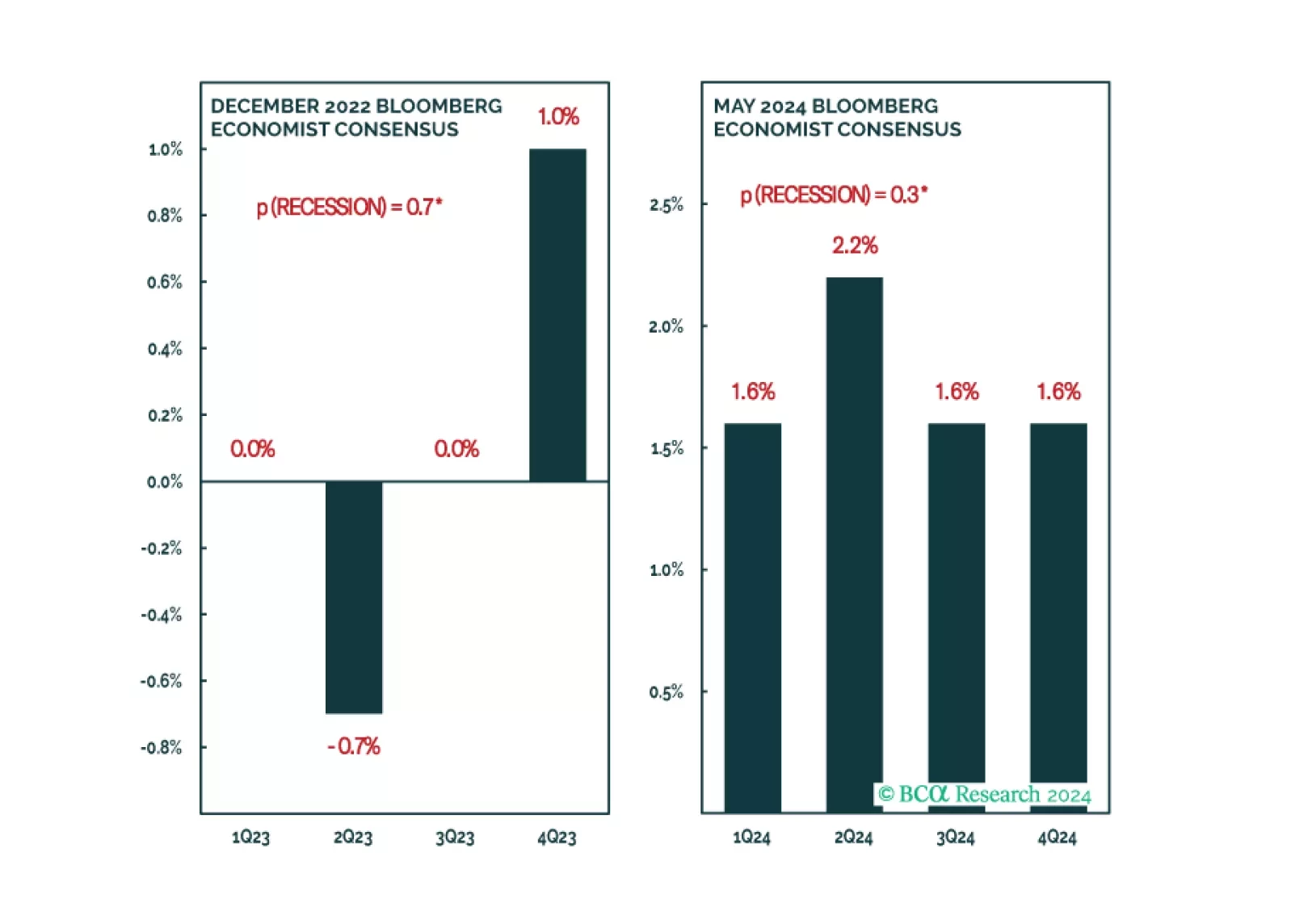

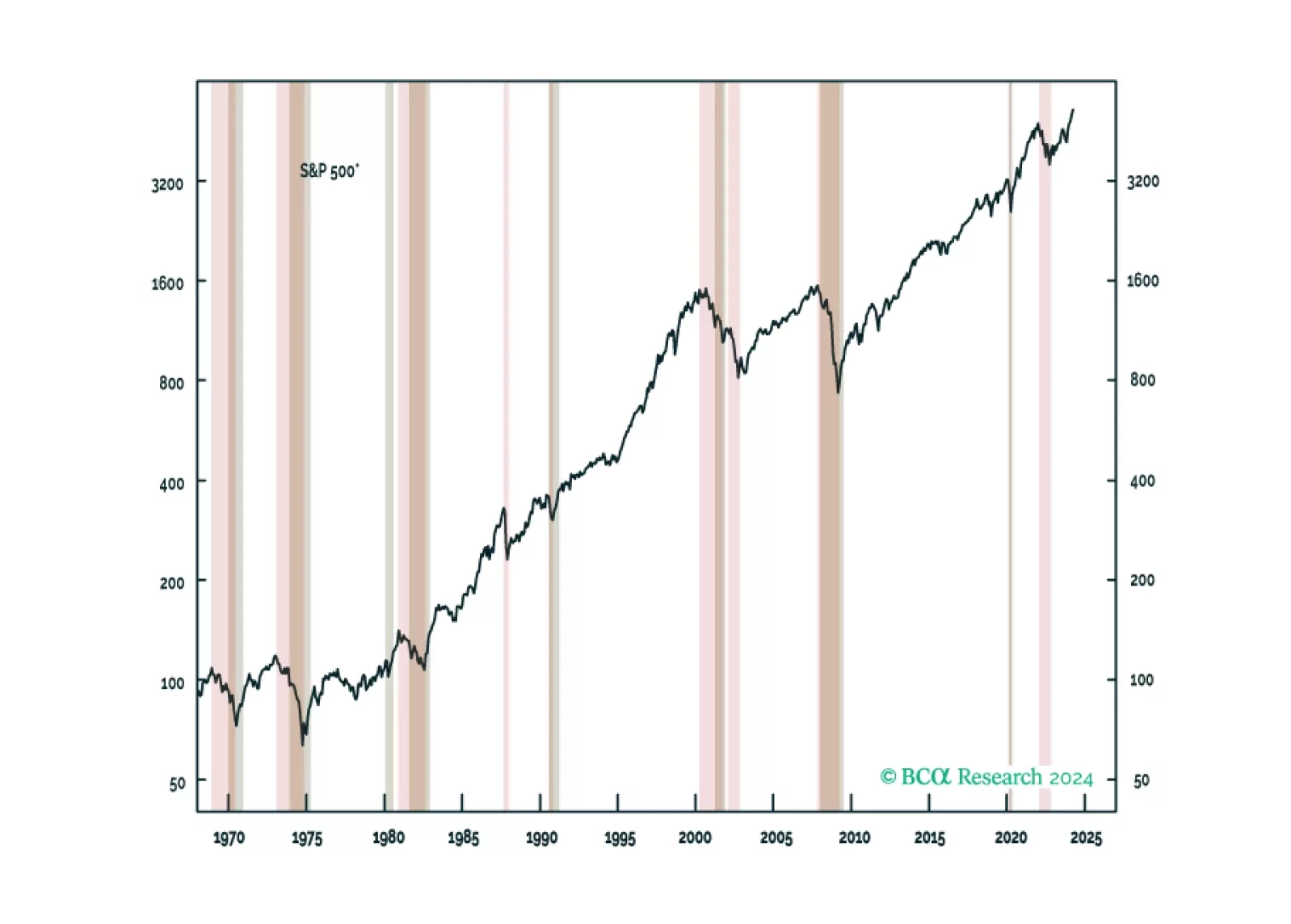

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

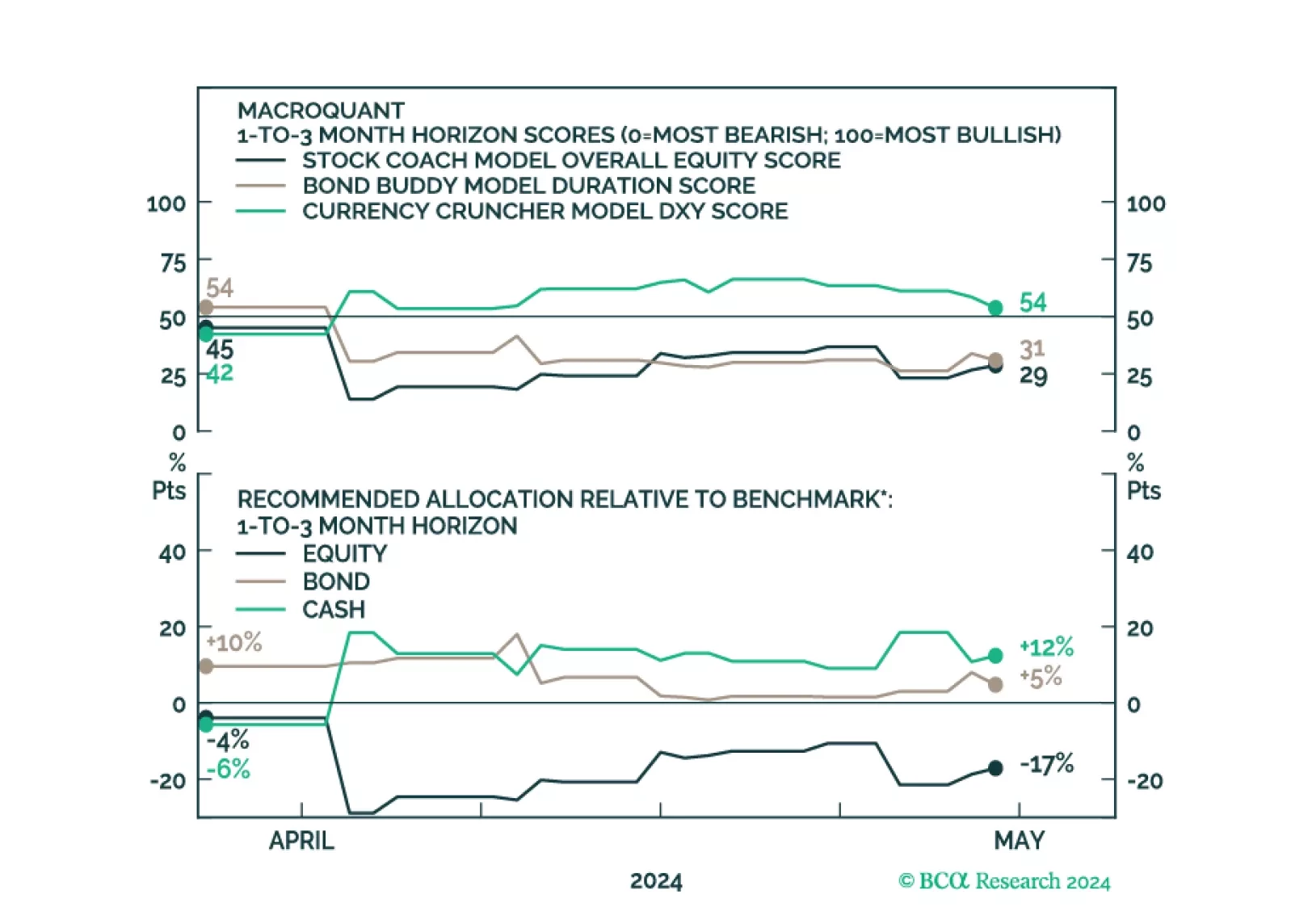

MacroQuant downgraded equities from neutral to underweight on a 1-to-3 month horizon. The model suggests increasing exposure to cash.

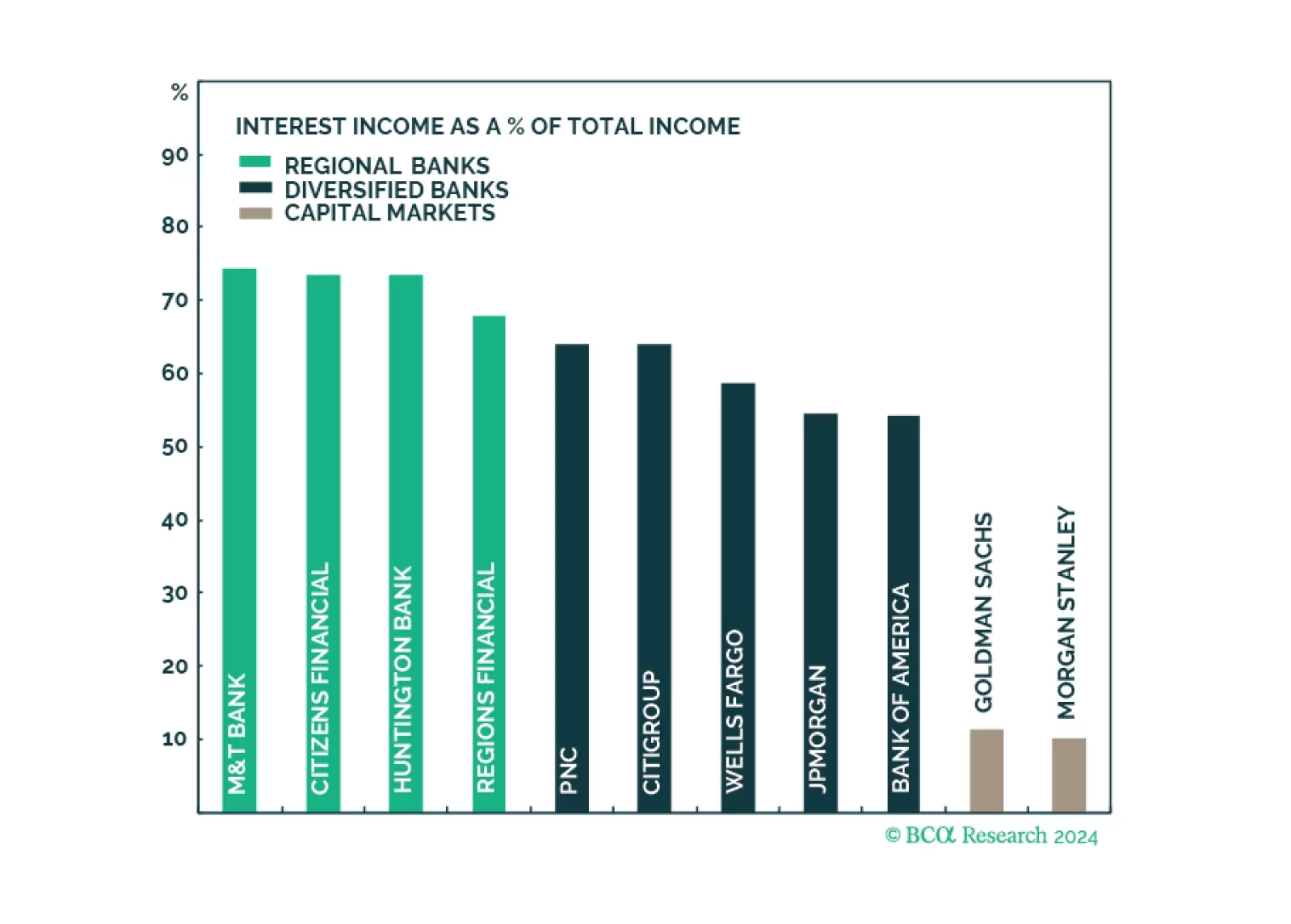

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

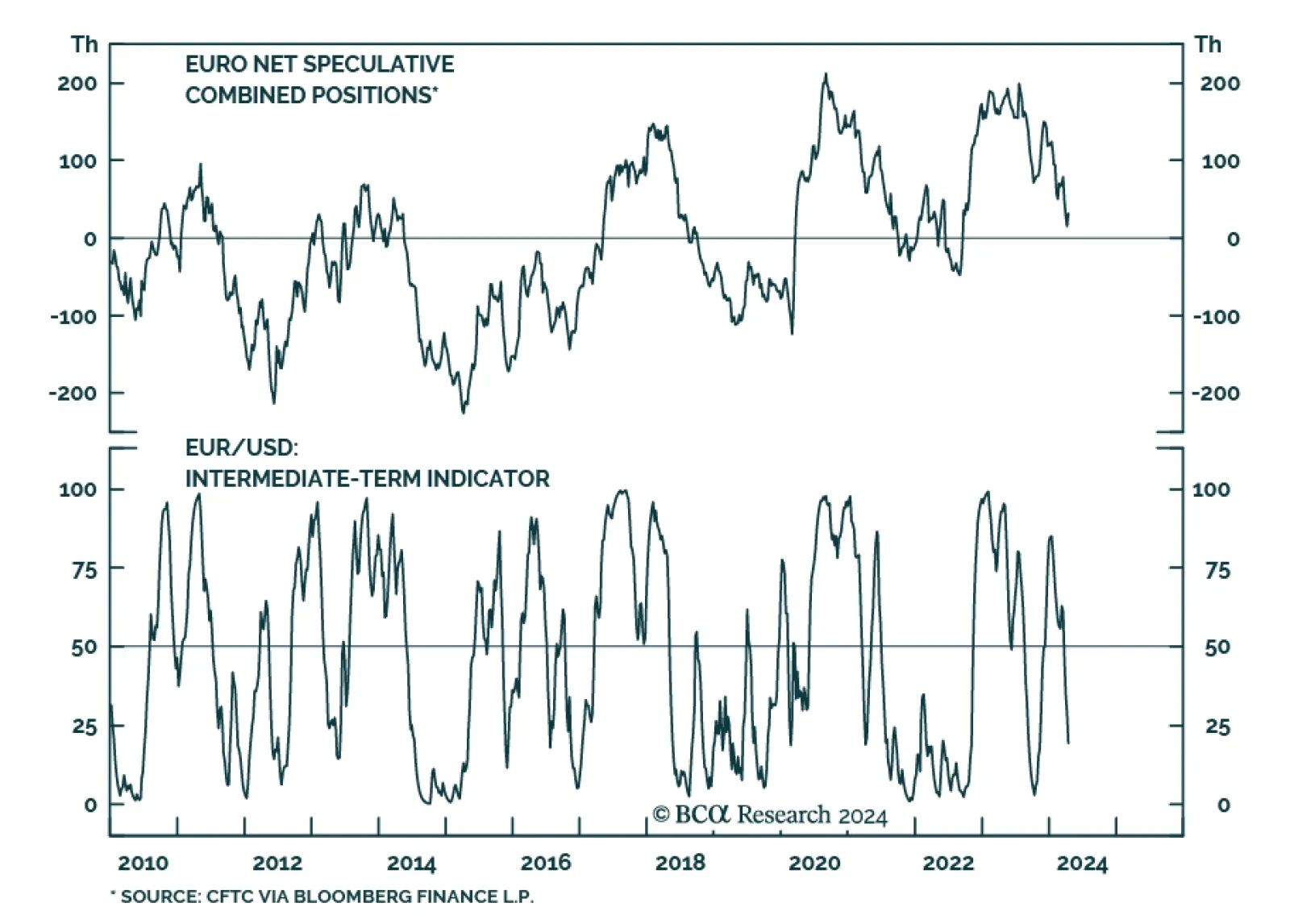

According to BCA Research’s European Investment Strategy service, a tactical buying opportunity for EUR/USD is approaching. However, this will not lead to a renewed bull market, only to a bounce toward 1.10-1.12. …

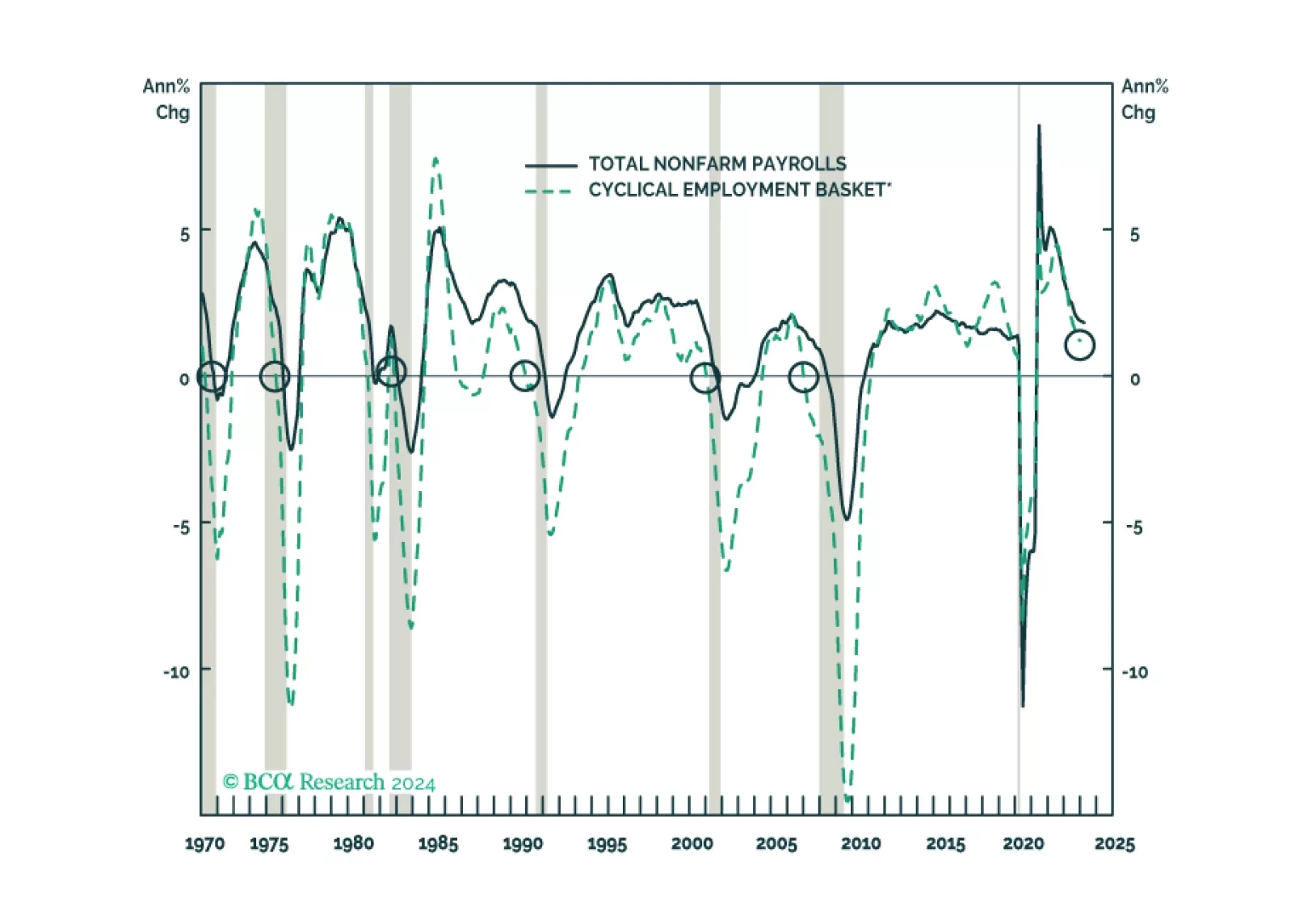

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

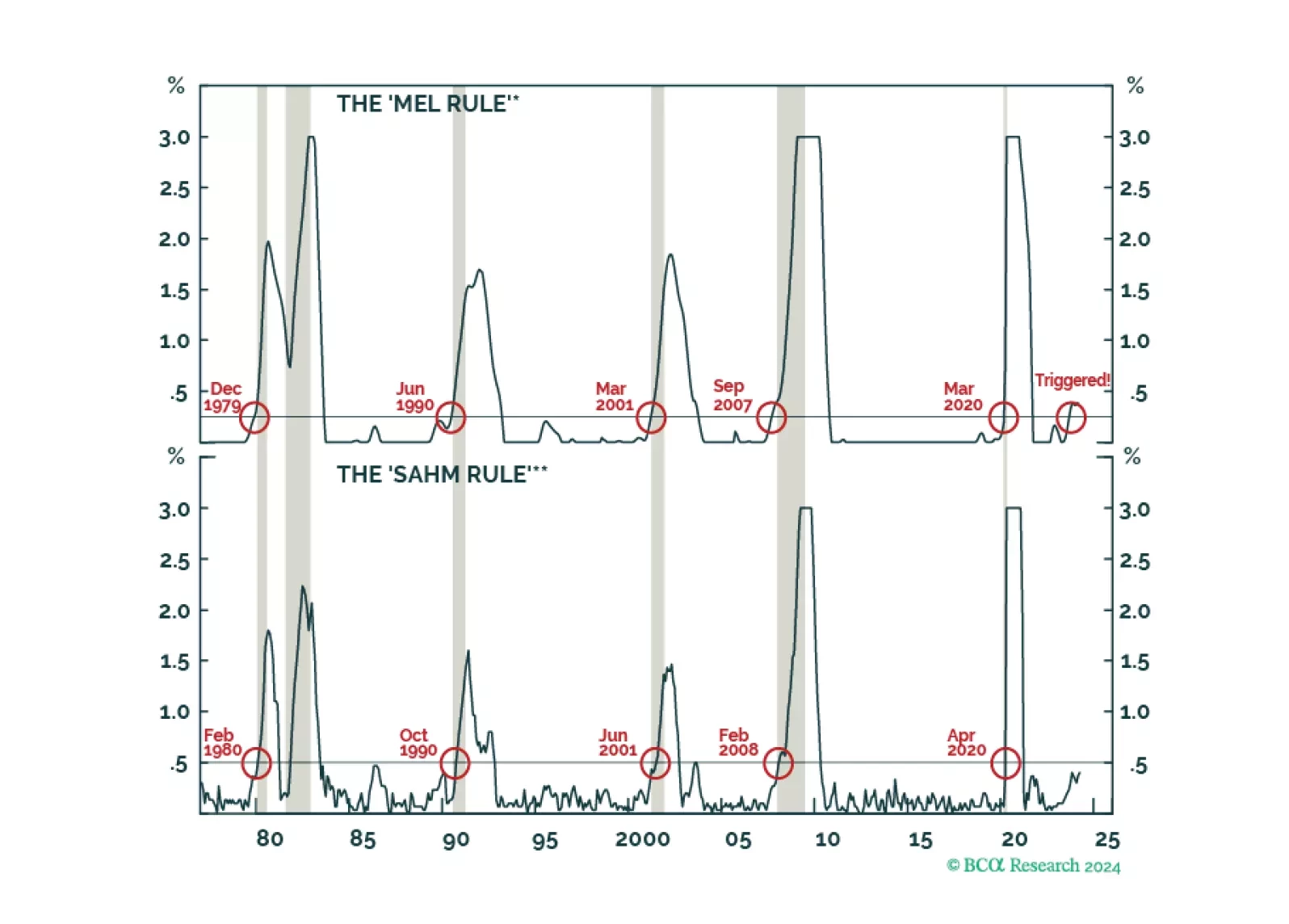

Contrary to conventional wisdom, most leading indicators suggest that the US labor market is weakening, including our very own “Mel rule.” After being overweight stocks last year, we moved to neutral at the start of 2024, and are now…

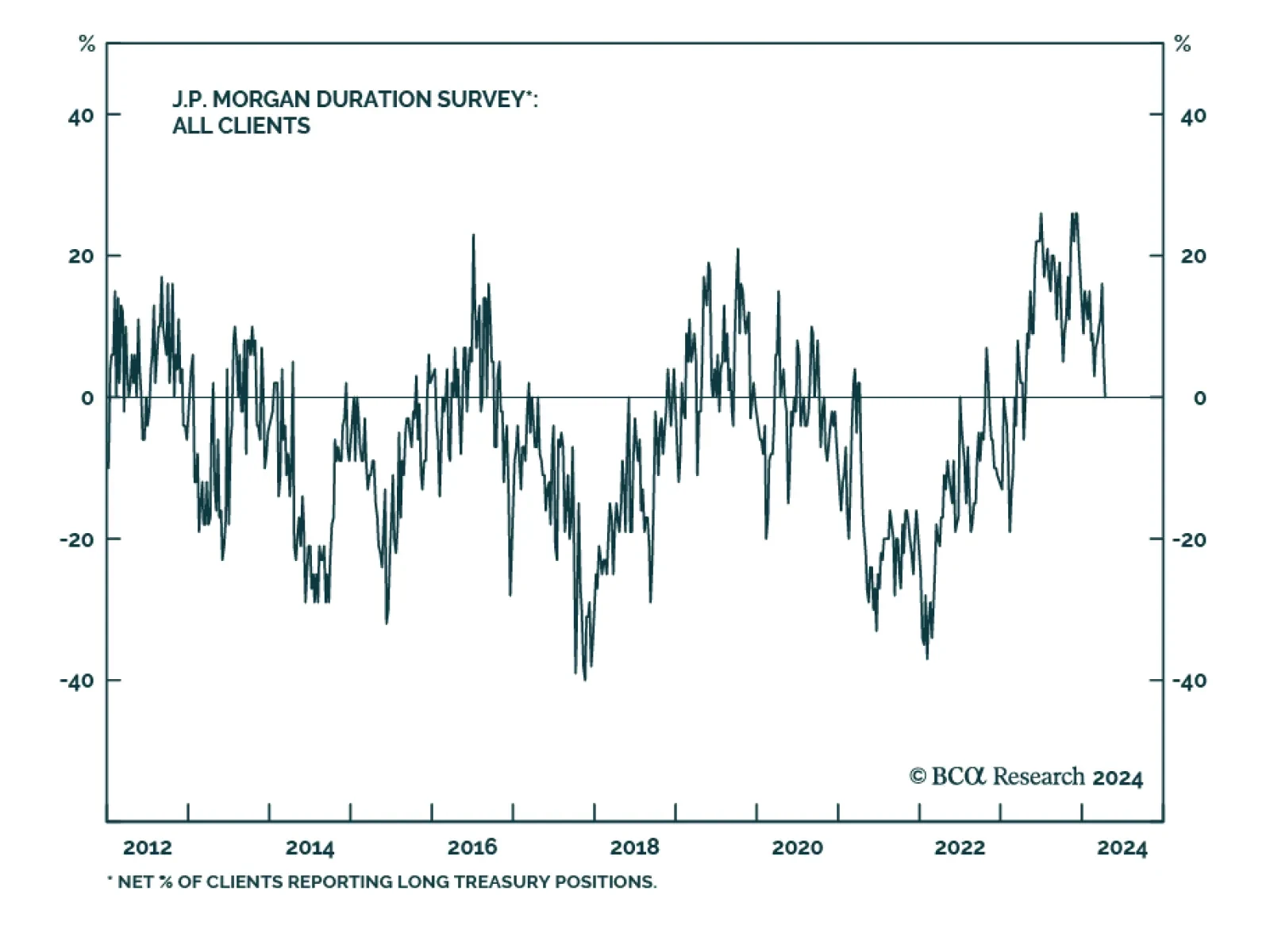

Treasurys have sold off substantially since the beginning of the year – the result of stickier-than-anticipated inflation and the repricing of Fed interest rate expectations. Some commentators have warned that there is…

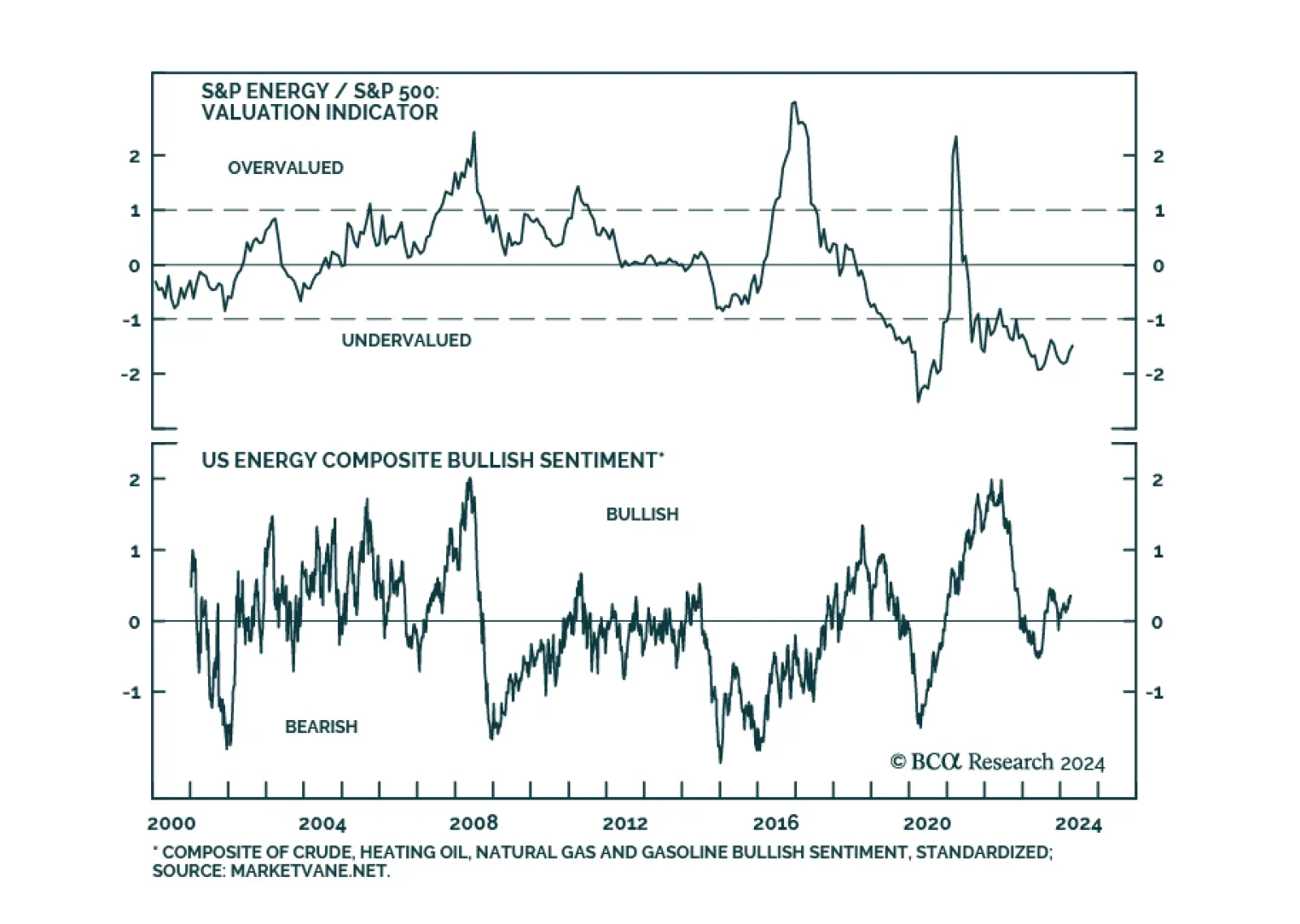

According to BCA Research’s US Equity Strategy service, rising inflation benefits Utilities, Energy, and Materials, and is a headwind for the Consumer Discretionary sector. After a protracted bout of underperformance,…

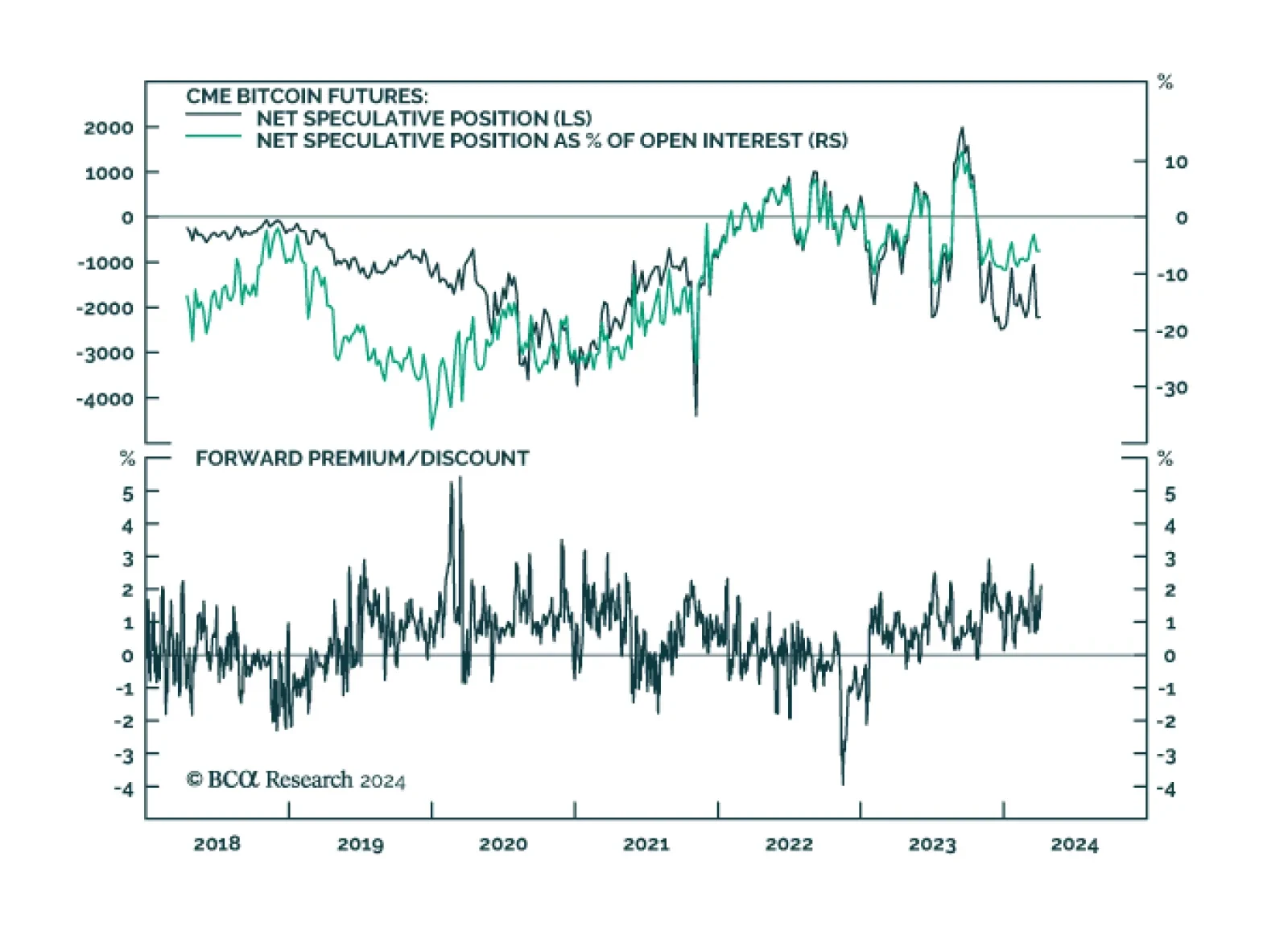

Short speculative positions on Bitcoin at the CME are near theie highest level on record. Some financial commentators have suggested that this bearish positioning in bitcoin could act as kindle and spark a short squeeze. But…

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.