Our Portfolio Allocation Summary for September 2025.

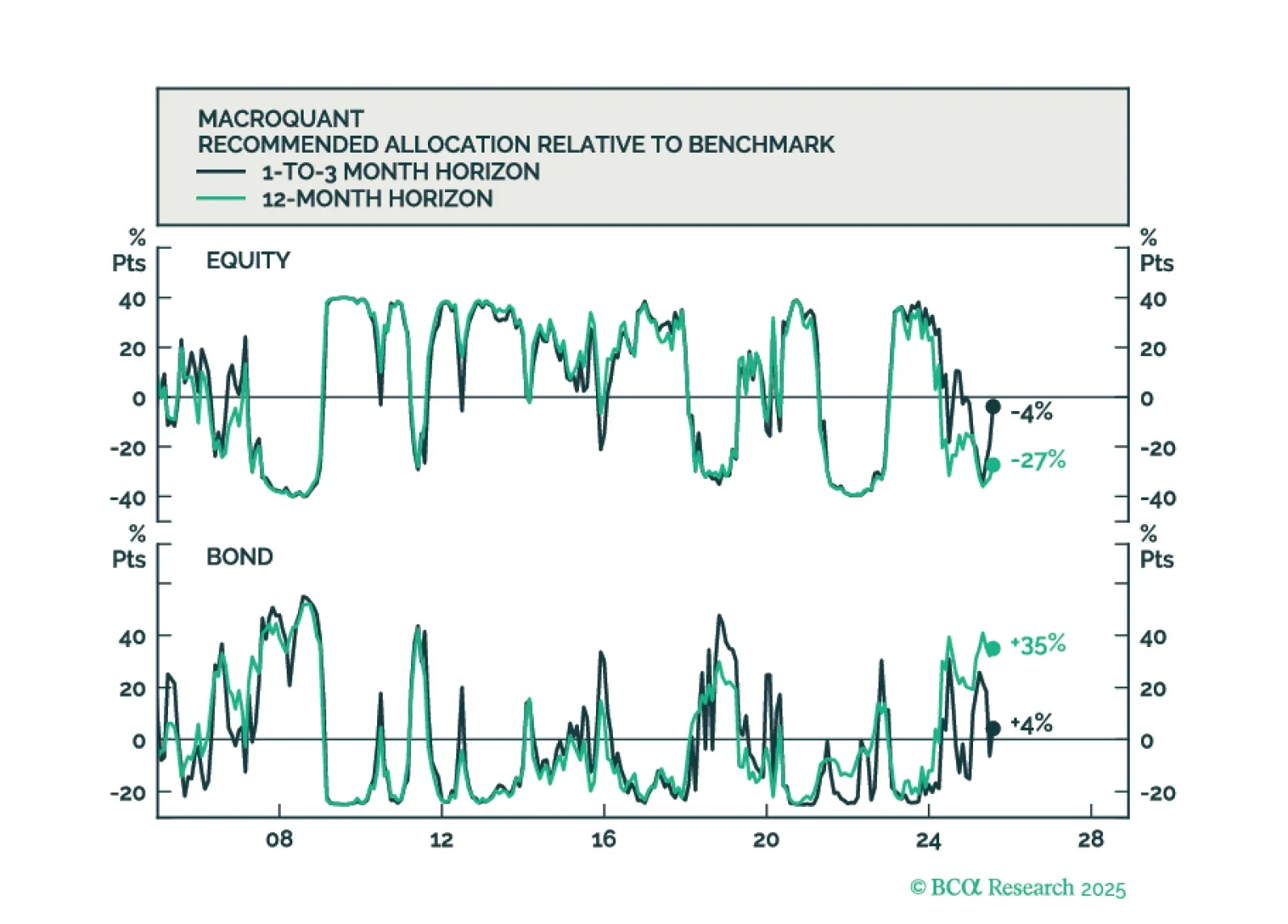

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

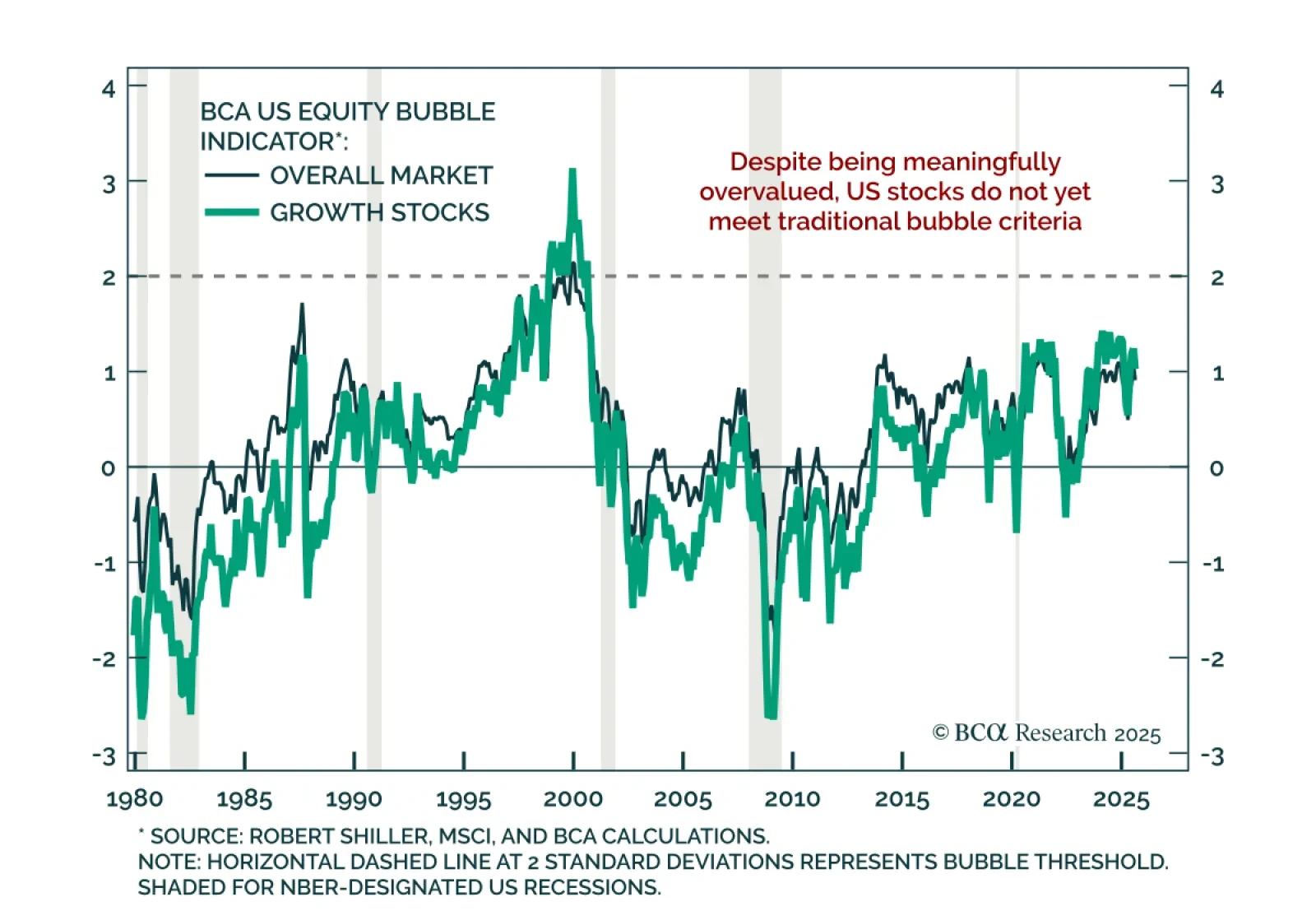

US equities remain significantly overvalued but fall short of classic bubble conditions. Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist of our Special Reports Unit.As the S&P 500 flirts with all-time highs,…

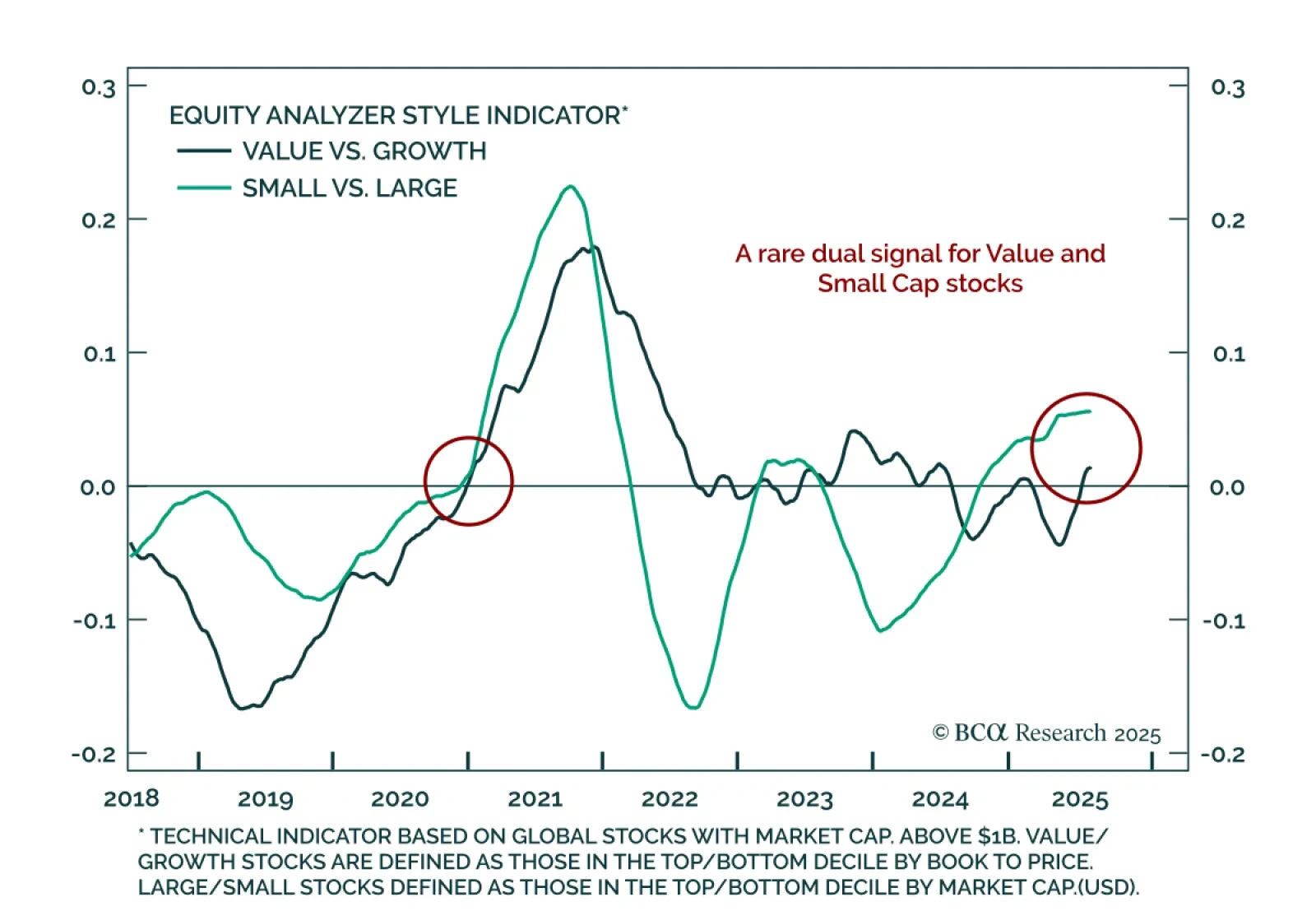

Momentum is building behind small-cap and value stocks, signaling a rare dual tailwind for cyclical styles. Our Chart Of The Week comes from Guy Russell, strategist for Equity Analyzer.While market attention remains focused on the…

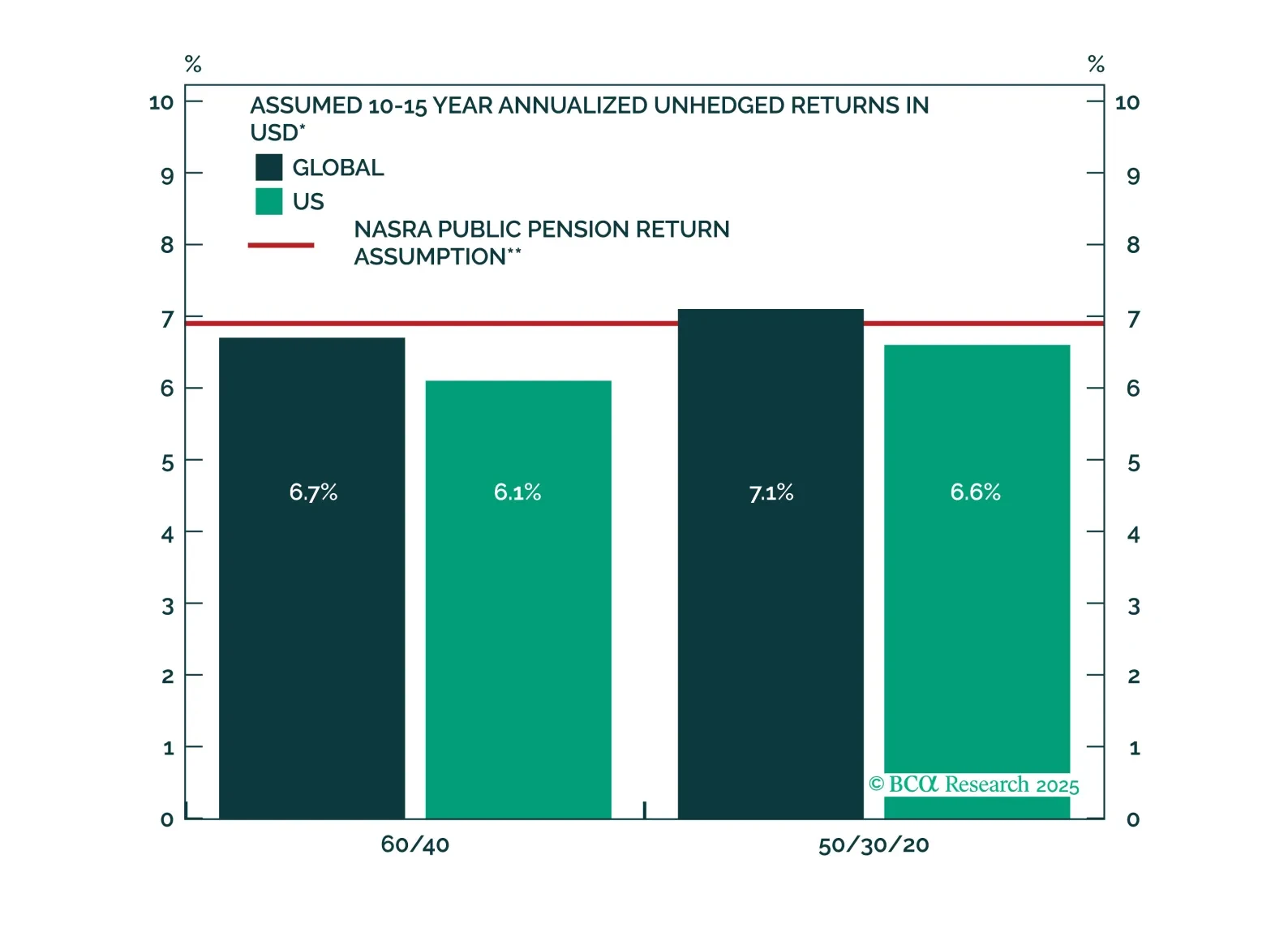

Our Portfolio Allocation Summary for August 2025.

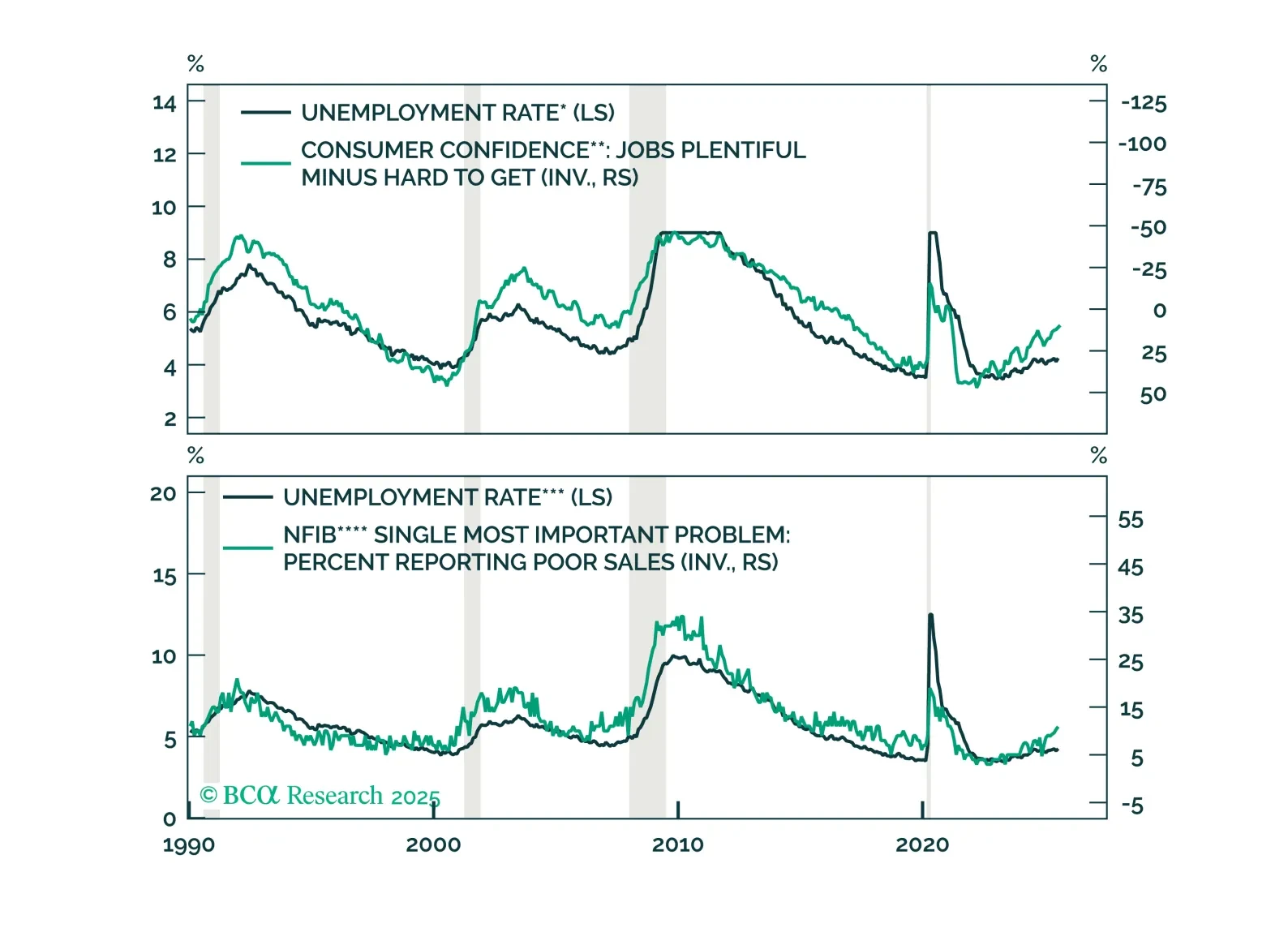

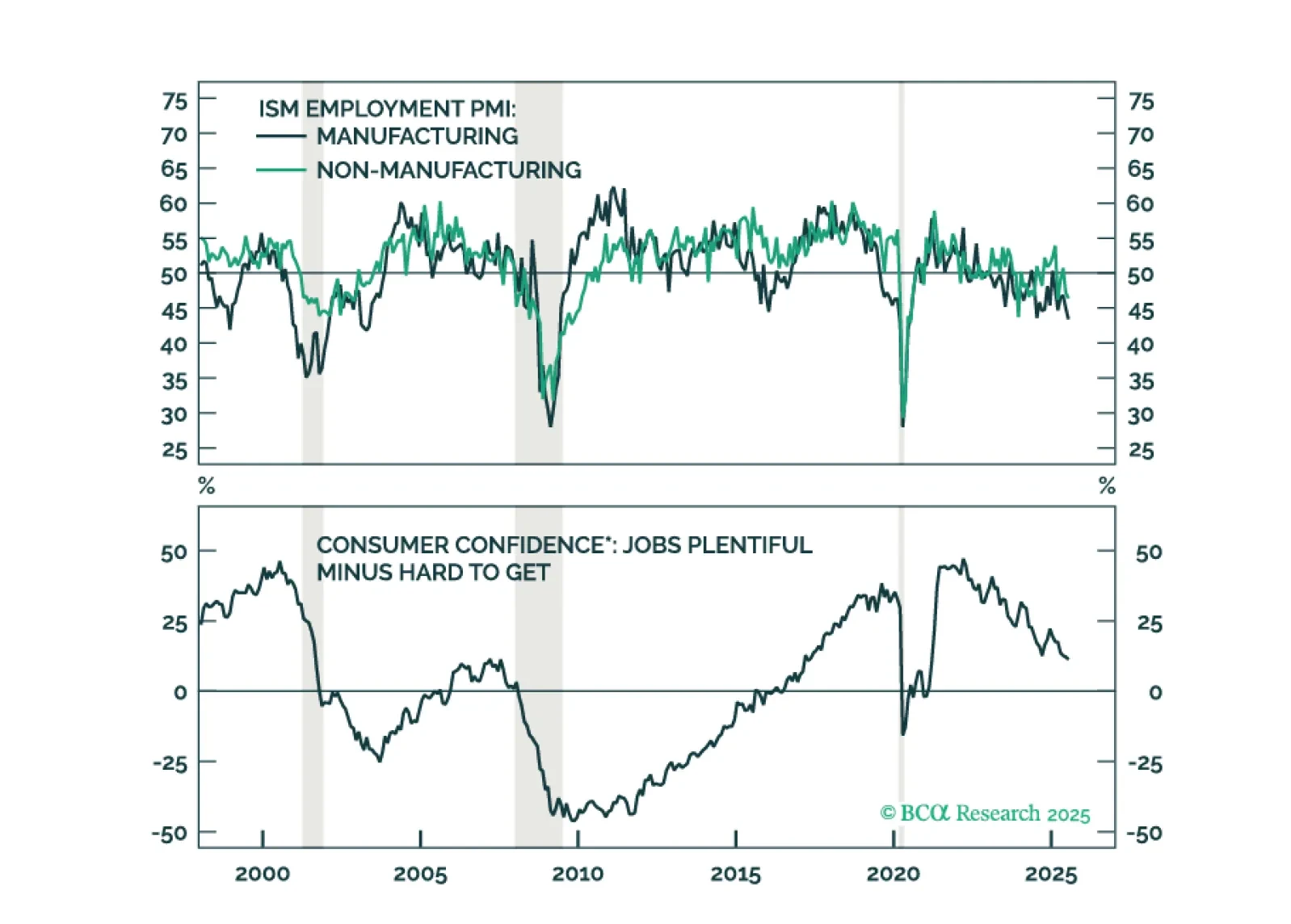

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

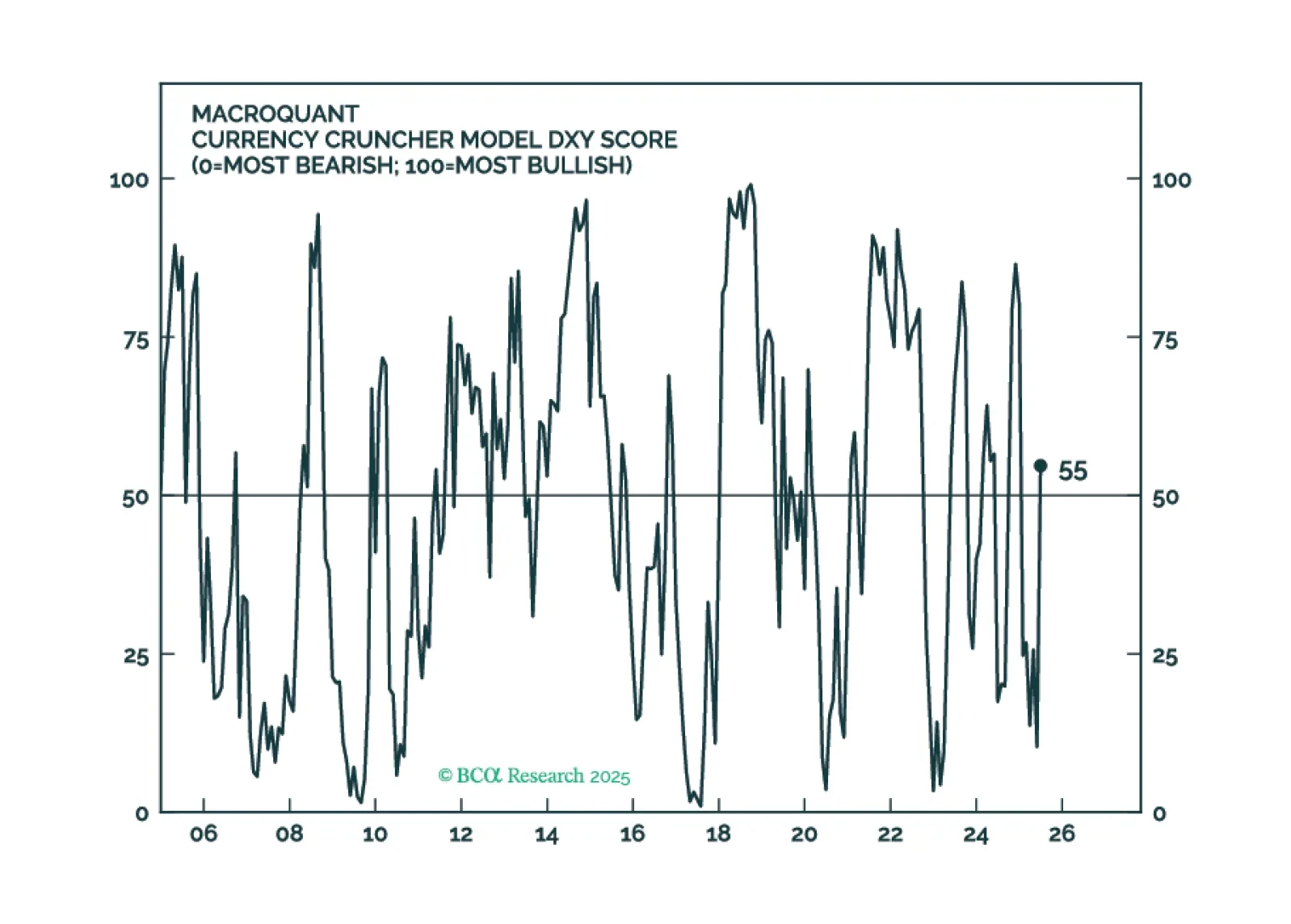

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.