The latest edition of our Big Bank Beige Book suggests the expansion remains intact, though weakness in C’s private-label credit card portfolio could be a harbinger of distress among lower-income consumers. We remain tactically…

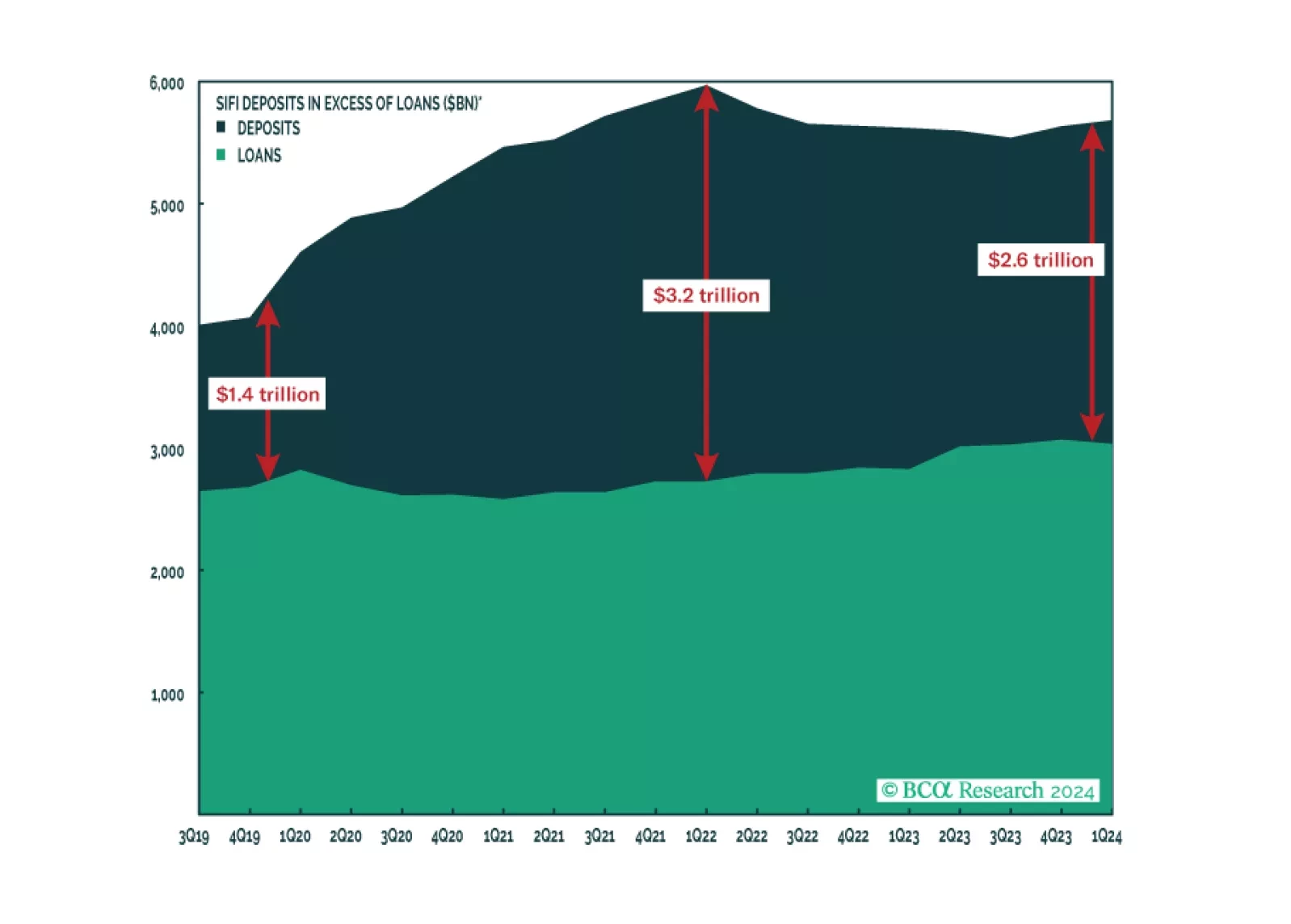

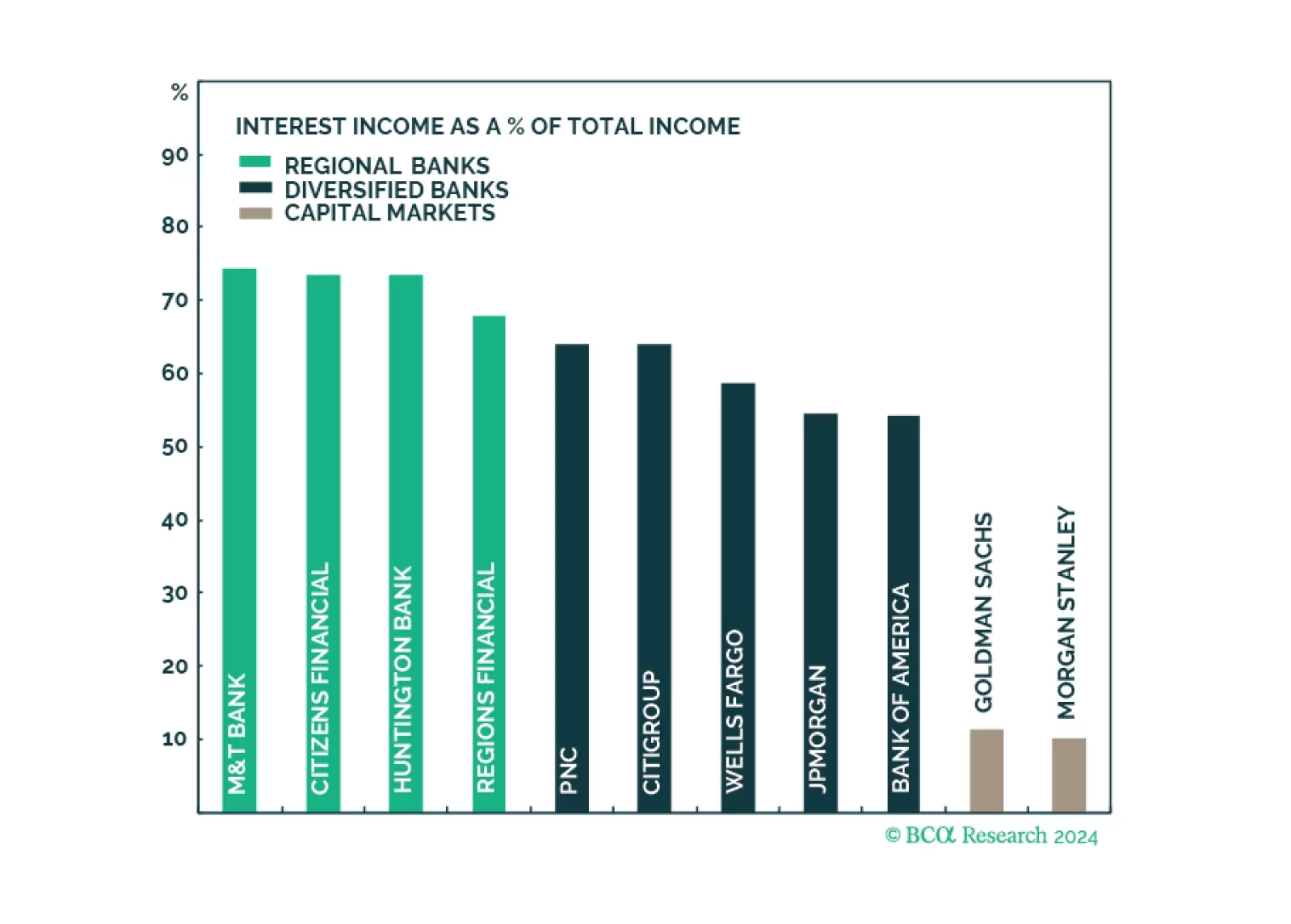

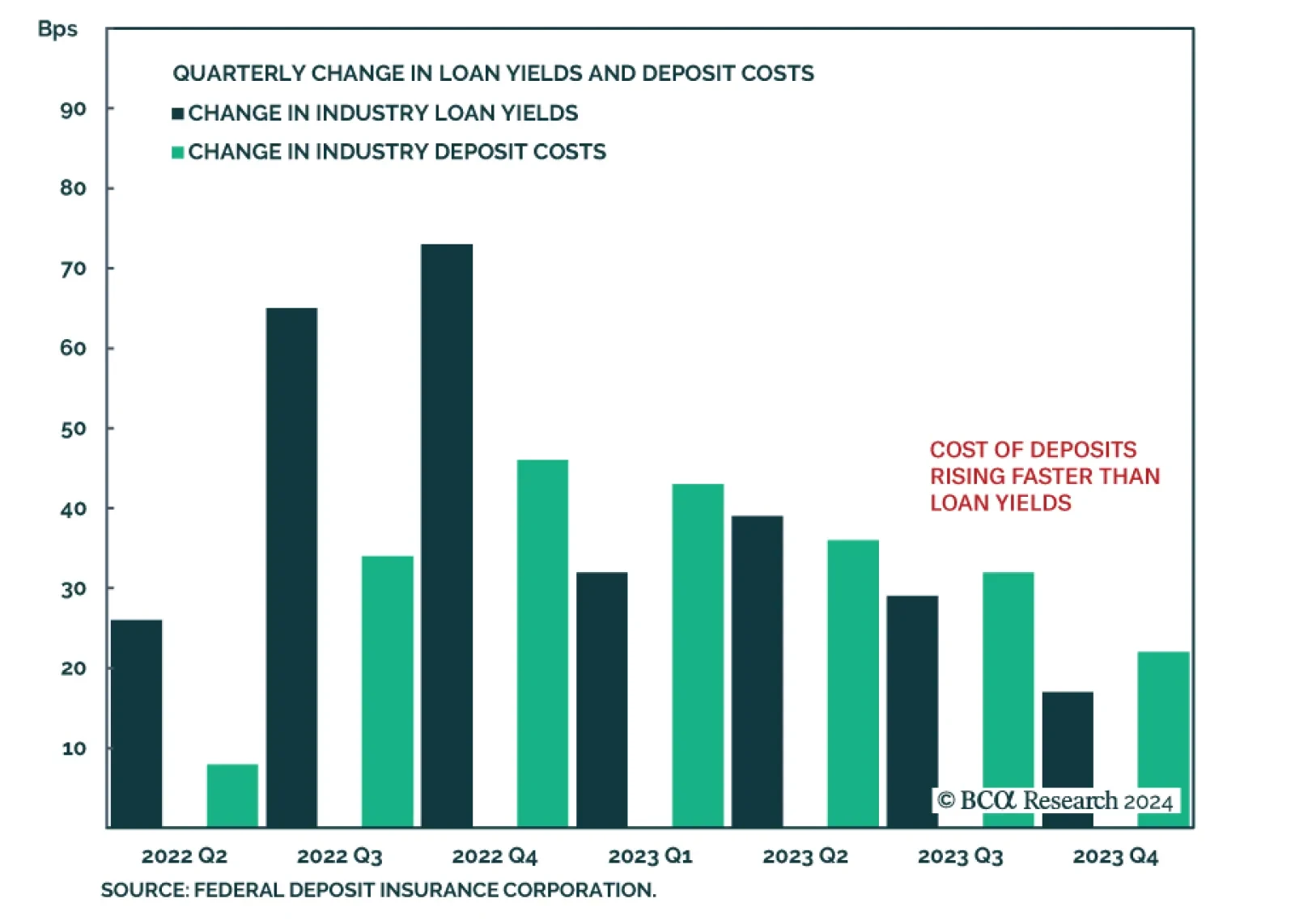

According to BCA Research’s US Equity Strategy service, Q1 earnings results signaled that net interest income (NII) growth is set to decline in US banks. For nearly two years, America’s largest banks enjoyed a…

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

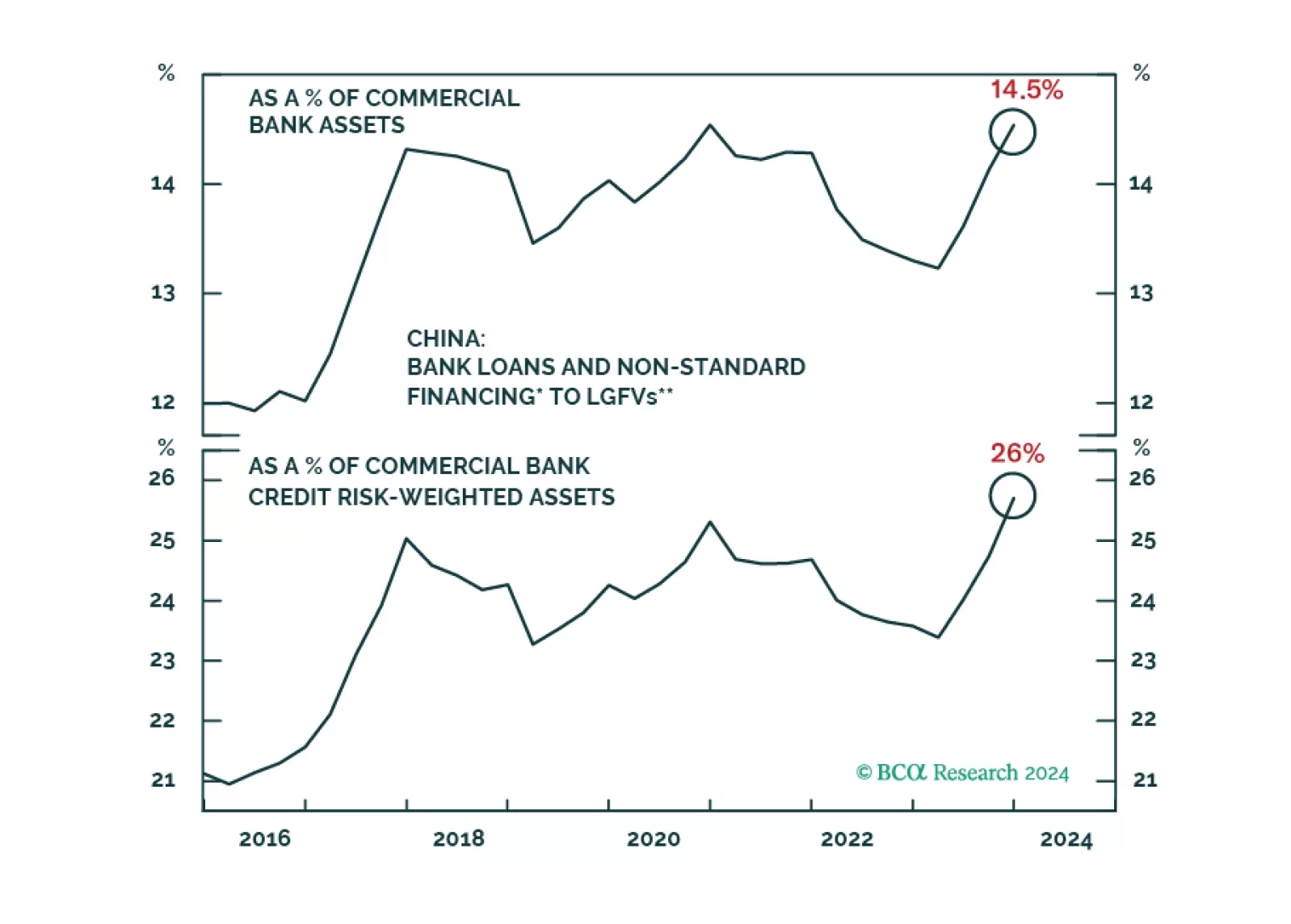

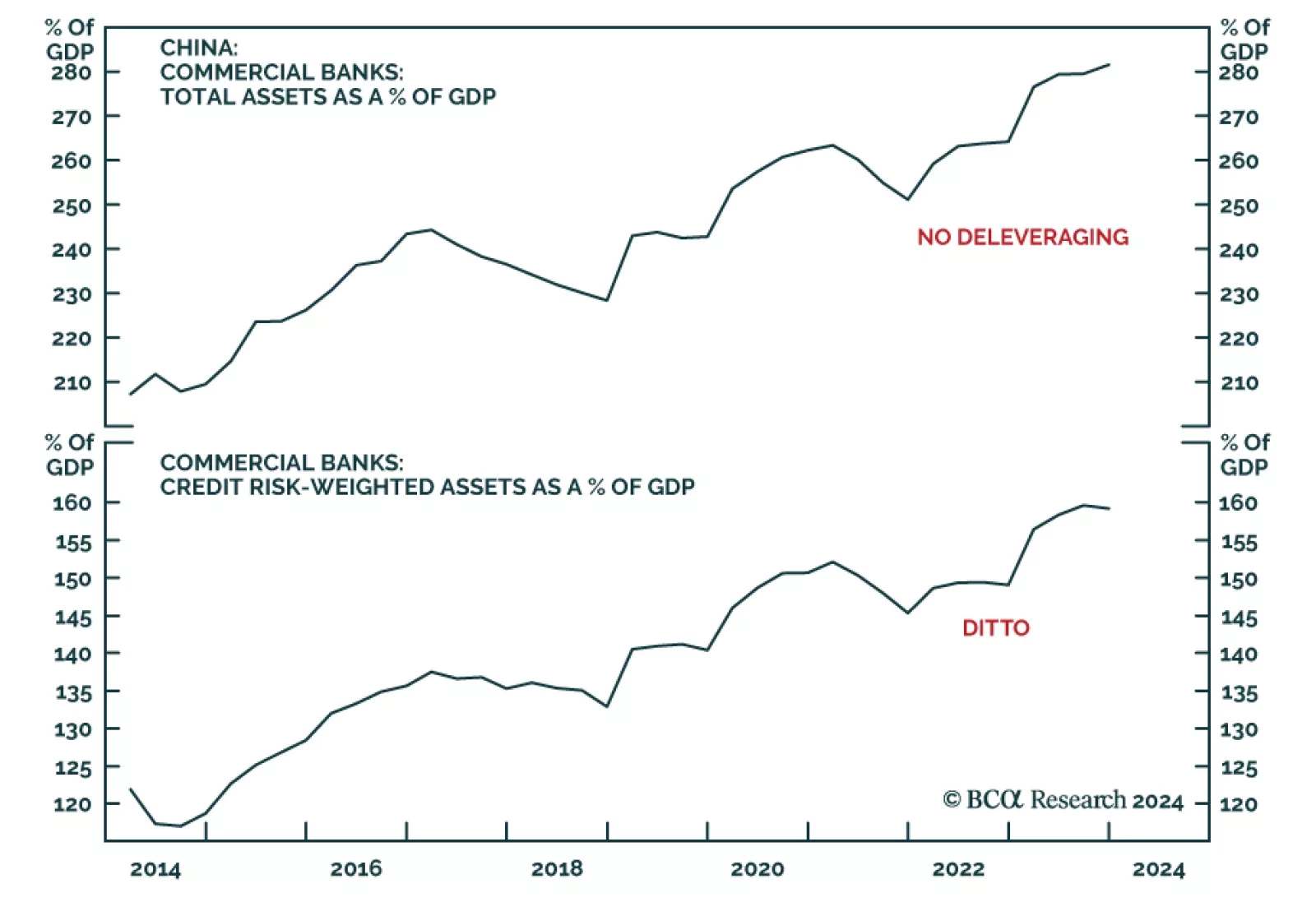

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

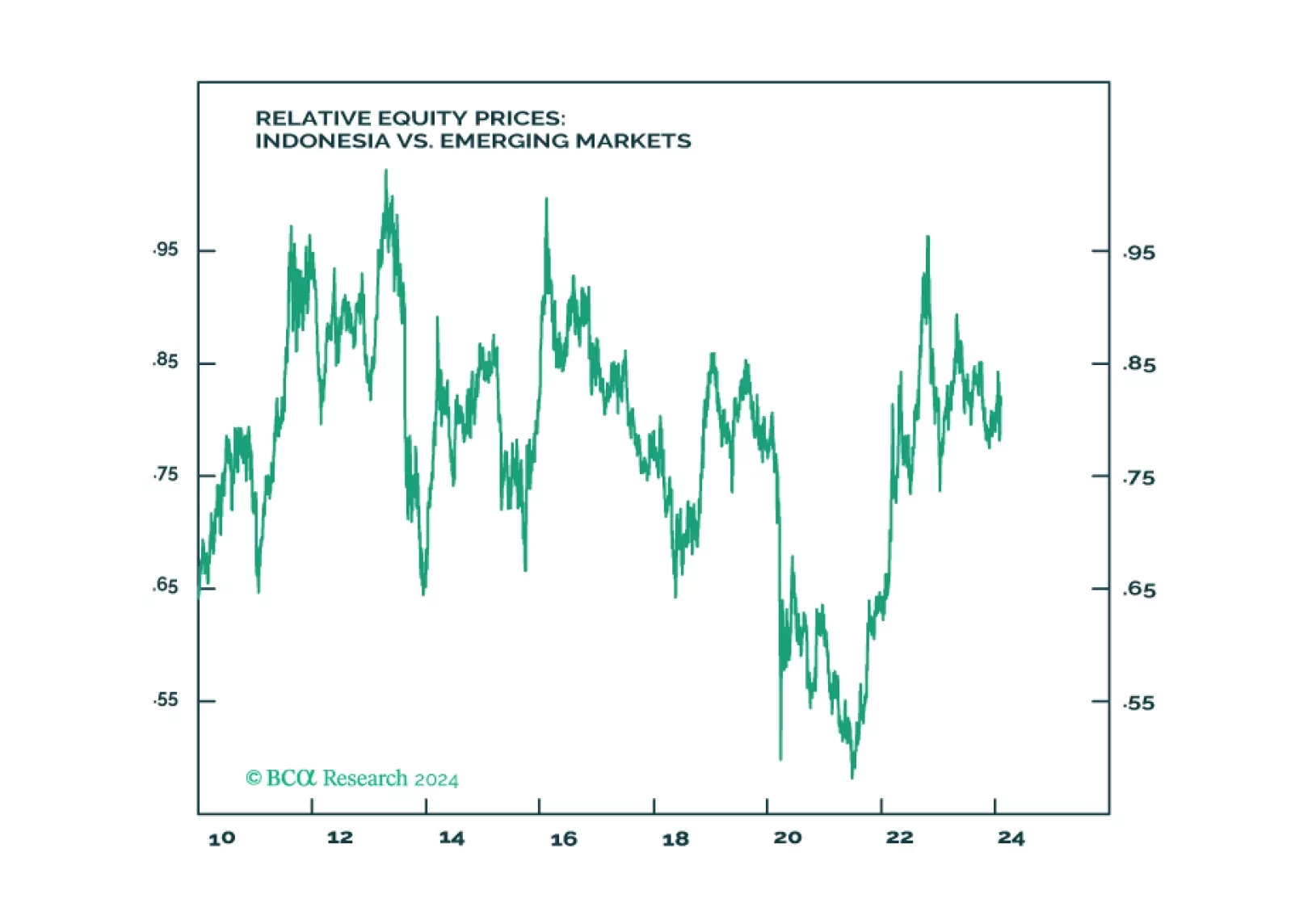

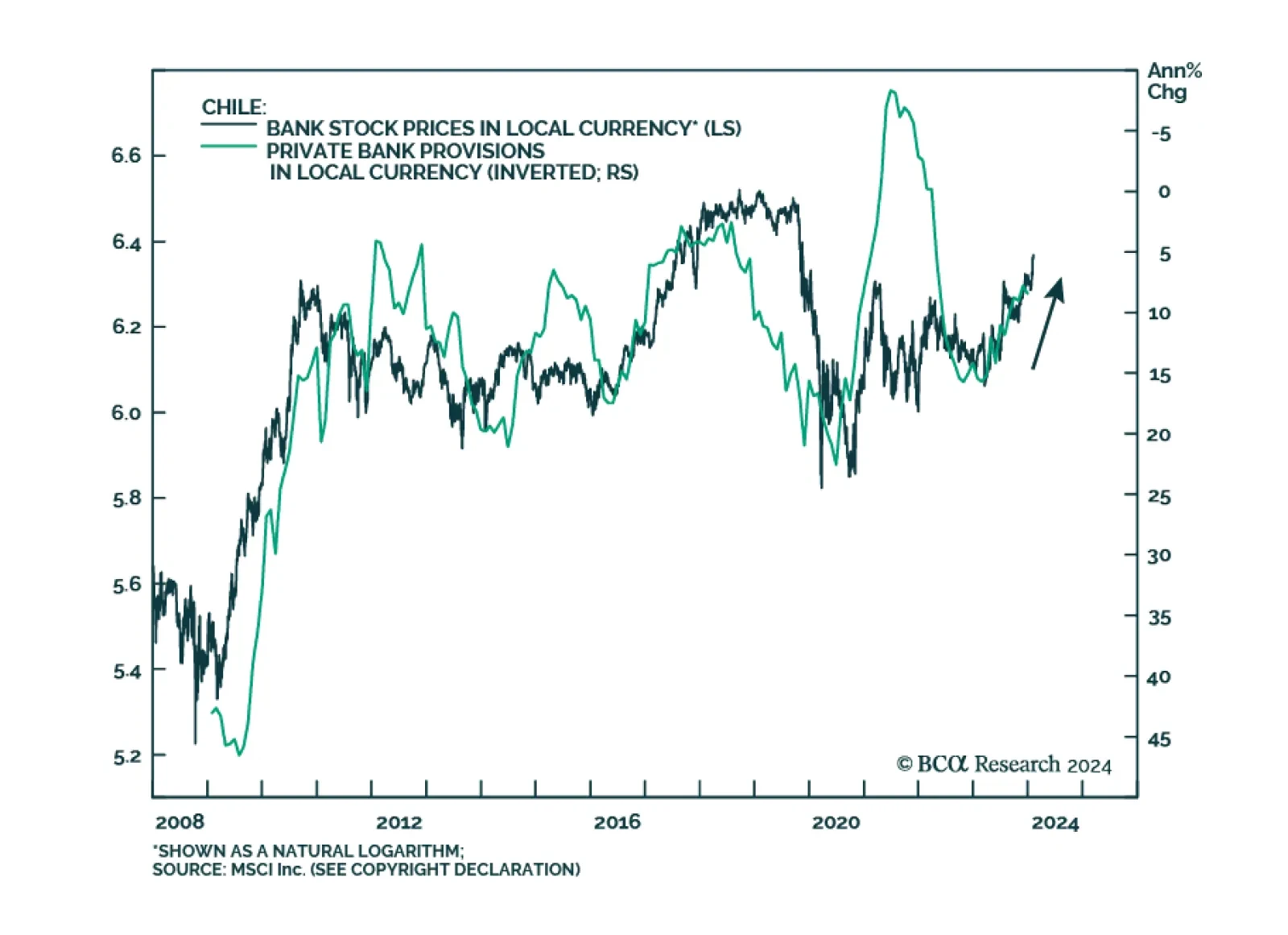

According to BCA Research’s Emerging Markets Strategy service, Chilean bank stocks offer great value and are poised to outperform the EM equity benchmark. Chilean bank share prices are well-positioned to outperform due…

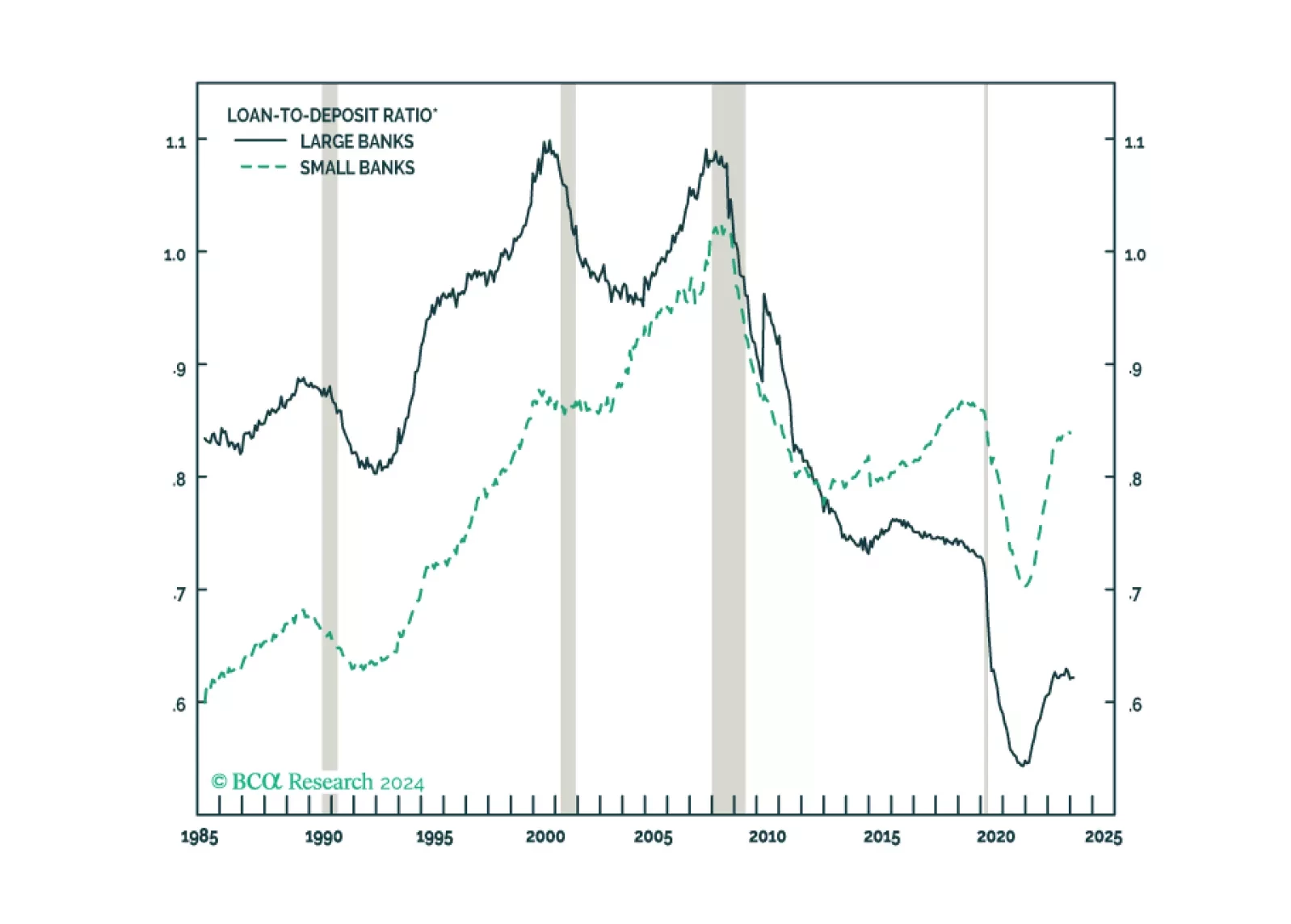

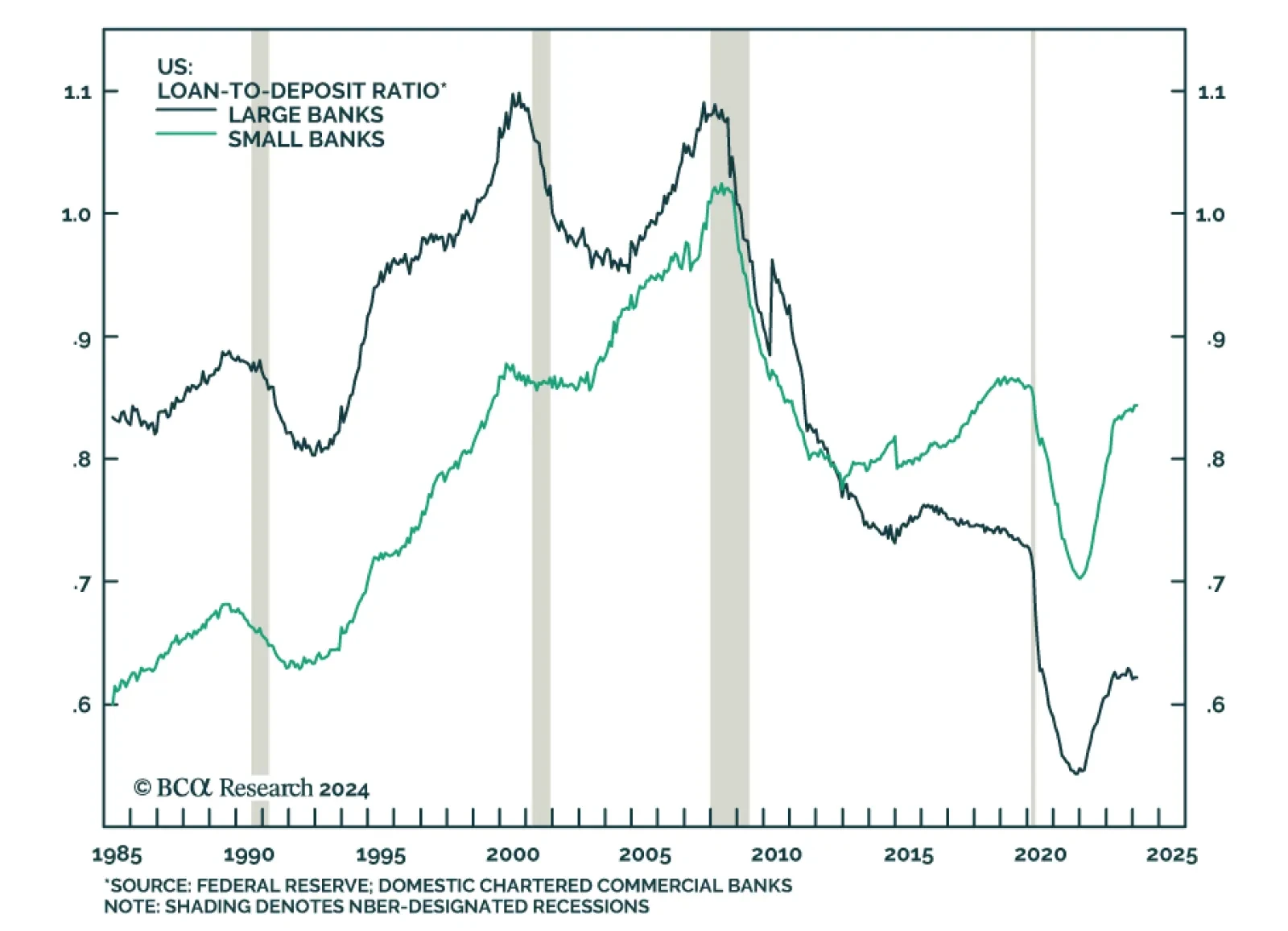

Banks were thrust back in the spotlight’s unflattering glare last week when mid-cap regional New York Community Bank shocked analysts and shareholders with an enormous credit loss. According to BCA Research’s US…

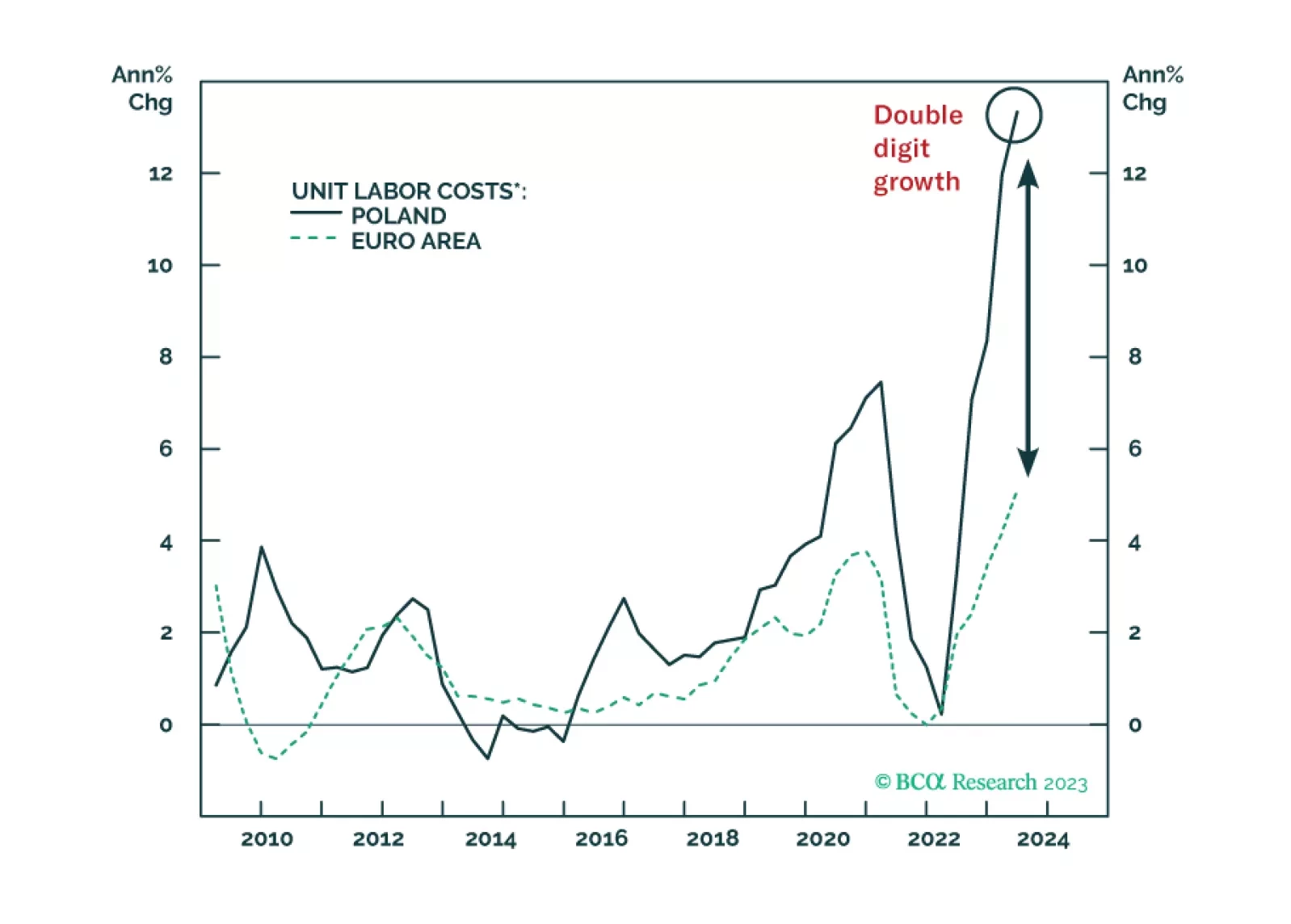

Poland’s inflation will stay elevated. And yet, its return to the European mainstream has improved its financial market outlook. Accordingly, we are recommending new trades on Polish equity, fixed income, and currency.