According to the 21st century’s encyclopedia, Wikipedia, “a domino effect or chain reaction is the cumulative effect produced when one event sets off a chain of similar events…It typically refers to a linked…

Highlights Did October's equity rout ... : Before bouncing back in its final two sessions, October was the S&P 500's 12th-worst month of the postwar era. ... represent a watershed for financial markets?: Shaken investors…

Highlights Investors are worrying too much about the things that caused the global financial crisis, and not enough about those that could cause the next downturn. Despite the recent patch of soft data, the U.S. housing market is in…

Dear Client, You will see in this Monthly Portfolio Update that we have expanded our table of Recommendations to include a wider range of the views that Global Asset Allocation (GAA) regularly discusses in its publications. Please see…

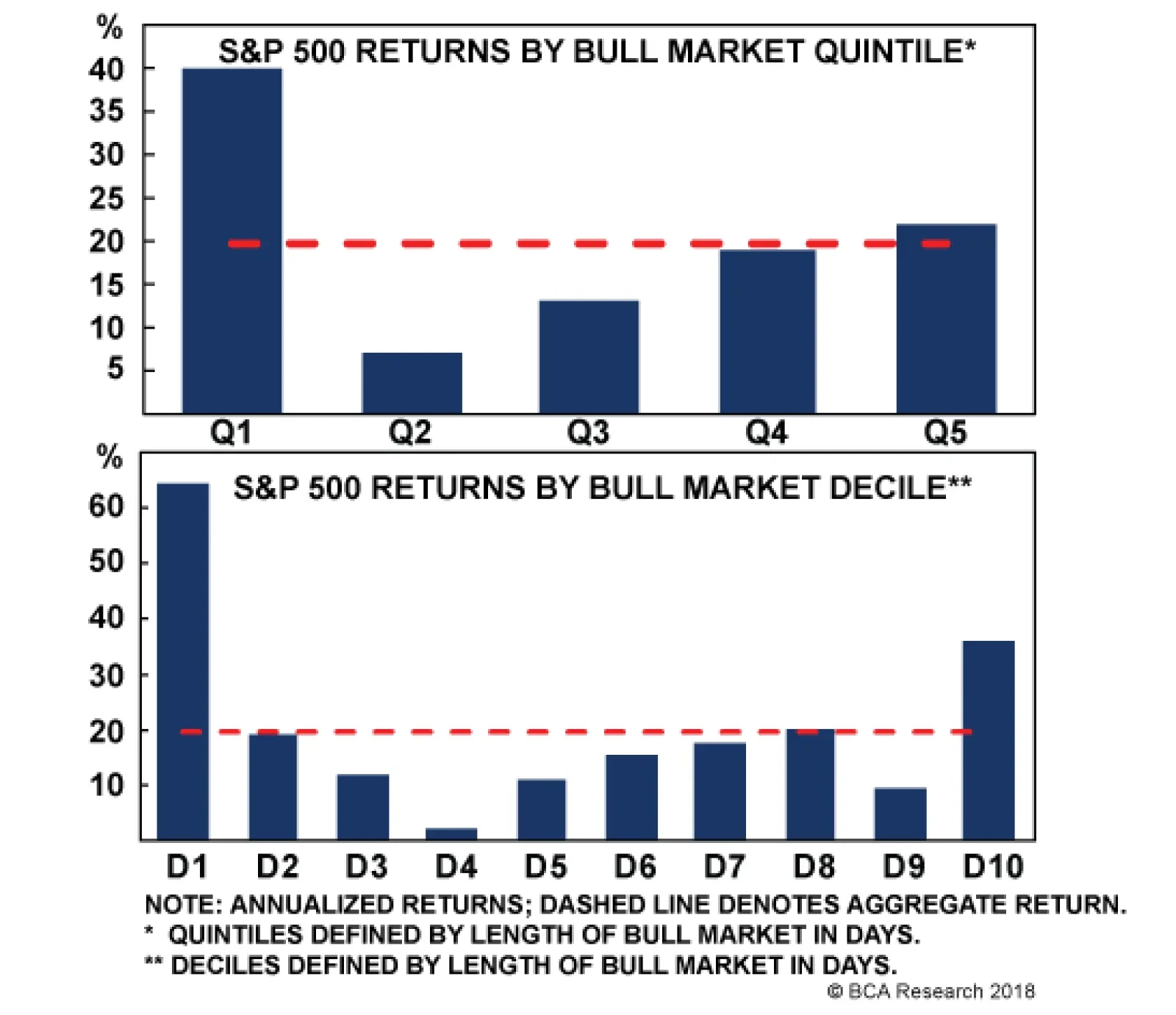

The latter stages of expansions and bull markets can be treacherous. Although we are not concerned about current valuation levels, the S&P 500 isn't cheap. We are encouraged that the forward earnings multiple is nearly…

Each quintile in the chart reflects the aggregate performance over the eight complete bull markets between 1966 and 2007; the first quintile's performance is calculated by linking the advance in the first 104 days of Bull #1…

Highlights The latter stages of expansions and bull markets ought to be jittery, ... : Equities tend to get jumpier in the final stages of equity bull markets, but performance typically improves enough to generate attractive risk-…

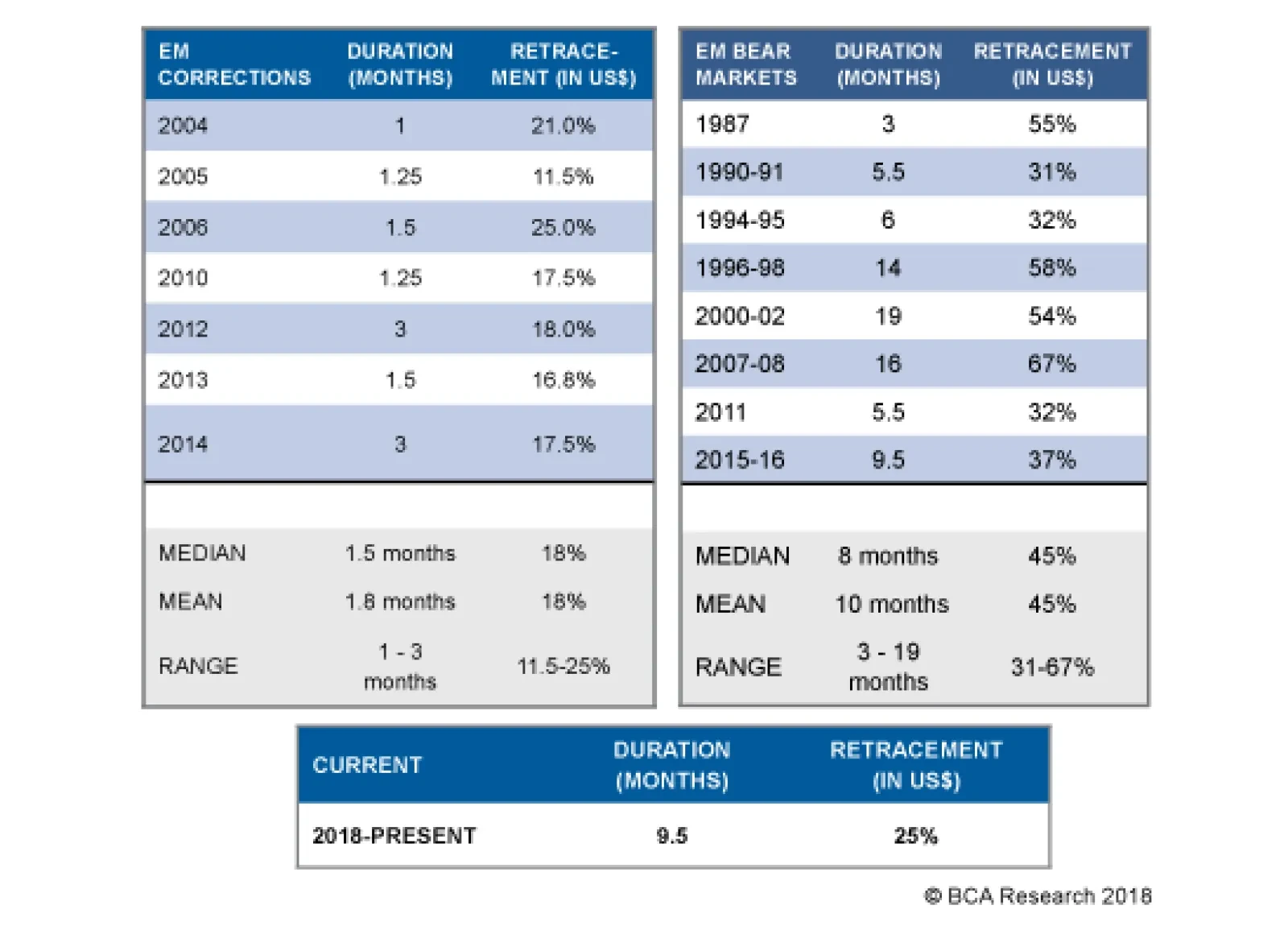

Highlights The correction in global equities is not yet over, but we would turn more constructive if stocks retreated about 6% from current levels. Among the many things bothering investors, the fate of the Chinese economy remains…

Highlights The combination of slower global growth, trade protectionism, Italy's budget crisis, and rising Treasury yields have made U.S. equities increasingly vulnerable to a phase transition from euphoric optimism to a more sober…