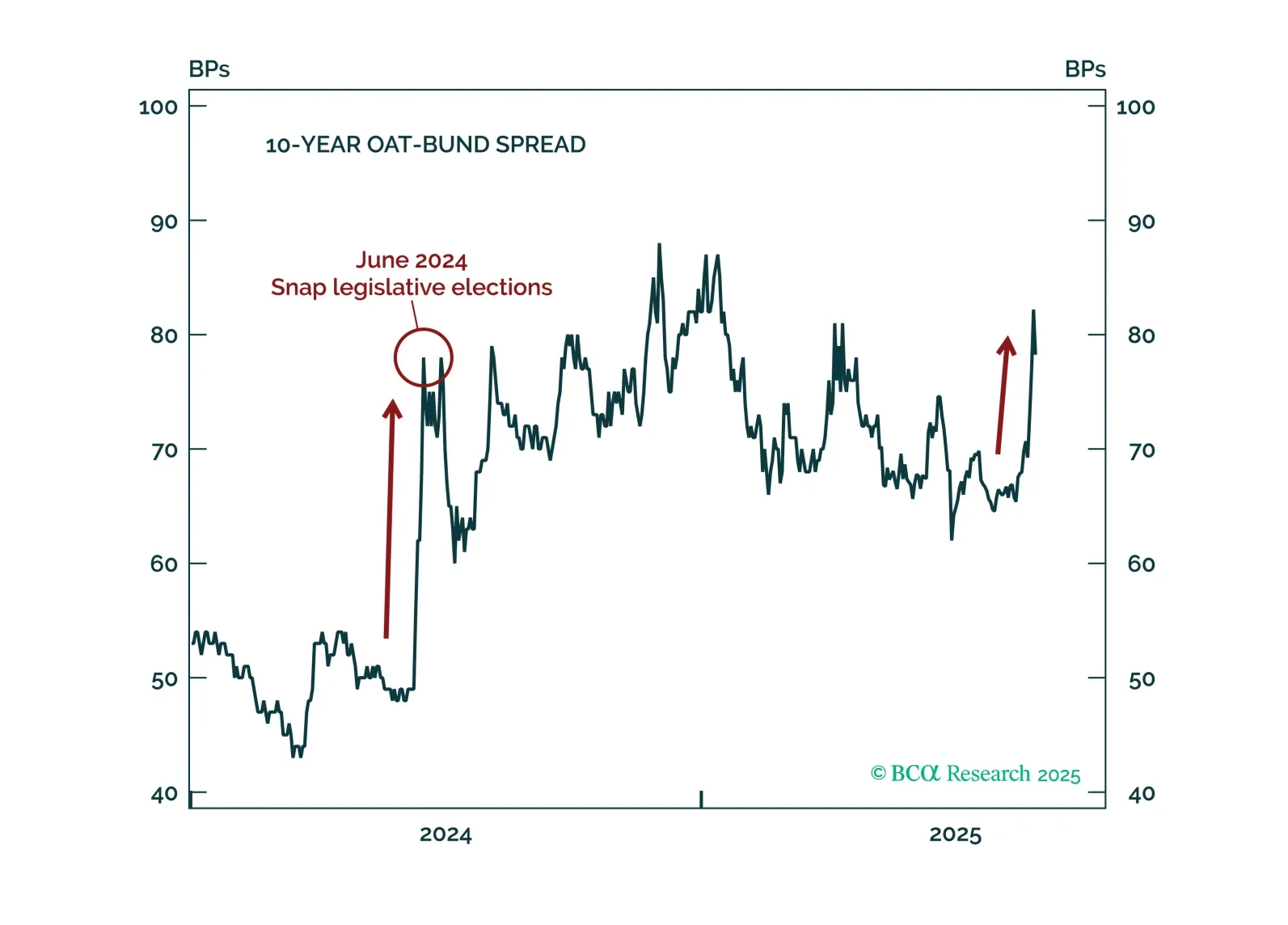

Political instability will persist in France as PM François Bayrou loses the confidence vote. The nomination of a new PM will not end the country’s political paralysis and will further fuel fiscal fears. Investors should remain…

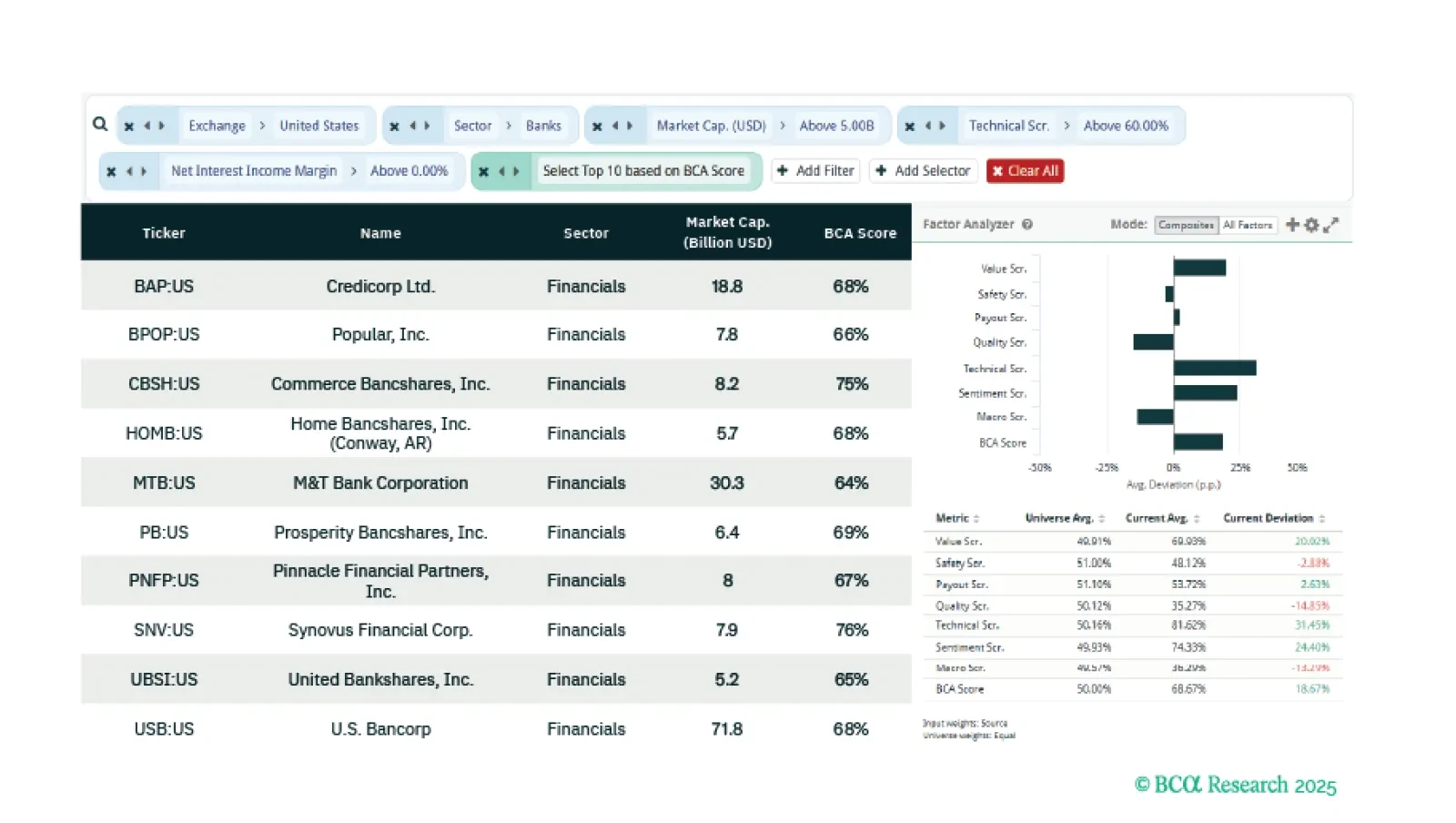

This week our three screeners identify: Equity plays on US banks, stocks that benefit from heightened US fiscal uncertainty, and a global Value and Technical basket of stocks.

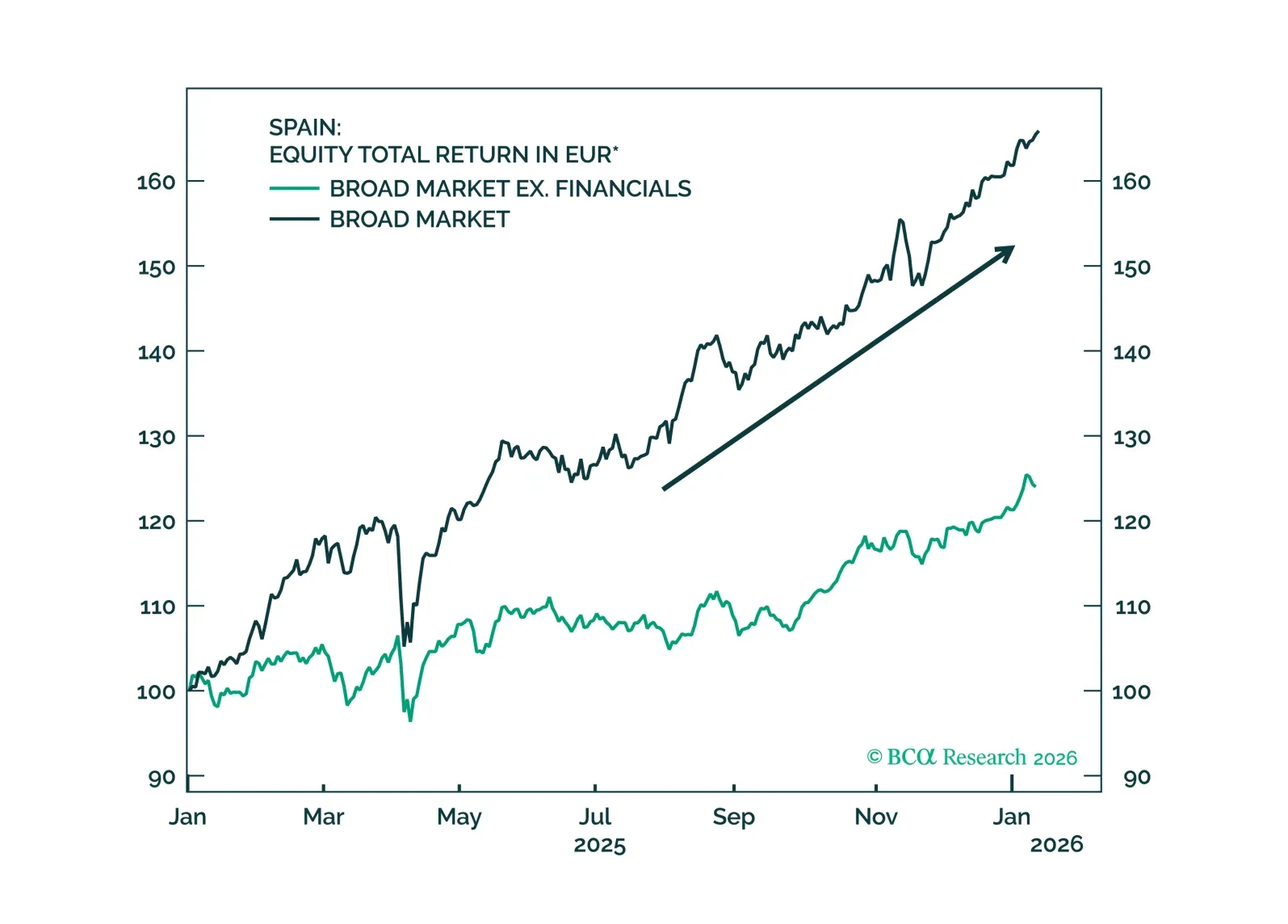

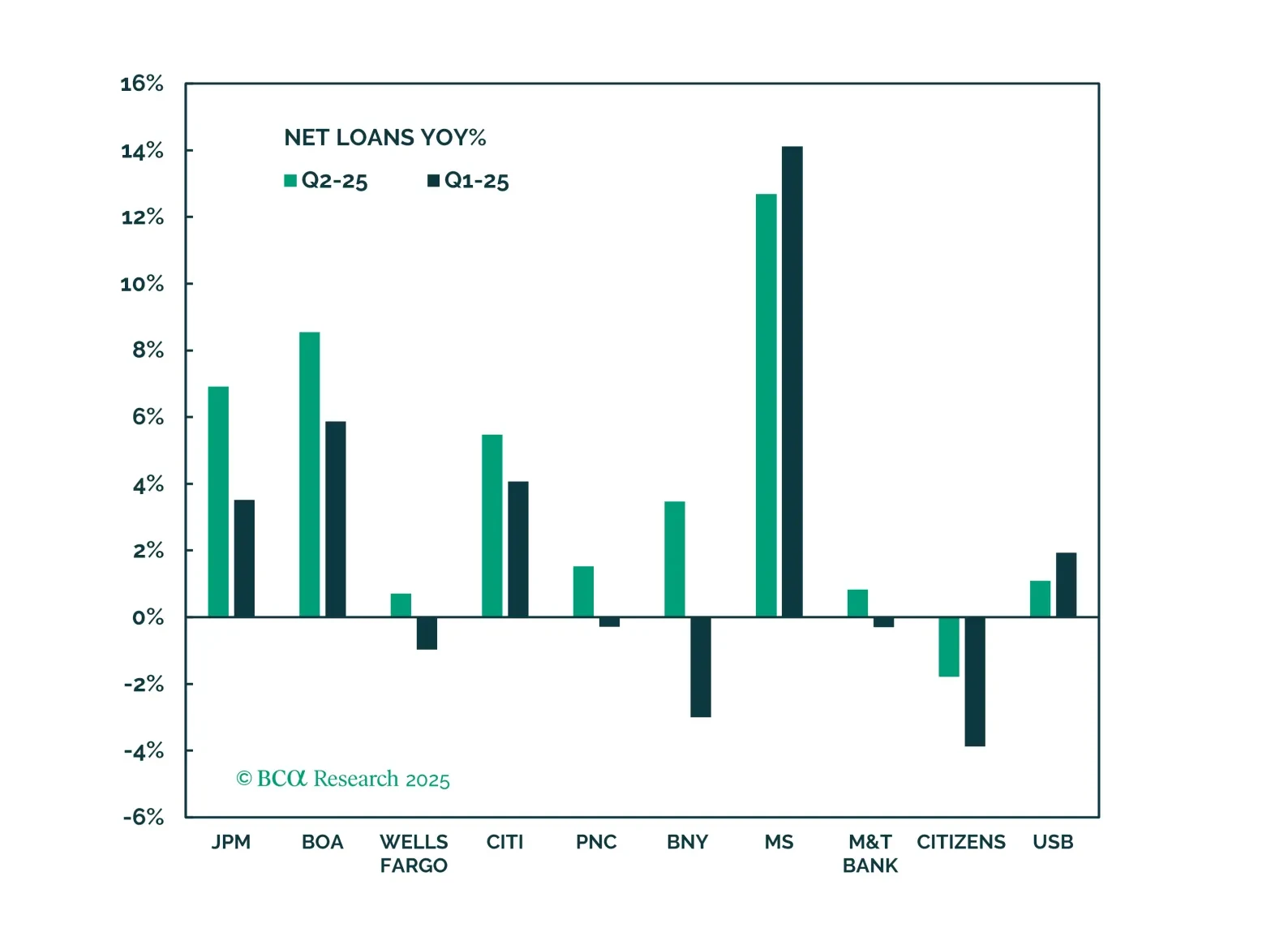

Banks have had a strong run and may continue to outperform, supported by a rebound in capital market activity, improving momentum in the core banking business, and the potential for rerating driven by deregulation. While risks remain…

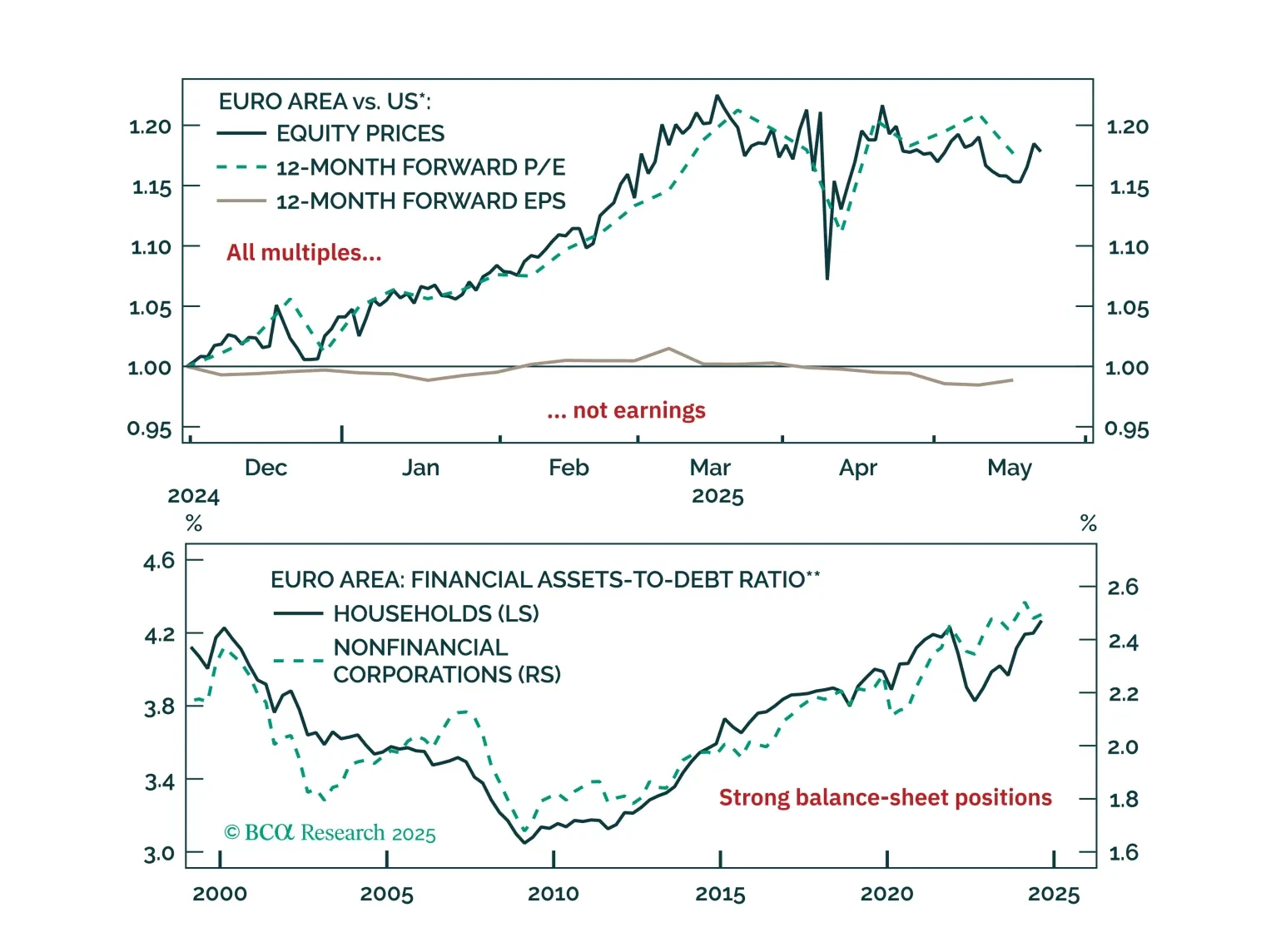

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

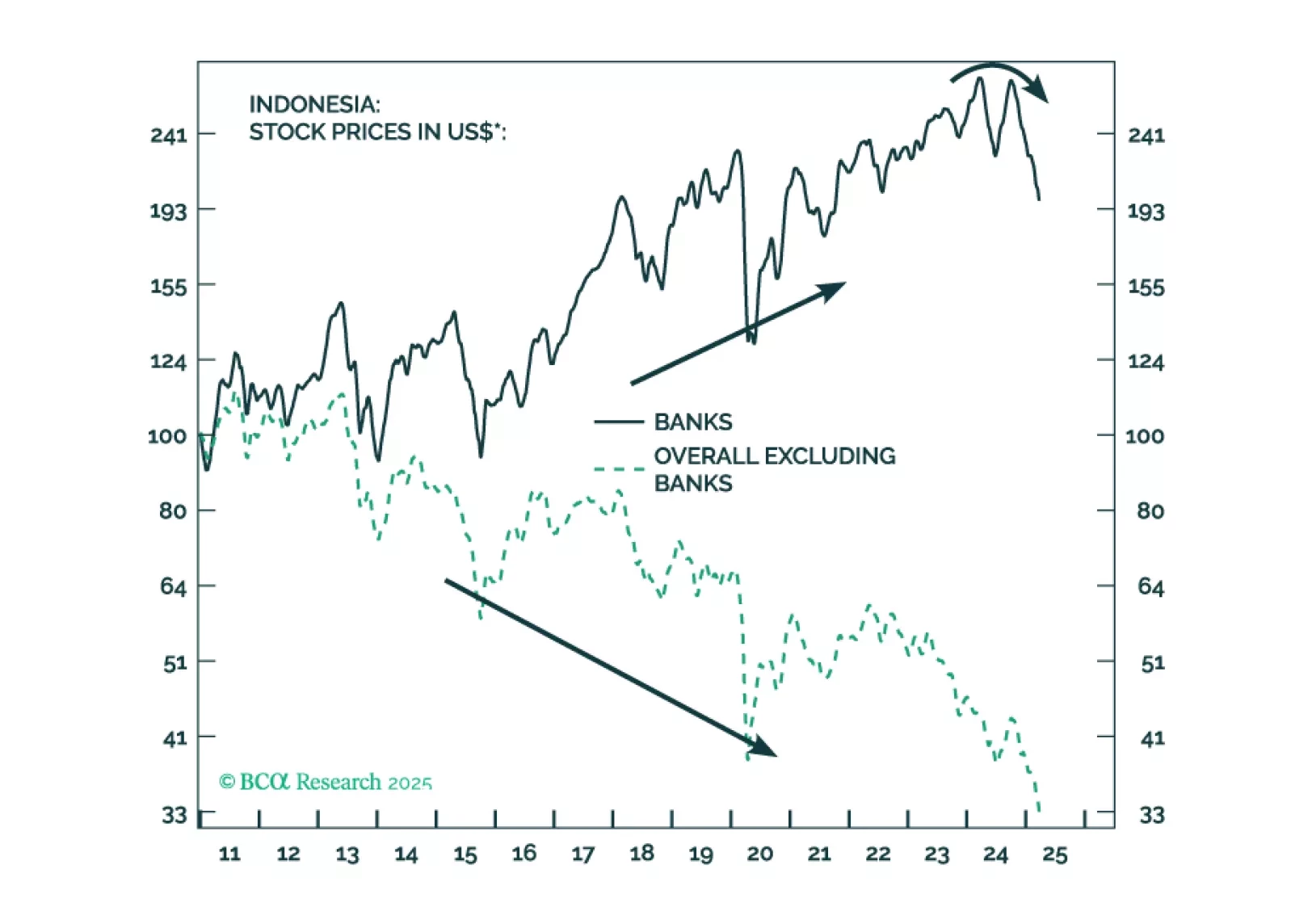

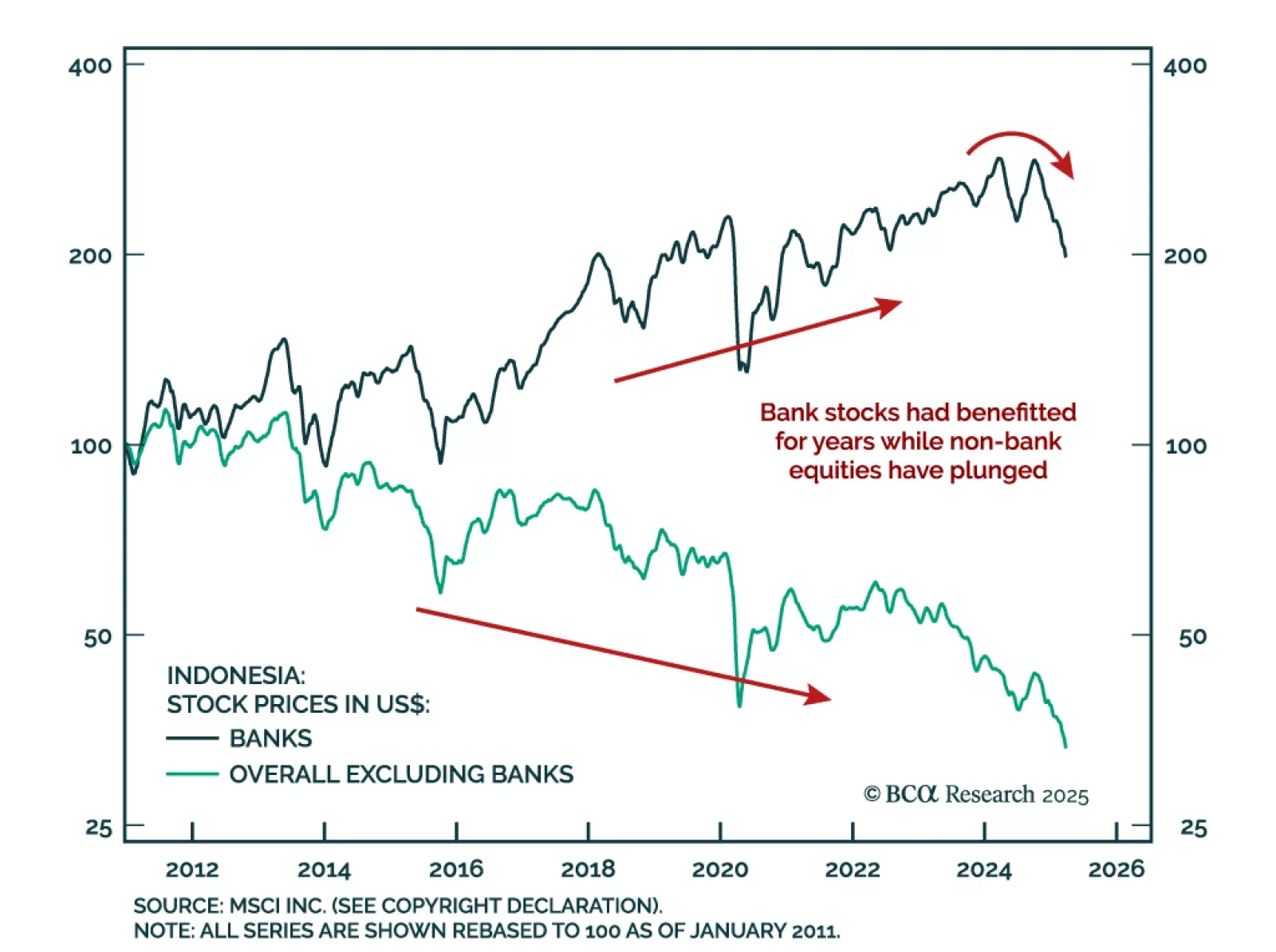

Our Emerging Markets strategists maintain a neutral view on Indonesia within EM equity and bond portfolios but continues to recommend shorting the rupiah versus the US dollar. They are closing their long Indonesian banks/short EM…

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

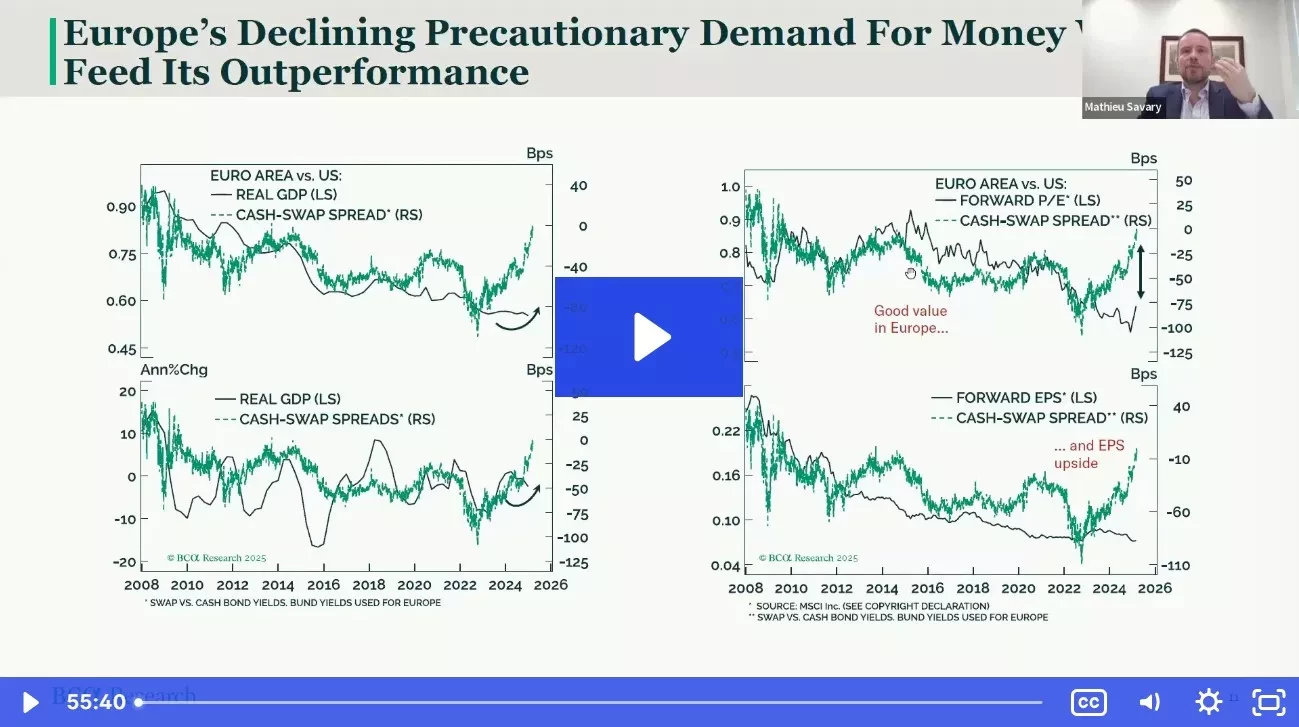

Join our webcast as we break down what’s next for European vs. U.S. equities—and where the best opportunities lie.

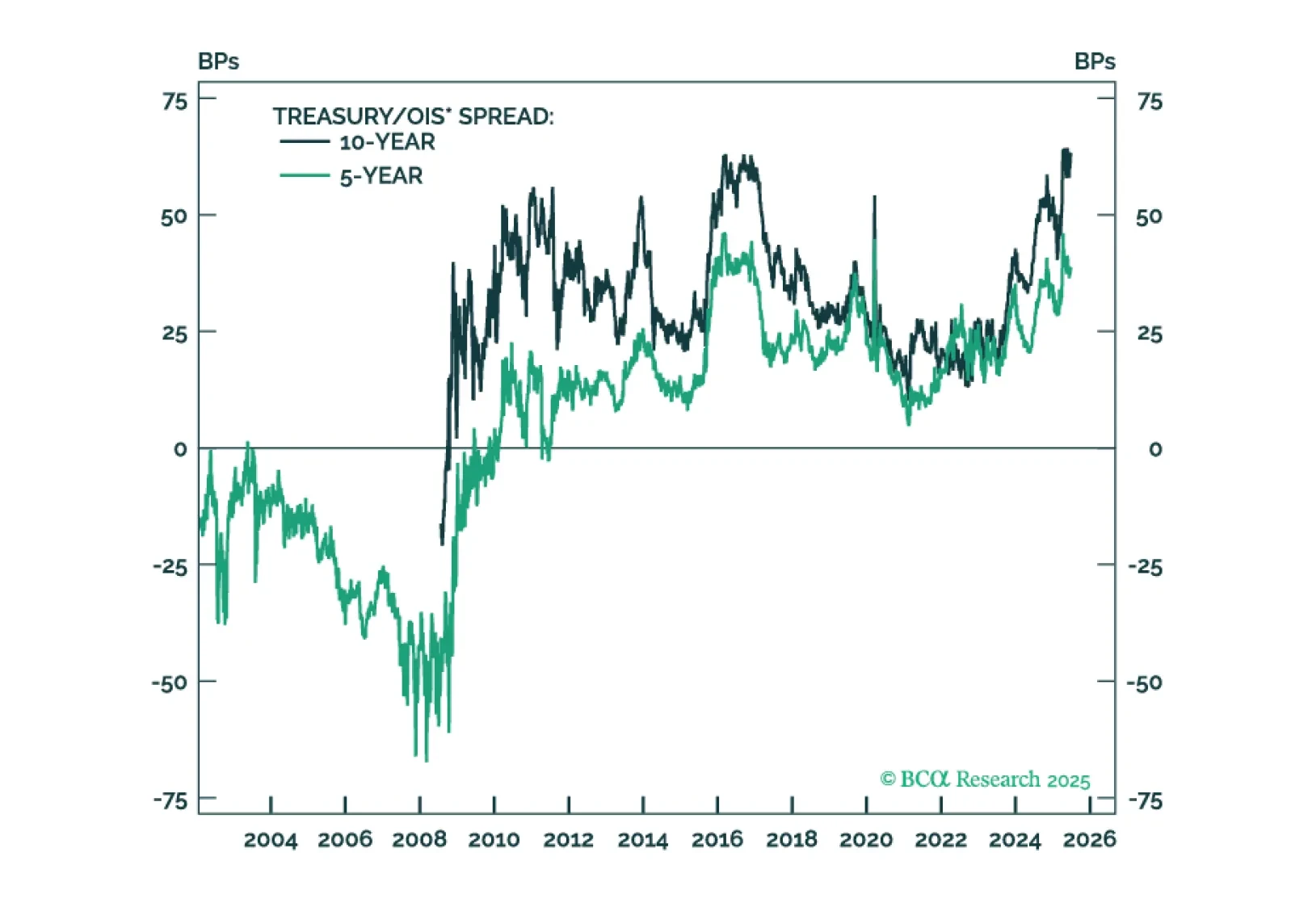

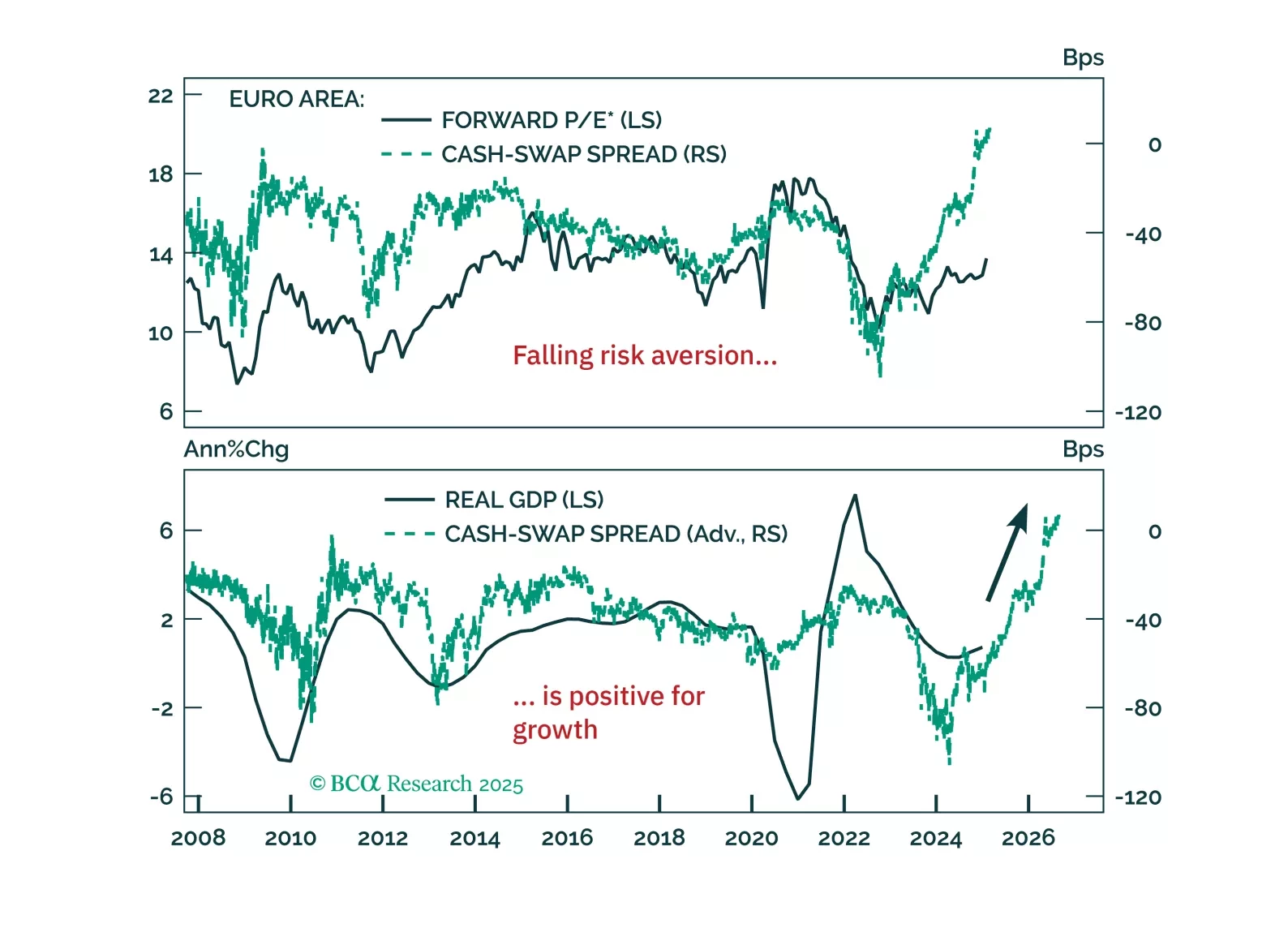

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…