On Monday, Moody’s downgraded the credit ratings of 10 small to mid-sized US banks and placed some of the biggest US banks on downgrade watch. The latter include Bank of New York Mellon, US Bancorp, State Street, and Truist…

The latest round of earnings calls from the systemically important banks suggested that the expansion is still intact. Households are still flush and still spending and consumer and business delinquencies remain remarkably low.

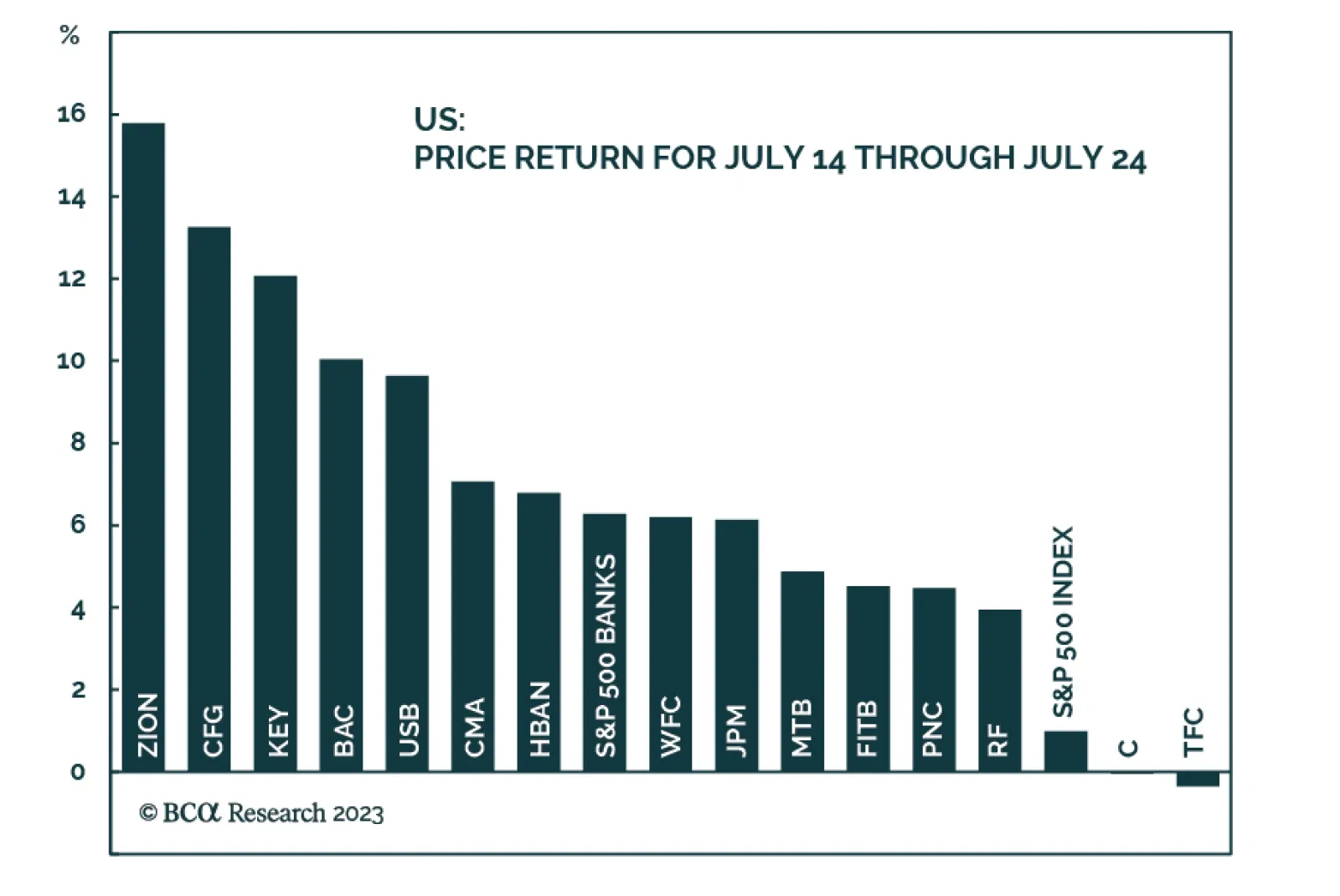

Equity investors resoundingly approved of the large-cap banks’ second-quarter earnings reports: in the seven sessions since C, JPM and WFC kicked off 2Q23 earnings on July 14th, the S&P 500 Banks Index rose 6.3% to the…

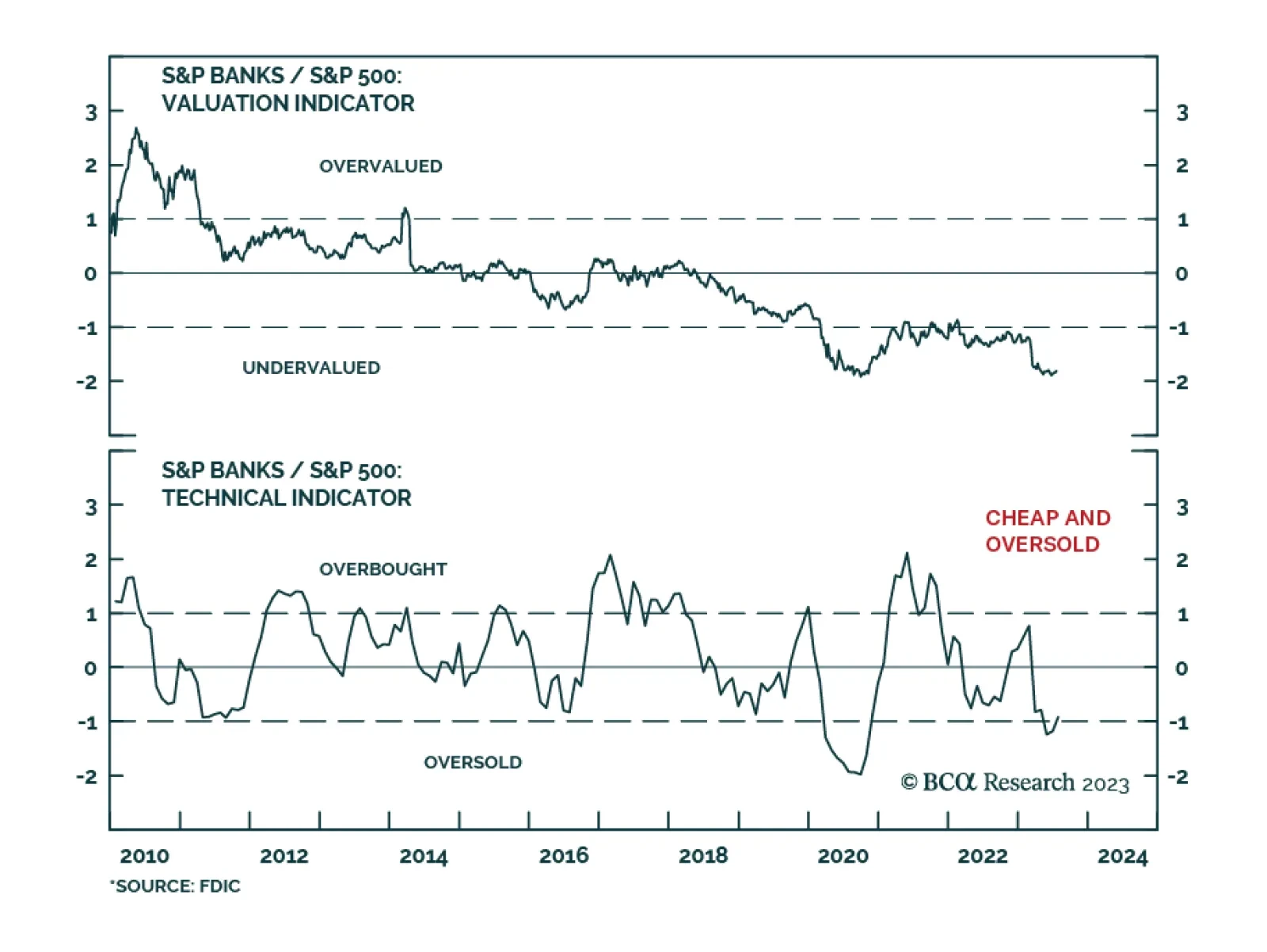

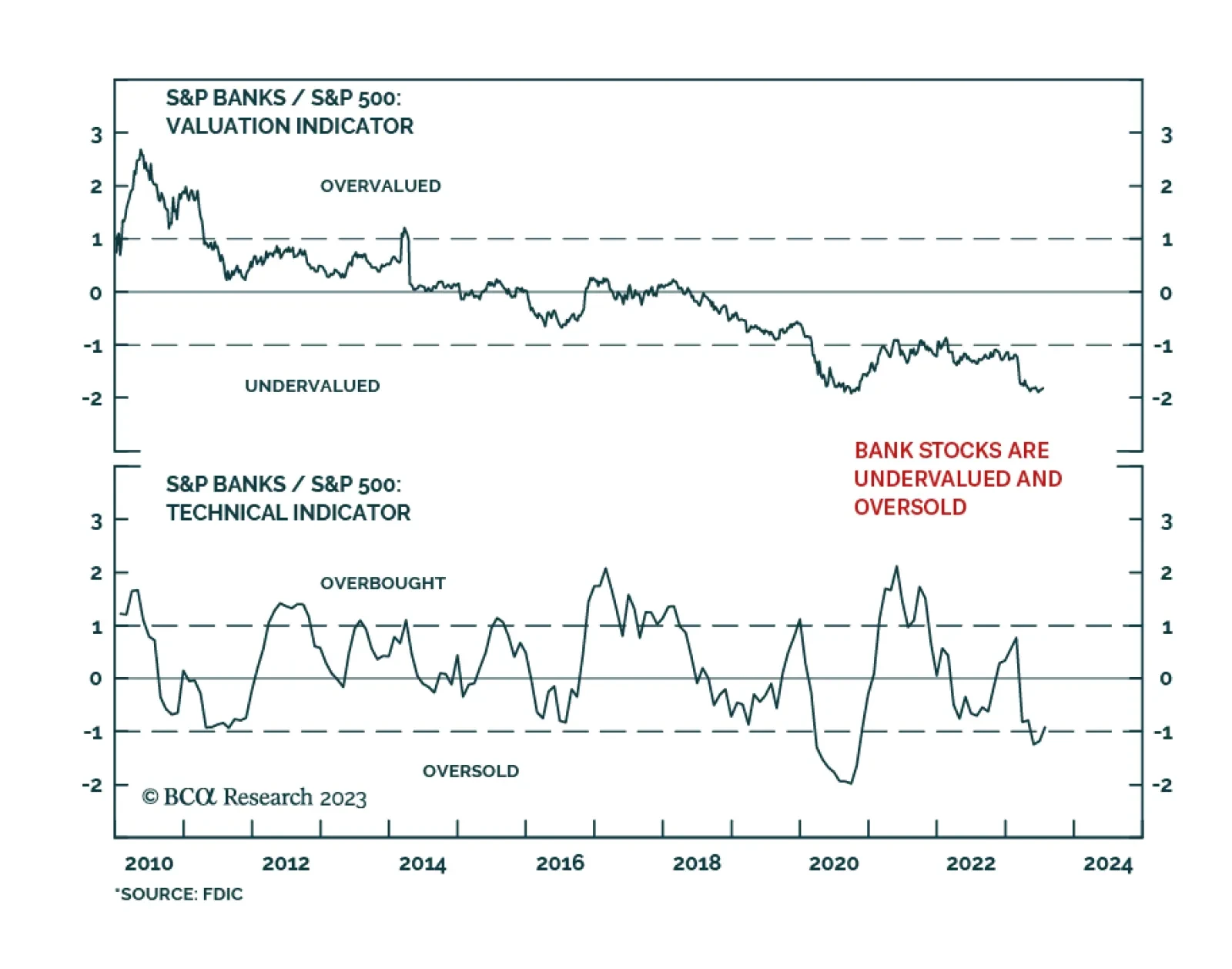

BCA Research’s US Equity Strategy service recommends investors move to overweight banks over a tactical horizon. Q2 earnings results, while cheered by investors, were quite a mixed bag. And most of the bank challenges…

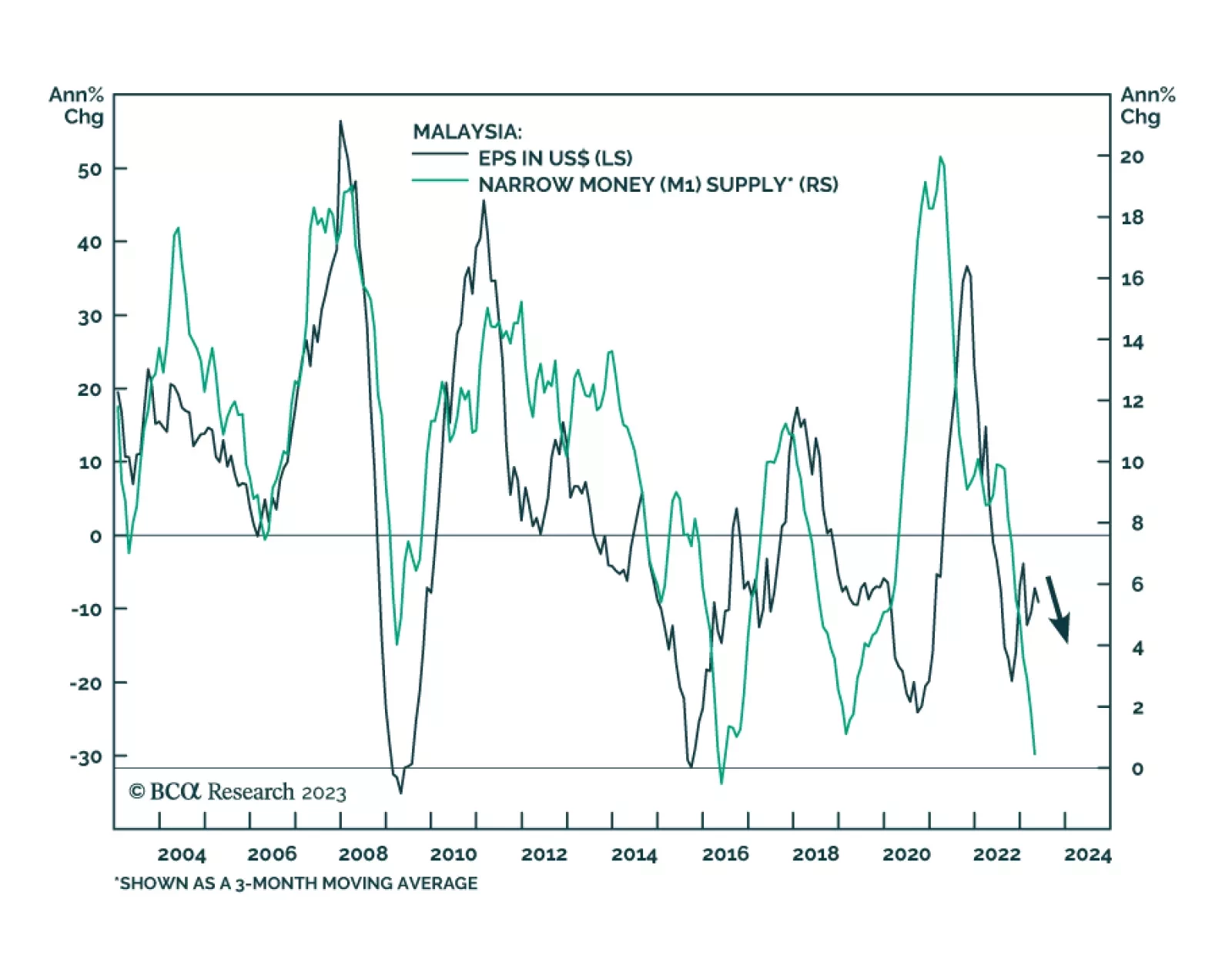

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

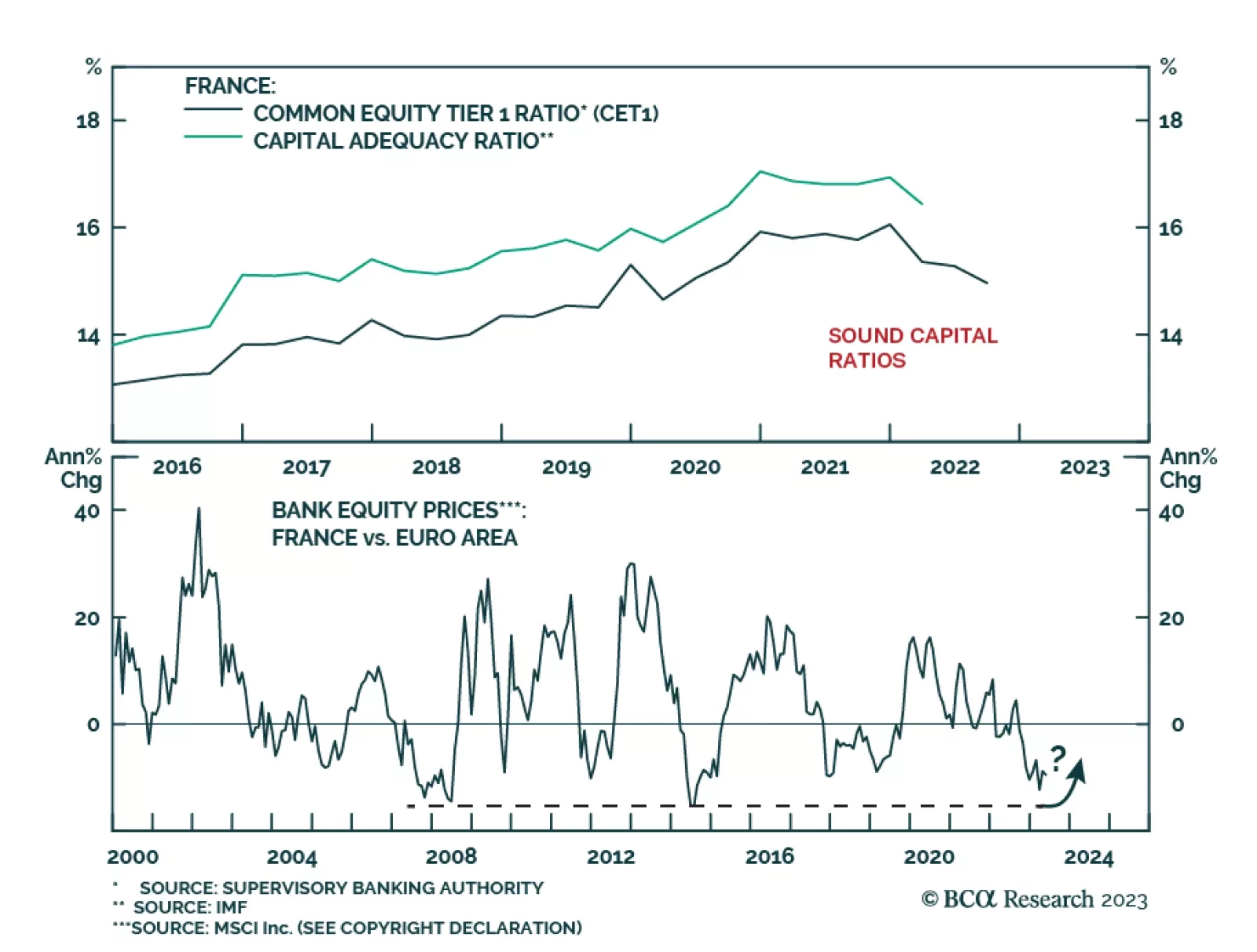

According to BCA Research’s European Investment Strategy service French banks are better positioned to weather current headwinds than their European peers. The team sees limited risks to the French banking sector from…

In this US Bond Strategy Insight we discuss the outlook for bank bonds.

According to BCA Research’s US Equity Strategy service, investors should stay underweight banks on a tactical investment horizon as the banking turmoil is far from over, and the industry’s profitability will be under…

If the recession begins this year, it is unlikely to be mild, because inflation will not have fallen by enough to allow the Fed to cut rates aggressively. In contrast, if the recession starts in 2024 or later, when inflation is…

The dollar has entered a structural bear market. Although the greenback could get a temporary reprieve during the next recession, investors should position for a weaker dollar over the long haul.