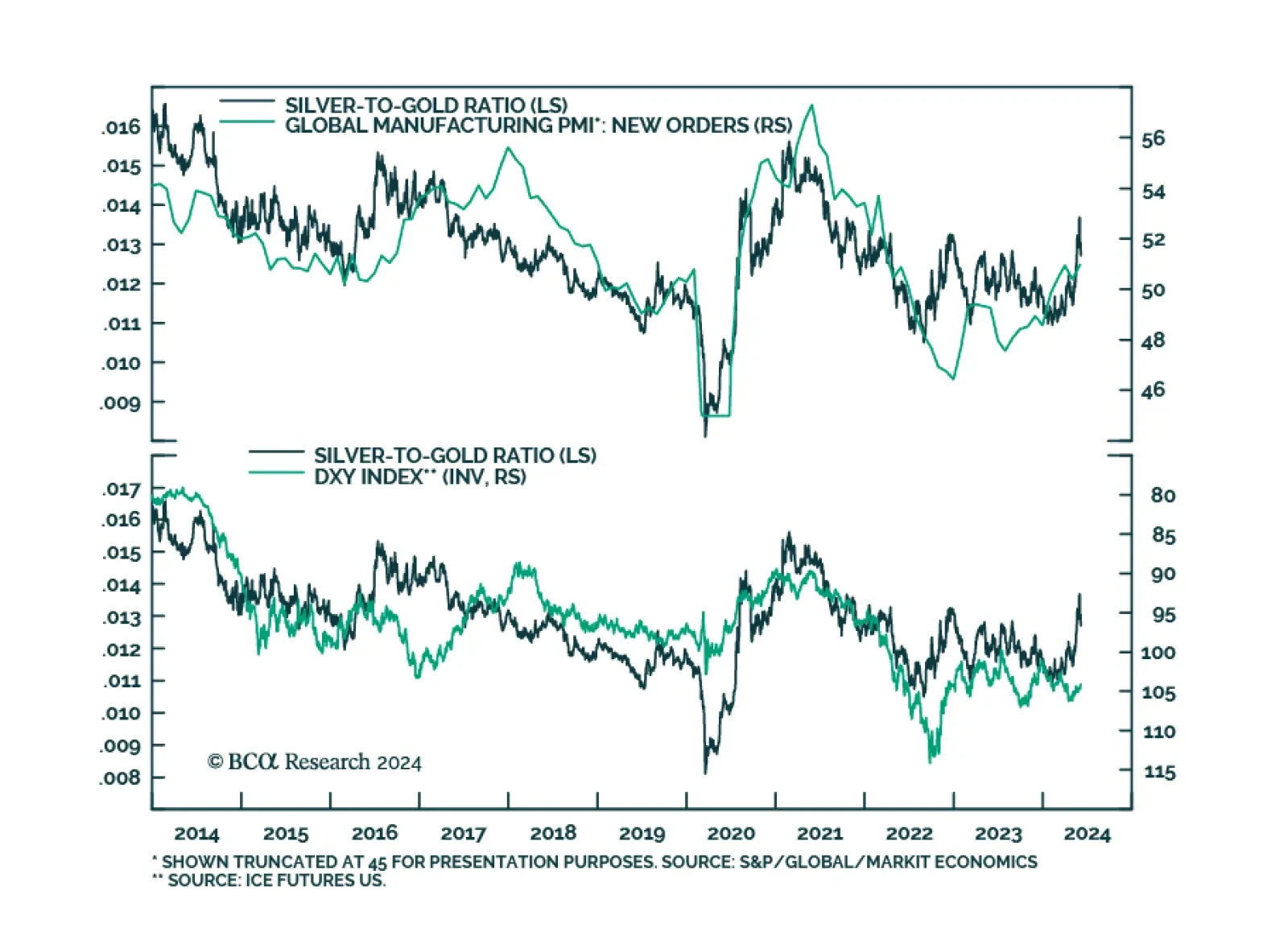

The silver-to-gold ratio has surged close to 10% this year on the back of silver prices catching up to gold. Silver has returned 22% on a YTD basis, against 12% for gold, 13% for industrial metals and 5% for the broad commodity…

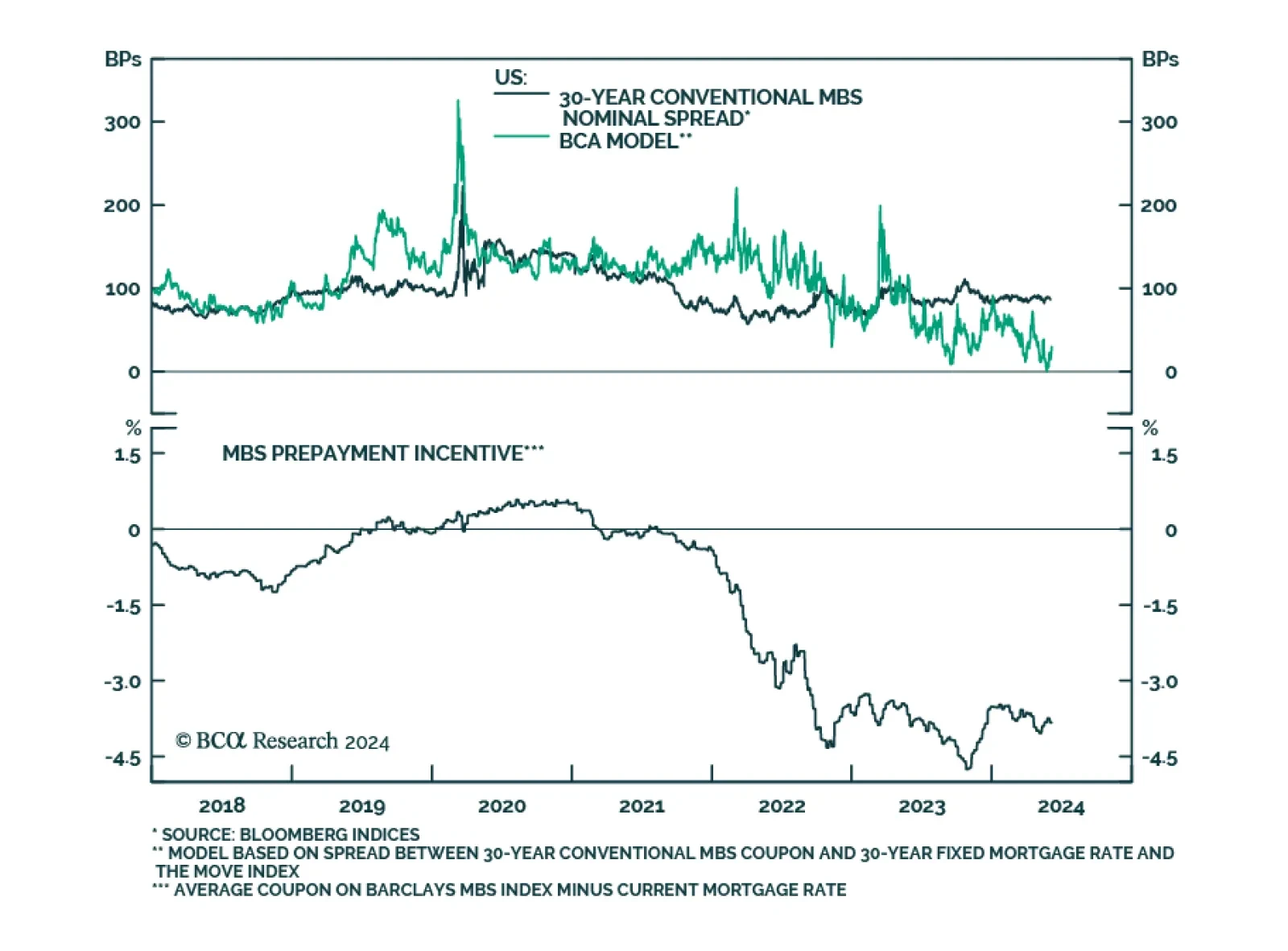

According to BCA Research’s US Bond Strategy service, Mortgage-Backed Securities are currently priced below fair value. Mortgage-Backed Securities outperformed the duration-equivalent Treasury index by 49 basis points in…

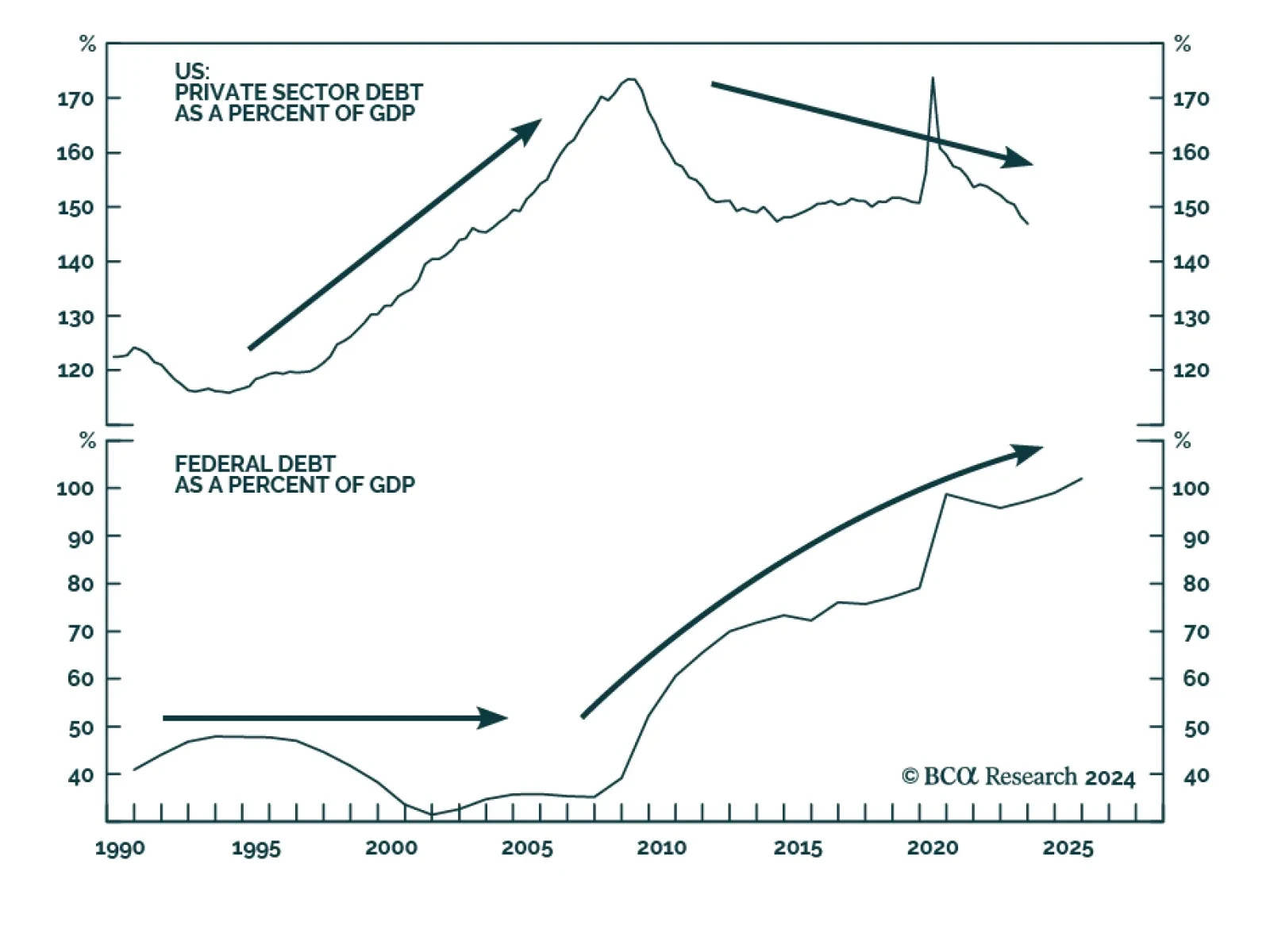

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly…

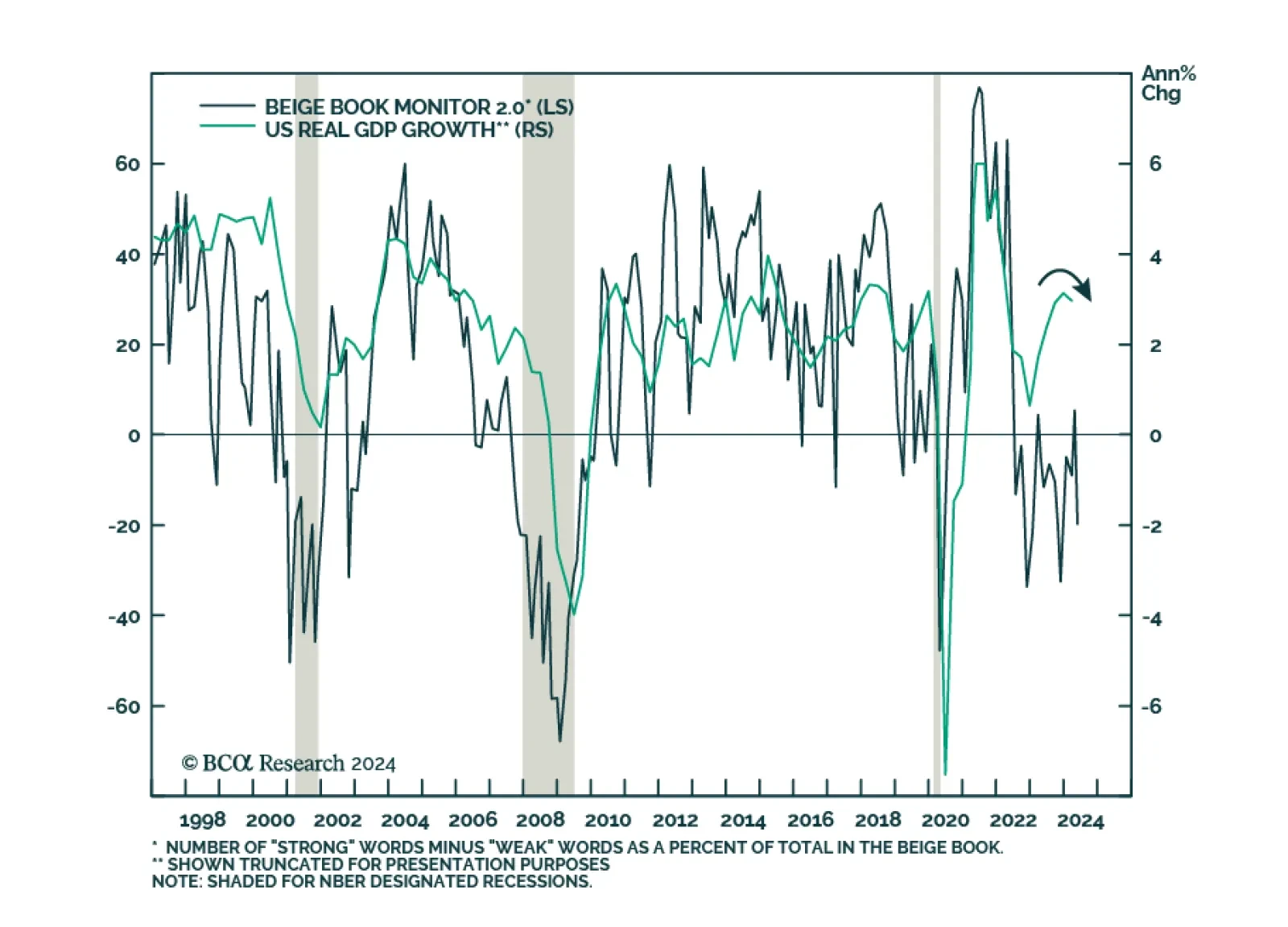

The message from the latest Beige Book release is confirming that US demand is showing signs of slowing down. Of the 12 Federal Reserve districts, 2 reported modest economic growth, 8 reported economic activity was slightly up,…

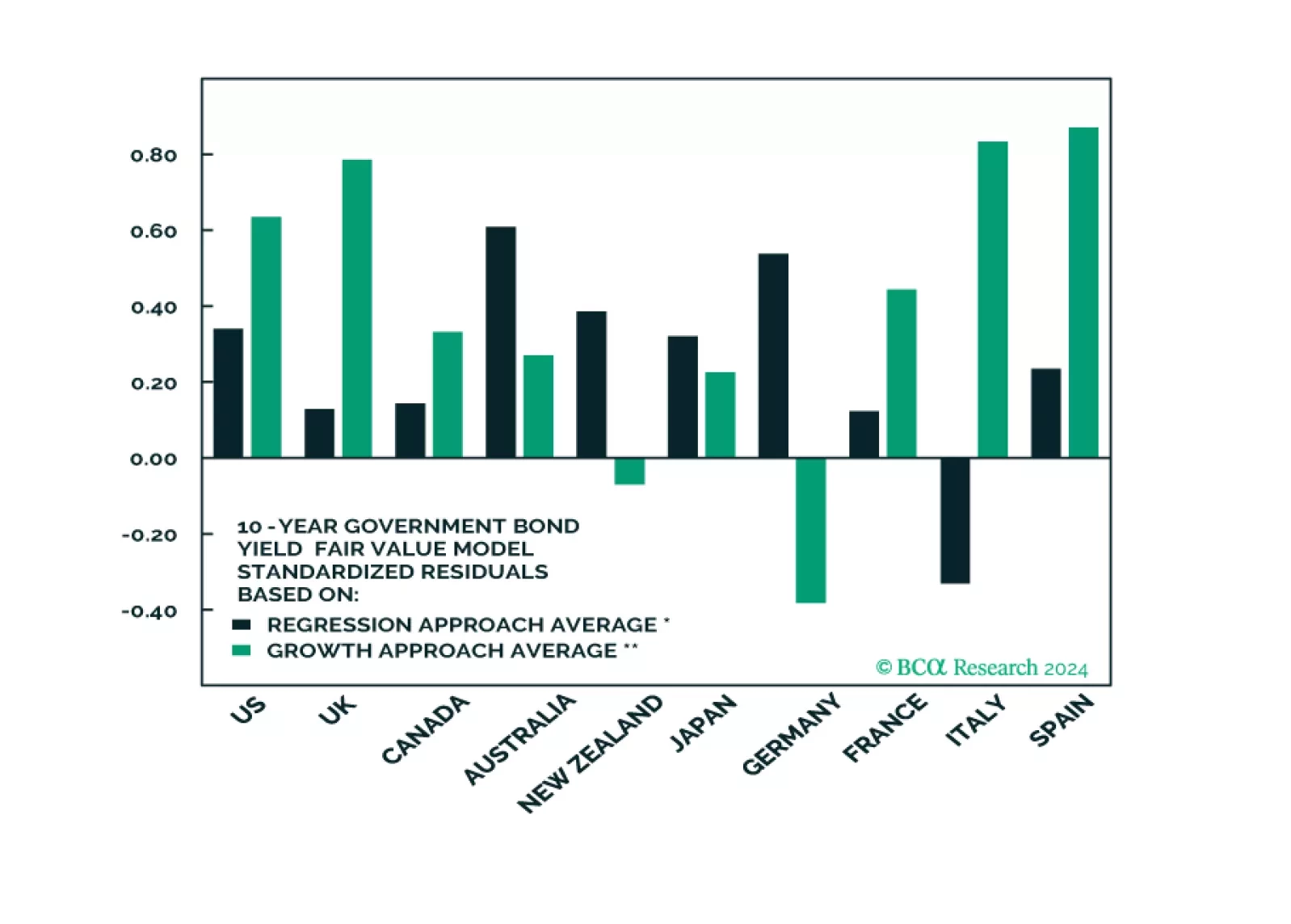

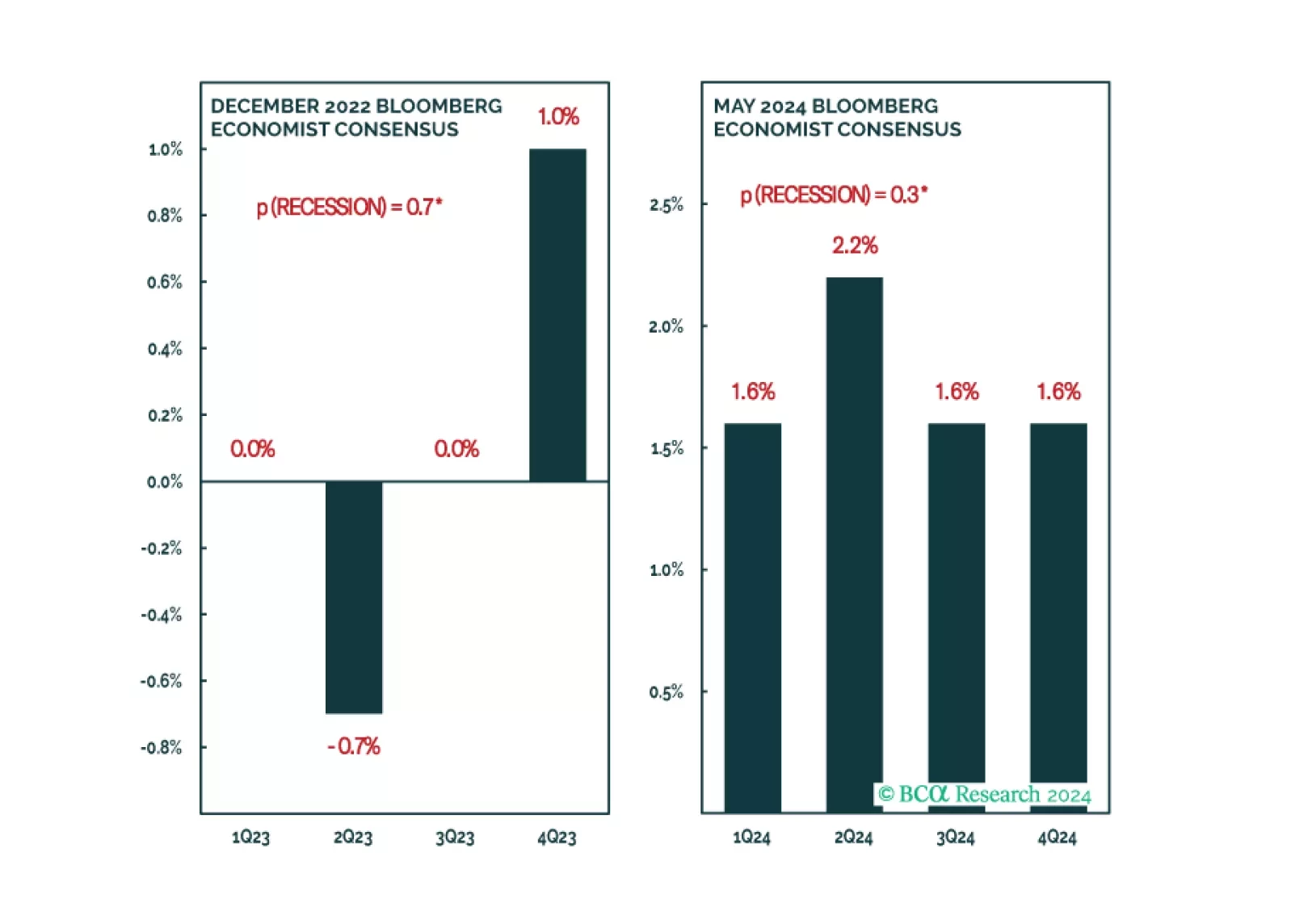

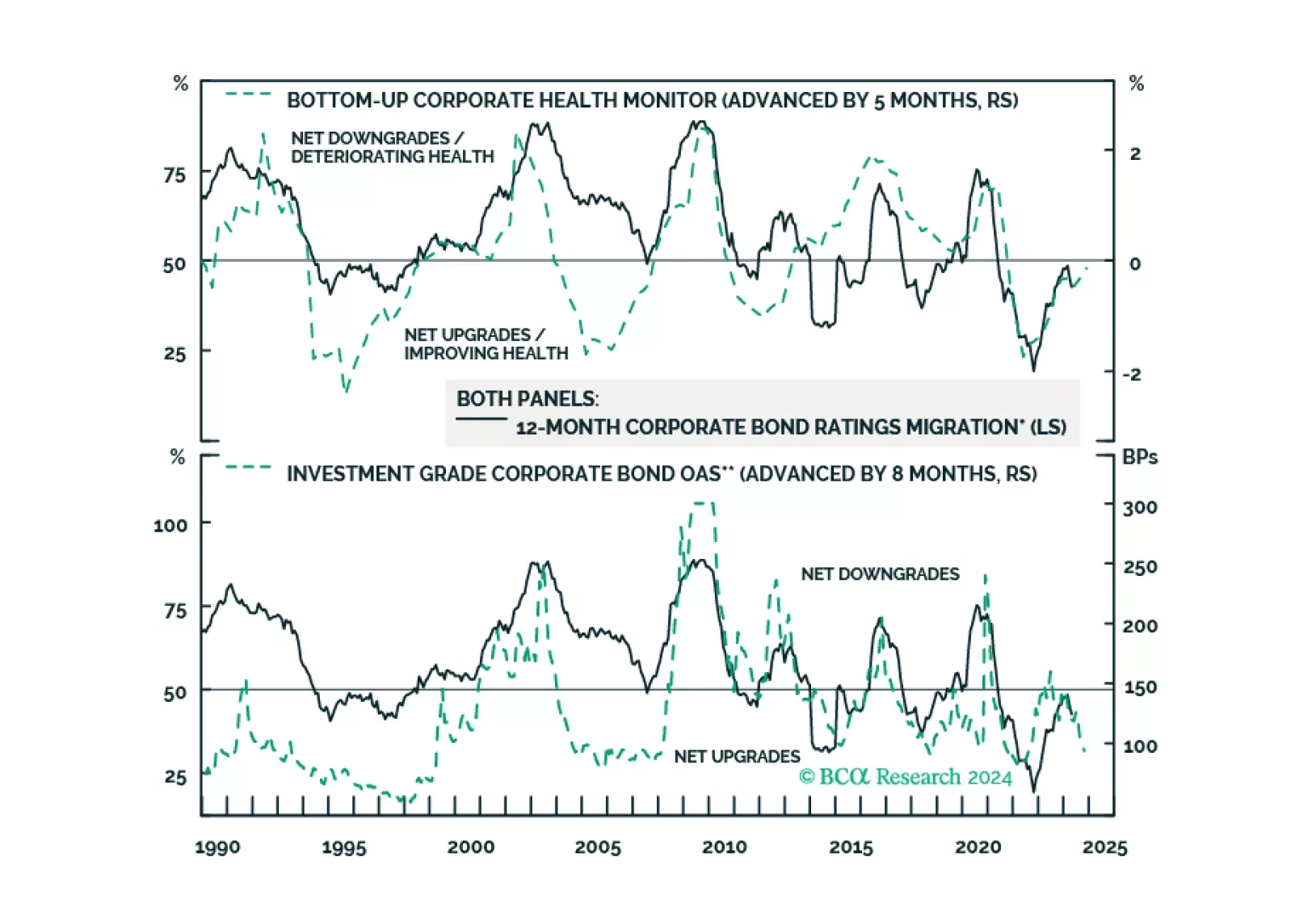

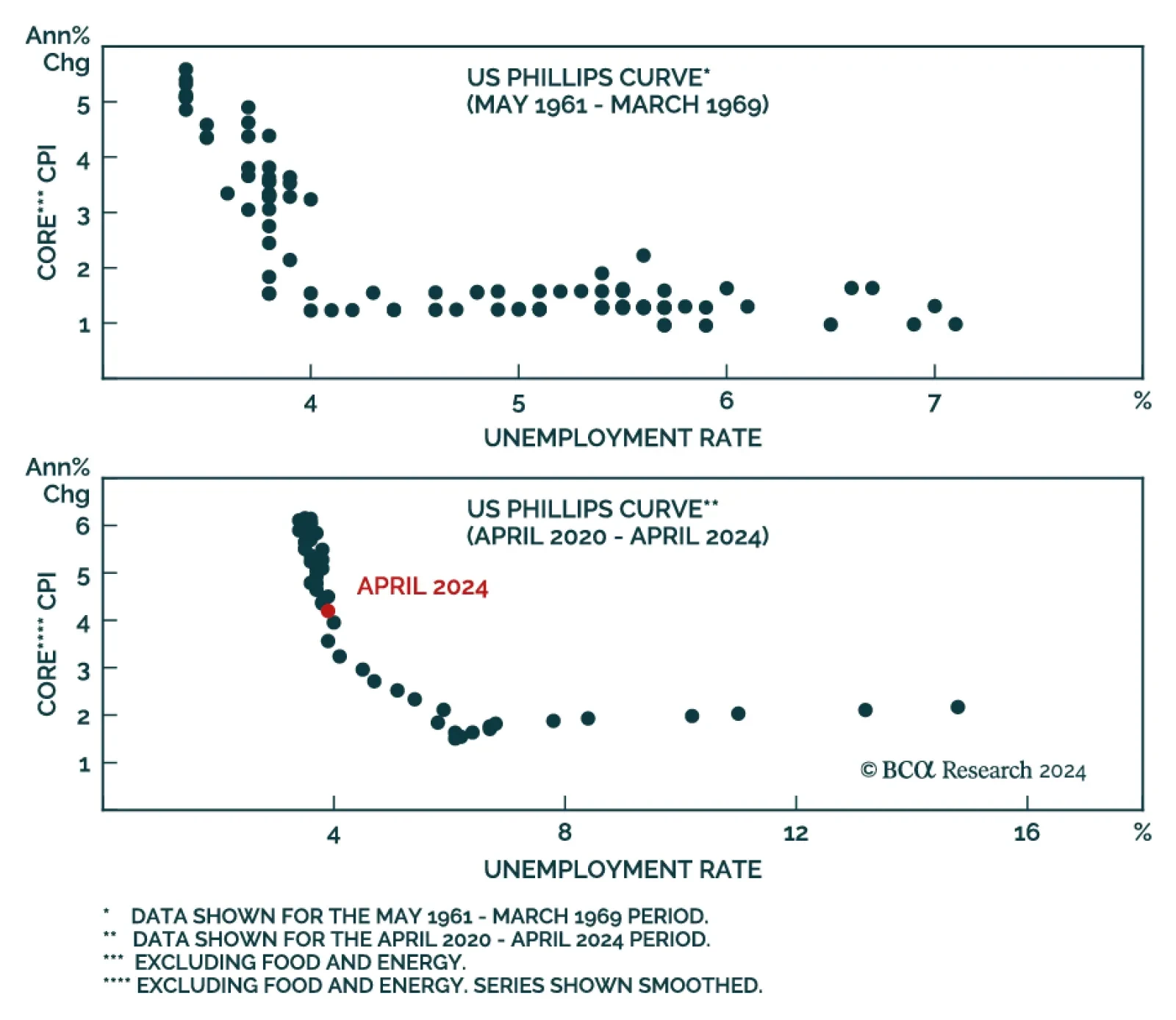

According to BCA Research’s Global Investment Strategy service, there is only a narrow path to a soft landing. Our colleagues estimate a mere 20% chance that the US will avoid a recession before the end of 2025. The US…

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

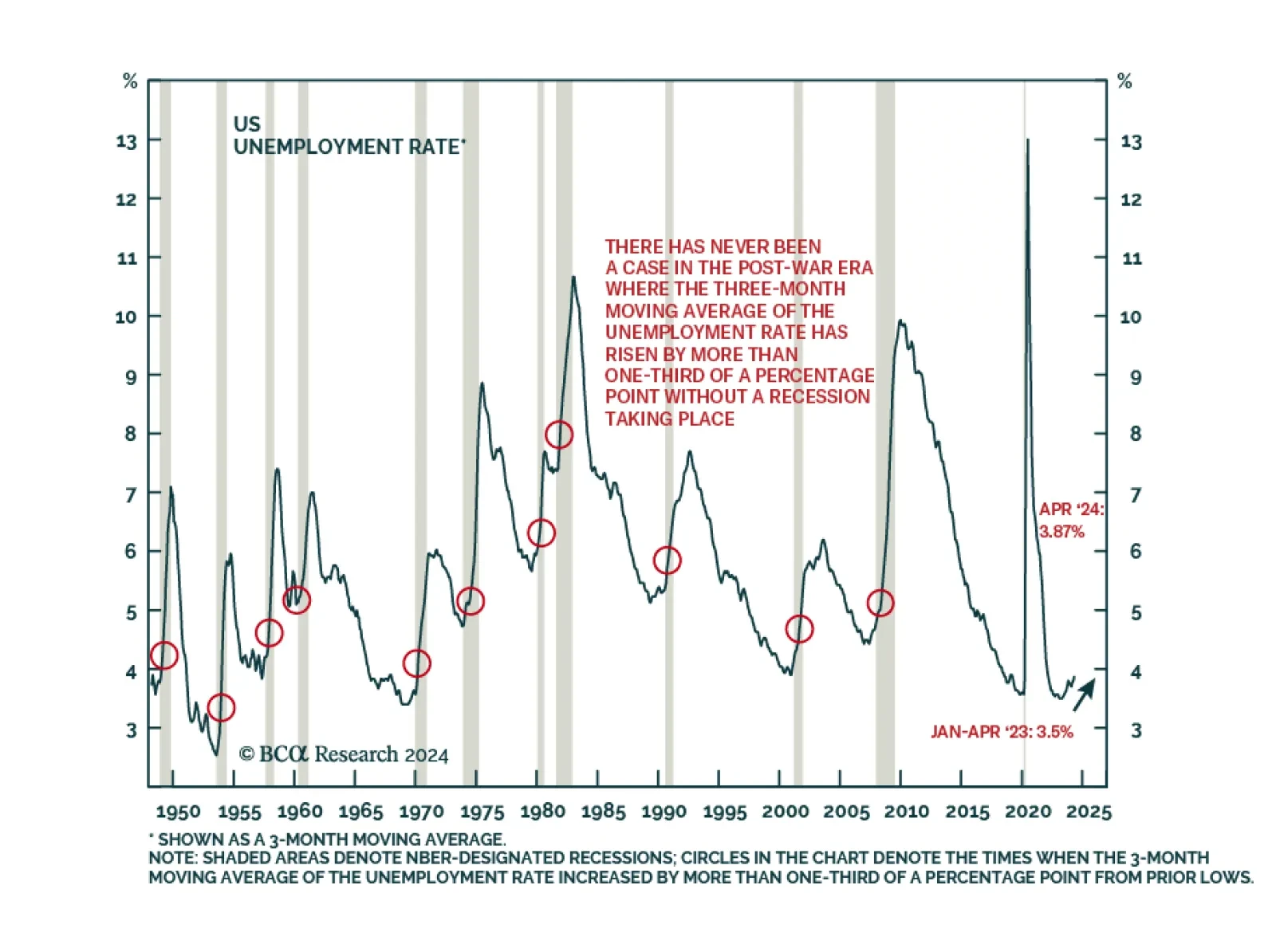

The 3-month moving average of the unemployment rate has been a reliable US recession indicator. Indeed, there has never been a case in the post-war era when it has increased by more than a third of a percentage point from its…

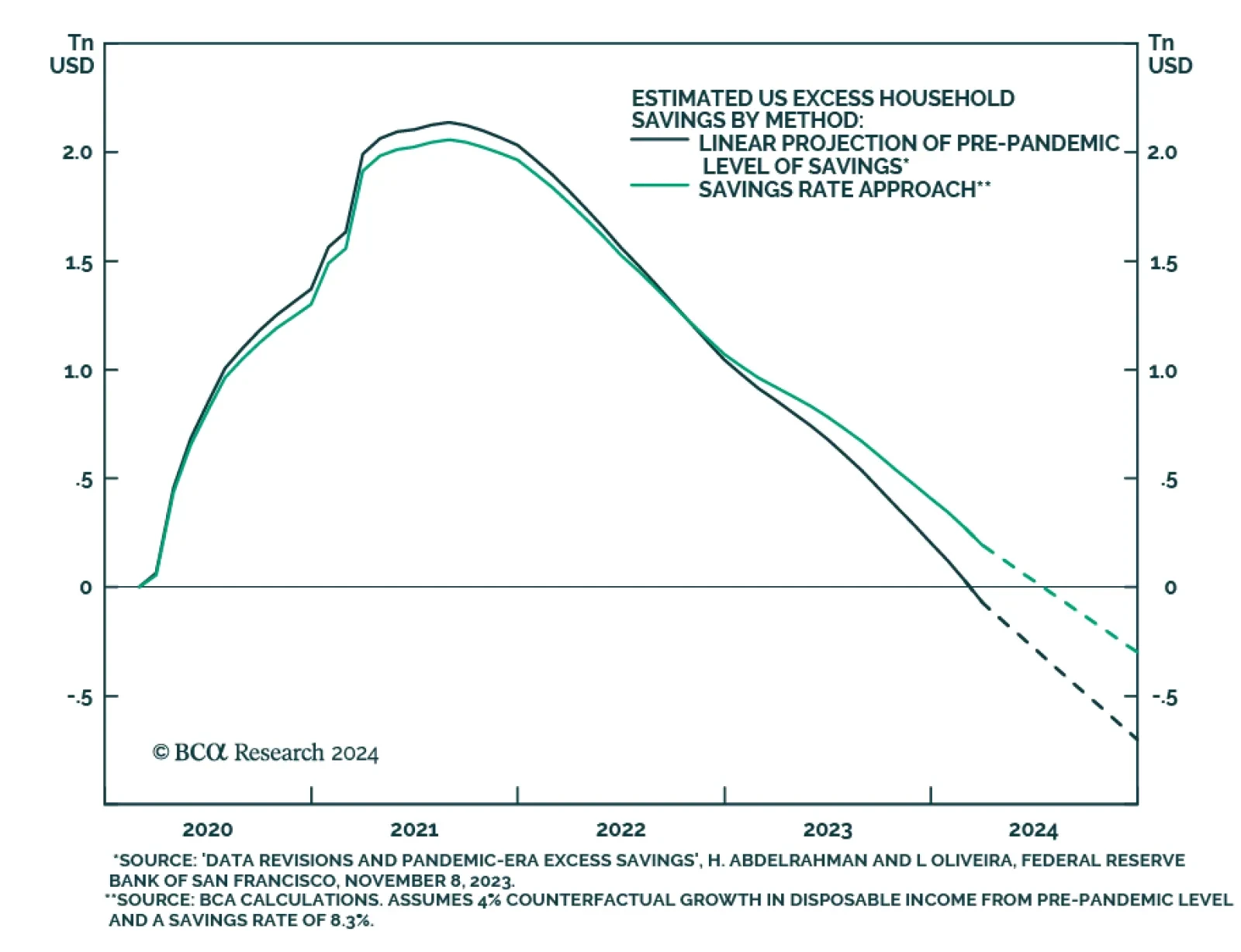

Emergency pandemic policies elongated the lag between Fed rate hikes and an observable slowdown in the economy. Notably, fiscal transfers and constrained consumption options endowed households with more than $2 trillion of…