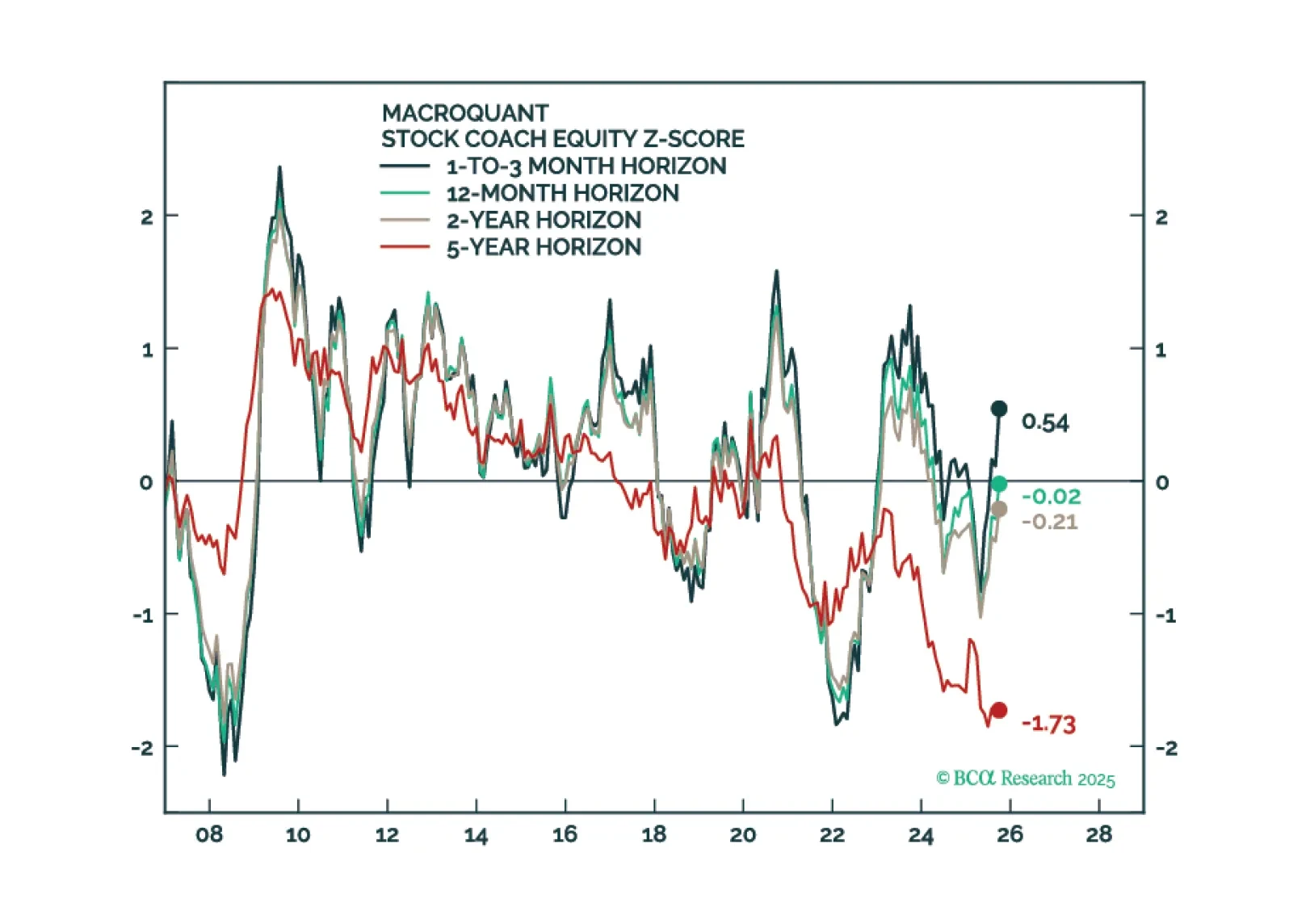

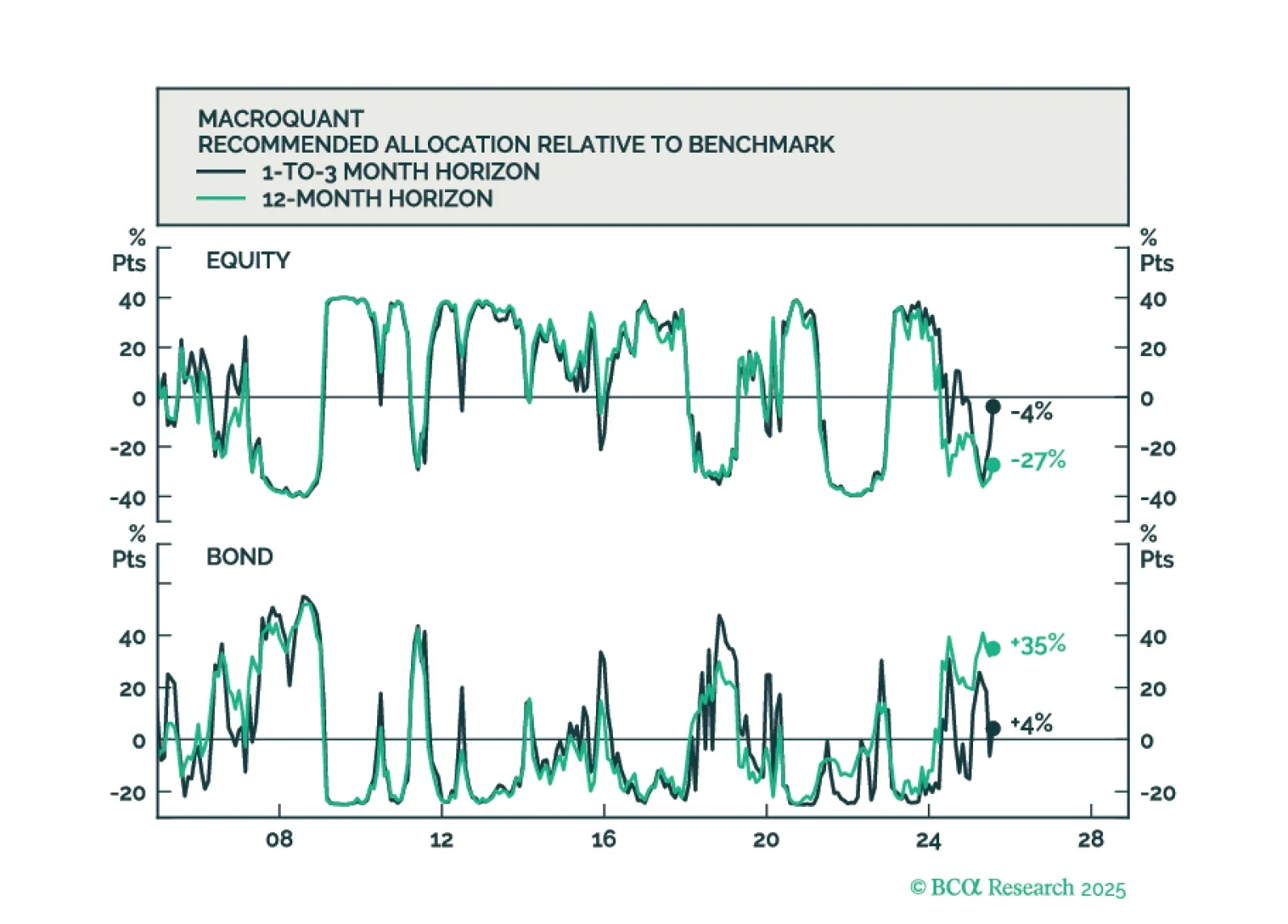

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

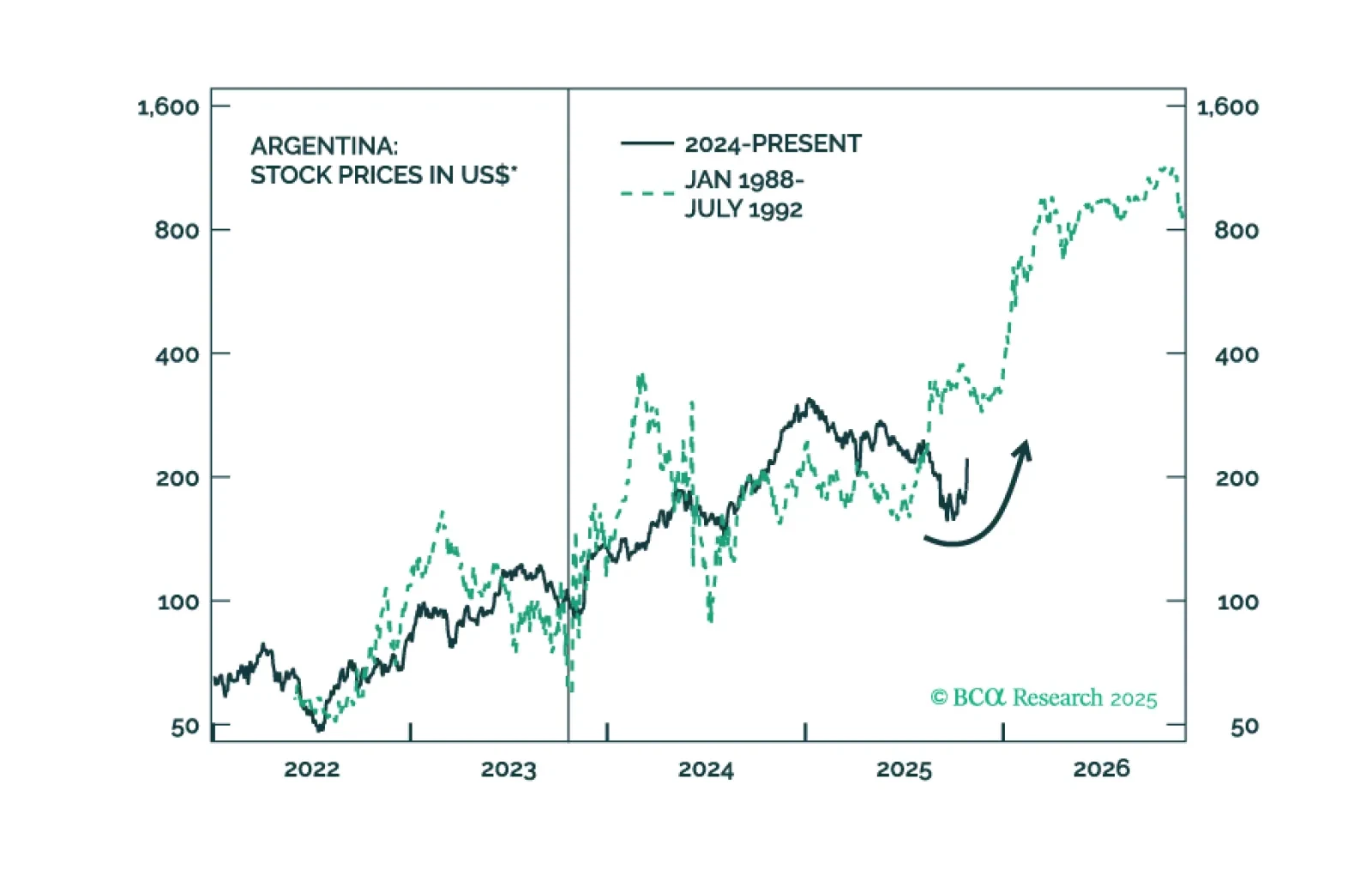

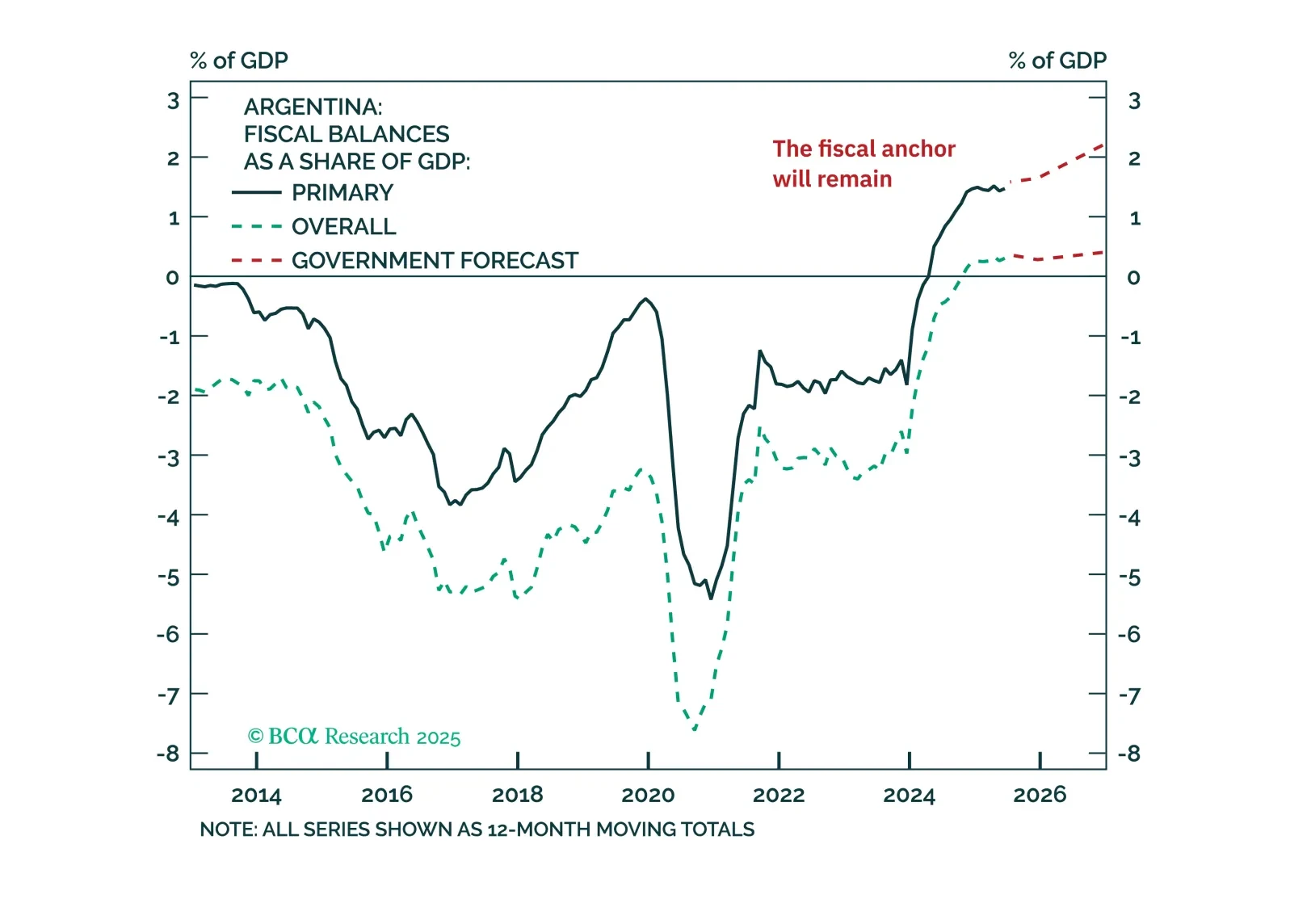

President Javier Milei’s electoral win has massively outperformed expectations. Meaningful legislative support and renewed market confidence will revitalize his liberalizing economic program. Our recommendation not to sell Argentine…

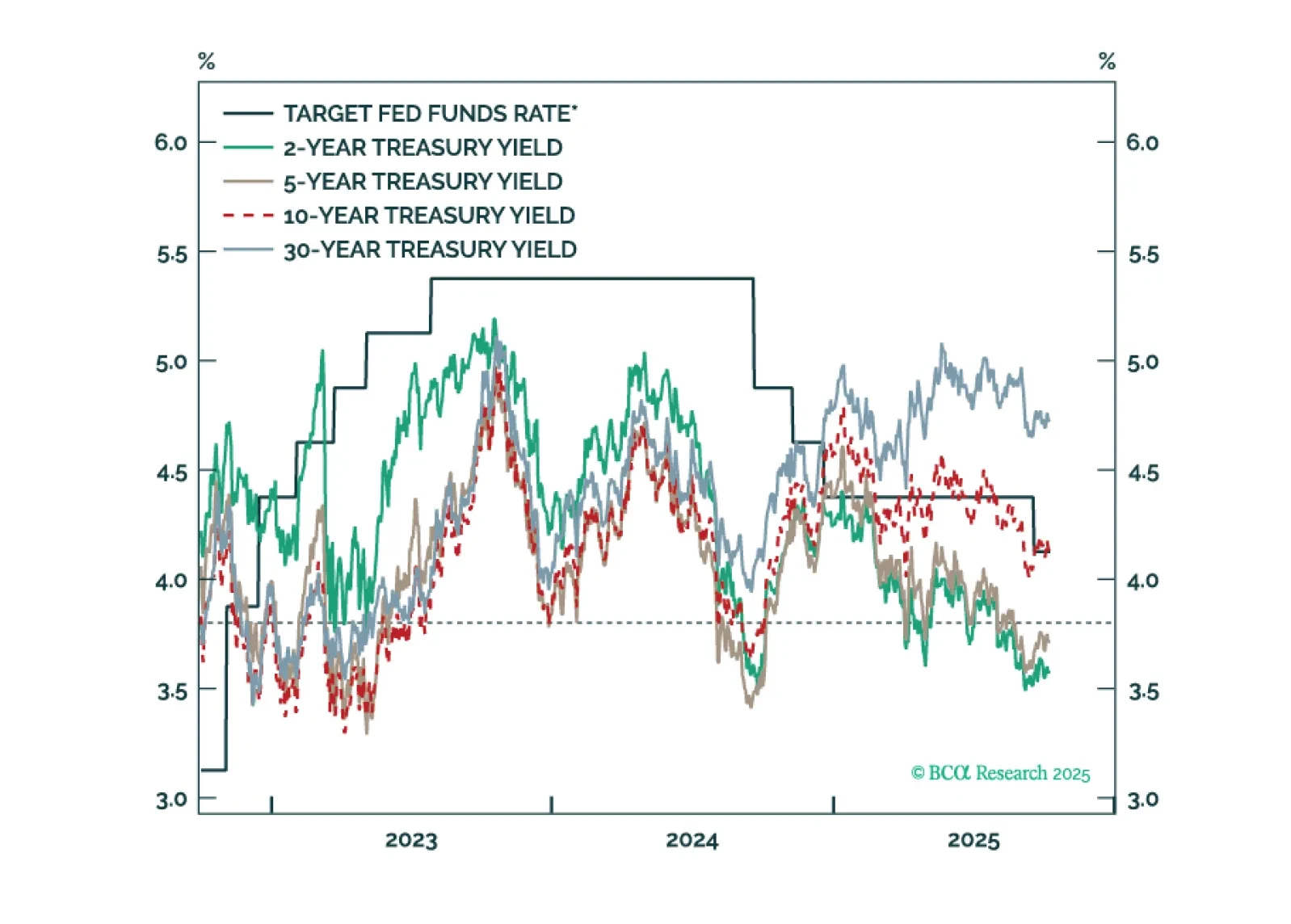

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.

Despite talk of September seasonality, the S&P 500 has not pulled back, and the pain trade remains higher. The sell-off many expected failed to materialize. Positioning is not stretched, and in an environment where dip-buying…

The Buenos Aires election results are a setback for the government's political momentum, but not the endgame. Our long-term bullish view remains in place, but short-term investors should stay on the sidelines in the near run.

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

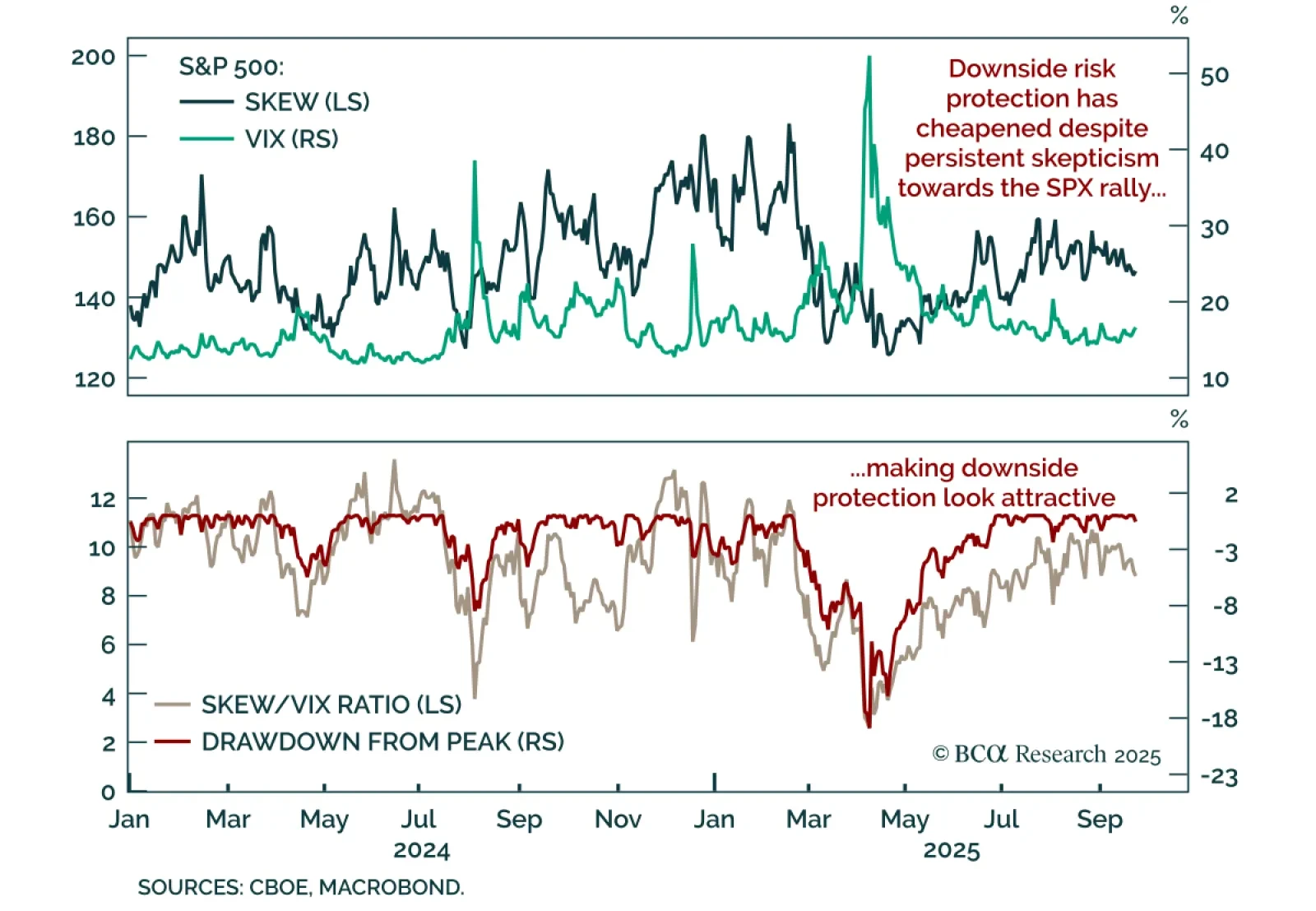

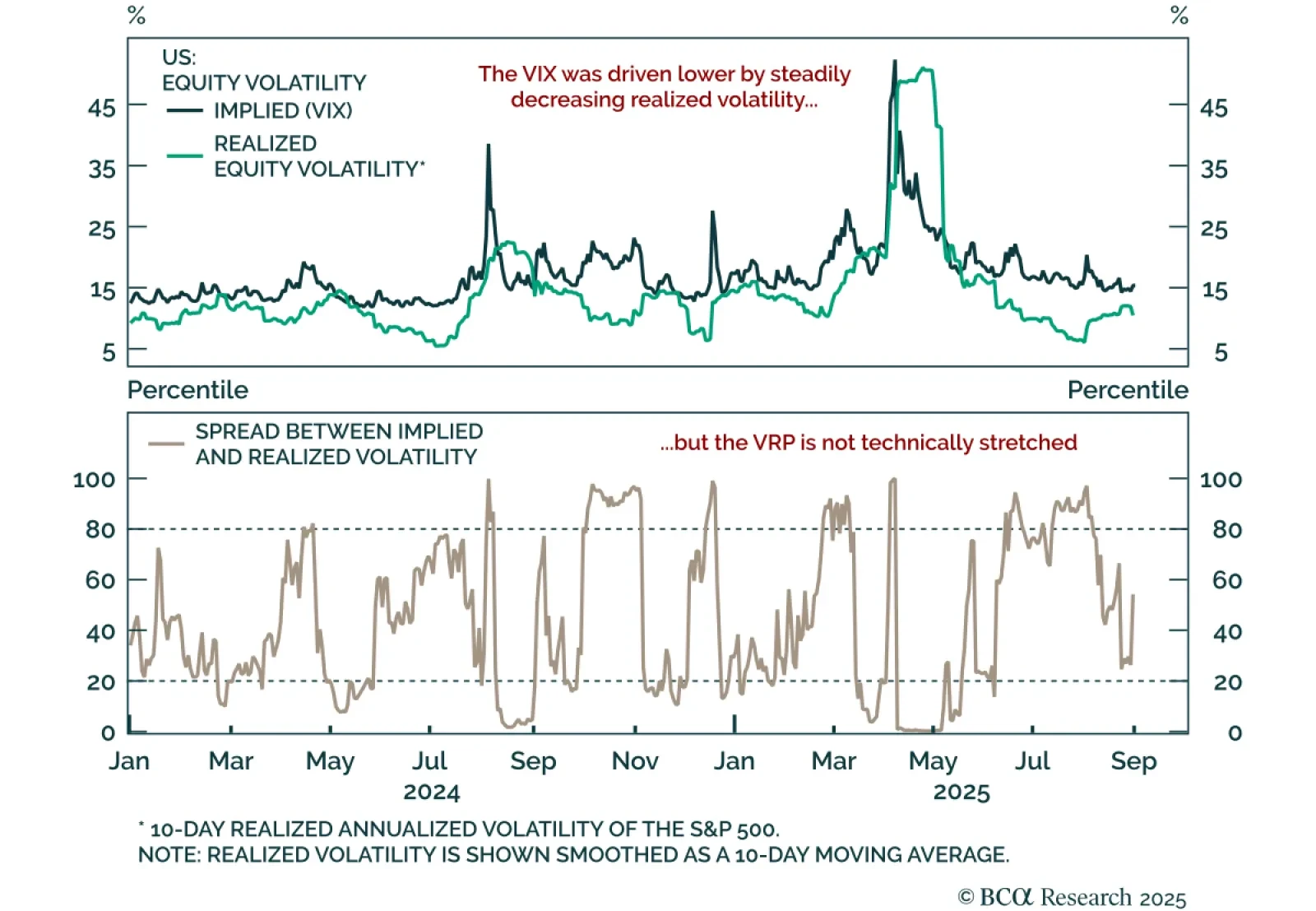

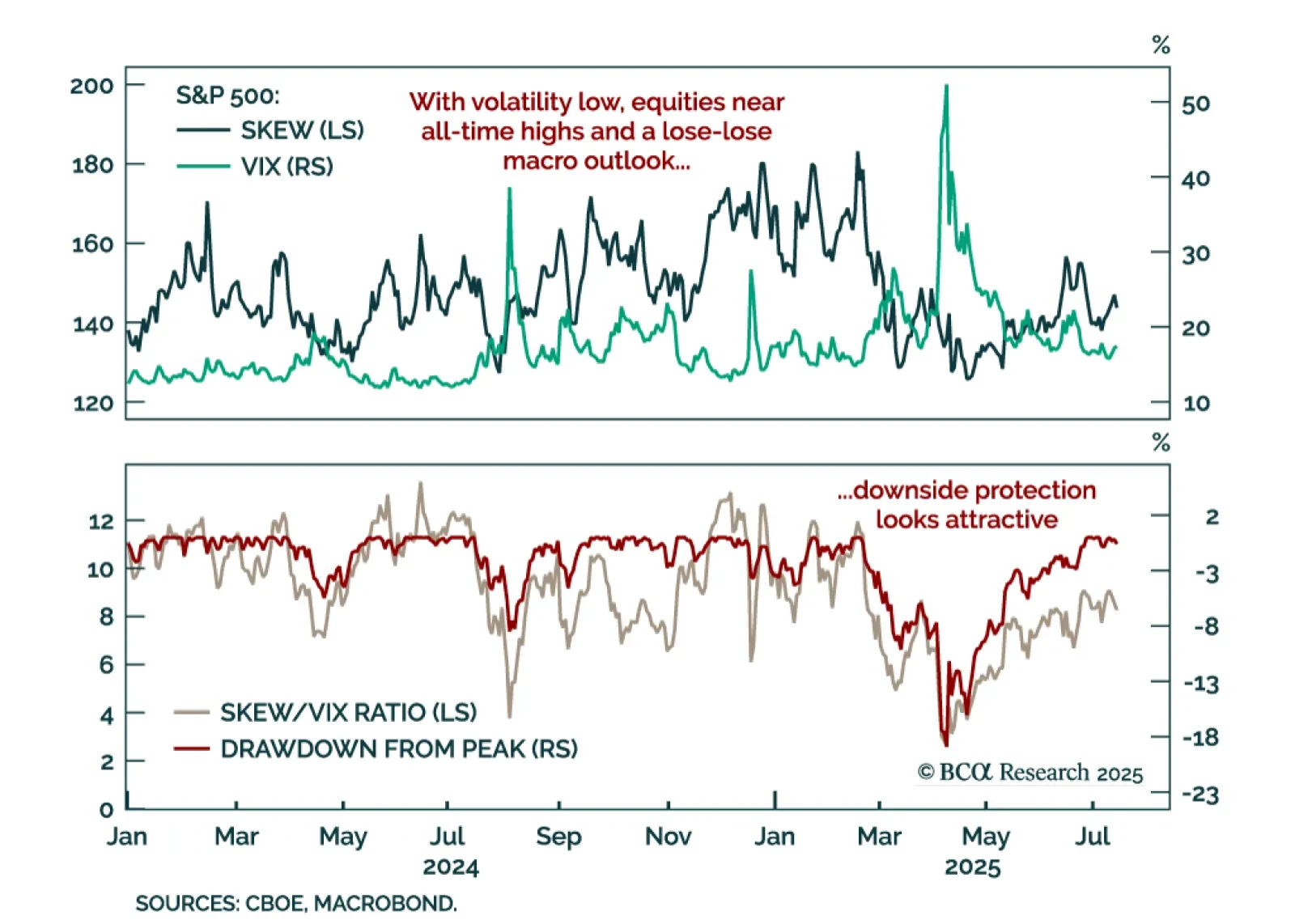

A smooth S&P 500 rally has crushed volatility, but stretched signals argue for buying protection. The index has climbed back to all-time highs with almost no drawdown, producing a steady decline in realized volatility. This…

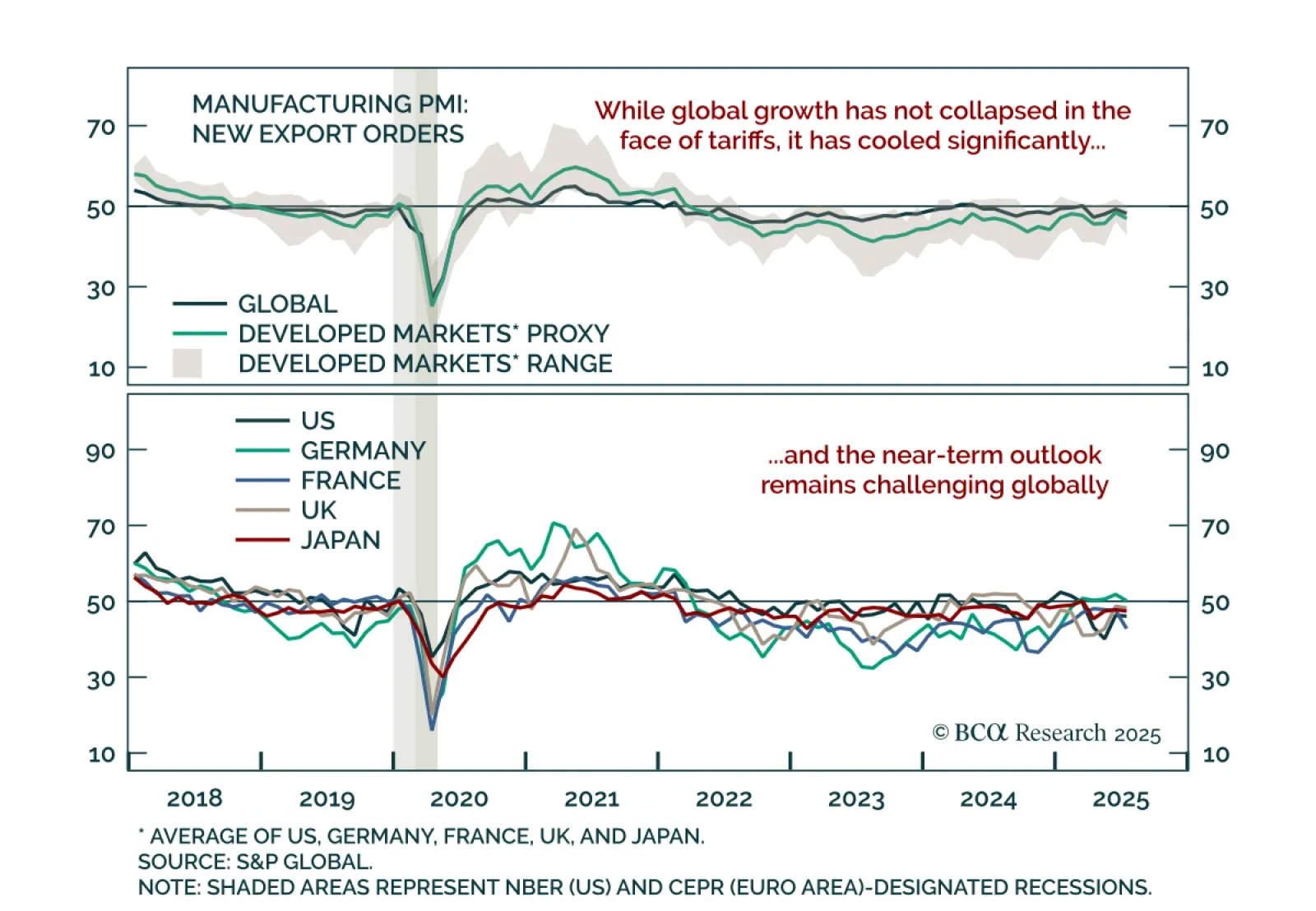

In response to trade uncertainty, global growth is cooling but not collapsing, supporting a cautious near-term view on risk assets. Trade disruption earlier this year raised fears of a global recession, but the data so far point…

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

The S&P 500 sits near all-time highs, but sentiment and positioning suggest euphoria has not driven this rally. Prices are elevated, yet the SKEW/VIX ratio sits at 8.3, or its 67th percentile. While not at extreme levels…