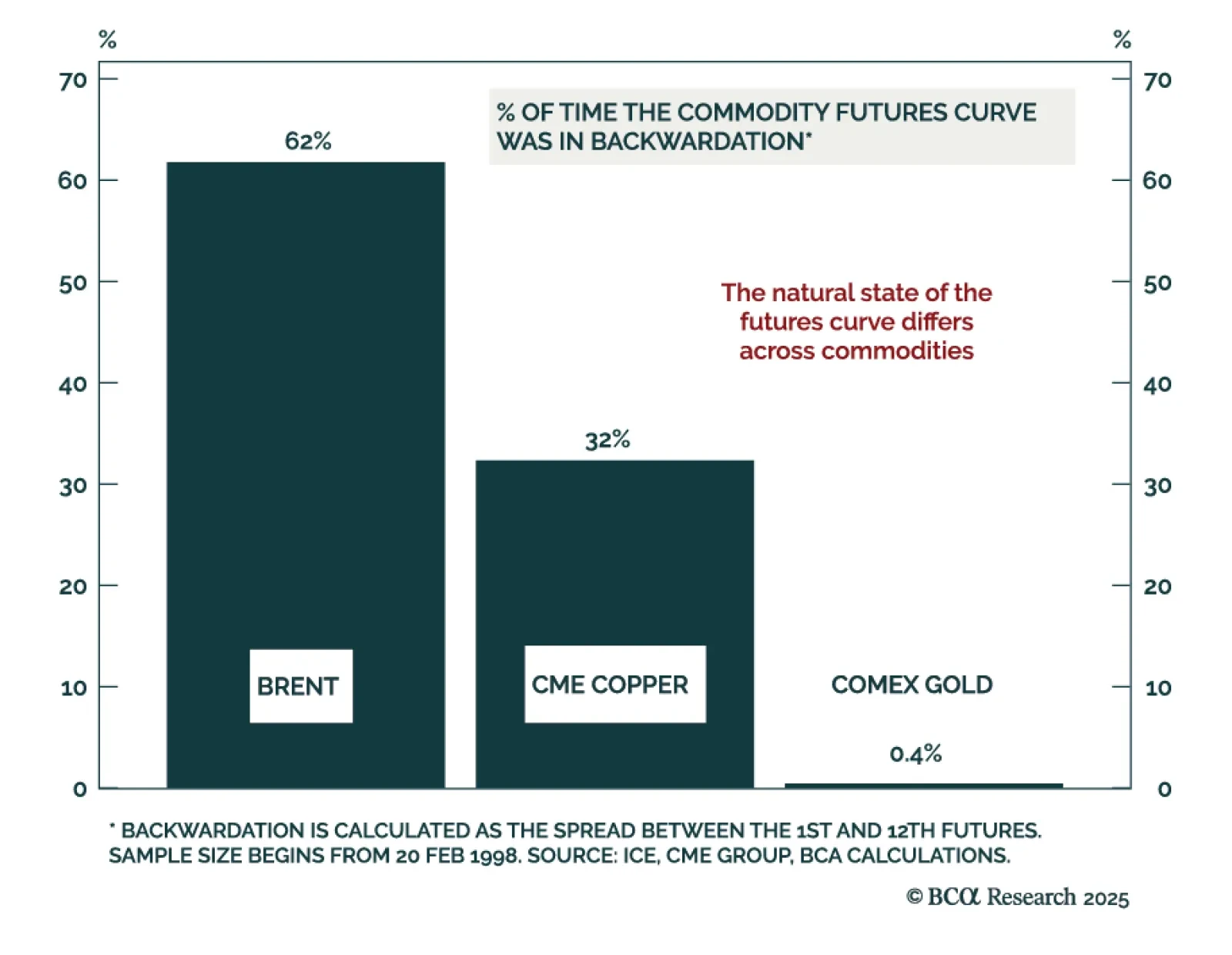

Oil, copper, and gold futures curves have experienced abnormal changes in the past few months, but a bearish global outlook will steepen contango structures across all three. Oil’s curve structure has flipped from backwardation…

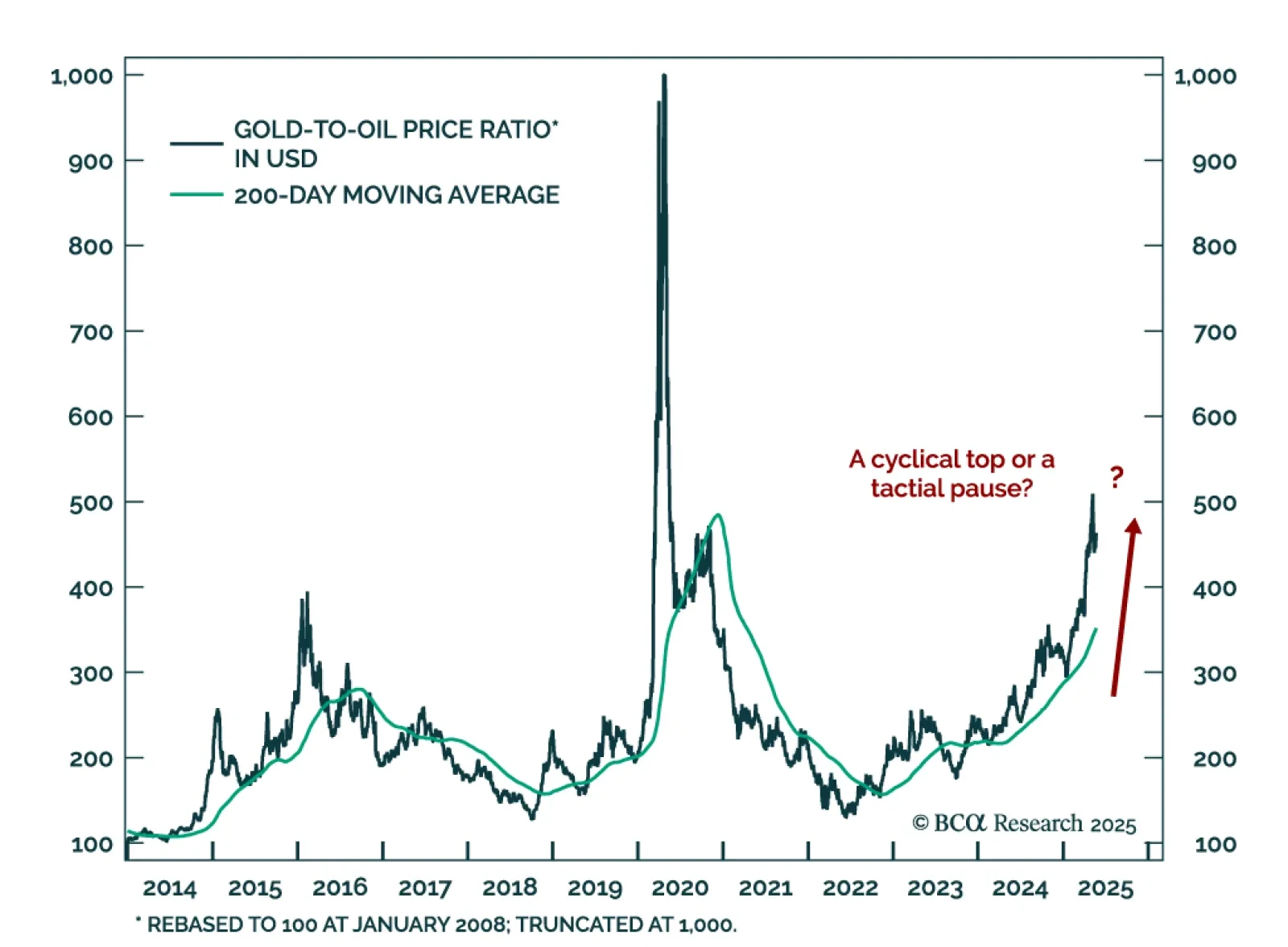

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

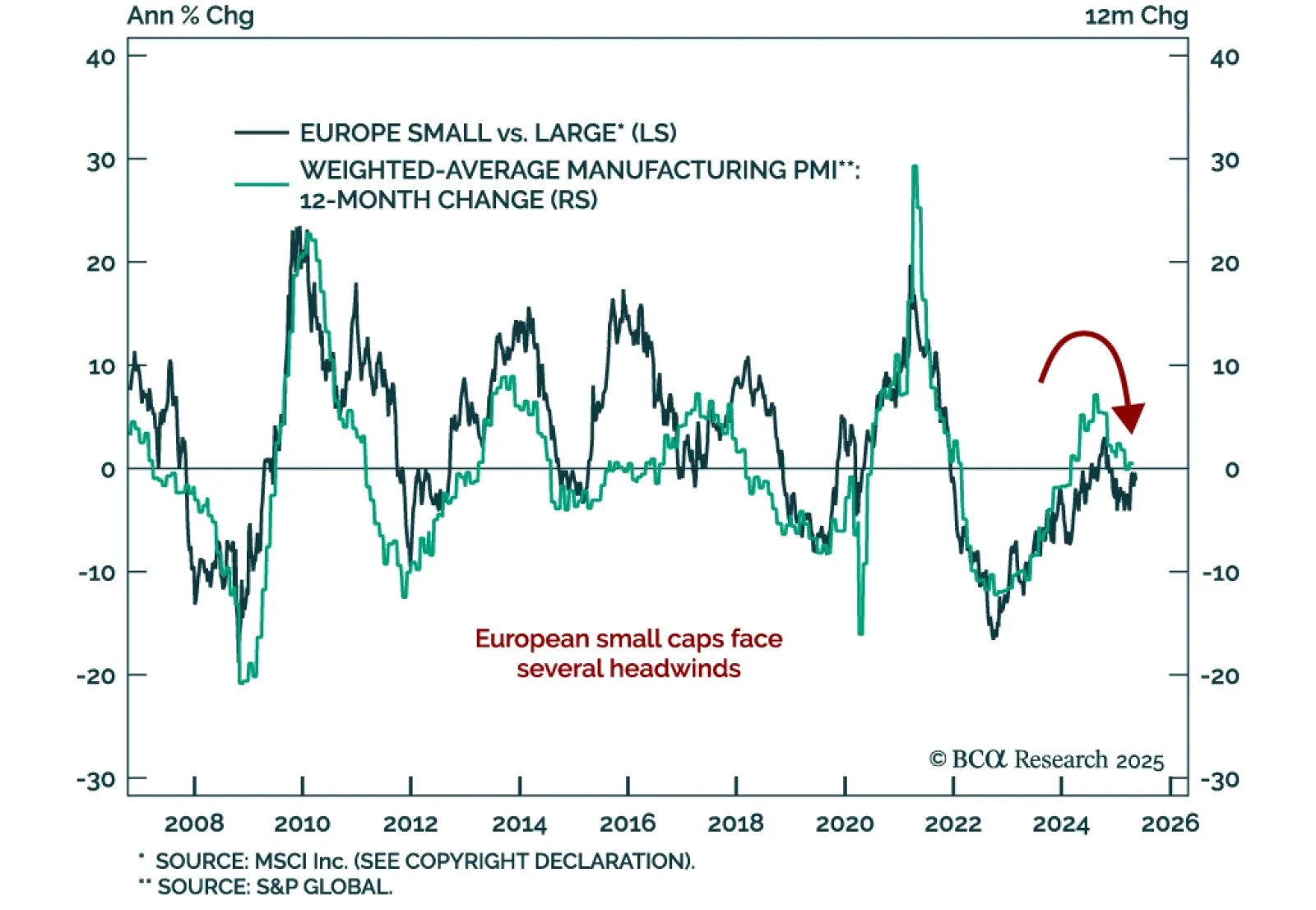

The outperformance of European small caps is coming to an end. Our Chart Of The Week comes from our European Investment Strategy team.The team identifies several headwinds for small caps in Europe in the near term. Small caps’…

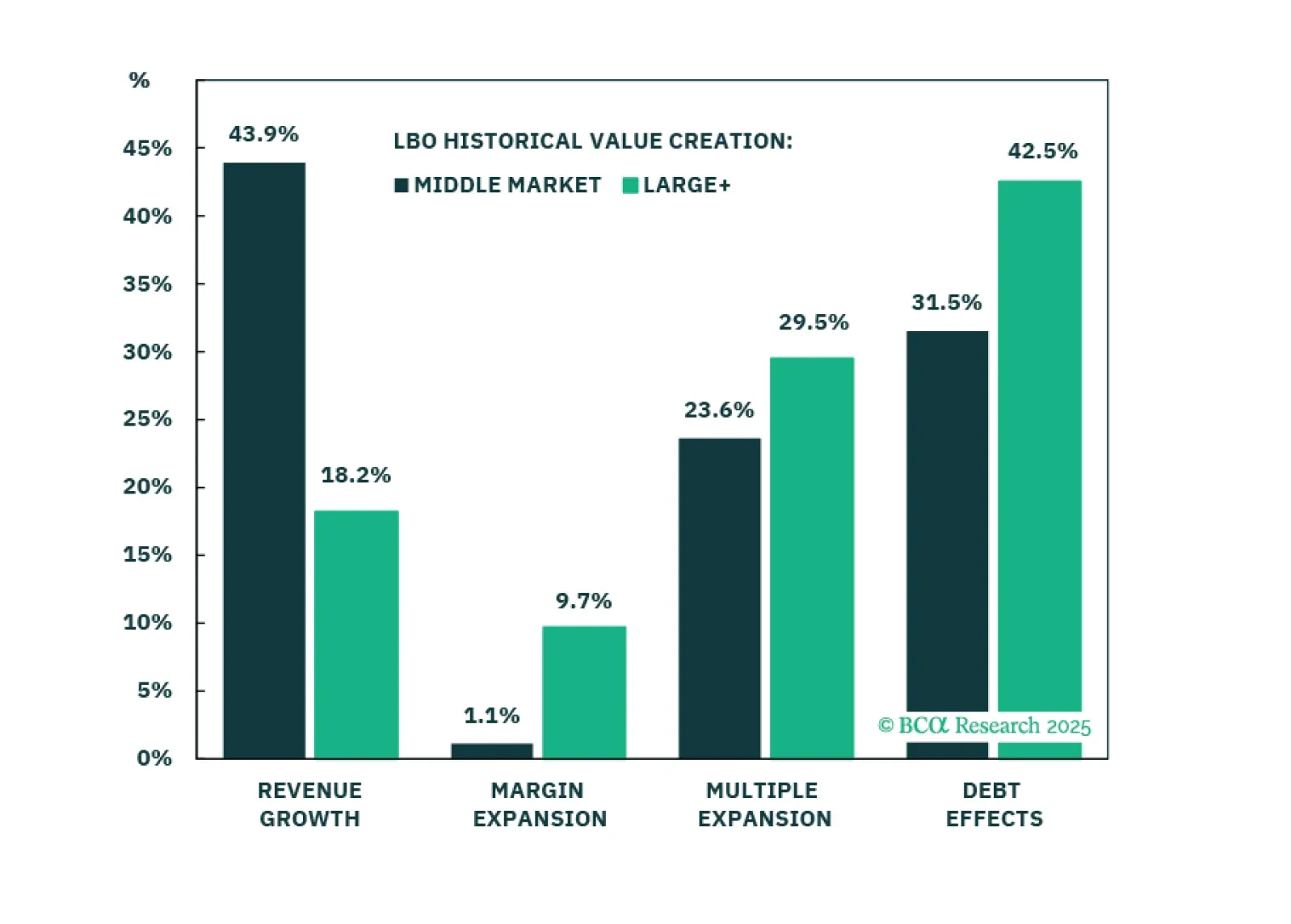

Return expectations have changed for Buyouts, but not equally for Large+ and Middle Market deals. While tariffs are dramatically reducing investor expectations, our return expectations are modestly increasing—with Large+ leading. In…

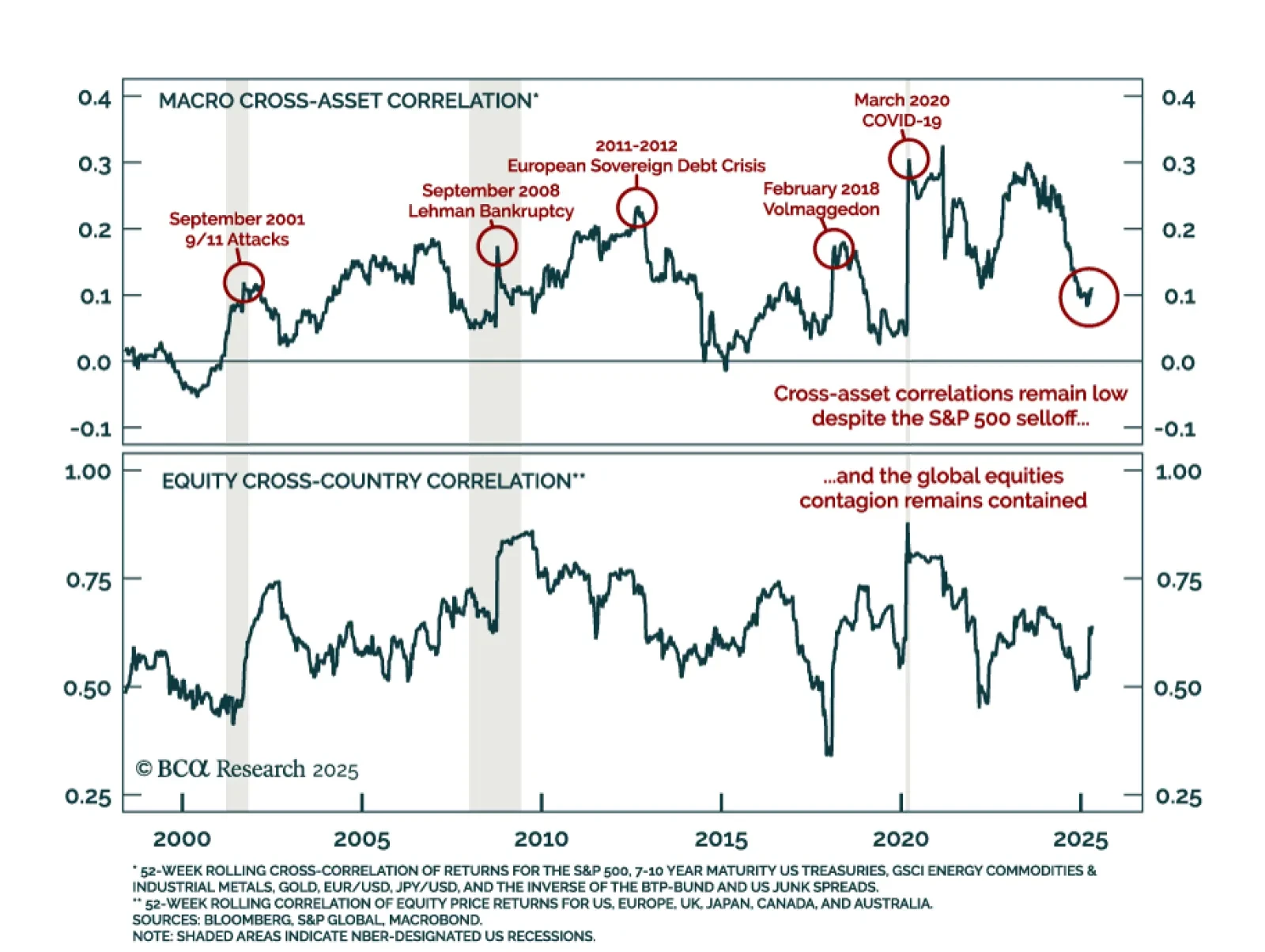

Cross-asset signals remain distorted by policy developments, but we expect the US dollar to rebound tactically. More than observable fundamentals, policy headlines have been driving cross-asset movements. Traditional leading…

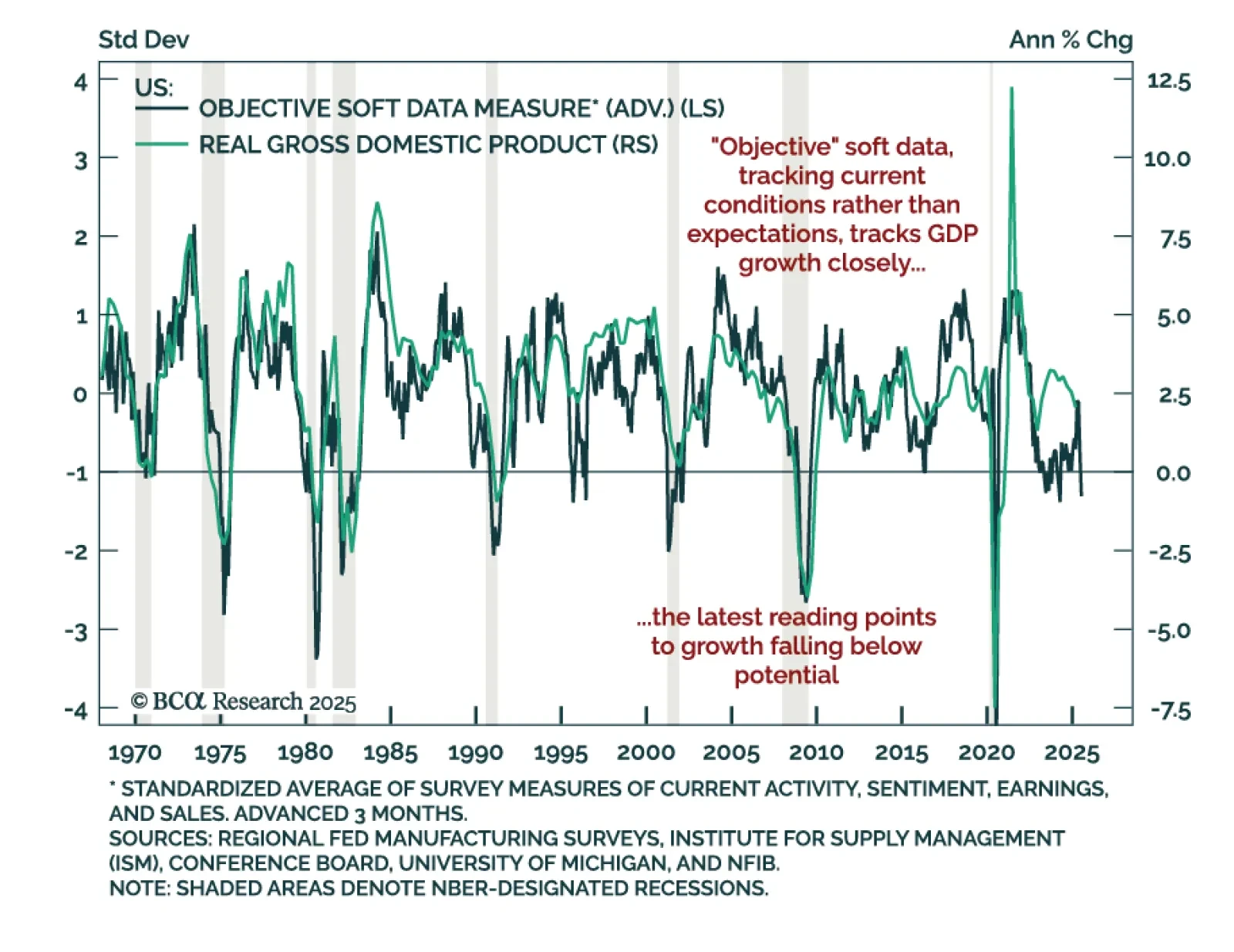

Markets no longer trade on soft-data fears; they now wait for hard-data proof, keeping us defensive on risk assets. Friday’s payroll beat highlighted the soft-hard split: Surveys flag weakness, but actual jobs hold up. In past…

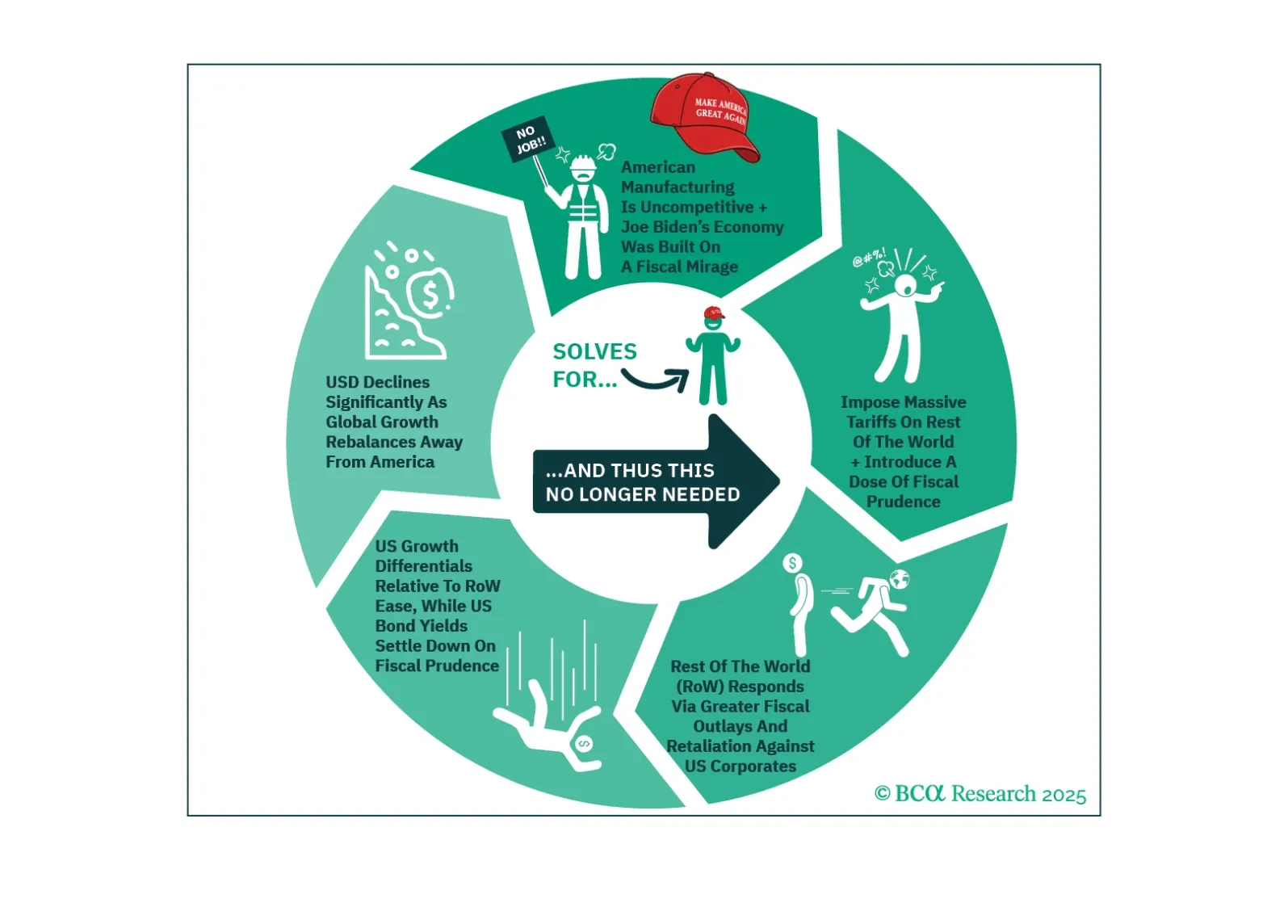

In our Alpha report, we explain how to trade the trade war and then conduct a scenario analysis for global asset allocation. The short version is that a policy induced recession has to be traded based on policy, not hard…

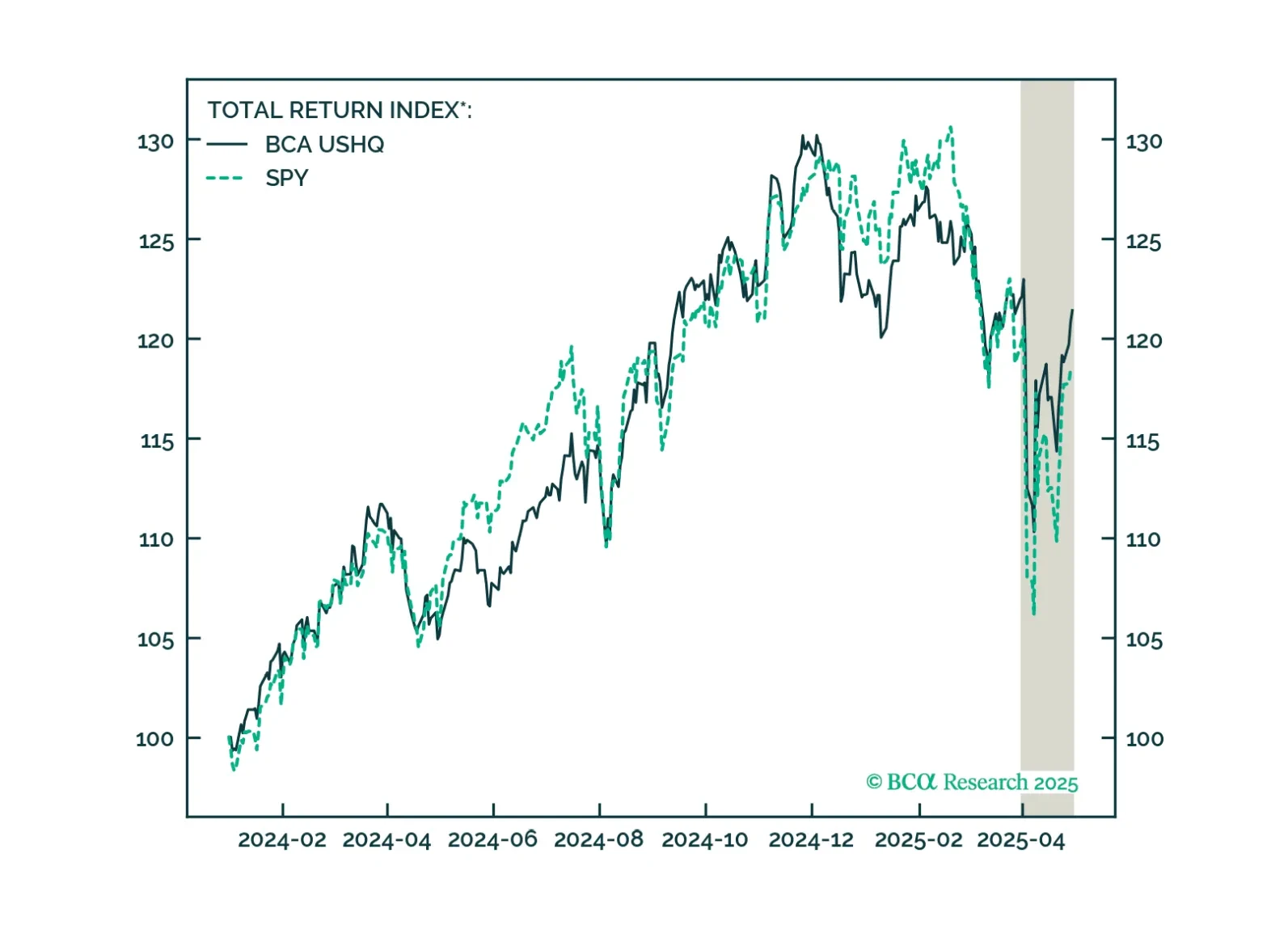

The US High Quality (USHQ) portfolio outperformed on the margin through April, returning -0.6%, whilst its SPY benchmark returned -1.2%. On a trailing three-month basis, performance remains robust vs. benchmark, with USHQ generating…

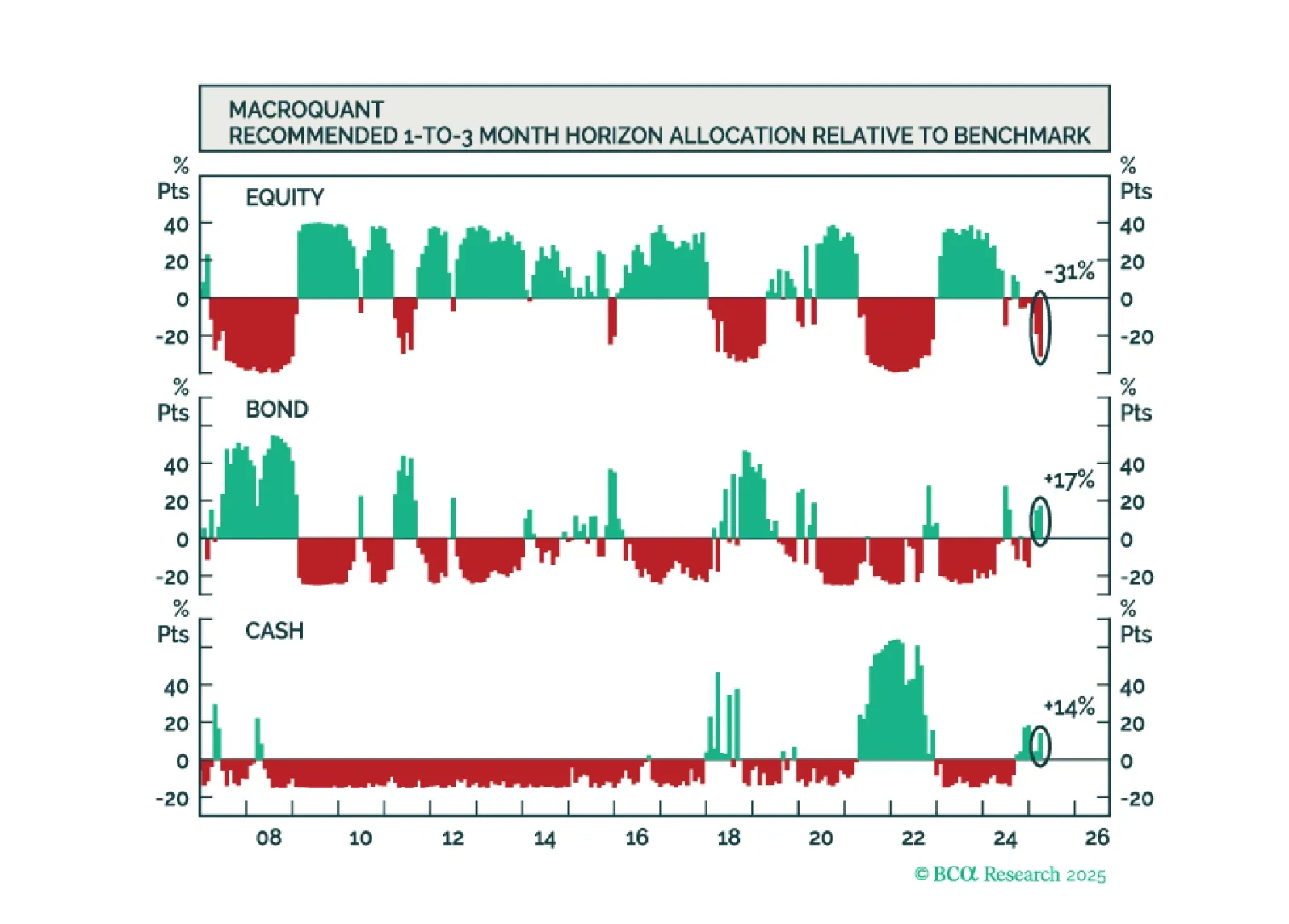

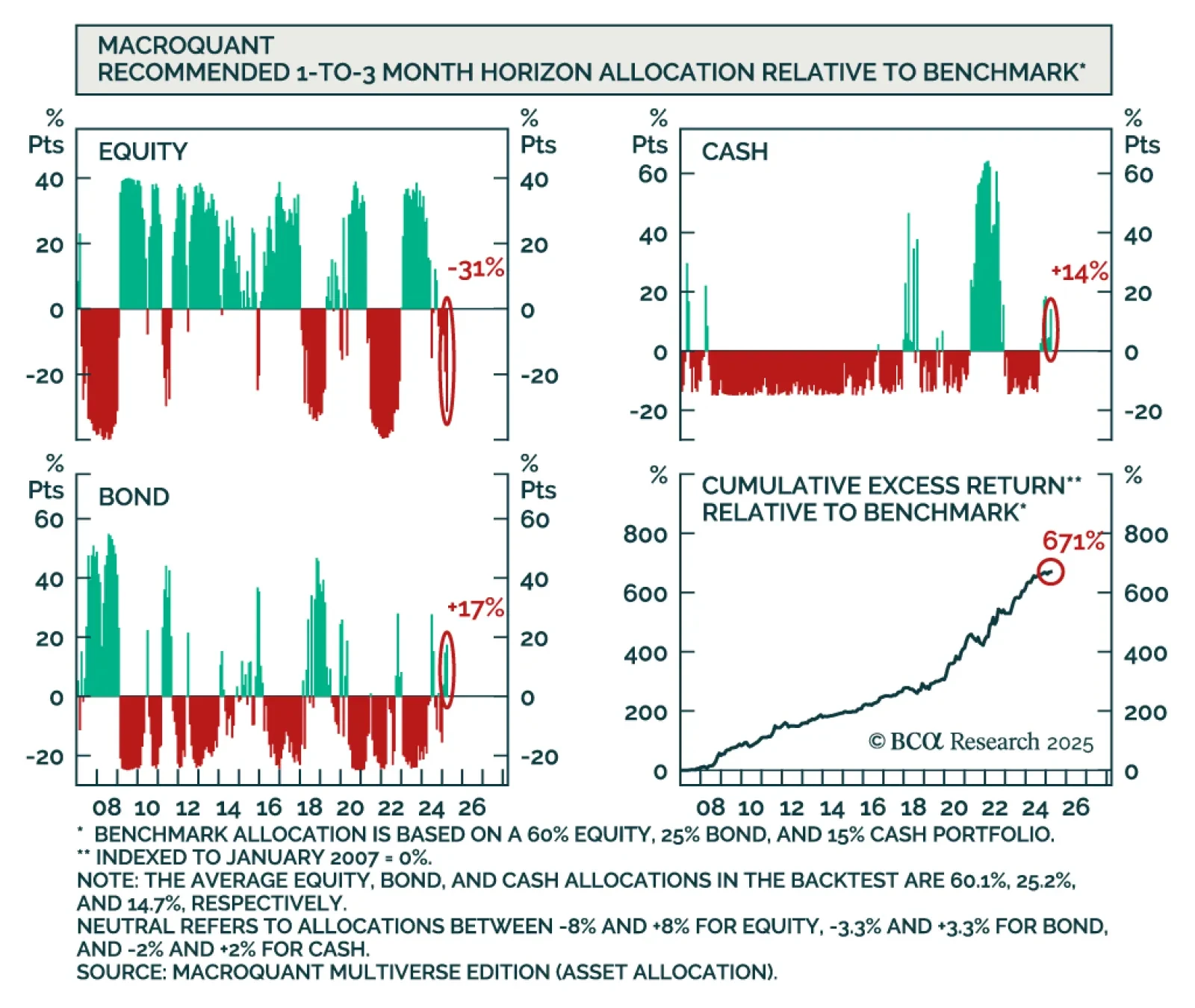

BCA’s MacroQuant model sees downside risks to US growth and upside risks to inflation. Our Chart Of The Week comes from Chanhyuck Lee in our Global Investment Strategy team. The model tracks hundreds of leading indicators and applies…

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.