Our Tesla-dominated S&P automobiles & components underweight is currently on fire (no pun intended) generating 34% in relative returns in just over a month. While our original rationale for the underweight exposure in…

Underweight Recently we highlighted how the inclusion of TSLA in the S&P consumer discretionary sector catapulted the sector’s 5-year growth forecasts to the stratosphere. We also mentioned anecdotes of sell-side analysts…

In last week’s US Sector Insight we showed how TSLA’s inclusion in the S&P 500 pushed consumer discretionary 5-year forward EPS growth into the stratosphere. We then dove deeper into this GICS1 sectors in this Monday…

Highlights Portfolio Strategy Speculative fervor dominates trading in the S&P auto & components group, but soaring long-term profit projections, lofty valuations, overbought technicals, and a looming German/Japanese/Chinese…

Highlights While difficult to forecast, the trajectory of global auto sales likely will follow that of GDP growth (Chart of the Week). As a result, palladium’s supply constraints will re-emerge, but its “epic rally”…

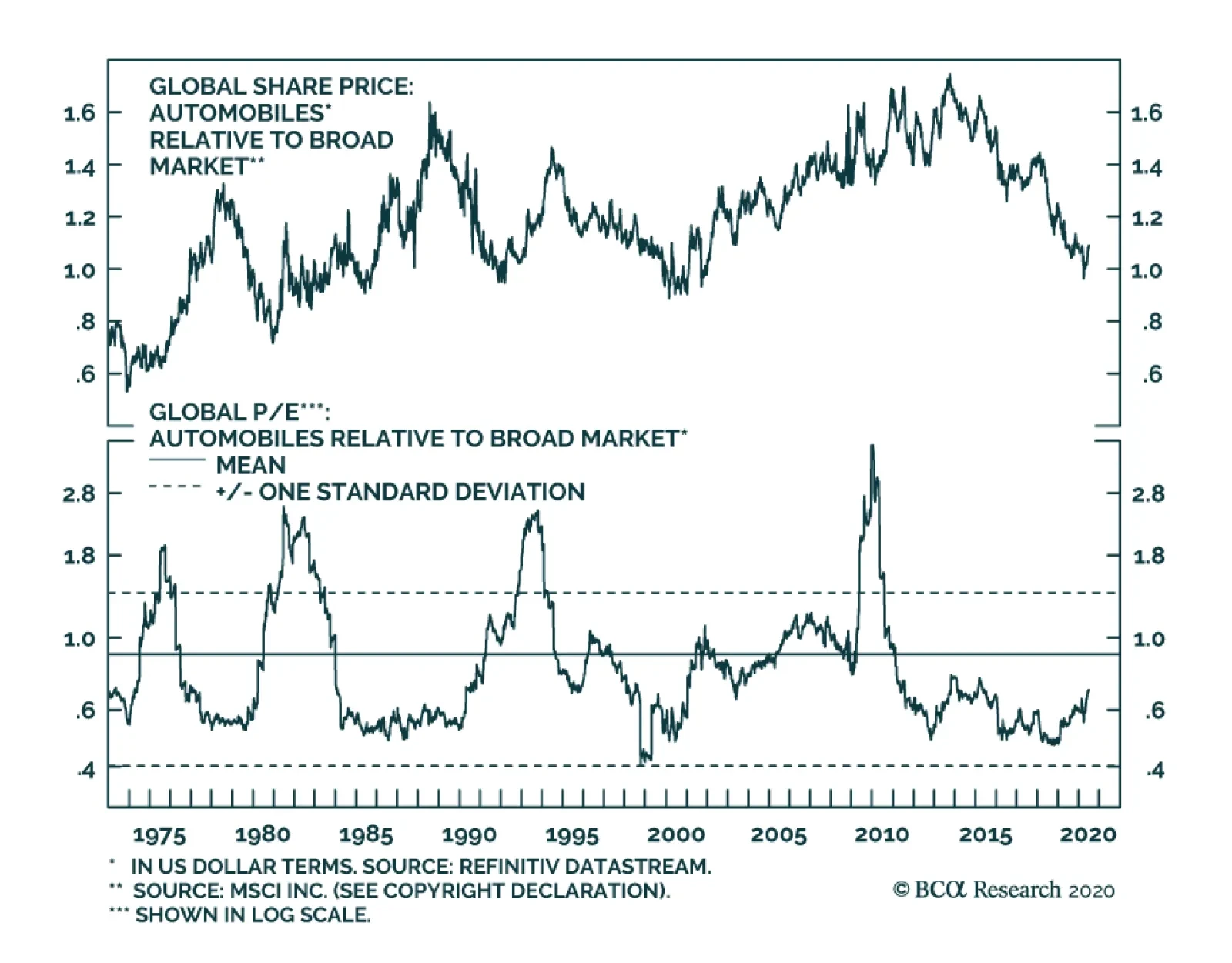

Global automotive stocks are sporting their worst performance in relative terms since March 2000. At the epicenter of the selloff have been two tectonic shifts. First, the COVID-19 crisis has led to widespread shutdowns and…

Analyses on Chinese autos and Brazil are available below. Highlights The Fed’s aggressive monetization of public and some private debt has inspired investors to allocate cash to risk assets However, a number of cyclical…

Highlights Bulk commodity markets – chiefly iron ore and steel – could see sharp rallies once Chinese authorities give the all-clear on COVID-19 (the WHO’s official name for the coronavirus). These markets rallied…

Highlights Chinese stocks made a comeback as soon as the speed of COVID-19 transmitting outside of the epicenter somewhat moderated. Inside the epicenter, the pandemic has not shown clear signs of easing, and could significantly…