Highlights Earnings season concerns will not materialize, … : The energy sector is suffering, but overall third-quarter S&P 500 earnings are comfortably beating consensus expectations and the bears’ worst-case-scenario…

Highlights We still don’t see a recession occurring in the next twelve months, … : Recessions only occur when monetary policy is restrictive. It’s easy now, and it will be a while before conditions push the Fed to…

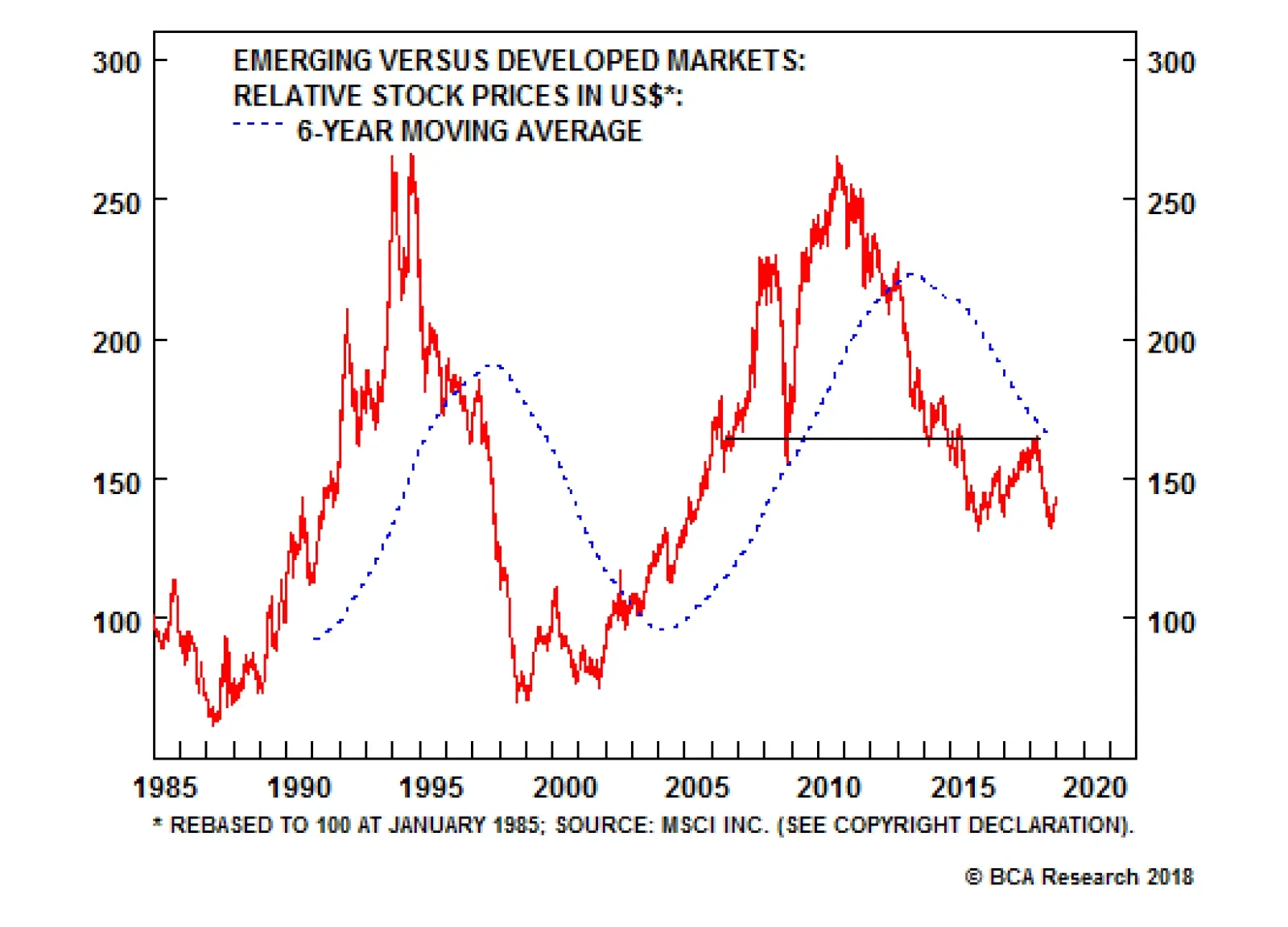

Analysis on Chile is available below. Highlights Major equity leadership rotations normally occur around bear markets or corrections. Hence, a major broad selloff will likely be a precondition for EM, commodities, global cyclicals…

Highlights Analysis on South Africa is published below. The “EM” label does not guarantee a secular bull market. None of the individual EM bourses has outperformed DM on a consistent basis over the past 40 years. EM…

Highlights All the U.S. data look broadly similar to us, …: The data series are decelerating, one by one, but they generally remain at a fairly high level relative to history. … and we have begun sounding like a broken…

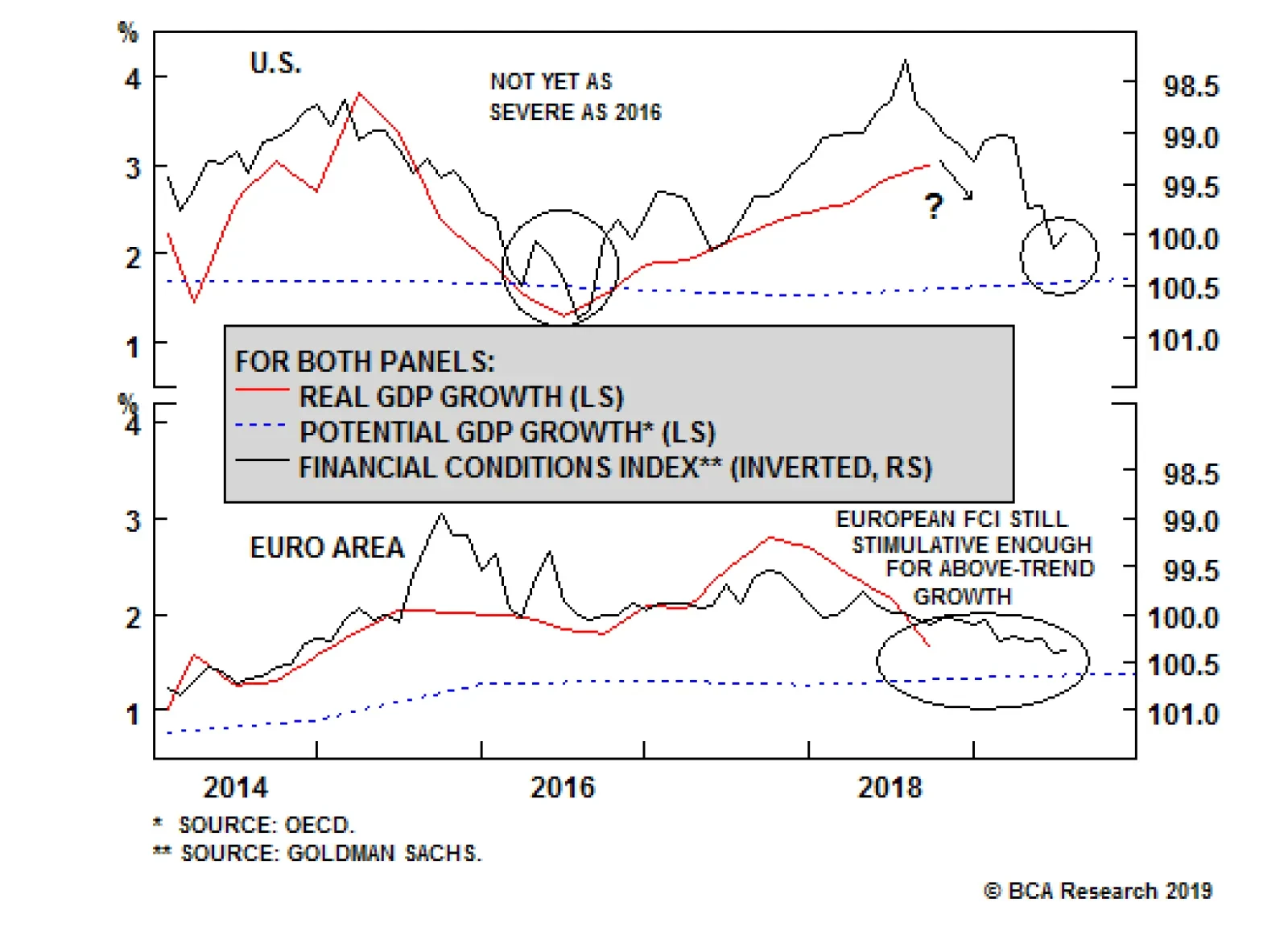

Highlights Hyman Minsky famously said that “stability begets instability.” The converse is also true: Instability begets stability. None of the preconditions for a U.S. recession are in place yet. The Fed’s decision…

Question Three: Have central banks become less concerned about financial market selloffs? The idea that central banks have fallen “out of tune” with financial markets has spooked investors who fear that…

Dear Client, This Wednesday January 9th 2019, we are publishing a joint report co-written with BCA’s Geopolitical Strategy team. There will be no report on Friday. Best Regards, Mathieu Savary, Vice President Foreign…

As we head into 2019, the past decade is shaping up to be a lost one for emerging markets (EM) assets. In particular: EM stocks have substantially underperformed DM equities since the end of 2010. In absolute terms, EM shares…

Highlights Downside risks to EM assets remain substantial. Stay put. EM stocks, credit and currencies will underperform their DM counterparts in the first half of 2019. The key and necessary condition for a new secular EM bull market…