Highlights Underweighting T-bonds, tech versus the market, growth versus value, new economy versus old economy, and US versus the euro area are all just one massive correlated trade. Get the direction of the T-bond yield right, and you…

Highlights A positive backdrop still supports a cyclical bull market in Chinese stocks, but the upside in prices could be quickly exhausted. Investors may be overlooking emerging negative signs in China’s onshore equity market.…

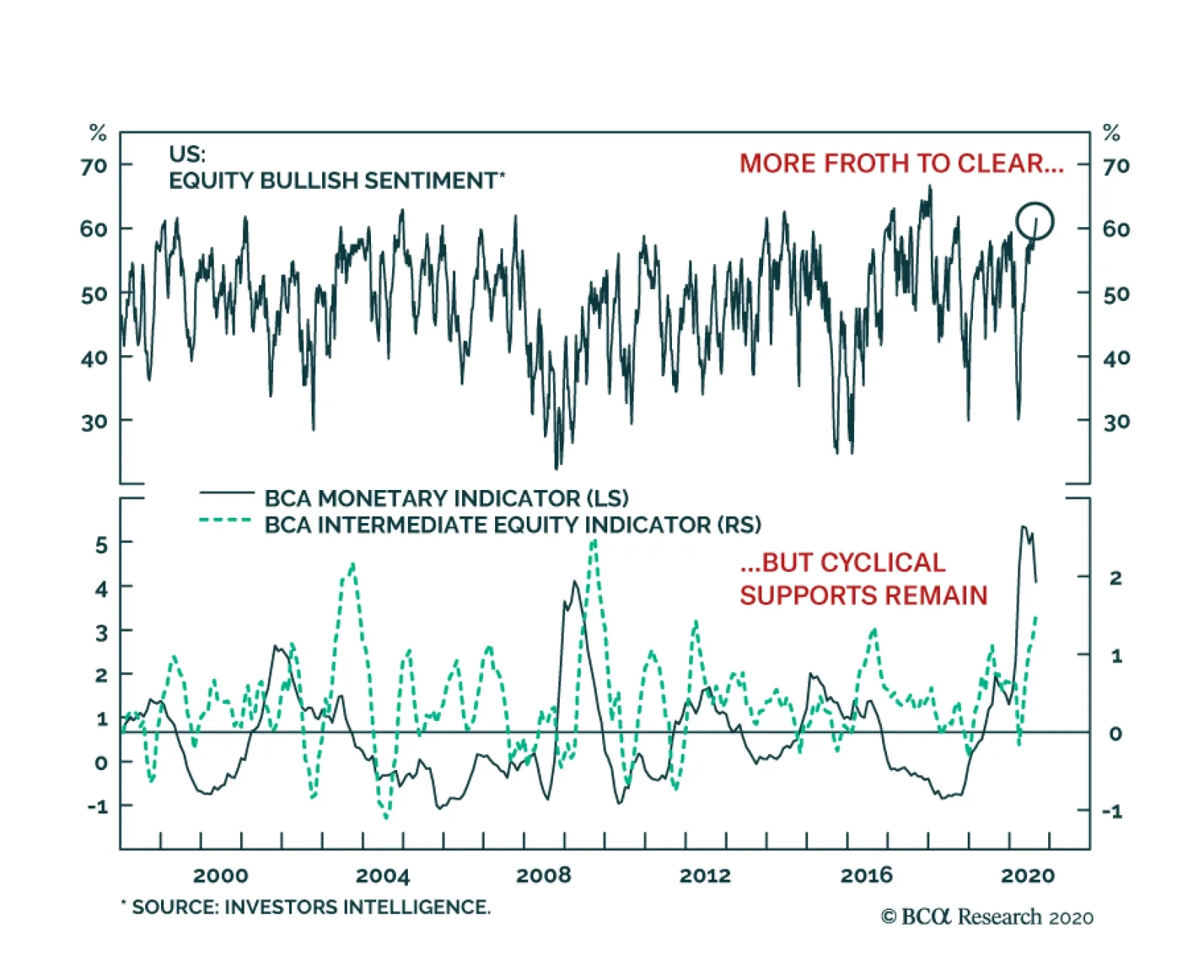

The recent market selloff continues to bear the mark of a correction. A pullback had become nearly unavoidable. Growth stocks had moved vertically and reached furious valuations. Yet, bond yields were not declining anymore. The…

Highlights US Dollar: The overvalued US dollar is finally cracking under the weight of aggressive Fed policy reflation and non-US growth outperformance coming out of the COVID-19 recession. The US dollar weakness has more room to run,…

Highlights Chinese stocks are still in the “public participation phase” of a cyclical bull market and have not yet reached the “excess phase.” Economic fundamentals should provide support for more upside in…

Highlights A clear U-turn in markets could make investors more conscious of losses, making them likely to sell. Hence, the fear-of-missing-out (FOMO) rally could turn into a fear-of-losing-out, or FOLO selloff. The P/E ratio is…

Highlights Recommended Allocation The coronavirus pandemic is not over. Enormous fiscal and monetary stimulus will soften the blow to the global economy, but there remain significant risks to growth over the next 12 months…

Highlights Should the DXY fail to breach below 92 in the coming months, momentum will be a risk to our short dollar positions. Another risk is valuation. The trade-weighted dollar is expensive, but not overly so. It is not especially…

In this Monday’s Special Report, we examined which S&P 500 GICS1 sectors have historically benefited from a falling greenback. Currently, piling evidence suggests that the path of least resistance will be lower…