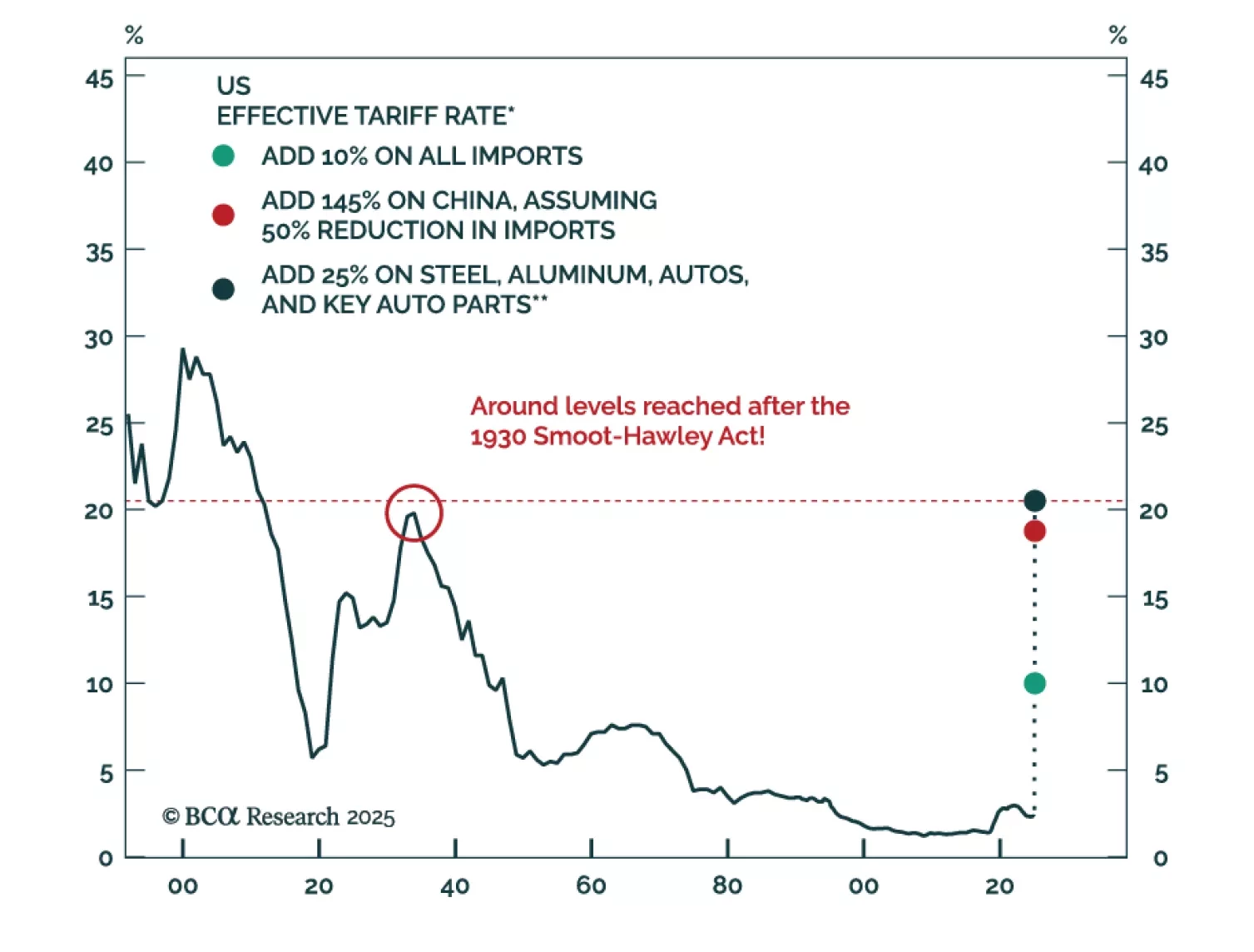

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

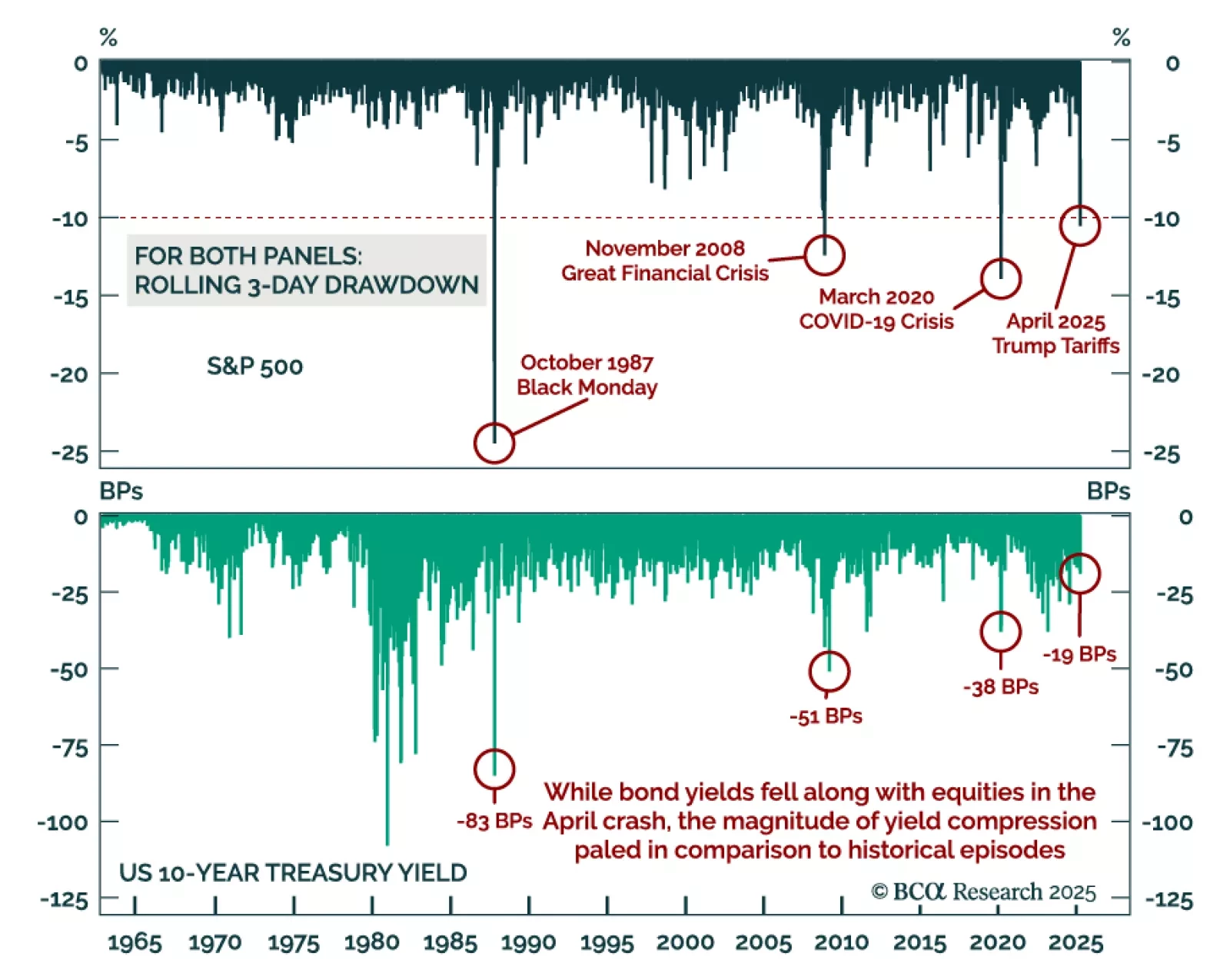

Equities’ post-Liberation Day selloff was historic, but cross-asset signals make it an anomaly. The post-Liberation Day S&P 500’s three-day, 10%+ drawdown joined a list of major episodes that includes the March 2020 COVID-19…

We maintain our defensive positioning as risk assets remain in a lose-lose situation. Monday’s trading session was volatile, and saw a brief rebound on a false headline about a 90-day tariff pause excluding China. The rally partially…

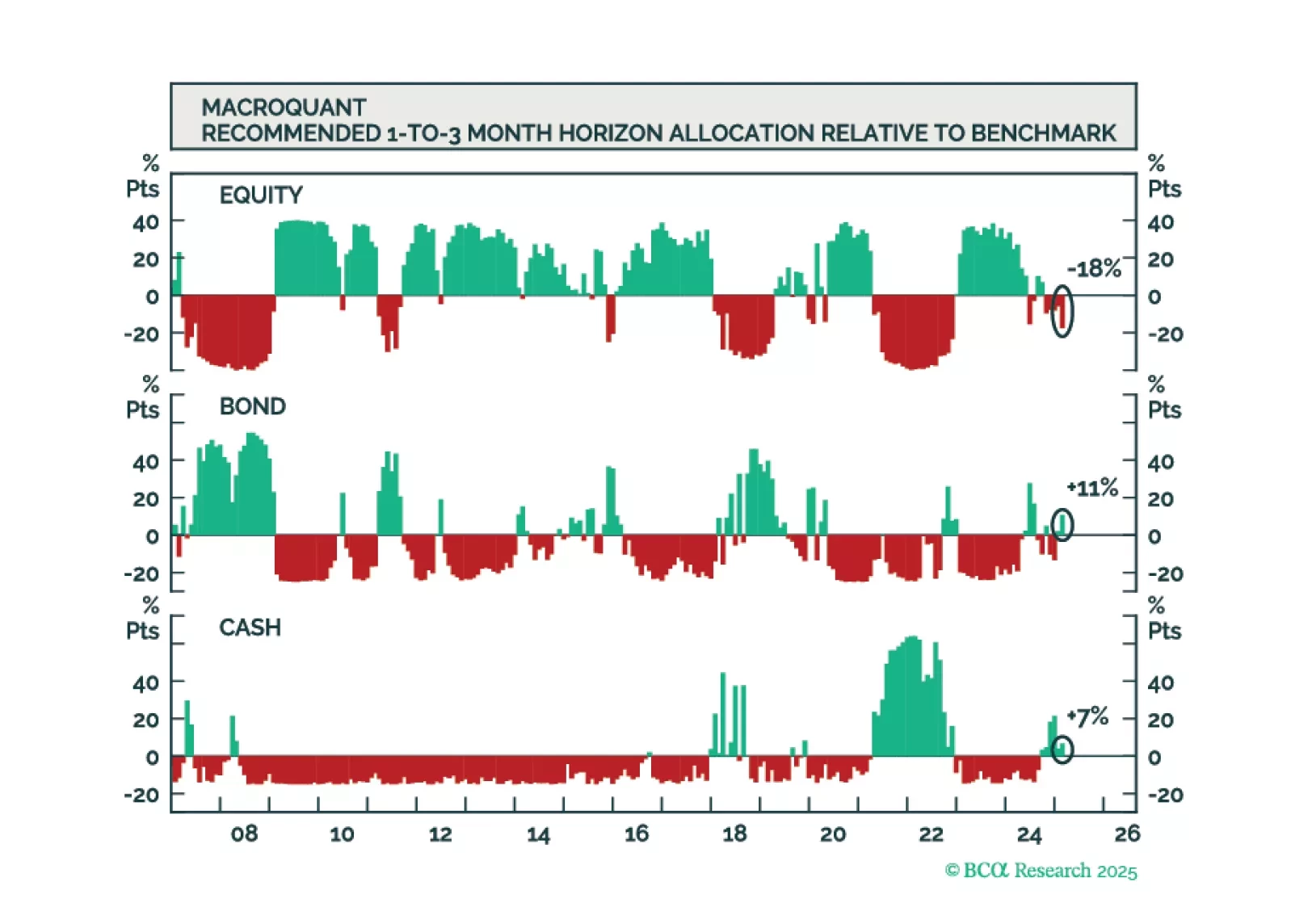

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

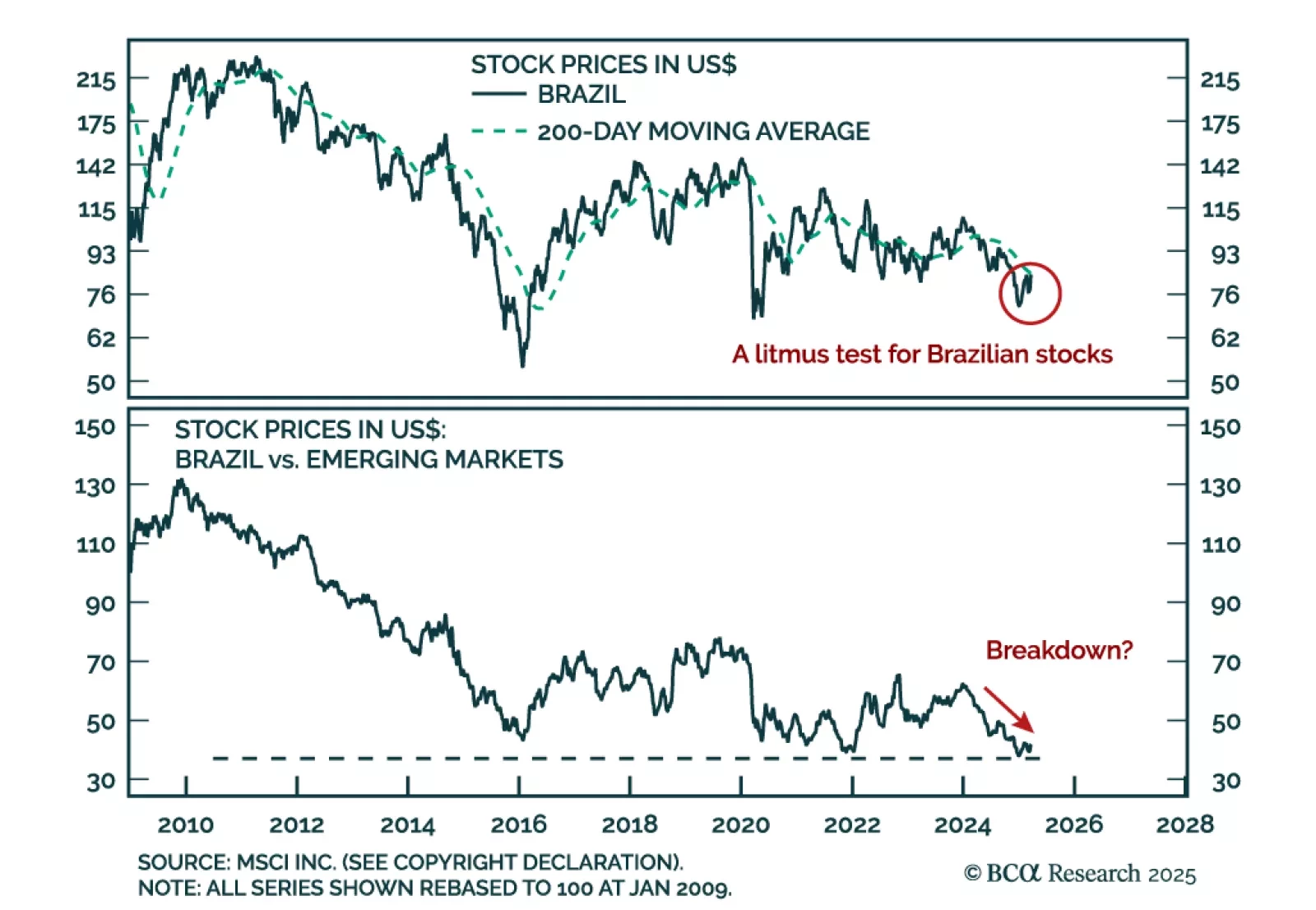

Our Emerging Market strategists downgraded Brazilian equities as public debt dynamics deteriorate and macro fundamentals weaken. While they previously maintained a neutral stance despite being bearish on the Bovespa, the risks have…

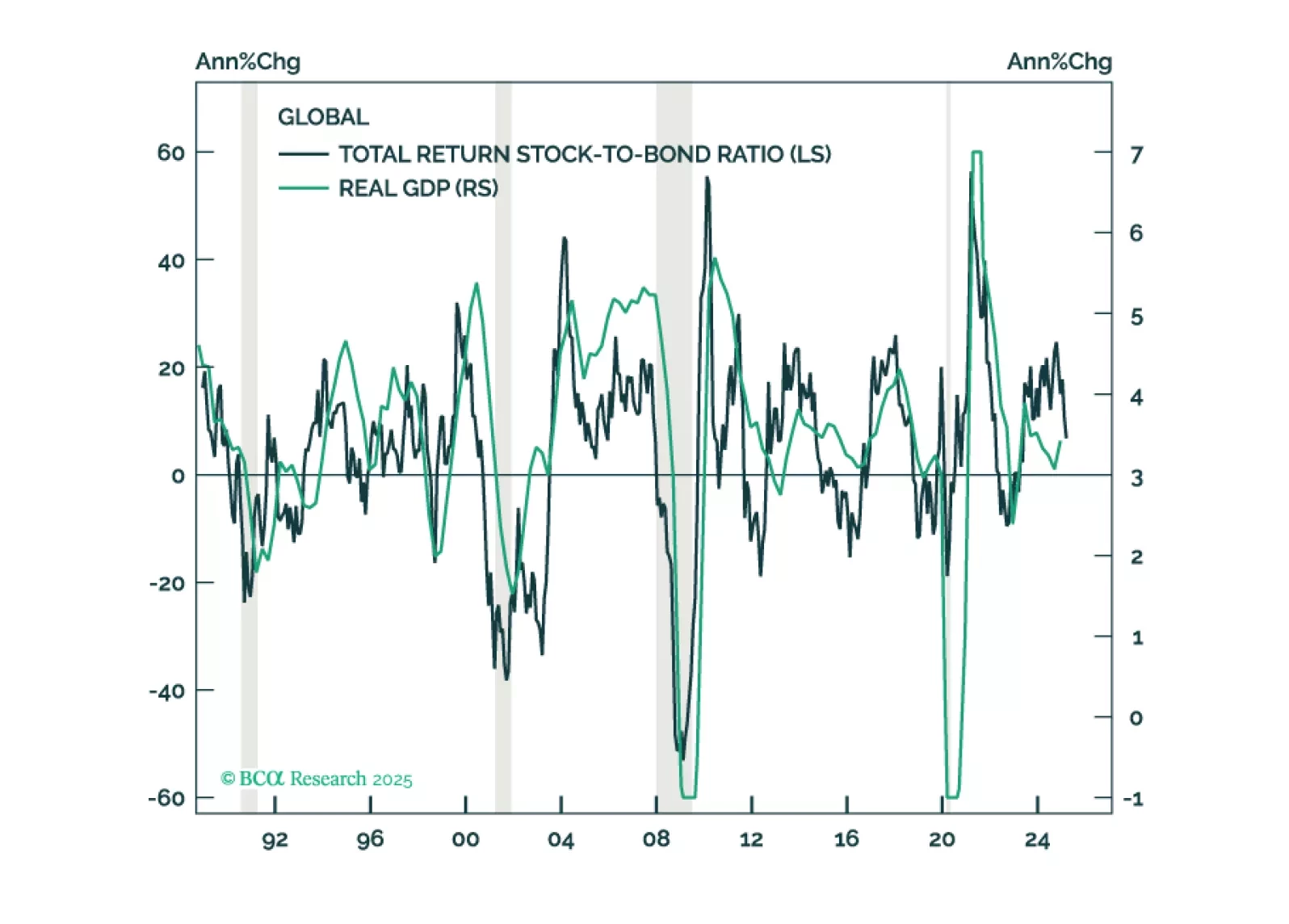

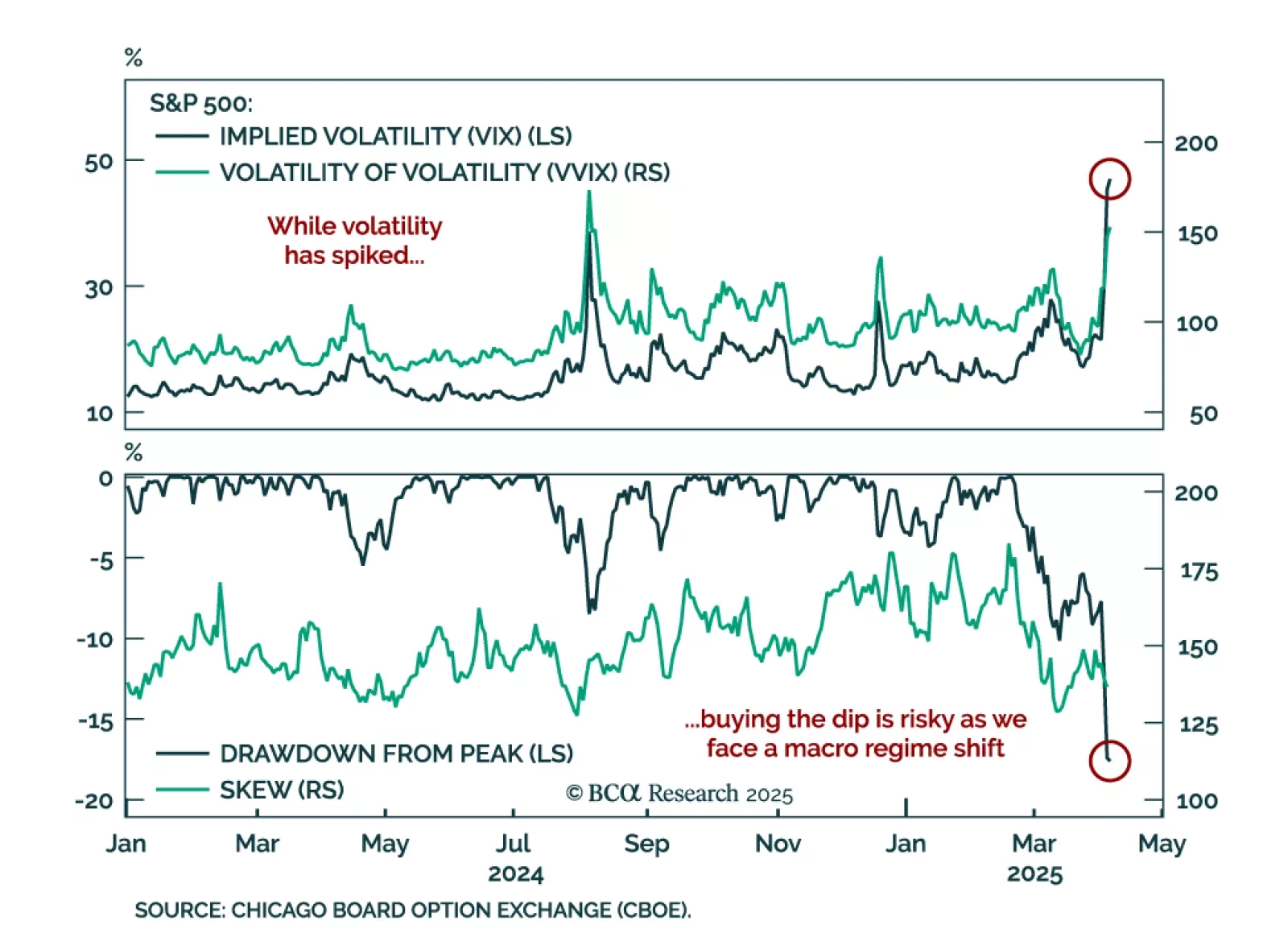

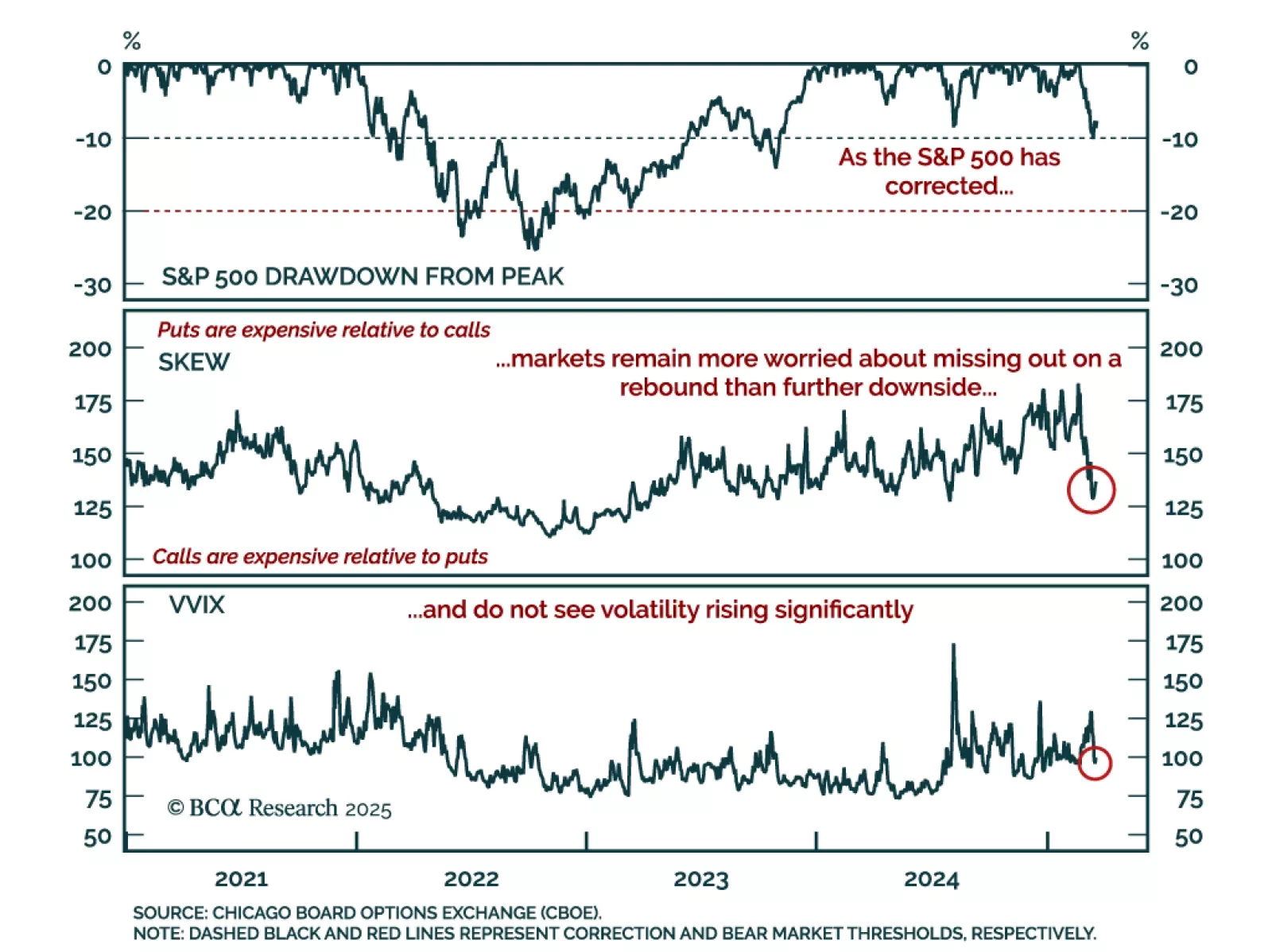

Recent years were marked by US equities rebounding from each drawdown to re-test all-time highs. The best absolute-return strategy has been to “buy the dip” and close your eyes. Is it still the case? The short answer is no, as…

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…

Despite our Global Investment strategists’ bearish stance, their latest report reviews scenarios that could be bullish for equities. Our colleagues remain bearish on equities, expecting a US recession this year. However, several…