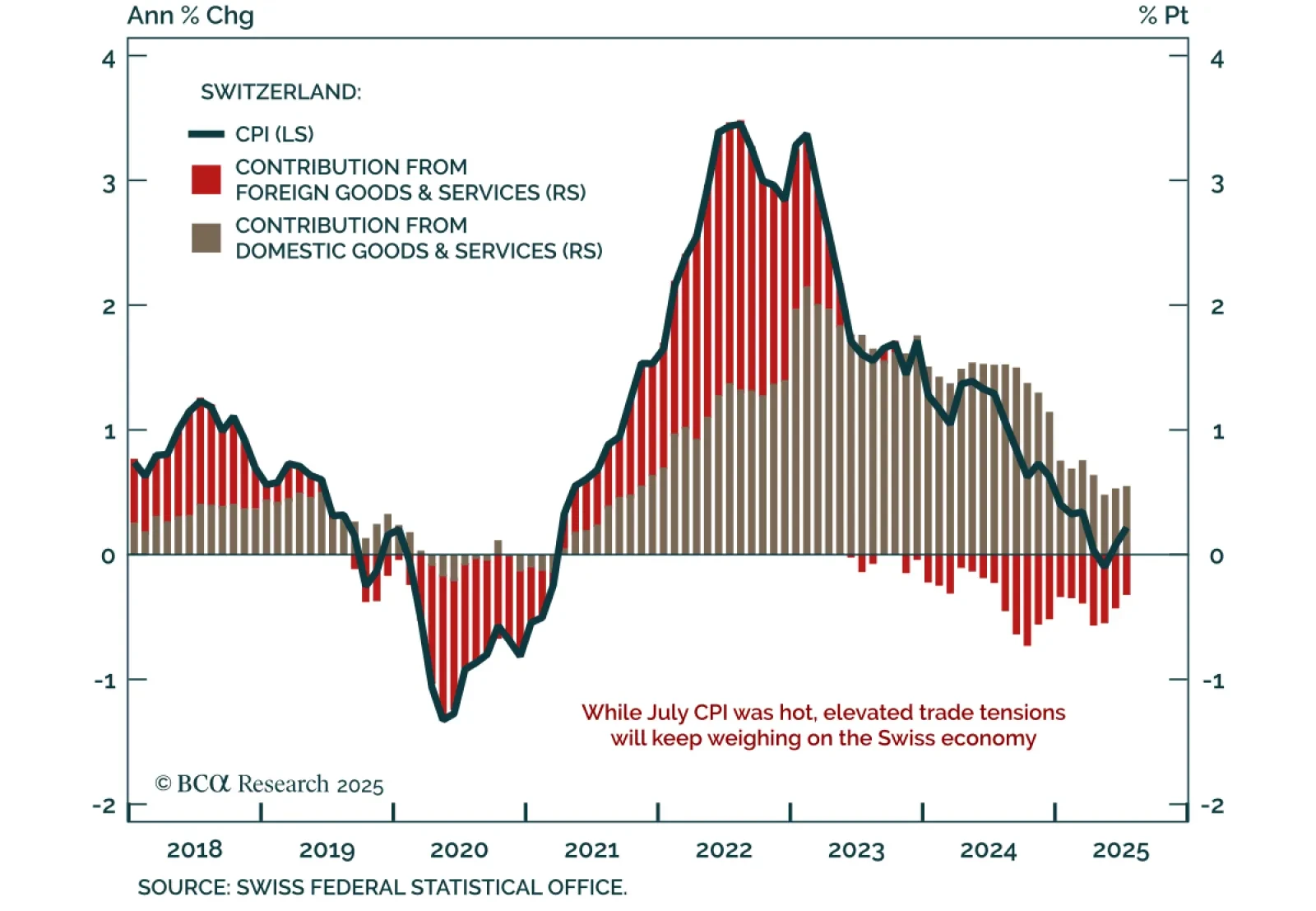

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

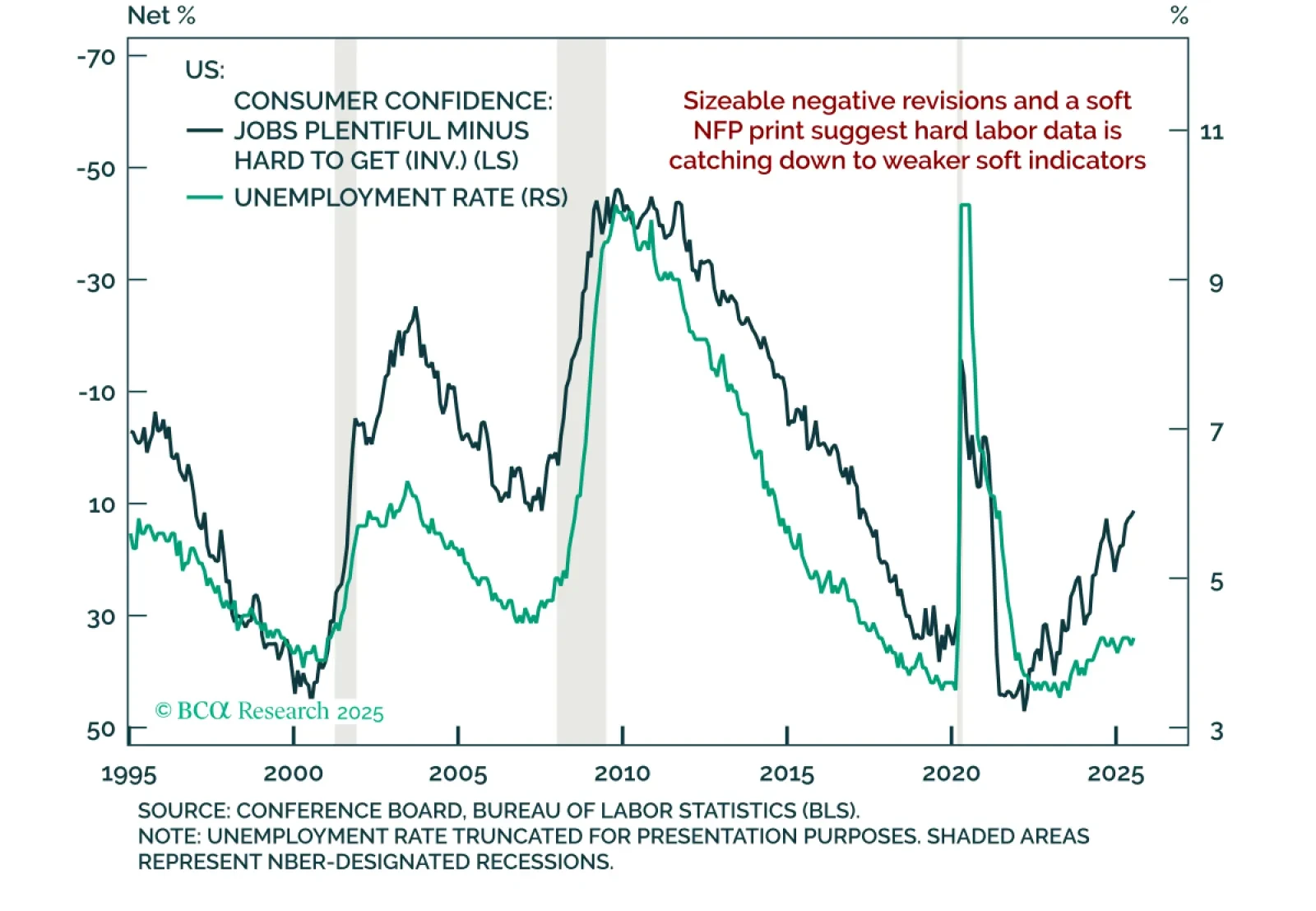

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…

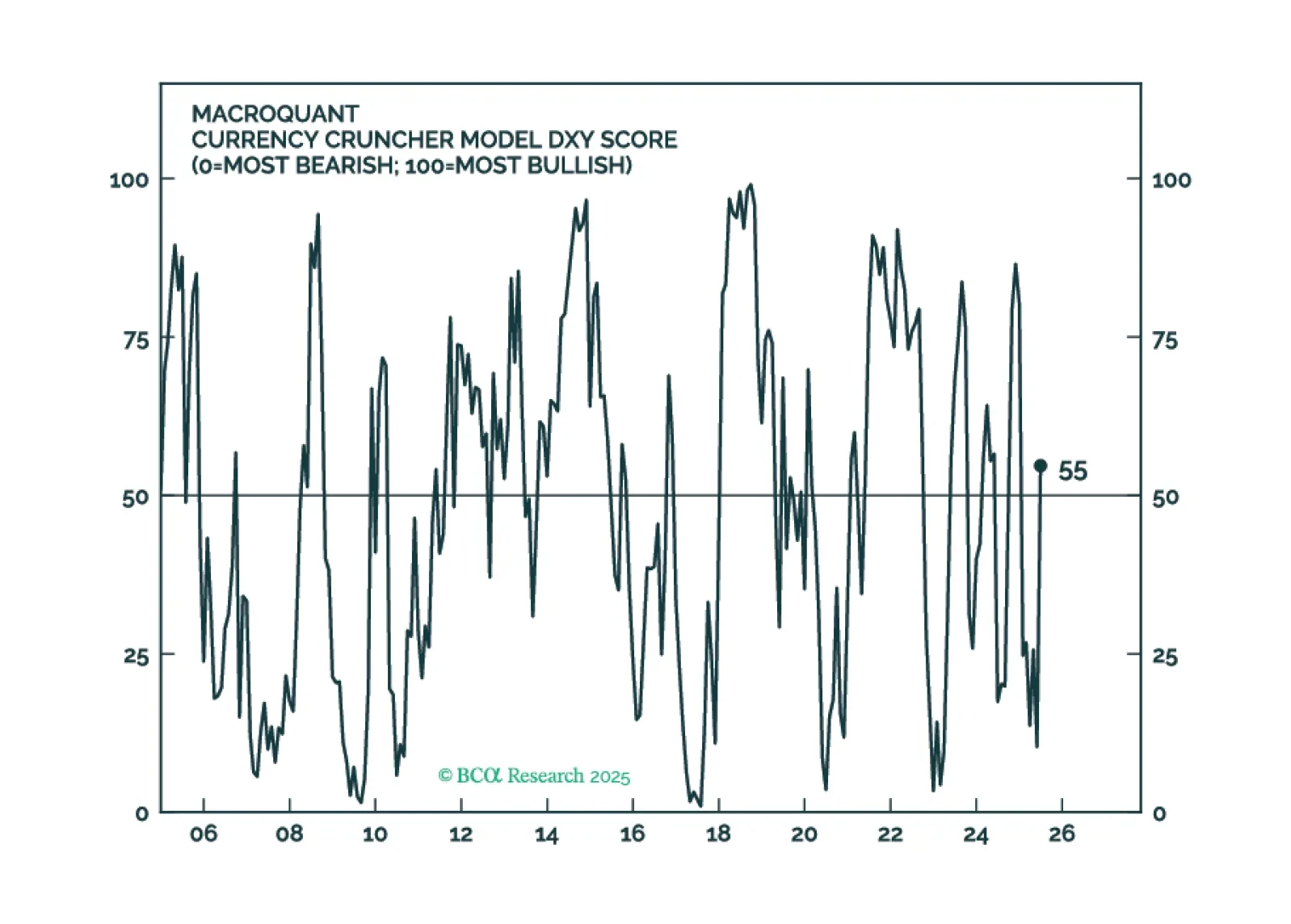

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

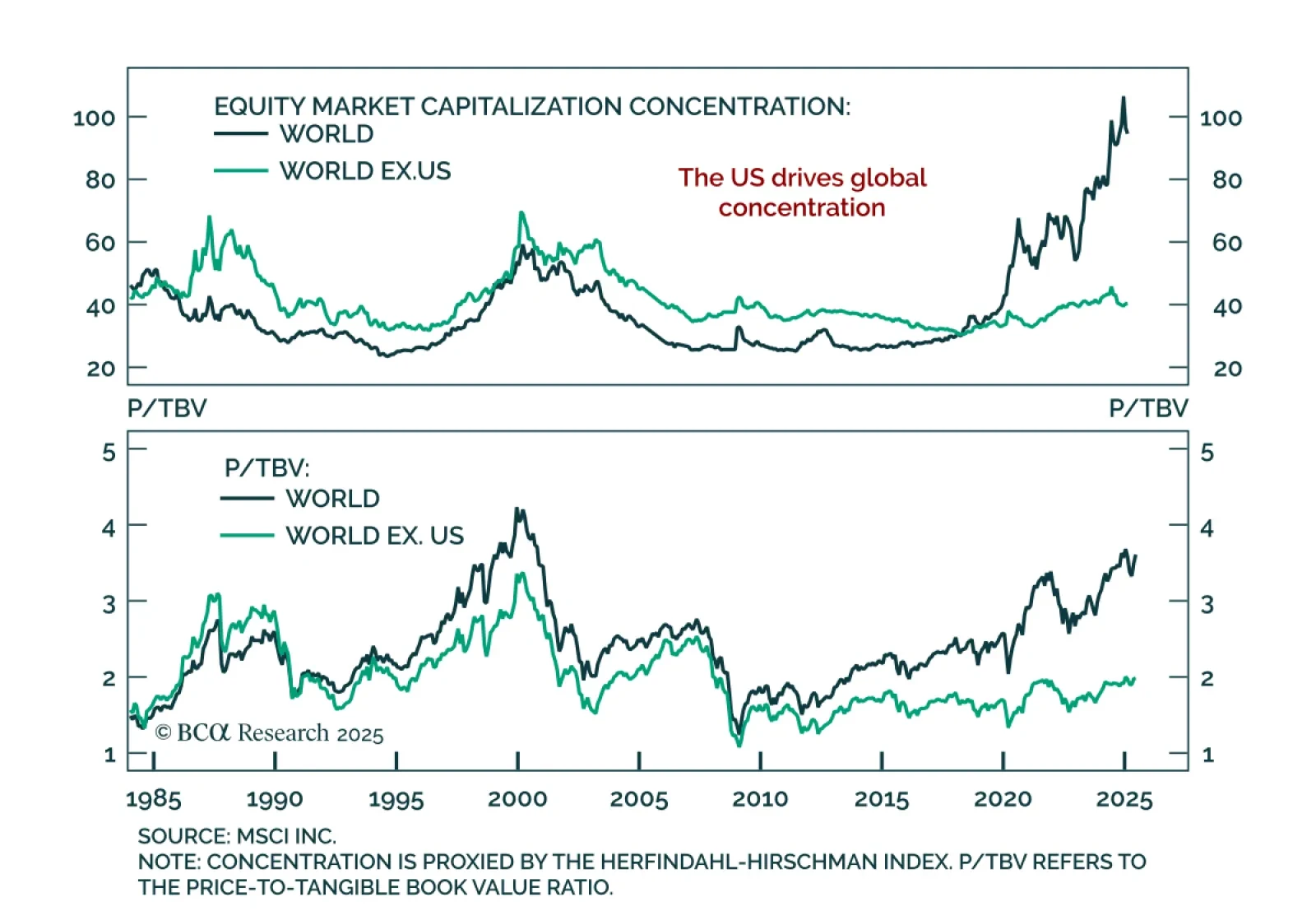

Our Global Asset Allocation strategists argue that equity market concentration is not a meaningful risk factor and does not help forecast returns. Cross-sectional concentration reflects index size, with smaller indices typically…

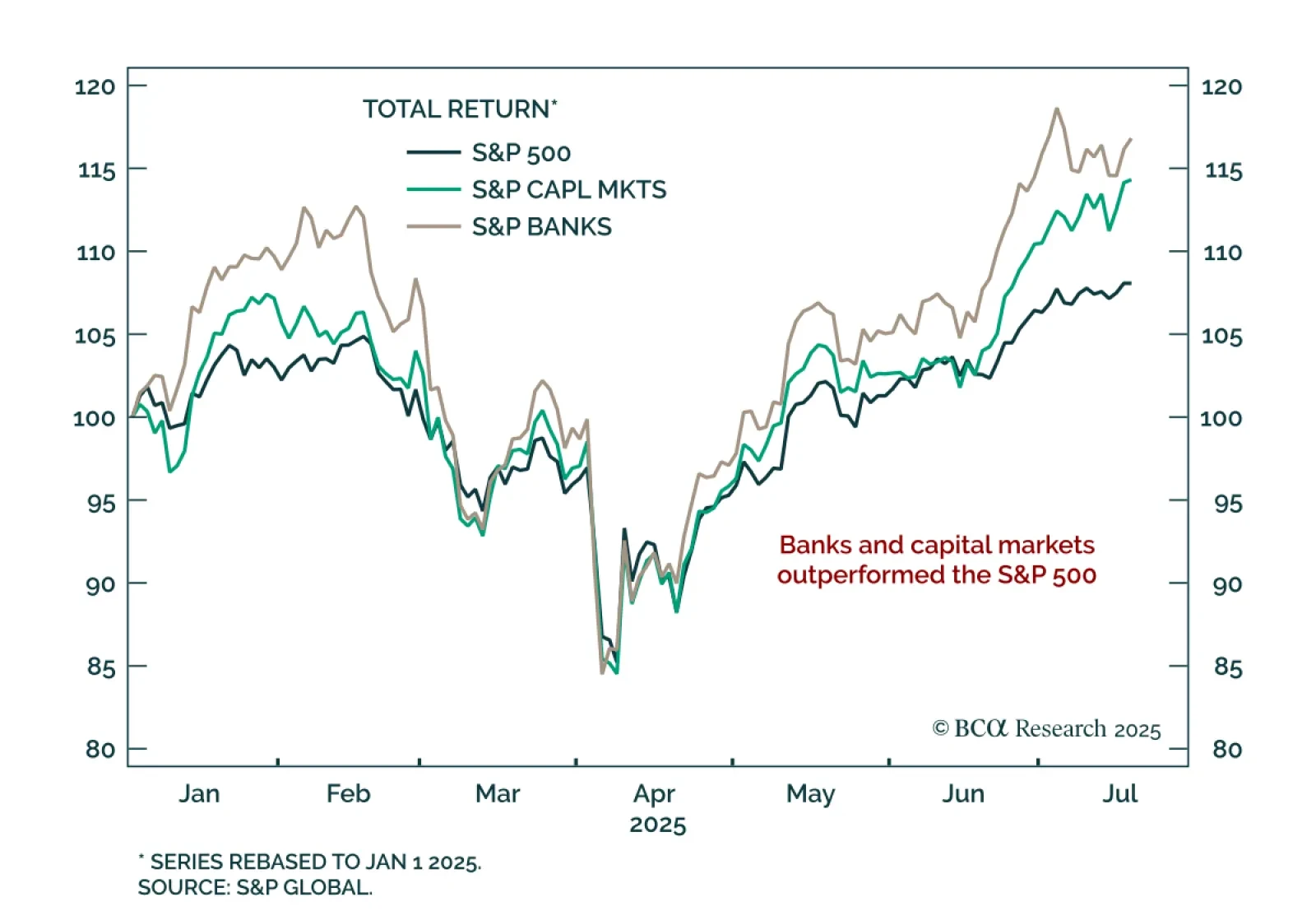

BCA’s US Equity strategists reiterate their overweight stance on Banks and Diversified Financials. Q2 results were solid, with resilient consumer strength and a rebound in capital markets activity. Net interest margins are…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

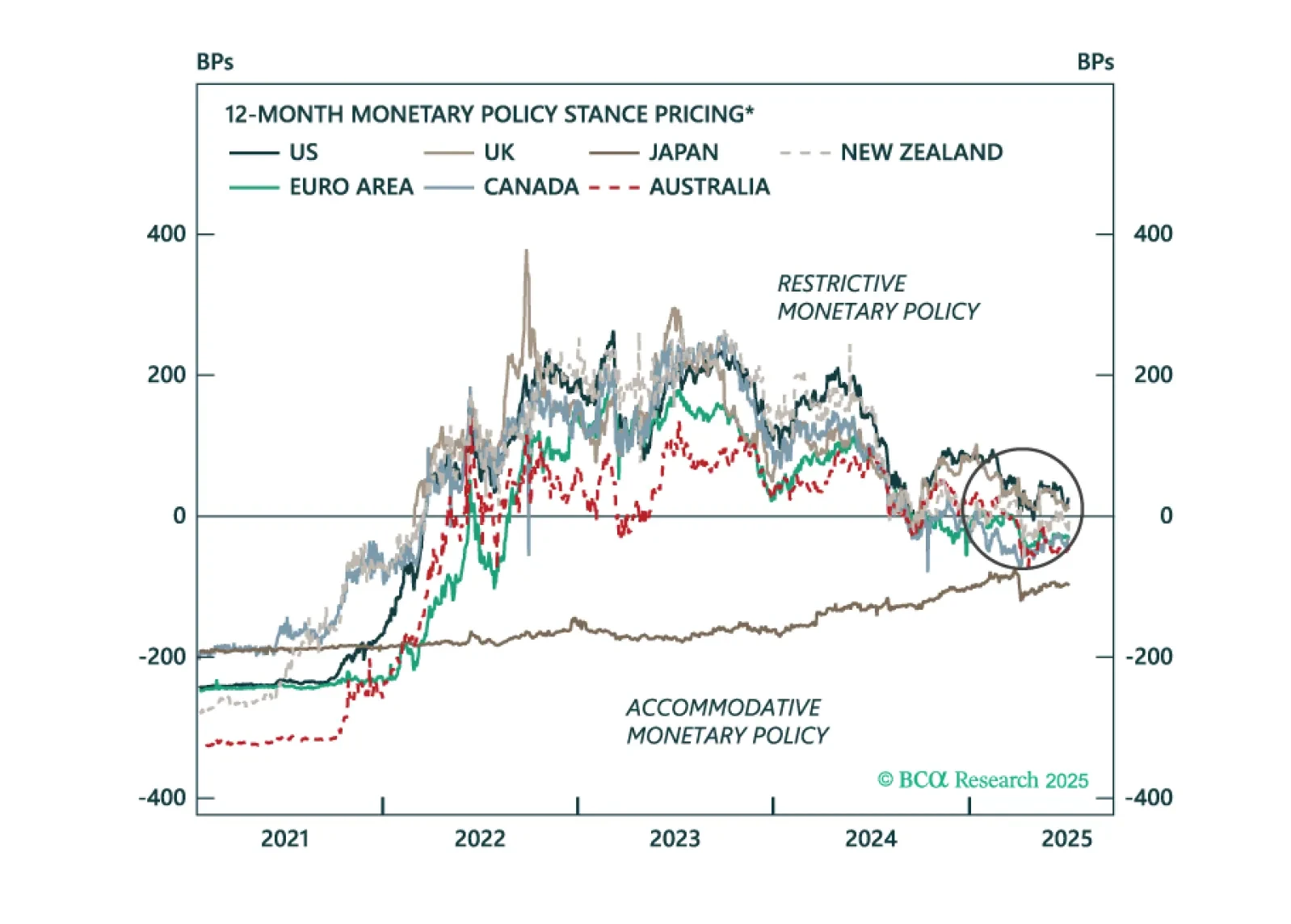

Markets are pricing a return to a neutral policy stance for the major central banks within the next 12 months. However, recession risks still loom amid slowing growth. We unpack where recession risks are underappreciated and what it…

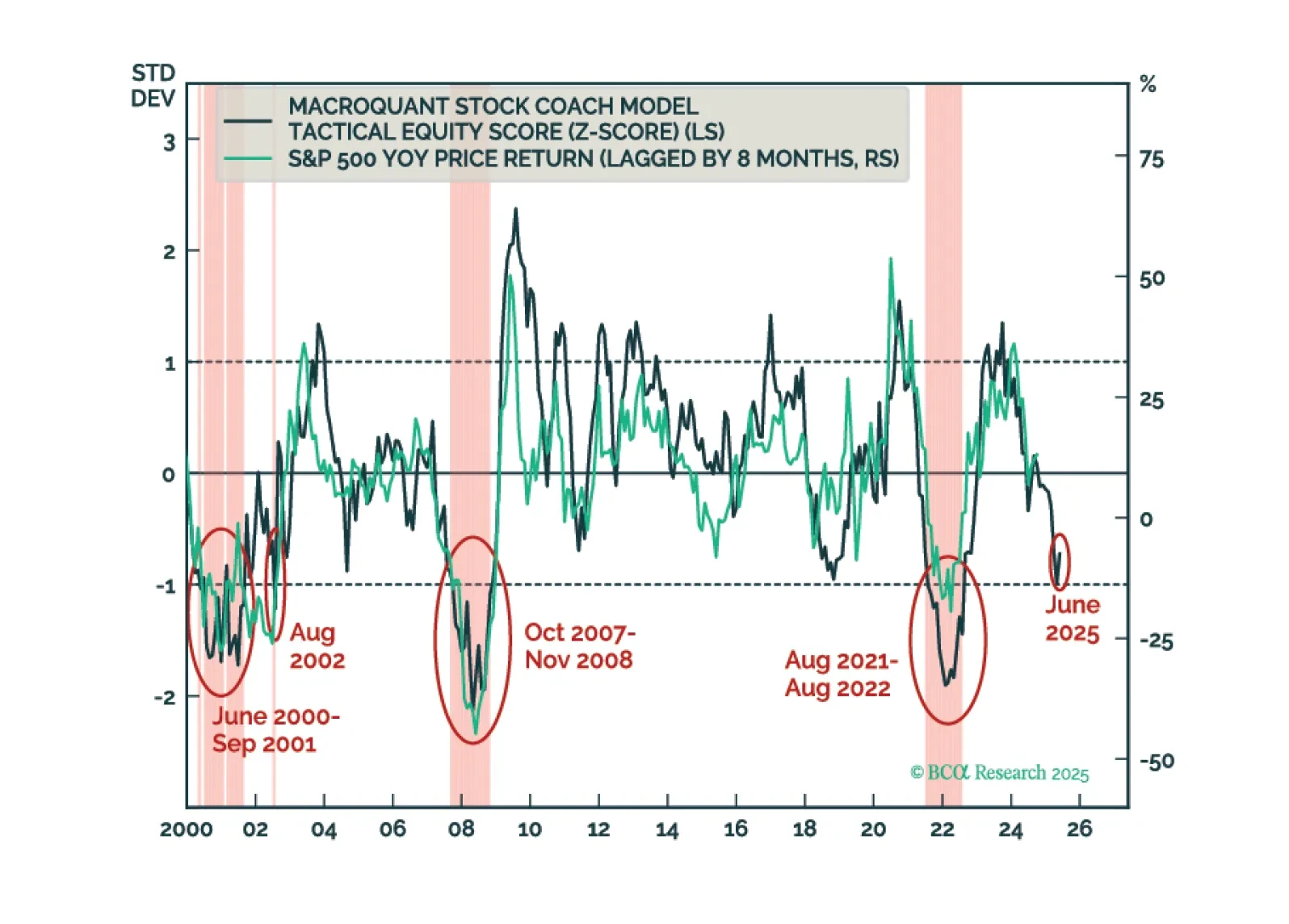

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

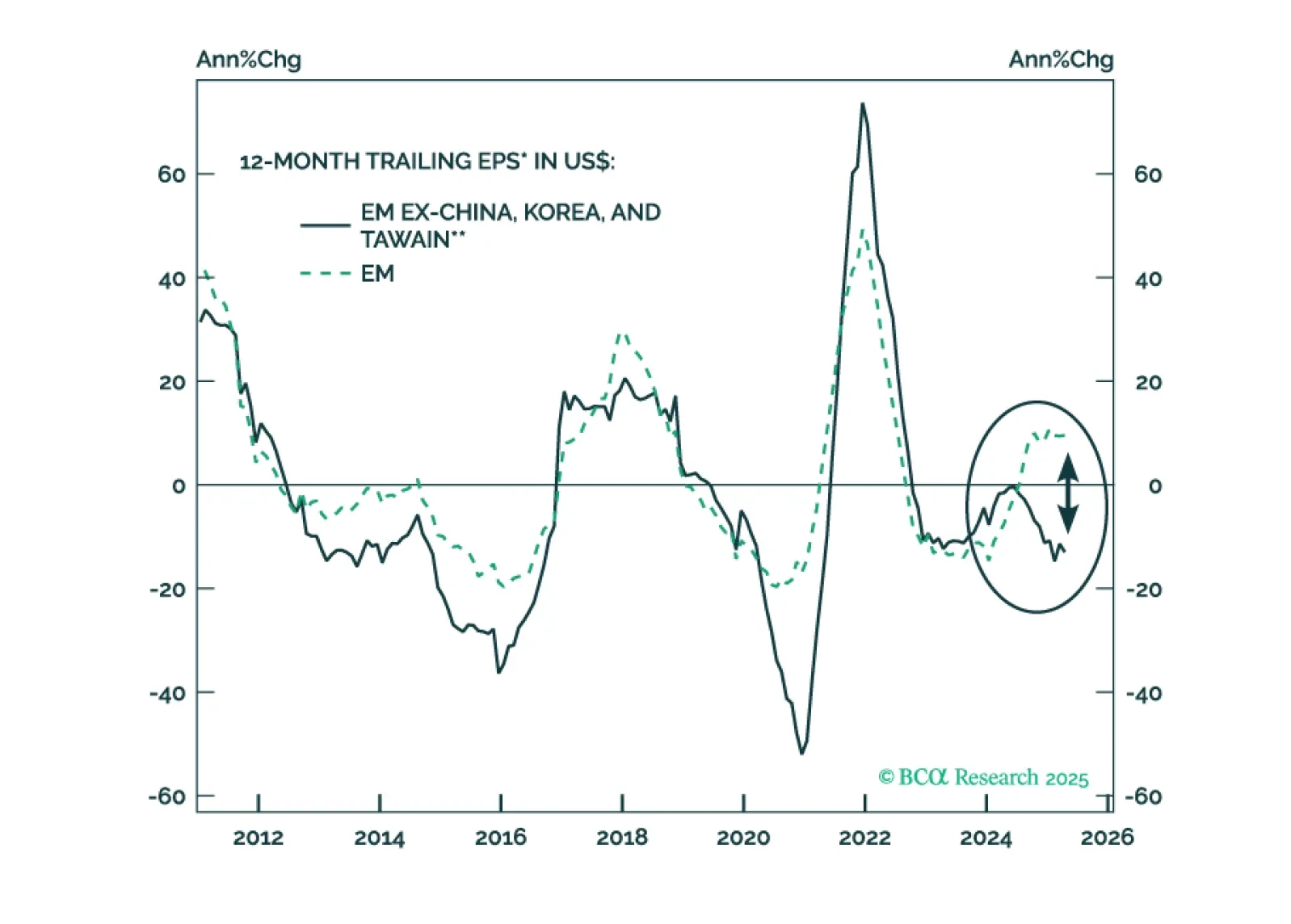

The EM EPS recovery has been narrow, solely driven by TMT stocks in China, Korea, and Taiwan. EM corporate profits are set to contract in the next six to nine months. Unlike in the past, US dollar weakness will be…