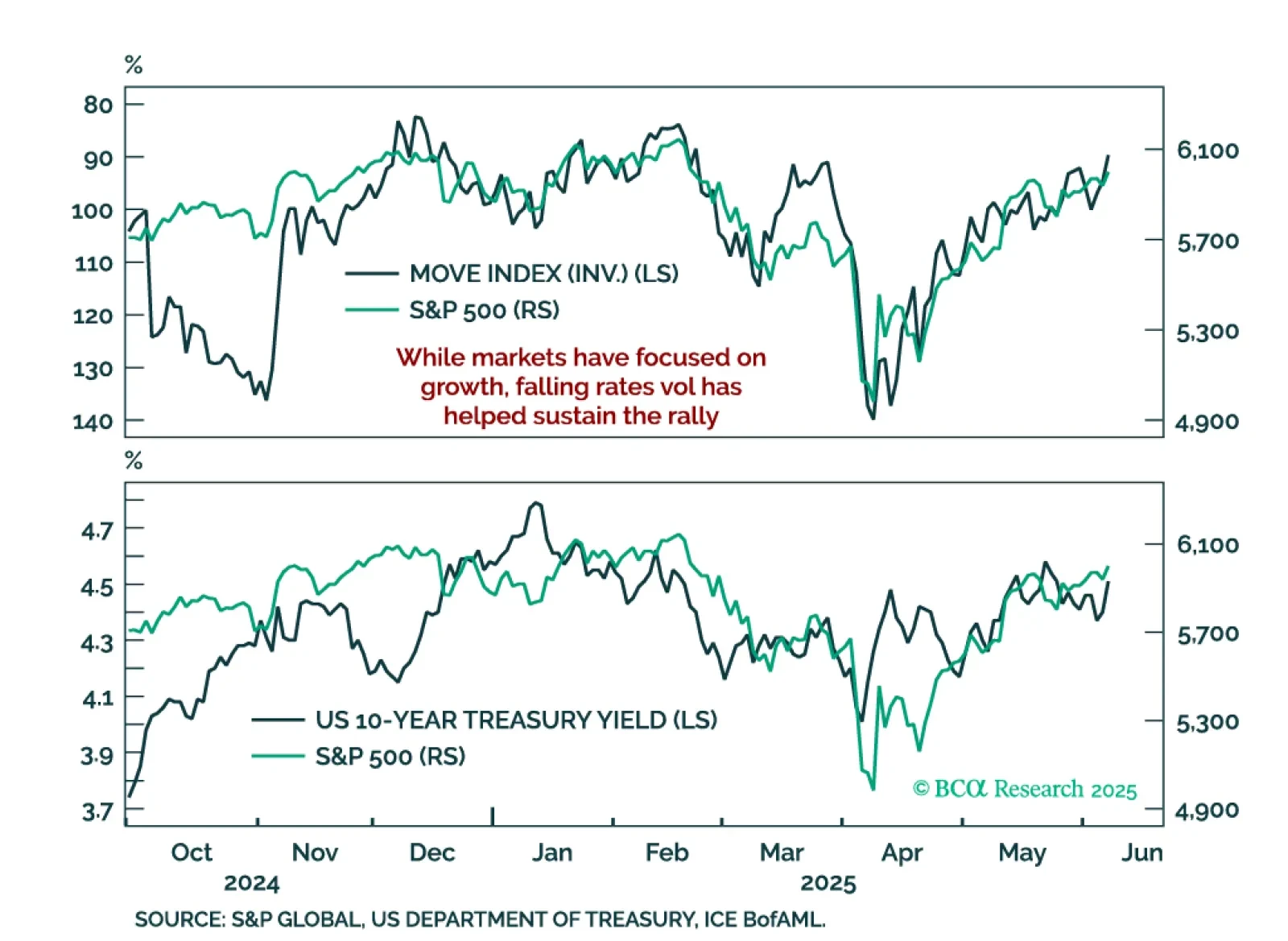

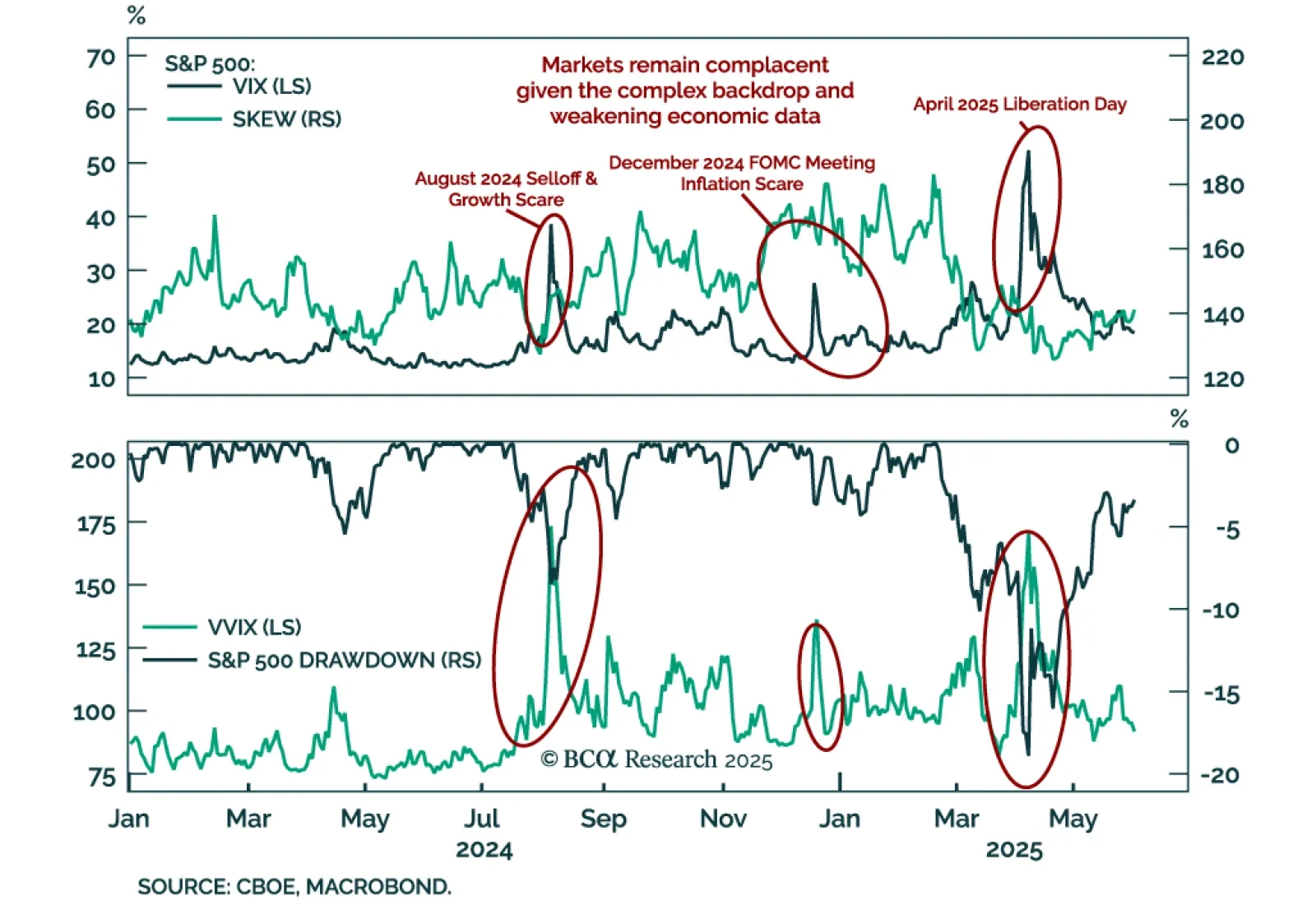

The equity rally faces two looming threats: Weakening growth expectations and a potential resurgence in rates volatility. Equities are vulnerable to any deterioration in growth sentiment. Economic surprises have turned lower and…

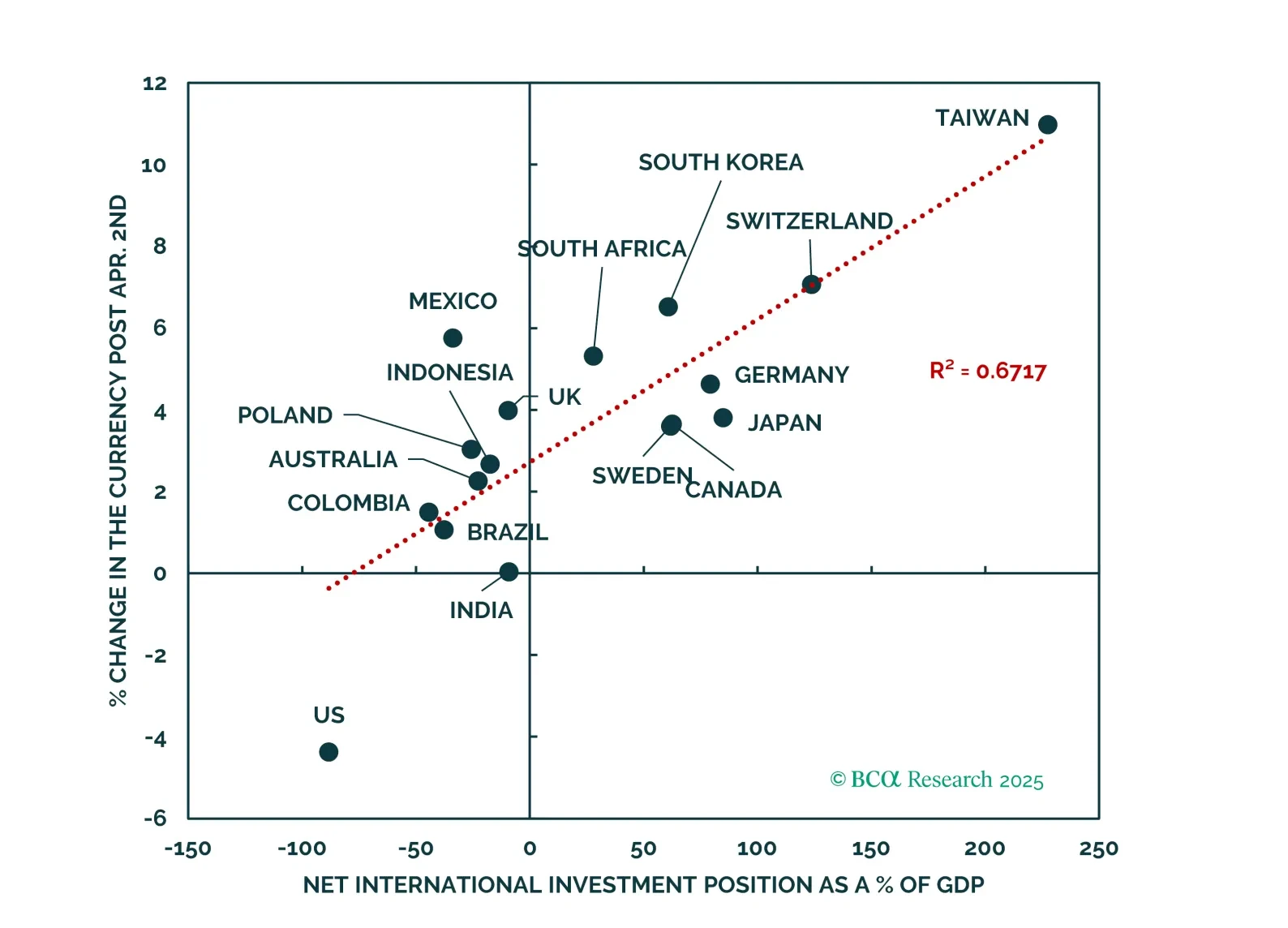

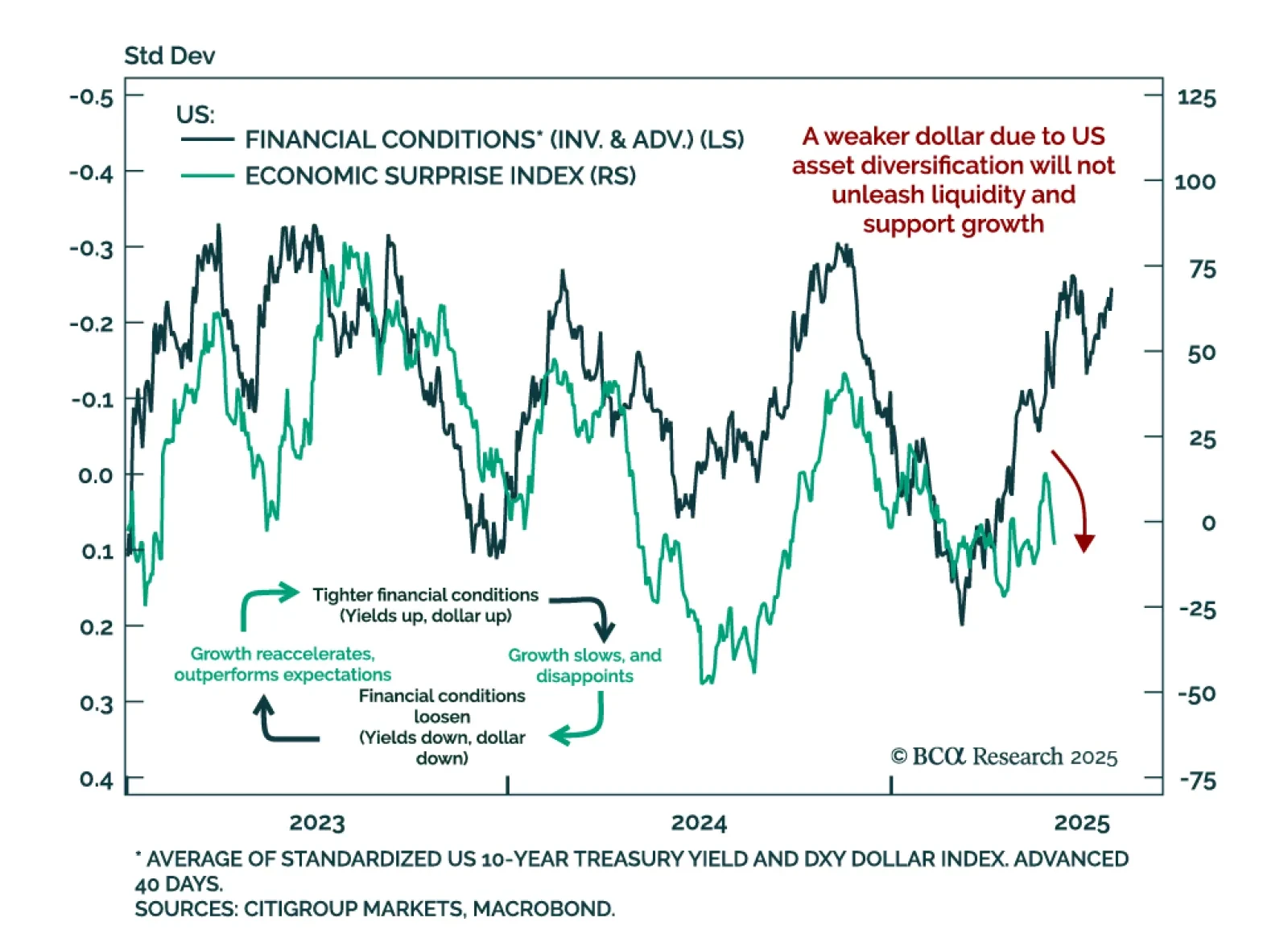

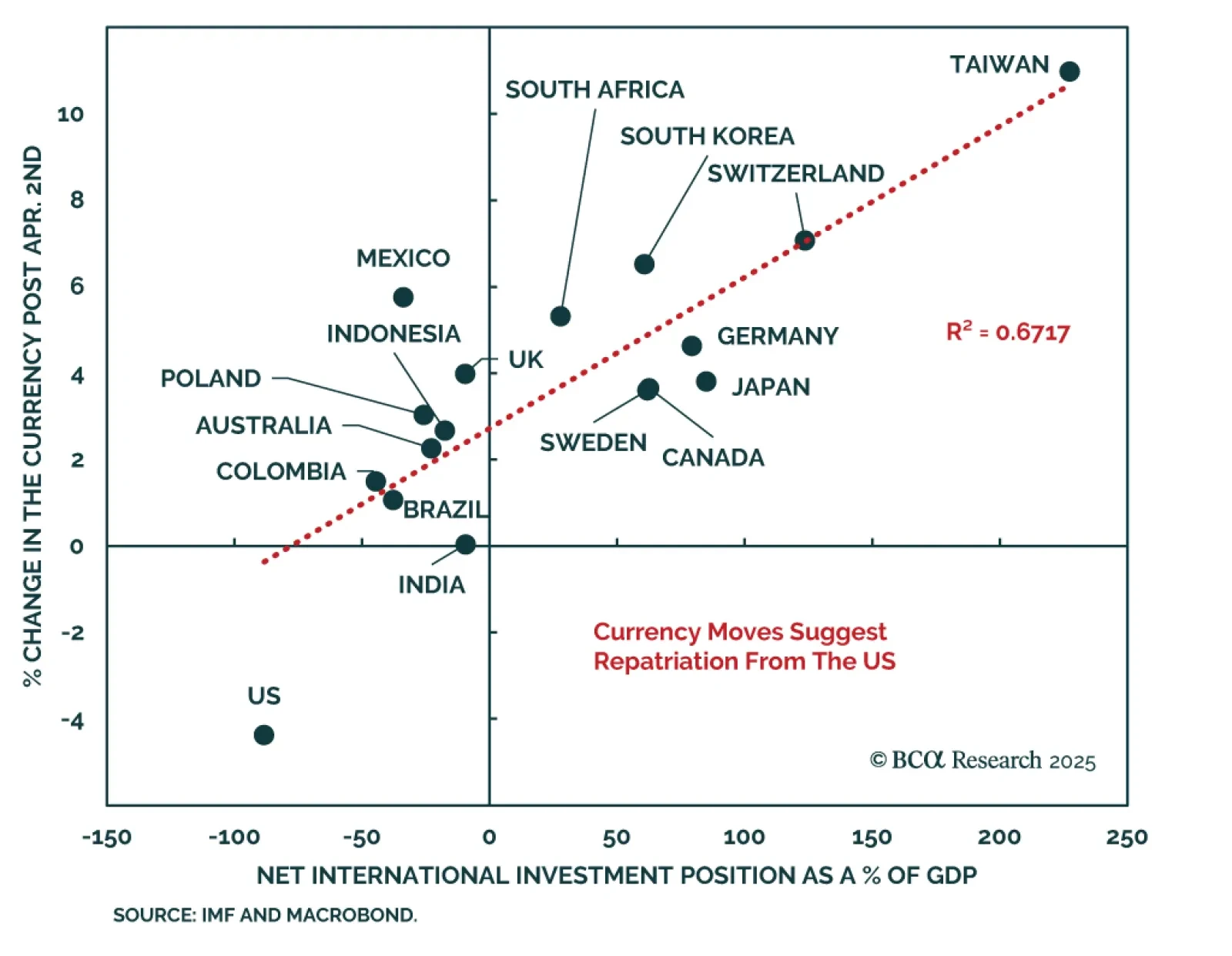

A falling dollar usually eases financial conditions, but recent dollar weakness is unlikely to reverse negative growth surprises, reinforcing our call to sell risk assets on strength. Our tactical framework tracks the reflexive…

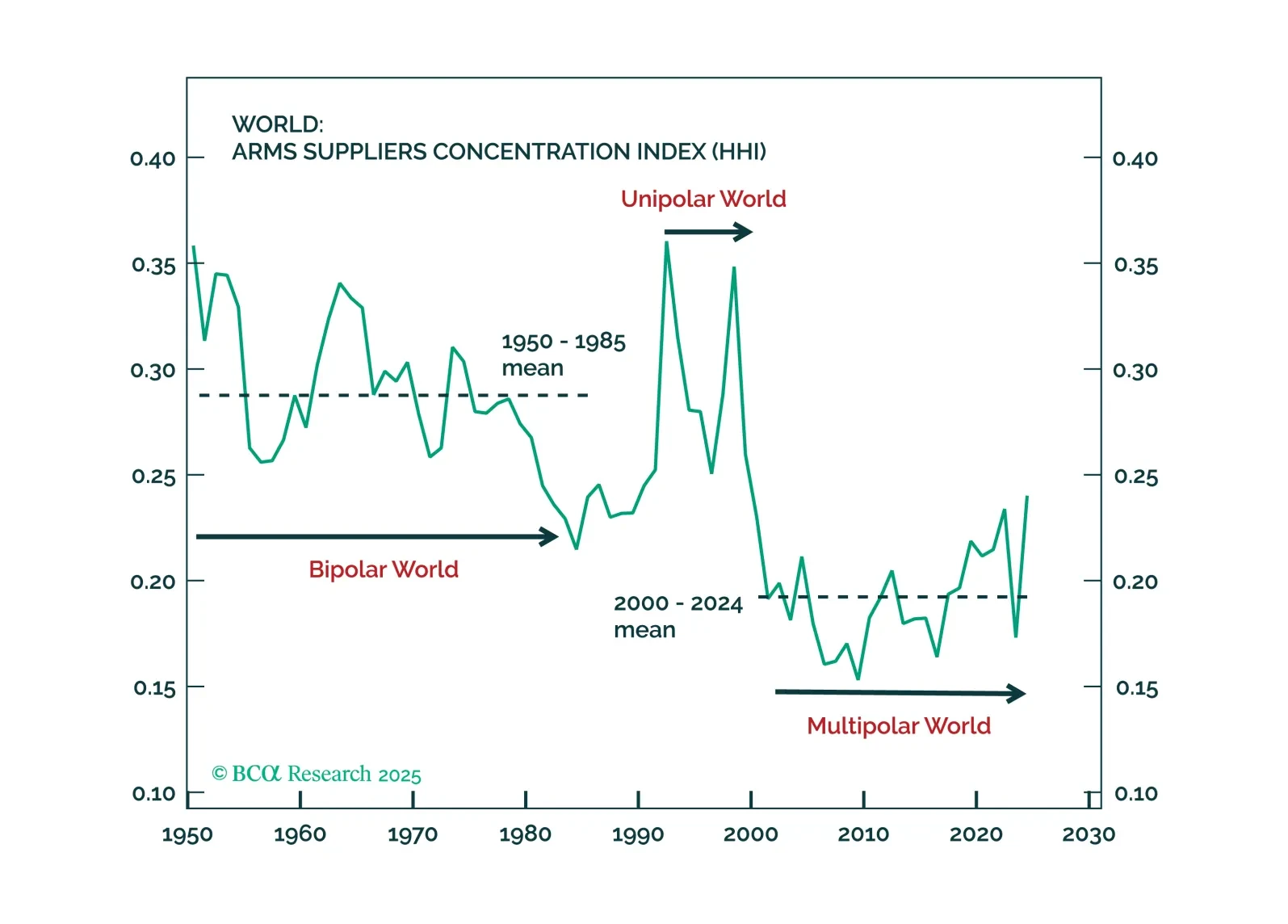

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…

The S&P 500’s rebound has outpaced fundamentals, and with the index back at the top of its range, investors shouldn’t chase the rally. Stocks are once again flirting with all-time highs after a 19.8% post-Liberation Day…

Our Global Asset Allocation strategists remain underweight US equities and the dollar, as fiscal policy overtakes tariffs as the key market driver. The “One Big Beautiful Bill” may avoid worst-case scenarios, but rising US yields are…

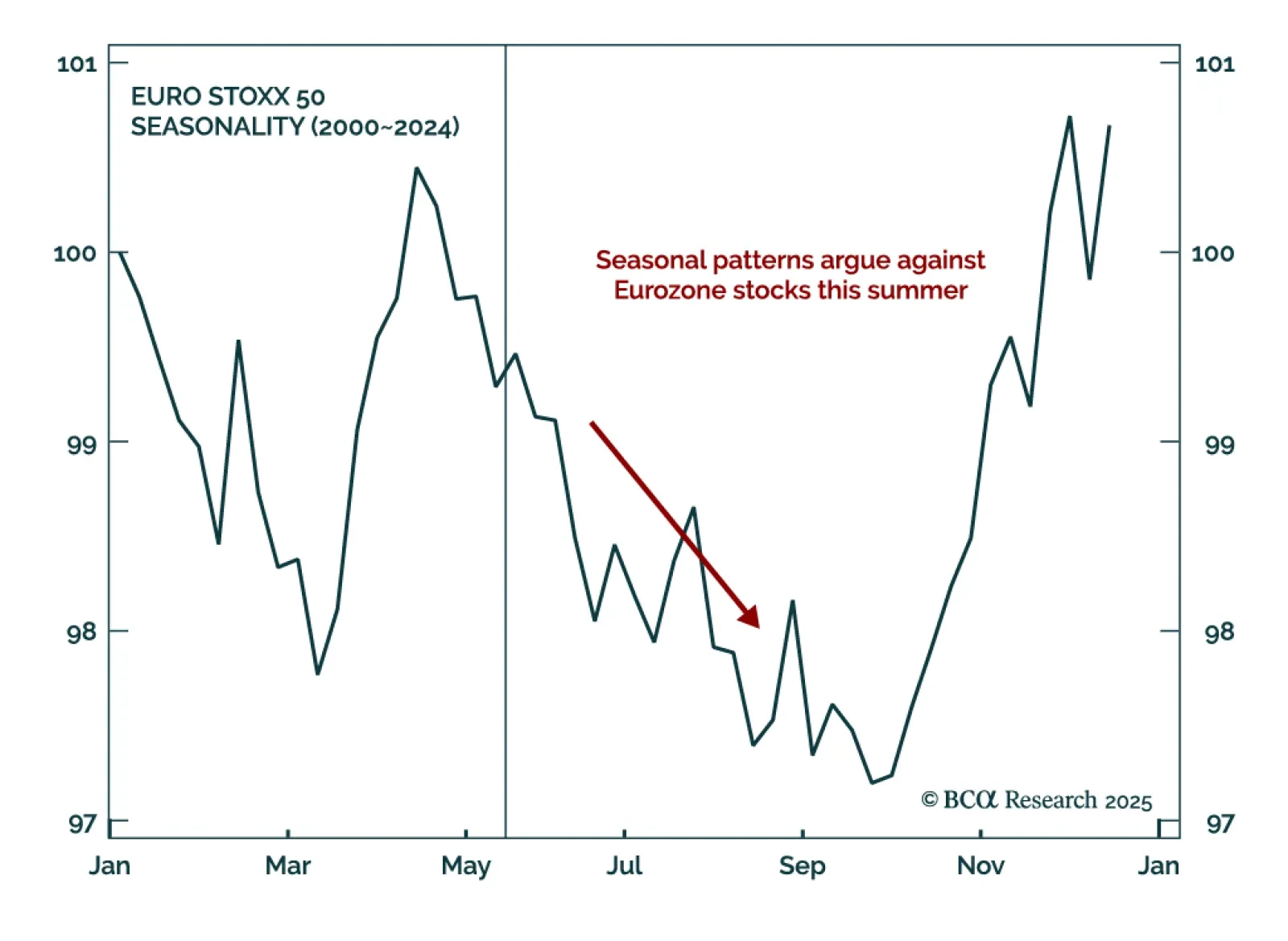

Our European strategists expect the EURO STOXX 50 to remain rangebound between 4750 and 5500 this summer, creating a punishing environment for buy-and-hold investors. With the index near the top of its range, they recommend trimming…

Fiscal policy, not tariffs, is now driving markets as Congress advances the One Big Beautiful Bill. The Senate cannot afford to remove the spending cuts in the bill, as they risk sparking a bond market riot. Even with this more…

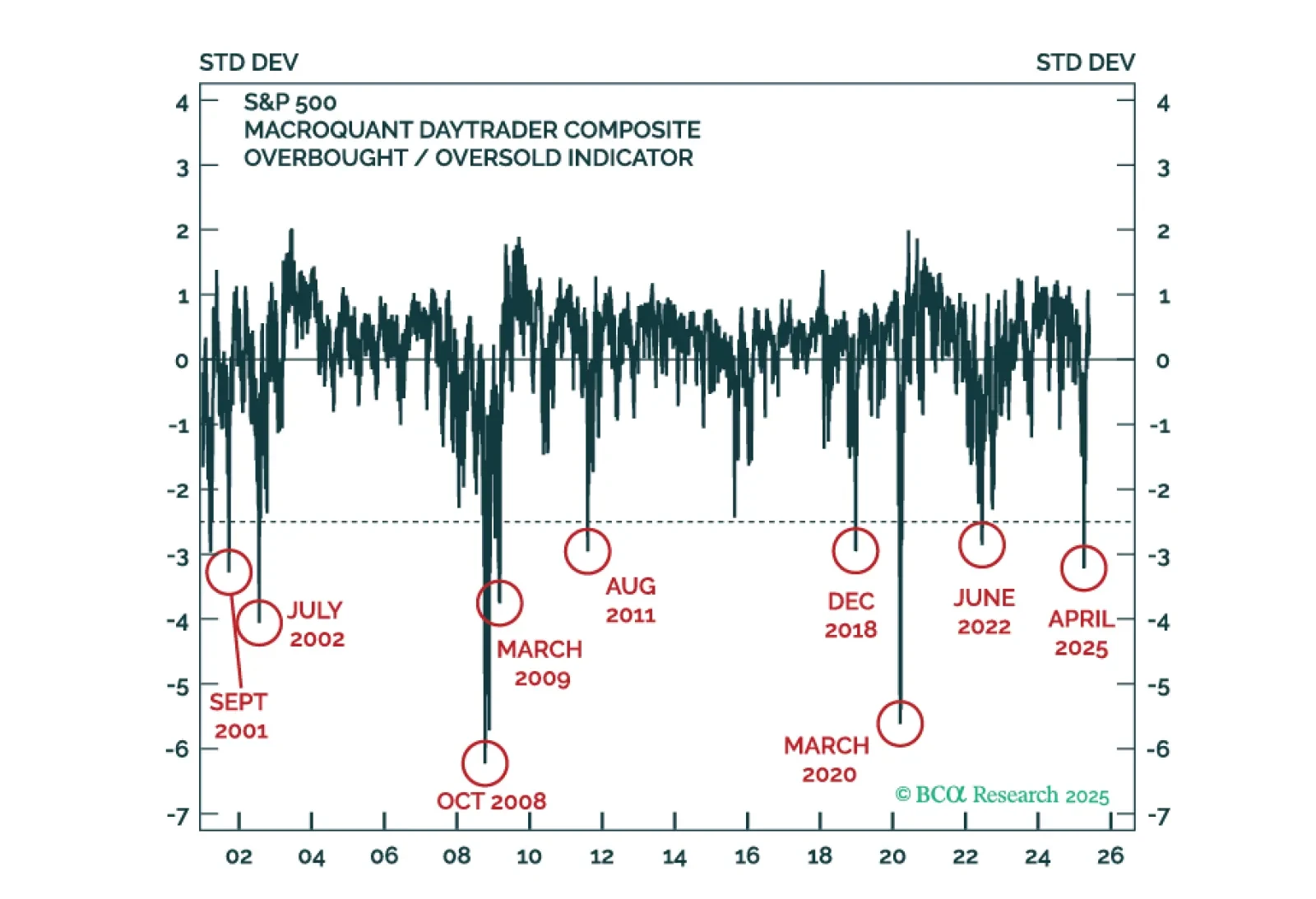

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

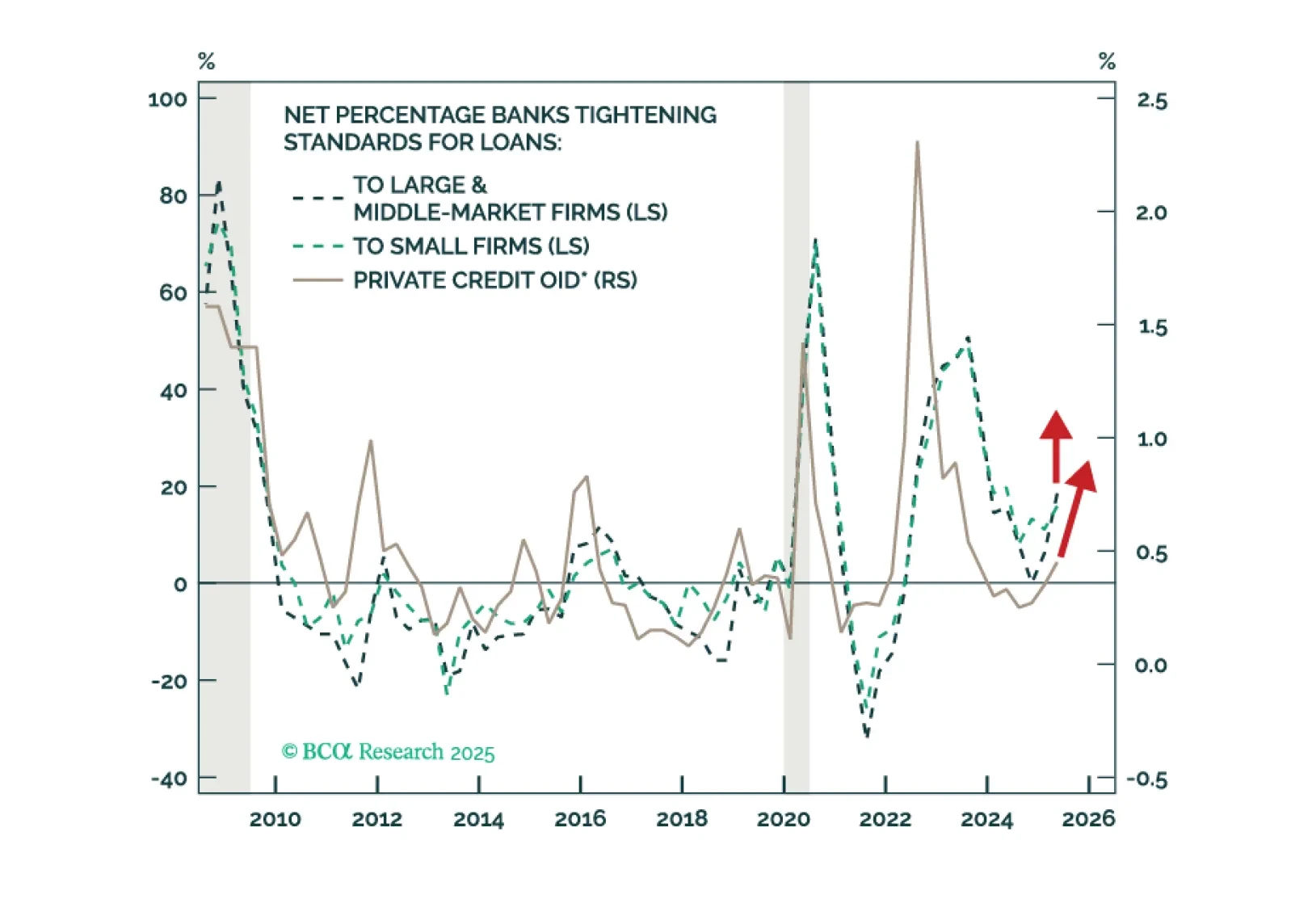

Private Credit return expectations edge lower. Middle Market Direct Lending remains attractive, rivaling Middle Market Buyouts.