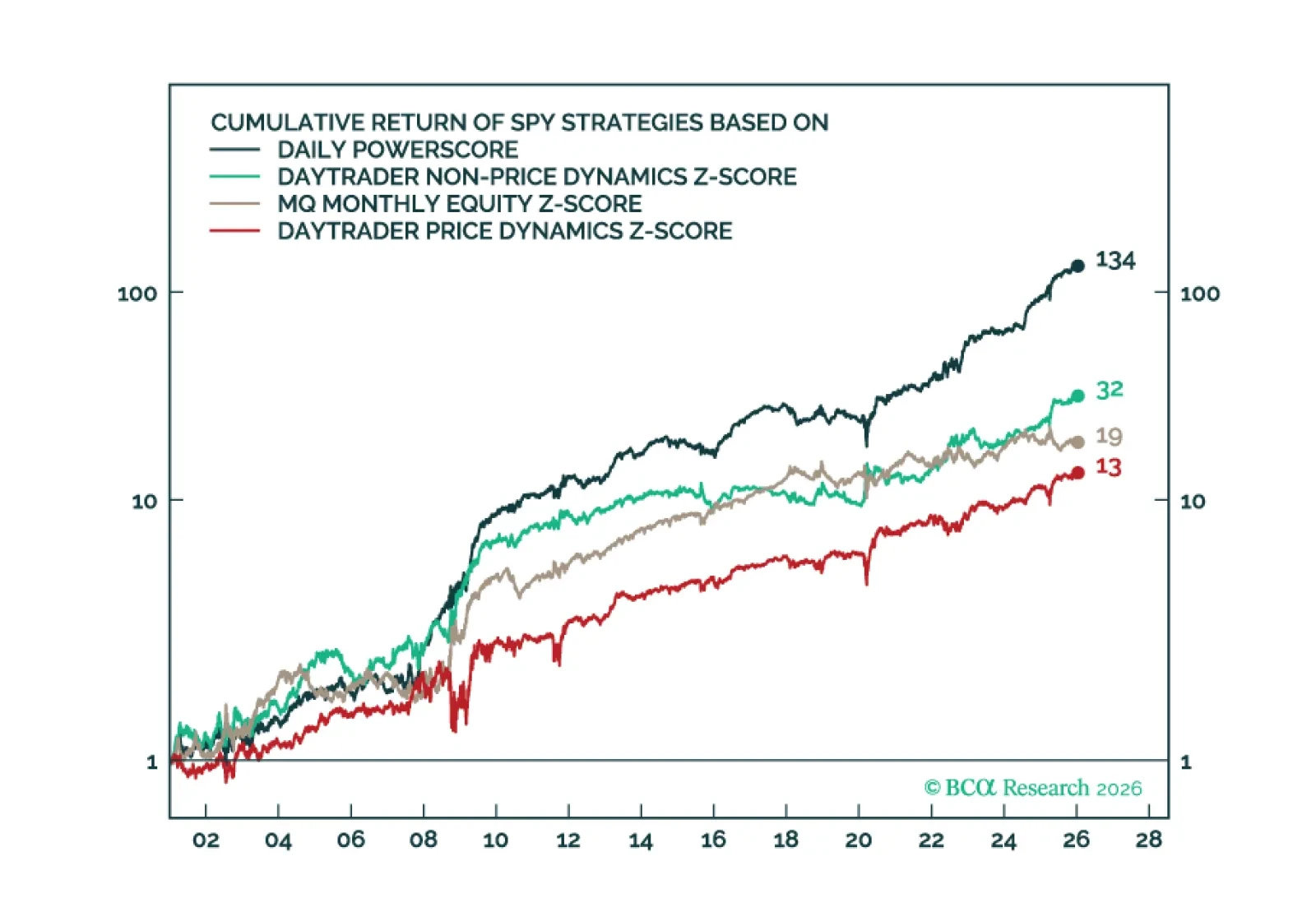

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

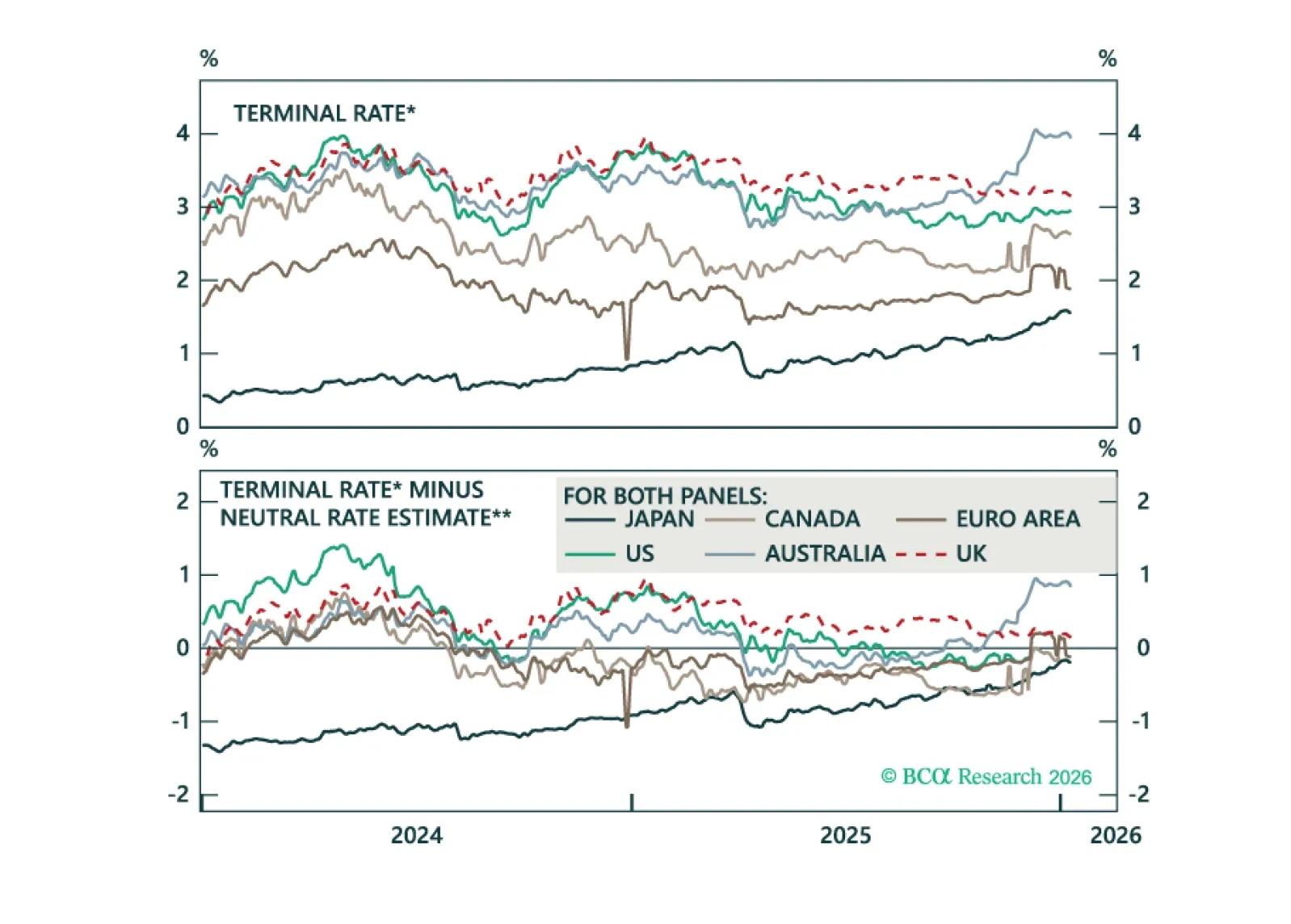

Our Q1 outlook maps global growth, curve dynamics, and policy surprises, which we then translate to our recommended global fixed income portfolio allocations and trades.

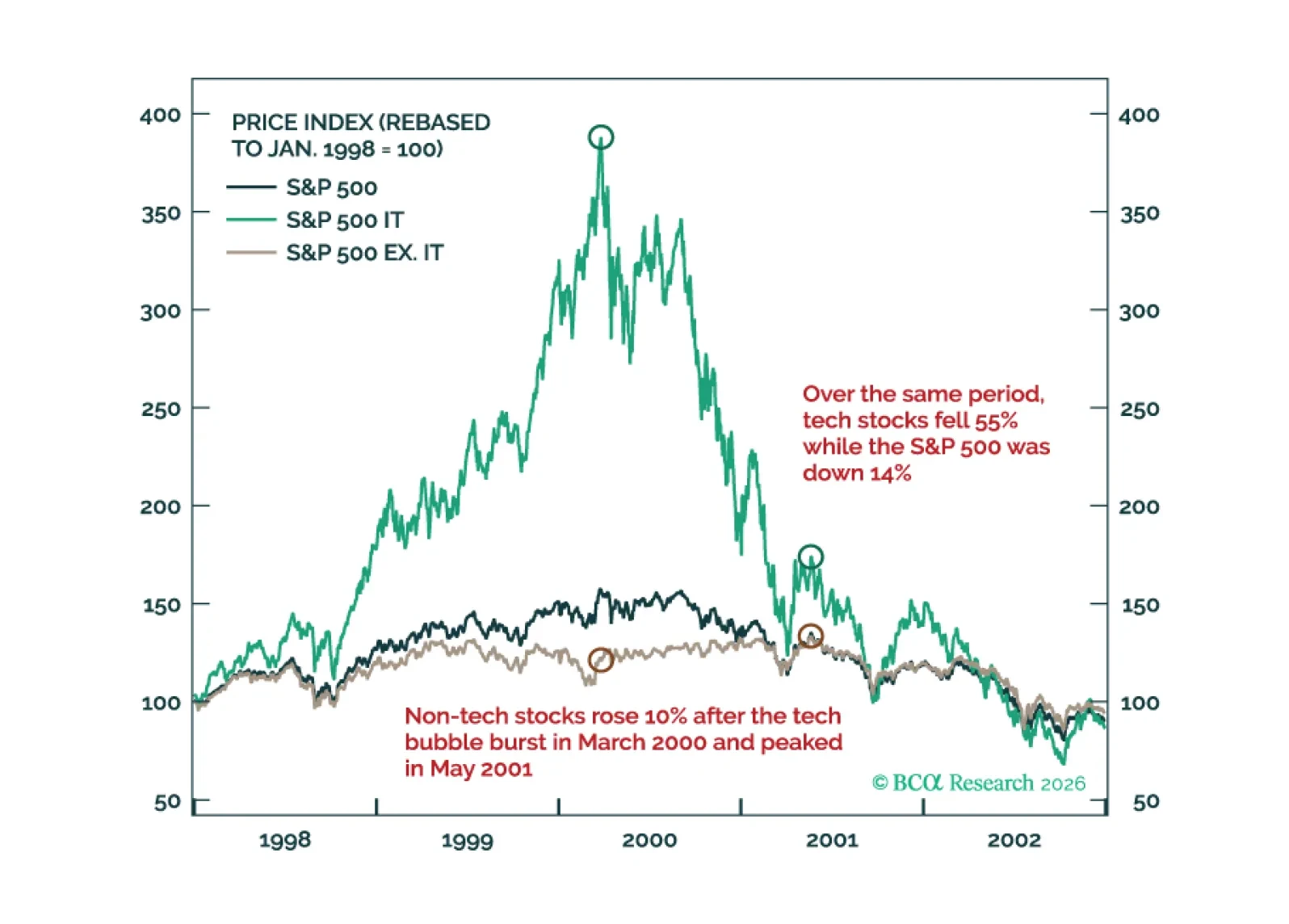

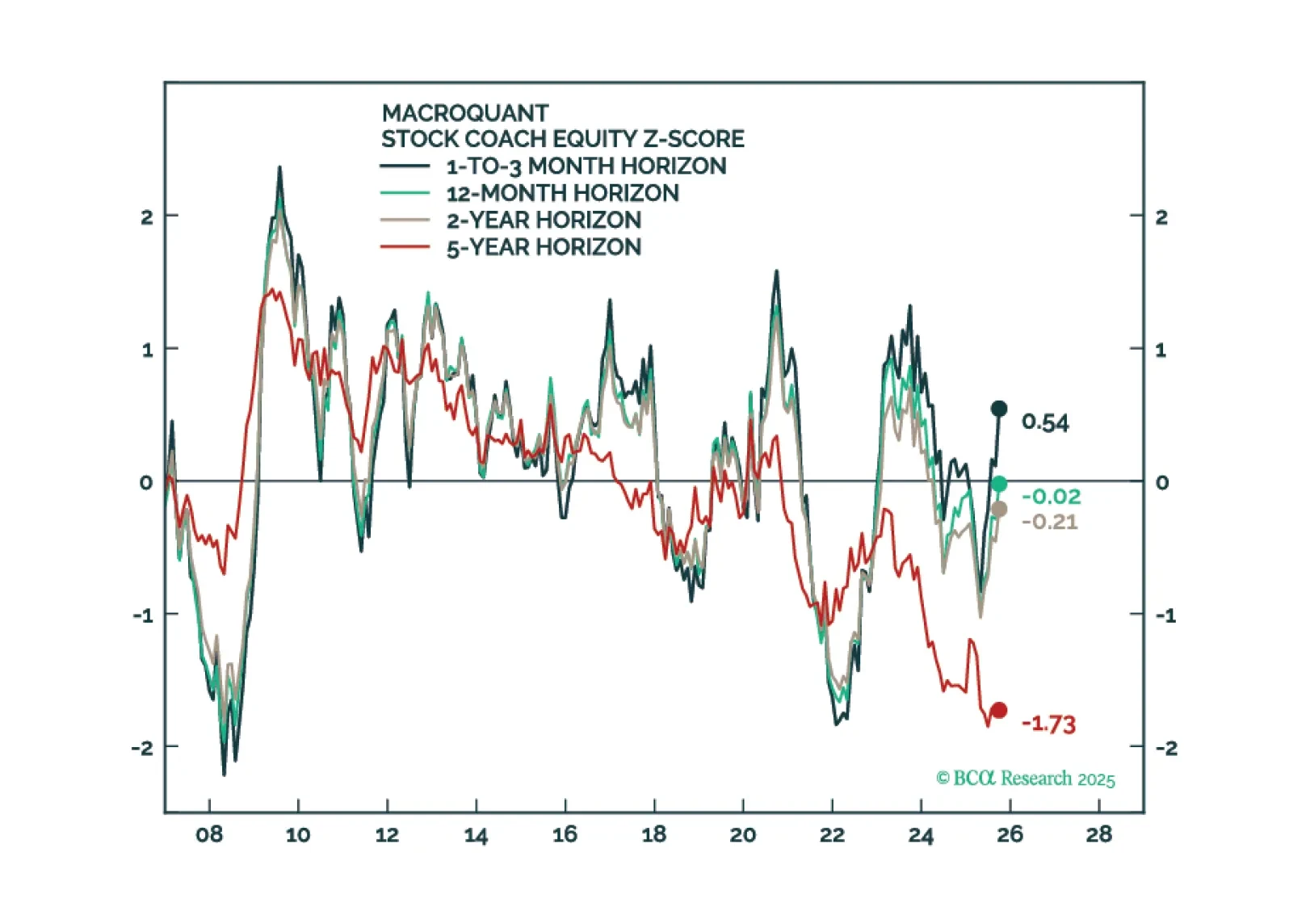

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

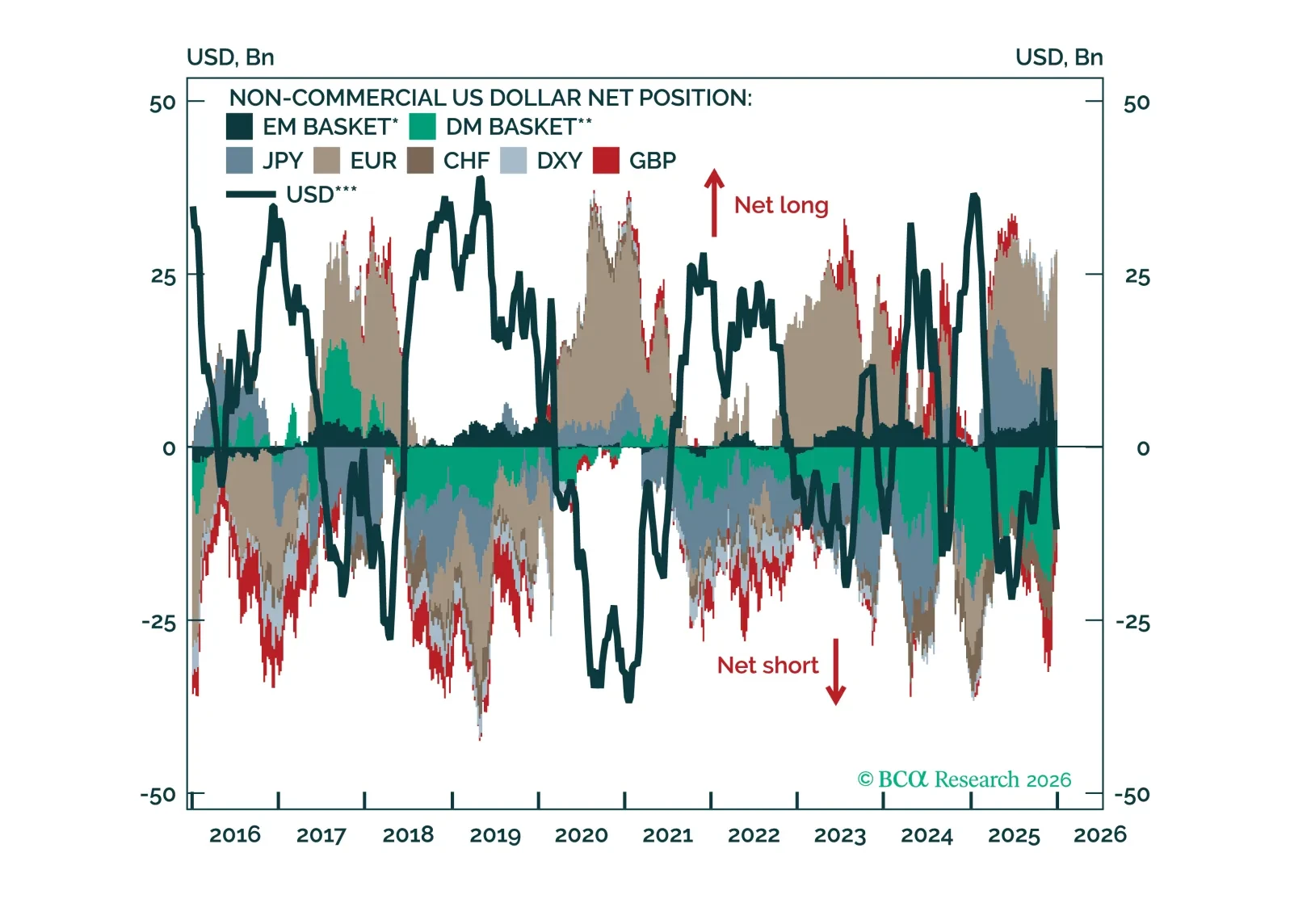

With FX volatility near cycle lows, this Insight examines where positioning has become most stretched across G10, EM FX, and precious metals – and what that implies for near-term moves and reversal risks.

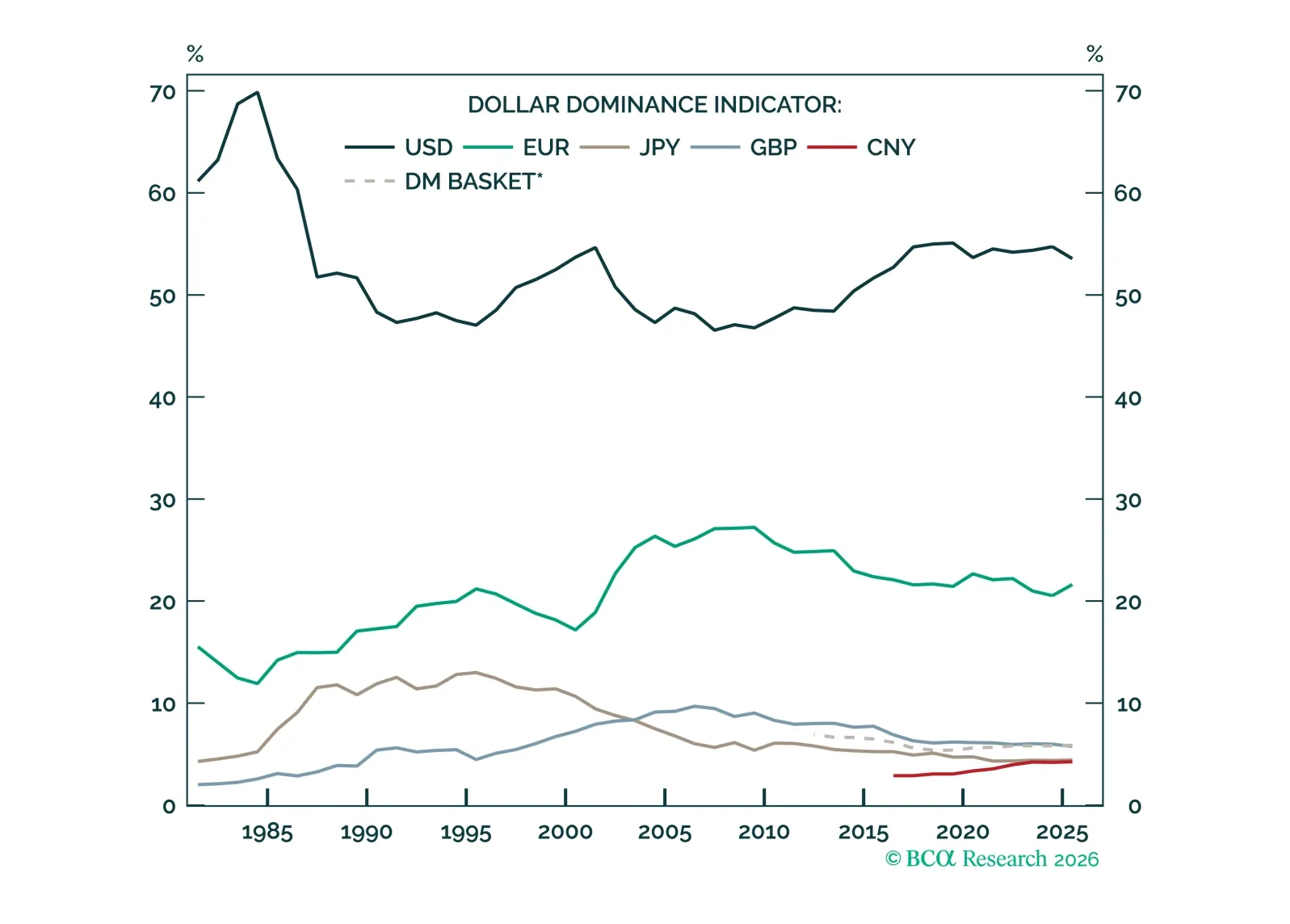

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

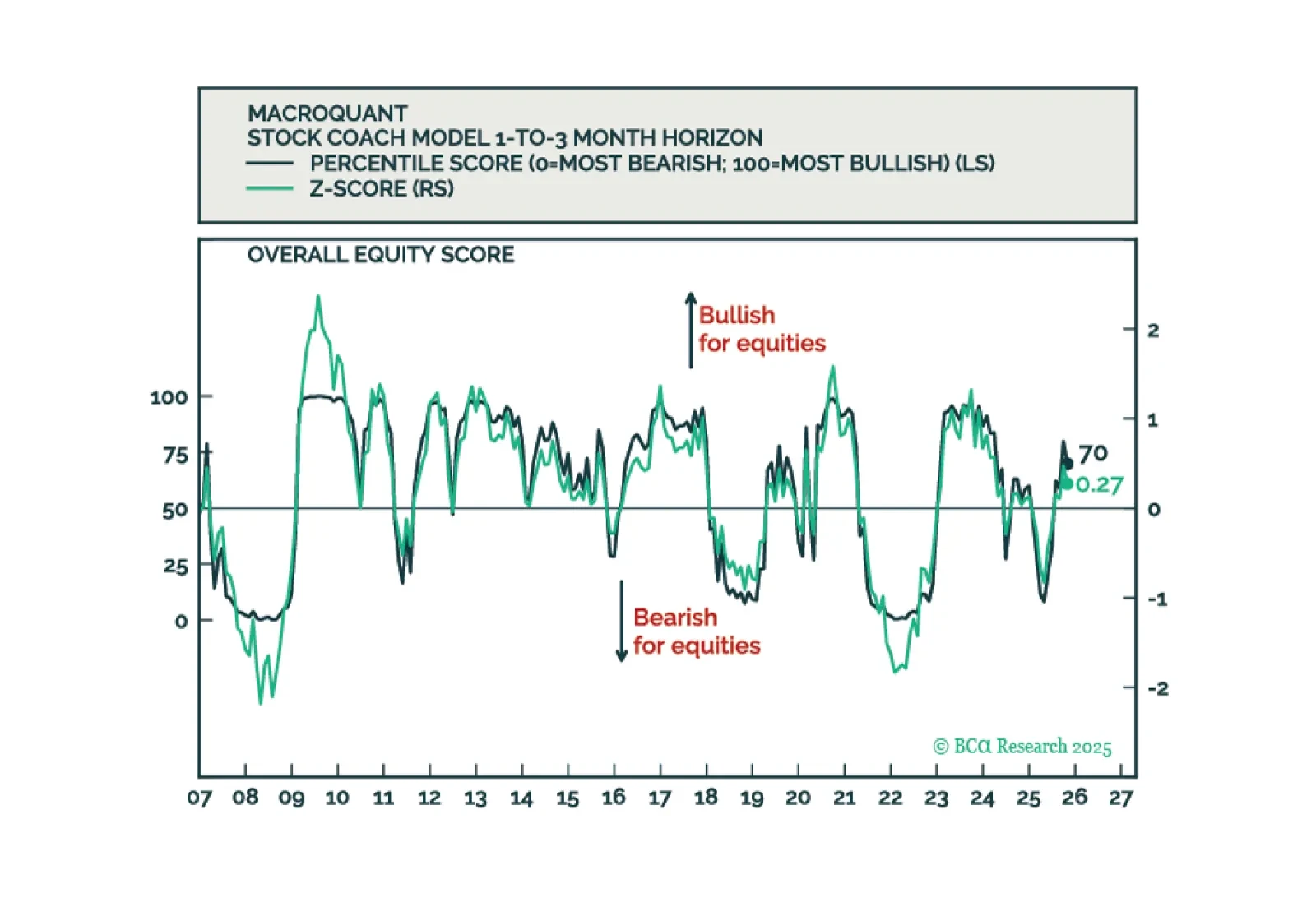

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

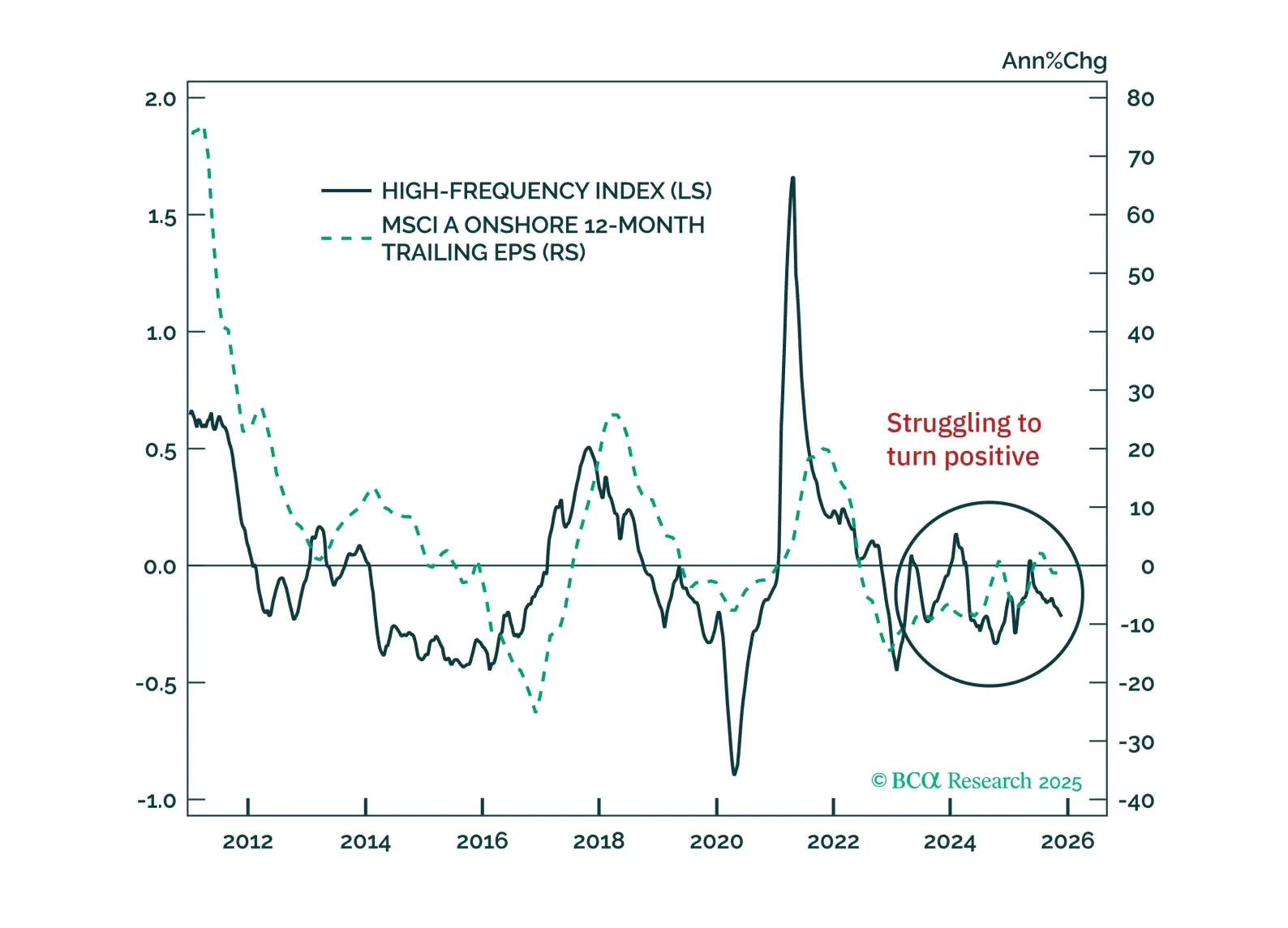

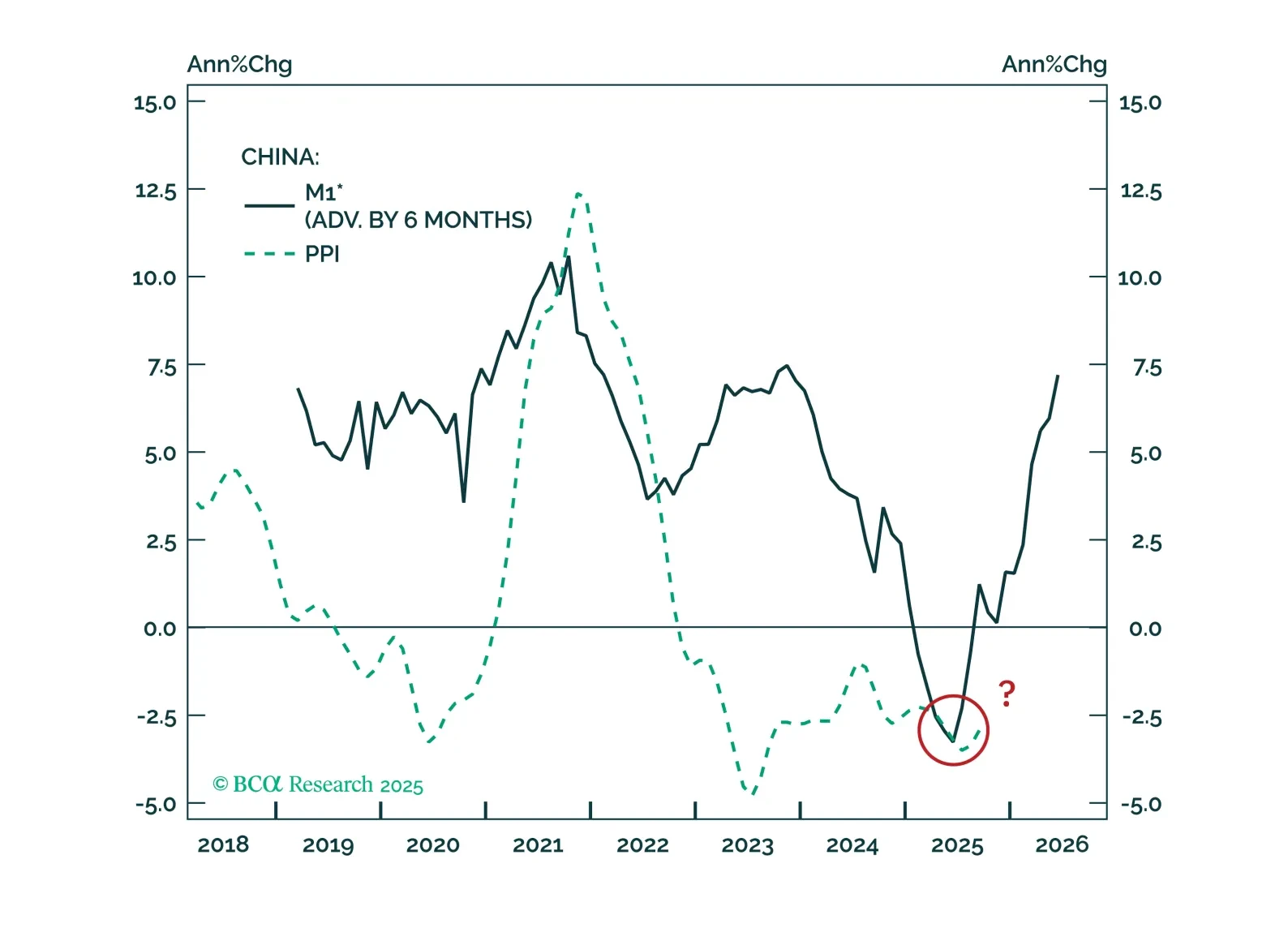

China’s economy is weakening across the board as global risk-off hits equities. With housing conditions worsening and exports contracting—a perfect storm—Beijing faces mounting pressure to deliver stronger, housing-focused stimulus…

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

This month’s China High-Frequency Indicator (HFI) Chartbook decodes the conflicting messages in recent economic data, highlights key signals from our HFI, and explains what they mean for China’s economy and markets.