This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

Highlights Portfolio Strategy The hardening insurance market on the back of firming demand for insurance services especially in residential real estate and automobile markets compel us to lift insurers to a benchmark allocation. A…

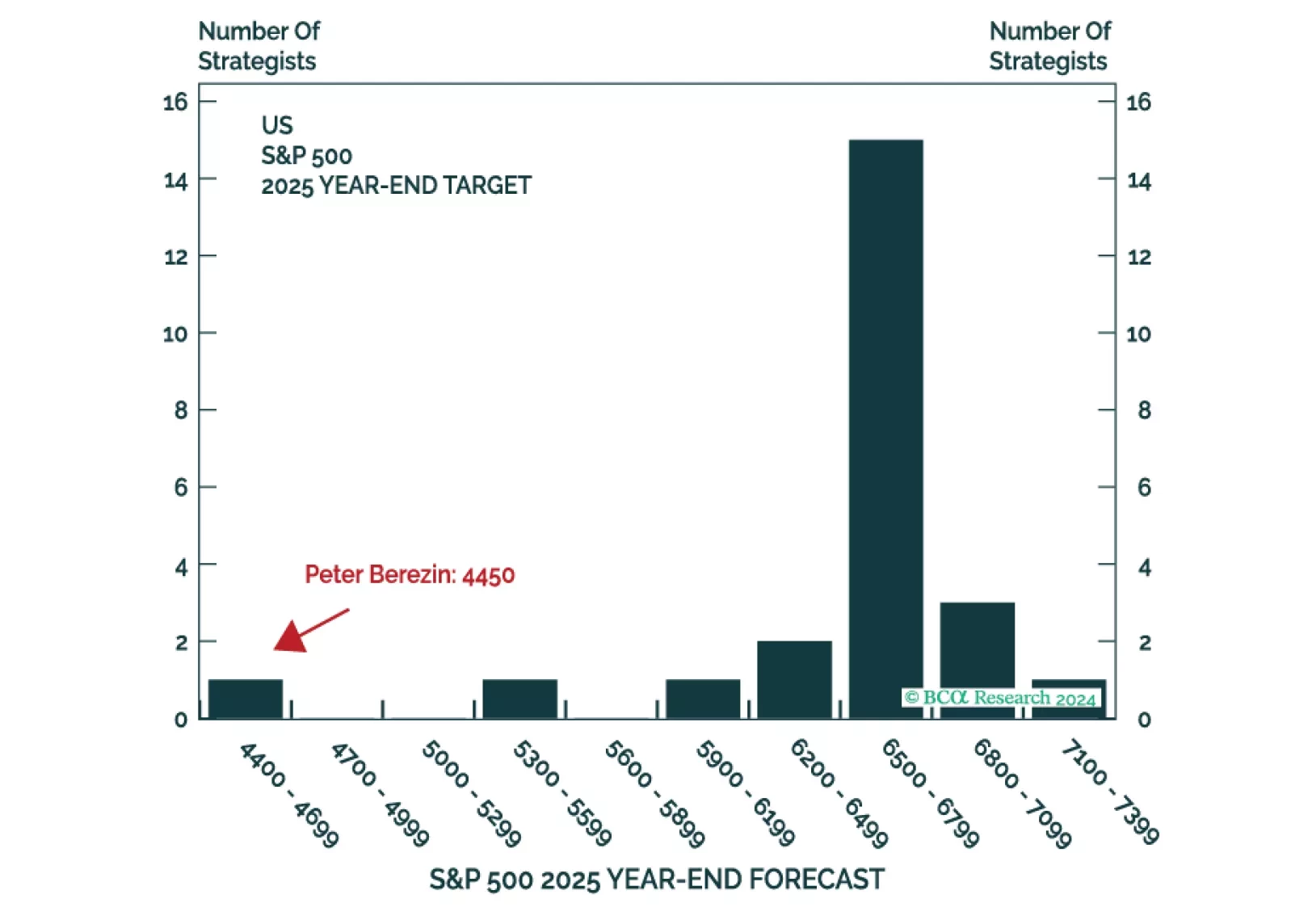

Highlights Portfolio Strategy The financials sector's fortunes are linked to the path of 10-year Treasury yields. BCA's view of a selloff in the bond market bodes well for this interest rate-sensitive sector. The S&P…

Overweight - High-Conviction The S&P asset management and custody banks (AMCB) index has outperformed both the S&P 500 and the broad financials index since we lifted it to a high-conviction overweight in mid-February. The…

The financial sector is regaining some momentum after this year's consolidation, and the S&P asset management and custody bank (AMCB) index has the potential to take a leadership role. AMCB remains one of the most undervalued…

Highlights Portfolio Strategy Add the S&P asset manager & custody banks index to the high-conviction overweight list. Prospects for higher interest rates bode well for a catch up phase with the rest of the financials sector.…

The S&P asset manager and custody bank index is in a prime position for a catch up rally. This interest rate and market-sensitive financial sector group has lagged most others at a time when macro forces are lining up bullishly. Fed…

After the Trump election victory, we immediately upgraded our financial sector view to neutral to protect against the benefit of rising interest rates and the potential for a clear asset preference shift in favor of stocks over bonds.…

Financials have celebrated the modest upshift in the interest rate structure and hopes for a reversal of the regulatory framework that has been a structural noose on profitability, and risk premiums. These factors, along with our…