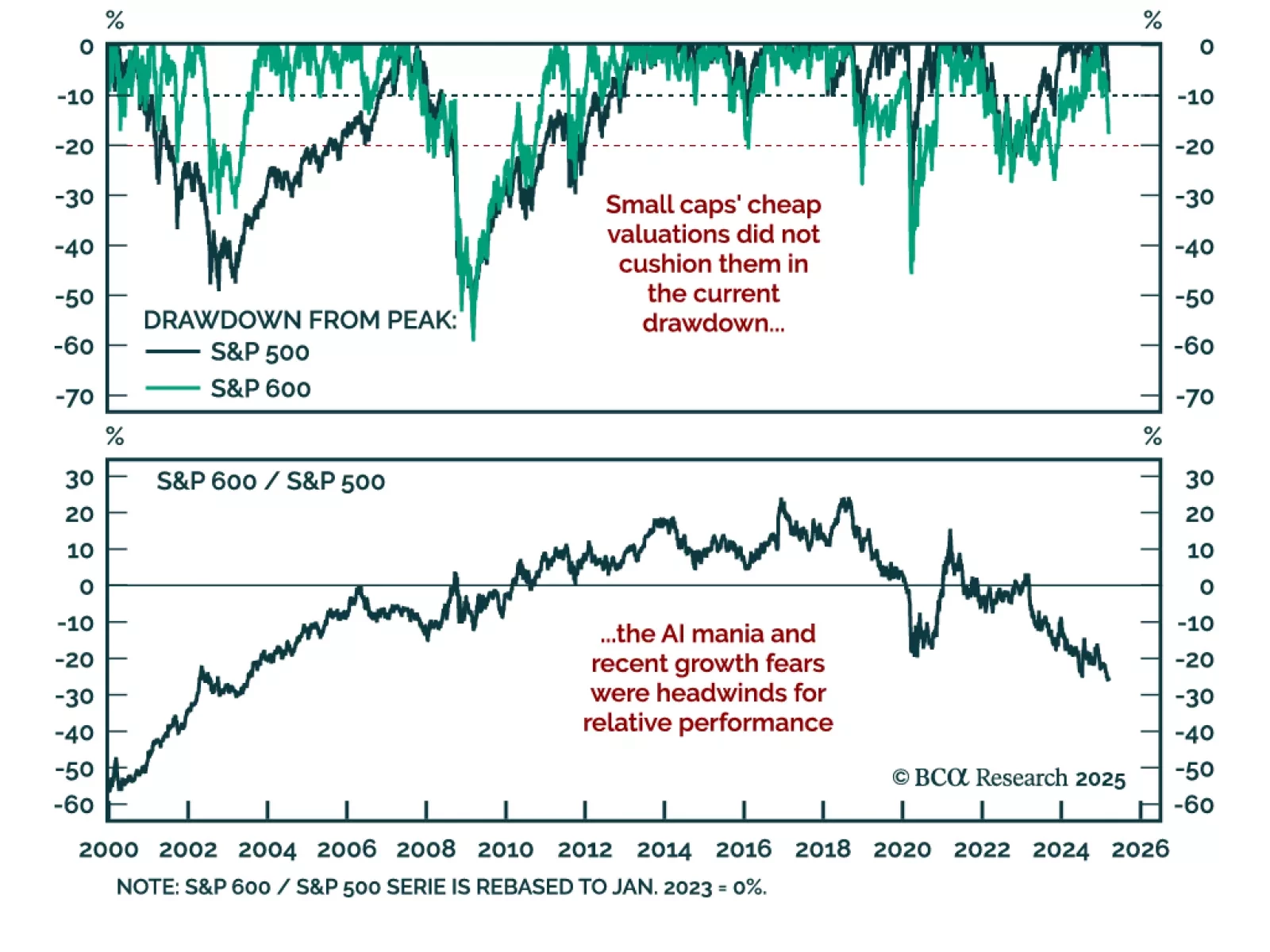

A reoccurring theme in client discussions has been how cheap US small-cap equities could siphon allocation away from their richly-valued large-cap peers. But valuations are no one’s friend in a drawdown. While the S&P 500 is in…

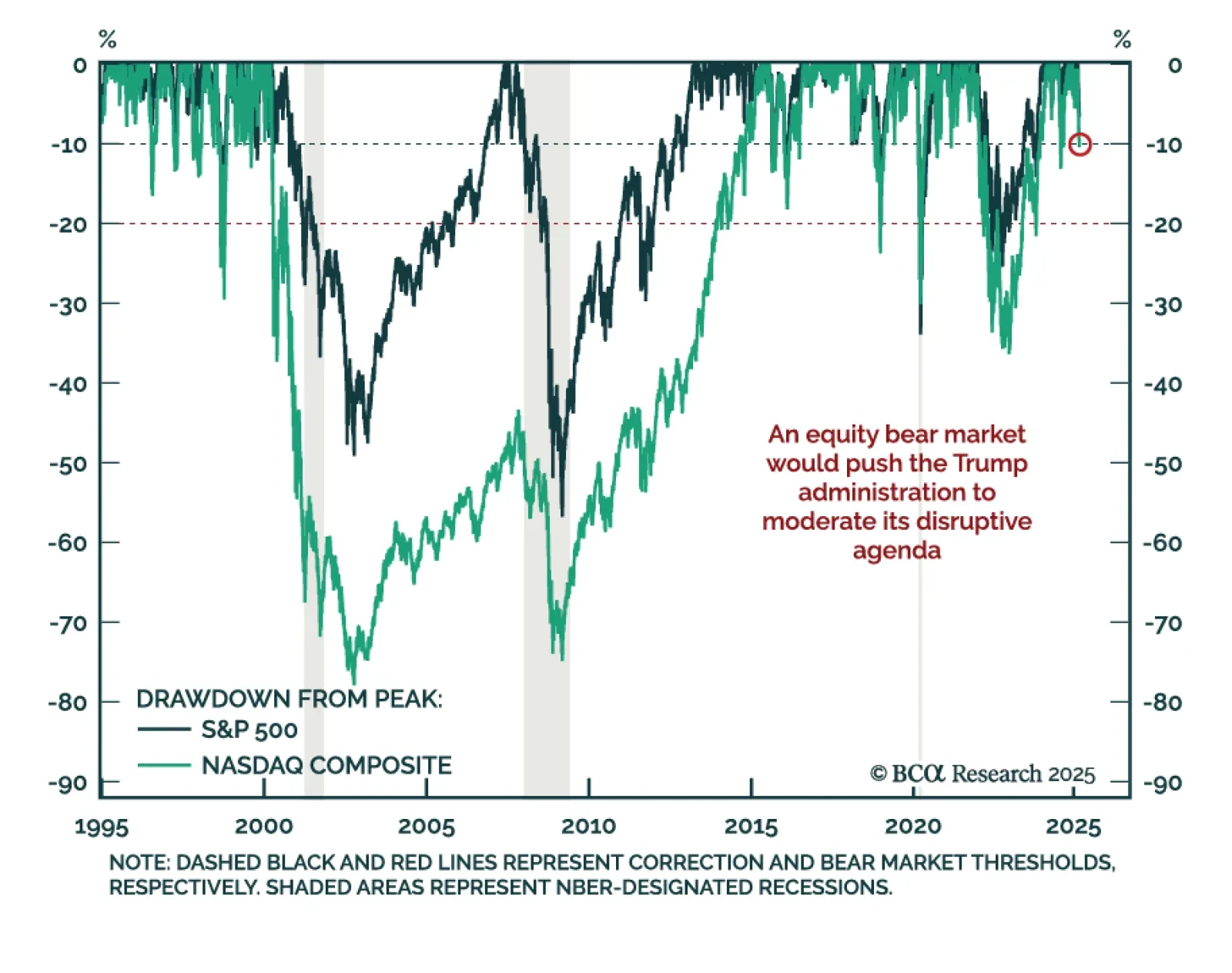

Treasury Secretary Scott Bessent said there is no “Trump put”, and acknowledged the administration’s policy could create short-term pain to achieve long-term gains. The concept of a “market put” implies policymakers would aim to put…

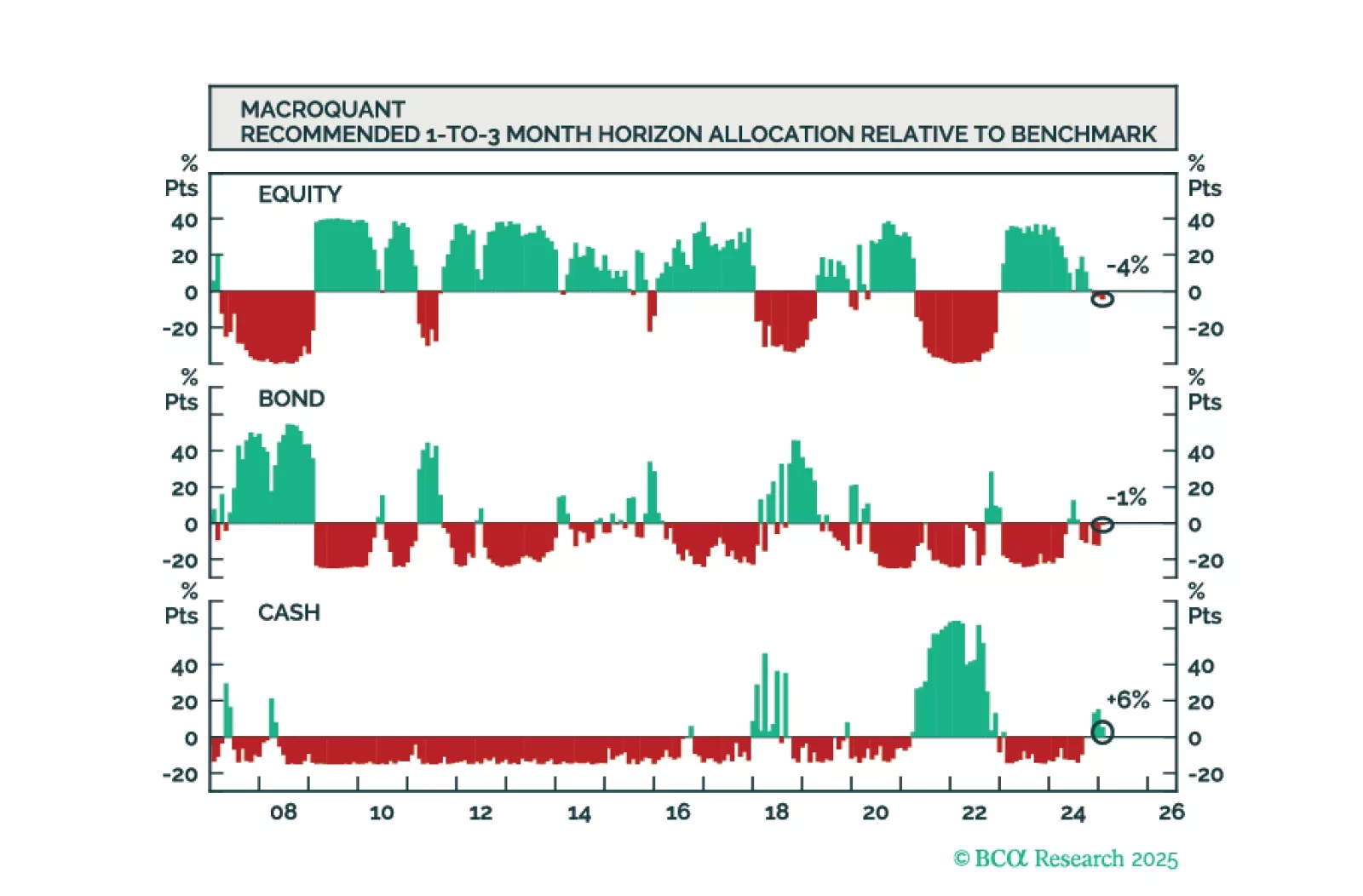

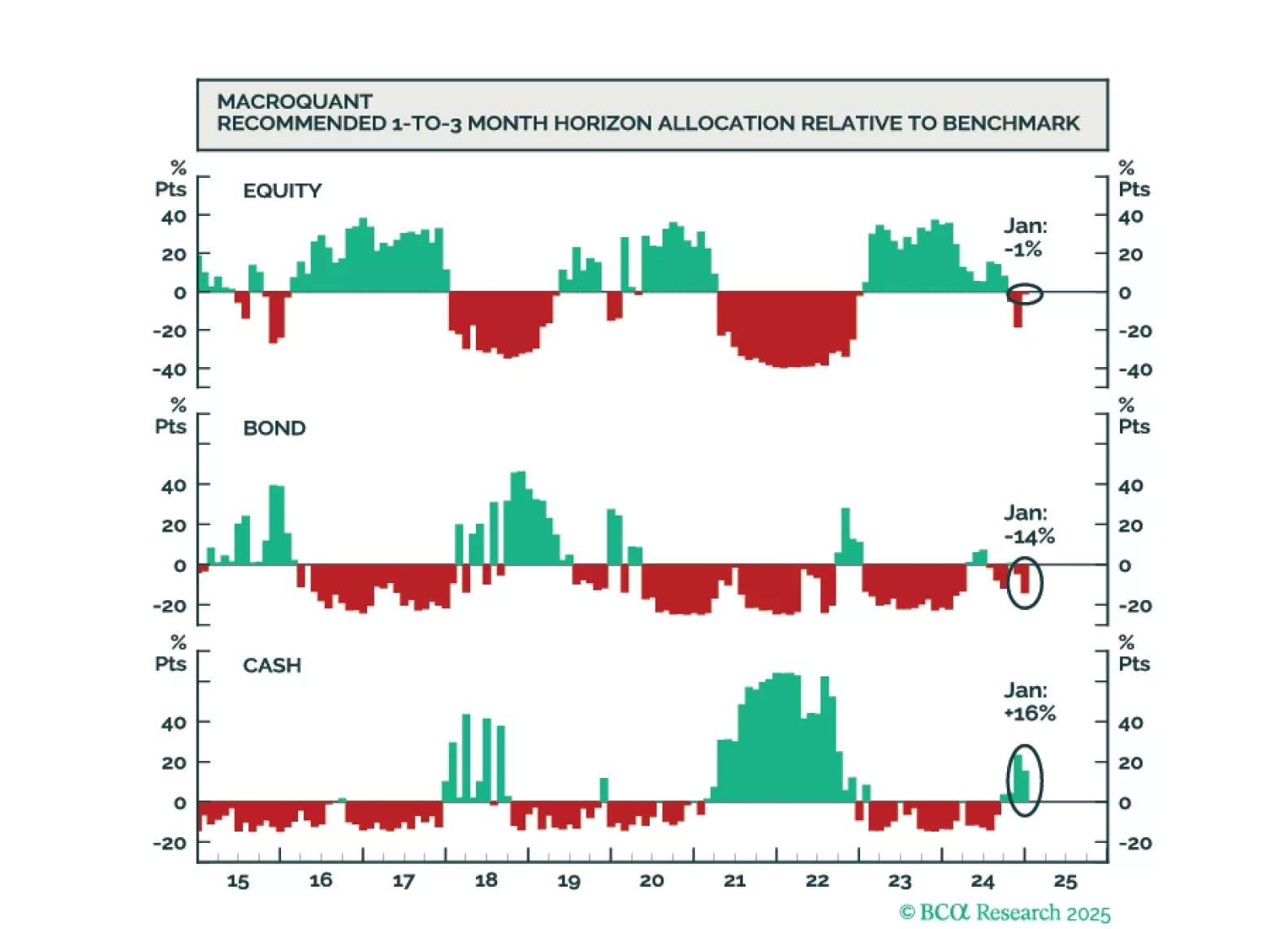

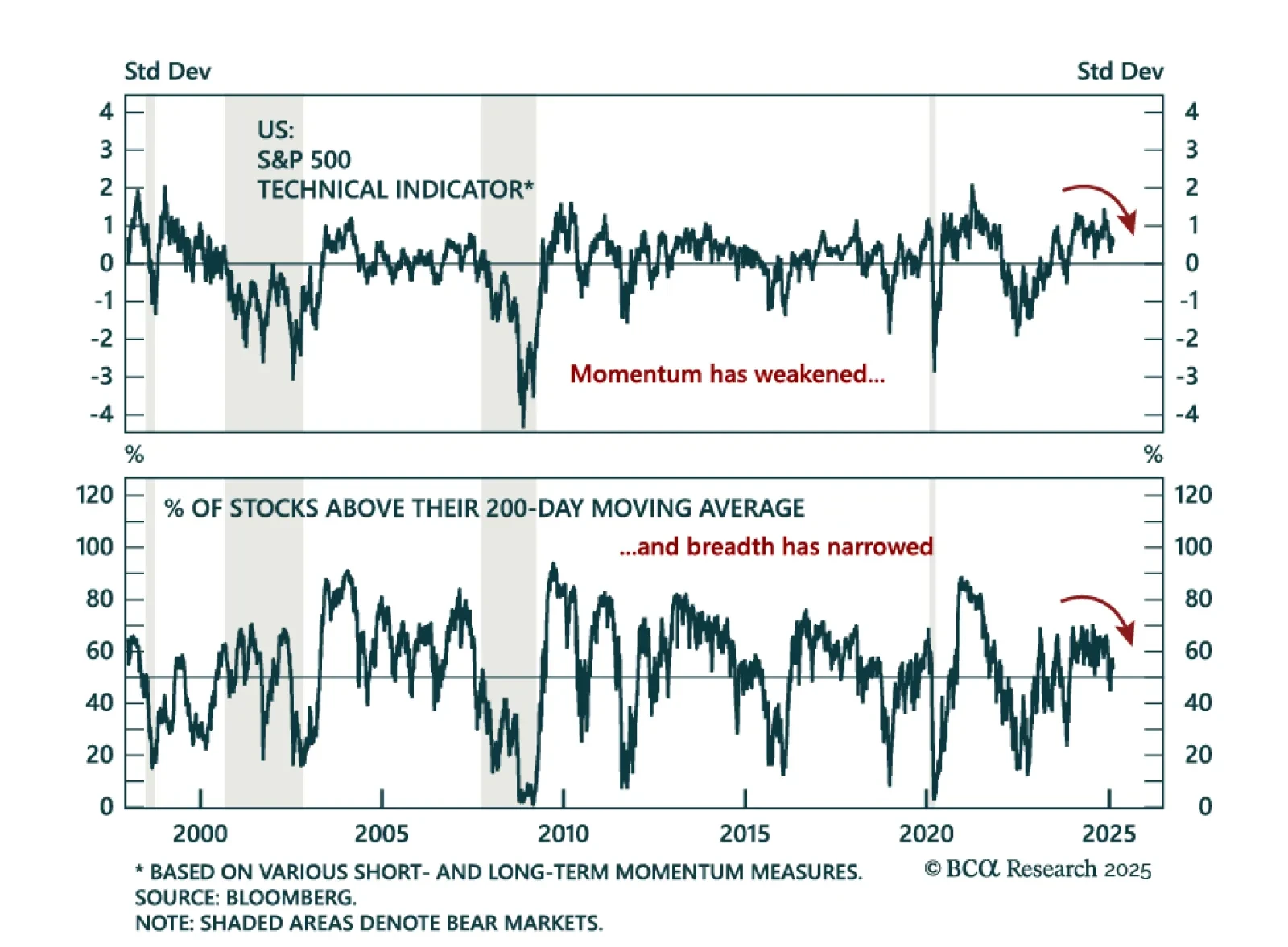

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

Our Chart Of The Week comes from Melanie Kermadjian, from our Global Investment Strategy team. The S&P 500 has been in a bull market for nearly five years and is currently up 2.5% YTD. A lot has been thrown at the US…

While the US economy could remain upright on the tightrope for a while longer, it will inevitably fall, leading to a major bear market in stocks. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

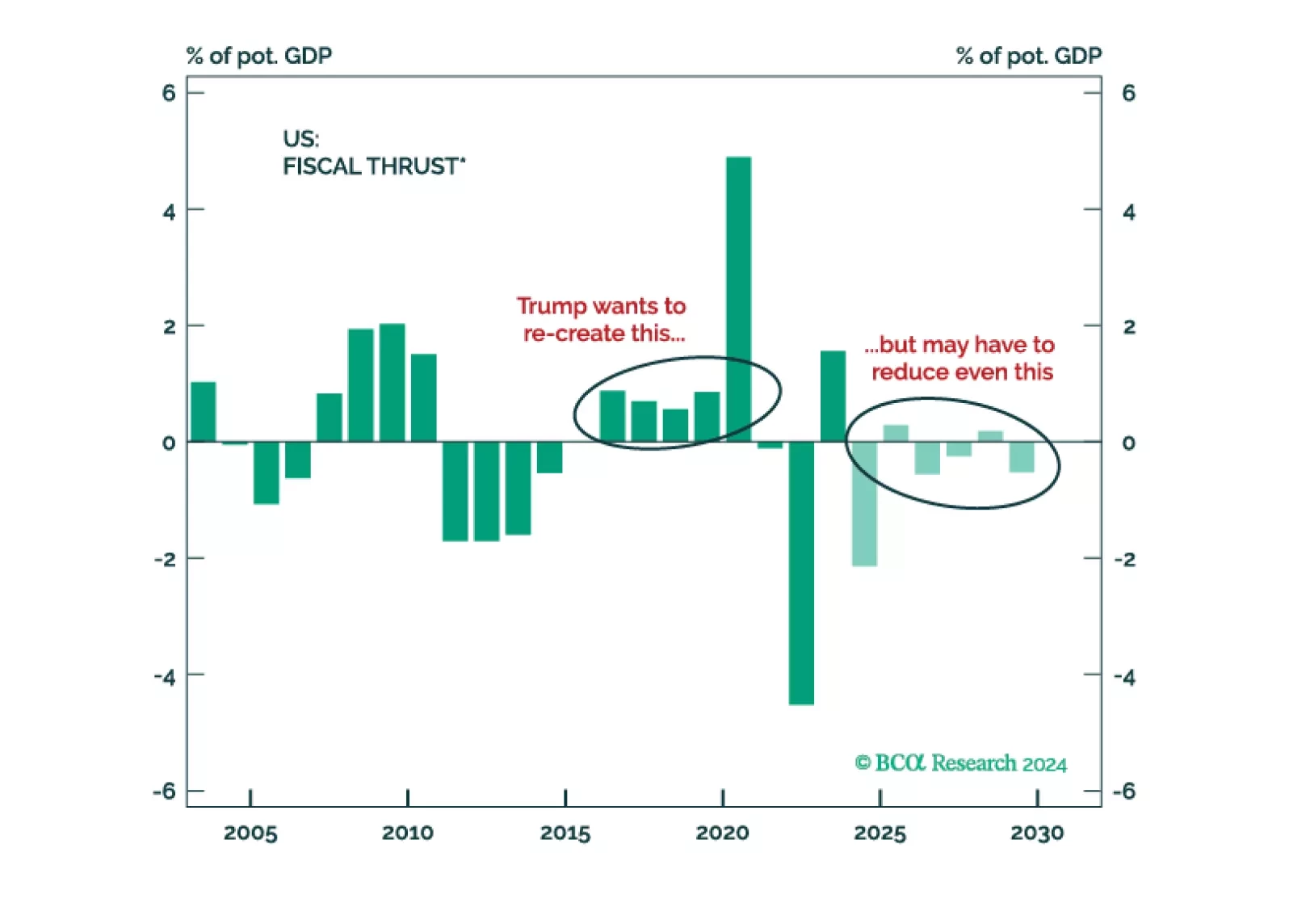

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

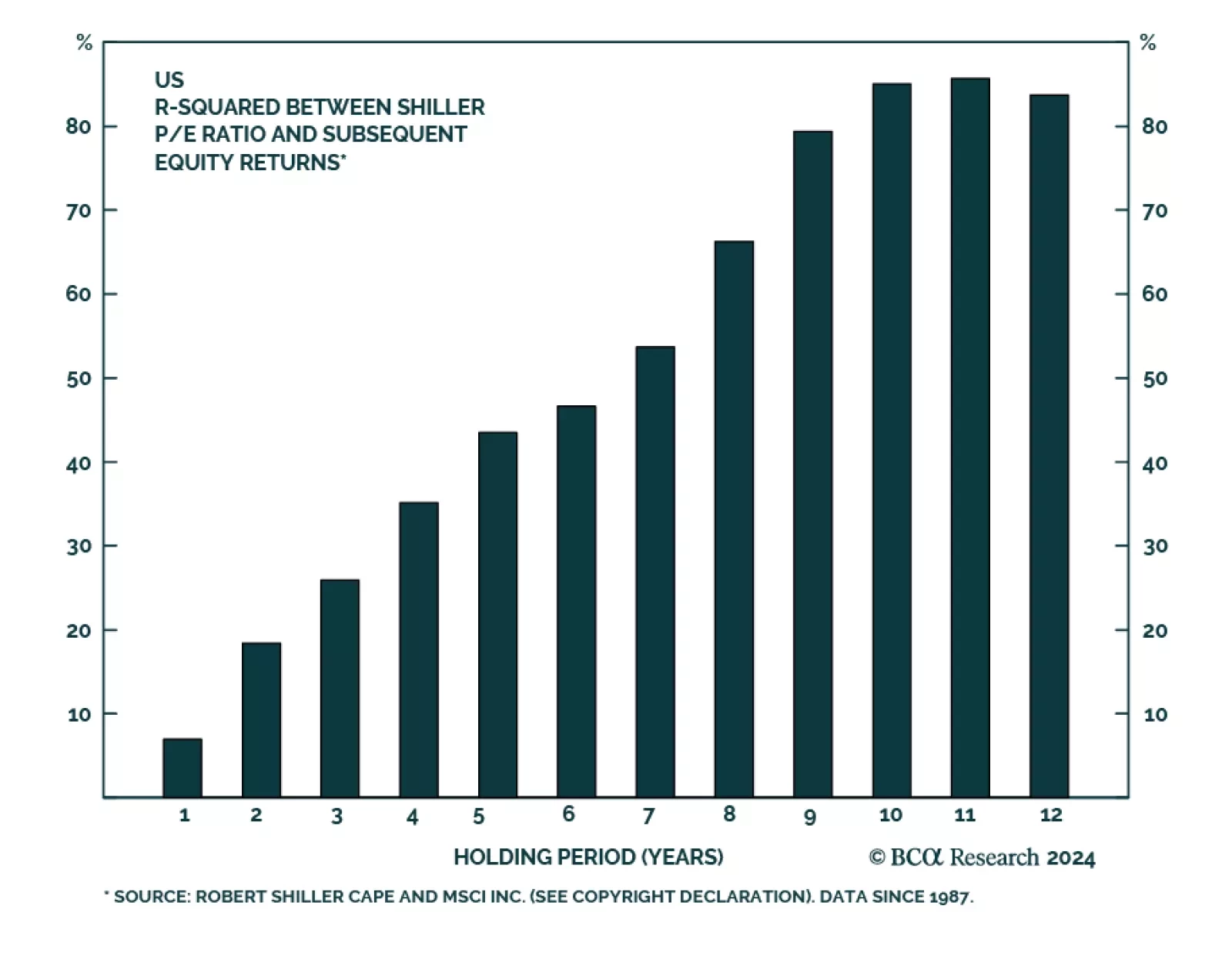

Elevated US equities valuations and their impact on returns are a hot topic right now. Valuations are not a tactical or cyclical timing tool, but they help predict long-term returns. Our Global Asset Allocation Strategy team…