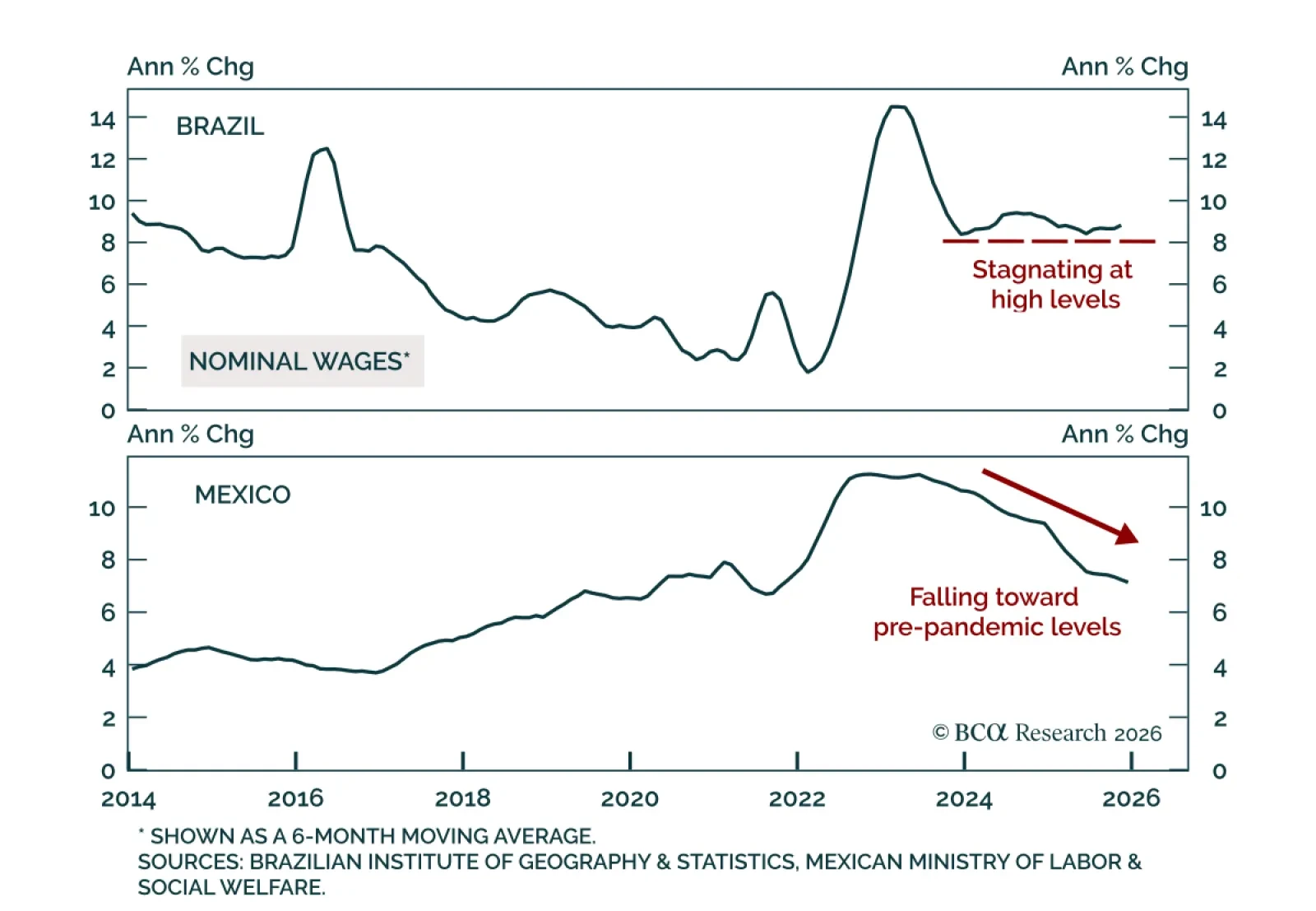

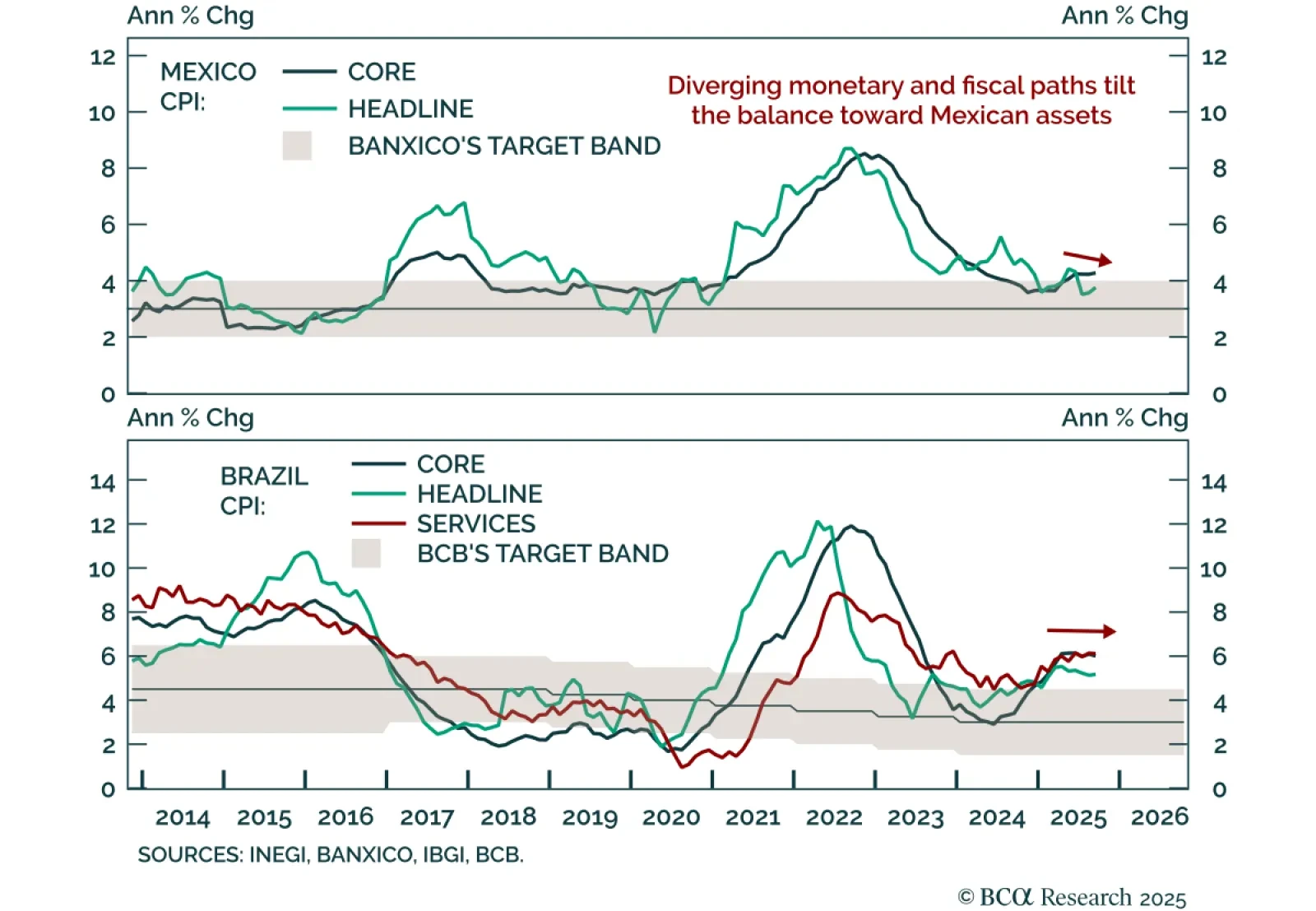

Although inflation has fallen within the upper end of the target range in both of LatAm’s largest economies, our EM strategists are more constructive on monetary easing and financial markets in Mexico than in Brazil. Mexico’s latest…

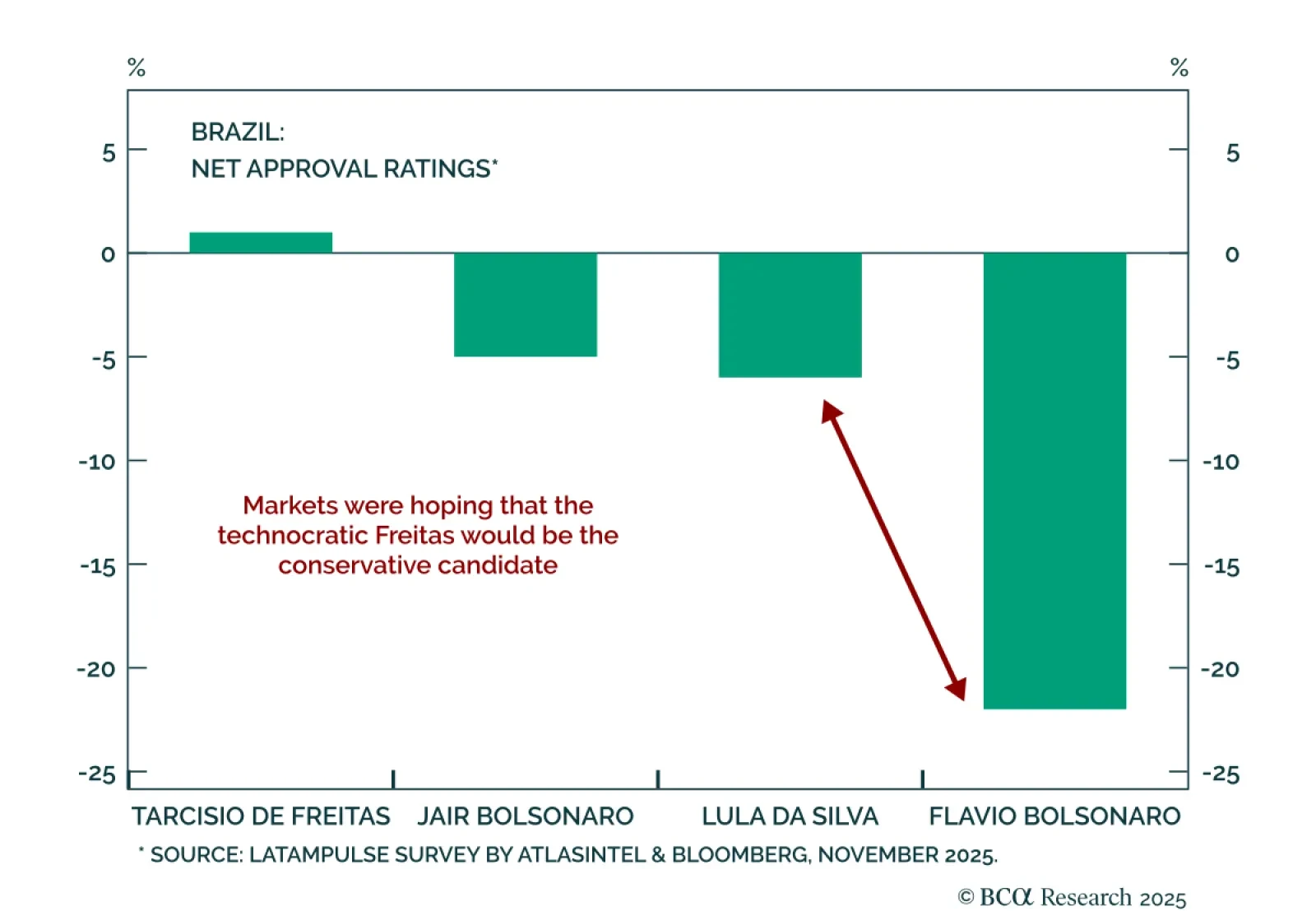

Brazil’s financial markets are on shaky ground following the central bank’s hawkish meeting and disappointing political developments, reinforcing our negative view on the country’s risk assets. The three pillars of this year’s rally…

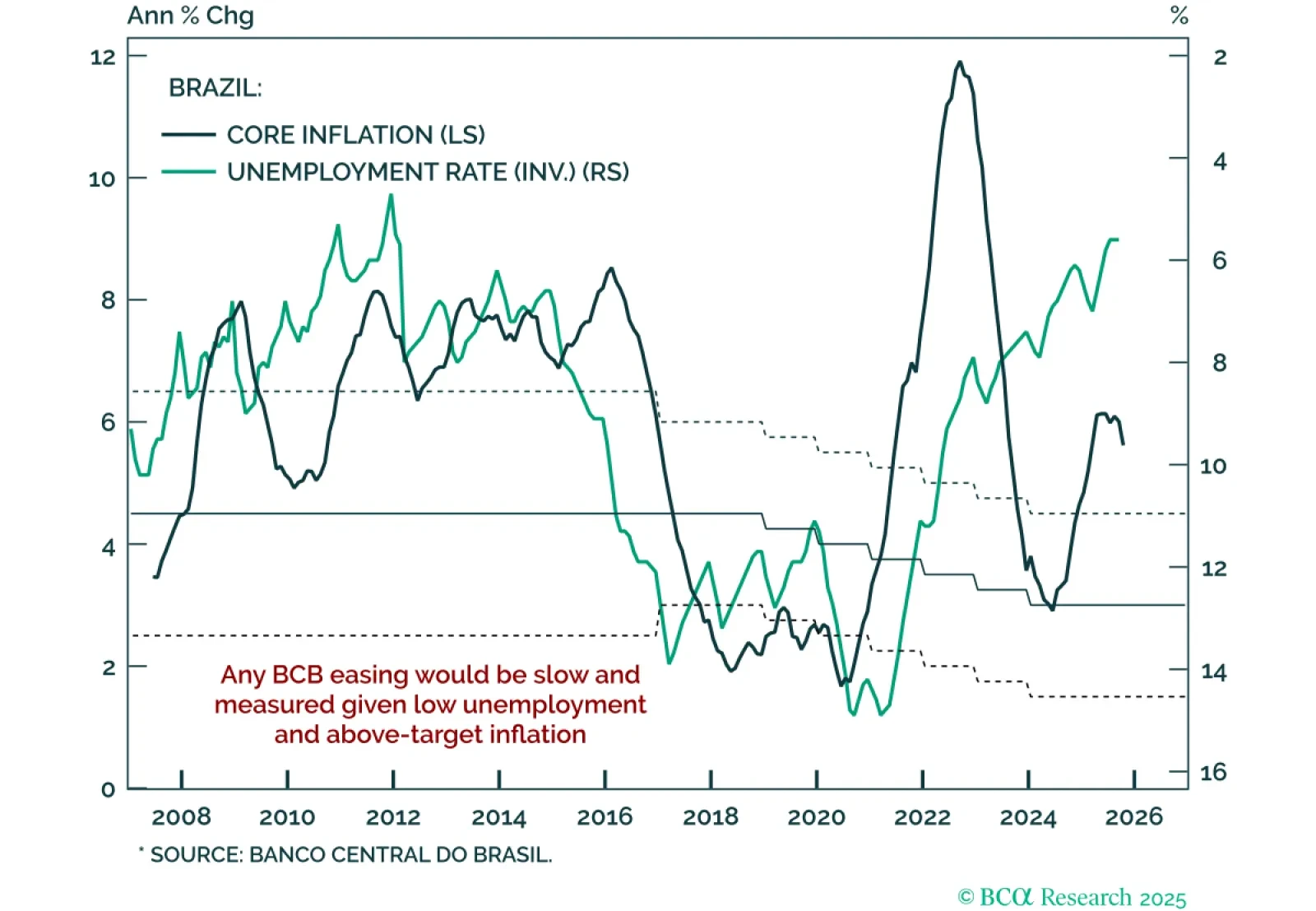

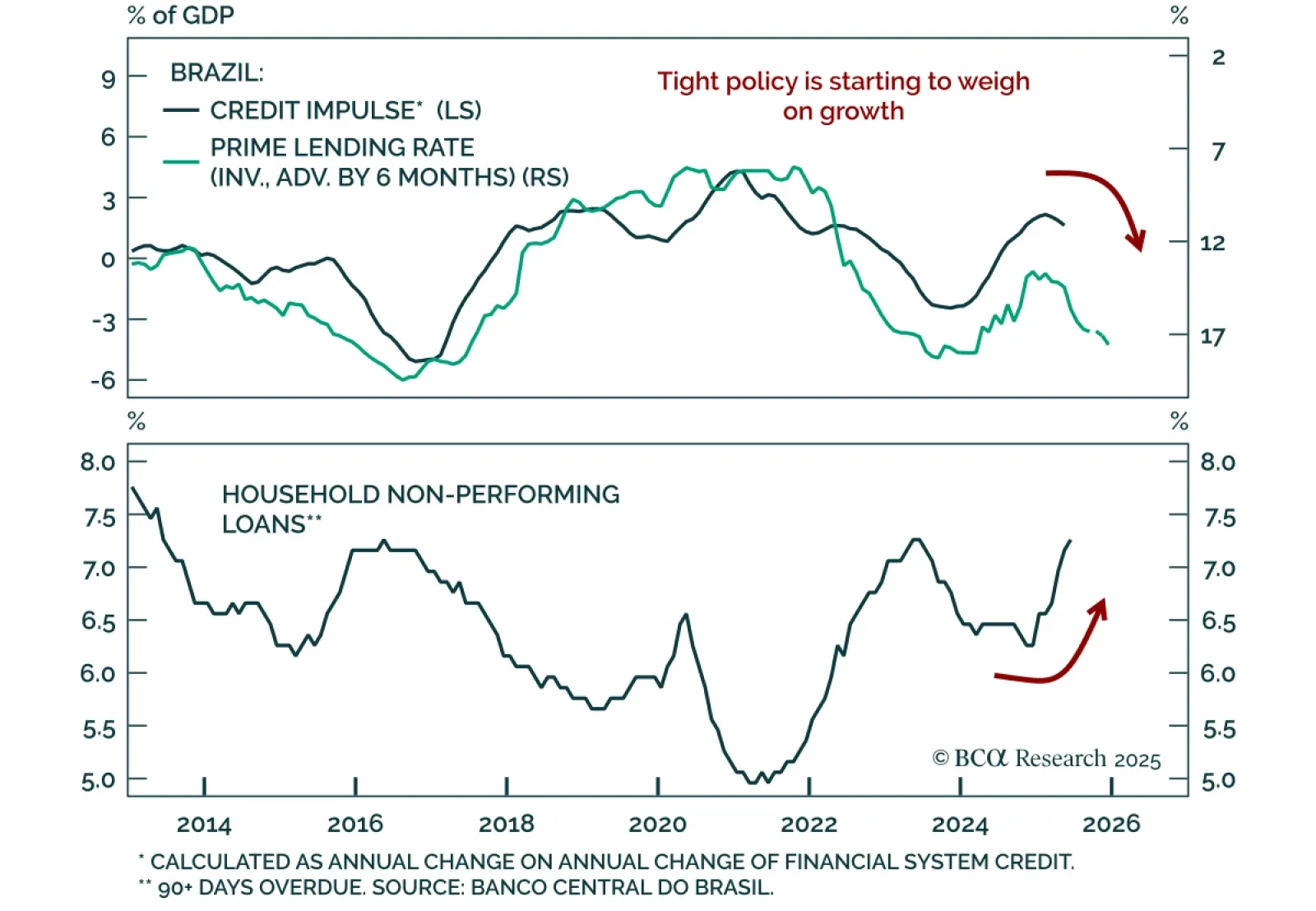

Despite a shift toward an easing bias, a December cut remains unlikely in Brazil. A BCB committee member stated the tightening cycle has ended and the next move could be a cut, shifting the bias from tightening to easing. But a…

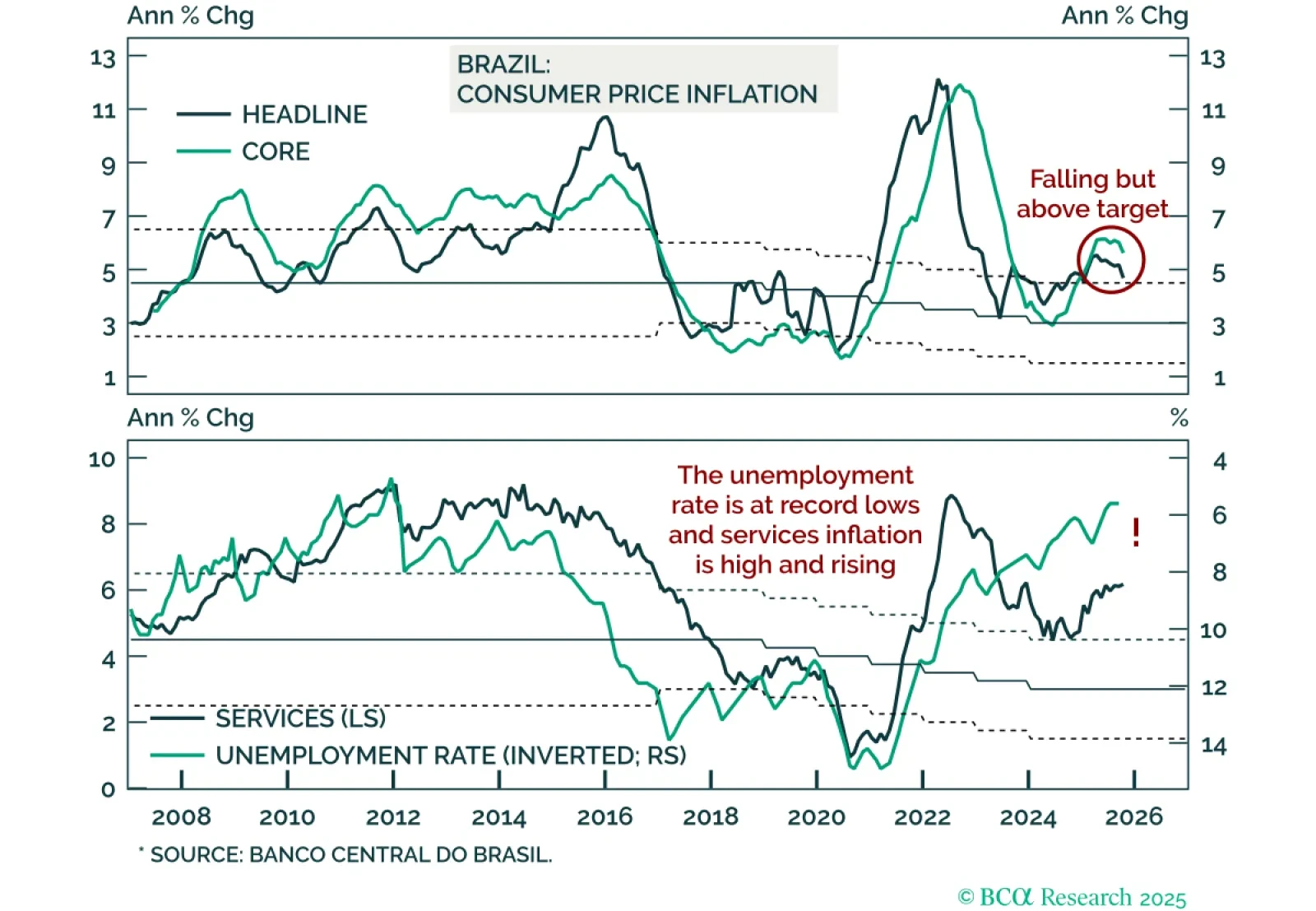

While Brazilian inflation has surprised to the downside, odds are the BCB will not ease anytime soon, creating a headwind for Brazilian markets. The October headline CPI print came in below expectations at 4.68%, lower than the 5.17…

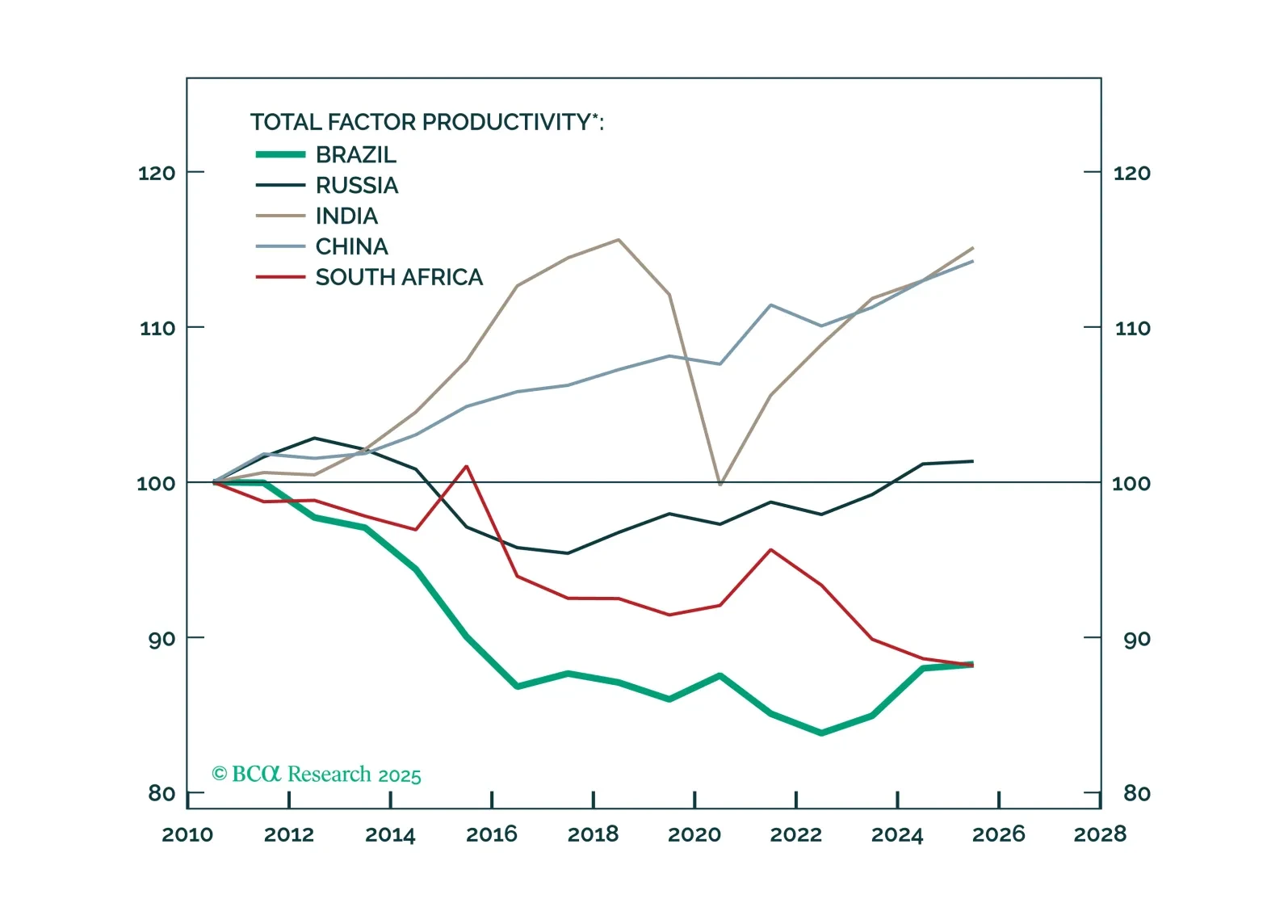

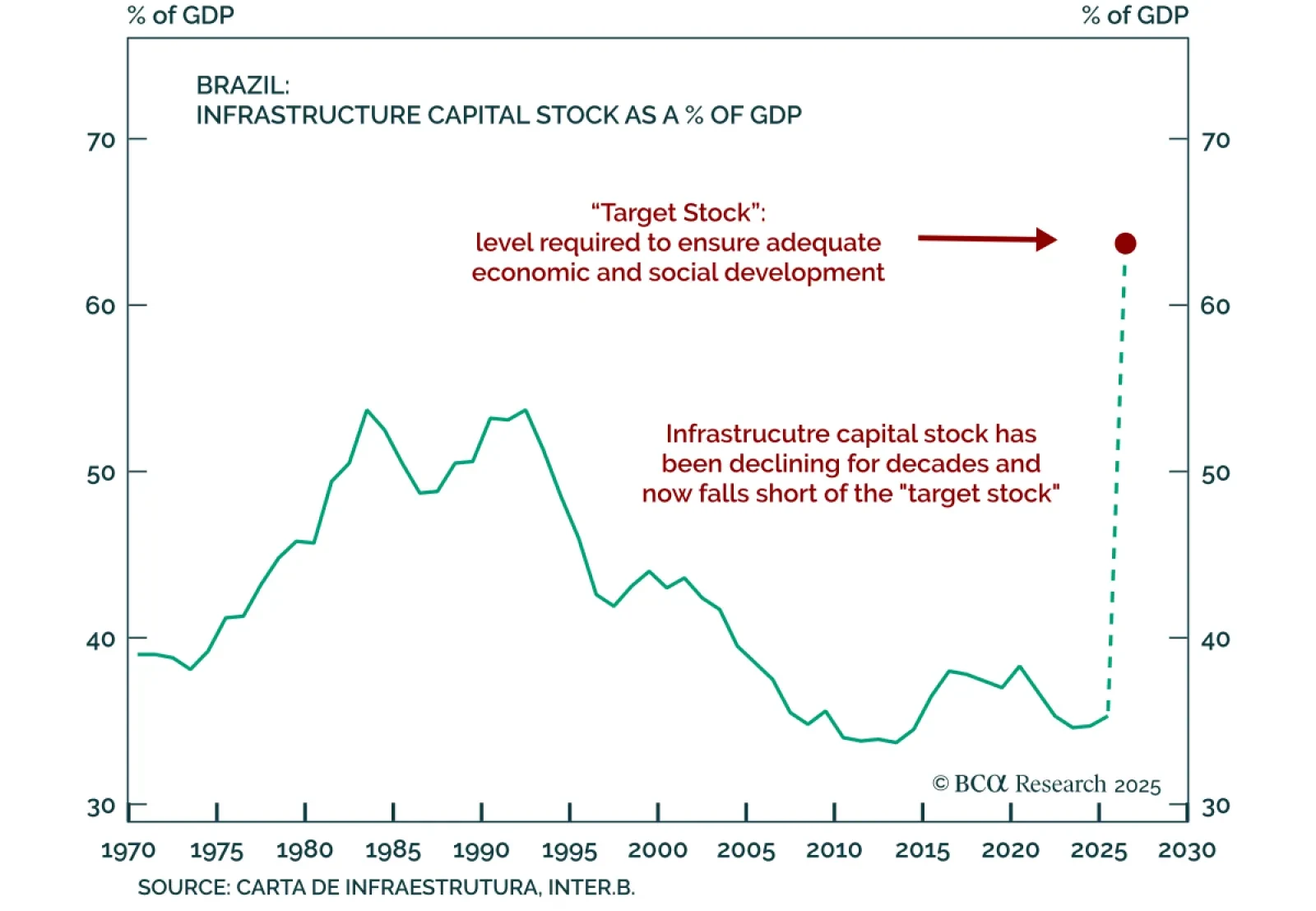

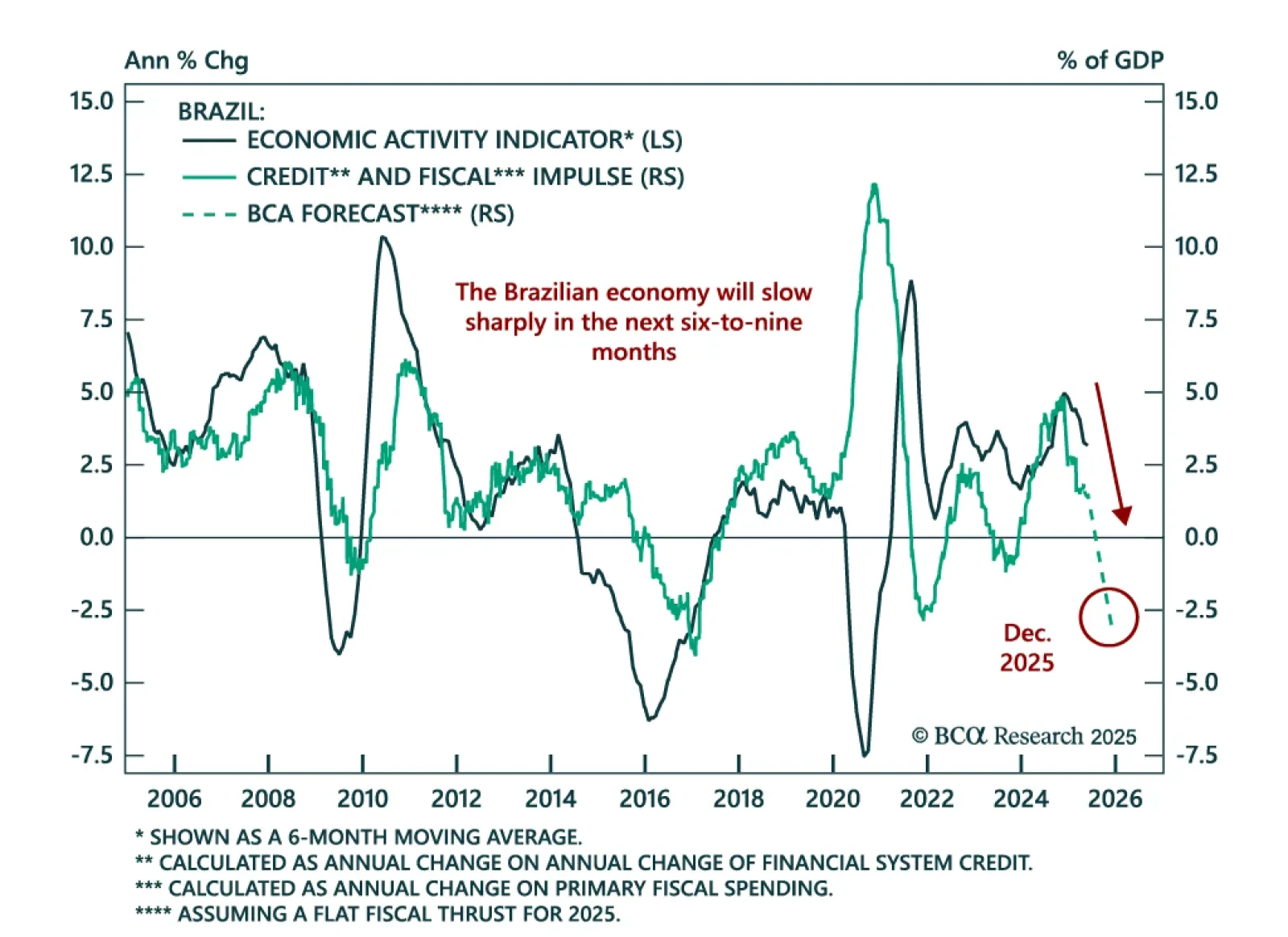

Our GeoMacro, Geopolitical, and EM strategists remain underweight Brazilian equities, local bonds, and sovereign credit over the next 6–12 months, as structural and macro constraints weigh on the outlook. Brazil has made some reform…

Brazil’s bleak macro outlook persists – rising debt, weak productivity, and political inertia. With 2026 elections looming, genuine reform seems unlikely, though Argentina’s bold turnaround could pressure Brasília to rethink its…

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

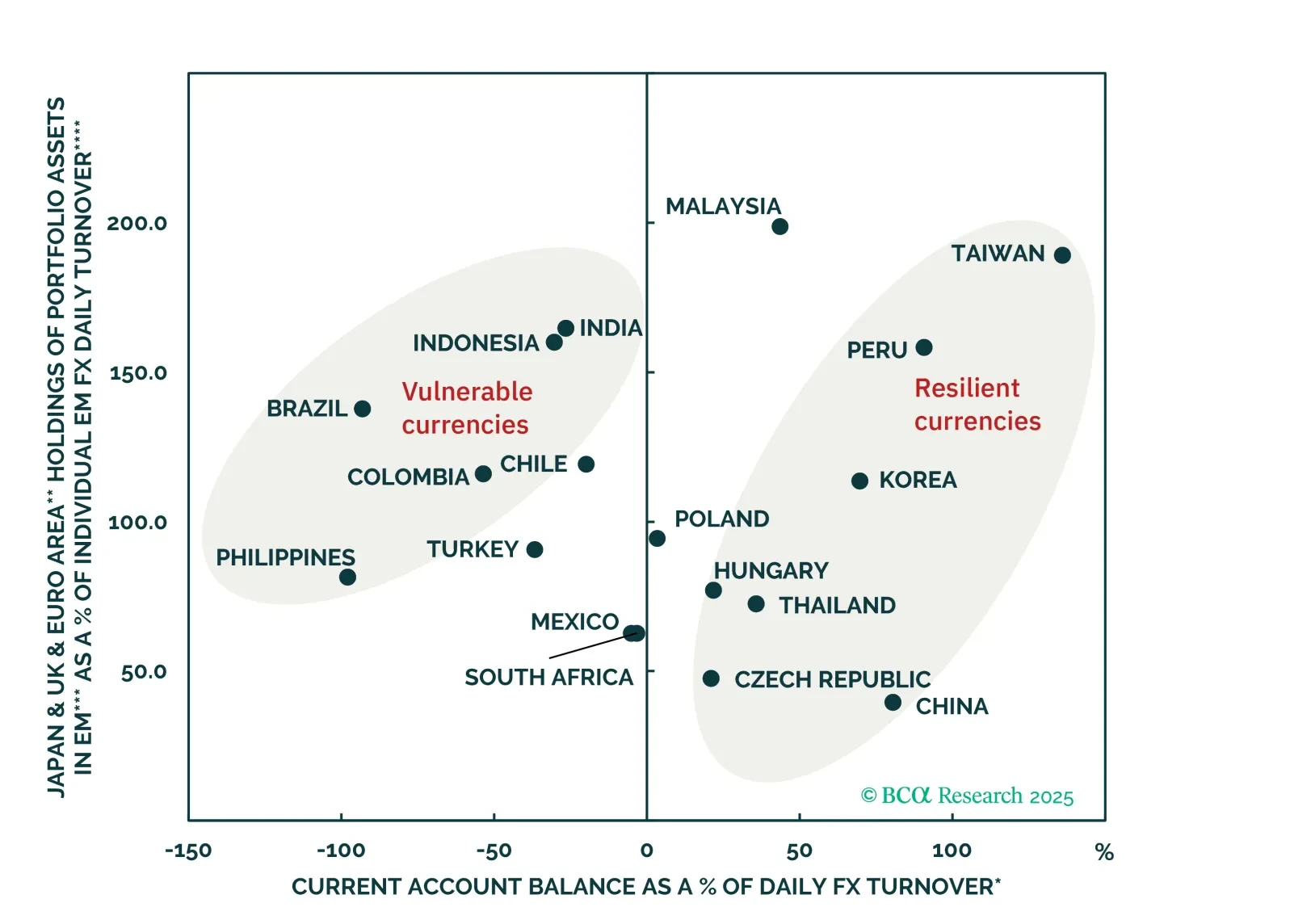

Despite widespread investor optimism Brazil’s currency outlook is challenged by a toxic mix of poor external, fiscal, and macro fundamentals. Expect BRL to underperform most EM peers.

The Central Bank of Brazil (BCB) held rates at 15%, guaranteeing a sharp growth slowdown and reinforcing our underweight stance on Brazilian equities versus EM. All Copom board members voted to maintain an ultra-hawkish policy…

BCA’s Emerging Markets strategists continue to underweight Brazilian equities, local bonds, and sovereign credit, and initiated a receiver position in 2-year swap rates. Brazil’s public debt remains on an unsustainable trajectory,…